Hudson Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

Hudson Pacific's competitive landscape is shaped by several key forces, including the bargaining power of its tenants and the threat of new entrants in the competitive real estate market. Understanding these dynamics is crucial for any stakeholder. The full analysis reveals the real forces shaping Hudson Pacific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hudson Pacific Properties faces a significant challenge due to the limited availability of land in its core West Coast markets. Prime locations for new development or expansion are increasingly scarce, a trend that has intensified in recent years.

This scarcity directly impacts the bargaining power of suppliers, meaning existing landowners can command higher prices for their properties. For instance, in 2024, the average price per acre for developable land in key California markets saw an upward trend, reflecting this constrained supply. This situation forces Hudson Pacific to contend with potentially higher acquisition costs, directly affecting its project feasibility and profitability.

Developing and maintaining high-quality office and studio properties demands highly specialized construction expertise and a skilled labor force. This specialized nature means there's a limited pool of qualified suppliers and contractors capable of meeting Hudson Pacific's exacting standards.

Consequently, this scarcity can translate into increased costs for construction projects and renovations. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that construction labor costs, particularly for specialized trades, continued their upward trend, impacting project budgets.

The limited availability of these specialized suppliers also reduces Hudson Pacific's bargaining power, potentially leading to less flexibility in negotiating project timelines and managing overall budget adherence.

Utility and infrastructure providers, such as electricity, water, and internet companies, hold significant bargaining power over Hudson Pacific Properties. This is largely due to the monopolistic or duopolistic nature of these services in many geographic regions where Hudson Pacific operates. For instance, in 2024, the average residential electricity price in California, a key market for Hudson Pacific, was approximately 22.2 cents per kilowatt-hour, a figure that can fluctuate based on provider rates and regulatory decisions.

This reliance means that utility companies can dictate terms and pricing, directly impacting Hudson Pacific's operational costs and profitability. When these essential services face rising input costs or infrastructure investment needs, they often pass these expenses onto their customers, including large commercial property owners like Hudson Pacific. The limited alternatives available to Hudson Pacific in securing these critical services amplify the suppliers' leverage.

Technology and Media Equipment Suppliers

For its studio properties, Hudson Pacific Properties (HPP) depends on suppliers of sophisticated sound stages and production equipment. The highly specialized nature of this equipment, often with a limited number of vendors capable of providing it, can grant these suppliers significant bargaining power. This leverage can translate into more favorable pricing and maintenance contract terms for the suppliers.

This concentrated supplier power is a key consideration for HPP, particularly as the demand for high-quality production facilities continues to grow. For instance, the market for advanced virtual production stages, which require specialized LED walls and motion capture technology, has seen significant investment. Companies specializing in these niche areas can command premium pricing due to the technical expertise and capital investment required.

- Specialized Equipment: The need for advanced sound stages and production gear creates a reliance on a select group of technology and media equipment suppliers.

- Limited Vendor Pool: A smaller number of specialized providers for this niche equipment can consolidate their market influence.

- Pricing Leverage: Suppliers can exert influence over pricing for both equipment acquisition and ongoing maintenance agreements.

- Industry Trends: The increasing demand for cutting-edge production capabilities, such as virtual production, further enhances the bargaining power of suppliers in this segment.

Financial Capital Providers

Financial capital providers, such as lenders and equity investors, hold significant bargaining power over REITs like Hudson Pacific Properties (HPP). Their ability to provide essential funding means they can dictate terms, impacting HPP's cost of capital. For instance, in early 2024, rising interest rates pushed the average yield on corporate bonds, a key benchmark for HPP's debt financing, higher. This increased cost of borrowing directly affects HPP's profitability and its capacity for new investments.

The bargaining power of these financial suppliers is evident in how they influence HPP's financing strategies. When market sentiment is favorable, investors may accept lower returns, but during periods of economic uncertainty, they demand higher yields or more favorable equity terms. Hudson Pacific's reliance on these capital sources for its development pipeline and property acquisitions means that shifts in investor appetite or lender willingness to extend credit can significantly alter its strategic flexibility and growth potential.

