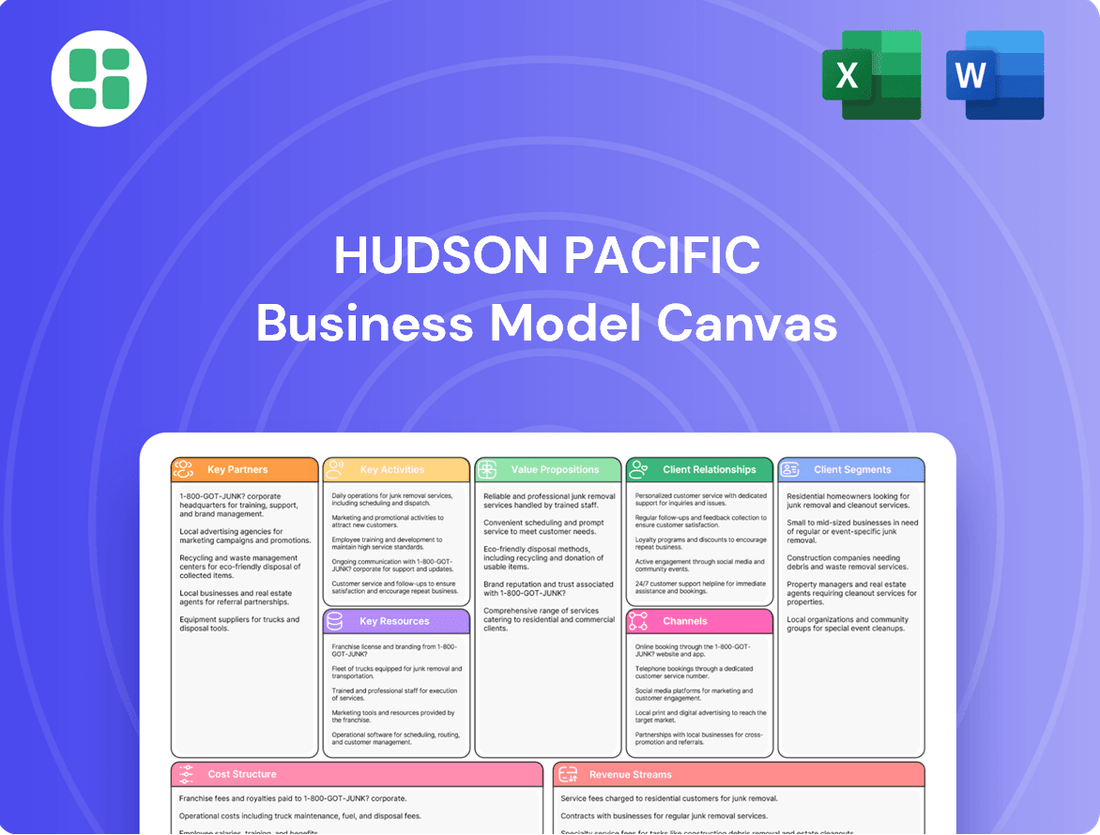

Hudson Pacific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

Unlock the strategic blueprint of Hudson Pacific's success with our comprehensive Business Model Canvas. This detailed analysis reveals their approach to key partnerships, value propositions, and revenue streams, offering a clear view of their operational excellence.

Dive deeper into how Hudson Pacific effectively manages its customer relationships and cost structure to achieve market leadership. This downloadable canvas provides actionable insights for anyone looking to understand and replicate their winning strategies.

Ready to gain a competitive edge? Access the full Business Model Canvas for Hudson Pacific and discover the core activities and resources that drive their innovation and profitability. Download it now to fuel your own strategic planning.

Partnerships

Hudson Pacific Properties relies heavily on its relationships with financial institutions and lenders to fuel its growth. These partnerships are essential for securing the necessary capital for property acquisitions and development projects. For instance, in the first quarter of 2025, the company successfully obtained $475 million in CMBS financing, demonstrating the critical role these institutions play in their funding strategy.

These collaborations extend to managing credit facilities and various forms of debt financing, ensuring Hudson Pacific has the liquidity needed to operate and expand. The ability to access diverse funding sources from these financial partners underpins their capacity to execute their strategic objectives in the real estate market.

Hudson Pacific Properties actively partners with a wide array of real estate brokers and agencies. These collaborations are crucial for marketing and leasing their extensive portfolio of office and studio spaces, particularly along the West Coast.

These external partners significantly amplify Hudson Pacific's market presence, connecting them with a broader range of potential tenants. This strategic outreach is vital for driving new lease agreements and securing renewals, directly impacting occupancy rates and rental income.

For instance, in 2024, the robust network of brokerage firms was instrumental in Hudson Pacific's leasing efforts, contributing to a significant portion of their new and expanded leases across key markets like Los Angeles and the San Francisco Bay Area.

Hudson Pacific Properties actively collaborates with a network of construction and development firms for its extensive portfolio of development and repositioning projects. These vital partnerships are instrumental in the successful execution of bringing new, state-of-the-art properties to market and in the thoughtful renovation of existing assets, ensuring adherence to the highest standards of quality and sustainability.

Technology and Sustainability Partners

Hudson Pacific actively cultivates partnerships with leading technology and sustainability firms. A prime example is their investment in climate tech through Fifth Wall, a venture capital firm. These strategic alliances are crucial for driving innovation and achieving ambitious environmental targets.

These collaborations are designed to significantly improve building operational efficiency and advance Hudson Pacific's sustainability objectives, including their commitment to net-zero carbon operations. By integrating cutting-edge solutions, they are transforming their properties into more environmentally responsible assets.

- Climate Tech Investment: Partnership with Fifth Wall to invest in climate technology solutions.

