Hyatt Hotels PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyatt Hotels Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hyatt Hotels's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify growth opportunities. Download the full version now and gain the competitive edge you need to navigate the complexities of the global hospitality industry.

Political factors

Government policies, such as evolving visa requirements and travel advisories, directly shape international travel flows, impacting Hyatt's global occupancy and revenue. For instance, the US Travel and Tourism Office reported that international arrivals to the US reached approximately 66.8 million in 2023, a significant increase but still below pre-pandemic levels, highlighting the sensitivity of the industry to such regulations.

Hyatt must remain agile in adapting to shifts in border control measures and public health protocols, as these can swiftly alter travel demand in key markets. The International Air Transport Association (IATA) has noted that while global air travel recovery is strong, geopolitical stability and government policies remain critical factors influencing passenger volumes and airline capacity, which in turn affects hotel bookings.

Geopolitical stability is a critical factor for Hyatt Hotels. For instance, the ongoing Russia-Ukraine conflict, which escalated significantly in early 2022, continues to impact travel patterns and consumer confidence in Eastern Europe and surrounding regions. This instability can directly affect occupancy rates and revenue for Hyatt properties in affected or nearby areas, prompting a need for diversified market strategies.

Fluctuations in corporate tax rates directly impact Hyatt's profitability and expansion strategies. For instance, in 2024, many countries are reviewing their corporate tax structures, which could alter Hyatt's net income. Tourism-specific taxes, such as occupancy taxes, also affect the overall cost for travelers, influencing demand for Hyatt's services.

Government incentives for hospitality development can significantly encourage new hotel construction and renovations. In 2024, some regions are offering tax credits or grants for sustainable building practices, potentially benefiting Hyatt's development pipeline. Conversely, increased taxation on the hospitality sector can reduce profit margins and slow down growth initiatives.

Hyatt closely monitors fiscal policies in its operating markets to optimize its financial performance. For example, changes in value-added tax (VAT) or goods and services tax (GST) rates in key markets like Europe or Asia can impact revenue and pricing strategies. The company's ability to adapt to these evolving tax landscapes is crucial for maintaining its competitive edge and maximizing shareholder value.

Tourism Promotion and Infrastructure Development

Government initiatives aimed at boosting tourism through infrastructure development and destination marketing directly benefit Hyatt Hotels. For instance, the Indian government's 'Dekho Apna Desh' initiative, launched in 2020, has seen continued emphasis in 2024, encouraging domestic tourism and leading to increased demand for hotel services in key tourist locales where Hyatt operates. Improved transportation networks, such as new airport expansions and high-speed rail projects, make destinations more accessible, driving higher occupancy rates.

Hyatt actively partners with local governments and tourism boards to capitalize on these advancements. In 2024, Hyatt Regency Kathmandu collaborated with the Nepal Tourism Board on promotional campaigns, aligning with the country's efforts to revive tourism post-pandemic. Such collaborations leverage government investment in infrastructure and marketing, enhancing Hyatt's visibility and attracting a broader customer base.

The impact of these political factors is quantifiable. For example, countries that have significantly increased tourism infrastructure spending often see a corresponding rise in international arrivals. The World Tourism Organization (UNWTO) reported that global international tourist arrivals recovered to 88% of pre-pandemic levels by the end of 2023, with projections for 2024 indicating a full recovery and potential growth, directly benefiting hotel chains like Hyatt.

- Government Investment: Increased public spending on transportation and destination marketing directly supports the hospitality sector.

- Infrastructure Improvements: Enhanced airports, roads, and public transport make travel easier, boosting visitor numbers for hotels.

- Destination Marketing: Government-led campaigns raise awareness and attract tourists to regions where Hyatt has a presence.

- Public-Private Partnerships: Collaborations between Hyatt and local authorities maximize the benefits of tourism promotion efforts.

Trade Agreements and International Regulations

International trade agreements and evolving regulatory frameworks significantly shape Hyatt's global operations. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA in 2020, continues to influence cross-border business for Hyatt properties in North America, impacting everything from sourcing to labor mobility. Similarly, the EU's General Data Protection Regulation (GDPR) and similar privacy laws worldwide dictate how Hyatt handles customer data across its international portfolio.

These agreements directly affect Hyatt's ability to manage its extensive global supply chain, which sources goods and services from numerous countries. Harmonized regulations, such as those aiming to simplify customs procedures, can reduce operational costs and lead times. Conversely, protectionist measures or trade disputes, like those that have periodically emerged between major economic blocs, introduce complexities and potential disruptions to Hyatt's international business model and investment strategies.

- Impact on Supply Chain: Trade agreements dictate tariffs and quotas, affecting the cost and availability of goods for Hyatt's hotels worldwide.

- Labor Mobility: Visa regulations and labor mobility agreements influence the ease with which Hyatt can deploy staff across international borders, particularly for management roles.

- Foreign Investment: Bilateral investment treaties and foreign ownership regulations can either encourage or restrict Hyatt's ability to invest in new properties or acquire existing ones in different markets.

- Regulatory Harmonization: Efforts to harmonize regulations, such as those concerning hospitality standards or environmental practices, can streamline Hyatt's operations and reduce compliance burdens across regions.

