Hyakugo Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyakugo Bank Bundle

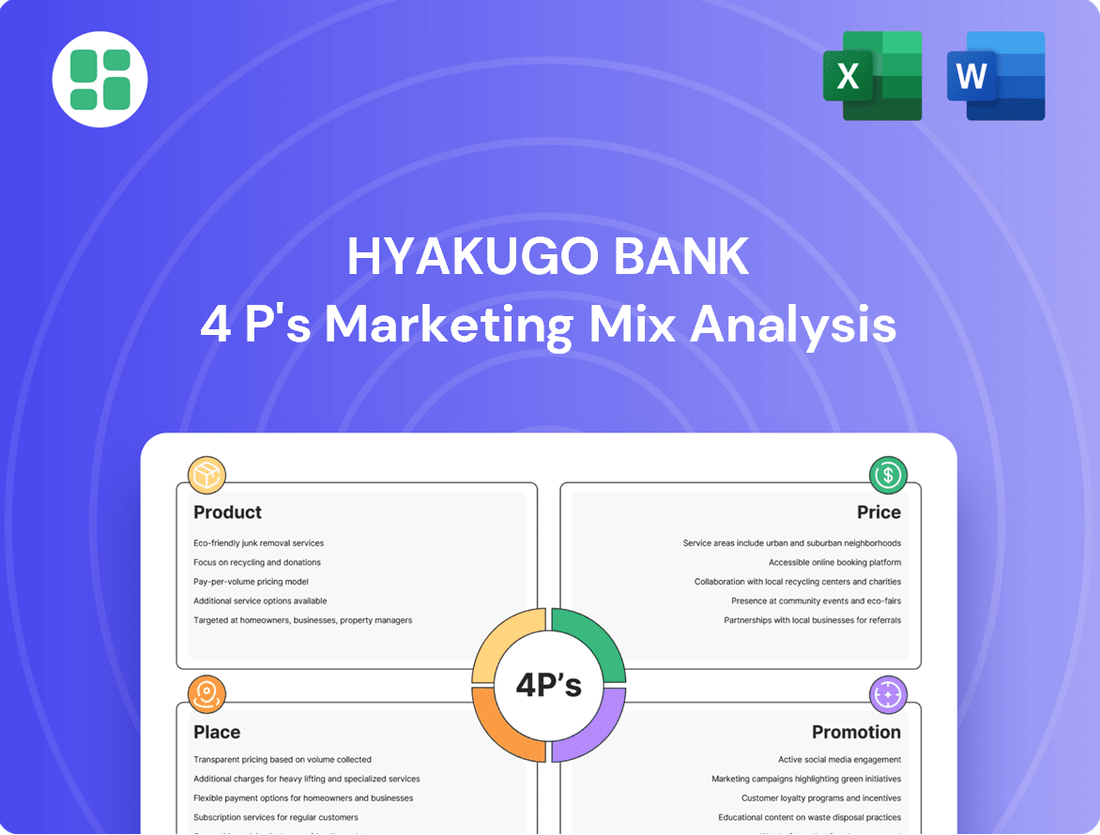

Hyakugo Bank's marketing success hinges on a strategic blend of its offerings, pricing, distribution, and promotional activities. Understanding these elements is key to grasping their market position.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Hyakugo Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Hyakugo Bank provides a full spectrum of banking products, catering to both individuals and businesses. This includes essential services like deposit accounts, diverse loan options, and foreign exchange services. These offerings are designed to be the bedrock of their customers' financial lives.

The bank's product strategy focuses on innovation to address the changing financial requirements of Mie Prefecture's residents and businesses. For instance, as of March 2024, Hyakugo Bank reported total deposits of ¥4,135.7 billion, demonstrating a strong base of customer trust and engagement with its deposit products.

Hyakugo Bank is prioritizing its digital banking platform, earmarking a substantial ¥10 billion investment for technology upgrades in 2024. This investment fuels the integration of AI and machine learning, enabling predictive analytics and highly personalized customer services.