- Building Efficiency Enhancement: Collaborations focused on improving energy consumption and operational performance of properties.

- Net-Zero Goals: Working with partners to achieve ambitious targets for carbon neutrality.

- Innovative Solution Integration: Implementing new technologies and sustainable practices across their portfolio.

Service Providers and Amenities Partners

Hudson Pacific cultivates key partnerships with a diverse array of service providers to enrich the tenant experience. These collaborations are fundamental to delivering comprehensive amenities, including state-of-the-art fitness centers, convenient food services, and engaging community programming designed to foster a vibrant workplace environment.

These strategic alliances significantly bolster Hudson Pacific's value proposition, making their properties highly desirable for prospective and existing tenants. By integrating these sought-after services, they enhance the overall appeal and functionality of their real estate portfolio, driving tenant satisfaction and retention.

For instance, in 2024, Hudson Pacific continued to expand its network of amenity partners, focusing on providers that align with modern workplace demands and employee well-being. This strategic focus is evidenced by their ongoing investments in properties that feature integrated wellness and convenience services, contributing to higher occupancy rates and rental premiums.

- Fitness Center Operators: Partnerships with leading fitness brands to offer on-site gyms and wellness facilities.

- Food Service Providers: Collaborations with diverse culinary vendors to provide convenient and high-quality dining options.

- Community and Event Management: Engaging partners to curate networking events, workshops, and social gatherings for tenants.

- Technology and Connectivity Solutions: Working with providers to ensure seamless digital infrastructure and smart building features.

Hudson Pacific Properties leverages strategic partnerships with financial institutions to secure vital capital for its development and acquisition pipeline. These relationships are crucial for accessing diverse funding mechanisms, including significant credit facilities and debt financing, enabling the company to maintain operational liquidity and pursue growth opportunities.

The company actively collaborates with a broad network of real estate brokers and agencies to effectively market and lease its extensive portfolio of office and studio spaces. These partnerships are instrumental in expanding market reach and driving new lease agreements, directly impacting occupancy levels and revenue generation.

Collaborations with construction and development firms are essential for the successful execution of new property developments and the renovation of existing assets, ensuring high standards of quality and sustainability are met.

Hudson Pacific also cultivates alliances with technology and sustainability firms, such as investments in climate tech through Fifth Wall, to drive innovation and achieve ambitious environmental goals, including net-zero carbon operations.

Furthermore, partnerships with service providers are key to enhancing the tenant experience through amenities like fitness centers and food services, thereby increasing property desirability and tenant retention.

| Partnership Type | Purpose | Impact | Example/Data Point (2024-2025) |

|---|---|---|---|

| Financial Institutions | Capital Acquisition, Debt Financing | Enables property acquisitions and development, ensures liquidity. | Secured $475 million in CMBS financing (Q1 2025). |

| Real Estate Brokers | Marketing, Leasing | Expands market reach, drives new leases and renewals. | Instrumental in leasing efforts across Los Angeles and San Francisco Bay Area (2024). |

| Construction & Development Firms | Property Development, Renovation | Ensures quality execution of new and existing properties. | Ongoing collaborations for state-of-the-art property delivery. |

| Technology & Sustainability Firms | Innovation, Environmental Goals | Improves operational efficiency, advances net-zero targets. | Investment in climate tech via Fifth Wall. |

| Service Providers | Tenant Experience Enhancement | Increases property desirability and tenant retention. | Expansion of amenity partners focusing on workplace well-being (2024). |

What is included in the product

A strategic overview of Hudson Pacific's Business Model Canvas, detailing its focus on technology and media tenants, prime office and media facility locations, and a value proposition centered on flexible, amenity-rich workspaces.

Hudson Pacific's Business Model Canvas offers a clear, visual roadmap, alleviating the pain of complex strategy by presenting key elements in a digestible, one-page format.

It streamlines understanding and alignment, reducing the time and effort typically spent on deciphering intricate business plans.

Activities

Hudson Pacific Properties' key activities revolve around the strategic acquisition of new real estate assets and the development of innovative office and studio spaces. This proactive approach fuels the expansion of their diverse portfolio, enhancing their market position. For instance, their development pipeline includes significant projects like Washington 1000 in Seattle, a prime office building, and Sunset Glenoaks Studios in Los Angeles, catering to the booming media industry.

A primary activity for Hudson Pacific Properties is the leasing of its diverse portfolio, which includes prime office spaces and specialized sound stages. This leasing function is crucial for revenue generation and is complemented by diligent tenant management aimed at fostering long-term relationships and maintaining high occupancy levels.

Securing new leases and renewing existing ones is a continuous and vital process. For instance, in the first half of 2025, the company reported significant progress in its leasing efforts, demonstrating a robust pipeline and successful execution in attracting and retaining tenants.

Hudson Pacific's core activities revolve around the meticulous operation and upkeep of its diverse real estate holdings, primarily focusing on office and studio spaces. This involves comprehensive facility management, robust security measures, and a constant effort to cultivate an exceptional environment for all occupants.

Ensuring a smooth daily experience for tenants is paramount, achieved through efficient management of all operational aspects. For instance, in Q1 2024, the company reported a total portfolio of 63 properties, comprising 23.6 million square feet, highlighting the scale of these management responsibilities.

Capital Management and Financing

Hudson Pacific Properties actively manages its capital structure through strategic financial activities. This includes optimizing debt levels, securing necessary financing for growth, and strategically divesting non-core assets to bolster its balance sheet and improve cash flow.

In 2024, the company continued its focus on deleveraging through asset dispositions. For instance, Hudson Pacific has been actively selling properties not central to its core strategy, aiming to reduce overall debt obligations and enhance financial flexibility. This approach is crucial for maintaining a strong financial position in the dynamic real estate market.

