Hengtong Optic-Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengtong Optic-Electric Bundle

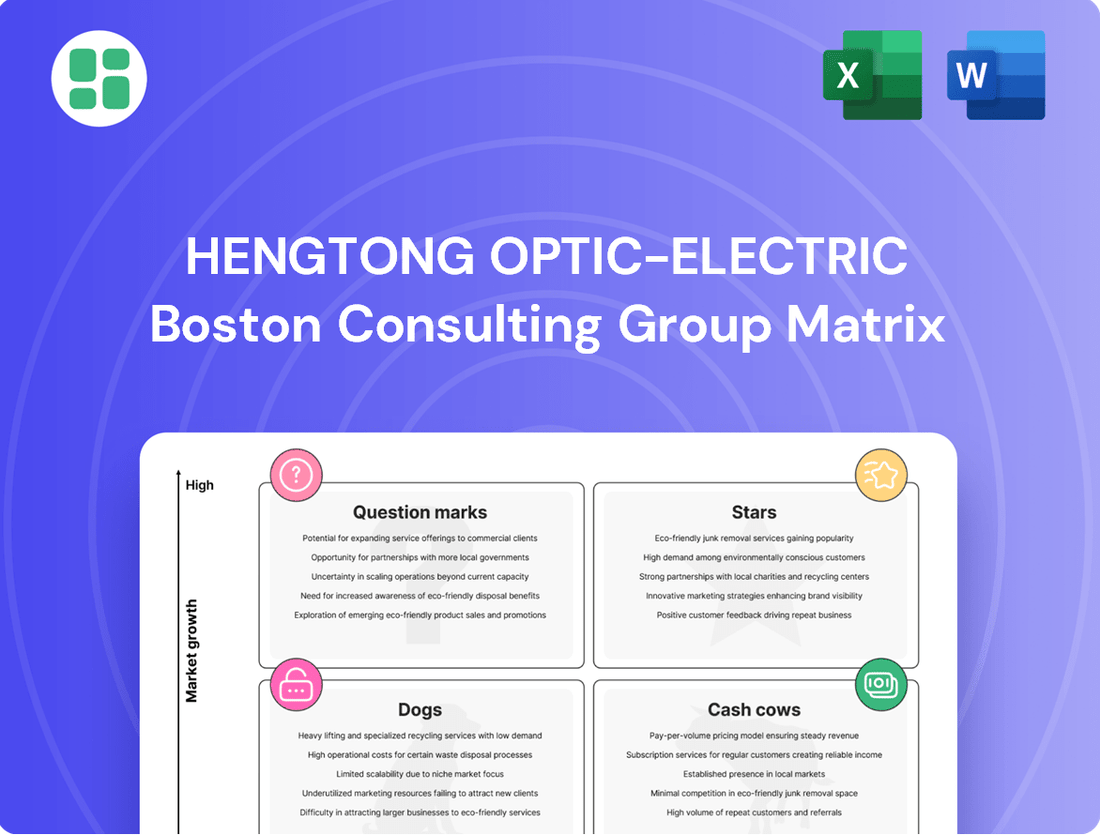

Curious about Hengtong Optic-Electric's market standing? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full strategic potential by purchasing the complete BCG Matrix, which provides a detailed breakdown of each quadrant, data-driven insights, and actionable recommendations to guide your investment decisions and optimize Hengtong's product strategy for maximum growth.

Stars

Hengtong Optic-Electric stands as a leading force in submarine communication cables, ranking among the top three global providers. Their expertise covers the entire lifecycle, from research and development to production and full system solutions for transoceanic networks.

This sector is experiencing significant expansion, fueled by the escalating need for high-capacity undersea communication and the exponential growth in global data traffic, which is further intensified by the demands of AI computing power. This trend positions submarine communication cables as a strong contender within the BCG matrix.

By the close of 2024, Hengtong had secured approximately RMB 5.5 billion in orders for its marine communication segment. This substantial order intake highlights the company's robust market presence and the stable, albeit challenging, competitive environment characterized by high barriers to entry.

