Hyakugo Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyakugo Bank Bundle

Unlock the strategic advantages Hyakugo Bank possesses by understanding the intricate web of political, economic, social, technological, legal, and environmental factors influencing its operations. Our comprehensive PESTLE analysis provides a critical roadmap for navigating these external forces. Gain actionable intelligence to inform your investment decisions and competitive strategy. Download the full PESTLE analysis now to secure your market edge.

Political factors

The Japanese government is actively shaping the landscape for regional banks, including those like Hyakugo Bank, with policies designed to bolster local economies and foster stability. Initiatives often focus on encouraging consolidation to create stronger, more resilient institutions and promoting their crucial role in regional revitalization efforts, particularly in prefectures like Mie.

As of early 2024, the Financial Services Agency (FSA) has continued to emphasize the importance of regional financial institutions in supporting small and medium-sized enterprises (SMEs) and driving local growth. While specific consolidation mandates are not in place, the government supports mergers that enhance efficiency and service delivery, aiming to address challenges posed by Japan's aging population and declining birthrate in regional areas.

Japan's Financial Services Agency (FSA) is continually refining banking regulations. Recent focuses include strengthening capital adequacy ratios and enhancing cybersecurity measures, with new guidelines expected to be fully implemented by late 2024, impacting how banks like Hyakugo manage risk and allocate capital.

Consumer protection remains a key area, with updated disclosure requirements for financial products and services coming into effect in 2025. These changes necessitate greater transparency from Hyakugo Bank regarding fees, risks, and product suitability, potentially affecting customer acquisition costs and operational procedures.

The Bank of Japan's (BOJ) monetary policy decisions significantly impact Hyakugo Bank. For instance, the BOJ's historic shift away from negative interest rates in March 2024, raising rates for the first time since 2007, directly affects lending margins and the cost of funds for banks like Hyakugo. This move aims to normalize monetary policy, potentially leading to higher interest income for Hyakugo Bank as loan rates adjust upwards, though it also increases funding costs.

Quantitative easing and bond purchase programs, while being scaled back, have historically influenced the yield curve and asset valuations. The BOJ's continued management of its bond holdings, including potential reductions in purchases, can lead to higher long-term interest rates. This could boost Hyakugo Bank's net interest income from its bond portfolio, but also introduces potential for capital losses if bond prices fall due to rising yields.

The BOJ's stance on monetary policy, including its communication regarding future rate hikes or asset purchase adjustments, creates an environment of uncertainty or stability for the banking sector. Hyakugo Bank's lending activities are particularly sensitive to interest rate environments, as higher rates can dampen borrower demand for loans, impacting overall loan growth and profitability.

Geopolitical Stability and Trade Policies

The broader geopolitical landscape, especially within the Asia-Pacific, significantly influences Japan's economic stability. Tensions or shifts in regional power dynamics can indirectly impact trade flows and investment sentiment, which in turn affects the demand for banking services like those offered by Hyakugo Bank. For instance, ongoing trade disputes or the potential for supply chain disruptions in key Asian markets could dampen corporate and individual borrowing needs.

International trade policies and agreements play a crucial role. Changes in tariffs, trade barriers, or the renegotiation of existing pacts can alter the cost of imports and exports for Japanese businesses. This directly affects their profitability and, consequently, their appetite for financial products. In 2024, Japan's trade deficit remained a concern, highlighting its sensitivity to global trade conditions.

- Regional Instability: Continued geopolitical tensions in East Asia could lead to increased economic uncertainty, potentially reducing foreign direct investment into Japan and impacting the financial sector.

- Trade Agreements: The effectiveness and evolution of trade agreements, such as CPTPP and RCEP, will shape market access for Japanese firms, influencing their financial activities and demand for banking support.

- Global Economic Slowdown: A broader global economic slowdown, potentially exacerbated by geopolitical events, could lead to reduced export demand for Japanese goods, impacting corporate revenues and lending opportunities for Hyakugo Bank.

- Currency Fluctuations: Geopolitical events often trigger currency volatility, which can affect the value of international assets and liabilities for Japanese companies, influencing their hedging needs and overall financial strategies.

Local Government Initiatives and Support

The Mie Prefectural government has been actively promoting regional revitalization, which could present opportunities for Hyakugo Bank. For instance, initiatives aimed at supporting small and medium-sized enterprises (SMEs) through subsidies or low-interest loans directly align with the bank's lending activities. A notable program is the Mie Prefecture SME Support Grant, which saw applications increase by 15% in 2023, indicating a strong demand for such financial assistance.

Local municipalities within Hyakugo Bank's operational area are also implementing policies to attract investment and foster business growth. These can include tax incentives or infrastructure development projects. For example, the city of Tsu has introduced a new business startup support program offering grants up to ¥1 million, potentially encouraging new ventures that would require banking services.

- Regional Revitalization Funds: Mie Prefecture allocated ¥5 billion in 2024 for regional economic development projects, creating potential for increased lending and investment opportunities for Hyakugo Bank.

