Hyatt Hotels Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyatt Hotels Bundle

Unlock the strategic blueprint behind Hyatt Hotels's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how Hyatt effectively targets diverse customer segments, builds strong partnerships, and delivers unique value propositions across its portfolio of brands. Discover the core activities and revenue streams that drive its competitive advantage.

Dive deeper into the operational engine of Hyatt Hotels by exploring its full Business Model Canvas. Understand its cost structure, key resources, and channels to market, providing a clear picture of how it manages its vast network and maintains brand loyalty. This is essential for anyone seeking to grasp the intricacies of a global hospitality leader.

Ready to gain actionable insights from Hyatt Hotels's proven business model? Our complete Business Model Canvas is your key to understanding its customer relationships, value creation, and competitive positioning. Download the full, professionally analyzed document to inform your own strategic planning and business development.

Partnerships

Hyatt's business model heavily relies on its relationships with strategic property owners and developers. These partnerships are the bedrock for its global expansion, allowing Hyatt to grow its brand presence through management and franchise agreements. This approach is key to Hyatt's asset-light strategy, minimizing the need for direct capital investment in property acquisition.

In 2024, Hyatt continued to forge these vital alliances, signing numerous deals for new hotel developments. For instance, the company announced significant expansion plans in India and Southwest Asia, with many of these new properties slated to open their doors in 2025. These collaborations are essential for diversifying Hyatt's portfolio and reaching new markets efficiently.

Hyatt’s partnerships with Global Distribution Systems (GDS) like Amadeus and Sabre, and Online Travel Agencies (OTAs) such as Expedia and Booking.com, are fundamental for achieving widespread market penetration and maintaining healthy occupancy rates. These collaborations are crucial for showcasing Hyatt's offerings to a vast global audience, thereby complementing the brand's direct booking efforts.

These digital marketplaces offer unparalleled visibility, ensuring Hyatt properties are discoverable by travelers actively searching for accommodations worldwide. In 2024, OTAs continued to be a significant booking channel for many hotel groups, with some reporting that over 50% of their bookings originated from these third-party platforms, highlighting their indispensable role in driving volume.

However, these vital partnerships necessitate a careful balancing act. Hyatt, like other major hotel chains, must strategically manage the commission structures inherent in these relationships. The goal is to maximize the booking volume generated through these channels while mitigating the associated costs to ensure profitability and a positive return on investment for each booking facilitated.

Hyatt actively partners with other loyalty programs, like its past collaboration with American Airlines AAdvantage, to boost the appeal of its World of Hyatt program. While the direct earning of reciprocal points shifted in January 2025, the ongoing option for members to choose shared benefits cultivates loyalty across brands and draws in a wider range of travelers.

Technology and Innovation Providers

Hyatt’s key partnerships with technology and innovation providers are critical for staying ahead in the hospitality industry. These collaborations fuel advancements in guest experience and operational efficiency. For instance, in 2024, Hyatt continued to leverage partnerships for its digital platforms, aiming to enhance direct booking channels and loyalty program engagement.

These partnerships are vital for integrating cutting-edge solutions. This includes collaborations for sophisticated booking engines, smart in-room technologies that offer personalized comfort, and advanced data analytics platforms. These tools allow Hyatt to better understand guest preferences, leading to more tailored services and smoother operations, a key focus for the company in 2024.

- Booking Platforms: Collaborations with global distribution systems and online travel agencies remain crucial for maximizing reach and direct bookings.

- In-Room Technology: Partnerships with providers of smart TVs, voice-activated assistants, and mobile key solutions enhance the guest stay.

- Data Analytics: Working with data science firms helps Hyatt analyze guest data to personalize marketing, improve service delivery, and optimize revenue management.

- Operational Software: Collaborations on property management systems (PMS) and other back-end software streamline operations and improve staff efficiency.

Local Suppliers and Community Organizations

Hyatt actively partners with local suppliers to source food, beverages, and amenities. This not only bolsters local economies but also enriches the guest experience with authentic regional offerings. For instance, in 2024, many Hyatt properties continued to highlight locally sourced ingredients in their dining establishments, contributing to the unique character of each location.

Beyond local commerce, Hyatt collaborates with community and sustainability organizations. These partnerships are crucial for advancing Hyatt's Environmental, Social, and Governance (ESG) goals. A prime example is their involvement with the Sustainable Hospitality Alliance, which guides efforts in responsible sourcing, efficient water management, and impactful community initiatives.

- Local Sourcing: Hyatt's commitment to local suppliers in 2024 supported numerous small businesses and agricultural producers, enhancing the authenticity of guest stays.

- Community Engagement: Partnerships with organizations like RiseHY provide pathways for local talent, fostering community development and employment opportunities.

- Sustainability Focus: Collaborations with groups like the Sustainable Hospitality Alliance drive progress in areas such as reducing water consumption and promoting responsible waste management across properties.

Hyatt's strategic alliances with property owners and developers are fundamental to its asset-light growth model, enabling global expansion through management and franchise agreements. These partnerships allow Hyatt to increase its brand footprint without significant capital outlay for property acquisition. In 2024, Hyatt actively pursued new development deals, particularly in emerging markets, underscoring the critical role of these owner relationships in diversifying its portfolio and market reach.

Collaborations with Global Distribution Systems (GDS) and Online Travel Agencies (OTAs) are vital for market penetration and occupancy rates, providing access to a vast global customer base. While OTAs continued to be a significant booking channel in 2024, with some hotel groups reporting over half their bookings from these platforms, managing commission structures remains a key strategic consideration for profitability.

