Hyatt Hotels Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyatt Hotels Bundle

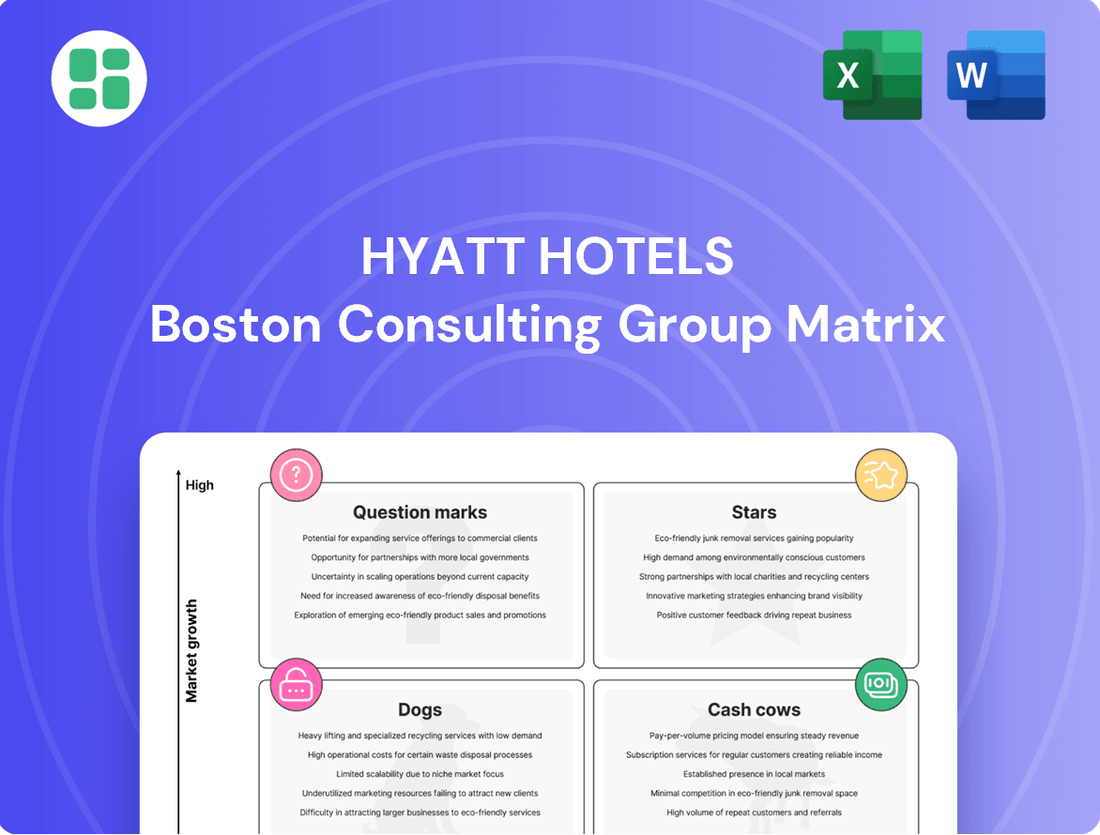

Hyatt Hotels' diverse portfolio likely includes a mix of brands that could be categorized within the BCG Matrix. Understanding which brands are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation and future growth. This preview offers a glimpse into how Hyatt's offerings might perform in the market.

To truly grasp Hyatt's competitive landscape and make informed decisions, dive deeper into the full BCG Matrix analysis. Gain a clear view of where its brands stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hyatt's Inclusive Collection, a key growth driver, saw its all-inclusive net package RevPAR increase by 2.9% in the fourth quarter of 2024. This segment, significantly expanded by acquisitions like Apple Leisure Group and Playa Hotels & Resorts, is showing strong forward bookings for early 2025, indicating continued momentum.

The strategic acquisition of Standard International and a joint venture with Grupo Piñero have further diversified Hyatt's all-inclusive portfolio, enhancing its market share in this burgeoning leisure travel category. Hyatt is focused on bolstering its all-inclusive infrastructure, particularly in Mexico and the Caribbean, due to the segment's attractive margins, yields, and robust cash flow generation.

