Hudson Pacific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

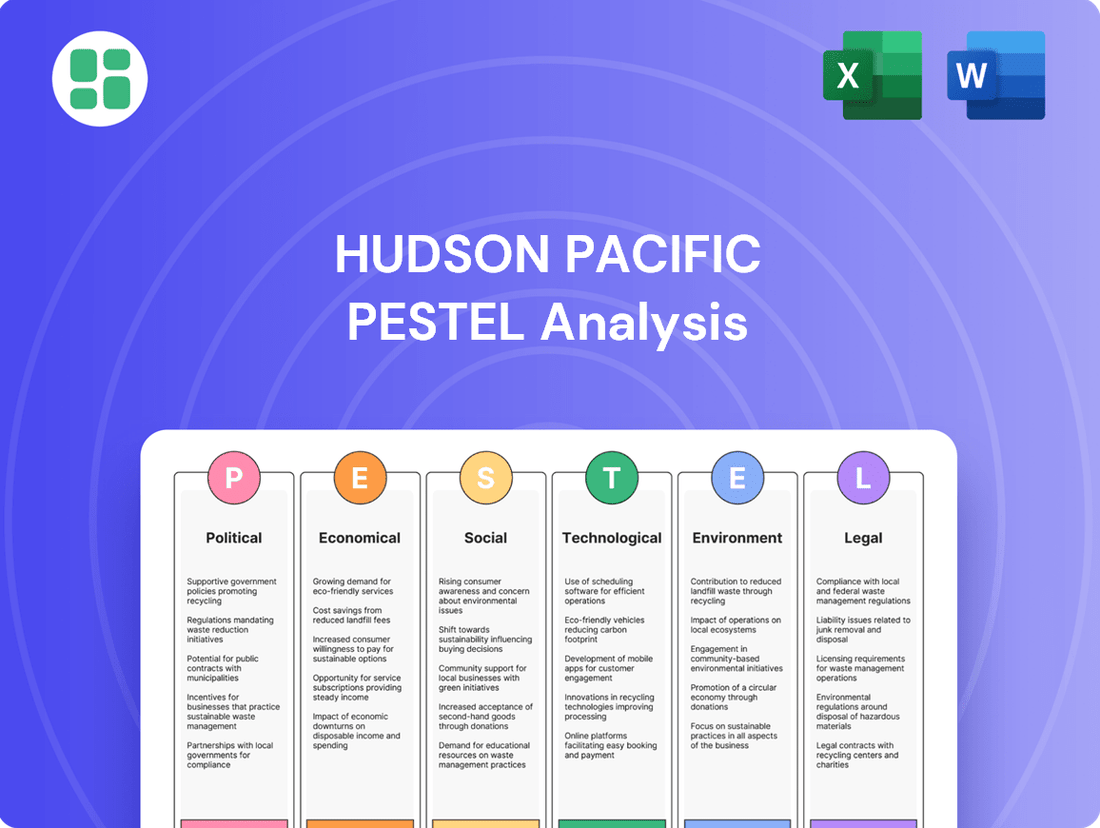

Hudson Pacific's future is intricately tied to the political, economic, social, technological, legal, and environmental forces at play. Our comprehensive PESTLE analysis dives deep into these external factors, revealing critical opportunities and potential challenges. Equip yourself with actionable intelligence to navigate this dynamic landscape and make informed strategic decisions. Download the full analysis now to gain a significant competitive advantage.

Political factors

Government policies on real estate development and zoning are critical for Hudson Pacific Properties. Changes in land use, zoning, and permitting at both local and state levels directly influence the company's capacity for new construction and redevelopment projects. For instance, new California real estate laws taking effect in 2025 are expected to impact housing project timelines and potentially alter rental market dynamics, affecting the supply and cost of new development.

Changes in corporate tax rates, like the potential adjustments discussed in the 2024 US federal budget proposals, can significantly impact Hudson Pacific's net income. For instance, a reduction in the corporate tax rate could boost profitability, while an increase might necessitate a review of operational efficiencies.

The stability of the REIT tax structure is paramount for Hudson Pacific's business model, as it relies on specific tax advantages. Any alterations to these, such as changes in depreciation schedules for investment properties at the state level, could directly affect the company's distributable income and, consequently, its valuation.

For example, if a particular state were to reduce capital gains tax rates in 2025, it could make Hudson Pacific's properties more attractive for sale, potentially leading to faster capital recycling and improved returns for shareholders. Conversely, an increase in property taxes could add to operational costs.