Hyatt's engagement with technology providers in 2024 focused on enhancing guest experiences and operational efficiency through digital platforms and smart in-room technologies. These partnerships are crucial for integrating advanced booking engines and data analytics to personalize services and optimize revenue management, ensuring Hyatt remains competitive in a rapidly evolving digital landscape.

| Partnership Type | Key Function | 2024 Impact/Focus |

|---|---|---|

| Property Owners & Developers | Brand expansion via management/franchise agreements | Secured numerous new development deals, particularly in India and Southwest Asia. |

| GDS & OTAs | Market reach, booking volume, occupancy rates | Continued reliance on these channels for visibility and reservations; strategic commission management. |

| Technology Providers | Guest experience enhancement, operational efficiency | Leveraged partnerships for digital platforms, loyalty engagement, and smart room technologies. |

| Loyalty Program Partners | Customer loyalty, cross-brand appeal | Cultivated loyalty through shared benefits, despite shifts in direct earning options in early 2025. |

| Local Suppliers | Authentic guest experience, community support | Highlighted locally sourced ingredients in dining, enriching unique property character. |

| Sustainability Orgs | ESG goals, responsible practices | Advanced efforts in responsible sourcing and community initiatives via alliances like the Sustainable Hospitality Alliance. |

What is included in the product

Hyatt's Business Model Canvas focuses on delivering differentiated guest experiences through a diverse portfolio of brands, targeting various traveler segments via direct bookings and strategic partnerships, and leveraging loyalty programs to foster repeat business and build strong customer relationships.

Hyatt's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and adaptation.

It efficiently condenses Hyatt's strategic approach into a digestible format, allowing for quick review and collaborative refinement of their hotel business model.

Activities

Hyatt's primary activities revolve around managing and franchising its extensive hotel and resort brands worldwide. This approach, often described as asset-light, allows the company to expand its reach and revenue streams by leveraging its brand recognition and operational know-how, rather than directly owning properties.

This strategic focus on management and franchise agreements is designed to generate substantial fee-based income. In 2023, Hyatt reported record gross fees, a testament to the success of this model. This growth in fees directly reflects the increasing number of hotels operating under Hyatt's management and franchise contracts.

Hyatt's brand development and portfolio expansion are crucial for its success, spanning from ultra-luxury to more accessible select-service options. This strategic growth ensures they cater to a wide range of travelers and market segments.

In 2024, Hyatt made significant moves by acquiring Standard International and its portfolio, including The Standard, The Peri, and The Mark, bolstering its lifestyle and luxury offerings. This was followed by the May 2025 launch of Unscripted by Hyatt, further diversifying their lifestyle brand collection.

Hyatt's core activities include managing the World of Hyatt loyalty program, a crucial driver of customer experience and retention. This program is designed to reward loyal guests, encouraging repeat stays and fostering deeper engagement with the brand.

In 2024, Hyatt enhanced its loyalty program with a revamped Milestone Rewards structure, offering more personalized reward choices. These updates aim to incentivize longer stays and encourage guests to participate more actively, ultimately boosting guest loyalty.

The focus on exceptional customer experiences, coupled with these loyalty program enhancements, directly translates into increased guest satisfaction and a stronger competitive position in the hospitality market. This strategic approach is key to driving sustained revenue growth.

Sales, Marketing, and Revenue Management

Hyatt's business model heavily relies on aggressive sales and marketing to drive demand across its diverse customer segments. This involves tailored campaigns for leisure, business, and group travelers, ensuring broad market reach.

Sophisticated revenue management is crucial for optimizing pricing and maximizing occupancy, directly impacting Revenue Per Available Room (RevPAR). Dynamic pricing strategies are employed to adapt to market conditions and demand fluctuations.

These efforts are reflected in Hyatt's financial performance. For instance, Hyatt reported a 5.7% increase in system-wide RevPAR in the first quarter of 2025, underscoring the effectiveness of their sales, marketing, and revenue management strategies.

- Targeted Traveler Segments: Campaigns focus on leisure, business, and group bookings.

- Dynamic Pricing: Strategies adjust rates based on real-time demand.

- RevPAR Growth: Q1 2025 saw a 5.7% increase in system-wide RevPAR.

- Occupancy Maximization: Key activities aim to fill rooms efficiently.

Property Development and Asset Recycling

Hyatt actively manages its real estate portfolio, balancing its asset-light approach with strategic property development. This involves creating new assets and selectively selling existing ones to optimize returns and generate capital.

A key aspect of this strategy is asset recycling, where Hyatt reinvests proceeds from property sales into new development opportunities or acquisitions. This ensures the portfolio remains dynamic and aligned with market demands.

Hyatt has a clear financial target for this activity, aiming to realize at least $2 billion in proceeds from asset sales by the end of 2027. This demonstrates a focused effort to unlock value from its owned real estate.

- Strategic Development: Hyatt undertakes new property development projects to expand its brand presence and offerings.

- Asset Sales: The company strategically disposes of owned real estate assets to optimize its portfolio and generate liquidity.

- Capital Generation: These asset sales are crucial for generating capital, supporting further investment and growth initiatives.

- Portfolio Optimization: By recycling assets, Hyatt ensures its real estate holdings are high-performing and strategically located.

Hyatt's key activities center on managing and franchising its hotel portfolio, focusing on brand development and expanding its diverse offerings. They actively manage the World of Hyatt loyalty program to boost customer retention and engagement. Furthermore, Hyatt employs robust sales, marketing, and revenue management strategies to drive demand and optimize occupancy.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Brand Management & Franchising | Overseeing and expanding hotel brands through management and franchise agreements. | Acquired Standard International in 2024, adding lifestyle brands. Launched Unscripted by Hyatt in May 2025. |

| Loyalty Program Management | Operating and enhancing the World of Hyatt program to drive guest loyalty. | Revamped Milestone Rewards in 2024 for more personalized guest choices. |

| Sales, Marketing & Revenue Management | Driving demand through targeted campaigns and optimizing pricing for occupancy. | System-wide RevPAR increased by 5.7% in Q1 2025. |

| Real Estate Portfolio Management | Strategic development and disposition of owned properties. | Aiming to realize at least $2 billion in asset sale proceeds by the end of 2027. |