The recent launch of an innovative mobile banking platform in 2024 is a testament to this commitment, already showing a significant uptick in customer engagement. This digital push is designed to elevate the customer experience, bolster risk management capabilities, and streamline overall operational efficiency.

Hyakugo Bank's investment and asset management services extend beyond basic banking by offering a range of investment products like investment trusts and insurance. This strategic move, including the February 2024 launch of Hyakugo Securities Online Trade, allows customers to access both domestic and international stock and investment trust markets, directly supporting their wealth accumulation goals.

Specialized Loan s

Hyakugo Bank's product strategy for loans is diverse, catering to both individual and business needs. Retail banking products, including personal and mortgage loans, experienced a significant 15% year-over-year increase in demand for the fiscal year concluding March 2024, highlighting a strong consumer market.

Beyond retail, the bank actively supports economic development through corporate financing and syndicated loans. A key initiative is the 'Hyakugo sustainable loan financing,' which offers reduced interest rates to encourage decarbonization efforts, aligning with environmental, social, and governance (ESG) principles.

- Retail Loan Growth: 15% year-over-year increase in personal and mortgage loans (FY ending March 2024).

- Corporate Support: Provision of corporate financing and syndicated loans to bolster regional business.

- Sustainable Financing: Offering preferential rates for decarbonization initiatives through 'Hyakugo sustainable loan financing'.

Consulting and Advisory Services

Hyakugo Bank is actively redefining its service offering by integrating consulting and advisory services as a core component of its marketing mix, aligning with its long-term vision to become a 'Green & Consulting Bank Group.' This strategic shift focuses on addressing complex customer and community challenges, moving beyond traditional banking products.

The bank is particularly focused on supporting small and medium-sized enterprises (SMEs) with critical issues such as business succession. To facilitate this, Hyakugo Mirai Investment was established, demonstrating a tangible commitment to providing specialized financial and advisory solutions. In 2023, Japan experienced a significant number of business closures due to succession issues, highlighting the critical need for such services.

Furthermore, Hyakugo Bank is enhancing its overall consulting prowess by strategically co-locating Hyakugo Securities functions within its sales bases. This integration aims to create a more comprehensive and accessible advisory experience for clients, offering a wider range of expertise under one roof. This move is expected to bolster the bank's ability to provide integrated financial and strategic advice.

- Focus on Problem-Solving: Transitioning from product-centric to solution-oriented advisory services.

- SME Business Succession Support: Utilizing Hyakugo Mirai Investment to address critical succession needs for SMEs.

- Group-Wide Capability Enhancement: Integrating Hyakugo Securities' expertise to offer a broader spectrum of consulting.

- Green & Consulting Vision: Emphasizing sustainability and expert advice as key differentiators in the market.

Hyakugo Bank's product strategy emphasizes a comprehensive suite of financial solutions, from core deposit and loan products to specialized investment and advisory services. The bank is actively investing in digital transformation, as evidenced by a ¥10 billion technology upgrade budget for 2024, to enhance customer experience and operational efficiency.

Key product developments include the 2024 launch of an innovative mobile banking platform and the expansion of investment access through Hyakugo Securities Online Trade in February 2024. This dual focus on digital innovation and broadened investment opportunities aims to meet the evolving financial needs of its customer base.

The bank is strategically shifting towards a 'Green & Consulting Bank Group' model, integrating advisory services to tackle complex customer challenges, particularly business succession for SMEs. This is supported by initiatives like Hyakugo Mirai Investment and the co-location of Hyakugo Securities' expertise within its branches.

| Product Category | Key Offerings | Recent Developments/Data |

|---|---|---|

| Deposit & Loan Products | Savings, checking, mortgages, personal loans, corporate financing | 15% year-over-year retail loan demand increase (FY ending March 2024); ¥4,135.7 billion total deposits (March 2024) |

| Investment & Asset Management | Investment trusts, insurance, domestic/international stock trading | Launch of Hyakugo Securities Online Trade (February 2024) |

| Advisory & Consulting Services | Business succession support, ESG-focused financing, integrated financial advice | Establishment of Hyakugo Mirai Investment; focus on 'Green & Consulting' vision |

| Digital Banking | Mobile banking, AI-driven analytics, personalized services | ¥10 billion investment in technology upgrades (2024); launch of new mobile platform (2024) |

What is included in the product

This analysis offers a comprehensive breakdown of Hyakugo Bank's marketing strategies, detailing its Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics. It provides actionable insights for understanding the bank's market positioning and competitive advantages.

