Hengtong Optic-Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengtong Optic-Electric Bundle

Unlock the strategic landscape surrounding Hengtong Optic-Electric with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping its operations and future growth. Equip yourself with actionable intelligence to make informed decisions and gain a competitive edge.

Don't get left behind in the dynamic telecommunications sector. Our PESTLE analysis of Hengtong Optic-Electric provides a crucial understanding of the external forces at play, from government policies impacting infrastructure to the growing demand for sustainable solutions. Purchase the full report to gain the in-depth insights you need to navigate these complexities and capitalize on emerging opportunities.

Political factors

China's commitment to bolstering its digital infrastructure is a significant tailwind for Hengtong Optic-Electric. The nation is targeting the completion of its primary national data infrastructure by 2029, a massive undertaking that involves substantial upgrades to existing 5G networks, moving towards 5G-Advanced (5G-A), and actively fostering research into 6G technology.

As a leading supplier of optical fiber and cable, critical components for these telecommunication advancements, Hengtong is directly positioned to capitalize on these government-driven investments. This strategic focus by the Chinese government ensures a robust and expanding domestic market for Hengtong's foundational products, providing a stable revenue stream and ample opportunities for growth.

Global trade policies significantly influence Hengtong Optic-Electric's international business. For instance, the imposition of tariffs on optical fiber preforms or telecommunications equipment by major economies could directly increase Hengtong's production costs or reduce its competitiveness in those markets. In 2024, ongoing trade disputes and the potential for new protectionist measures, such as those seen in the US-China trade relations, create uncertainty for supply chains and market access.

As a global player, Hengtong is susceptible to geopolitical shifts that can manifest as trade barriers. For example, restrictions on technology exports or import bans in certain regions could limit Hengtong's ability to sell its products or procure essential raw materials. The company's strategy to mitigate these risks involves diversifying its manufacturing bases and customer markets, aiming to reduce reliance on any single region vulnerable to political instability or protectionist policies.

Governments globally are pushing for greener energy, setting targets to reduce carbon emissions and boost renewable power. This creates a strong market for products like power and submarine cables, which are crucial for projects such as offshore wind farms. For instance, the US aims for a carbon-free electricity sector by 2035, and the EU's Green Deal encourages eco-friendly investments.

Regulatory Environment in Key Markets

The regulatory environment for telecommunications and power transmission across Hengtong Optic-Electric's key markets presents a dynamic challenge. For instance, in 2024, the European Union continued to emphasize cybersecurity standards for network infrastructure, potentially requiring additional investment in compliance for Hengtong's fiber optic products. Similarly, varying national licensing procedures for telecommunication equipment can influence market entry timelines and operational costs.

Compliance with these diverse regulations is paramount for Hengtong's global expansion strategy. This includes adhering to specific product safety certifications and performance benchmarks mandated by authorities in regions like North America and Asia. For example, in 2025, several Southeast Asian nations are expected to update their telecommunications equipment standards, necessitating proactive adaptation by Hengtong.

- Telecommunications Equipment Standards: Countries like the United States (FCC) and China (MIIT) have distinct approval processes for telecommunications hardware, impacting product design and market access.

- Power Transmission Regulations: Standards for grid connectivity and safety in power transmission equipment vary, with bodies like the IEEE setting benchmarks that Hengtong must meet for its submarine cable systems.

- Data Privacy and Security Laws: Emerging regulations concerning data handling within telecommunication networks, such as GDPR in Europe, influence the operational framework for network providers utilizing Hengtong's infrastructure.

- Trade and Import/Export Controls: Geopolitical considerations can lead to evolving trade policies and tariffs, directly affecting the cost and feasibility of importing and exporting components and finished goods for Hengtong.

Data Governance and Cybersecurity Policies

Data governance and cybersecurity policies are increasingly shaping the telecommunications landscape. Hengtong Optic-Electric must navigate a complex web of global regulations focused on data security and privacy, particularly as nations build out their national data infrastructures. For instance, China's new national framework for digital infrastructure transformation emphasizes an integrated data network, which directly impacts how communication network products are designed and secured.

This evolving regulatory environment necessitates that Hengtong's optical fiber and cable solutions are not only technologically advanced but also compliant with stringent data governance frameworks and cybersecurity standards. Meeting these requirements is crucial for satisfying client demands and adhering to legal obligations. The global cybersecurity market, projected to reach $345 billion by 2026, highlights the significant investment and attention companies like Hengtong must dedicate to these areas.

- Global Data Privacy Regulations: Hengtong must ensure compliance with frameworks like GDPR and CCPA, which impact data handling throughout its product lifecycle.

- National Data Infrastructure Focus: China's emphasis on an integrated data network requires products to support secure data flow and management.

- Cybersecurity Standards: Adherence to international cybersecurity standards (e.g., ISO 27001) is vital for building trust and meeting client security expectations.

- Product Design Implications: Future product development will likely incorporate enhanced encryption and security features to align with these policy trends.