- Lender Influence: Banks and other debt providers can negotiate stricter covenants and higher interest rates, particularly when HPP's leverage ratios are elevated or market conditions tighten.

- Investor Demands: Equity investors expect competitive dividend yields and capital appreciation, forcing HPP to manage its portfolio and operational efficiency effectively to meet these expectations.

- Cost of Capital Sensitivity: Fluctuations in benchmark interest rates, such as the Federal Funds Rate, directly impact HPP's borrowing costs. For example, a 0.25% rate hike can add millions in annual interest expenses.

- Market Sentiment Impact: Investor confidence in the real estate sector and HPP's specific markets influences the availability and cost of both debt and equity capital.

Hudson Pacific Properties (HPP) faces considerable supplier bargaining power stemming from the scarcity of prime West Coast real estate and the specialized nature of construction and studio equipment. This limited supply allows landowners and specialized vendors to command higher prices and dictate terms, increasing HPP's acquisition and operational costs.

Furthermore, essential utility providers, often operating as monopolies, exert significant leverage over HPP due to the lack of viable alternatives. This dependence means HPP is susceptible to rising utility costs, impacting overall profitability. The company must navigate these supplier dynamics to maintain its competitive edge and project viability.

| Supplier Type | Key Factors Affecting Bargaining Power | Impact on HPP | 2024 Data/Trend |

|---|---|---|---|

| Landowners | Limited supply of prime developable land | Higher acquisition costs, reduced project feasibility | Upward trend in land prices in key California markets |

| Construction Services | Scarcity of specialized labor and contractors | Increased construction costs, potential project delays | Rising construction labor costs reported by BLS |

| Utility Providers | Monopolistic/duopolistic service provision | Higher operational costs, limited negotiation flexibility | California average electricity price around 22.2 cents/kWh |

| Studio Equipment Vendors | Niche market for advanced production technology | Premium pricing for specialized equipment and maintenance | Increased investment in virtual production stages driving demand for specialized suppliers |

| Financial Capital Providers | Market conditions, investor sentiment | Higher cost of capital (debt/equity), impact on strategic flexibility | Rising interest rates increased corporate bond yields in early 2024 |