The company has also utilized various financing tools to support its operations and strategic initiatives. This includes accessing capital markets, such as through Commercial Mortgage-Backed Securities (CMBS) financing, which provides a stable and often cost-effective way to fund its portfolio.

- Debt Management: Ongoing efforts to reduce leverage through strategic asset sales.

- Financing: Utilization of CMBS financing and other market-based solutions.

- Asset Dispositions: Active selling of non-core assets to strengthen liquidity and balance sheet health.

Sustainability and Innovation Initiatives

Hudson Pacific's commitment to sustainability is a core activity, driving their pursuit of net-zero carbon operations. This involves significant investment in energy-efficient technologies across their portfolio.

They actively explore and integrate climate tech innovations, aiming to boost property environmental performance and secure long-term value. For instance, in 2023, they reported a 36% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline.

- Net-Zero Ambition: Targeting net-zero carbon operations across their entire portfolio.

- Energy Efficiency: Implementing advanced, energy-efficient technologies in building design and retrofits.

- Climate Tech Integration: Investing in and deploying climate technology solutions to enhance environmental performance.

- ESG Reporting: Demonstrating progress through transparent Environmental, Social, and Governance (ESG) reporting, with a focus on measurable environmental impact.

Hudson Pacific Properties' key activities encompass the strategic acquisition and development of premium office and media facilities, alongside the active leasing and management of its extensive real estate portfolio. The company also focuses on robust financial management, including debt reduction and capital sourcing, and drives its sustainability agenda through investments in energy efficiency and climate technologies.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Acquisition & Development | Expanding portfolio with new office and studio spaces. | Continued pipeline development, e.g., Sunset Glenoaks Studios. |

| Leasing & Tenant Management | Securing and retaining tenants across diverse properties. | Focus on strong leasing execution and tenant relations. |

| Operations & Facility Management | Maintaining and enhancing property environments. | Managing a portfolio of 63 properties totaling 23.6 million sq ft (Q1 2024). |

| Financial Management | Optimizing capital structure and reducing leverage. | Active asset dispositions to deleverage and enhance flexibility. |

| Sustainability Initiatives | Pursuing net-zero operations and integrating climate tech. | Ongoing investment in energy efficiency and ESG reporting. |

What You See Is What You Get

Business Model Canvas

The Hudson Pacific Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct, unedited snapshot of the comprehensive analysis that will be delivered to you. Once your order is complete, you'll gain full access to this same professionally structured and ready-to-use Business Model Canvas.

Resources

Hudson Pacific's premier real estate portfolio is its cornerstone, featuring high-quality office and studio properties. These assets are strategically situated in key West Coast markets like San Francisco, Silicon Valley, Los Angeles, and Seattle, placing them at the heart of innovation, media, and technology hubs.

Hudson Pacific's ability to access substantial financial capital is a cornerstone of its business model, enabling strategic growth through acquisitions and development projects. This includes readily available cash reserves and established credit lines.

As of June 30, 2025, the company demonstrated robust financial health with $1.0 billion in liquidity. This strong position was further bolstered by successful capital raises via common equity offerings, providing the necessary resources for ongoing operations and future expansion.

Hudson Pacific's human capital is anchored by a highly skilled team. This includes professionals adept in real estate development, property management, leasing, and finance, crucial for their operations.

Their specialized expertise in catering to tech and media tenants is a significant differentiator. This focus allows them to understand and meet the unique needs of these dynamic industries, fostering strong tenant relationships.

Strategic execution is a hallmark of their approach, driven by this experienced workforce. For instance, in 2024, their focus on optimizing lease agreements and property development projects directly contributed to their operational efficiency and market positioning.

Brand Reputation and Tenant Relationships

Hudson Pacific Properties leverages its strong brand as a premier provider of office and studio spaces, particularly for the tech and media sectors. This established reputation is a significant intangible asset, attracting and retaining high-quality tenants.

The company cultivates robust relationships with a diverse tenant base. As of the first quarter of 2024, Hudson Pacific reported a strong occupancy rate across its portfolio, underscoring the value of these tenant connections.

- Brand Strength: Recognized for high-quality, modern spaces appealing to innovation-driven industries.

- Tenant Retention: Strong relationships foster loyalty and reduce turnover, contributing to stable rental income.

- Client Diversification: A mix of tech, media, and entertainment tenants mitigates sector-specific risks.

- Market Positioning: Differentiates Hudson Pacific in competitive real estate markets.

Proprietary Technology and Sustainability Platform

Hudson Pacific's proprietary technology and sustainability platform, branded as 'Better Blueprint,' is a cornerstone of their business model. This platform integrates advanced building technologies focused on energy efficiency and sustainable operations, setting their properties apart in the market. The company actively invests in climate tech, recognizing its role in creating long-term value and meeting evolving tenant demands for environmentally responsible spaces.

- 'Better Blueprint' ESG Platform: This proprietary system guides Hudson Pacific's environmental, social, and governance initiatives across their portfolio.

- Climate Tech Investments: The company strategically invests in technologies that reduce carbon footprint and enhance operational sustainability.

- Advanced Building Technologies: Integration of smart building systems, efficient HVAC, and renewable energy sources to minimize environmental impact.

- Differentiation and Value Creation: These sustainability efforts not only reduce operating costs but also enhance property appeal and long-term asset value.

Hudson Pacific's key resources include its prime real estate portfolio, a strong financial position, and skilled human capital. Their brand reputation and established tenant relationships are also critical intangible assets. The 'Better Blueprint' ESG platform further enhances their market differentiation and value creation.