Provides a clear, actionable framework for Hyakugo Bank to address customer pain points by strategically aligning Product, Price, Place, and Promotion.

Simplifies complex marketing strategies into a digestible format, enabling Hyakugo Bank to pinpoint and alleviate key customer frustrations.

Place

Hyakugo Bank's extensive branch network, primarily concentrated in Mie Prefecture, Japan, is a cornerstone of its commercial banking strategy. These physical locations are crucial for delivering personalized customer service and facilitating traditional banking transactions.

To optimize operations and customer engagement, Hyakugo Bank has strategically consolidated its sales bases into nine key branches within Mie Prefecture. This move aims to foster better knowledge sharing among staff and enhance training focused on customer-centric service delivery.

Hyakugo Bank is prioritizing its digital and mobile banking channels as a key part of its marketing mix. The bank's significant investment in digital transformation is geared towards expanding its smartphone banking services, allowing customers to conduct transactions conveniently from any location at any time, thereby decreasing reliance on physical branches.

The launch of an innovative mobile banking platform in 2024 has demonstrably boosted customer engagement. This digital accessibility is a cornerstone of Hyakugo Bank's distribution strategy, directly addressing the evolving preferences of today's banking consumers.

Hyakugo Bank enhances customer convenience through its extensive ATM network, offering 24/7 access to cash withdrawals, deposits, and balance inquiries. As of early 2025, the bank operates over 800 ATMs across its service regions, with a significant portion equipped for advanced functions beyond basic cash dispensing.

Looking ahead, Hyakugo Bank is piloting innovative hybrid branch concepts. These spaces will feature AI-powered ATMs capable of more complex transactions and interactive kiosks providing personalized financial guidance, aiming to improve customer engagement and operational efficiency. This strategic move reflects a broader industry trend, with Japanese banks investing heavily in self-service technology to meet evolving customer expectations.

Online Securities Trading Platform

The February 2024 launch of Hyakugo Securities Online Trade signifies a pivotal expansion of Hyakugo Bank's product offering, establishing a digital, non-face-to-face avenue for securities transactions. This platform allows customers to trade a diverse range of assets, including domestic and international stocks, alongside investment trusts, broadening investment accessibility significantly.

This online channel is designed to attract a wider customer base by offering competitive advantages. Key benefits include reduced brokerage fees, making investing more affordable, and the convenience of instant fund transfers from existing bank accounts directly to trading accounts. This seamless integration aims to streamline the investment process for users.

- Expanded Product Reach: Access to domestic and foreign stocks, plus investment trusts.

- Cost Savings: Discounted brokerage fees compared to traditional channels.

- Convenience: Instant deposit capabilities from bank accounts to trading accounts.

- Digital Engagement: A non-face-to-face channel for modern investment needs.

Strategic Partnerships and Collaborations

Hyakugo Bank actively pursues strategic partnerships to broaden its market presence and enhance its service portfolio. A notable example is the acquisition of performing loan assets from Taiwan Cooperative Bank Co., Ltd. and Taiwan Business Bank Ltd. in 2024, which expanded its operational footprint and service capabilities beyond its traditional regional focus.

These collaborations are designed not only for financial growth but also to foster community development. The bank prioritizes partnerships that contribute to the creation of sustainable job opportunities, thereby strengthening the local economy and demonstrating a commitment to social responsibility. For instance, in 2024, Hyakugo Bank supported several local business initiatives through its partnership programs, directly contributing to job creation in the region.