What is included in the product

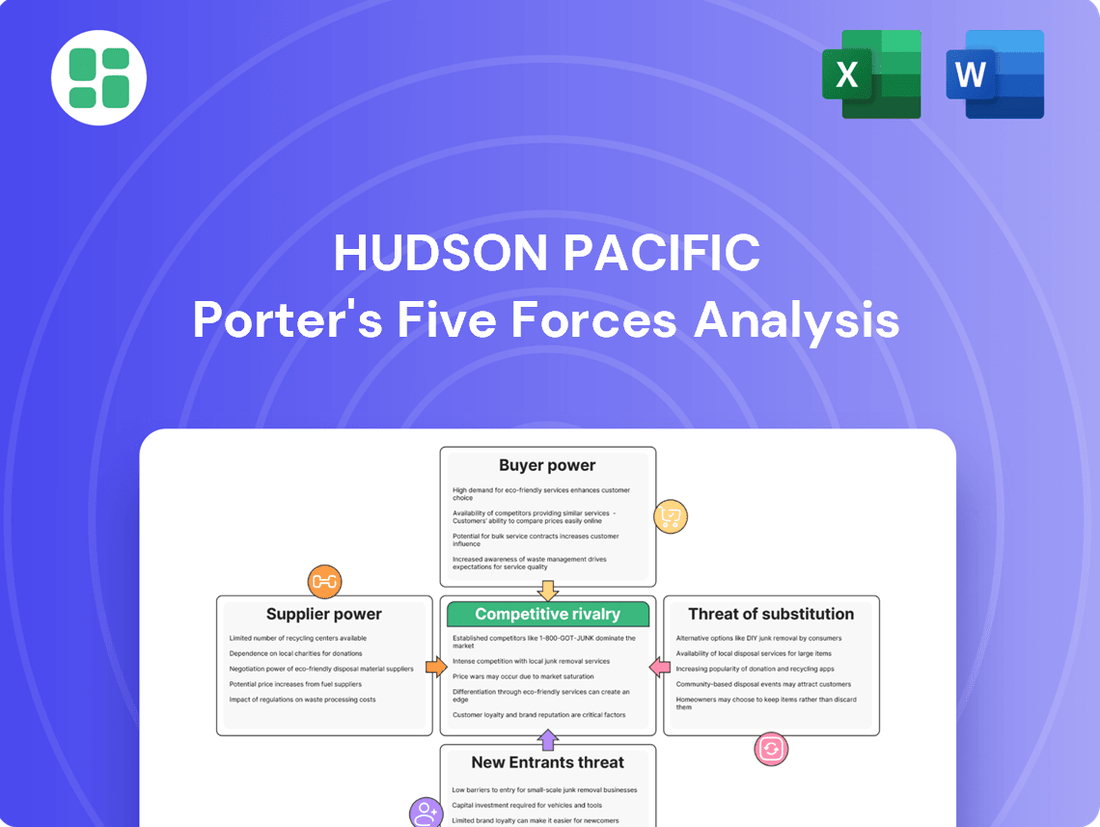

This analysis provides a comprehensive assessment of the competitive forces impacting Hudson Pacific, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces model, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Hudson Pacific Properties' focus on the technology and media sectors means many of its tenants are large, established corporations. These significant clients, often occupying substantial square footage, possess considerable bargaining power. For instance, a major tech firm leasing hundreds of thousands of square feet can negotiate favorable lease terms and demand concessions, impacting Hudson Pacific's rental income and profitability.

The West Coast office market, especially in major hubs like San Francisco and Los Angeles, is currently grappling with elevated vacancy rates. For instance, San Francisco's office vacancy rate reached a staggering 36.6% in the first quarter of 2024, a significant increase from previous years. This oversupply of available space fundamentally tips the scales, granting tenants considerable leverage.

This heightened tenant power translates directly into their ability to negotiate more advantageous lease agreements. Landlords are compelled to offer concessions such as reduced rental rates, extended rent abatement periods, and more generous tenant improvement allowances to attract and retain occupants. These terms reflect the current market conditions where demand for office space has softened considerably.

Tenants, particularly in the aftermath of the pandemic, are increasingly vocal about their need for flexibility. This translates into a strong desire for shorter lease agreements and office spaces that can easily adapt to changing work arrangements. For example, in 2024, a significant portion of office leasing activity focused on flexible-term spaces, reflecting this growing tenant preference.

Industry-Specific Market Conditions

The bargaining power of customers, particularly tenants, for Hudson Pacific Properties is significantly shaped by the health of its core tenant industries: technology and media. When these sectors are robust, demand for office and creative space is high, giving Hudson Pacific more leverage. However, a downturn can shift this power towards tenants.

A prime example of this dynamic is the recovery pace of studio demand. As of early 2024, the media and entertainment industry has been navigating a period of adjustment. This slower-than-anticipated recovery in studio production and related space needs can directly translate to reduced tenant demand for Hudson Pacific's properties. Consequently, tenants may find themselves in a stronger position to negotiate lease terms, potentially impacting rental income and occupancy rates.

- Tech Sector Performance: The tech industry, a key driver of demand for Hudson Pacific's modern office spaces, experienced a mixed performance in 2023 and early 2024, with some companies focusing on cost optimization, potentially reducing their real estate footprint.

- Media and Entertainment Recovery: The media and entertainment sector's recovery, particularly studio demand, has been slower than many anticipated, impacting Hudson Pacific's ability to lease its creative office and studio properties at previous rates.