Hyatt's luxury and lifestyle brands, including Andaz, Thompson Hotels, Alila, The Unbound Collection by Hyatt, and The Standard, represent a dynamic growth area. Since 2017, Hyatt has doubled its luxury room count and quintupled its lifestyle rooms, demonstrating a strong commitment to this segment. This expansion is fueled by a clear consumer shift towards experiential travel and distinctive accommodations.

The company's strategic acquisitions, such as Standard International with brands like The Standard, have significantly accelerated its lifestyle development. This move alone increased Hyatt's lifestyle properties by nearly 50% year-over-year. With over 35 luxury hotel and resort openings planned globally through 2025, Hyatt is solidifying its position in this high-demand market.

These brands are particularly appealing to younger demographics, like millennials and Gen Z, who prioritize unique design, sustainability, and authentic local immersion. This focus on evolving traveler preferences positions these lifestyle brands as key drivers of future growth for Hyatt.

The World of Hyatt loyalty program is a significant asset for Hyatt, acting as a powerful engine for repeat business and customer loyalty. By the close of 2024, the program boasted an impressive membership base of around 54 million individuals, marking a substantial 22% surge compared to the previous year. This growth highlights the program's success in cultivating deep guest connections and steering choices toward Hyatt's varied hotel offerings.

This loyalty initiative is instrumental in building Hyatt's 'network effect,' where increased member engagement leads to greater value for all participants. The program's consistent expansion, with an average annual growth rate of 27% since 2017, clearly demonstrates its resilience and effectiveness within the intensely competitive hospitality industry.

Park Hyatt

Park Hyatt, a distinguished ultra-luxury offering from Hyatt Hotels, is actively pursuing global growth. New properties are slated to open in prominent locations like London, Johannesburg, Cancun, and Taipei by 2025, underscoring its commitment to expanding its footprint in key luxury markets.

This brand consistently achieves impressive average daily rates (ADR) and revenue per available room (RevPAR), reflecting its appeal to discerning travelers who prioritize exceptional service and sophisticated environments. For instance, in 2023, luxury hotel segments globally saw ADRs often exceeding $500, with Park Hyatt brands typically performing at the higher end of this spectrum.

Despite operating within a mature luxury segment, Park Hyatt's strategic expansion into new territories and ongoing property enhancements are designed to maintain its significant market share and robust financial performance. This proactive approach ensures its continued strong contribution to Hyatt's overall portfolio.

- Brand Positioning: Ultra-luxury, targeting high-net-worth individuals.

- Market Share: Strong in established luxury markets, growing in emerging ones.

- Financial Contribution: High ADR and RevPAR drive significant revenue.

- Growth Strategy: Global expansion into key luxury destinations.

Hyatt Centric

Hyatt Centric is a star in Hyatt's BCG Matrix, showcasing rapid growth and strong market appeal. The brand is actively expanding, with over 35 new hotels slated to open by 2028, which is a 50% increase in its current portfolio. This aggressive expansion aims to reach over 100 hotels worldwide by 2029.

The brand's strategy targets a key demographic: modern travelers who value exploration and authentic experiences in vibrant urban and leisure settings. This focus aligns with a high-growth market segment, contributing to its star status. Hyatt Centric's success is further bolstered by its commitment to local culture and strategic entries into new markets, particularly in the Americas and Asia-Pacific regions.

- Global Expansion: Over 35 new hotels planned by 2028, increasing the portfolio by 50%.

- Target Audience: Modern travelers seeking exploration in prime urban and leisure destinations.

- Market Position: Strong growth potential due to tailored local experiences and strategic market entries.

- Future Outlook: Expected to surpass 100 hotels globally by 2029.