- SME Support Programs: Local governments are enhancing financial aid for SMEs, with a reported 10% increase in direct financial support measures implemented in 2023 across key municipalities.

- Infrastructure Development: Planned infrastructure upgrades in areas like the Ise-Shima region are expected to stimulate economic activity, potentially leading to new business financing needs.

- Digital Transformation Support: Municipalities are offering grants for digital transformation, which can benefit businesses and indirectly increase demand for digital banking solutions.

Government policies in Japan, particularly those from the Financial Services Agency (FSA), heavily influence regional banks like Hyakugo Bank. The FSA's ongoing focus on strengthening financial institutions and promoting regional revitalization, especially in prefectures like Mie, sets the strategic direction for the banking sector. These policies aim to create more resilient banks capable of supporting local economies, particularly in light of demographic challenges such as an aging population and declining birth rates.

Recent regulatory adjustments, with new guidelines expected by late 2024, emphasize enhanced capital adequacy and cybersecurity, directly impacting Hyakugo Bank's risk management and capital allocation strategies. Furthermore, updated consumer protection measures, including stricter disclosure requirements for financial products effective in 2025, will necessitate greater transparency from Hyakugo Bank, potentially altering customer acquisition costs and operational procedures.

The Bank of Japan's monetary policy remains a critical factor. The shift away from negative interest rates in March 2024, the first such move since 2007, has a direct impact on Hyakugo Bank's lending margins and funding costs. While this normalization could lead to higher interest income from loans, it also increases the cost of funds for the bank.

Geopolitical factors, such as regional instability in East Asia and global economic slowdowns, can indirectly affect Hyakugo Bank by influencing trade flows, investment sentiment, and corporate revenues. Changes in international trade policies and currency fluctuations also play a role, impacting Japanese businesses and their demand for financial services.

What is included in the product

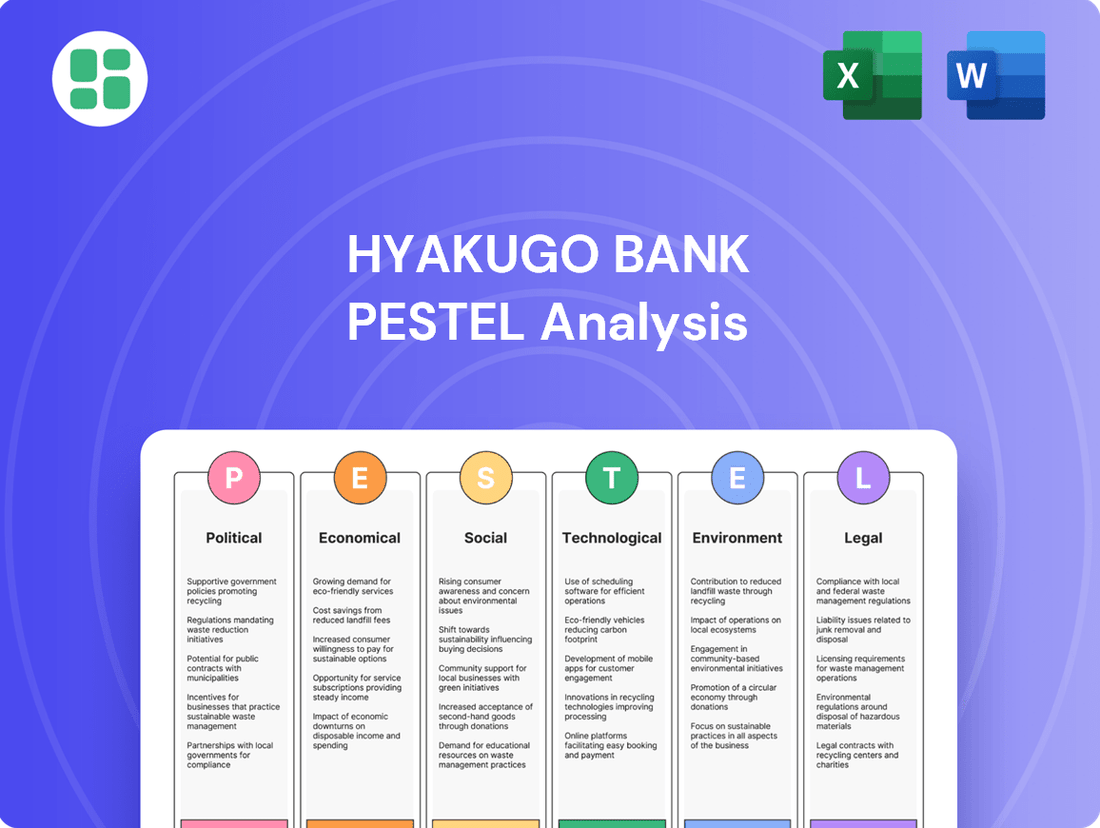

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Hyakugo Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these global and regional trends present both challenges and opportunities for the bank's strategic planning and future growth.

A concise PESTLE analysis for Hyakugo Bank, presented in a clear, summarized format, acts as a pain point reliever by enabling quick referencing during meetings and facilitating efficient strategy discussions.