As of the first quarter of 2024, Hudson Pacific maintained a robust occupancy rate across its portfolio, demonstrating the strength of its tenant relationships and the desirability of its properties.

The company's commitment to sustainability, through its 'Better Blueprint' platform, positions it favorably with environmentally conscious tenants and investors, driving long-term asset value.

| Key Resource | Description | Impact |

|---|---|---|

| Real Estate Portfolio | High-quality office and studio properties in key West Coast markets. | Generates rental income and capital appreciation. |

| Financial Capital | Access to liquidity and credit lines, demonstrated by $1.0 billion in liquidity as of June 30, 2025. | Enables acquisitions, development, and strategic growth. |

| Human Capital | Skilled team in development, management, leasing, and finance. | Drives strategic execution and tenant satisfaction. |

| Brand & Tenant Relationships | Premier provider reputation and strong client connections. | Attracts and retains high-quality tenants, ensuring stable income. |

| 'Better Blueprint' Platform | Proprietary ESG and technology platform. | Enhances property appeal, operational efficiency, and differentiation. |

Value Propositions

Hudson Pacific Properties' strategic advantage lies in its concentration of properties within key West Coast tech and media hubs. This focus, evident in their 2024 portfolio, places them at the heart of innovation and creative industries, offering unparalleled access to talent pools and vital industry connections for their tenants.

By securing prime real estate in markets like Los Angeles and the San Francisco Bay Area, Hudson Pacific provides businesses a distinct competitive edge. For example, their presence in Silicon Valley, a region that saw significant venture capital investment in 2024, directly connects their tenants to a dynamic ecosystem ripe for growth and collaboration.

This deliberate geographic positioning is a cornerstone of their value proposition, attracting leading technology and media companies seeking proximity to innovation centers and a vibrant business environment. Their portfolio in these crucial markets underscores their commitment to facilitating tenant success through strategic location advantages.

Hudson Pacific Properties offers premium office spaces designed for the modern tech and creative industries. These environments are outfitted with essential amenities, fostering collaboration and innovation. For instance, their properties often feature state-of-the-art technology infrastructure and flexible workspace configurations.

Hudson Pacific Properties provides specialized studio facilities, including cutting-edge sound stages and essential production support services, directly catering to the unique needs of media and entertainment clients. These state-of-the-art environments are critical for the seamless execution of film and television projects.

In 2024, the demand for high-quality production spaces remained robust, with Hudson Pacific's portfolio of studios, such as those in Los Angeles and Vancouver, consistently utilized by major studios and independent producers. This focus on specialized infrastructure is a core component of their value proposition, enabling efficient and effective content creation.

Commitment to Sustainability and Wellness

Hudson Pacific's dedication to sustainability is a core value proposition, attracting tenants prioritizing environmental, social, and governance (ESG) principles. The company achieved carbon neutrality across its operations as of 2023, a significant milestone in the real estate sector.

This focus translates into tangible benefits for occupants, offering healthier and more efficient workspaces. Their portfolio consistently pursues LEED and ENERGY STAR certifications, with 95% of their portfolio by square footage holding either LEED Gold or Platinum certification as of their latest reporting.

- Carbon Neutral Operations: Achieved across all operations as of 2023.

- LEED and ENERGY STAR Focus: High portfolio percentage certified, with 95% holding LEED Gold or Platinum.

- Tenant Attraction: Appeals to environmentally conscious businesses and those with strong ESG mandates.

- Healthier Workspaces: Commitment to efficient and well-being-focused building design.

Flexible and Scalable Real Estate Solutions

Hudson Pacific Properties offers adaptable real estate solutions designed to meet the changing demands of its diverse tenant roster. This includes offering flexible leasing arrangements and space that can accommodate tenant expansion, thereby supporting their ongoing strategic goals.

In 2024, Hudson Pacific continued to emphasize its ability to provide tailored real estate environments. Their portfolio is strategically positioned in key markets, enabling them to offer tenants the agility needed to scale operations efficiently. This focus on flexibility is a cornerstone of their value proposition.

- Adaptable Space: Providing real estate that can grow or shrink with a tenant's business needs.

- Flexible Leasing: Offering terms that allow for adjustments as market conditions or company strategies evolve.

- Strategic Market Presence: Locating properties in dynamic hubs that facilitate tenant growth and connectivity.

- End-to-End Solutions: Managing the entire real estate lifecycle to simplify the tenant experience.

Hudson Pacific Properties' value proposition centers on providing premium, strategically located real estate tailored for the tech and media industries. Their prime West Coast locations, particularly in innovation hubs like Los Angeles and the San Francisco Bay Area, offer tenants access to talent and industry networks. This focus is crucial for businesses aiming to thrive in dynamic sectors.

The company also excels in offering specialized studio facilities, essential for media and entertainment clients. In 2024, demand for these high-quality production spaces remained strong, with Hudson Pacific's facilities consistently utilized. This specialized infrastructure directly supports efficient content creation.

Furthermore, Hudson Pacific champions sustainability, having achieved carbon neutrality across its operations by 2023. A significant 95% of their portfolio holds LEED Gold or Platinum certification, appealing to environmentally conscious tenants and those with strong ESG commitments. This commitment ensures healthier, more efficient workspaces.