Hyatt Centric and Park Hyatt are strong contenders in Hyatt's portfolio, exhibiting characteristics of Stars in the BCG Matrix. Hyatt Centric is experiencing rapid expansion, with over 35 new hotels planned by 2028, representing a 50% portfolio increase and aiming for over 100 hotels globally by 2029. Park Hyatt, while in a more mature segment, is strategically growing in key luxury markets, consistently achieving high ADR and RevPAR, with new openings planned in London, Johannesburg, Cancun, and Taipei by 2025.

| Brand | BCG Category | Key Growth Drivers | Market Position | Financial Performance Indicator |

| Hyatt Centric | Star | Aggressive expansion, target demographic alignment, focus on local experiences | Strong growth potential in urban and leisure settings | Rapid RevPAR growth in key markets |

| Park Hyatt | Star | Global expansion into prime luxury destinations, property enhancements | Dominant in established luxury markets, growing in emerging ones | High Average Daily Rate (ADR) and RevPAR |

What is included in the product

This BCG Matrix overview analyzes Hyatt's hotel brands, categorizing them by market share and growth potential.

A clear BCG Matrix visualizes Hyatt's portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Hyatt Regency, a cornerstone of Hyatt's portfolio, operates as a classic Cash Cow within the BCG Matrix. Its established global footprint and reputation for reliable, full-service accommodations consistently drive substantial revenue, particularly from its strong appeal to business travelers and large-scale events.

Despite potentially slower growth in the broader full-service hotel market, Hyatt Regency commands a significant market share. This is a testament to its enduring brand equity and vast operational network, allowing it to maintain profitability with a more predictable, lower investment in promotional activities compared to emerging brands.

In 2024, Hyatt reported that its full-service brands, including Hyatt Regency, continued to be significant contributors to overall revenue. For instance, the company noted robust performance in its Americas region, where many Hyatt Regency properties are situated, benefiting from a rebound in business travel and corporate events.

Hyatt Place stands as a significant Cash Cow within the Hyatt Hotels portfolio. Its dominance in the select-service segment is built on consistent performance and efficient operations, attracting a broad base of business and leisure travelers. This brand consistently generates substantial revenue, benefiting from a high market share in a stable, mature market.

The brand's widespread presence and standardized operating model translate into predictable revenue streams and robust financial margins. In 2024, Hyatt reported strong performance across its brands, with Hyatt Place contributing significantly to the company's overall profitability. The brand's ability to deliver value through comfort and convenience at a competitive price point solidifies its position as a reliable cash generator for Hyatt Hotels.

Grand Hyatt hotels are significant players in the upper-upscale and luxury segments, often found in prime urban and resort locations. These properties are known for their substantial size and iconic status, which helps them achieve high occupancy rates and strong average daily rates, especially among group travelers and those seeking premium leisure experiences.

In 2024, Hyatt Hotels reported that its Grand Hyatt brand continued to be a robust generator of cash flow. For instance, during the first quarter of 2024, the company noted that its full-service hotels, which include the Grand Hyatt brand, saw a revenue per available room (RevPAR) increase of approximately 6% year-over-year, indicating strong performance in a mature market.

The brand's established reputation and efficient operations are key to its role as a cash cow for Hyatt. This consistent profitability supports the company's ability to invest in other growth areas within its portfolio, leveraging the substantial cash generated by these flagship properties.

Hyatt House

Hyatt House operates within the extended-stay hotel market, a segment that attracts guests needing accommodations for longer periods, often due to business assignments or temporary relocations. This focus on extended stays allows for a more predictable revenue stream, as guests typically book for weeks or even months at a time.

The brand benefits from a stable market with consistent demand, which is a key characteristic of a cash cow. In 2024, the extended-stay segment continued to show resilience, with occupancy rates often outperforming other hotel categories, particularly in markets with strong corporate travel. For instance, some reports indicated extended-stay hotels maintained occupancy rates in the high 70s to low 80s throughout much of the year, demonstrating this stability.

- Established Market Position: Hyatt House has a significant presence in the extended-stay sector, a segment known for its steady demand.

- Predictable Revenue Streams: The brand's specialization in longer stays leads to consistent and reliable income.

- Operational Efficiency: Its model is designed for longer-term guests, optimizing for profitability and strong cash flow generation.

- Healthy Profit Margins: The efficiency in catering to extended stays typically results in robust profit margins for the brand.