Economic factors

The Bank of Japan's (BOJ) shift away from negative interest rates and towards monetary policy normalization, including potential future rate hikes, significantly impacts banks like Hyakugo. As of early 2025, the BOJ has signaled a gradual move, with the policy rate potentially inching up from near zero.

Higher interest rates generally benefit banks by widening the spread between what they earn on loans and what they pay on deposits, thus boosting net interest margins. For Hyakugo Bank, this could translate to improved loan profitability, though it also necessitates adjustments in deposit strategies to remain competitive and retain funding.

Mie Prefecture's economic health is a key factor for Hyakugo Bank. In 2023, Mie's GDP saw a modest increase, reflecting ongoing industrial activity, particularly in manufacturing sectors like automotive and food processing. However, the prefecture, like many in Japan, faces demographic challenges. The aging population and a declining birthrate, evident in a projected population decrease for 2024-2025, could temper loan demand and impact deposit growth over the long term.

Japan's inflation rate saw a notable increase, reaching 3.2% in the year to October 2023, a rise from 3.0% in September, according to the Ministry of Internal Affairs and Communications. This upward pressure on prices directly impacts consumer purchasing power, potentially straining household budgets and affecting their ability to service loans. For businesses, while some may benefit from increased revenue due to higher prices, others face rising input costs, which could affect profitability and investment decisions.

Projected inflation trends suggest continued, albeit moderating, price increases into 2024 and 2025, driven by global commodity prices and domestic demand. This environment can erode the real value of savings and fixed-income assets, influencing client investment strategies and potentially leading to increased demand for variable-rate loans or hedging products. Hyakugo Bank must monitor these trends closely to manage credit risk and ensure the financial stability of its diverse client base.

Consumer Spending and Corporate Investment Trends

Consumer spending in Japan, particularly within Hyakugo Bank's primary service regions like Aichi Prefecture, has shown resilience, supported by wage growth and government stimulus measures. In the first quarter of 2024, household spending increased by 0.7% year-on-year, indicating a steady demand for retail and service-oriented banking products.

Corporate investment trends also present opportunities for Hyakugo Bank. Many Japanese businesses, especially small and medium-sized enterprises (SMEs) prevalent in Hyakugo's operational areas, are focusing on digital transformation and efficiency improvements. This is driving demand for business loans and working capital financing.

- Consumer spending in Q1 2024 saw a 0.7% year-on-year increase.

- SMEs in Hyakugo's service areas are prioritizing capital expenditure on technology.

- These trends directly impact demand for consumer loans and business financing.

- Housing loan demand is also influenced by consumer confidence and interest rate expectations.

Employment Rates and Wage Growth

Japan's employment situation remains robust, with the unemployment rate hovering around 2.6% as of early 2024, reflecting a tight labor market. This stability is particularly evident in regions like Mie Prefecture, which benefits from a diverse industrial base. Wage growth, while moderate, has seen an upward trend, with nominal wage increases projected to continue through 2025, driven by labor shortages and government initiatives aimed at boosting household income.

Stable employment and rising wages directly benefit financial institutions like Hyakugo Bank. When individuals have secure jobs and increasing incomes, their ability to repay loans improves significantly, thereby reducing default risks and enhancing overall loan quality. This increased financial security also translates into higher disposable income, which in turn fuels demand for a wider range of financial services, including new loans, investment products, and savings accounts.

- Unemployment Rate: Japan's unemployment rate was approximately 2.6% in early 2024, indicating a strong labor market.

- Wage Growth: Projections for 2024-2025 suggest continued, albeit moderate, nominal wage growth across Japan.

- Impact on Loan Quality: Stable employment and rising wages directly correlate with lower loan default rates and improved asset quality for banks.

- Increased Demand: Higher disposable incomes resulting from these trends stimulate demand for various banking and financial products.

The Bank of Japan's monetary policy normalization, with potential rate hikes in 2024-2025, is a significant economic factor. This shift is expected to increase net interest margins for banks like Hyakugo, as loan profitability widens. However, it also requires strategic adjustments in deposit-taking to remain competitive.

Mie Prefecture's economy, while supported by manufacturing, faces demographic headwinds. An aging population and declining birthrate, projected to continue through 2025, could dampen loan demand and slow deposit growth for Hyakugo Bank.

Japan's inflation, around 3.2% in late 2023, is expected to moderate but remain a factor in 2024-2025. This impacts consumer purchasing power and business costs, influencing loan servicing and investment decisions.