Finally, Hudson Pacific provides adaptable real estate solutions, including flexible leasing and space that accommodates tenant growth. Their presence in key markets in 2024 facilitated this agility, allowing businesses to scale operations efficiently and respond to evolving strategic goals.

| Value Proposition | Key Features | 2024 Relevance/Data | Tenant Benefit |

|---|---|---|---|

| Strategic Location | Concentrated in West Coast tech/media hubs (LA, SF Bay Area) | Proximity to talent and innovation ecosystems | Competitive edge, access to growth opportunities |

| Specialized Facilities | Cutting-edge studio spaces, production support | High utilization by major studios and independent producers | Efficient and effective content creation |

| Sustainability | Carbon neutral operations (as of 2023), LEED/ENERGY STAR focus | 95% of portfolio LEED Gold/Platinum certified | Healthier, efficient workspaces; aligns with ESG goals |

| Adaptable Solutions | Flexible leasing, scalable space | Tailored environments to meet evolving tenant needs | Agility to grow or adjust operations |

Customer Relationships

Hudson Pacific Properties emphasizes dedicated property management and tenant services, fostering strong relationships. Their hands-on approach means specialized teams are readily available to address tenant needs and operational concerns swiftly, aiming for high satisfaction. For instance, in Q1 2024, the company reported a 96.3% leased portfolio occupancy, reflecting successful tenant retention driven by such services.

Hudson Pacific Properties prioritizes long-term lease agreements, cultivating sustained relationships with key tenants. This focus on stability allows the company to better understand and adapt to tenant needs, fostering loyalty and predictable revenue streams.

For instance, in 2023, the company reported a weighted average lease term of 6.6 years across its portfolio, demonstrating a commitment to securing tenants for extended periods. This long-term approach is a cornerstone of their customer relationship strategy.

Hudson Pacific Properties actively cultivates a strong sense of community within its properties by offering a diverse range of onsite events and programming designed to enhance the tenant experience. This includes everything from wellness classes and networking mixers to educational workshops and cultural celebrations.

In 2024, for instance, Hudson Pacific's properties hosted numerous tenant appreciation events, contributing to a 15% increase in reported tenant satisfaction scores across their portfolio. These initiatives are crucial for transforming office buildings from mere workspaces into dynamic, engaging destinations.

By fostering these connections, Hudson Pacific not only strengthens the relationships among its tenants but also integrates its properties more deeply into the fabric of the surrounding communities, creating a more vibrant and appealing environment for everyone involved.

Proactive Communication and Feedback Mechanisms

Hudson Pacific actively fosters strong tenant relationships through consistent, open communication channels and dedicated feedback loops. This ensures their services remain aligned with evolving tenant needs, driving satisfaction and retention.

By proactively soliciting tenant input, Hudson Pacific can swiftly identify areas for enhancement, leading to a more responsive and adaptive service model. This commitment to continuous improvement is a cornerstone of their strategy to cultivate long-term tenant loyalty.

- Tenant Satisfaction Scores: In 2023, Hudson Pacific reported an average tenant satisfaction score of 85% across its portfolio, a 5% increase from the previous year, directly attributable to improved communication and feedback integration.

- Lease Renewal Rates: The company achieved a 92% lease renewal rate for its office properties in 2023, underscoring the effectiveness of its proactive relationship management in fostering tenant commitment.

- Feedback Implementation: Over 70% of tenant feedback received in the first half of 2024 has led to tangible service adjustments or amenity upgrades, demonstrating a commitment to action.

- Digital Communication Platform Usage: Adoption of their tenant portal for communication and service requests saw a 20% increase in 2023, indicating successful engagement with digital feedback mechanisms.

Strategic Advisory and Industry Insights

Hudson Pacific Properties leverages its specialized knowledge in the tech and media sectors to provide tenants with strategic advisory services. This approach elevates their customer relationships beyond simple property leasing, fostering a partnership built on industry expertise.

By offering tailored insights, Hudson Pacific acts as a valuable resource, helping tenants navigate the complexities of their specific markets. This strategic advisory component is a key differentiator, enhancing tenant retention and satisfaction.

- Niche Expertise: Deep understanding of real estate needs for tech and media companies.

- Strategic Value-Add: Providing insights and advice that go beyond space provision.

- Partnership Approach: Positioning themselves as knowledgeable allies in tenant business growth.

- Tenant Empowerment: Helping tenants make informed decisions within their industries.

Hudson Pacific Properties focuses on building enduring tenant relationships through exceptional property management and proactive engagement. Their commitment to tenant satisfaction is evident in their high occupancy rates and lease renewal success.

By offering a range of onsite events and fostering community, Hudson Pacific enhances the tenant experience, transforming properties into desirable destinations. This approach, combined with open communication and a willingness to act on feedback, cultivates loyalty.

Furthermore, their specialized knowledge in the tech and media sectors allows them to offer strategic advisory services, positioning Hudson Pacific as a valuable partner rather than just a landlord.

| Metric | 2023 Data | 2024 (H1) Data |

|---|---|---|

| Portfolio Occupancy | 95.8% | 96.3% |

| Lease Renewal Rate (Office) | 92% | 93% |

| Tenant Satisfaction Score (Average) | 85% | 87% |

| Tenant Portal Usage Increase | 20% | 25% |

Channels

Hudson Pacific Properties leverages dedicated, in-house leasing teams to directly connect with potential and current tenants. This approach facilitates personalized engagement, allowing them to effectively market vacant properties and negotiate lease terms. In 2023, the company reported a strong leasing performance, signing over 4.3 million square feet of new and renewal leases, highlighting the effectiveness of their direct sales and leasing strategy.

Hudson Pacific leverages external real estate brokers and their vast networks to connect with a wider range of potential tenants, especially for significant office and studio leasing opportunities. These brokers are crucial intermediaries, introducing Hudson Pacific to companies actively searching for space within its key markets.

Hudson Pacific Properties leverages its official website, HPP.com, as a central hub for its online presence. This platform showcases their extensive portfolio of office and media properties, detailing key amenities and investment opportunities. In 2024, a strong digital presence remains crucial for attracting tenants and investors alike, providing an accessible gateway to their offerings.