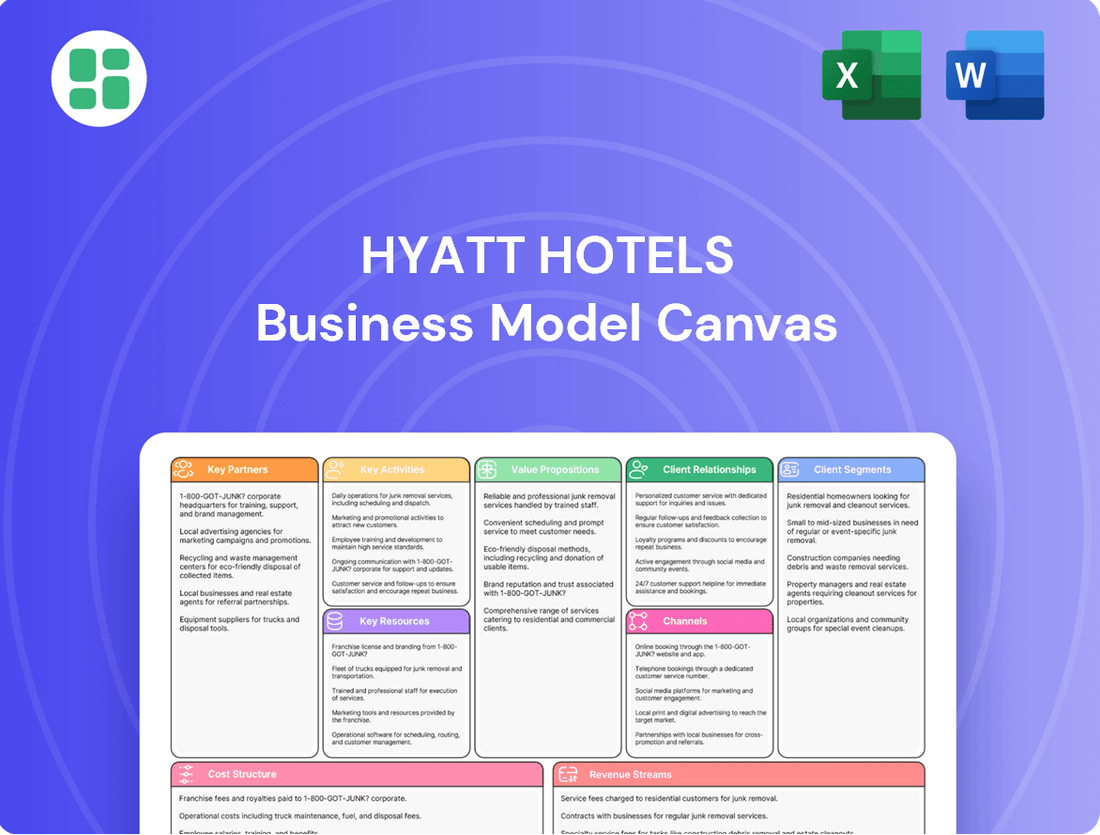

Preview Before You Purchase

Business Model Canvas

The Hyatt Hotels Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive analysis, ready for your strategic planning.

Resources

Hyatt's global brand portfolio, encompassing luxury names like Park Hyatt and lifestyle offerings such as Andaz, alongside its inclusive collections, is a cornerstone of its business. This diverse array of brands allows Hyatt to cater to a wide range of traveler preferences and market segments.

The company's proprietary operational systems and extensive intellectual property, including its reservation platforms and loyalty programs, are critical assets. These systems drive efficiency and customer engagement, providing a significant competitive edge in the hospitality industry.

In 2024, Hyatt continued to expand its brand presence, with a notable focus on its inclusive collection, aiming to capture a larger share of the vacation ownership and resort market. This strategic brand development underpins its ability to attract and retain a broad customer base.

Hyatt's physical hotel properties, encompassing owned, leased, managed, and franchised locations, are the bedrock of its service delivery. These tangible assets, even as Hyatt pursues an asset-light strategy, represent the core of its operational footprint and guest experience.

As of the first quarter of 2024, Hyatt's portfolio included over 1,400 hotels. This diverse mix of ownership and management structures allows Hyatt to maintain a strong brand presence while adapting to market dynamics and capital efficiency goals.

The World of Hyatt loyalty program stands as a cornerstone of Hyatt's business model, boasting a substantial and growing member base. By the close of 2024, this program is projected to encompass around 54 million members, representing a significant intangible asset for the company.

This vast network of loyal customers is instrumental in driving repeat business, as members are incentivized to choose Hyatt properties for their travel needs. The program's structure encourages consistent engagement, leading to a predictable revenue stream and a reduced reliance on less predictable new customer acquisition.

Furthermore, the extensive data generated by these millions of members provides invaluable insights into customer preferences, booking patterns, and spending habits. This information allows Hyatt to personalize offers, refine marketing strategies, and enhance the overall guest experience, thereby strengthening brand loyalty and driving long-term value.

Human Capital and Expertise

Hyatt's human capital and expertise are foundational to its business model. This includes the collective knowledge and skills of its entire workforce, from frontline hotel associates to seasoned corporate leadership. Their deep understanding of hospitality operations, brand stewardship, and exceptional customer service delivery is what truly differentiates Hyatt in a competitive market.

The ability of Hyatt's employees to consistently provide high-quality guest experiences and effectively manage intricate global operations is absolutely crucial for the company's sustained success and brand reputation.

- Skilled Workforce: Hyatt employs a diverse global team with specialized skills in hotel management, culinary arts, marketing, and finance.

- Expertise in Hospitality: Years of experience in the hospitality sector translate into efficient operations and superior guest satisfaction.

- Brand Management: Employees are trained to embody and uphold Hyatt's brand values, ensuring consistent service quality across all properties.

- Customer Service Excellence: A strong focus on training and development empowers staff to deliver personalized and memorable guest interactions.

Technology Platforms and Data Infrastructure

Hyatt leverages sophisticated technology platforms as a cornerstone of its operations. These include robust systems for reservations, property management, and customer relationship management (CRM), all designed to streamline guest interactions and internal processes.

The company's investment in data analytics infrastructure is paramount. This allows Hyatt to process vast amounts of guest data, enabling personalized experiences and driving more informed strategic decisions across the organization.

In 2024, the hospitality sector continued its digital transformation, with companies like Hyatt prioritizing technology to enhance efficiency and guest satisfaction. For example, advancements in AI-powered chatbots and personalized booking engines are becoming standard, reflecting the industry's move towards greater digital integration.