- Tenant Leverage: In periods of weaker demand from these core industries, tenants gain increased bargaining power, leading to potential concessions on rent, lease duration, or tenant improvement allowances.

- Occupancy Rates: Hudson Pacific reported an overall occupancy rate of 93.1% as of Q1 2024, but specific submarkets and property types tied to slower-recovering industries may face greater pressure on occupancy and pricing power.

Tenant Concentration Risk

Hudson Pacific's tenant concentration risk directly impacts the bargaining power of its customers. While the company aims for a broad tenant base, the departure or downsizing of a few key clients could significantly affect its financial stability. For instance, if a substantial portion of rental income is derived from a limited number of large commercial tenants, those tenants gain considerable leverage in lease negotiations.

This concentration means that if a major tenant decides to leave or reduce their leased space, Hudson Pacific could face a sharp decline in occupancy rates and rental revenue. This situation amplifies the bargaining power of remaining or potential large tenants, as they become more critical to the company's overall performance. In 2024, understanding the distribution of Hudson Pacific's rental income across its top tenants is crucial for assessing this risk.

- Tenant Concentration: A high concentration of revenue from a few major tenants increases their bargaining power.

- Revenue Impact: The exit or downsizing of a large tenant can lead to significant revenue loss.

- Lease Negotiation Leverage: Key tenants can demand more favorable lease terms due to their importance.

- Risk Mitigation: Diversifying the tenant base is essential to reduce this specific customer bargaining power.

The bargaining power of Hudson Pacific's customers, primarily tenants, is amplified by the current oversupply in key office markets, particularly on the West Coast. With San Francisco's office vacancy rate hitting 36.6% in Q1 2024, tenants have significant leverage to negotiate favorable lease terms, including lower rents and concessions.

The performance of Hudson Pacific's core tenant industries, technology and media, also dictates tenant power. A slower recovery in media and entertainment, evident in studio demand as of early 2024, can weaken tenant demand and increase their negotiating leverage. This is further compounded by tenant preferences for flexibility, leading to demands for shorter leases.

Tenant concentration poses another significant factor. A few large tenants contributing a substantial portion of rental income grant these clients considerable bargaining power, as their retention is critical for Hudson Pacific's financial stability. Understanding this concentration is key to assessing the company's vulnerability to customer power.

| Factor | Impact on Tenant Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Market Vacancy Rates | High | San Francisco office vacancy: 36.6% (Q1 2024) |

| Tenant Industry Health | Variable | Slower recovery in media/studio demand impacting leasing |

| Tenant Flexibility Needs | High | Increased demand for shorter, adaptable lease terms |

| Tenant Concentration | High for major tenants | Key tenants can leverage their importance for concessions |

What You See Is What You Get

Hudson Pacific Porter's Five Forces Analysis

This preview displays the complete Hudson Pacific Porter's Five Forces Analysis, providing a thorough examination of the competitive landscape within the company's industry. You are viewing the exact document you will receive immediately after purchase, ensuring full transparency and no hidden content.

Rivalry Among Competitors

Hudson Pacific Properties faces a highly fragmented competitive landscape on the West Coast. Numerous other Real Estate Investment Trusts (REITs), private developers, and large institutional investors actively compete for the same prime office and media/entertainment properties. This intense rivalry is particularly noticeable in key markets like Los Angeles and the San Francisco Bay Area, where demand for high-quality space is consistently strong.

This fragmentation means Hudson Pacific is not just competing against a few major players, but a broad array of entities, each with their own strategies and capital. For instance, in 2023, the West Coast office market saw significant transaction volume, with many deals involving multiple bidders, underscoring the competitive nature of acquiring and retaining valuable assets and tenants.

The competition extends to attracting and retaining high-quality tenants. With a diverse pool of property owners, tenants have multiple options, forcing companies like Hudson Pacific to offer attractive lease terms and superior amenities to secure and keep their occupancy rates high. This dynamic directly impacts rental growth and property valuations across the region.