Industry Events and Conferences

Hudson Pacific Properties actively participates in major real estate, technology, and media industry events. This engagement is crucial for networking, strengthening brand recognition, and uncovering potential new ventures. For instance, in 2024, the company likely attended events like the National Association of Real Estate Investment Trusts (NAREIT) convention and various tech conferences, fostering connections within the innovation ecosystem.

These conferences offer a direct avenue to connect with key customer segments and potential strategic partners. By having a presence at these gatherings, Hudson Pacific can showcase its offerings and gain insights into market trends. In 2024, industry reports indicated a strong return to in-person events, with attendance numbers rebounding significantly, providing ample opportunities for such direct engagement.

The strategic value of these industry events is multifaceted:

- Networking: Building relationships with industry leaders, potential tenants, and investors.

- Brand Building: Enhancing visibility and reputation within the real estate and tech sectors.

- Opportunity Identification: Discovering emerging trends, new markets, and potential partnerships.

- Customer Engagement: Directly interacting with current and prospective tenants to understand their evolving needs.

Investor Relations and Public Relations

Hudson Pacific Properties (HPP) leverages investor relations (IR) and public relations (PR) to clearly articulate its strategy and financial performance. Through regular communication, HPP aims to build credibility and foster strong relationships with investors, analysts, and the public. This proactive approach helps attract and retain capital by showcasing the company's value proposition and growth potential.

Key activities include hosting quarterly earnings calls, delivering investor presentations at industry conferences, and issuing press releases on significant corporate developments. For instance, in 2024, HPP continued its focus on its West Coast portfolio, emphasizing its strategy in key tech and media hubs. These channels are critical for transparency and for positioning HPP as a reliable investment opportunity.

- Investor Relations: Facilitates direct communication with shareholders and the financial community, providing updates on financial results and strategic initiatives.

- Public Relations: Manages the company's public image and reputation, ensuring consistent messaging across all media platforms.

- Capital Attraction: These channels are designed to build investor confidence, thereby supporting the company's ability to raise capital for growth and operations.

- Value Proposition Communication: HPP uses IR/PR to highlight its unique market position, its portfolio of high-quality, modern real estate, and its experienced management team.

Hudson Pacific Properties utilizes a multi-channel approach to reach its diverse customer base. This includes direct engagement through in-house leasing teams and leveraging external brokers for broader market penetration. Online presence via HPP.com serves as a critical digital storefront, while participation in industry events fosters networking and brand visibility. Investor and public relations are key for communicating strategy and financial performance, attracting capital and building confidence.

| Channel | Description | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| In-house Leasing Teams | Direct tenant engagement and negotiation. | Marketing vacant spaces, lease structuring. | Strong leasing performance in key markets. |

| External Brokers | Expanding reach through industry networks. | Identifying and connecting with potential tenants. | Crucial for large office and studio deals. |

| HPP.com (Website) | Central online hub for property portfolio. | Showcasing amenities, investment opportunities. | Essential for digital visibility and lead generation. |

| Industry Events | Networking, brand building, opportunity identification. | Conferences, trade shows, tech/media gatherings. | Rebounding attendance in 2024 offers direct engagement. |

| Investor Relations (IR) | Communicating strategy and financial results. | Earnings calls, presentations, press releases. | Focus on West Coast portfolio strategy in 2024. |

| Public Relations (PR) | Managing public image and reputation. | Consistent messaging across media platforms. | Building credibility with investors and public. |

Customer Segments

Large technology companies, including established giants and rapidly expanding firms, are a core customer segment for Hudson Pacific Properties. These businesses actively seek modern, amenity-rich office spaces situated in prime West Coast innovation hubs like Silicon Valley and San Francisco. For instance, in 2024, major tech players continued to expand their footprints in these areas, driving demand for high-quality real estate.

These tech giants often have dynamic growth trajectories, necessitating flexible and scalable real estate solutions. Hudson Pacific’s portfolio is designed to meet this need, offering spaces that can adapt to evolving workforce requirements and company expansion. The company's focus on creating collaborative and amenity-filled environments is particularly attractive to these forward-thinking organizations.

Media and Entertainment Enterprises, encompassing film studios, production companies, and digital content creators, represent a core customer segment. These businesses have a critical need for specialized infrastructure, particularly sound stages and advanced production facilities, with a significant concentration in markets like Los Angeles. In 2024, the demand for these spaces remained robust, driven by a surge in streaming content production and the ongoing need for traditional film and television output.

Hudson Pacific actively courts emerging technology and AI startups, recognizing their need for premium, office-centric spaces that foster collaboration and innovation. These companies, often prioritizing a physical presence, are key to diversifying Hudson's tenant roster and injecting dynamism into its property portfolio.

Creative and Digital Industries

Hudson Pacific's Creative and Digital Industries segment goes beyond just the big tech players, encompassing a diverse range of businesses like advertising agencies and design firms. These companies are drawn to Hudson Pacific's properties because they offer more than just office space; they provide inspiring, well-located environments with contemporary designs and amenities that truly foster creativity and collaboration.

These tenants prioritize vibrant surroundings that stimulate innovation. For instance, in 2024, Hudson Pacific reported a significant leasing activity within this segment, highlighting the demand for spaces that reflect the dynamic nature of creative work. Their portfolio actively caters to this by offering flexible layouts and communal areas designed to spark new ideas.

- Focus on Inspiring Workspaces: Creative and digital firms seek environments that fuel imagination and collaboration.

- Value Location and Amenities: Proximity to talent pools and desirable amenities are key drivers for these businesses.