Local governments in Hudson Pacific's key West Coast markets, such as Los Angeles and the San Francisco Bay Area, are increasingly offering targeted incentives to attract and retain technology and media companies. For instance, Los Angeles has implemented programs like the California Film & Television Tax Credit, which has seen significant uptake, directly benefiting media tenants. These initiatives, including potential property tax abatements or streamlined permitting processes, can directly influence tenant demand for Hudson Pacific's properties.

Regulatory Stability in Key West Coast Markets

Hudson Pacific's primary West Coast markets, particularly California and Washington, benefit from a generally stable regulatory environment for commercial real estate. This stability is crucial for operational predictability and informed investment decisions. For instance, California's recent legislative sessions have focused on refining existing zoning and development laws rather than introducing sweeping, unpredictable changes, fostering a more predictable landscape for companies like Hudson Pacific.

A consistent and transparent regulatory framework, such as the established permitting processes in major hubs like Seattle and Los Angeles, provides a more favorable climate for long-term planning and capital allocation in the commercial real estate sector. This predictability allows for more accurate financial modeling and risk assessment.

Conversely, while major shifts are infrequent, localized regulatory adjustments or evolving environmental standards can introduce minor complexities. For example, new energy efficiency mandates in Washington state, while beneficial long-term, require ongoing adaptation and compliance investment. Hudson Pacific must remain attuned to these nuanced changes to maintain operational efficiency.

- California's commercial real estate vacancy rate stood at approximately 11.5% in Q1 2024, reflecting a relatively stable market influenced by regulatory predictability.

- Washington state's economic growth, supported by a consistent business regulatory framework, saw its GDP increase by an estimated 3.2% in 2023.

- The cost of compliance for new commercial developments in California can add 5-10% to project budgets, a factor influenced by regulatory requirements.

Film and TV Tax Credits

The availability and expansion of film and television tax credits in California directly impact the demand for Hudson Pacific's studio properties. These credits make California a more appealing filming location, which in turn drives higher occupancy and leasing rates for their sound stages and related facilities.

California's film and TV tax credit program has seen recent enhancements, including an increase in its annual cap. This expansion is a significant positive development, with projections indicating a boost in studio demand, particularly expected to materialize by late 2025.

- California Film and Television Tax Credit Program: Extended through 2030, offering a robust incentive for productions.

- Increased Annual Cap: The program's annual cap has been raised, allowing for larger productions to qualify for significant tax benefits.

- Economic Impact: In 2023, California's film and TV industry generated an estimated $50 billion in direct economic activity, underscoring the importance of these tax credits.

- Studio Demand: The enhanced credits are anticipated to drive increased demand for studio space, benefiting companies like Hudson Pacific.

Government policies, particularly those concerning real estate development and tax structures, significantly shape Hudson Pacific's operational landscape. Changes in zoning laws and permitting processes, like those being refined in California for 2025, directly influence new construction timelines and costs. Furthermore, shifts in corporate tax rates, as debated in 2024 federal budget proposals, can impact net income, while the stability of REIT tax advantages is crucial for the company's financial model.

Local incentives, such as California's Film & Television Tax Credit, are vital for driving tenant demand in key markets like Los Angeles. The extension and enhancement of these credits through 2030 are expected to boost studio occupancy, with projections suggesting increased demand by late 2025. Conversely, evolving environmental standards, like new energy efficiency mandates in Washington, require ongoing adaptation and investment.

The overall regulatory environment in Hudson Pacific's primary West Coast markets, particularly California and Washington, has remained relatively stable, offering predictability for long-term planning. For instance, California's focus on refining existing laws rather than introducing sweeping changes fosters a more predictable climate for commercial real estate investment. This stability is underscored by California's commercial real estate vacancy rate, which stood at approximately 11.5% in Q1 2024.

| Policy Area | Impact on Hudson Pacific | Relevant Data/Trend |

|---|---|---|

| Zoning & Permitting | Affects development timelines and costs | California refining laws for 2025; development costs can add 5-10% to project budgets. |

| Tax Rates (Corporate & REIT) | Influences net income and distributable income | 2024 federal budget proposals debated tax rate adjustments; REIT tax stability is paramount. |

| Film & TV Tax Credits | Drives demand for studio properties | California credits extended through 2030; projected to boost studio demand by late 2025. |

| Environmental Regulations | Requires ongoing compliance investment | New energy efficiency mandates in Washington state necessitate adaptation. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Hudson Pacific, covering Political, Economic, Social, Technological, Environmental, and Legal factors, to identify strategic opportunities and potential risks.