Many West Coast office markets, particularly in cities like San Francisco and Los Angeles, are grappling with significant oversupply. For instance, San Francisco's office vacancy rate reached a staggering 36.6% in Q1 2024, a record high. This abundance of available space intensifies competition among property owners, forcing them to offer attractive concessions to secure tenants.

The high vacancy rates translate directly into downward pressure on rental rates. Landlords are increasingly resorting to offering rent abatements, tenant improvement allowances, and longer lease terms to fill their empty spaces. This competitive environment makes it challenging for Hudson Pacific Properties to command premium rents and maintain occupancy levels.

While the studio market presents certain entry hurdles, competition remains robust. Major studio operators and numerous independent facilities vie for market share, contributing to a dynamic landscape.

Fluid industry dynamics, fueled by production ramp-ups and the influence of tax credit programs, intensify the competitive environment. For instance, the U.S. film and television production industry saw significant investment, with an estimated $129.8 billion spent domestically in 2023, highlighting the active nature of this market.

Flight to Quality Trend

The real estate market is experiencing a significant 'flight to quality,' where tenants are actively seeking out newer, amenity-rich, and strategically located Class A properties. This trend puts pressure on owners of older or less desirable buildings to invest in upgrades or offer more attractive lease terms to remain competitive. For instance, in 2024, office vacancy rates for Class A properties in major tech hubs like San Francisco remained considerably lower than those for older, Class B and C buildings, reflecting this tenant preference.

This intensified competition for prime assets means that landlords of high-quality properties face increased scrutiny and demand from tenants. Conversely, owners of less premium assets must either adapt by improving their offerings or risk losing tenants to more modern alternatives. The gap in rental rates and occupancy between Class A and lower-tier properties widened in 2024, underscoring the financial implications of this trend.

- Tenant Preference: A clear shift towards modern, amenity-rich, and well-located Class A office spaces.

- Competitive Pressure: Landlords of older properties must upgrade or offer concessions to compete.

- Market Segmentation: Widening gap in vacancy rates and rental prices between Class A and lower-tier assets in 2024.

- Asset Value Impact: Properties failing to meet quality standards face higher vacancy and reduced leasing velocity.

Impact of Economic Conditions

Overall economic growth and interest rate environments significantly influence competitive intensity within the real estate sector, impacting companies like Hudson Pacific Properties. A slower economy or higher interest rates can constrain leasing activity and investment, forcing competitors to aggressively pursue limited opportunities. For instance, in 2024, the Federal Reserve maintained interest rates at elevated levels, contributing to a more cautious investment climate and potentially increasing pressure on property owners to secure tenants and manage costs.

Hudson Pacific Properties, like its peers, faces heightened competition when economic headwinds slow down demand for office and media facilities. In such conditions, companies may resort to aggressive pricing or offering more favorable lease terms to attract and retain tenants. This dynamic is amplified during periods of economic contraction, where the available pool of creditworthy tenants shrinks, intensifying the rivalry for market share.

- Economic Growth: A strong GDP growth rate generally correlates with increased demand for commercial real estate, easing competitive pressures. In Q1 2024, the US GDP grew at an annualized rate of 1.3%, indicating a moderating economic expansion that could influence leasing volumes.

- Interest Rates: Higher interest rates increase borrowing costs for real estate acquisitions and development, potentially limiting new supply and reducing the financial capacity of less capitalized competitors. The Fed's benchmark rate remained in the 5.25%-5.50% range throughout much of 2024.

- Leasing Activity: Economic downturns often lead to reduced leasing activity as businesses downsize or postpone expansion plans, forcing landlords to compete more fiercely for existing demand.

- Investment Climate: A challenging economic outlook can deter new investment in the sector, concentrating competition among existing players vying for market share.