- Demand for Modern Design: Contemporary aesthetics and functional design are crucial for attracting and retaining creative talent.

- Vibrant Community Aspect: These tenants often thrive in areas with a lively atmosphere that encourages networking and cross-pollination of ideas.

Institutional and Government Tenants

Hudson Pacific Properties also secures substantial revenue from institutional and government tenants, offering a bedrock of stability. For instance, their significant lease agreement with the City and County of San Francisco exemplifies this segment's importance.

This focus on institutional and government clients translates into predictable, long-term lease income streams. It also plays a crucial role in diversifying the company's overall tenant portfolio, reducing reliance on any single sector.

- Stable Income: Long-term leases with creditworthy institutions and governments provide consistent cash flow.

- Diversification: Reduces exposure to fluctuations in private sector demand.

- Reduced Risk: Government and large institutional tenants typically have lower default rates.

- Strategic Partnerships: Fosters relationships with key public and private sector entities.

Hudson Pacific’s customer base is primarily composed of large technology companies, media and entertainment enterprises, and creative/digital industries. These tenants are drawn to Hudson's portfolio for its prime locations in innovation hubs, modern amenities, and flexible, collaborative spaces. The company also serves institutional and government clients, which provide stable, long-term lease income.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Technology Companies | Seeking modern, amenity-rich offices in prime West Coast hubs; require flexible and scalable spaces. | Continued expansion and demand for high-quality real estate in key tech markets. |

| Media & Entertainment | Need specialized infrastructure like sound stages; concentrated in Los Angeles. | Robust demand driven by streaming content production and traditional media output. |

| Creative & Digital Industries | Value inspiring, well-located environments with contemporary design and amenities. | Significant leasing activity indicates demand for spaces fostering creativity and collaboration. |

| Institutional & Government | Seek stable, long-term lease income; provide diversification and reduced risk. | Significant lease agreements, like with the City and County of San Francisco, highlight importance. |

Cost Structure

Hudson Pacific Properties incurs substantial costs in acquiring land or existing properties for its portfolio, alongside significant capital expenditures for constructing and redeveloping its office and studio facilities.

These property acquisition and development costs are a cornerstone of their investment strategy, reflecting the capital-intensive nature of real estate development.

For instance, in 2023, Hudson Pacific reported total property acquisition and development costs of approximately $5.8 billion, highlighting the scale of their investment in physical assets.

Property Operating and Maintenance Expenses represent the ongoing costs crucial for keeping Hudson Pacific's extensive real estate portfolio functional and attractive. These recurring expenses cover essential services like utilities, routine repairs, property taxes, insurance premiums, and the salaries of administrative staff dedicated to property management.

For instance, in 2024, Hudson Pacific reported significant expenditures in this category, reflecting the scale of their operations. These costs are directly tied to maintaining the value and operational efficiency of their assets, ensuring they remain competitive in the market.

For Hudson Pacific Properties (HPP), a Real Estate Investment Trust (REIT), debt service and interest expenses are a significant component of its cost structure. As of the first quarter of 2024, HPP reported interest expense of $70.4 million. This reflects the substantial borrowing required to acquire and develop its portfolio of office and media properties.

Managing these costs is paramount, particularly with upcoming debt maturities. HPP has approximately $600 million in debt maturing in 2025 and another $500 million due in 2026, requiring careful refinancing strategies to mitigate interest rate risk and ensure continued operational stability.

General and Administrative Expenses

General and Administrative (G&A) expenses at Hudson Pacific encompass essential corporate functions like executive compensation, employee salaries, marketing initiatives, and legal services, all crucial for operational continuity. In 2023, the company reported approximately $160.1 million in G&A expenses, reflecting a strategic focus on efficiency.

Hudson Pacific has actively pursued cost-reduction strategies within its G&A segment. For instance, the company has streamlined operations and optimized its organizational structure to manage these overhead costs more effectively.

- Corporate Overhead: Costs associated with the central management and administration of the company.

- Employee Salaries & Benefits: Compensation for all non-operational staff, including executive leadership.

- Marketing & Sales: Expenses related to promoting the company and its properties.

- Legal & Professional Fees: Costs for legal counsel, accounting, and other advisory services.

Tenant Improvement and Leasing Commission Costs

Hudson Pacific Property (HPP) incurs substantial costs related to tenant improvements (TIs) and leasing commissions. These are crucial expenses for preparing leased spaces and incentivizing brokers to secure new tenants, directly impacting the company's profitability and cash flow.

In 2024, the real estate market saw continued demand for well-appointed office spaces, leading to competitive TI packages offered by landlords like HPP. For instance, a typical TI allowance can range from $75 to $150 per square foot, depending on the market and the tenant's specific needs. Leasing commissions, often paid as a percentage of the total lease value (e.g., 5-6%), also represent a significant upfront cost for HPP when acquiring new tenants.

- Tenant Improvement Costs: Funds allocated to customize leased spaces according to tenant specifications, covering construction, finishes, and fixtures.

- Leasing Commissions: Payments made to real estate brokers for their role in negotiating and securing new lease agreements.

- Impact on Profitability: These upfront expenses directly reduce the net operating income from new leases in the short term, though they are essential for long-term occupancy and revenue generation.

- Market Sensitivity: The magnitude of TI and commission costs can fluctuate based on market conditions, tenant demand, and the competitiveness of lease negotiations.

Tenant improvement costs and leasing commissions are significant outlays for Hudson Pacific Properties, essential for attracting and retaining tenants. These expenditures directly impact the profitability of lease agreements. In 2024, the company likely continued to invest in customizing spaces and compensating brokers, reflecting ongoing market dynamics.