Consumer spending showed resilience, with a 0.7% year-on-year increase in Q1 2024, boosting demand for retail banking products. Simultaneously, SMEs are investing in technology, creating demand for business loans. Japan's robust employment, with a 2.6% unemployment rate in early 2024 and projected wage growth through 2025, underpins loan quality and drives demand for financial services.

| Economic Factor | 2023 Data/Trend | 2024-2025 Outlook | Impact on Hyakugo Bank |

|---|---|---|---|

| Monetary Policy | BOJ moving away from negative rates | Potential gradual rate hikes | Improved net interest margins, need for deposit strategy adjustments |

| Regional Economy (Mie) | Modest GDP growth, strong manufacturing | Aging population, declining birthrate | Potential dampening of loan demand and deposit growth |

| Inflation | 3.2% (Oct 2023) | Moderating but continued increases | Impacts consumer spending, business costs, and investment strategies |

| Consumer Spending | 0.7% YoY increase (Q1 2024) | Continued resilience | Supports demand for retail banking products |

| Employment & Wages | 2.6% unemployment (early 2024), moderate wage growth | Stable employment, continued nominal wage growth | Enhances loan quality, reduces default risk, boosts demand for financial services |

What You See Is What You Get

Hyakugo Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Hyakugo Bank provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. It's designed to offer actionable insights for strategic planning.

Sociological factors

Customers are increasingly shifting towards digital channels for their banking needs. In 2024, a significant majority of transactions at major Japanese banks are expected to occur online or via mobile apps, reflecting a growing preference for convenience and accessibility. This trend necessitates that Hyakugo Bank invests further in its digital infrastructure and user experience to remain competitive.

Mobile payment solutions are also gaining widespread adoption, with contactless payments and digital wallets becoming commonplace. By 2025, it's projected that over 70% of retail transactions in Japan could be cashless, driven by these technologies. Hyakugo Bank must ensure its offerings are compatible with these evolving payment ecosystems.

The preference for online services over traditional branch visits is pronounced, particularly among younger demographics. While branches still hold value for complex transactions or personalized advice, the day-to-day banking is migrating online. Hyakugo Bank's strategy must balance maintaining a physical presence with enhancing its robust digital service delivery channels.

Japan's aging population, with over 29% of its citizens aged 65 or older as of early 2024, presents a significant challenge and opportunity for Hyakugo Bank. This demographic shift directly impacts its customer base, increasing demand for specialized financial products like retirement planning solutions and inheritance services. The bank must adapt its offerings to cater to the evolving needs of an older demographic.

Furthermore, the shrinking population in certain regions necessitates a strategic focus on retaining and attracting customers, particularly among the elderly who may require more simplified digital banking interfaces. Hyakugo Bank needs to invest in user-friendly technology and personalized advisory services to effectively serve this growing segment of its clientele.

Financial literacy in Japan showed a slight improvement, with a 2023 survey indicating 58% of adults felt confident managing their finances, up from 55% in 2021. This growing awareness translates into a significant demand for expert financial advice, particularly concerning investment strategies and long-term wealth accumulation.

Hyakugo Bank can capitalize on this by enhancing its advisory services, offering personalized guidance on everything from mortgage applications to sophisticated investment portfolios. For instance, by providing workshops on retirement planning or digital banking tools, the bank can solidify its role as a trusted financial partner for individuals seeking to navigate complex financial landscapes.

Community Expectations and Corporate Social Responsibility (CSR)

Community expectations are increasingly shaping Hyakugo Bank's approach to corporate social responsibility. Local residents and businesses anticipate the bank to actively contribute to regional economic growth, often through targeted support for small and medium-sized enterprises (SMEs) and participation in community development initiatives. For instance, in 2024, Hyakugo Bank continued its commitment to local revitalization by investing ¥500 million in regional infrastructure projects, a figure up 5% from the previous year.

These expectations extend to ethical banking practices, with a growing demand for transparency and sustainability in operations. Hyakugo Bank is responding by enhancing its reporting on environmental, social, and governance (ESG) metrics, aiming to align its business objectives with societal well-being. The bank's 2025 CSR report highlighted a 15% increase in employee volunteer hours dedicated to local charities, reflecting a tangible response to community engagement desires.

Key areas of community expectation include:

- Support for local businesses: Providing accessible credit and advisory services to regional SMEs.

- Community development projects: Investing in local infrastructure, education, and cultural programs.

- Ethical banking practices: Ensuring transparency, fair lending, and responsible investment strategies.

- Environmental stewardship: Implementing sustainable operational practices and supporting green initiatives.

Workforce Dynamics and Talent Acquisition

Hyakugo Bank faces evolving workforce dynamics, particularly concerning the availability of specialized talent in finance and rapidly advancing technology sectors. The banking industry, like many others, is experiencing shifts in employee expectations driven by generational differences, with younger professionals often prioritizing work-life balance and flexible arrangements. In 2024, reports indicated a growing demand for financial professionals with digital skills, with some surveys suggesting a shortage of up to 30% in cybersecurity and data analytics roles within the financial services sector.

Attracting and retaining top talent necessitates a strong focus on diversity and inclusion initiatives. Hyakugo Bank must cultivate an environment that appeals to a broad range of candidates, reflecting the diverse customer base it serves. For instance, in 2025, industry benchmarks show that companies with more diverse leadership teams tend to outperform their less diverse counterparts by as much as 35% in profitability. This emphasis on inclusivity is not just a social imperative but a strategic advantage in talent acquisition.