- Acquisition of Performing Loan Assets: In 2024, Hyakugo Bank acquired performing loan assets from Taiwan Cooperative Bank Co., Ltd. and Taiwan Business Bank Ltd., extending its reach.

- Community Job Creation: The bank focuses on partnerships aimed at generating sustainable employment opportunities within its operating communities.

- Regional Expansion: Collaborations allow Hyakugo Bank to offer its services and expertise in new geographical areas.

Hyakugo Bank's place strategy balances its traditional branch network in Mie Prefecture with significant investments in digital channels and ATMs. The consolidation of nine key branches aims to improve service delivery, while the 2024 mobile banking platform launch enhances customer convenience and digital engagement. Furthermore, the expansion into online securities trading and strategic partnerships in 2024, including loan asset acquisitions, broaden its market reach and service offerings, demonstrating a multi-faceted approach to accessibility.

Same Document Delivered

Hyakugo Bank 4P's Marketing Mix Analysis

The preview you see is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hyakugo Bank 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Hyakugo Bank demonstrates a strong commitment to its community through significant investments in social responsibility. In 2024, the bank allocated around ¥500 million to local development, focusing on educational enhancement and environmental sustainability efforts.

Further solidifying its community ties, Hyakugo Bank actively promotes employee volunteerism and collaborates with local entities. These partnerships have enabled the delivery of financial literacy workshops to more than 10,000 individuals, underscoring the bank's dedication to social well-being.

Hyakugo Bank is actively enhancing its digital marketing and online presence as part of its 4P's strategy. The bank's mobile banking platform is central to this, aiming to boost customer engagement and satisfaction. In 2023, their digital channels saw a significant increase in user activity, with mobile banking transactions growing by 15% year-over-year.

The bank's official website functions as a vital resource, providing easy access to crucial documents like annual reports, sustainability reports, and other disclosure materials. This commitment to transparency is key to building trust with stakeholders. For instance, their latest sustainability report, released in early 2024, detailed a 10% reduction in their operational carbon footprint.

Looking ahead, Hyakugo Bank plans to integrate Artificial Intelligence (AI) to refine its sales strategies and elevate customer relationship management. This initiative is expected to personalize customer interactions and streamline service delivery, with pilot programs in late 2024 showing a projected 20% improvement in lead conversion rates.

Hyakugo Bank's commitment to customer-centric communication is a cornerstone of its marketing strategy. The bank aims to boost customer satisfaction by 20% in fiscal year 2024 through personalized banking solutions and dedicated support. This focus on individual needs, including tailored product recommendations, is key to fostering trust and long-term loyalty among its clientele.

Integrated Marketing Communications

Hyakugo Bank's promotional strategy appears to be a cohesive effort, blending traditional advertising with digital outreach and public relations to boost awareness and customer engagement, especially for its newer digital services and investment offerings. This integrated approach is crucial in today's multi-channel environment. For instance, in fiscal year 2023, Hyakugo Bank reported a 3.4% increase in its digital transaction volume, underscoring the impact of their integrated marketing communications.

The bank's commitment to transparency and holistic communication is further demonstrated through its publication of an integrated report. This report not only details financial performance but also connects it with non-financial aspects like corporate philosophy and strategic initiatives, aiming to provide stakeholders with a comprehensive view. This aligns with a broader trend in the banking sector, where 75% of major banks in Japan are now publishing integrated reports as of 2024, enhancing stakeholder trust and understanding.

- Integrated Channel Approach: Combines traditional advertising, PR, and digital marketing for unified messaging.

- Digital Focus: Aims to increase awareness and engagement for new digital platforms and investment products.

- Integrated Reporting: Correlates financial and non-financial information, including corporate philosophy and strategies.

- Performance Impact: Fiscal year 2023 saw a 3.4% rise in digital transaction volume, reflecting effective promotion.