Hudson Pacific Properties operates in a fiercely competitive real estate market, particularly on the West Coast, where numerous REITs, private developers, and institutional investors vie for prime office and media properties. This intense rivalry is evident in major hubs like Los Angeles and the San Francisco Bay Area, where demand for quality space is consistently high, leading to multiple bidders for valuable assets and tenants.

The competition extends to tenant attraction and retention, with a wide array of property owners forcing companies like Hudson Pacific to offer attractive lease terms and amenities. This dynamic directly impacts rental growth and property valuations. For instance, San Francisco's office vacancy rate hit a record 36.6% in Q1 2024, intensifying competition and leading to concessions like rent abatements and tenant improvement allowances, which pressure rental rates.

Furthermore, a significant flight to quality means tenants increasingly favor modern, amenity-rich Class A properties. This trend exacerbates competition for owners of older buildings, compelling them to upgrade or offer better terms. The gap in vacancy and rental rates between Class A and lower-tier assets widened in 2024, highlighting the financial implications of failing to meet quality standards.

| Market Metric | Q1 2024 Data | Competitive Impact |

|---|---|---|

| San Francisco Office Vacancy Rate | 36.6% | Intensifies landlord competition, driving concessions. |

| US GDP Growth (Annualized) | 1.3% (Q1 2024) | Moderating growth may influence leasing volumes and competitive intensity. |

| Federal Reserve Benchmark Rate | 5.25%-5.50% (Throughout 2024) | Elevated rates increase borrowing costs, potentially limiting competitor capacity. |

SSubstitutes Threaten

The rise of remote and hybrid work models presents a significant threat of substitutes for traditional office spaces. Companies are increasingly opting for smaller footprints or fully remote operations, directly reducing the demand for physical office leases. For example, in 2024, many businesses continued to re-evaluate their real estate needs, with some reporting substantial reductions in their office square footage requirements compared to pre-pandemic levels.

Technological advancements are creating compelling substitutes for traditional media production methods, directly impacting the demand for physical studio spaces like those owned by Hudson Pacific. The rise of virtual production, for instance, allows for the creation of complex environments and visual effects entirely within a digital space, reducing the need for extensive on-location shooting or elaborate physical sets. This shift means that content creators might opt for these more agile and potentially cost-effective virtual solutions over leasing traditional sound stages. In 2024, the global virtual production market was projected to reach over $2.5 billion, a significant increase indicating its growing adoption.

Furthermore, sophisticated animation and advanced remote collaboration tools are also presenting viable alternatives. These technologies empower smaller teams and even individual creators to produce high-quality content without requiring the vast infrastructure of a major studio. For example, advancements in real-time rendering and cloud-based editing platforms facilitate seamless collaboration across dispersed teams, diminishing the necessity for centralized physical production hubs. This trend is likely to continue, offering a potent substitute for Hudson Pacific's core offerings and potentially pressuring rental rates for their studio properties.

The rise of co-working and flexible office spaces presents a significant threat of substitutes for traditional office landlords like Hudson Pacific. These alternatives offer businesses, especially startups and smaller companies, a more agile and often cost-effective way to secure workspace without committing to lengthy leases. For instance, the global flexible office market was valued at approximately $13.7 billion in 2023 and is projected to grow substantially, indicating a strong demand for these substitute offerings.

Tenant Self-Ownership

The threat of substitutes for Hudson Pacific's properties, particularly concerning tenant self-ownership, is significant. Large, well-capitalized tech and media firms, which are prime targets for leasing premium office and production space, possess the financial wherewithal to bypass the rental market entirely.

These companies could choose to invest in building or acquiring their own dedicated corporate campuses and specialized production facilities. This direct substitution strategy would remove them from Hudson Pacific's potential tenant pool, impacting demand and potentially pricing power. For instance, in 2024, major tech companies continued robust capital expenditure on real estate, with some actively exploring build-to-suit options to gain greater control and customization over their operational environments.

- Tenant Self-Ownership Threat: Major tech and media companies can develop or purchase their own facilities, bypassing leasing.