The Hudson Pacific PESTLE Analysis provides a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of sifting through extensive data.

Economic factors

Changes in interest rates significantly impact Hudson Pacific’s borrowing costs for new projects and property valuations. For instance, if the Federal Reserve maintains its benchmark interest rate around the 5.25%-5.50% range seen in late 2024 and into 2025, this sustained higher cost of capital will directly affect debt service expenses for acquisitions and development. Conversely, a decrease in rates would lower these costs, potentially boosting profitability and making real estate investments more appealing.

As monetary policy continues its normalization throughout 2025, the returns for Real Estate Investment Trusts (REITs) like Hudson Pacific are anticipated to be more closely correlated with their underlying operational performance rather than solely benefiting from a low-interest-rate environment. This shift means that factors like rental income growth and occupancy rates will become even more critical drivers of investor returns.

The economic vitality of West Coast tech and media centers directly fuels demand for Hudson Pacific's real estate portfolio. A booming economy in these areas encourages companies to expand, hire more people, and consequently, seek more office and studio space.

Investments in artificial intelligence are particularly impactful, with significant capital flowing into AI development on the West Coast. This trend is a key driver of increased demand for modern, adaptable office spaces within Hudson Pacific's core markets.

Inflationary pressures are a significant concern for Hudson Pacific, directly impacting its operating expenses. Costs for property taxes, utilities, routine maintenance, and labor are all susceptible to rising prices.

While Hudson Pacific can adjust rental income to keep pace with inflation, a substantial increase in operating costs that outstrips rent growth will inevitably squeeze profit margins. This dynamic is particularly relevant as upward pressure on these expenses is expected to persist through 2025.

Unemployment Rates and Office Demand

Unemployment rates, especially in key sectors like technology and media, significantly influence the demand for office spaces. A robust job market, signaled by low unemployment, generally translates to a higher need for physical office environments, whereas rising unemployment can curb office utilization and increase vacancies.

As of mid-2024, the U.S. unemployment rate hovered around 3.9%, with the tech sector showing resilience despite some earlier layoffs. Media sector employment has also seen stabilization. This backdrop suggests a cautiously optimistic outlook for office demand.

- Tech Sector Impact: While the tech industry experienced significant hiring surges in prior years, a more measured pace of employment growth in 2024, with some companies still undergoing restructuring, impacts demand for large-scale office leases.

- Media Sector Trends: The media industry's employment landscape is evolving with digital transformation, influencing the type and location of office space required, often favoring flexible and collaborative environments.

- Office Leasing Activity: Despite the prevalence of hybrid work models, office leasing activity has shown signs of stabilization in major markets through the first half of 2024, indicating a continued, albeit more selective, need for physical workspaces.

Venture Capital Funding Trends

Venture capital funding on the West Coast, especially for tech and media startups, directly impacts the expansion strategies of companies looking for office space. A robust VC environment fuels new business creation and growth, thereby boosting demand for both flexible and conventional office solutions.

Hudson Pacific is currently capitalizing on significant venture capital inflows, with a notable surge in investments directed towards the artificial intelligence (AI) sector. This trend is particularly relevant as AI companies often require substantial, high-quality office footprints.

- Record VC Investments: Global venture capital funding reached approximately $300 billion in 2024, with a substantial portion flowing into technology and AI startups, particularly on the West Coast.

- AI Sector Growth: The AI sector alone saw over $60 billion in funding in 2024, indicating strong demand from these innovative companies for office space.

- Hudson Pacific's Position: Hudson Pacific, with its focus on prime West Coast real estate, is well-positioned to benefit from this influx of capital, attracting tenants from rapidly expanding AI and tech firms.

Economic factors like interest rates and inflation directly influence Hudson Pacific's costs and revenue potential. Sustained interest rates around 5.25%-5.50% in 2024-2025 increase borrowing expenses for development and acquisitions. Inflationary pressures also raise operating costs for utilities and maintenance, potentially squeezing profit margins if rent increases don't keep pace.