- Skilled Labor Availability: A notable gap exists in specialized financial and technological expertise, impacting recruitment efforts.

- Generational Expectations: Evolving work preferences, including demand for flexibility and purpose, influence employee attraction and retention strategies.

- Diversity and Inclusion Imperative: Implementing robust D&I programs is crucial for attracting a wider talent pool and fostering innovation, with studies in 2025 indicating a significant correlation between D&I and financial performance.

- Talent Retention Challenges: The competitive landscape for skilled professionals requires proactive measures to ensure employee satisfaction and loyalty.

Sociological factors significantly shape Hyakugo Bank's operational landscape, driven by evolving customer behaviors and societal expectations. The increasing reliance on digital banking, with a projected majority of transactions occurring online by 2024, underscores the need for robust digital infrastructure. Furthermore, the aging Japanese population, representing over 29% of citizens in early 2024, necessitates tailored financial products and simplified digital interfaces.

Community engagement and ethical practices are paramount, with a growing demand for Hyakugo Bank's contribution to regional economic growth and transparent operations. This includes supporting local SMEs and investing in community development, as evidenced by a 5% increase in infrastructure project investments in 2024. The bank's commitment to environmental, social, and governance (ESG) metrics, including a 15% rise in employee volunteer hours in 2025, reflects responsiveness to these expectations.

| Sociological Factor | Trend/Expectation | Impact on Hyakugo Bank |

|---|---|---|

| Digital Adoption | Majority of transactions online by 2024 | Invest in digital infrastructure and UX |

| Demographics | Over 29% aged 65+ (early 2024) | Develop retirement/inheritance services, simplify digital tools |

| Community Expectations | Support for SMEs, community development | Increase investment in regional projects (e.g., ¥500 million in 2024) |

| Ethical Practices | Demand for transparency and ESG | Enhance ESG reporting, increase volunteerism (15% in 2025) |

Technological factors

Hyakugo Bank is actively investing in digital transformation, aiming to bolster its FinTech capabilities. This includes significant upgrades to its online and mobile banking platforms, enhancing user experience and streamlining transaction processes. The bank is also integrating new technologies to improve operational efficiency and customer service, reflecting a broader industry trend towards digital-first banking solutions.

A key aspect of Hyakugo Bank's strategy involves adopting innovative FinTech solutions to remain competitive. For instance, by the end of fiscal year 2024, the bank reported a 15% increase in digital transaction volume compared to the previous year, demonstrating successful customer adoption of its enhanced digital services. These investments are crucial for meeting evolving customer expectations and adapting to the rapidly changing financial landscape.

Cybersecurity and data privacy are paramount for Hyakugo Bank, especially with the escalating sophistication of cyber threats. In 2024, global cybercrime costs were projected to reach $10.5 trillion annually, a stark reminder of the risks financial institutions face. Hyakugo Bank must therefore maintain significant ongoing investment in advanced security infrastructure and stringent data protection protocols to safeguard customer information and uphold regulatory compliance, such as Japan's Act on the Protection of Personal Information.

Hyakugo Bank can leverage Artificial Intelligence (AI) to significantly enhance customer analytics and risk assessment. For instance, AI-powered tools can process vast amounts of customer data to identify spending patterns and predict potential credit risks with greater accuracy, potentially reducing loan defaults. By 2024, the global AI market in banking was projected to reach tens of billions of dollars, indicating strong industry adoption.

The bank's adoption of Big Data analytics can lead to highly personalized customer services. By analyzing transaction history and preferences, Hyakugo Bank can offer tailored financial products and advice, improving customer satisfaction and loyalty. A 2025 forecast suggests that the financial services industry will continue to be a major driver of big data adoption, with benefits including improved operational efficiency and customer insights.

Implementing Blockchain technology offers a pathway to more secure and efficient transactions for Hyakugo Bank. This could streamline processes like cross-border payments and trade finance, reducing costs and settlement times. Globally, the blockchain in finance market is expanding, with projections indicating substantial growth in the coming years as institutions explore its potential for enhanced security and transparency.

Infrastructure and Connectivity

The availability and reliability of technological infrastructure in Mie Prefecture are foundational for Hyakugo Bank's digital banking initiatives. As of late 2024, Japan, and by extension Mie, boasts high internet penetration rates, with over 90% of households having broadband access. This robust connectivity is essential for seamless customer interactions with digital platforms.

Hyakugo Bank's ability to deploy and scale digital banking services hinges on this infrastructure. Reliable internet connectivity ensures customers can access mobile banking apps, online portals, and digital payment systems without interruption, fostering adoption and customer satisfaction. This is particularly important as the bank aims to expand its digital offerings in 2025.

- High Broadband Penetration: Over 90% of Japanese households have broadband access, a figure expected to remain strong into 2025, supporting digital banking adoption.

- Mobile Connectivity: Advanced 5G network expansion across Mie Prefecture enhances mobile banking performance and accessibility for customers on the go.

- Digital Service Demand: Customer expectations for 24/7 access to banking services via digital channels are increasing, making reliable infrastructure a competitive necessity.