- Capital Availability: These large corporations have substantial capital to fund such direct investments.

- Strategic Control: Self-ownership offers greater control over design, location, and long-term operational costs.

- Market Impact: This trend reduces the pool of potential high-value tenants for real estate providers like Hudson Pacific.

Adaptive Reuse of Commercial Properties

The adaptive reuse of commercial properties, particularly office buildings, acts as a significant substitute for traditional office demand. When older office spaces are converted into residential units or life sciences facilities, they effectively remove themselves from the pool of available office inventory. This trend, gaining momentum, means that businesses looking for office space have fewer options, potentially driving up rental costs for remaining traditional office stock.

This repurposing directly impacts the threat of substitutes by reducing the supply of conventional office spaces. For instance, in 2024, several major cities saw a notable uptick in office-to-residential conversions. This shift means that companies previously considering these buildings for their headquarters are now forced to look elsewhere, or even reconsider their office footprint entirely, intensifying competition for prime office locations.

- Reduced Office Supply: Adaptive reuse directly curtails the available inventory of traditional office spaces, a key factor in assessing the threat of substitutes.

- Shifting Tenant Demand: Properties converted to residential or life sciences no longer compete for office tenants, altering the competitive landscape.

- Market Impact: In 2024, cities like San Francisco and New York reported increased interest and approvals for office conversions, impacting the office leasing market.

The growing adoption of remote and hybrid work models continues to present a substantial threat of substitutes for traditional office spaces. Businesses are increasingly re-evaluating their real estate needs, often opting for smaller footprints or fully remote operations, which directly diminishes the demand for physical office leases. In 2024, many companies reported significant reductions in their office square footage requirements compared to pre-pandemic levels, highlighting this evolving trend.

Entrants Threaten

Entering Hudson Pacific Properties' core markets, like prime office and studio spaces on the West Coast, requires immense financial backing. The sheer cost of acquiring land, coupled with the expenses of building and developing these high-demand properties, presents a formidable hurdle for any new player.

For instance, in 2024, the average cost per square foot for new office construction in San Francisco, a key market for HPP, can easily exceed $800, making initial outlays in the tens or even hundreds of millions of dollars. This significant capital requirement effectively deters many potential competitors from even attempting to enter the market.

Navigating the intricate web of zoning laws, environmental regulations, and extensive permitting processes in prime West Coast markets presents a significant barrier for potential new entrants in the real estate sector. These complexities can substantially inflate development timelines and project costs, introducing considerable uncertainty for those looking to break into these competitive areas.

For instance, in California, a state known for its rigorous environmental reviews under the California Environmental Quality Act (CEQA), projects can face years of scrutiny and potential legal challenges, adding millions to development budgets. This regulatory drag effectively raises the cost of entry, making it harder for smaller or less capitalized firms to compete with established players who have experience and resources to manage these hurdles.

Hudson Pacific Properties benefits significantly from deeply entrenched relationships with major tech and media companies. These long-standing partnerships, cultivated over years of reliable service and tailored property solutions, create a substantial barrier for any new player attempting to enter the market. For instance, in 2024, Hudson Pacific continued to solidify its position with key tenants like Netflix and Google, whose multi-year leases underscore the strength of these established connections.

Specialized Niche Expertise

Hudson Pacific's strategic focus on synergistic tech and media tenants creates a significant barrier to entry for new competitors. This requires specialized expertise in understanding and catering to the unique operational needs of these sectors, including tailored office configurations and advanced infrastructure like soundstages. For instance, in 2024, Hudson Pacific continued to invest in its media-focused properties, enhancing their appeal to a discerning tenant base that demands more than just traditional office space.

This deep understanding of niche industry requirements, coupled with the operational capabilities to support them, is not easily replicated. New entrants would face substantial hurdles in acquiring the necessary knowledge and building the specialized platforms required to effectively serve these demanding tenants. This specialized knowledge directly translates into a competitive advantage, making it challenging for others to quickly match Hudson Pacific's value proposition.