The global push for renewable energy, with offshore wind leading the charge, creates a substantial growth avenue for Hengtong. The company is a key player, supplying submarine power cables and comprehensive solutions for offshore wind installations, a sector seeing robust investment and expansion, particularly in Europe and Asia-Pacific.

Hengtong's commitment to sustainability is evident through its subsidiary, Hengtong Submarine Power Cable Co., Ltd., which has earned Five-Star Certification for Carbon Peak and Carbon Neutrality Management. This recognition underscores their dedication to eco-friendly practices within this rapidly expanding market.

Hengtong Optic-Electric is actively building comprehensive clean energy hubs, encompassing wind, solar, energy storage, charging, and smart green hydrogen systems. This strategic focus positions them at the forefront of the global energy transition.

A prime example of their innovation is their involvement in China's largest integrated offshore photovoltaic project. This pioneering initiative seamlessly merges solar power generation with hydrogen production and energy storage, underscoring Hengtong's commitment to cutting-edge, high-growth clean energy infrastructure.

By offering integrated services for these complex clean energy projects, Hengtong is not only addressing the growing demand for sustainable energy solutions but also demonstrating its capacity to deliver end-to-end project execution. This approach aligns with the increasing global shift towards decarbonization and diversified energy portfolios.

800G and 400G Optical Transceivers

Hengtong Optic-Electric's 800G and 400G optical transceivers are key players in the Stars category of the BCG matrix. The company has successfully launched 800G QSFP-DD 2×FR4 optical transceivers and seen small-scale applications of its 400G products domestically and internationally. These high-speed solutions are vital for the expanding data center and telecommunication infrastructure, fueled by 5G, IoT, and cloud computing growth.

The market for high-speed optical transceivers is experiencing robust expansion. For instance, the global optical transceiver market was valued at approximately $12.5 billion in 2023 and is projected to reach over $25 billion by 2030, with a compound annual growth rate (CAGR) exceeding 10%. This growth is directly attributable to the increasing demand for faster data transmission speeds required by next-generation networks and data centers.

- Market Growth: The demand for 400G and 800G transceivers is driven by the need for higher bandwidth in data centers and telecom networks, with the overall optical transceiver market expected to double by 2030.

- Hengtong's Position: Hengtong's successful launch of 800G QSFP-DD 2×FR4 and application of 400G products places it in a strong position within this high-growth segment.

- Key Applications: These advanced transceivers are critical for supporting the infrastructure demands of 5G deployment, the Internet of Things (IoT), and the increasing reliance on cloud computing services.

- Innovation Driver: Continuous innovation in high-bandwidth optical technology is essential for companies like Hengtong to maintain leadership in this rapidly evolving and competitive market.

Global Information and Energy Network Service Provider

Hengtong Optic-Electric's Global Information and Energy Network Service Provider segment is a prime example of their strategic evolution into a comprehensive solutions provider. This division is actively capitalizing on the burgeoning demand for integrated services in telecommunications, power, and marine sectors worldwide.

The company's transformation is evident in its focus on advanced systematic integration and internet services, moving beyond traditional manufacturing. This strategic pivot targets high-growth markets where comprehensive engineering and service solutions are increasingly valued. For instance, in 2023, Hengtong reported significant growth in its international projects, demonstrating their expanding capabilities in these complex, high-value areas.

- Global Reach: Hengtong operates sales offices in over 40 countries and supplies products to more than 150 nations, showcasing a robust international presence.

- Market Focus: The service provider segment targets high-growth areas like telecommunication infrastructure, smart grid development, and offshore engineering.

- Strategic Shift: The company is transitioning from a component manufacturer to a full-service integrator, offering end-to-end solutions.

- Revenue Contribution: While specific segment revenue figures for 2024 are not yet fully disclosed, the overall international business of Hengtong Optic-Electric saw a notable uptick in project wins throughout 2023, indicating strong performance in these service-oriented areas.

Hengtong's 800G and 400G optical transceivers are firmly positioned in the Stars category due to their high growth and strong market position.

The company's successful development and deployment of these advanced products cater to the escalating bandwidth demands of data centers and telecommunications, driven by trends like 5G and AI.