Government initiatives to advance digital infrastructure, such as China's push for 5G-A and 6G research, create a strong domestic market for Hengtong's optical fiber and cable products. Conversely, global trade policies and geopolitical tensions can introduce tariffs and trade barriers, impacting costs and market access, as seen in US-China trade relations in 2024. Furthermore, varying national regulations on telecommunications equipment and data security, like EU cybersecurity standards, necessitate ongoing compliance efforts and product adaptation for Hengtong's international operations.

| Political Factor | Impact on Hengtong | Example/Data (2024-2025) |

| Government Digital Infrastructure Investment | Drives demand for core products | China's 2029 national data infrastructure target |

| Trade Policies & Tariffs | Affects costs and competitiveness | US-China trade disputes impacting component imports/exports |

| Geopolitical Stability & Export Controls | Influences market access and supply chains | Potential restrictions on technology exports to certain regions |

| Regulatory Compliance (Telecom & Data Security) | Requires investment and product adaptation | EU cybersecurity standards for network infrastructure (2024), evolving Southeast Asian standards (2025) |

What is included in the product

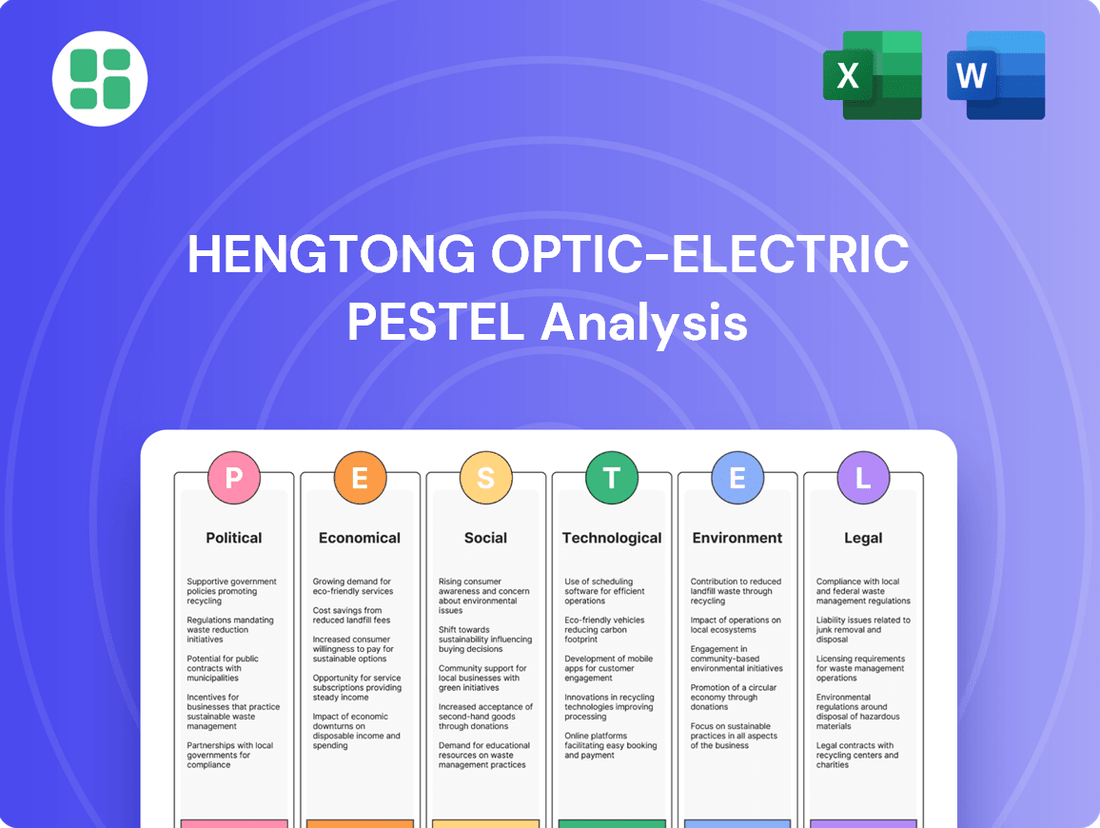

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hengtong Optic-Electric, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Hengtong Optic-Electric.

Helps support discussions on external risk and market positioning during planning sessions, acting as a valuable tool for strategic decision-making.

Economic factors

Global economic expansion is a key driver for Hengtong Optic-Electric. As economies grow, so does the need for enhanced infrastructure, directly boosting demand for Hengtong's core products like optical fiber and power cables. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, signaling continued investment in telecommunications and energy sectors.

Industrial development, particularly in emerging markets, further fuels this demand. Sectors such as 5G deployment, renewable energy projects, and digital transformation initiatives require significant investment in advanced cabling solutions. This trend is supported by data showing a steady rise in global infrastructure spending, with projections indicating continued growth through 2025 as countries prioritize digital connectivity and green energy transitions.