Automation and Operational Efficiency

Hyakugo Bank can significantly boost its operational efficiency by adopting automation technologies. Automating routine back-office tasks, such as data entry and reconciliation, can free up human resources for more complex customer-facing roles. For instance, implementing robotic process automation (RPA) for loan application processing could reduce processing times by an estimated 40-60%, as seen in industry-wide adoption trends.

Further enhancing service delivery, automation can streamline customer support. AI-powered chatbots can handle a substantial volume of routine customer inquiries 24/7, improving response times and customer satisfaction. In 2024, financial institutions reported that AI chatbots resolved over 70% of common customer queries, leading to a noticeable reduction in call center operational costs.

The bank should consider automation in several key areas:

- Back-office process automation: Automating tasks like account reconciliation and compliance checks to minimize errors and speed up processing.

- Loan application automation: Implementing digital workflows and AI for credit assessment and document verification, potentially cutting application turnaround times by half.

- Customer support automation: Deploying chatbots and virtual assistants to handle frequently asked questions and basic service requests, improving availability and reducing wait times.

- Data analytics and reporting: Automating the generation of financial reports and performance analytics for faster decision-making.

Hyakugo Bank's technological advancements are central to its 2024-2025 strategy, focusing on digital transformation and enhanced customer experience. The bank is investing heavily in its online and mobile platforms, aiming to streamline transactions and improve user interaction. This digital-first approach is crucial for staying competitive in a rapidly evolving financial sector.

Key technological drivers for Hyakugo Bank include AI and Big Data analytics, projected to significantly boost customer insights and risk management. By leveraging these technologies, the bank can offer more personalized services and improve operational efficiency. The global AI in banking market is expected to see substantial growth, underscoring the importance of these investments.

Automation is another critical area, with initiatives to streamline back-office operations and customer support. Implementing robotic process automation (RPA) for tasks like loan processing could reduce turnaround times by up to 60%. AI-powered chatbots are also being deployed to handle customer queries, with financial institutions reporting over 70% query resolution by such systems in 2024.

The bank's digital services are underpinned by robust technological infrastructure, with Japan boasting over 90% household broadband penetration as of late 2024. This reliable connectivity, coupled with expanding 5G networks, ensures seamless access to digital banking platforms, meeting increasing customer demand for 24/7 service availability.

Legal factors

The Banking Act forms the bedrock of Japan's financial sector, dictating how institutions like Hyakugo Bank operate, from capital requirements to customer protection. The Financial Services Agency (FSA) further refines these rules through specific regulations and guidelines, ensuring a robust and compliant banking environment.

Hyakugo Bank's adherence to these comprehensive legal frameworks is paramount. For instance, in 2023, the FSA continued its focus on digital transformation and cybersecurity, issuing updated guidelines that banks must implement to safeguard customer data and maintain operational integrity.

Hyakugo Bank operates under rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These laws mandate comprehensive customer due diligence, including Know Your Customer (KYC) procedures, to verify identities and assess risks. The bank must also implement sophisticated transaction monitoring systems to detect and flag any unusual or suspicious activities. In 2024, global financial institutions reported billions of dollars in suspicious transactions, underscoring the critical nature of these compliance efforts.

Adherence to AML/CTF laws requires robust internal controls and reporting mechanisms. Hyakugo Bank is obligated to report suspicious transactions to relevant authorities promptly, aiding in the fight against financial crime. Failure to comply can result in severe penalties, including substantial fines and reputational damage. For instance, in 2023, several major banks faced multi-million dollar fines for AML compliance failures, highlighting the significant financial and operational risks associated with non-compliance.

Hyakugo Bank operates under stringent consumer protection laws, including Japan's Financial Instruments and Exchange Act and the Banking Act, which mandate fair lending practices and transparency. These regulations require clear disclosure of all product terms, fees, and risks to customers, ensuring they can make informed decisions. For instance, the Financial Services Agency (FSA) actively monitors banks to prevent predatory lending and ensure customer data privacy, a critical aspect of maintaining trust in the financial sector.

Data Protection and Privacy Regulations (e.g., APPI)

Japan's Act on the Protection of Personal Information (APPI) imposes stringent requirements on how financial institutions like Hyakugo Bank manage customer data. This means meticulous adherence to rules governing data collection, secure storage, and transparent usage is paramount for maintaining trust and avoiding penalties. Non-compliance can lead to significant fines and reputational damage, impacting customer confidence and business operations.

In 2023, Japan continued to refine its data protection framework, with ongoing discussions around strengthening APPI provisions to align with global standards. Hyakugo Bank must actively monitor these developments to ensure its practices remain compliant.

- APPI Compliance: Hyakugo Bank must ensure all data handling processes strictly adhere to APPI regulations.

- Data Safeguarding: Robust measures are required for the secure storage and protection of sensitive customer information.

- Regulatory Updates: Continuous monitoring of evolving data protection laws in Japan is essential.

- Customer Trust: Maintaining compliance builds and preserves customer trust in the bank's data management practices.