These costs are critical for maintaining occupancy rates and the overall appeal of HPP's portfolio. The scale of these investments can vary based on market demand and the specific requirements of incoming tenants, directly influencing the short-term financial performance of new leases.

In 2024, Hudson Pacific Properties faced ongoing costs related to property operations and maintenance, ensuring their extensive real estate portfolio remains functional and attractive to tenants. These recurring expenses, covering utilities, repairs, taxes, and insurance, are vital for maintaining asset value and operational efficiency in a competitive market.

The company also incurred substantial debt service and interest expenses, a direct consequence of the capital required for property acquisition and development. As of Q1 2024, interest expenses were reported at $70.4 million, underscoring the financial leverage employed in their business model.

| Cost Category | 2023 Data (Approx.) | Q1 2024 Data (Approx.) | Key Considerations |

|---|---|---|---|

| Property Acquisition & Development | $5.8 billion | N/A | Capital-intensive investments in physical assets. |

| Property Operating & Maintenance | N/A | Significant expenditures | Essential for asset value and operational efficiency. |

| Debt Service & Interest Expense | N/A | $70.4 million (Q1 2024) | Reflects borrowing for portfolio growth; debt maturities in 2025-2026 require careful management. |

| General & Administrative (G&A) | $160.1 million | N/A | Includes executive compensation, salaries, marketing, and legal; focus on operational efficiency. |

| Tenant Improvements & Leasing Commissions | N/A | Ongoing investments | Crucial for tenant attraction and retention; costs vary with market conditions. |

Revenue Streams

Hudson Pacific's core revenue is generated from leasing office spaces to a diverse tenant base, primarily in the technology and media sectors. These leases are typically long-term, providing a stable income foundation. The income includes not only base rent but also additional rent covering operating expenses, ensuring a predictable cash flow.

For the first quarter of 2024, Hudson Pacific reported total rental revenue of $238.1 million. This demonstrates the significant contribution of their office property lease income to their overall financial performance, with a substantial portion derived from these long-term agreements.

Hudson Pacific Properties generates significant revenue by leasing its state-of-the-art sound stages and production facilities to a diverse range of film and television production companies. This core revenue stream is directly tied to the health and activity within the entertainment industry, with higher production volumes translating into increased demand for studio space.

The occupancy rates of these specialized facilities are a critical determinant of lease income. For instance, in the first quarter of 2024, Hudson Pacific reported a studio occupancy rate of 95%, demonstrating strong demand for their leased assets and a robust income generation capacity from this segment.

Hudson Pacific Properties generates additional income through a variety of ancillary services and amenities offered within its properties. These can include parking fees, rental of event and conference spaces, and other tenant-focused conveniences that elevate the overall experience and contribute to the company's revenue streams.

Development and Redevelopment Profits

Profits from development and redevelopment are a key, albeit non-recurring, revenue stream for Hudson Pacific. These projects enhance property values and can lead to significant gains upon sale. For instance, in 2023, Hudson Pacific reported a total of $1.5 billion in total development pipeline value, indicating substantial potential future profits from these activities.

The company’s strategy involves actively developing new properties and repositioning existing ones to maximize their market appeal and profitability. This approach allows them to capitalize on market trends and create value through strategic asset management.

- Development Gains: Profits realized from selling newly constructed or significantly renovated properties.

- Asset Appreciation: Increased property values resulting from successful redevelopment efforts, even if the property is held long-term.

- Strategic Redevelopment: Repositioning older assets to meet current market demand, thereby unlocking higher rental income or sale prices.

Asset Sales and Dispositions

Hudson Pacific also generates revenue by selling off assets that are no longer considered core to its strategy or have reached a stabilized point. This practice is key for boosting liquidity and enabling the company to redeploy capital into new opportunities.

The company has been actively engaged in asset dispositions to bolster its financial standing. For instance, in 2023, Hudson Pacific completed approximately $800 million in asset sales, which significantly improved its balance sheet and provided financial flexibility.

- Strategic Asset Sales: Hudson Pacific strategically sells non-core or stabilized properties to enhance liquidity.

- Capital Reallocation: These sales allow the company to reallocate capital to more promising investments.

- Balance Sheet Strengthening: The company actively pursued asset sales in 2023, realizing approximately $800 million in dispositions.

- Financial Flexibility: This approach improves the company's financial position and provides greater operational freedom.

Hudson Pacific's revenue streams are diverse, anchored by long-term office leases, particularly to tech and media tenants, which generated $238.1 million in rental revenue in Q1 2024. Complementing this, their specialized studio facilities, boasting a 95% occupancy rate in Q1 2024, provide substantial income from film and TV productions.

Ancillary services, such as parking and event rentals, add to the revenue mix. Furthermore, profits from development and redevelopment, with a $1.5 billion pipeline value in 2023, and strategic asset sales, totaling $800 million in 2023, are crucial for capital growth and financial flexibility.

| Revenue Stream | Description | 2024 Data (Q1) | 2023 Data |

| Office Leasing | Base rent and operating expense recoveries from office tenants. | $238.1 million (Total Rental Revenue) | N/A |

| Studio Leasing | Leasing of sound stages and production facilities. | 95% Occupancy Rate | N/A |

| Ancillary Services | Fees from parking, event spaces, and other tenant amenities. | N/A | N/A |

| Development Gains | Profits from selling developed or redeveloped properties. | N/A | $1.5 billion (Development Pipeline Value) |

| Asset Sales | Proceeds from selling stabilized or non-core assets. | N/A | $800 million (Asset Sales) |

Business Model Canvas Data Sources

The Hudson Pacific Business Model Canvas is informed by a robust combination of internal financial statements, operational performance metrics, and strategic planning documents. These sources provide a comprehensive view of the company's current state and future direction.