Hengtong Optic-Electric's manufacturing heavily depends on raw materials like copper, aluminum, and specialty chemicals. For instance, copper prices saw significant volatility in late 2023 and early 2024, influenced by global industrial demand and geopolitical factors.

These price swings directly affect Hengtong's production costs. A substantial increase in metal prices, for example, could squeeze profit margins if not effectively passed on to customers or managed through procurement strategies. The company's 2023 annual report highlighted that raw material costs represented a significant portion of its operating expenses.

To counter this, Hengtong employs robust supply chain management, including forward contracts and diversification of suppliers, to stabilize input costs. Hedging strategies are crucial for mitigating the impact of unpredictable commodity markets on their financial performance, especially as global economic recovery in 2024 continues to shape demand for key industrial inputs.

Massive global investments in digital transformation, 5G expansion, and the upcoming 6G era are powerful economic forces directly benefiting Hengtong Optic-Electric. These trends create a substantial and growing demand for the advanced optical fiber and related infrastructure that Hengtong specializes in, as high-speed, low-latency connectivity becomes essential across industries.

The surge in data consumption and cloud traffic is a key economic indicator, directly translating into market growth for crucial infrastructure components. For instance, the global submarine cable systems market is expected to see significant expansion, with some projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years, underscoring the critical need for Hengtong's products.

Exchange Rate Volatility

As a global player with extensive international operations and sales, Hengtong Optic-Electric is inherently exposed to the ebb and flow of currency exchange rates. Fluctuations in these rates can significantly influence its financial results. For instance, a strong appreciation of the Chinese Yuan (CNY) against other major currencies could make Hengtong's exports pricier for overseas buyers, potentially dampening demand and impacting its competitive edge in international markets. Conversely, a weaker Yuan would make imports cheaper, which could benefit its raw material sourcing but also increase the cost of repatriating foreign earnings.

Managing this foreign exchange risk is not just a matter of prudence but a critical component of ensuring stable and predictable financial performance for Hengtong. The company's ability to effectively hedge against adverse currency movements directly affects its profitability and the overall value proposition it offers to investors. For example, in 2024, the Yuan experienced periods of volatility against the US Dollar, with the USD/CNY exchange rate fluctuating, impacting companies with substantial cross-border transactions like Hengtong.

- Impact on Exports: A stronger local currency makes Hengtong's products more expensive abroad, potentially reducing sales volume.

- Impact on Imports: A weaker local currency makes imported raw materials and components cheaper, potentially lowering production costs.

- Profitability: Exchange rate shifts can directly affect the reported profits when foreign earnings are converted back to the company's reporting currency.

- Hedging Strategies: Hengtong likely employs financial instruments like forward contracts and options to mitigate currency risks, aiming to lock in favorable exchange rates for future transactions.

Capital Expenditure and Infrastructure Spending

Government and private sector investment in major infrastructure projects, like smart cities, offshore wind farms, and international communication links, directly creates business prospects for Hengtong Optic-Electric. These substantial, long-term commitments ensure a consistent demand for Hengtong's specialized fiber optic cables, submarine systems, and related engineering expertise.

For instance, China's continued push for digital infrastructure development, including the expansion of 5G networks and data centers, is a significant driver. In 2023, China's fixed-asset investment in the information transmission, software, and information technology services sector grew by 10.3%, providing a strong market for Hengtong's products.

Globally, the energy transition is also a key factor. The development of offshore wind farms, requiring extensive subsea power cables, presents a growing opportunity. In 2024, the global offshore wind market is projected to see significant growth, with new project announcements and investments expected to reach hundreds of billions of dollars, directly benefiting companies like Hengtong that supply critical subsea cable solutions.

- Smart City Initiatives: Increased government spending on smart city infrastructure globally, with projected market sizes reaching over $1.5 trillion by 2025, fuels demand for Hengtong's fiber optic solutions for connectivity and data transmission.

- Offshore Wind Farms: The expansion of offshore wind energy projects, a sector seeing substantial investment in 2024 and beyond, requires vast amounts of subsea fiber optic cables for power transmission and data management, a core product for Hengtong.

- Cross-Border Communication Networks: Investments in submarine cable systems to enhance global internet connectivity and data transfer capabilities, with projects valued in the tens of billions of dollars annually, directly align with Hengtong's strategic focus and capabilities.

- Digital Infrastructure Upgrade: Ongoing global upgrades to telecommunications infrastructure, including 5G deployment and fiber-to-the-home (FTTH) expansion, continue to drive demand for high-capacity optical fiber and related components manufactured by Hengtong.

Global economic expansion continues to be a primary driver for Hengtong Optic-Electric, with projected global growth of 3.2% in 2024 according to the IMF. This growth underpins increased investment in telecommunications and energy infrastructure, directly benefiting demand for Hengtong's optical fiber and power cables. Emerging markets are particularly significant, with digital transformation and renewable energy projects requiring advanced cabling solutions, supported by a steady rise in global infrastructure spending anticipated through 2025.