The economic health of West Coast tech and media hubs is paramount for Hudson Pacific, as robust job markets and venture capital funding, particularly in AI, drive demand for office and studio space. For example, over $60 billion in venture capital flowed into the AI sector in 2024, directly benefiting companies like Hudson Pacific that cater to these growth industries.

What You See Is What You Get

Hudson Pacific PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hudson Pacific Properties details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

The shift towards work-from-home and hybrid models has fundamentally altered the demand for traditional office spaces. While the peak of fully remote work may have passed, hybrid arrangements are now the norm for many organizations, with employees expected in the office for a portion of their work week.

Hudson Pacific Properties, a major player in the office real estate market, has experienced a dip in office occupancy rates due to these trends. However, there are emerging indicators of a rebound as companies are actively reassessing and adjusting their physical office footprints to align with new working paradigms.

Data from Q1 2024 indicates that while office leasing activity is showing signs of life, the overall demand remains below pre-pandemic levels. For instance, Hudson Pacific reported a leased occupancy of 87.8% in Q1 2024, a slight improvement from previous quarters, but still reflecting the ongoing recalibration of space needs by tenants.

Tenant preferences are shifting towards office spaces that offer more than just desks; they want amenities that foster collaboration, well-being, and engagement. This trend is a significant sociological factor influencing the commercial real estate market. Hudson Pacific's strategy of developing world-class, amenitized spaces directly addresses this evolving demand.

In 2024, surveys indicated that over 70% of employees value office amenities like fitness centers, cafes, and communal areas when choosing a workplace. This highlights the critical need for property owners like Hudson Pacific to invest in these features to remain competitive and attract top-tier tenants seeking a more holistic work experience.

Population shifts on the West Coast significantly impact real estate demand. California, despite some domestic outmigration, continues to attract international arrivals, influencing the tenant pool and market dynamics for companies like Hudson Pacific.

In 2023, California saw a net domestic migration loss of approximately 343,000 people, yet its population grew due to international migration and births, reaching over 39 million. This influx, particularly in tech hubs, sustains demand for commercial and residential spaces.

Workforce Demographics in Tech/Media Sectors

The tech and media industries are experiencing a significant shift in workforce demographics, with a growing emphasis on age diversity, evolving lifestyle preferences, and a strong desire for work-life balance. These changes directly impact the demand for office and studio spaces, pushing for more adaptable and amenity-rich environments. Hudson Pacific's ability to align its real estate solutions with these evolving employee needs is crucial for maintaining its competitive edge.

For instance, the increasing prevalence of flexible work arrangements, including hybrid and remote models, is particularly attractive to segments of the workforce such as women and caregivers who often seek greater autonomy and control over their schedules. Data from 2024 indicates that companies offering robust flexible work policies saw a 25% higher employee retention rate in the tech sector compared to those with rigid in-office mandates. This trend necessitates that landlords like Hudson Pacific offer spaces that can accommodate varied work styles and support employee well-being.

- Age Diversity: The tech sector, while historically young, is seeing an increase in experienced professionals aged 40+, influencing demand for more mature and well-equipped workspaces.

- Lifestyle Preferences: Younger generations prioritize collaborative spaces, wellness amenities, and locations with strong community ties, impacting the design and location of new developments.

- Work-Life Balance: A significant majority of tech and media professionals, over 70% in recent surveys, now rank work-life balance as a top priority when choosing an employer, influencing their office location decisions.

- Flexible Work Impact: The rise of flexible work models means companies are looking for office spaces that serve as hubs for collaboration and culture, rather than just places for individual work, requiring adaptable layouts.

Urbanization and Live-Work-Play Environments

The increasing movement of people into cities, a trend known as urbanization, is a significant factor influencing real estate demand. This shift means more people are looking for places to live, work, and enjoy leisure activities all within close proximity. Hudson Pacific's focus on urban centers aligns well with this desire for integrated live-work-play environments, making their properties in places like Los Angeles and the San Francisco Bay Area particularly appealing.

This preference for convenience and a connected lifestyle directly boosts demand for the types of modern, well-located office and mixed-use spaces Hudson Pacific specializes in. As of early 2024, major metropolitan areas continue to see strong rental demand, with vacancy rates in prime urban office markets showing signs of stabilization or even slight improvement in some submarkets as companies prioritize quality and location to attract employees back to the office.

- Urbanization Trend: Global urbanization continues, with an increasing percentage of the world's population residing in cities, driving demand for urban real estate.