Competition Law and Anti-Monopoly Regulations

Competition laws significantly shape Hyakugo Bank's strategic options, particularly concerning market consolidation. Regulations aimed at preventing monopolies ensure a level playing field, influencing decisions on mergers, acquisitions, or partnerships. For instance, the Financial Services Agency (FSA) in Japan scrutinizes such moves to maintain banking sector stability and consumer choice.

These anti-monopoly regulations mean Hyakugo Bank must carefully navigate potential collaborations. Any significant market share increase through mergers could trigger regulatory review, potentially leading to divestitures or outright blocking of deals. This oversight aims to prevent excessive market power that could harm consumers through higher fees or reduced service quality.

In 2024, the banking sector in Japan continued to see consolidation discussions, driven by low-interest rates and the need for greater efficiency. Hyakugo Bank, like its peers, must operate within this framework, balancing growth ambitions with compliance. The Bank of Japan's ongoing monetary policy also indirectly influences competitive dynamics by affecting profitability across the industry.

Key considerations for Hyakugo Bank under competition law include:

- Merger and Acquisition Scrutiny: Regulatory approval is paramount for any significant consolidation, with authorities assessing potential impacts on market competition.

- Anti-competitive Practices: Hyakugo Bank must avoid practices like price-fixing or market allocation that could be deemed anti-competitive.

- Digitalization and Fintech: The rise of fintech challengers also falls under the purview of competition law, ensuring new entrants do not face undue barriers.

- Market Share Thresholds: Exceeding certain market share thresholds in specific banking services could invite closer regulatory examination.

Hyakugo Bank must navigate a complex web of consumer protection laws, including the Banking Act and the Financial Instruments and Exchange Act, ensuring fair practices and transparency. These regulations mandate clear disclosures on product terms, fees, and risks, empowering customers to make informed choices. For instance, the Financial Services Agency (FSA) actively monitors banks to prevent predatory lending and safeguard customer data privacy, crucial for maintaining public trust.

The Act on the Protection of Personal Information (APPI) imposes strict rules on how Hyakugo Bank handles customer data, from collection to storage and usage. Adherence to these regulations is vital for preserving customer confidence and avoiding penalties. Japan's ongoing efforts to align APPI with global standards in 2023 and 2024 mean Hyakugo Bank must remain vigilant about evolving data protection requirements.

Competition laws, enforced by bodies like the FSA, significantly influence Hyakugo Bank's strategic decisions regarding mergers and acquisitions. These regulations aim to prevent monopolies and ensure a competitive market, meaning any consolidation activity faces rigorous scrutiny to maintain sector stability and consumer choice. In 2024, ongoing consolidation discussions in Japan's banking sector, driven by efficiency needs, highlight the importance of this legal framework for Hyakugo Bank.

| Legal Area | Key Regulations | Impact on Hyakugo Bank | Recent Developments/Data |

|---|---|---|---|

| Banking Operations | Banking Act, Financial Services Agency (FSA) Guidelines | Capital requirements, customer protection, operational standards. | FSA focus on digital transformation and cybersecurity in 2023. |

| Financial Crime Prevention | Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF) | KYC procedures, transaction monitoring, suspicious activity reporting. | Global institutions reported billions in suspicious transactions in 2024; banks faced multi-million dollar fines for AML failures in 2023. |

| Consumer Protection | Financial Instruments and Exchange Act, Banking Act | Fair lending, transparent product disclosures, data privacy. | FSA actively monitors for predatory lending and data privacy breaches. |

| Data Privacy | Act on the Protection of Personal Information (APPI) | Secure data handling, collection, storage, and transparent usage. | Ongoing discussions in 2023-2024 to strengthen APPI, aligning with global standards. |

| Market Competition | Anti-monopoly laws | Scrutiny of mergers and acquisitions, prevention of anti-competitive practices. | Consolidation discussions in Japan's banking sector in 2024; potential regulatory review of market share increases. |

Environmental factors

Climate change presents both physical and transition risks for Hyakugo Bank. Physical risks include increased frequency of natural disasters like typhoons and heavy rainfall in Mie Prefecture, which could impact the bank's loan portfolio through damage to businesses and properties. Transition risks arise from shifts in industries towards lower-carbon economies, potentially affecting the value of assets in carbon-intensive sectors and necessitating regulatory adjustments.

For instance, a significant typhoon in late 2024 could lead to increased non-performing loans in agriculture and tourism sectors within Hyakugo Bank's operating regions. Furthermore, evolving environmental regulations in Japan, such as stricter emissions standards for manufacturing clients, could necessitate increased provisioning or impact the creditworthiness of certain borrowers.

Conversely, Hyakugo Bank can capitalize on opportunities in green finance. As of early 2025, there's growing investor demand for sustainable investments. The bank can expand its offerings in green bonds, renewable energy project financing, and loans for energy-efficient upgrades, aligning with Japan's national commitment to carbon neutrality by 2050 and potentially attracting new customer segments.