Owned and Leased Properties (Strategic Assets)

Hyatt's owned and leased properties, even as they pursue an asset-light strategy, function as significant cash cows. These prime-location assets, especially those with robust performance, are crucial for generating direct revenue and EBITDA.

The owned and leased segment saw a notable increase in Adjusted EBITDA, rising by 18% in Q1 2025, even after accounting for asset sales. This demonstrates the continued financial strength of the retained properties.

- Prime Locations: Retained properties are situated in highly desirable areas, ensuring consistent demand and revenue.

- Direct Revenue Generation: These assets contribute directly to Hyatt's top-line performance and profitability.

- Stable Cash Flow: Despite strategic divestments, high-performing owned and leased properties provide substantial and reliable cash flow.

- Q1 2025 Performance: The segment's Adjusted EBITDA grew by 18% in Q1 2025, underscoring their cash-generating power.

Hyatt Centric hotels are positioned as key cash cows, focusing on vibrant, centrally located properties that appeal to travelers seeking an immersive local experience. These hotels leverage their prime urban locations to capture consistent demand from both leisure and business segments, ensuring a steady flow of revenue.

The brand's success is rooted in its ability to deliver a distinct, localized guest experience, which fosters loyalty and repeat business. In 2024, Hyatt reported that its lifestyle brands, including Hyatt Centric, saw strong RevPAR growth, with some properties exceeding pre-pandemic performance levels, highlighting their cash-generating capabilities.

Hyatt Centric's operational model is designed for efficiency, allowing it to maintain healthy profit margins even in competitive urban markets. This consistent profitability makes it a reliable contributor to Hyatt's overall financial health, supporting investments in other parts of the portfolio.

The brand's established presence and consistent guest satisfaction translate into predictable revenue streams, a hallmark of a strong cash cow. This allows Hyatt to rely on Hyatt Centric for a stable financial contribution year after year.

Delivered as Shown

Hyatt Hotels BCG Matrix

The Hyatt Hotels BCG Matrix preview you see is the complete, unedited document you will receive upon purchase. This means you're getting the full strategic analysis, ready for immediate application in your business planning. No watermarks or demo content will obscure the detailed insights into Hyatt's brand portfolio.

Dogs

Underperforming older full-service Hyatt hotels, especially those in need of modernization or situated in stagnant markets, can be considered Hyatts Dogs. These establishments often struggle with declining occupancy rates and lower RevPAR (Revenue Per Available Room) compared to newer or renovated competitors. For instance, in 2024, hotels that haven't seen significant capital investment might be experiencing RevPAR growth rates significantly below the system average, potentially in the low single digits or even negative territory.

Hyatt's pursuit of an asset-light model includes divesting properties like the Hyatt Regency O'Hare Chicago. These assets, once sold, are categorized as Non-Strategic Divested Assets, often characterized by lower growth prospects or a departure from the company's core strategic focus.

This strategic shedding of assets is a key component of Hyatt's financial planning, with the company targeting over $2 billion in asset dispositions by the close of 2027. This aggressive divestment plan highlights a commitment to optimizing the portfolio by removing less critical or underperforming real estate holdings.

Legacy Properties in Declining Markets represent Hyatt's 'Dogs' in the BCG Matrix. These are individual hotels situated in areas facing economic downturns or significant changes in travel trends, where Hyatt's brand strength isn't enough to overcome these challenges. For instance, a historic hotel in a Rust Belt city that has seen its manufacturing base shrink might fall into this category.

These assets often struggle to maintain competitive occupancy and revenue per available room (RevPAR), contributing little to no positive cash flow. While Hyatt's portfolio is generally robust, older properties in specific, less desirable locations can become a drag. As of early 2024, some reports indicated a slight softening in occupancy for certain legacy assets in secondary markets, though Hyatt's overall performance remained strong due to its diversified portfolio and focus on premium brands.