- Live-Work-Play Appeal: Tenants increasingly seek properties offering convenient access to amenities, transportation, and residential areas, enhancing the value of integrated urban developments.

- Market Demand Support: This trend directly supports rental demand for Hudson Pacific's strategically located urban properties, particularly in key technology and media hubs.

- Vacancy Rates: In Q1 2024, prime office vacancy rates in major US tech hubs like San Francisco and Los Angeles remained a consideration, but demand for high-quality, amenity-rich buildings in desirable locations persisted.

Sociological factors significantly shape real estate demand, with evolving work preferences and employee expectations at the forefront. The ongoing embrace of hybrid work models, for instance, means companies are prioritizing office spaces that foster collaboration and well-being, rather than just providing desks. Hudson Pacific's focus on amenity-rich environments directly addresses this, as evidenced by tenant demand for features like fitness centers and communal areas.

Demographic shifts, including an aging workforce in tech and a desire for work-life balance across generations, also influence property needs. Younger professionals, in particular, seek vibrant urban locations with integrated live-work-play environments, a trend that Hudson Pacific's urban-centric portfolio is well-positioned to capitalize on. This preference for convenience and community drives demand for quality, well-located spaces.

Population movements, such as continued urbanization and international migration into key West Coast hubs, further bolster demand for commercial real estate. While domestic outmigration exists, the influx of new residents, particularly in tech-focused areas, sustains the need for modern office and studio spaces. This dynamic supports rental demand for Hudson Pacific's strategically located properties.

| Sociological Factor | Impact on Real Estate Demand | Hudson Pacific Relevance |

|---|---|---|

| Hybrid Work Models | Increased demand for collaborative, amenity-rich spaces | Focus on world-class, amenitized developments |

| Work-Life Balance Priority | Preference for flexible arrangements and accessible locations | Properties in desirable urban centers |

| Urbanization & Live-Work-Play | Growing demand for integrated, convenient urban environments | Portfolio concentrated in key tech and media hubs |

| Demographic Shifts (Age, Lifestyle) | Need for adaptable spaces catering to diverse employee needs | Developing adaptable layouts and modern facilities |

Technological factors

Smart building technologies, encompassing IoT sensors and AI, are becoming essential for operational efficiency and tenant satisfaction. Hudson Pacific can deploy these to cut energy use, boost security, and provide valuable data to occupants. The global smart building market was valued at approximately $80 billion in 2023 and is expected to reach over $100 billion by 2025, indicating robust growth and adoption.

High-speed, reliable broadband infrastructure is paramount for Hudson Pacific’s tech and media tenants, directly impacting their operational efficiency. As of early 2025, the demand for symmetrical gigabit internet speeds and low-latency connections continues to surge, with many tenants requiring redundant fiber optic networks to ensure uninterrupted data-intensive operations.

Hudson Pacific must ensure its properties are equipped with cutting-edge network capabilities, including 5G readiness and robust Wi-Fi 6E deployments, to support seamless streaming, cloud computing, and collaborative work environments. This advanced connectivity is no longer a luxury but a fundamental expectation for attracting and retaining high-value clients in the competitive real estate market.

The rise of AI and automation is reshaping how companies utilize office space. While some tasks become automated, the need for human collaboration and specialized AI development facilities is growing, impacting demand for specific types of office environments.

For instance, in 2024, many AI-focused companies are actively expanding their physical footprints. Hudson Pacific, a real estate investment trust with significant office holdings, has seen this trend firsthand, with AI startups and established tech firms that are heavily invested in AI research and development leasing new or expanded spaces within their portfolios. This indicates a shift from purely density-driven office needs to requirements for more flexible, technologically advanced, and collaborative workspaces.

Evolution of Content Creation Technologies

The media production industry is rapidly adopting new content creation technologies, directly influencing the demand for specialized studio facilities. Advances like virtual production, extended reality (XR), and 8K filming necessitate studios equipped with cutting-edge infrastructure, including advanced LED volumes and robust connectivity. Hudson Pacific's portfolio must adapt to these technological shifts to retain its competitive edge.

These technological advancements are not just trends; they represent a fundamental change in how content is produced. For instance, virtual production, which uses real-time rendering and LED screens, can reduce reliance on traditional green screens and location shooting. This shift requires studios to invest in specialized power, cooling, and network infrastructure to support these complex, data-intensive workflows. The global market for virtual production is projected to reach $4.5 billion by 2028, indicating a significant demand for facilities that can accommodate these technologies.