Government policies, including evolving visa requirements and travel advisories, directly influence international travel, impacting Hyatt's global occupancy and revenue. For example, the US Travel and Tourism Office reported that international arrivals to the US reached approximately 66.8 million in 2023, a significant increase but still below pre-pandemic levels, highlighting the industry's sensitivity to such regulations.

Hyatt must remain agile in adapting to shifts in border control measures and public health protocols, as these can swiftly alter travel demand in key markets. The International Air Transport Association (IATA) notes that while global air travel recovery is strong, geopolitical stability and government policies remain critical factors influencing passenger volumes and airline capacity, which in turn affects hotel bookings.

Geopolitical stability is a critical factor for Hyatt Hotels, with ongoing conflicts impacting travel patterns and consumer confidence in affected regions. This instability can directly affect occupancy rates and revenue for Hyatt properties, prompting a need for diversified market strategies.

Fluctuations in corporate tax rates directly impact Hyatt's profitability and expansion strategies, with many countries reviewing their corporate tax structures in 2024. Tourism-specific taxes also affect the overall cost for travelers, influencing demand for Hyatt's services.

What is included in the product

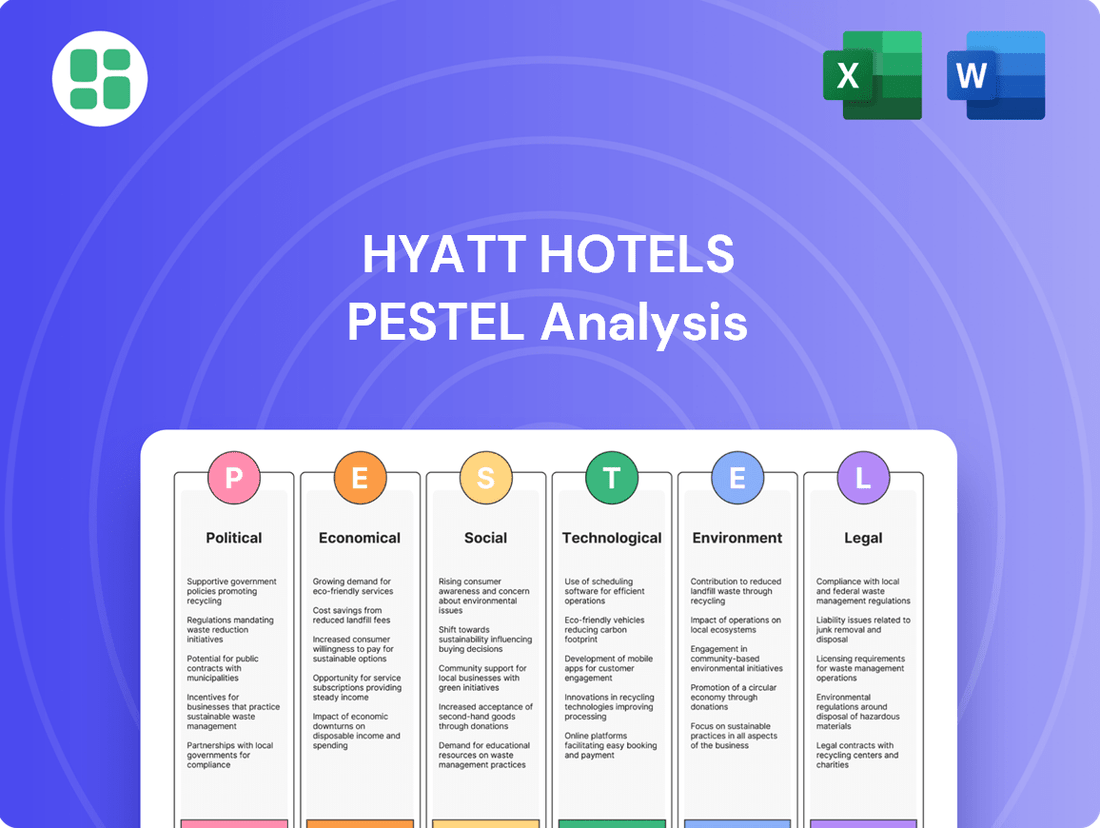

This PESTLE analysis delves into the external macro-environmental forces influencing Hyatt Hotels, examining Political, Economic, Social, Technological, Environmental, and Legal factors to identify strategic opportunities and challenges.

A concise PESTLE analysis of Hyatt Hotels, presented in a digestible format, helps alleviate the pain of information overload by providing clear, actionable insights for strategic decision-making.

This PESTLE analysis serves as a pain point reliever by offering a structured overview of external factors impacting Hyatt, enabling proactive strategy development and risk mitigation.

Economic factors

Global economic growth directly impacts Hyatt's revenue by influencing both consumer and business travel spending. Strong economic expansion in 2024 and projected for 2025 typically means higher disposable incomes and larger corporate travel budgets, which translates to increased demand for accommodations.

For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a pace expected to continue into 2025, supporting travel demand. Regions with robust GDP growth, such as parts of Asia and North America, often see higher occupancy rates and average daily rates for hotels like Hyatt.