- Reservations Systems: Integrated platforms that manage bookings across all channels, ensuring real-time availability and pricing.

- Property Management Systems (PMS): Core software for hotel operations, covering check-in/check-out, room assignments, and billing.

- Customer Relationship Management (CRM): Tools to track guest preferences, loyalty program data, and communication history for personalized service.

- Data Analytics Infrastructure: Systems for collecting, analyzing, and interpreting guest behavior and operational data to inform business strategy.

Hyatt's key resources include its extensive global brand portfolio, proprietary operational systems, and a vast network of physical hotel properties. The World of Hyatt loyalty program, with its substantial and growing membership, is a critical intangible asset, driving repeat business and providing valuable customer insights.

The company's human capital, encompassing skilled employees across all levels, is fundamental to delivering exceptional guest experiences and managing complex operations. Sophisticated technology platforms for reservations, property management, and CRM, supported by robust data analytics, further enhance efficiency and personalization.

| Resource Category | Key Components | Significance |

|---|---|---|

| Brand Portfolio | Luxury (Park Hyatt), Lifestyle (Andaz), Inclusive Collections | Caters to diverse traveler preferences and market segments. |

| Intellectual Property & Systems | Proprietary operational systems, reservation platforms, loyalty programs | Drives efficiency, customer engagement, and competitive advantage. |

| Physical Assets | Owned, leased, managed, and franchised hotel properties | Core operational footprint and guest experience delivery. |

| Loyalty Program (World of Hyatt) | ~54 million members (projected end of 2024) | Drives repeat business, customer insights, and predictable revenue. |

| Human Capital | Skilled workforce, expertise in hospitality, brand management | Ensures consistent service quality and operational excellence. |

| Technology & Data | Reservations, PMS, CRM systems, data analytics infrastructure | Streamlines operations, enables personalized experiences, informs strategy. |

Value Propositions

Hyatt’s strength lies in its diverse portfolio of high-quality brands, spanning from the opulent Park Hyatt to the convenient Hyatt Place. This broad offering ensures they can cater to virtually any traveler's needs, whether for a business trip or a leisurely vacation.

This brand diversity is a key value proposition, allowing guests to select an experience that perfectly matches their trip's purpose, budget, and desired service level. For instance, in 2024, Hyatt continued to expand its presence in the select-service segment, a popular choice for value-conscious travelers, while also maintaining its appeal in the luxury market.

Hyatt's commitment to exceptional guest experiences and personalized service is central to its appeal. This translates into attentive staff anticipating needs and unique property designs that offer a sense of place, all aimed at making guests feel genuinely cared for.

This focus on individual attention is more than just a philosophy; it's a tangible part of their operation. For instance, Hyatt's loyalty program members often receive tailored offers and recognition, enhancing their feeling of value and encouraging repeat business.

In 2024, Hyatt continued to invest in training and technology to further elevate these personalized interactions. Their dedication to 'care for people so they can be their best' directly fuels these efforts, aiming to create memorable stays that drive customer loyalty and positive word-of-mouth.

The World of Hyatt loyalty program offers substantial value by delivering personalized rewards and exclusive benefits across Hyatt's worldwide properties. This program is designed to encourage repeat business and build strong customer relationships.

Hyatt has continued to enhance the World of Hyatt program, with notable updates in 2024 and planned for 2025. These include expanded milestone rewards, offering members more choices as they reach new tiers, further incentivizing loyalty and engagement.

Global Presence and Accessibility

Hyatt's global presence is a cornerstone of its value proposition, offering unparalleled accessibility to travelers. As of December 31, 2024, the company boasted over 1,400 properties strategically situated in 79 countries spanning six continents. This expansive network ensures that guests can find Hyatt accommodations in virtually any major business or leisure hub they wish to visit, simplifying travel arrangements whether for corporate trips or personal vacations.

This extensive global footprint translates into significant convenience for its customers. Travelers benefit from a consistent brand experience and readily available options, reducing the friction often associated with navigating unfamiliar destinations. Hyatt's commitment to widespread accessibility means that its diverse portfolio of brands is within reach for a broad spectrum of travelers, catering to various needs and preferences across the globe.

Key aspects of Hyatt's global presence and accessibility include:

- Vast Network: Over 1,400 properties worldwide as of year-end 2024.

- Geographic Reach: Operations in 79 countries across six continents.

- Convenient Access: Properties located in key business and leisure destinations globally.

- Travel Facilitation: Supports both domestic and international travel needs.

Wellness and Lifestyle Focus

Hyatt is doubling down on wellness and lifestyle, recognizing a significant shift in traveler preferences. Brands like Miraval, a luxury wellness resort, and Alila, known for its sustainable and experiential design, are central to this strategy. This focus isn't limited to specific brands; Hyatt is actively integrating wellbeing elements, such as enhanced fitness facilities and healthy dining options, across its broader portfolio.

This strategic pivot directly addresses the growing demand from travelers who prioritize health-conscious choices and seek immersive, experiential stays over traditional lodging. By offering these curated wellness and lifestyle experiences, Hyatt aims to carve out a distinct niche and build stronger connections with a key demographic. For instance, Miraval resorts offer programs focused on mindfulness, nutrition, and physical activity, appealing to those seeking rejuvenation.

The market for wellness tourism is robust and expanding. Globally, wellness tourism was projected to reach $1.5 trillion in 2022 and was expected to grow to $2.2 trillion by 2027, demonstrating a clear and substantial opportunity. Hyatt's investment in this area, including its acquisition of Apple Leisure Group in 2021 which brought in brands with lifestyle elements, positions it to capture a significant share of this growth. In 2024, this trend continues to shape travel decisions, with many consumers actively seeking out accommodations that support their wellbeing goals.

- Miraval's Growth: Miraval resorts continue to be a cornerstone of Hyatt's wellness offerings, providing comprehensive programs designed for mental, physical, and spiritual rejuvenation.

- Alila's Experience: Alila properties emphasize unique, sustainable travel experiences often in natural settings, aligning with the lifestyle aspect of this value proposition.