- Virtual Production Growth: The virtual production market is expanding rapidly, with significant investment flowing into technologies like LED volumes.

- XR Integration: Extended Reality (XR) technologies are increasingly being used in pre-production and post-production, demanding flexible studio spaces.

- High-Definition Filming: The continued push for higher resolution content, such as 8K, requires studios with upgraded power and data transfer capabilities.

- Infrastructure Demands: Meeting these technological needs means investing in specialized power, cooling, and high-speed networking solutions for sound stages.

Cybersecurity Risks for Building Systems

As buildings increasingly integrate advanced technology, cybersecurity risks to building management systems, tenant data, and operational networks are becoming paramount. Hudson Pacific must prioritize robust cybersecurity measures to safeguard its infrastructure and tenant information, ensuring uninterrupted operations and preserving client trust. This growing concern is amplified in today's interconnected real estate landscape.

The sophistication of cyber threats continues to escalate, with ransomware attacks on commercial real estate firms showing a significant upward trend. For instance, a 2024 report indicated a 70% increase in reported cyber incidents targeting property management systems compared to the previous year. Failure to address these vulnerabilities could lead to substantial financial losses, reputational damage, and operational paralysis.

- Increased Threat Landscape: The proliferation of IoT devices within buildings expands the attack surface for cybercriminals.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.45 million, a figure that could significantly impact Hudson Pacific if tenant data is compromised.

- Operational Disruption: Attacks on building management systems can disrupt essential services like HVAC, lighting, and security, impacting tenant experience and business continuity.

- Regulatory Compliance: Stricter data privacy regulations, such as GDPR and CCPA, impose significant penalties for data breaches, underscoring the need for proactive security.

The integration of Artificial Intelligence (AI) and automation is fundamentally altering office space utilization, with a growing demand for specialized environments catering to AI development and collaborative workflows. Hudson Pacific is experiencing this firsthand in 2024, as AI-centric companies expand their physical footprints, seeking technologically advanced and flexible workspaces.

The media production sector's rapid adoption of new content creation technologies, such as virtual production and 8K filming, necessitates specialized studio facilities. Hudson Pacific's portfolio must adapt to these shifts, as the global virtual production market is projected to reach $4.5 billion by 2028, highlighting a clear demand for accommodating these advanced workflows.

Cybersecurity risks are escalating with the increasing integration of advanced technology in buildings, impacting building management systems and tenant data. In 2024, cyber incidents targeting property management systems saw a 70% increase, underscoring the critical need for robust security measures to prevent operational paralysis and protect tenant information.

Legal factors

Changes in tenant-landlord laws and lease regulations across West Coast markets are a significant factor for Hudson Pacific. These laws dictate crucial aspects of their business, from how long leases can be, how much rent can be raised, and what rights tenants have.

For instance, new California real estate laws taking effect in 2025 will impact Hudson Pacific. These include updated rules on security deposits, the reporting of rent payments, and the required notice periods for evictions. Adhering to these regulations is essential and can directly influence the company's financial management and operational efficiency.

Hudson Pacific must diligently adhere to evolving building codes and safety regulations, which are crucial for its development and ongoing operations. For instance, California's recent balcony inspection mandates, effective January 1, 2025, require property owners to inspect and repair structural issues, potentially leading to substantial capital outlays and project delays for companies like Hudson Pacific.

Failure to comply with these stringent standards, which include accessibility requirements and fire safety measures, can result in significant financial penalties, including hefty fines and costly legal damages. These regulatory hurdles directly influence project feasibility and ongoing operational costs, impacting Hudson Pacific's bottom line.

Strict data privacy laws, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), significantly impact Hudson Pacific's technology tenants. These regulations mandate how companies handle personal data, influencing their operational practices and, consequently, their demand for specific types of office space, including secure data centers or areas with enhanced physical security. For instance, the CPRA, which became fully enforceable in July 2023, expanded consumer rights and increased compliance burdens for businesses, potentially altering their real estate footprints.

Zoning and Land Use Regulations

Zoning and land use regulations are critical to Hudson Pacific's operations, defining where and how it can develop properties. These rules directly influence the feasibility and profitability of new projects, impacting property values across its portfolio.