Rising inflation is a significant concern for Hyatt Hotels, directly impacting operating costs. For instance, the US Consumer Price Index (CPI) saw an annual increase of 3.4% in April 2024, a figure that influences everything from employee wages to the cost of supplies. This means higher expenses for labor, food and beverage, energy, and property upkeep, all of which can compress profit margins if not managed carefully.

While Hyatt can pass some of these increased costs onto consumers through higher room rates, there's a delicate balance. If prices become too high, particularly in a competitive market, it could deter budget-conscious travelers, impacting occupancy levels. For example, a 10% increase in average daily rates (ADR) might be necessary to offset a 5% rise in operating expenses, but this strategy carries the risk of alienating a segment of the customer base.

Effectively managing these escalating operating costs is therefore paramount for Hyatt's profitability. This involves strategic sourcing of supplies, optimizing energy consumption, and implementing efficient labor management practices to mitigate the impact of inflation. The ability to control expenses while maintaining service quality will be a key determinant of financial success in the coming periods.

Interest rates significantly influence Hyatt's financial strategy. For instance, the Federal Reserve's benchmark rate, which stood around 5.25%-5.50% in early 2024, directly affects the cost of borrowing for new hotel developments and acquisitions. If rates climb, as some economists predict for later in 2024 or 2025, Hyatt's expenses for expanding its portfolio could increase substantially, potentially dampening investment in new properties.

Higher borrowing costs can also impact Hyatt's ability to refinance existing debt, potentially leading to increased interest expenses on its balance sheet. This can reduce profitability and free cash flow available for other strategic initiatives or shareholder returns. The attractiveness of new projects is also diminished when the cost of capital rises, potentially slowing down Hyatt's growth pipeline.

Hyatt's asset-light strategy relies heavily on accessing capital markets efficiently. Favorable interest rates and readily available credit are crucial for funding the development of new hotels managed under franchise or management agreements. In 2024, the global hospitality sector saw a rebound, but access to affordable capital remains a key determinant of how quickly companies like Hyatt can capitalize on market opportunities and expand their global footprint.

Disposable Income and Consumer Spending

Disposable income is a huge driver for the travel industry, and Hyatt is no exception. When people have more money left over after covering essential expenses, they're more likely to book a hotel stay, especially for leisure. This directly impacts Hyatt’s ability to attract guests to its premium and lifestyle brands, which cater to those with higher discretionary spending power.

Consumer confidence plays a crucial role here. As of early 2024, consumer confidence indexes in major markets like the US have shown resilience, suggesting a continued willingness to spend on experiences. For instance, the Conference Board Consumer Confidence Index remained elevated, indicating a positive outlook that supports demand for hospitality services. This trend is particularly beneficial for Hyatt, as it often targets travelers seeking higher-end accommodations and experiences.

- Disposable Income Growth: In 2024, projections for real disposable income growth in developed economies suggest a stable to slightly increasing trend, supporting consumer spending on travel.

- Consumer Confidence: High consumer confidence levels, as seen in recent surveys from late 2023 and early 2024, translate into greater willingness to spend on discretionary items like hotel stays.

- Luxury Segment Demand: Hyatt's focus on luxury and lifestyle brands directly benefits from increased discretionary spending by higher-income households.

- Travel Spending Trends: Reports indicate a strong rebound in leisure travel spending post-pandemic, with many consumers prioritizing experiences, which bodes well for hotel occupancy rates.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact global companies like Hyatt. When Hyatt reports its financial results, earnings from international operations are converted back to its primary reporting currency, the U.S. dollar. This conversion means that changes in exchange rates can directly affect the reported value of those revenues and costs.

For instance, a stronger U.S. dollar can make Hyatt's international earnings appear smaller when translated, potentially impacting profitability metrics. Conversely, a weaker dollar can make travel to the U.S. more affordable for international visitors, potentially boosting demand for Hyatt's U.S. properties. In 2024, the U.S. dollar has shown periods of strength against various global currencies, which could present headwinds for companies with substantial international earnings.

Managing this foreign exchange risk is crucial for Hyatt's financial stability. The company likely employs hedging strategies to mitigate the impact of adverse currency movements. For example, if the euro weakens against the dollar, revenue generated in euros by Hyatt's European hotels would translate to fewer dollars.

- Impact on Reported Earnings: A stronger USD in 2024 could reduce the reported value of international revenue for Hyatt.

- Travel Demand: A weaker USD can make international destinations like the U.S. more appealing to global travelers, potentially benefiting Hyatt's domestic properties.

- Risk Management: Proactive management of foreign exchange exposure through hedging is vital for consistent financial performance.

The economic landscape in 2024 and projected into 2025 presents a mixed but generally supportive environment for Hyatt Hotels. Global economic growth, estimated by the IMF at 3.2% for 2024 and expected to continue at a similar pace, underpins travel demand. However, persistent inflation, with the US CPI at 3.4% in April 2024, increases operating costs, requiring careful cost management and strategic pricing to maintain profitability.