Raw material price volatility, such as copper, directly impacts Hengtong's production costs, as highlighted in their 2023 report where material costs formed a substantial portion of operating expenses. The company actively manages these risks through robust supply chain strategies, including supplier diversification and forward contracts, to stabilize input costs and mitigate the effects of unpredictable commodity markets in 2024.

Currency exchange rate fluctuations pose a significant risk to Hengtong's international operations, affecting export competitiveness and the repatriation of foreign earnings. The volatility of the Yuan against the US Dollar in 2024 exemplifies this, underscoring the critical need for effective hedging strategies to ensure stable financial performance and profitability.

Government and private sector investments in infrastructure, such as smart cities and offshore wind farms, create substantial opportunities for Hengtong. China's 10.3% growth in information transmission fixed-asset investment in 2023, alongside global offshore wind market growth projected for 2024, directly translates into sustained demand for Hengtong's specialized cable solutions.

Full Version Awaits

Hengtong Optic-Electric PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hengtong Optic-Electric delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

The world's increasing dependence on the internet for everything from work and school to entertainment and staying connected fuels the core need for robust communication networks. This societal move towards digital living means there's a constant requirement to build and improve fiber optic systems, which is exactly what Hengtong specializes in.

The desire for faster internet speeds, like gigabit and even higher, is growing rapidly. This is driven by popular uses such as watching ultra-high-definition videos and working together effectively from different locations.

Global urbanization is accelerating, with projections suggesting that by 2050, 68% of the world's population will live in urban areas. This surge in city dwellers directly fuels demand for robust telecommunication and power infrastructure. Hengtong Optic-Electric's fiber optic cables and related solutions are fundamental to building and upgrading these essential urban networks, enabling smart city technologies and expanding access to vital services for burgeoning urban populations.

Hengtong Optic-Electric's reliance on advanced optical and submarine cable technologies necessitates a workforce proficient in highly specialized engineering and research fields. The global shortage of such talent, particularly those with expertise in areas like fiber optics manufacturing and subsea deployment, presents a significant challenge. For instance, a 2024 report indicated a growing demand for skilled telecommunications engineers, with projections suggesting a continued deficit in key regions.

Corporate Social Responsibility (CSR) and ESG Expectations

Societal expectations around Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) factors are significantly shaping business operations. Hengtong Optic-Electric's proactive stance on sustainability, demonstrated by initiatives like its 'Global Forest Action 2025' program and inclusion in various ESG impact indices, bolsters its brand image and stakeholder appeal. This focus is crucial as investors increasingly scrutinize companies' ESG performance, with new reporting mandates set to take effect in 2025, requiring more transparent and detailed disclosures.

The growing emphasis on ESG is translating into tangible investor preferences and regulatory shifts. For instance, a significant portion of global assets under management are now tied to ESG criteria, with projections indicating this trend will continue to accelerate through 2025. Hengtong's commitment to ethical conduct and community engagement not only aligns with these evolving expectations but also provides a competitive advantage in attracting capital and talent.

- Hengtong's 'Global Forest Action 2025' targets significant reforestation efforts, contributing to environmental sustainability.

- The company's recognition on ESG impact lists highlights its commitment to responsible business practices.

- New ESG reporting regulations expected in 2025 will mandate greater transparency from companies like Hengtong.

- Investor demand for ESG-compliant investments is projected to reach trillions of dollars by 2025.

Digital Divide and Access to Technology

Efforts to bridge the digital divide, connecting underserved and rural areas globally, represent a significant social goal and a burgeoning market for infrastructure providers like Hengtong Optic-Electric. As of early 2024, initiatives like the US’s Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, highlight the global commitment to expanding internet access. This focus on connectivity directly benefits companies like Hengtong, which supply the essential fiber optic cables and related infrastructure needed to build out these networks, opening up new avenues for market penetration in developing regions.

Hengtong's role in providing foundational connectivity infrastructure positions it to capitalize on this global push. The expansion of 5G networks, for instance, requires extensive fiber optic backhaul, a core offering of Hengtong. By 2025, it's projected that over 60% of the world's population will be covered by 5G, a significant increase from 2023 levels, underscoring the demand for Hengtong's products in enabling this technological advancement.

- Global Internet Penetration: While global internet penetration reached approximately 66% in late 2023, significant disparities remain, particularly in rural and low-income countries, presenting a substantial growth opportunity.

- Infrastructure Investment: Governments worldwide are channeling billions into digital infrastructure development; for example, India's BharatNet project aims to connect all its villages with broadband, creating massive demand for optical fiber.

- 5G Rollout: The continued global expansion of 5G networks necessitates robust fiber optic infrastructure, a key area of expertise for Hengtong, driving demand for its advanced cabling solutions.

Societal trends like the increasing reliance on digital connectivity and the growing demand for faster internet speeds directly benefit Hengtong Optic-Electric. The global push for urbanization, with a projected 68% of the world's population living in cities by 2050, further amplifies the need for robust telecommunication infrastructure, a core area for Hengtong.