For instance, in 2024, cities like Los Angeles, a key market for Hudson Pacific, continued to grapple with housing shortages, leading to proposed zoning reforms aimed at increasing density. While some of these changes could benefit mixed-use developments, others might impose stricter limitations on commercial or industrial projects, requiring careful navigation.

- Impact on Development: Zoning dictates permissible building types, heights, and densities, directly affecting Hudson Pacific's ability to execute its development strategy.

- Regulatory Shifts: Evolving land use policies, especially those promoting housing or specific economic activities, can create new opportunities or introduce unforeseen constraints for commercial real estate.

- Property Valuation: Favorable zoning can significantly enhance property values, while restrictive regulations can limit potential returns on investment.

Environmental Regulations and Compliance

Hudson Pacific Properties operates within an evolving landscape of environmental regulations. Increasingly stringent laws concerning energy efficiency, emissions reduction, and sustainable construction practices directly impact the company's real estate portfolio. Compliance with these mandates, such as potential Building Performance Standards (BPS) being implemented in key markets, necessitates investments in green building certifications and property retrofits.

These regulatory pressures influence design, construction, and ongoing operational expenses. For instance, the push for higher energy efficiency in commercial buildings, a trend accelerating through 2024 and into 2025, can lead to increased upfront costs for new developments and significant capital expenditures for existing property upgrades. This also creates opportunities for Hudson Pacific to differentiate its properties by achieving recognized green building certifications, which are becoming more valued by tenants and investors alike.

- Rising Compliance Costs: Expect continued investment in meeting stricter energy efficiency and emissions standards.

- Impact on Operations: Building performance mandates will shape property management and operational strategies.

- Green Certifications: Investments in LEED, Energy Star, and other certifications are becoming critical for market competitiveness.

- Retrofit Demands: Older properties will require significant upgrades to meet new environmental benchmarks.

Legal frameworks governing tenant rights and lease agreements are continually evolving, directly influencing Hudson Pacific's operational and financial strategies. For example, California's new tenant protection laws enacted in 2024, which include stricter limits on rent increases and enhanced eviction notice periods, require careful lease structuring and tenant relations management.

Furthermore, building codes and safety regulations, such as the 2025 California balcony inspection mandate, necessitate proactive capital planning for property maintenance and upgrades. Compliance with these evolving standards, including accessibility and fire safety, is paramount to avoid penalties and ensure operational continuity.

Data privacy laws, like the California Privacy Rights Act (CPRA), which became fully enforceable in July 2023, impact Hudson Pacific's technology-focused tenants. These regulations influence their demand for secure and compliant office environments, potentially shaping leasing preferences and the types of amenities required in their leased spaces.

Zoning and land use policies, particularly in key markets like Los Angeles, continue to be shaped by housing needs and economic development goals, affecting permissible building types and densities. These shifts can create both opportunities and challenges for Hudson Pacific's development pipeline, requiring adaptive planning.

Environmental factors

Hudson Pacific's West Coast portfolio faces significant climate change threats, including increased wildfire frequency, prolonged droughts, and the growing risk of sea-level rise impacting coastal properties. These environmental factors directly translate into physical risks for their real estate assets.

To counter these threats, the company must invest in resilient building designs and infrastructure. For example, utilizing wildfire-resistant materials for exterior construction and implementing advanced flood-resistant foundation systems are critical steps in mitigating potential physical damage and the associated financial fallout.

The financial implications are substantial; for instance, in 2023, California experienced over 7,500 wildfires, burning more than 300,000 acres, highlighting the tangible risk to properties in the region. Similarly, projected sea-level rise could inundate coastal areas, increasing insurance premiums and potentially decreasing property values if not adequately addressed.

Hudson Pacific's focus on sustainability is increasingly critical, driven by rising expectations from tenants, investors, and regulators for strong Environmental, Social, and Governance (ESG) performance. This emphasis directly shapes their operational strategies and investment choices, making eco-friendly building practices a core component of their business model.

The company's dedication to developing sustainable office and studio environments serves as a significant draw for both capital and quality tenants. For instance, in 2023, Hudson Pacific reported that 95% of its portfolio was LEED certified or pursuing certification, underscoring its commitment to environmentally responsible development.

Hudson Pacific Properties must navigate increasingly stringent energy efficiency standards and the growing demand for green building certifications, such as LEED and BREEAM. These evolving regulations necessitate significant investment in advanced energy-saving technologies and sustainable construction methods to ensure compliance and maintain property value.