Interest rates, hovering around 5.25%-5.50% for the Federal Reserve's benchmark in early 2024, influence Hyatt's borrowing costs for expansion. While disposable income and consumer confidence remain robust, supporting leisure travel, currency fluctuations, particularly a strong U.S. dollar in 2024, can impact the reported value of international earnings.

| Economic Factor | 2024/2025 Trend | Impact on Hyatt | Data Point |

|---|---|---|---|

| Global Economic Growth | Stable to Moderate | Supports travel demand, increasing occupancy and ADR | IMF projects 3.2% global growth for 2024 |

| Inflation | Elevated | Increases operating costs (labor, supplies, energy) | US CPI at 3.4% (April 2024) |

| Interest Rates | High, potential for stabilization/slight increase | Affects borrowing costs for development and refinancing | Federal Reserve rate 5.25%-5.50% (early 2024) |

| Disposable Income/Consumer Confidence | Resilient | Drives leisure travel spending, benefits premium brands | Elevated Consumer Confidence Index (e.g., Conference Board) |

| Currency Exchange Rates | Volatile, USD strength observed | Impacts reported international earnings; affects international travel affordability | USD showed strength against major currencies in 2024 |

Full Version Awaits

Hyatt Hotels PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hyatt Hotels delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the hospitality giant. Understand the strategic landscape and potential challenges and opportunities facing Hyatt.

Sociological factors

Modern travelers are actively seeking more than just a place to sleep; they crave unique, personalized, and culturally rich experiences. This shift is evident in the growing popularity of boutique hotels and immersive local activities. For instance, a 2024 report indicated that 65% of travelers prioritize authentic experiences over standard tourist attractions.

Hyatt is strategically adapting to these evolving preferences by expanding its portfolio with lifestyle and luxury brands like The Unbound Collection and Thompson Hotels. These brands are designed to offer guests genuine connections to local culture, distinctive design, and curated amenities, moving beyond the conventional hotel offering.

The rise of 'bleisure' travel, where business trips are extended for leisure, is another significant trend influencing consumer choices. In 2025, it's projected that over 70% of business trips will incorporate leisure days, prompting hotels like Hyatt to enhance their offerings with amenities that cater to both work and relaxation, such as co-working spaces and wellness facilities.

Global demographic shifts are profoundly reshaping travel patterns. The burgeoning Gen Z demographic, known for prioritizing experiences and digital integration, represents a significant new market. Concurrently, an aging global population often seeks comfort, accessibility, and longer stays, while the expanding middle classes in emerging economies are increasingly entering the travel market with distinct preferences and budget considerations.

Hyatt is actively responding to these demographic evolutions. For instance, the company's strategic focus on developing brands like Thompson Hotels and the expansion of its all-inclusive portfolio aims to capture the attention of younger, experience-seeking travelers and those from burgeoning markets. In 2024, Hyatt continued to emphasize personalized service and digital convenience, features highly valued by Gen Z and increasingly by other age groups as well.

The post-pandemic era has significantly amplified guest expectations for robust health and safety measures, directly impacting travel decisions. Hyatt's commitment to advanced hygiene standards, like their Global Care & Cleanliness Commitment, aims to reassure travelers and foster confidence in their accommodations.

The wellness tourism sector is experiencing substantial growth, with travelers increasingly seeking experiences that prioritize their well-being. This trend is evident in the projected market size, with the global wellness tourism market expected to reach $1.5 trillion by 2027, up from $700 billion in 2022. Hyatt is responding by expanding its wellness offerings, including enhanced spa services and fitness amenities, to cater to this burgeoning demand.

Work-Life Balance and Remote Work Trends

The evolving landscape of work-life balance, particularly the surge in remote and hybrid models, significantly impacts the hospitality sector. This shift has fueled the rise of 'workcations' and extended stays, as individuals seek to combine professional responsibilities with leisure travel. For instance, a 2024 survey indicated that over 60% of remote workers expressed interest in taking workcations, highlighting a substantial market opportunity.

Hyatt Hotels is strategically positioned to capitalize on these evolving work trends. By enhancing in-room connectivity, offering dedicated co-working spaces within properties, and providing flexible booking options, the company enables guests to seamlessly integrate work and relaxation. This approach directly addresses the needs of digital nomads and those seeking to extend their travel experiences.

- Increased Demand for Extended Stays: The trend of 'workcations' is driving longer hotel bookings as guests utilize accommodations as temporary offices.

- Focus on Connectivity and Workspace Amenities: Hotels are investing in robust Wi-Fi and business-friendly facilities to attract remote workers.

- Flexible Booking and Loyalty Programs: Offering adaptable reservation policies and rewarding extended stays encourages guest loyalty among this demographic.

- Integration of Leisure and Business: The blurring lines between work and leisure necessitate hotel offerings that cater to both productivity and relaxation needs.

Cultural Diversity and Localization

Hyatt Hotels, operating in over 75 countries, must navigate a complex tapestry of cultural norms. For instance, in 2024, Hyatt's presence in markets like India and Japan necessitates a deep understanding of distinct dining preferences and service expectations. This cultural sensitivity is crucial for guest satisfaction and brand loyalty.