Furthermore, the global effort to bridge the digital divide, connecting underserved areas, presents a significant market opportunity, as evidenced by initiatives like the US's $42.45 billion BEAD program. This societal commitment to broader internet access directly fuels demand for Hengtong's fiber optic solutions.

Societal expectations around Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) are also increasingly influential. Hengtong's commitment to sustainability, including its 'Global Forest Action 2025' program, aligns with these growing demands and enhances its appeal to investors and stakeholders, especially with new ESG reporting mandates expected in 2025.

| Societal Factor | Impact on Hengtong | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Digital Dependence | Increased demand for fiber optic infrastructure | Global internet penetration ~66% (late 2023), with ongoing disparities driving expansion needs. |

| Urbanization | Growth in demand for urban telecommunication networks | Projected 68% global urban population by 2050; smart city initiatives require advanced connectivity. |

| Digital Inclusion Efforts | Market opportunities in underserved regions | US BEAD program allocation: $42.45 billion for broadband deployment. |

| ESG Expectations | Enhanced brand reputation and investor appeal | Growing investor preference for ESG-compliant assets; new ESG reporting mandates by 2025. |

Technological factors

Hengtong Optic-Electric's competitive edge hinges on continuous innovation in optical fiber technology. Advancements like ultra-low loss fiber and bend-insensitive fiber are key. These improvements allow for faster data speeds and more robust networks, essential for today's data-intensive world.

The telecommunications industry is rapidly evolving, with a strong push towards higher network capacities. We're seeing a significant drive towards 100G, 400G, and even 800G network capabilities, with research already exploring even greater speeds. Hengtong's ability to integrate these cutting-edge fiber technologies directly impacts its ability to serve these growing market demands.

Innovations in submarine cable systems are a key technological driver. Advancements like enhanced optical amplifiers and more robust cable materials are pushing the boundaries of deep-sea connectivity. Hengtong's expertise in developing and deploying these advanced solutions, particularly for challenging deep-sea environments, is crucial for its success in marine engineering.

The integration of artificial intelligence and automation is also revolutionizing how submarine cables are managed and maintained. This technological shift allows for more efficient operations and predictive maintenance, which is vital for ensuring the reliability of global subsea networks.

The integration of AI and Machine Learning (ML) is rapidly reshaping network management. Companies are increasingly adopting these technologies for tasks like optimizing network performance, predicting potential failures, and monitoring operations in real-time. For instance, a 2024 report indicated that over 70% of telecommunications companies are investing in AI for network automation.

Hengtong Optic-Electric can capitalize on this trend by embedding AI and ML capabilities into its optical network solutions. This would allow Hengtong to offer clients enhanced network reliability and efficiency, while also significantly lowering operational expenditures. AI's predictive power can proactively identify and mitigate network disruptions before they impact service.

Development of 5G-Advanced and 6G Technologies

The continuous advancement of wireless communication, from 5G to 5G-Advanced (5G-A) and early 6G research, directly fuels the need for high-capacity fiber optic infrastructure. Hengtong Optic-Electric is strategically positioned to supply the essential optical networks required for these future mobile generations.

This technological shift presents a significant opportunity for Hengtong. As networks evolve, the demand for more sophisticated and higher-performing fiber solutions will increase. For instance, 5G-A aims to deliver enhanced capabilities such as higher speeds and lower latency, necessitating upgrades in the underlying fiber infrastructure that Hengtong provides.

- 5G-A Rollout: Expected to significantly increase data traffic, requiring denser fiber deployments.

- 6G Research: Early stages indicate a need for even more advanced optical solutions.

- Hengtong's Contribution: Supplying critical optical fiber and cable for network backhaul and front-haul.

- Market Growth: The global fiber optics market is projected to reach hundreds of billions of dollars in the coming years, driven by these technological transitions.

Smart Manufacturing and Industry 4.0 Adoption

Hengtong Optic-Electric's commitment to smart manufacturing and Industry 4.0 principles is a significant technological driver. The company's 'Lighthouse Factory' initiative, for instance, exemplifies this by integrating advanced automation and data analytics to boost production efficiency and quality. This strategic adoption allows Hengtong to reduce costs and react swiftly to evolving market needs, crucial for maintaining its competitive standing.

The implementation of these technologies directly impacts Hengtong's operational capabilities. By leveraging automation, the company can streamline complex manufacturing processes, leading to higher output and fewer errors. Data analytics further refines these operations, providing insights for continuous improvement and predictive maintenance, ultimately enhancing overall cost-effectiveness.

Hengtong's focus on Industry 4.0 positions it well for future growth. The ability to harness real-time data and automated systems enables greater flexibility in production, allowing for quicker adaptation to customized orders and fluctuating demand. This technological edge is vital for staying ahead in the fast-paced telecommunications and optical fiber industry.