Adherence to these green building principles not only helps reduce carbon footprints but also demonstrably lowers operating expenses, a crucial factor in attracting and retaining tenants in the current market. For instance, properties with higher LEED certifications often command premium rents and experience lower vacancy rates, as evidenced by market trends showing a growing tenant preference for sustainable spaces.

Waste Management and Recycling Initiatives

Hudson Pacific's commitment to sustainability is evident in its waste management and recycling programs across its portfolio. These initiatives are crucial for meeting environmental regulations and the growing demand from tenants for eco-friendly operations. For instance, in 2024, the company continued to expand its recycling efforts, aiming to divert a significant portion of waste from landfills.

The company's approach supports a circular economy by prioritizing waste reduction, reuse, and recycling. This not only minimizes environmental impact but also enhances the company's brand reputation and tenant satisfaction. By 2025, Hudson Pacific plans to further integrate advanced waste tracking technologies to better measure and improve its diversion rates, aligning with broader industry trends toward resource efficiency in commercial real estate.

- Waste Diversion Goals: Hudson Pacific aims to increase its waste diversion rate by 10% by the end of 2025.

- Tenant Engagement: Programs are in place to educate tenants on proper recycling procedures, with participation rates monitored.

- Circular Economy Principles: The company is exploring partnerships for material reuse and upcycling within its properties.

- Operational Efficiency: Investments in smart waste bins and data analytics are being made to optimize collection and reduce costs.

Water Scarcity and Conservation in Drought-Prone Regions

Water scarcity remains a critical environmental challenge for Hudson Pacific, particularly in its California holdings. As of 2024, many regions within the state continue to face drought conditions, necessitating proactive water management strategies. For instance, California's State Water Resources Control Board has implemented varying levels of water use restrictions depending on regional severity, impacting commercial property operations.

Hudson Pacific is therefore compelled to integrate robust water conservation measures across its portfolio. This includes exploring investments in water-efficient landscaping, upgrading to low-flow fixtures, and potentially implementing advanced water recycling systems. Such initiatives are crucial not only for responsible resource stewardship but also for ensuring compliance with evolving local and state water usage mandates, which can include penalties for non-adherence.

Key areas for action and consideration include:

- Tenant education and engagement programs on water conservation practices.

- Regular audits of water usage across all properties to identify areas for improvement.

- Investment in drought-tolerant landscaping and smart irrigation systems, which can reduce outdoor water consumption by up to 50%.

- Exploration of greywater recycling systems for non-potable uses like irrigation and toilet flushing, a technology gaining traction in water-stressed urban areas.

Hudson Pacific's environmental strategy is increasingly shaped by climate change impacts like wildfires and droughts, especially in California, where over 7,500 wildfires occurred in 2023. The company's proactive stance includes investing in resilient design and sustainable practices, evidenced by 95% of its portfolio being LEED certified or pursuing it as of 2023.

Water scarcity is another key concern, with California facing ongoing drought conditions in 2024. Hudson Pacific is implementing water conservation measures, including drought-tolerant landscaping and exploring greywater recycling systems, to manage usage and comply with mandates.

The company also prioritizes waste reduction, aiming to increase its waste diversion rate by 10% by the end of 2025, reinforcing its commitment to operational efficiency and tenant satisfaction through eco-friendly practices.

| Environmental Factor | Impact on Hudson Pacific | Mitigation Strategy/Action | Relevant Data/Target (2023-2025) |

| Climate Change (Wildfires, Droughts) | Physical risk to West Coast assets, increased insurance costs | Wildfire-resistant materials, advanced flood-resistant foundations | 7,500+ wildfires in California (2023) |

| Sustainability Demand | Tenant and investor expectations for ESG performance | LEED certification, eco-friendly building practices | 95% portfolio LEED certified or pursuing (2023) |

| Energy Efficiency Regulations | Need for investment in advanced energy-saving technologies | Compliance with evolving standards, green building certifications | Focus on reducing operational expenses |

| Waste Management | Regulatory compliance, tenant demand for eco-friendly operations | Waste diversion programs, circular economy principles | 10% waste diversion rate increase goal by end of 2025 |

| Water Scarcity | Operational challenges in drought-prone areas | Water-efficient landscaping, low-flow fixtures, greywater recycling exploration | California drought conditions (2024), potential 50% water reduction with smart irrigation |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hudson Pacific is built on a comprehensive review of data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing their operations.