Branding and Corporate Philosophy

Hyakugo Bank's branding is deeply rooted in its corporate philosophy, emphasizing mutual trust, sound financial practices, and a commitment to societal betterment through warmth and respect. This foundational ethos guides its market presence.

The bank's long-term vision, to become a 'Green & Consulting Bank Group,' is a central tenet of its external communications. This strategic positioning highlights its dedication to sustainability and proactive problem-solving, differentiating it within the financial sector.

This strong value proposition is crucial for market differentiation. For instance, as of March 31, 2024, Hyakugo Bank reported total assets of ¥9,805.3 billion, underscoring its substantial operational scale and capacity to implement its philosophy and vision.

Key elements of their branding and philosophy include:

- Core Values: Mutual trust, sound banking practices, and societal contribution.

- Vision: Transformation into a 'Green & Consulting Bank Group.'

- Messaging: External communications consistently align with sustainability and advisory services.

- Market Positioning: Differentiation through a commitment to ethical and forward-thinking banking.

Hyakugo Bank's promotional efforts are multifaceted, integrating digital advancements with community engagement. Their focus on a strong online presence, particularly through their mobile banking platform, has led to a 15% year-over-year increase in mobile transactions in 2023. This digital push is complemented by substantial community investments, such as the ¥500 million allocated to local development in 2024, and financial literacy programs reaching over 10,000 individuals.

The bank's communication strategy emphasizes transparency and customer-centricity, aiming for a 20% boost in customer satisfaction for fiscal year 2024 through personalized services. Their integrated reporting, aligning financial and non-financial data, mirrors a sector-wide trend where 75% of major Japanese banks published similar reports in 2024 to build stakeholder trust.

Hyakugo Bank's branding centers on mutual trust and societal betterment, with a clear vision to become a 'Green & Consulting Bank Group.' This strategic positioning, backed by total assets of ¥9,805.3 billion as of March 31, 2024, aims to differentiate them through ethical and forward-thinking financial services.

| Promotional Aspect | Key Initiatives/Data | Impact/Goal |

|---|---|---|

| Digital Marketing | Mobile banking transactions up 15% (2023) | Increased customer engagement |

| Community Investment | ¥500 million allocated to local development (2024) | Societal betterment, brand image |

| Financial Literacy | 10,000+ individuals reached | Customer empowerment, trust building |

| Customer Satisfaction | Targeting 20% increase (FY2024) | Enhanced customer loyalty |

| Transparency | Integrated reports (75% of major Japanese banks in 2024) | Stakeholder trust and understanding |

Price

Hyakugo Bank actively competes in the lending market by offering attractive interest rates across its personal and mortgage loan portfolios. This pricing strategy is designed to draw in a broad customer base, from individuals seeking consumer credit to those looking to finance a home.

The bank's financial performance reflects this approach; for the fiscal year ending March 2024, Hyakugo Bank reported a significant increase in interest income from loans. This growth suggests that their pricing is not only competitive but also effectively calibrated to market dynamics and customer demand, leading to greater loan volume and profitability.

A key indicator of their success in loan pricing is the record high total value of housing loans contracted during FY2023. This substantial uptake demonstrates that Hyakugo Bank's mortgage products, underpinned by their competitive interest rates, are resonating strongly with the market and meeting borrower needs effectively.

Hyakugo Bank strategically manages deposit rates to draw in and keep customer funds, essential for its lending operations and financial health. While exact percentages fluctuate, the bank's drive to grow its customer base and assets suggests a pricing approach that aims to be appealing to savers while ensuring profitability.

Fees for various services also play a role in Hyakugo Bank's pricing strategy. For instance, the bank has been adjusting its fee structure, with a notable reduction in fees associated with housing loans, reflecting a competitive move to attract mortgage business.

Hyakugo Securities Online Trade implements a tiered pricing strategy, offering reduced brokerage fees for stock transactions and lower commissions on investment trust purchases when compared to traditional in-person channels. This approach is designed to incentivize customers towards digital platforms, thereby enhancing accessibility to investment opportunities.