Localization extends beyond cuisine; it involves adapting service styles and even interior design. Hyatt Regency hotels might incorporate local art or architectural influences to resonate with regional heritage, thereby creating a more authentic guest experience. This approach was evident in recent renovations of properties in Southeast Asia, aiming to blend modern amenities with traditional aesthetics.

The company's commitment to cultural diversity is reflected in its workforce and marketing. By employing local staff and tailoring marketing campaigns to specific cultural contexts, Hyatt aims to build stronger community ties. This strategy is vital for long-term success in diverse global markets, ensuring that Hyatt is perceived as a welcoming and understanding brand.

Key aspects of cultural diversity and localization for Hyatt include:

- Localized culinary offerings: Adapting menus to regional tastes and dietary restrictions, a significant factor in guest reviews.

- Culturally sensitive service standards: Training staff on local etiquette and customs to provide appropriate guest interactions.

- Heritage-inspired design: Integrating local art, materials, and architectural elements into hotel aesthetics.

- Community engagement: Partnering with local artisans and cultural organizations to enrich guest experiences and support local economies.

Sociological factors highlight a growing demand for authentic, personalized travel experiences, with travelers increasingly seeking cultural immersion. This is supported by data indicating that a significant percentage of travelers, around 65% in 2024, prioritize unique local encounters over typical tourist spots.

Hyatt is actively addressing this by expanding its lifestyle brands, like The Unbound Collection, which focus on local culture and distinctive design. Furthermore, the rise of 'bleisure' travel, where business trips blend with leisure, is reshaping hotel needs, with projections suggesting over 70% of business trips will include leisure days by 2025.

Demographic shifts, including the rise of Gen Z who value experiences and digital integration, alongside an aging population seeking comfort and accessibility, are also influencing travel patterns. Hyatt's strategy, including its focus on brands like Thompson Hotels and its all-inclusive portfolio, aims to cater to these diverse and evolving consumer preferences.

The post-pandemic emphasis on health and safety, coupled with the booming wellness tourism sector—expected to reach $1.5 trillion by 2027—is driving demand for enhanced hygiene and well-being amenities. Hyatt's Global Care & Cleanliness Commitment and expanded spa and fitness offerings directly respond to these critical guest priorities.

Technological factors

The travel industry's digital shift is undeniable, with platforms like Booking.com and Expedia dominating online bookings. Hyatt's own World of Hyatt app saw significant growth, with mobile bookings accounting for a substantial portion of their direct reservations in 2023, reflecting a trend that continued into early 2024.

Hyatt's commitment to digital innovation is evident in their investment in mobile app features like contactless check-in and personalized offers, aiming to streamline the guest experience. This focus is crucial for maintaining competitiveness, as data from 2024 indicates that over 70% of travelers prefer booking through mobile channels for convenience.

Hyatt is leveraging Artificial Intelligence and Machine Learning to significantly improve guest satisfaction and operational performance. For instance, AI-powered chatbots are handling an increasing volume of customer inquiries, freeing up human staff for more complex issues. This adoption is directly tied to enhancing guest experiences through personalized recommendations and streamlined service delivery.

Predictive analytics, a core component of their ML strategy, is crucial for optimizing pricing and demand forecasting. By analyzing vast datasets, Hyatt can better anticipate occupancy rates and adjust pricing dynamically, aiming to maximize revenue. This data-driven approach is essential in the competitive hospitality market, with industry-wide revenue management software seeing significant adoption.

Hyatt is increasingly integrating smart room technologies, featuring voice-activated controls and personalized climate settings, to elevate guest comfort and convenience. These advancements also enable more efficient energy management and streamlined maintenance, directly impacting operational costs and sustainability efforts.

The proliferation of Internet of Things (IoT) devices within hotel rooms allows for a more connected and responsive guest experience. This technological shift is crucial for meeting evolving guest expectations, with reliable high-speed Wi-Fi remaining a fundamental requirement for a positive stay.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical for Hyatt Hotels, given the vast amount of guest information they handle. In 2024, the hospitality industry faced escalating cyber threats, with data breaches costing an average of $4.45 million globally, according to IBM's 2024 Cost of a Data Breach Report. Hyatt's commitment to protecting sensitive customer data from unauthorized access and breaches is not just a legal requirement but a cornerstone of guest trust and loyalty. Failure to do so can lead to significant financial penalties and severe reputational damage.

Adherence to stringent data privacy regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is non-negotiable. These regulations impose strict rules on how personal data is collected, processed, and stored. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Hyatt's ongoing investment in advanced data security infrastructure and employee training is therefore essential to navigate this complex regulatory landscape and safeguard guest information.

- Global average cost of a data breach in 2024: $4.45 million

- Potential GDPR fines: up to 4% of global annual turnover or €20 million

- Key regulations impacting data handling: GDPR, CCPA

- Consequences of breaches: loss of guest trust, legal penalties, reputational damage

Virtual and Augmented Reality for Marketing

Virtual and augmented reality (VR/AR) are increasingly vital for marketing, allowing potential guests to experience Hyatt properties immersively before booking. These technologies offer virtual tours of rooms and amenities, significantly influencing decisions. For instance, a 2024 report indicated that 65% of consumers are more likely to book a hotel after a virtual tour, highlighting VR's impact on customer engagement and conversion rates.