Key aspects of Hengtong's technological advancement include:

- 'Lighthouse Factory' Initiative: A flagship program for implementing advanced manufacturing technologies.

- Automation Integration: Widespread use of robotics and automated systems in production lines.

- Data Analytics for Optimization: Utilizing big data to improve process efficiency and quality control.

- Agile Manufacturing Capabilities: Enabling rapid response to market demands and product customization.

Hengtong Optic-Electric's technological prowess is a cornerstone of its market position, driven by continuous innovation in optical fiber. Advancements like ultra-low loss and bend-insensitive fibers are critical for enabling faster data speeds and more resilient networks, directly addressing the escalating demands of data-intensive applications.

The telecommunications sector's rapid evolution, particularly the push towards 100G, 400G, and 800G network capabilities, underscores the need for Hengtong's cutting-edge fiber solutions. This trend is further amplified by the ongoing development of 5G-Advanced and early 6G research, which necessitate more sophisticated optical infrastructure for enhanced speeds and reduced latency.

Hengtong's strategic adoption of Industry 4.0 principles, exemplified by its 'Lighthouse Factory' initiative, is revolutionizing its manufacturing processes. By integrating advanced automation and data analytics, the company is achieving greater production efficiency, improved quality control, and enhanced cost-effectiveness, allowing for agile responses to market demands.

| Technological Factor | Description | Impact on Hengtong | Market Trend (2024-2025) |

|---|---|---|---|

| Optical Fiber Advancements | Ultra-low loss, bend-insensitive fibers | Enables higher data speeds and network resilience. | Growing demand for high-capacity networks (100G, 400G, 800G). |

| 5G-A & 6G Development | Next-generation wireless communication | Drives demand for advanced fiber optic backhaul and front-haul. | Significant investment in 5G-A infrastructure globally. |

| Industry 4.0 & Automation | Smart manufacturing, AI, ML | Boosts production efficiency, quality, and cost-effectiveness. | Increased adoption of AI in network management by over 70% of telcos. |

Legal factors

Hengtong Optic-Electric faces a complex legal landscape, particularly concerning Environmental, Social, and Governance (ESG) regulations. As a global player, the company must navigate evolving compliance standards like the EU's Corporate Sustainability Reporting Directive (CSRD), which mandates detailed disclosures on environmental impact and social responsibility, with reporting obligations escalating from 2025. Similarly, anticipated SEC rules in the United States will likely require enhanced transparency regarding ESG performance, directly influencing Hengtong's operational strategies and public reporting.

Hengtong Optic-Electric places significant emphasis on safeguarding its intellectual property, particularly its patents covering advanced optical fiber, cable, and marine engineering technologies. This focus is crucial for maintaining its competitive edge in the global market.

Navigating the diverse legal landscapes of intellectual property rights across different countries is a key challenge. Hengtong's strategy involves robust patent registration, vigilant enforcement, and proactive defense mechanisms to protect its innovations and market position.

Hengtong Optic-Electric navigates a complex web of regulations in both the telecommunications and power industries. Compliance with national and international standards is crucial for its cable manufacturing, deployment, and network operations. For instance, in 2024, China's Ministry of Industry and Information Technology continued to emphasize stringent quality control for telecommunications equipment, impacting component sourcing and production processes for companies like Hengtong.

Licensing and safety regulations are also non-negotiable. These legal frameworks are designed to guarantee product quality, ensure network reliability, and safeguard public safety, especially as 5G infrastructure and smart grid technologies expand. In 2025, the global push for cybersecurity in critical infrastructure will likely lead to updated regulations, requiring Hengtong to adapt its operational and product development strategies to meet evolving security mandates.

International Trade Laws and Sanctions

Hengtong Optic-Electric's global operations are significantly shaped by international trade laws and sanctions. Navigating complex customs regulations and adhering to economic sanctions imposed by entities like the US and EU is paramount to avoid substantial penalties and maintain market access. For instance, in 2024, the ongoing geopolitical tensions continue to influence trade flows, potentially impacting the cost and availability of raw materials and components for fiber optic cable manufacturing.

Violating these regulations can result in severe consequences, including hefty fines, reputational damage, and disruptions to Hengtong's international supply chain. The company must remain vigilant in monitoring and adapting to evolving trade policies. In 2023, several companies faced significant challenges due to unexpected trade restrictions, highlighting the need for proactive compliance strategies. Hengtong's ability to secure key components and reach diverse markets in 2024 and beyond hinges on its adeptness in managing these legal complexities.

- Compliance with international trade laws: Ensuring adherence to import/export regulations and customs procedures across all operating regions.

- Sanctions monitoring: Staying updated on and complying with economic sanctions imposed by major global powers, which can affect market access and supplier relationships.

- Geopolitical trade policy adaptation: Proactively adjusting business strategies in response to shifts in international trade agreements and political landscapes, particularly concerning technology and critical infrastructure.

- Supply chain resilience: Mitigating risks associated with trade disruptions by diversifying sourcing and logistics to maintain operational continuity.