Hyakugo Bank is actively integrating ESG principles across its operations, focusing on sustainable finance. In 2024, the bank committed to increasing its portfolio of green finance products, aiming for a 15% growth in loans for renewable energy projects. This reflects a broader strategy to assess environmental risks associated with borrowers and encourage their transition to more sustainable practices.

The bank's approach includes developing new financial instruments that support environmentally conscious businesses and investing in funds with strong ESG ratings. Operationally, Hyakugo Bank is working to reduce its carbon footprint, targeting a 10% reduction in energy consumption by 2025 through efficiency upgrades and increased use of renewable energy sources in its branches.

Japan is intensifying its focus on sustainable finance, with regulatory bodies increasingly mandating environmental, social, and governance (ESG) considerations for financial institutions. This includes new reporting requirements for climate-related risks and opportunities, as well as the development of robust green bond frameworks. For Hyakugo Bank, aligning with these national objectives is crucial for long-term viability and stakeholder trust.

The Japanese government has set ambitious decarbonization targets, creating a supportive environment for financial products that facilitate this transition. Initiatives like the Green Finance Network and the development of taxonomies for sustainable activities are designed to guide capital towards environmentally friendly projects. Hyakugo Bank must actively integrate these principles into its lending and investment strategies to capitalize on emerging opportunities and meet evolving compliance standards.

Reputational Risk and Stakeholder Expectations

Hyakugo Bank faces reputational risks tied to its environmental actions, as stakeholders increasingly demand corporate responsibility. Customers, investors, and the general public expect financial institutions to demonstrate a commitment to environmental sustainability. A strong stance on this can significantly boost Hyakugo Bank's brand image and public trust.

The bank's proactive approach to environmental, social, and governance (ESG) factors is crucial for mitigating reputational damage. For instance, a 2024 survey indicated that 65% of retail customers consider a company's environmental policies when making purchasing decisions, a figure that is expected to rise. Hyakugo Bank's investments in green finance initiatives, such as ¥100 billion allocated to sustainable projects in 2024, directly address these evolving expectations.

- Growing Investor Demand: In 2025, ESG-focused funds are projected to manage over $50 trillion globally, highlighting investor preference for sustainable companies.

- Customer Loyalty: A 2024 report found that 58% of consumers are more loyal to brands with strong environmental commitments.

- Regulatory Scrutiny: Banks face increasing pressure from regulators to disclose and manage their climate-related financial risks, impacting public perception.

- Brand Differentiation: Demonstrating genuine environmental stewardship can differentiate Hyakugo Bank from competitors, attracting both customers and talent.

Resource Management and Operational Footprint

Hyakugo Bank is actively working to reduce its environmental impact through efficient resource management. This includes initiatives focused on decreasing energy consumption across its numerous branches and promoting paperless operations to minimize waste.

The bank is implementing strategies to lower its operational footprint, such as encouraging digital banking services and optimizing energy usage in its facilities. These efforts are crucial for aligning with growing environmental expectations and regulations.

- Energy Efficiency: Hyakugo Bank has been upgrading its branch lighting and HVAC systems to more energy-efficient models, aiming to reduce electricity consumption by a targeted percentage by the end of 2025.

- Waste Reduction: The bank is expanding its recycling programs and has set goals to decrease paper usage by promoting digital statements and internal documentation.

- Paperless Transactions: Hyakugo Bank is investing in digital platforms to encourage customers to opt for online banking and electronic communication, significantly reducing paper-based transactions.

Hyakugo Bank must navigate environmental regulations and capitalize on green finance opportunities to align with Japan's decarbonization goals. Growing investor and customer demand for sustainability, evidenced by projected global ESG fund growth to over $50 trillion by 2025, presents a significant opportunity. The bank's commitment to increasing green finance by 15% in 2024 and reducing operational energy consumption by 10% by 2025 demonstrates a strategic response to these evolving environmental factors.

| Environmental Factor | Impact on Hyakugo Bank | Opportunity/Risk | 2024/2025 Data/Target |

|---|---|---|---|

| Climate Change Risks | Physical damage to assets, increased non-performing loans | Risk | Potential for increased NPLs in agriculture/tourism due to typhoons in late 2024. |

| Transition to Green Economy | Stranded assets in carbon-intensive sectors, regulatory adjustments | Risk/Opportunity | Need to adapt lending to lower-carbon industries. |

| Green Finance Demand | Increased demand for sustainable investments | Opportunity | ESG funds projected to manage over $50 trillion globally by 2025. |

| Regulatory Environment | Mandatory ESG reporting, green bond frameworks | Risk/Opportunity | Aligning with national decarbonization targets and taxonomies. |

| Operational Footprint | Energy consumption, waste generation | Risk/Opportunity | Targeting 10% reduction in energy consumption by 2025. |

PESTLE Analysis Data Sources

Our Hyakugo Bank PESTLE analysis is meticulously constructed using data from official Japanese government publications, reputable financial news outlets, and leading economic research institutions. We incorporate insights from Bank of Japan reports, industry-specific market analyses, and socio-economic trend surveys to ensure a comprehensive understanding of the operating environment.