Hyatt can leverage VR/AR to provide unparalleled pre-arrival experiences, showcasing unique selling propositions and differentiating itself in a competitive market. This approach allows for a detailed exploration of facilities, from conference spaces to dining options, directly impacting guest expectations and satisfaction. The global VR in travel market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially by 2028, indicating a strong trend towards immersive digital experiences in the hospitality sector.

- Immersive Property Showcases: VR/AR enables virtual tours of hotel rooms, suites, and common areas, allowing guests to explore layouts and décor remotely.

- Enhanced Pre-Arrival Engagement: These technologies provide interactive experiences that build anticipation and inform booking decisions, potentially reducing uncertainty.

- Competitive Differentiation: By offering cutting-edge VR/AR marketing, Hyatt can stand out from competitors and attract tech-savvy travelers.

Hyatt's digital transformation is accelerating, with mobile bookings comprising a significant portion of direct reservations in early 2024, mirroring a trend where over 70% of travelers prefer mobile booking for convenience. The company is actively integrating AI and machine learning to enhance guest experiences through personalized recommendations and efficient service delivery via chatbots. Furthermore, predictive analytics are being employed to optimize pricing and forecast demand, crucial for revenue management in the competitive hospitality landscape.

The adoption of smart room technologies, including voice controls and personalized settings, is on the rise to improve guest comfort and operational efficiency. Internet of Things (IoT) devices are also being integrated for a more connected guest experience, with high-speed Wi-Fi remaining a fundamental expectation. Cybersecurity is a paramount concern, especially given that data breaches in the hospitality sector cost an average of $4.45 million globally in 2024, and adherence to regulations like GDPR and CCPA is critical to avoid substantial fines and maintain guest trust.

Virtual and augmented reality (VR/AR) are becoming key marketing tools, with studies in 2024 showing that 65% of consumers are more likely to book after a virtual tour, enhancing engagement and conversion rates. These immersive technologies allow potential guests to experience Hyatt properties remotely, offering a competitive edge in the market.

| Technology Area | Hyatt's Application | Industry Trend/Impact | Key Data Point (2024/Early 2025) |

|---|---|---|---|

| Mobile Technology | Direct reservations via World of Hyatt app | Over 70% of travelers prefer mobile booking | Mobile bookings a substantial portion of direct reservations |

| AI & Machine Learning | AI chatbots, personalized recommendations | Improving guest satisfaction and operational efficiency | AI adoption for enhanced guest experiences |

| Data Analytics | Predictive analytics for pricing and demand | Optimizing revenue management | Significant adoption of revenue management software |

| Smart Room Tech & IoT | Voice controls, personalized settings, connected devices | Elevating guest comfort and operational efficiency | High-speed Wi-Fi a fundamental requirement |

| Cybersecurity | Protecting guest data, regulatory compliance | Mitigating risks of data breaches | Global average cost of data breach: $4.45 million |

| VR/AR | Virtual property tours, immersive marketing | Influencing booking decisions, competitive differentiation | 65% more likely to book after virtual tour |

Legal factors

Hyatt Hotels, operating globally, faces a complex landscape of data privacy regulations. Key examples include the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, alongside a growing number of similar laws emerging worldwide. These regulations significantly influence how Hyatt collects, stores, processes, and safeguards customer information, directly impacting marketing initiatives and the operation of loyalty programs.

Compliance with these stringent data privacy laws is paramount. For instance, GDPR mandates specific consent mechanisms and data subject rights, while CCPA grants consumers rights regarding their personal information. Failure to adhere to these rules can lead to severe consequences, including substantial financial penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Beyond financial repercussions, non-compliance can also inflict significant damage to Hyatt's reputation and customer trust.

Hyatt Hotels, a global employer, navigates a complex web of labor laws. These regulations dictate minimum wages, overtime pay, and mandated employee benefits, directly influencing operational expenses. For instance, in the US, the federal minimum wage remains $7.25 per hour, though many states and cities, including those where Hyatt operates, have significantly higher rates, impacting the company's wage bill.

Adherence to these diverse employment regulations is crucial for maintaining positive employee relations and avoiding costly legal penalties. Hyatt's human resource strategies must constantly adapt to evolving legislation concerning working conditions, anti-discrimination, and collective bargaining rights. In 2024, ongoing discussions around gig economy worker classification and potential mandates for increased paid sick leave in various regions present ongoing compliance challenges.

Changes in labor laws can force significant adjustments to staffing models and compensation frameworks. For example, a new law mandating higher overtime pay could prompt Hyatt to re-evaluate scheduling practices to manage labor costs more effectively. The potential for increased unionization activity in the hospitality sector also means Hyatt must remain vigilant in its approach to employee representation and negotiation.

Hyatt Hotels operates within a framework of rigorous health and safety standards, intensified by the global focus on hygiene and well-being following the COVID-19 pandemic. These regulations encompass everything from meticulous sanitation and food handling practices to robust fire prevention and emergency response plans.