Labor Laws and Employment Regulations

Hengtong Optic-Electric, as a significant global employer, navigates a complex web of labor laws and employment regulations across its various operating regions. These laws dictate crucial aspects of its workforce management, from minimum wage requirements and working hour limits to employee safety standards and anti-discrimination policies. For instance, in 2024, many countries continued to strengthen regulations around fair wages and benefits, with some jurisdictions implementing phased increases to minimum wage levels.

Adherence to these diverse legal frameworks is not merely a compliance matter but a strategic imperative for Hengtong. It directly impacts the company's ability to foster a positive and productive work environment, which is essential for attracting and retaining skilled employees. Failure to comply can lead to costly legal disputes, reputational damage, and difficulties in talent acquisition, as seen in cases where companies faced significant fines for labor law violations in recent years.

Key areas of focus for Hengtong's labor law compliance include:

- Fair Wages and Compensation: Ensuring compliance with statutory minimum wages and overtime pay regulations, which are subject to periodic review and adjustment by governments worldwide.

- Working Conditions and Safety: Meeting occupational health and safety standards, including provisions for safe machinery operation and adequate rest periods, a critical factor in manufacturing sectors.

- Employee Rights and Non-Discrimination: Upholding principles of equal opportunity in hiring, promotion, and treatment, and adhering to laws prohibiting discrimination based on age, gender, race, or other protected characteristics.

- Labor Relations: Managing relationships with employee representatives and unions in line with local labor relations laws, which can vary significantly in their scope and impact.

Hengtong Optic-Electric's global operations are significantly influenced by evolving international trade laws and sanctions. Navigating customs regulations and economic sanctions, such as those imposed by the US and EU, is critical for market access and avoiding penalties. In 2024, geopolitical tensions continued to impact trade flows, affecting raw material costs for fiber optic cable manufacturing.

Compliance with intellectual property rights across various jurisdictions is paramount for protecting Hengtong's technological innovations. The company actively pursues patent registration and enforcement to maintain its competitive advantage. Failure to protect IP can lead to market erosion and revenue loss.

The company must adhere to stringent telecommunications and power industry regulations, including quality control standards and cybersecurity mandates. As 5G and smart grid technologies advance in 2025, updated security regulations will necessitate strategic adaptations in product development and operations.

Hengtong also faces diverse labor laws globally, impacting workforce management, safety, and employee rights. In 2024, many regions strengthened fair wage and benefit regulations, requiring continuous adaptation to ensure compliance and foster a positive work environment.

Environmental factors

Global commitments to net-zero emissions, such as China's goal of peaking carbon dioxide emissions before 2030 and achieving carbon neutrality before 2060, are driving significant investment in green energy infrastructure. This trend directly benefits Hengtong Optic-Electric, as demand for its fiber optic cables and submarine communication cables, crucial for connecting renewable energy sources like offshore wind farms, is expected to rise.

Hengtong's strategic focus on marine energy and offshore wind power equipment positions it favorably to capitalize on the decarbonization push. For instance, the global offshore wind market is projected to grow substantially, with capacity expected to reach over 300 GW by 2030, according to industry forecasts from 2024. This expansion necessitates robust subsea cable infrastructure, a core area of Hengtong's expertise.

The availability and sustainable sourcing of raw materials, especially non-renewable resources like copper and plastics essential for cable manufacturing, present significant environmental hurdles. Global demand for these materials continues to rise, putting pressure on supply chains and potentially increasing costs for companies like Hengtong Optic-Electric.

Hengtong's proactive approach to establishing green supply chains and prioritizing the use of sustainably sourced or recycled materials is crucial. This strategy helps to mitigate risks tied to resource depletion and the increasing likelihood of stricter environmental regulations worldwide, ensuring more stable operations and a reduced ecological footprint.

Hengtong Optic-Electric faces increasingly stringent global regulations concerning industrial and electronic waste, particularly concerning product end-of-life management. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive, which mandates collection and recycling targets, impacts companies like Hengtong that produce electronic components. Failure to comply with these evolving environmental laws, which are becoming more common in major markets throughout 2024 and into 2025, could lead to significant financial penalties and reputational damage, underscoring the need for proactive waste reduction and recycling initiatives.

Pollution Control and Emissions Standards

Hengtong Optic-Electric's manufacturing processes are intrinsically linked to environmental regulations, particularly concerning pollution control and emissions standards. These regulations govern air, water, and soil pollution, requiring significant investment in cleaner production technologies and robust environmental management systems. For instance, China, where Hengtong is headquartered, has been progressively tightening its environmental protection laws, with significant updates to air pollution control measures and industrial wastewater discharge standards expected to be fully implemented by 2025. This necessitates continuous adaptation and upgrades to Hengtong’s facilities to ensure ongoing compliance and minimize its environmental impact.