- Portfolio Integration: Hyatt's commitment extends to enhancing wellness amenities and services across its diverse brand portfolio, making healthy choices more accessible to a wider range of guests.

- Market Demand: The increasing consumer preference for health-conscious and experiential travel fuels Hyatt's strategy, tapping into a rapidly growing segment of the tourism market.

Hyatt's value proposition centers on delivering a spectrum of high-quality lodging experiences through its diverse brand portfolio. This allows them to cater to a wide array of traveler needs, from luxury seekers to those prioritizing value. The company's commitment to personalized service and creating a sense of place further enhances guest satisfaction, driving loyalty.

The World of Hyatt loyalty program is a key differentiator, offering tangible benefits and tailored rewards that encourage repeat business. Hyatt's strategic expansion into wellness and lifestyle segments, exemplified by brands like Miraval and Alila, taps into growing consumer demand for health-conscious and experiential travel.

| Value Proposition Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Brand Diversity | Catering to varied guest needs with brands like Park Hyatt (luxury) and Hyatt Place (select-service). | Continued expansion in select-service, appealing to value-conscious travelers. |

| Personalized Guest Experience | Attentive service, unique property designs, and anticipating guest needs. | Investment in training and technology to enhance personalized interactions. |

| World of Hyatt Loyalty Program | Tailored rewards, exclusive benefits, and milestone rewards to foster loyalty. | Program enhancements in 2024, including expanded milestone rewards. |

| Global Presence & Accessibility | Over 1,400 properties in 79 countries as of Dec 31, 2024, offering convenience. | Strategic positioning in key business and leisure hubs worldwide. |

| Wellness & Lifestyle Focus | Integrating wellness elements and offering experiential stays via brands like Miraval and Alila. | Capitalizing on the growing wellness tourism market, projected to reach $2.2 trillion by 2027. |

Customer Relationships

The World of Hyatt loyalty program is the cornerstone of Hyatt's customer relationship strategy, driving engagement through tiered benefits and personalized experiences. This program directly cultivates long-term loyalty by offering exclusive access and rewards, encouraging members to choose Hyatt repeatedly. In 2024, Hyatt continued to emphasize its loyalty program, with a significant portion of its bookings originating from World of Hyatt members, underscoring its effectiveness in fostering brand advocacy and repeat business.

Hyatt excels in personalized guest services, utilizing data from its World of Hyatt loyalty program to anticipate and fulfill individual needs. In 2024, this focus on tailored experiences, informed by millions of member interactions, aims to foster deeper guest connections.

Hyatt strengthens customer relationships through robust digital and mobile engagement. Their website, the World of Hyatt mobile app, and social media platforms serve as key touchpoints for guests. These digital channels streamline the entire guest journey, from booking and check-in to accessing in-stay services, providing unparalleled convenience and direct communication.

The World of Hyatt app is particularly central to this strategy, offering features like Mobile Entry, which allows guests to bypass the front desk and access their rooms directly. This focus on digital interaction enhances guest satisfaction and loyalty, fostering a more personalized and efficient experience. By mid-2024, over 50% of World of Hyatt members were actively using the mobile app for bookings and check-ins, demonstrating strong adoption.

Direct Feedback Mechanisms

Hyatt actively gathers guest input through various channels, including post-stay surveys and direct interactions, ensuring their voices are heard.

This commitment to listening allows Hyatt to swiftly address any issues and refine its offerings, fostering stronger connections with its clientele.

- Guest Satisfaction Scores: Hyatt aims to maintain high guest satisfaction scores, with recent reports indicating scores consistently above 85% across its brands.

- Feedback Response Time: The company targets a response time of under 48 hours for most customer feedback received through digital channels.

- Service Improvement Initiatives: In 2023, Hyatt implemented over 50 new service enhancements directly based on guest feedback, ranging from room amenities to digital check-in processes.

Corporate and Group Sales Relationships

Hyatt cultivates robust corporate and group sales relationships by deploying specialized sales teams focused on securing substantial bookings. These dedicated professionals manage corporate accounts, ensuring consistent business from meetings, incentives, conferences, and exhibitions (MICE). This strategic focus is vital for driving revenue and building enduring partnerships with key business clients.

These relationships are the bedrock for Hyatt's group business, a segment that saw significant recovery and growth in 2024. For instance, the MICE sector, a primary driver of group bookings, experienced a strong rebound, with many companies resuming in-person events and corporate travel. Hyatt's investment in dedicated sales personnel directly supports this by fostering loyalty and ensuring a steady flow of large-scale bookings.

- Dedicated Sales Force: Hyatt employs specialized sales teams to manage corporate accounts and MICE business, fostering deep relationships.

- MICE Segment Focus: The company actively targets meetings, incentives, conferences, and exhibitions to secure high-volume bookings.

- Long-Term Partnerships: Building enduring relationships with corporate clients is a key strategy for sustained revenue generation.

- 2024 Performance: The corporate and group segment showed strong recovery in 2024, with MICE bookings playing a crucial role in this resurgence.

Hyatt's customer relationships are primarily built through the World of Hyatt loyalty program, which offers tiered benefits and personalized experiences to foster repeat business and brand advocacy. In 2024, a substantial portion of bookings came from these loyal members, highlighting the program's success.

Personalized guest services, informed by data from millions of World of Hyatt interactions, are central to deepening guest connections in 2024. Digital engagement via the app and website streamlines the guest journey, with over 50% of members actively using the app for bookings and check-ins by mid-2024.

Hyatt also cultivates strong corporate and group sales relationships through dedicated teams, particularly focusing on the MICE segment. This strategy proved effective in 2024, as the corporate and group sector showed robust recovery and growth.

| Customer Relationship Aspect | Key Initiative | 2024 Impact/Data Point |

|---|---|---|

| Loyalty Program | World of Hyatt | Significant portion of bookings from members |

| Personalization | Data-driven guest experiences | Aimed to foster deeper guest connections |

| Digital Engagement | Mobile app & website | Over 50% of members actively using app by mid-2024 |

| Corporate & Group Sales | Dedicated sales teams, MICE focus | Strong recovery and growth in corporate/group segment |

Channels

Hyatt.com and the World of Hyatt app are Hyatt's core direct booking channels. They are crucial for offering members the best available rates and exclusive perks, like bonus points or room upgrades, directly fostering loyalty and reducing distribution costs. This direct engagement is key to their strategy, aiming to bypass costly online travel agencies (OTAs).