To maintain its operational licenses and safeguard its esteemed brand reputation, Hyatt is obligated to not only meet but often exceed these mandated health and safety benchmarks across all its global properties. This commitment is crucial for protecting both guests and its workforce.

In 2024, the hospitality sector, including major players like Hyatt, continues to invest heavily in advanced cleaning technologies and staff training to ensure consistent compliance. For instance, many hotel chains reported a significant increase in spending on enhanced disinfection protocols and air filtration systems in 2023, a trend expected to continue into 2025 as guest expectations for safety remain high.

Consumer Protection Laws

Consumer protection laws significantly shape Hyatt's operations, mandating transparency in advertising, booking terms, and cancellation policies. Regulations around data privacy, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which came into full effect in 2023, impact how Hyatt handles guest information and loyalty program data. Ensuring fair business practices and robust dispute resolution mechanisms are critical to maintaining guest trust and avoiding costly legal challenges.

These legal frameworks necessitate clear communication regarding pricing, fees, and loyalty program benefits. For instance, the U.S. Department of Justice has continued to enforce accessibility standards under the Americans with Disabilities Act (ADA), requiring hotels like Hyatt to ensure their physical spaces and digital platforms are accessible to all guests. Hyatt's commitment to these standards, including website accessibility, is an ongoing operational and legal consideration.

- Advertising Standards: Laws prevent deceptive advertising, ensuring pricing and amenity claims are accurate.

- Booking and Cancellation Policies: Consumer protection requires clear, upfront terms for bookings and fair cancellation procedures.

- Data Privacy: Regulations like CCPA/CPRA govern how Hyatt collects, uses, and protects guest personal information.

- Dispute Resolution: Hotels must provide fair and accessible methods for resolving customer complaints and disputes.

Property Development and Zoning Laws

Hyatt's expansion is heavily influenced by property development and zoning laws. New hotel construction and renovations must adhere to local zoning regulations, building codes, and environmental impact assessments. For instance, in 2024, many cities are tightening regulations on urban development, potentially increasing approval times and costs for new projects.

Navigating these legal landscapes is critical for Hyatt's growth strategy. Securing necessary permits and licenses requires careful engagement with local authorities. Failure to comply can lead to project delays and increased expenses, impacting Hyatt's ability to execute its development pipeline efficiently.

- Zoning Compliance: Hyatt must ensure all new developments meet local zoning ordinances, which dictate land use and building density.

- Building Codes: Adherence to updated building codes, often revised in 2024 to include enhanced safety and sustainability features, is mandatory.

- Environmental Reviews: Environmental impact assessments are crucial, especially in areas with sensitive ecosystems, potentially adding months to project timelines.

- Licensing: Obtaining operational licenses, including liquor and business permits, requires thorough vetting by municipal bodies.

Hyatt Hotels must navigate a complex web of international and national laws affecting its operations, from data privacy to labor practices. For instance, the EU's GDPR and the US's CCPA/CPRA dictate stringent data handling protocols, with GDPR fines potentially reaching 4% of global annual revenue. Labor laws also significantly impact costs, with varying minimum wages and benefits across regions; in the US, many states and cities have minimum wages substantially higher than the federal $7.25 per hour.

Environmental factors

Consumer and investor appetite for sustainable travel is on the rise, compelling companies like Hyatt to prioritize eco-friendly operations. In 2023, a significant portion of travelers indicated they would pay more for sustainable options, a trend expected to continue through 2025.

Hyatt is responding by integrating green building standards and focusing on waste reduction initiatives across its portfolio. Efforts to conserve energy and water are key components of this strategy, aligning with guest preferences for environmentally conscious accommodations.

Climate change presents significant physical risks to Hyatt's properties, particularly those in coastal areas susceptible to rising sea levels and regions experiencing more frequent extreme weather events. For example, a 2024 report indicated that coastal erosion is accelerating in many popular tourist destinations where Hyatt operates. This necessitates substantial investment in resilient infrastructure and potentially revising future development strategies to account for these evolving environmental conditions.

Resource scarcity, especially concerning water, is another critical factor impacting hotel operations. In 2024, several regions where Hyatt has a presence experienced severe droughts, leading to increased operational costs for water management and potentially affecting guest experience. Adapting to these challenges might involve implementing advanced water conservation technologies and exploring alternative water sources to ensure business continuity.

Hyatt Hotels is actively pursuing efficient resource management, a critical environmental factor. This includes ambitious targets for reducing energy and water consumption across its global portfolio. For instance, by the end of 2023, Hyatt reported a 15% reduction in energy intensity compared to its 2019 baseline, demonstrating tangible progress.

Waste reduction and recycling programs are also central to Hyatt's environmental strategy. The company has made significant strides in eliminating single-use plastics, with over 90% of its properties having phased out key items by early 2024. Furthermore, efforts to manage food waste are ongoing, aiming to divert a substantial portion from landfills, aligning with broader sustainability objectives.