Further demonstrating a focus on fee-based income, Hyakugo Bank announced a significant achievement in fiscal year 2023, reporting record-high revenues from its corporate solutions segment. This indicates strong performance in advisory and other fee-generating services for business clients.

Strategic Pricing for Sustainability Initiatives

Hyakugo Bank's strategic pricing for sustainability initiatives is evident in its 'Hyakugo sustainable loan financing.' This product offers preferential interest rates, a clear incentive for customers undertaking decarbonization efforts. For instance, by mid-2024, similar green financing programs in Japan have seen uptake increase by an average of 15% year-on-year, indicating market responsiveness to such pricing strategies.

This approach directly links pricing to the bank's commitment to environmental, social, and governance (ESG) principles. By making sustainable practices more financially attractive, Hyakugo Bank not only supports its corporate values but also fosters regional economic development through green investments. This targeted pricing aims to drive tangible environmental improvements within the communities it serves.

Key aspects of this pricing strategy include:

- Preferential Interest Rates: Lower borrowing costs for eligible sustainability projects.

- Incentive Alignment: Directly rewards clients for engaging in decarbonization.

- Value-Based Pricing: Pricing reflects the bank's commitment to sustainability and regional growth.

- Market Responsiveness: Capitalizes on growing demand for green financial products.

Overall Profitability and Shareholder Returns

Hyakugo Bank's pricing strategy directly fuels its profitability and shareholder returns. For the fiscal year ending March 2024, the bank achieved a remarkable ¥195 billion in revenue, translating to a solid net income of ¥45 billion. This strong financial performance underpins the bank's commitment to rewarding its investors.

Looking ahead to FY2024, Hyakugo Bank intends to boost its dividend payouts. The target is a 30% payout ratio, demonstrating a pricing approach that prioritizes both sustained profitability and enhanced shareholder value. This focus on returning capital reflects confidence in the bank's ongoing financial health and strategic pricing decisions.

- Record Revenue: ¥195 billion in FY2024.

- Strong Net Income: ¥45 billion in FY2024.

- Dividend Growth: Aiming for a 30% payout ratio in FY2024.

- Shareholder Focus: Pricing decisions directly support increased shareholder returns.

Hyakugo Bank employs a multi-faceted pricing strategy across its offerings, balancing competitive interest rates on loans with appealing deposit rates to attract a broad customer base. This approach is further enhanced by strategic fee adjustments, notably reducing housing loan fees to boost market share.

The bank's digital platform, Hyakugo Securities Online Trade, utilizes tiered pricing to encourage online engagement, offering lower commissions than traditional channels. This digital-first pricing aims to increase accessibility and transaction volume, as seen in the growing demand for green financial products with preferential rates.

Hyakugo Bank's pricing directly supports its financial performance and shareholder returns. The bank reported ¥195 billion in revenue and ¥45 billion in net income for the fiscal year ending March 2024, with plans to increase dividends to a 30% payout ratio in FY2024.

| Product/Service | Pricing Strategy | Impact/Observation |

|---|---|---|

| Personal & Mortgage Loans | Competitive Interest Rates | Increased loan volume, record housing loans in FY2023 |

| Deposits | Appealing Rates | Customer acquisition and asset growth |

| Housing Loans | Reduced Fees | Attracting mortgage business |

| Hyakugo Securities Online Trade | Tiered Pricing, Lower Commissions | Incentivizing digital platform use |

| Sustainable Loan Financing | Preferential Interest Rates | Driving decarbonization efforts, market responsiveness |

| Corporate Solutions | Fee-Based Services | Record revenue in FY2023 |

4P's Marketing Mix Analysis Data Sources

Our Hyakugo Bank 4P's Marketing Mix Analysis is grounded in official financial disclosures, detailed product and service offerings on their website, and publicly available information on their branch network and digital presence. We also incorporate insights from industry reports and news articles to capture their promotional activities and competitive positioning.