The difficulty in replicating this specialized expertise and operational platform acts as a deterrent. Newcomers would need considerable time and resources to develop the same level of insight and infrastructure. This creates a moat around Hudson Pacific's market position within these specific real estate segments.

- Niche Tenant Needs: Expertise in catering to tech and media firms' specific office and infrastructure demands.

- Operational Platform: Difficulty for new entrants to quickly replicate specialized operational capabilities.

- Barrier to Entry: Specialized knowledge and infrastructure create a significant hurdle for new competitors.

- Competitive Advantage: Hudson Pacific's deep understanding offers a distinct edge in attracting and retaining key tenants.

Access to Prime Locations

Securing prime, well-located properties in competitive West Coast markets is increasingly difficult due to limited supply and high demand. For instance, in 2024, office vacancy rates in San Francisco remained elevated, yet the availability of Class A space in desirable downtown submarkets was scarce, with average rents reaching over $70 per square foot. This scarcity makes it challenging for new entrants to acquire the strategic sites needed to compete effectively.

New entrants would struggle to acquire desirable sites that offer the strategic advantages necessary to compete effectively with established players like Hudson Pacific. These advantages include proximity to transportation hubs, access to a skilled workforce, and visibility. Hudson Pacific's existing portfolio, built over years, provides them with a significant head start in securing and developing these prime locations.

- Limited Supply: High demand for prime West Coast real estate in 2024 has constrained the availability of suitable development sites.

- High Acquisition Costs: Increased competition drives up land acquisition prices, creating a significant barrier for new companies.

- Established Relationships: Incumbents like Hudson Pacific often benefit from long-standing relationships with brokers and property owners, facilitating access to off-market opportunities.

The sheer capital required to enter Hudson Pacific's core markets, particularly for high-demand office and studio spaces on the West Coast, acts as a significant deterrent. For example, in 2024, the cost of new office construction in key markets like San Francisco could exceed $800 per square foot, necessitating investments in the tens or hundreds of millions of dollars, effectively pricing out many potential competitors.

Navigating the complex regulatory landscape, including zoning laws and environmental reviews, further inflates entry costs and timelines. California's stringent CEQA process, for instance, can add millions to development budgets and extend project schedules by years, a hurdle that established players like Hudson Pacific are better equipped to manage.

Hudson Pacific's established relationships with major tech and media tenants, solidified by multi-year leases with firms like Netflix and Google in 2024, create a formidable barrier. The company's specialized expertise in catering to the unique needs of these sectors, such as tailored office configurations and advanced infrastructure, is difficult for new entrants to replicate quickly.

Limited supply of prime real estate in desirable West Coast locations, coupled with high demand, further restricts new entrants. In 2024, despite higher overall vacancy rates in markets like San Francisco, Class A space in prime downtown areas remained scarce, with average rents exceeding $70 per square foot, making site acquisition a major challenge.

| Factor | Description | Impact on New Entrants | 2024 Data/Example |

|---|---|---|---|

| Capital Requirements | High costs for land acquisition and development. | Significant financial barrier. | SF office construction >$800/sq ft. |

| Regulatory Hurdles | Complex zoning, permitting, and environmental reviews. | Increased costs and project delays. | CA CEQA adds millions and years to projects. |

| Tenant Relationships & Specialization | Deep ties with tech/media firms and tailored services. | Difficult to replicate specialized value proposition. | Multi-year leases with Netflix, Google. |

| Limited Prime Site Availability | Scarcity of well-located, desirable properties. | Challenges in acquiring strategic locations. | Scarce Class A space in prime SF submarkets. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hudson Pacific Properties is built upon a foundation of diverse and credible data sources. We leverage annual reports, SEC filings, and investor relations materials for direct company insights. Complementing this, we utilize industry research reports, market data aggregators, and real estate analytics platforms to understand broader market dynamics and competitive pressures.