Carbon Footprint Reduction Goals

Hyatt is actively pursuing ambitious carbon footprint reduction goals as part of its broader climate action strategy. The company has committed to science-based targets, aiming to significantly decrease greenhouse gas emissions throughout its extensive operations and complex supply chain. This commitment is not just about environmental stewardship; it's also about aligning with global sustainability efforts and responding to increasing stakeholder demand for responsible business practices.

To achieve these targets, Hyatt is making substantial investments in key areas. These include a strategic shift towards renewable energy sources to power its hotels, implementing advanced energy efficiency measures within its properties to minimize consumption, and actively collaborating with its vast network of suppliers to encourage and integrate sustainable practices across the entire value chain. These initiatives are critical for meeting environmental obligations and enhancing the company's long-term resilience.

Hyatt's progress is being tracked with tangible results. For instance, by the end of 2023, the company reported a 23% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline, exceeding its interim goal. Furthermore, Hyatt has set a target to engage 75% of its suppliers by spend to set their own science-based targets by 2025. This proactive approach underscores the company's dedication to measurable environmental impact.

- Science-Based Targets: Hyatt has committed to reducing absolute Scope 1 and 2 greenhouse gas emissions by 46.2% by 2030 from a 2019 baseline.

- Renewable Energy Adoption: By the close of 2023, 35% of Hyatt's global electricity consumption was sourced from renewable energy.

- Supplier Engagement: Hyatt aims to have 75% of its suppliers by spend set science-based targets by 2025.

- Energy Efficiency Investments: Over $150 million has been invested since 2019 in energy efficiency projects across its portfolio, resulting in an estimated 10% reduction in energy intensity.

Environmental Regulations and Certifications

Hyatt Hotels operates within a complex web of environmental regulations, covering everything from carbon emissions and water usage to waste management and responsible land development. For instance, in 2024, the EU continued to strengthen its Emissions Trading System (ETS), impacting travel and hospitality sectors. Hyatt's commitment to sustainability is further underscored by its pursuit of certifications like Green Key, a leading eco-label for tourism establishments.

These initiatives are not just about compliance; they are strategic. By actively managing its environmental footprint and obtaining certifications, Hyatt enhances its brand image, attracting a growing segment of travelers who prioritize eco-friendly options. This also resonates with investors increasingly focused on Environmental, Social, and Governance (ESG) performance, a trend that saw significant growth in sustainable investment funds throughout 2024 and early 2025.

- Regulatory Compliance: Hyatt must adhere to diverse environmental laws, including those governing air and water quality, waste disposal, and sustainable sourcing.

- Green Certifications: Pursuing certifications like Green Key or LEED (Leadership in Energy and Environmental Design) validates Hyatt's environmental efforts.

- Reputation Enhancement: Demonstrating strong environmental stewardship improves brand perception among environmentally conscious consumers and stakeholders.

- Investor Appeal: Robust ESG performance, including environmental management, is increasingly a key factor for attracting investment capital in 2024-2025.

Hyatt is actively addressing environmental concerns by focusing on sustainability and climate action. The company has set ambitious science-based targets to reduce greenhouse gas emissions, aiming for a 46.2% reduction in absolute Scope 1 and 2 emissions by 2030 compared to a 2019 baseline. By the end of 2023, Hyatt reported sourcing 35% of its global electricity from renewable sources, demonstrating a tangible shift towards cleaner energy. Furthermore, Hyatt is engaging its supply chain, with a goal for 75% of its suppliers by spend to set their own science-based targets by 2025, highlighting a commitment to a broader environmental impact.

Hyatt's investments in energy efficiency are substantial, with over $150 million allocated since 2019 to projects that have already led to an estimated 10% reduction in energy intensity. These efforts are crucial for managing operational costs and aligning with growing consumer and investor demand for eco-friendly practices. The company's progress in reducing waste, particularly single-use plastics, with over 90% of properties phasing them out by early 2024, further solidifies its commitment to environmental stewardship.

Climate change poses physical risks, such as extreme weather events and rising sea levels, which necessitate investments in resilient infrastructure. Resource scarcity, particularly water, also presents operational challenges, driving Hyatt to implement advanced conservation technologies. Navigating a complex regulatory landscape, including evolving emissions standards like the EU ETS in 2024, requires continuous adaptation and strategic planning to maintain compliance and enhance brand reputation through certifications like Green Key.

| Environmental Factor | Hyatt's Action/Commitment | Key Data/Target (2023-2025) |

|---|---|---|

| Greenhouse Gas Emissions | Science-based targets for absolute reduction | 46.2% reduction by 2030 (vs. 2019 baseline); 23% reduction in Scope 1 & 2 intensity by end of 2023. |

| Renewable Energy | Increased sourcing of renewable electricity | 35% of global electricity consumption from renewables by end of 2023. |

| Supplier Engagement | Encouraging suppliers to set emission targets | 75% of suppliers by spend to set science-based targets by 2025. |

| Energy Efficiency | Investment in efficiency projects | Over $150 million invested since 2019; ~10% reduction in energy intensity. |

| Waste Reduction | Elimination of single-use plastics | Over 90% of properties phased out key items by early 2024. |

PESTLE Analysis Data Sources

Our Hyatt Hotels PESTLE Analysis is built on a comprehensive review of data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are well-founded and current.