Certain Acquired Properties Not Fully Integrated

Following significant acquisitions, such as the integration of Apple Leisure Group in 2021 and Standard International in 2023, a few specific properties might not immediately align with Hyatt's growth trajectory. These individual assets, if they exhibit a low local market share and operate within slower-growing segments of the hospitality industry, could be temporarily classified as question marks. For instance, a newly acquired boutique hotel in a mature urban market with limited differentiation might fall into this category.

These underperforming acquired properties, while part of a larger, robust portfolio, require careful management. Their current position, characterized by low relative market share within their specific geographic sub-markets and operating in segments experiencing subdued growth, necessitates a strategic re-evaluation. The aim is to either fully integrate them into Hyatt's successful brand families, rebrand them to better suit market demand, or consider divestment if they do not meet long-term strategic objectives.

- Low Market Share: Specific acquired properties may struggle to capture a significant portion of their local market, especially if they lack distinct offerings.

- Slow-Growth Segments: Properties situated in hospitality sub-segments that are not experiencing rapid expansion pose a challenge.

- Integration Period: During the transition phase post-acquisition, some assets might temporarily be categorized as question marks.

- Strategic Re-evaluation: Hyatt's approach involves assessing these properties for rebranding, full integration, or potential divestment to optimize its portfolio.

Specific Niche Ventures with Limited Scalability

Hyatt's portfolio may include highly specialized, niche ventures that haven't yet demonstrated significant market traction or scalability. These could be experimental concepts, such as a unique, hyper-local co-working space integrated into a specific hotel property, or a pilot program for a new sustainable amenity that hasn't been rolled out broadly. For instance, a small-scale, tech-focused hospitality solution tested in a single market might represent such a venture.

These initiatives, while potentially innovative, could be categorized as Dogs if their growth prospects are limited and they are not contributing substantially to Hyatt's overall market share or revenue. For example, a limited-run, themed dining experience in one hotel that failed to attract consistent patronage would fit this description. The decision here would likely be to divest or phase out these ventures to reallocate resources to more promising areas.

- Limited Market Penetration: Ventures with minimal customer adoption or a very narrow target audience.

- Low Growth Potential: Initiatives that show little to no indication of expanding their customer base or revenue streams.

- Resource Drain: Projects that require ongoing investment without a clear path to profitability or significant return.

- Strategic Re-evaluation: Such ventures often undergo a review to determine if further investment is warranted or if discontinuation is the more prudent path.

Hyatt's 'Dogs' typically include older, underperforming hotels in stagnant markets or those requiring significant modernization. These properties often exhibit lower occupancy and RevPAR compared to the brand average, potentially seeing growth rates in the low single digits or even negative territory as of early 2024, especially if capital investment has been minimal. For example, a legacy hotel in a declining secondary market might struggle to maintain competitive performance.

The company's strategic divestment of non-core or underperforming assets, part of its asset-light strategy, aims to optimize the portfolio. Hyatt has targeted over $2 billion in asset dispositions by the end of 2027, indicating a proactive approach to shedding properties that do not align with its growth objectives or financial targets.

These 'Dog' assets, while a small portion of Hyatt's overall portfolio, can represent a drag on profitability if not managed or divested effectively. Their limited market share and slow-growth segment characteristics necessitate careful strategic re-evaluation, which could lead to rebranding, integration, or sale.

Question Marks

Hyatt Studios, a new player in the upper-midscale extended-stay market, is positioned as a Star within Hyatt's BCG Matrix. With over 50 deals signed and its first opening slated for Q1 2025, it represents a high-growth potential segment for Hyatt. The brand is actively pursuing expansion, particularly in secondary and tertiary markets, indicating a strategic push to capture market share.

Caption by Hyatt is positioned as a question mark within Hyatt's BCG Matrix. This newer lifestyle select-service brand is experiencing global growth, with new openings planned in Asia Pacific and North America by 2025. While it operates in a high-growth segment, its market share and brand recognition are still developing.

Significant investment is necessary to solidify Caption by Hyatt's market position and capitalize on its growth potential. Without this strategic investment, the brand risks becoming a 'Dog' rather than achieving a strong market presence. For instance, Hyatt's overall expansion plans include a substantial number of new properties across its brands, underscoring the capital commitment required for emerging brands like Caption.