In 2024, Hyatt has continued to emphasize the value proposition of booking direct. Members who book through these channels often gain access to flexible cancellation policies and earn World of Hyatt points, which can be redeemed for free nights or experiences. This direct relationship allows Hyatt to gather valuable customer data for personalized marketing and service improvements.

Global Distribution Systems (GDS) are vital for Hyatt to connect with corporate travel agencies and managers. These platforms ensure real-time availability and pricing for business travelers, streamlining bookings for corporate accounts and group events.

In 2024, GDS continued to be a significant driver of corporate bookings, with travel management companies leveraging these systems to secure competitive rates for their clients. Hyatt's integration with major GDS providers like Amadeus, Sabre, and Travelport allows for efficient distribution and access to a broad segment of the business travel market.

Hyatt Hotels maintains strategic partnerships with major Online Travel Agencies (OTAs) such as Expedia and Booking.com. These collaborations are crucial for extending Hyatt's market reach, especially to the leisure travel segment, tapping into a vast global customer base that might otherwise be inaccessible.

While these partnerships involve commission expenses, the significant visibility and customer acquisition capabilities offered by OTAs are indispensable. For instance, in 2024, OTAs continued to be a primary booking channel for a substantial portion of the global travel market, driving significant volume for hotel chains like Hyatt.

Direct Sales Teams and Corporate Partnerships

Hyatt leverages dedicated direct sales teams to cultivate strong relationships with corporations, travel agencies, and event planners. These teams are crucial for securing significant bookings within the high-value business transient and group segments.

These direct interactions are foundational for driving substantial revenue, especially for events and extended stays. In 2024, Hyatt continued to emphasize these relationships, recognizing their impact on occupancy and average daily rates, particularly in key business travel markets.

- Corporate Accounts: Direct sales teams manage relationships with thousands of companies worldwide, negotiating preferred rates and services for their employees.

- Travel Agency Partnerships: Collaborations with major travel management companies and independent agencies ensure visibility and bookings from a broad traveler base.

- Event and Group Sales: Dedicated specialists focus on securing meetings, conferences, and social events, driving significant group revenue and ancillary spending.

- Loyalty Program Integration: Direct sales efforts often integrate with Hyatt's loyalty program, World of Hyatt, to enhance customer retention and lifetime value.

Traditional Travel Agencies and Tour Operators

Traditional travel agencies and tour operators are still a significant part of how people book trips, particularly for complex or specialized vacations. These partners offer expertly crafted packages and a human touch, which many travelers value for international journeys or luxury experiences. In 2024, the global travel market saw continued reliance on these intermediaries for niche segments, with some agencies reporting strong demand for curated cultural and adventure tours.

- Specialized Travel: Agencies excel in offering unique itineraries and handling intricate logistics for luxury, adventure, and international tours.

- Personalized Service: They provide tailored recommendations and support, fostering strong customer relationships.

- Market Reach: These partners connect Hyatt with travelers who prefer expert guidance over online self-booking.

Hyatt's channel strategy balances direct engagement with broad market access. Direct channels like Hyatt.com and the World of Hyatt app are paramount for loyalty and cost efficiency. In 2024, these platforms continued to offer exclusive member benefits, reinforcing their importance. Global Distribution Systems (GDS) remain critical for capturing corporate and business travel, with Hyatt actively integrating with major providers like Amadeus and Sabre to ensure seamless bookings for business clients.

Customer Segments

Leisure travelers, encompassing individuals, couples, and families seeking vacations and relaxation, represent a core customer segment for Hyatt. In 2024, the travel and tourism sector continued its robust recovery, with leisure travel spending projected to significantly outpace business travel. Hyatt addresses this by offering a diverse portfolio, from its luxury Grand Hyatt resorts to its more accessible Hyatt Centric lifestyle hotels, each designed to enhance personal enjoyment and create memorable experiences.

Business travelers, a core demographic for Hyatt, include professionals attending conferences, corporate meetings, or on project assignments. They prioritize seamless connectivity, efficient service, and convenient locations, often near business districts or event venues. In 2024, business travel spending in the U.S. was projected to reach $360 billion, highlighting the significant market opportunity.

Hyatt caters to these needs by strategically placing hotels in major business centers and offering robust amenities. This includes dedicated business centers, flexible meeting spaces equipped with modern technology, and high-speed internet access, ensuring productivity on the go. The average business trip length remained around 4.6 days in early 2024, reinforcing the need for reliable in-room and common area connectivity.

Hyatt actively courts Group and Event Organizers (MICE) by offering comprehensive solutions for meetings, incentives, conferences, and exhibitions. This segment encompasses a wide range of clients, from corporate associations to individual planners, all seeking seamless event execution.

In 2024, Hyatt continued to leverage its extensive network of properties, boasting over 1,400 hotels globally, to cater to these large-scale gatherings. The company's dedicated event planning services and flexible meeting spaces are key differentiators, ensuring that organizers can find suitable venues and support for events of any size.

Hyatt's group booking options provide a streamlined process for managing accommodations for attendees, a critical factor for MICE clients. This focus on ease of booking and robust event support makes Hyatt a consistently preferred partner for significant industry conferences and corporate retreats.

High-Net-Worth Individuals and Luxury Seekers

High-net-worth individuals and luxury seekers represent a crucial customer segment for Hyatt. These travelers are actively looking for premium, often exclusive, experiences that go beyond standard accommodations. They are drawn to Hyatt's portfolio of luxury brands, which includes names like Park Hyatt, Grand Hyatt, and Alila, known for their sophisticated design and high-quality service.