Adherence to these evolving standards is not merely a matter of compliance but a strategic imperative for Hengtong. The company must actively invest in and adopt advanced technologies that reduce emissions and waste. This proactive approach helps mitigate potential fines, operational disruptions, and reputational damage. Furthermore, demonstrating strong environmental stewardship can enhance brand image and attract environmentally conscious investors and customers. For example, companies investing in energy-efficient manufacturing processes and waste reduction technologies often report lower operational costs in the long run, as seen in the broader Chinese manufacturing sector where environmental upgrades are increasingly tied to long-term economic viability.

- Regulatory Landscape: Hengtong must navigate increasingly stringent pollution control and emissions standards in its key operating regions, particularly in China.

- Technological Investment: Continuous investment in cleaner production technologies and efficient waste management systems is crucial for compliance and reducing environmental footprint.

- Operational Impact: Failure to meet these standards can lead to penalties, operational shutdowns, and damage to corporate reputation.

- Strategic Advantage: Proactive environmental management can provide a competitive edge by improving efficiency and appealing to ESG-focused stakeholders.

Biodiversity Protection and Marine Ecosystem Impact

Hengtong Optic-Electric's extensive submarine cable and marine engineering projects necessitate a keen focus on biodiversity protection and the potential impact on delicate marine ecosystems. For instance, the company's involvement in laying subsea fiber optic cables across vast ocean floors presents challenges in minimizing seabed disturbance and protecting sensitive marine habitats. Adherence to international environmental standards and rigorous environmental impact assessments are paramount to ensure these operations do not adversely affect marine life and their environments.

The company's commitment to sustainability in these areas is crucial. In 2023, Hengtong reported progress in implementing advanced environmental management systems for its marine projects, aiming to reduce its ecological footprint. This includes employing specialized installation techniques and conducting post-installation monitoring to assess and mitigate any residual impacts on marine biodiversity.

Key considerations for Hengtong include:

- Minimizing Seabed Disturbance: Employing trenching and burial techniques that limit the physical disruption of the seabed, protecting benthic communities.

- Protecting Marine Species: Implementing measures to avoid noise pollution and physical contact with marine mammals and other sensitive species during installation and maintenance.

- Compliance with Regulations: Strictly adhering to national and international maritime environmental regulations, such as those set by the International Maritime Organization (IMO) and regional environmental protection agencies.

- Sustainable Material Sourcing: Evaluating and selecting materials for submarine cables and associated infrastructure with a lower environmental impact.

Global shifts towards sustainability, including China's ambitious carbon neutrality goals, are fueling demand for Hengtong's fiber optic and submarine cables, essential for renewable energy infrastructure like offshore wind farms. The company's focus on marine energy positions it to benefit from the projected growth in the offshore wind market, which is expected to exceed 300 GW by 2030, requiring extensive subsea cable networks.

Hengtong must manage the environmental challenges associated with sourcing raw materials like copper and plastics, as rising global demand strains supply chains and increases costs. The company's commitment to green supply chains and recycled materials is vital for mitigating resource depletion risks and adhering to increasingly strict global environmental regulations.

Navigating stringent regulations on electronic waste, such as the EU's WEEE directive, is critical for Hengtong. Compliance requires proactive waste reduction and recycling initiatives to avoid financial penalties and reputational damage, especially as these regulations become more prevalent through 2024 and 2025.

Hengtong's operations face scrutiny regarding pollution control and emissions, necessitating investment in cleaner production technologies to meet tightening standards, particularly in China where environmental laws are becoming more robust by 2025. Proactive environmental management offers a strategic advantage, enhancing efficiency and appealing to ESG-conscious stakeholders.

| Environmental Factor | Impact on Hengtong Optic-Electric | Key Considerations | Data/Forecast (2024-2025+) |

|---|---|---|---|

| Climate Change & Renewables | Increased demand for fiber optic and submarine cables for green energy infrastructure. | Capitalize on offshore wind growth, requiring robust subsea cable solutions. | Global offshore wind capacity projected to exceed 300 GW by 2030. |

| Resource Scarcity & Sustainability | Pressure on supply chains for raw materials like copper and plastics. | Develop green supply chains and utilize recycled materials to mitigate risks. | Rising global demand for key manufacturing materials. |

| Waste Management & Circular Economy | Compliance with e-waste regulations (e.g., WEEE directive). | Implement proactive waste reduction and recycling programs. | Increasingly stringent regulations in major markets through 2024-2025. |

| Pollution Control & Emissions | Need for investment in cleaner production technologies to meet stricter standards. | Upgrade facilities to meet evolving air, water, and soil pollution regulations. | Tightening environmental protection laws in China, with full implementation of updated standards expected by 2025. |

| Biodiversity & Marine Ecosystems | Potential impact of submarine cable laying on marine life. | Minimize seabed disturbance and protect marine species through specialized techniques and compliance. | Adherence to international maritime environmental standards and rigorous environmental impact assessments. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hengtong Optic-Electric is built upon a robust foundation of data from official government publications, international economic organizations, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the optical-electric sector.