The Unscripted by Hyatt Collection, launched in May 2025, represents a new venture targeting travelers desiring spontaneous, immersive experiences. As a nascent brand, it currently holds a minimal market share but is positioned to capture a growing segment of leisure travelers seeking authenticity.

Hyatt's investment in Unscripted is crucial for its development, aiming to establish a distinct identity that appeals beyond its traditional elite customer base. The collection's potential to evolve into a Star within Hyatt's portfolio is contingent on achieving substantial market penetration and demonstrating strong revenue growth in the competitive lifestyle hotel segment.

Recently Acquired Niche Brands (e.g., Bunkhouse Hotels within Standard International)

Hyatt's acquisition of Standard International, including brands like Bunkhouse Hotels, positions these as potential Stars or Question Marks within its BCG Matrix. While Bunkhouse Hotels operates in the high-growth experiential travel niche, its current market share within Hyatt's vast portfolio is likely modest, characteristic of a Question Mark.

These niche brands offer Hyatt the chance to tap into unique, high-demand segments. For instance, Bunkhouse Hotels, known for its distinct design and community focus, could attract a younger, trend-conscious demographic. This segment is experiencing robust growth, with the global boutique hotel market projected to reach $117.6 billion by 2027, growing at a CAGR of 4.5%.

- Niche Appeal: Bunkhouse Hotels cater to a specific traveler seeking unique, design-forward experiences, a segment showing strong consumer interest.

- Market Share Potential: While currently a smaller player within Hyatt's overall brand structure, these niche brands have significant room for expansion and market share capture.

- Strategic Investment: Successful integration and targeted marketing are crucial for Bunkhouse Hotels to transition from a Question Mark to a Star, requiring investment in scaling operations and brand visibility.

- Experiential Growth: The broader trend towards experiential travel, valued by millennials and Gen Z, supports the high growth potential for brands like Bunkhouse.

New Market Entries in Emerging Regions

Hyatt's strategic new market entries in emerging regions, such as its recent expansion into Vietnam with the Hyatt Regency Danang Resort and Spa, exemplify its 'Question Marks' in the BCG Matrix. These ventures target high-growth potential markets but demand significant upfront investment to establish brand presence and capture market share.

These emerging market entries are characterized by substantial investment requirements and uncertain future returns, fitting the 'Question Mark' profile. For instance, Hyatt's continued focus on expanding its footprint in Southeast Asia, a region experiencing robust economic growth, requires considerable capital for new hotel developments and marketing efforts.

- Hyatt's expansion into emerging markets like Vietnam and India represents significant investments in high-potential but unproven territories.

- These new ventures require substantial capital for property development, local marketing, and building brand awareness.

- The success of these 'Question Marks' depends on future market acceptance and Hyatt's ability to gain substantial local market share.

- Hyatt reported a 10% increase in its pipeline for the Asia Pacific region in 2024, indicating a strong commitment to these emerging markets.

Caption by Hyatt and Unscripted by Hyatt are prime examples of Hyatt's Question Marks. These brands are in high-growth segments but require substantial investment to build market share and brand recognition. Their success hinges on strategic capital allocation and effective market penetration to avoid stagnating.

Hyatt's expansion into emerging markets, like its recent push into Vietnam, also falls into the Question Mark category. These ventures target high-growth potential but demand significant upfront investment and face market uncertainties. Hyatt's 2024 pipeline growth in Asia Pacific, a 10% increase, underscores this commitment to developing these nascent opportunities.

| Brand/Venture | BCG Category | Key Characteristics | Growth Potential | Investment Needs |

|---|---|---|---|---|

| Caption by Hyatt | Question Mark | Lifestyle select-service, global expansion underway | High | Significant for market share & recognition |

| Unscripted by Hyatt | Question Mark | Experiential travel, nascent brand | High | Crucial for identity & penetration |

| Emerging Market Entries (e.g., Vietnam) | Question Mark | New regions, high-growth potential | High | Substantial for development & marketing |

BCG Matrix Data Sources

Our Hyatt Hotels BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.