This segment prioritizes bespoke services, unique architectural and interior design, and elevated amenities such as fine dining, spa facilities, and personalized concierge assistance. Their spending habits directly contribute to the growth and profitability of Hyatt's high-end properties. For instance, in 2024, luxury travel spending continued to show robust growth, with affluent consumers demonstrating a willingness to invest in memorable and differentiated stays.

- Targeted Brands: Park Hyatt, Grand Hyatt, Alila

- Key Valued Attributes: Bespoke service, unique design, elevated amenities

- Impact on Hyatt: Drives growth in the high-end portfolio

- Market Trend: Continued strong demand from affluent travelers in 2024

Loyalty Program Members (World of Hyatt)

Loyalty Program Members, specifically those enrolled in World of Hyatt, represent a crucial customer segment for Hyatt Hotels. This group spans a wide spectrum, from road warriors on constant business trips to individuals who prioritize leisure travel and seek rewarding experiences. These members are actively cultivated through tailored promotions and elevated benefits, solidifying their position as a cornerstone of Hyatt's loyal customer base.

Hyatt consistently invests in its loyalty program to foster deeper engagement and drive repeat business. For instance, in 2024, Hyatt continued to refine its tiered benefits, offering perks like room upgrades, late check-out, and bonus points that incentivize continued patronage. The program's structure is designed to reward members for their spending, encouraging them to choose Hyatt properties consistently.

- Loyalty Program Focus: World of Hyatt members are a primary target, receiving personalized offers and exclusive access.

- Customer Value: This segment forms a significant portion of Hyatt's recurring revenue due to their frequent stays and brand preference.

- Engagement Strategy: Hyatt utilizes tiered benefits and targeted promotions to maintain high member engagement and satisfaction.

- 2024 Initiatives: Continued enhancements to the loyalty program in 2024 aimed at increasing member value and driving bookings.

Hyatt's customer segments are diverse, encompassing leisure travelers seeking relaxation, business professionals requiring efficient services, and groups organizing events. The company also targets high-net-worth individuals looking for luxury experiences and, crucially, members of its World of Hyatt loyalty program, who represent a consistent and valuable revenue stream. In 2024, the travel industry saw a strong rebound, with leisure and group travel showing particularly robust growth, reinforcing the importance of these segments for Hyatt's strategy.

| Customer Segment | Key Characteristics | Hyatt's Approach | 2024 Relevance |

|---|---|---|---|

| Leisure Travelers | Individuals, couples, families seeking vacations | Diverse brand portfolio catering to different preferences | Continued strong demand, driving occupancy |

| Business Travelers | Professionals needing connectivity and convenience | Strategic locations, business amenities, efficient service | Projected significant spending, focus on productivity |

| Group & Event Organizers (MICE) | Corporate, associations needing event solutions | Extensive property network, dedicated event services | Robust market for conferences and gatherings |

| Luxury Seekers | High-net-worth individuals desiring premium experiences | Luxury brands, bespoke services, elevated amenities | Growing spending on differentiated, high-quality stays |

| Loyalty Program Members (World of Hyatt) | Frequent travelers seeking rewards and recognition | Tiered benefits, personalized offers, exclusive access | Cornerstone of repeat business and brand advocacy |

Cost Structure

Property operating expenses are the day-to-day costs directly tied to keeping Hyatt's hotels running smoothly. This includes paying staff their wages and benefits, covering utility bills like electricity and water, and managing regular maintenance and the purchase of necessary supplies.

For Hyatt, these expenses are a substantial part of their financial outlay, especially for hotels they own or lease directly. In 2024, labor costs alone are a major component, reflecting the significant workforce required to deliver guest services.

Hyatt's sales, marketing, and distribution costs are significant investments to bring guests through the door. These include extensive advertising campaigns, both online and offline, to build brand awareness and attract bookings. In 2023, Hyatt's selling, general, and administrative expenses, which encompass these areas, were approximately $2.2 billion, highlighting the scale of their customer acquisition efforts.

A substantial portion of these costs involves commissions paid to Online Travel Agencies (OTAs) and traditional travel agents, essential partners in reaching a broad customer base. Furthermore, the operation and promotion of Hyatt's World of Hyatt loyalty program represent a considerable expense, designed to foster repeat business and guest loyalty. Managing these expenditures effectively is paramount for maintaining healthy profit margins.

Hyatt incurs significant costs for its franchise and management support, encompassing brand standards, training, and technology. These expenses are crucial for maintaining service consistency across its diverse portfolio. For instance, in 2023, Hyatt reported selling its portfolio of 11 owned and leased hotels in the U.S. and Caribbean for $700 million, signaling a continued push towards an asset-light strategy where these support costs become even more central to their revenue generation.

Technology and Innovation Investments

Hyatt Hotels dedicates substantial resources to its technology and innovation endeavors, forming a significant component of its cost structure. These expenditures are crucial for maintaining and enhancing its operational backbone and guest interactions.

Key areas of investment include the development and upkeep of sophisticated reservation systems, property management software, and user-friendly guest applications. These platforms are essential for seamless operations across its global portfolio and for delivering a superior guest experience.

- Technology Platforms: Investments in reservation, property management, and guest-facing applications are core costs.

- Operational Efficiency: Technology spending directly supports streamlined hotel operations and back-office functions.

- Guest Experience Enhancement: Funding innovation in digital tools and services aims to improve guest satisfaction and loyalty.

For instance, in 2023, Hyatt reported significant capital expenditures, a portion of which is allocated to technology upgrades and digital innovation, reflecting a commitment to staying competitive in the rapidly evolving hospitality tech landscape.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at Hyatt Hotels encompass the essential corporate overhead required to run a global hospitality giant. These costs include the salaries of top executives, the administrative teams that support them, and vital functions like legal counsel and accounting services. In 2024, managing these overheads efficiently is crucial for maintaining Hyatt's overall financial health and profitability.

These corporate functions are the backbone of operations, ensuring compliance, strategic direction, and efficient resource allocation across Hyatt's vast network. The cost of managing such a complex, international business directly impacts the bottom line, making streamlined G&A a key performance indicator.

- Executive Salaries: Compensation for the leadership team driving the company's strategy.

- Administrative Staff: Support personnel in areas like HR, IT, and corporate communications.

- Legal and Compliance: Costs associated with legal counsel, regulatory adherence, and risk management.

- Accounting and Finance: Expenses for financial reporting, auditing, and treasury functions.

Hyatt's cost structure is multifaceted, encompassing property operating expenses, sales and marketing, franchise support, technology, and general administrative costs. These elements are critical for maintaining brand standards, driving customer acquisition, and ensuring efficient global operations.

In 2023, Hyatt's selling, general, and administrative expenses were approximately $2.2 billion, underscoring the significant investment in these areas. Property operating expenses, particularly labor, remain a substantial outlay, especially for owned and leased properties.

The company also invests heavily in technology platforms to enhance guest experience and operational efficiency. These costs are vital for staying competitive in the digital age of hospitality.

| Cost Category | Description | 2023 Data (Approximate) |

| Property Operating Expenses | Day-to-day hotel operations, including labor, utilities, and maintenance. | Significant portion of total costs, with labor being a major component. |

| Sales, Marketing & Distribution | Advertising, OTA commissions, loyalty program management. | Included in SG&A, which was ~$2.2 billion. |

| Franchise & Management Support | Brand standards, training, technology support for franchisees. | Crucial for maintaining service consistency across the portfolio. |

| Technology & Innovation | Reservation systems, property management software, guest apps. | Capital expenditures include technology upgrades and digital innovation. |

| General & Administrative (G&A) | Corporate overhead, executive salaries, legal, accounting. | Essential for global operations and strategic direction. |

Revenue Streams

Room revenue from owned and leased properties forms the bedrock of Hyatt's earnings, directly reflecting the success of its operational strategies. This income is a function of how many rooms are filled and the average price guests pay per night.

In 2024, Hyatt reported significant growth in this core segment. For instance, their full-year 2024 results showed a substantial increase in revenue per available room (RevPAR), a key industry metric, indicating strong demand and effective pricing strategies across their portfolio.

Hyatt generates revenue through franchise fees, which are payments from franchisees for the right to use Hyatt's established brands, operational systems, and ongoing support. This income stream is crucial to Hyatt's asset-light approach, allowing for expansion without significant capital investment.

In 2023, Hyatt's total revenue reached $6.0 billion, a significant portion of which is attributable to fees from its franchised and managed properties. While specific figures for franchise fees alone are not always broken out, they represent a predictable and growing revenue source as the company continues to expand its global footprint through franchising.

Hyatt earns revenue through management fees charged for overseeing hotel properties owned by third parties. These fees are structured as a base percentage of gross revenues and often include an incentive fee tied to the property's profitability. This dual structure ensures Hyatt is rewarded for operational excellence and financial success, aligning its goals with those of the property owners.

Food and Beverage Sales

Hyatt Hotels generates substantial revenue from food and beverage sales, encompassing offerings in their diverse dining venues, bars, and in-room dining services. This segment is particularly vital for their full-service and luxury brands, where guest experience heavily relies on high-quality culinary options.

In 2023, Hyatt reported that food and beverage revenue represented a significant portion of their overall income, underscoring its importance as a core revenue stream. For instance, during the first quarter of 2024, comparable system-wide RevPAR (Revenue Per Available Room) increased by 3.7% compared to the first quarter of 2023, with food and beverage sales playing a key role in driving this growth through enhanced guest spending.

- Direct Sales: Revenue from restaurant dining, bar purchases, and room service orders.

- Event Catering: Income generated from providing food and beverages for hotel banquets, conferences, and private events.

- Premium Offerings: Sales from specialty menus, fine dining experiences, and branded beverage selections.

- Ancillary Services: Revenue from minibar sales and grab-and-go food options.

Other Ancillary Services and Loyalty Program Revenue

Hyatt Hotels generates revenue from a variety of ancillary services that complement its core lodging business. These include offerings like spa treatments, fitness center access, and retail sales within its properties, all contributing to a richer guest experience and additional income. For instance, in 2023, the spa and wellness sector continued to be a significant revenue driver for many hospitality groups as travelers increasingly prioritize well-being during their stays.

Furthermore, Hyatt leverages its World of Hyatt loyalty program for revenue generation. This involves the strategic sale of loyalty points to program partners, such as airlines and credit card companies, which is a crucial element in maintaining program engagement and creating value for both the company and its partners. In 2024, the travel loyalty market is expected to see continued growth, with programs like World of Hyatt playing a vital role in customer retention and incremental revenue.

- Ancillary Services: Revenue from spas, fitness centers, and retail sales enhances guest experience and profitability.

- Loyalty Program Income: Sales of World of Hyatt points to partners like airlines and credit card companies.

- Market Trend: The wellness sector and loyalty program partnerships are key growth areas for the hospitality industry in 2024.

Hyatt's revenue streams are diversified, extending beyond just room bookings. These include substantial income from food and beverage sales across its various dining outlets and event catering services, which are integral to the guest experience, especially in their full-service and luxury properties. In 2023, food and beverage revenue remained a significant contributor to Hyatt's overall financial performance, reflecting strong guest spending in these areas.

Furthermore, Hyatt benefits from franchise fees and management fees generated from its extensive network of hotels operated by third-party owners and franchisees. This asset-light strategy allows for global expansion while generating predictable income. The company also earns revenue from ancillary services like spas and fitness centers, and importantly, through its World of Hyatt loyalty program by selling points to strategic partners.

| Revenue Stream | Description | 2023 Relevance |

|---|---|---|

| Room Revenue | Income from hotel room occupancy and rates. | Core revenue driver, directly tied to RevPAR. |

| Food & Beverage | Sales from restaurants, bars, room service, and events. | Significant contributor, enhancing guest experience. |

| Franchise & Management Fees | Payments from franchisees and managed properties. | Supports asset-light growth and predictable income. |

| Ancillary Services & Loyalty | Revenue from spas, retail, and loyalty program partnerships. | Growing segment, leveraging guest loyalty and well-being trends. |

Business Model Canvas Data Sources

The Hyatt Hotels Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and operational performance data. This ensures a comprehensive understanding of current business activities and their effectiveness.