With the global optical transceiver market projected for significant growth, Hengtong's investment in high-speed solutions like 800G QSFP-DD 2×FR4 positions them for continued success in this dynamic sector.

| Product Category | Hengtong's Position | Market Growth | Key Drivers |

| 800G/400G Optical Transceivers | Strong Market Share, Leading Innovator | High (Projected to double by 2030) | 5G, AI, Cloud Computing, IoT |

What is included in the product

Hengtong Optic-Electric's BCG Matrix offers a tailored analysis of its product portfolio, guiding strategic decisions for investment and divestment.

Eliminate data silos with a unified view, simplifying complex network analysis.

Cash Cows

Hengtong Optic-Electric's optical fiber and cable manufacturing segment is a classic Cash Cow. As the largest manufacturer in China and a top 10 global player, Hengtong commands a significant market presence, supplying around 25% of China's domestic volume and 15% of international volume. This strong market share, even in a mature industry, translates to reliable and substantial cash flow generation.

The mature nature of the optical fiber and cable market means growth opportunities are limited, but Hengtong's established leadership position allows them to generate consistent profits with minimal need for aggressive marketing or expansion investments. Their dominant market share ensures steady demand, solidifying this segment's role as a primary cash generator for the company.

Hengtong Optic-Electric's power cables for traditional grid infrastructure represent a significant cash cow. The company's expertise spans low, high, and extra-high voltage cables, up to 500kV, catering to established power transmission needs. This segment benefits from ongoing electrification and grid upgrades, ensuring consistent demand.

With a robust market share in this mature sector, Hengtong generates stable and predictable cash flows. Their long-standing industry presence and loyal customer relationships solidify this business unit's position as a reliable source of earnings, underpinning the company's financial strength.

Hengtong Optic-Electric's copper communication cables, though a mature market segment, continue to be a reliable source of revenue. Despite the rise of fiber optics, these cables serve essential legacy systems and niche applications, ensuring consistent demand. This segment acts as a cash cow, generating stable cash flow with minimal need for substantial new investment. In 2023, Hengtong's revenue from its copper cable business remained a significant contributor, though specific figures are often bundled with broader product categories.

EPC Turnkey Services for Established Projects

Hengtong Optic-Electric's EPC turnkey services for established telecommunication and power transmission projects function as a Cash Cow within its business portfolio. These services are particularly effective for traditional projects where the technology is well-understood and has a proven track record.

The company leverages its deep experience and consistent delivery capabilities in these mature markets to secure reliable cash flow. This efficiency translates into healthy profit margins, making these services a stable contributor to Hengtong's overall financial performance.

- Established Markets: Hengtong's EPC services are most profitable in mature telecommunication and power transmission sectors.

- Reliable Cash Flow: These projects, characterized by predictable execution and demand, generate consistent revenue.

- Profitability: High-profit margins are achieved through operational efficiency and extensive experience in traditional project delivery.

- 2024 Outlook: For 2024, Hengtong expects continued strong performance from its EPC segment, particularly in infrastructure upgrades and maintenance within its core markets, contributing significantly to its revenue streams.

Cable Accessories and Components

Cable accessories and components are a cornerstone of Hengtong Optic-Electric's business, acting as reliable cash cows. The persistent need for these items in sectors like telecommunications and energy ensures a consistent revenue flow. These are not just one-off sales; they are crucial for the upkeep and growth of existing networks, fostering repeat business.

Hengtong's broad range of offerings likely includes these fundamental products, which are vital for generating stable cash. For instance, in 2023, the global market for fiber optic cables and accessories was valued at approximately USD 15.5 billion, with steady growth projected. This indicates a robust and enduring demand for the very components Hengtong supplies.

- Steady Revenue: Continuous demand from telecommunications and power industries.

- Recurring Sales: Essential for infrastructure maintenance and expansion.

- Foundational Products: Hengtong's comprehensive portfolio supports stable cash generation.

- Market Size: The global fiber optic accessories market was around USD 15.5 billion in 2023.

Hengtong Optic-Electric's optical fiber and cable manufacturing segment stands as a prime example of a Cash Cow. Its position as China's largest and a top global optical fiber cable manufacturer, supplying approximately 25% of China's domestic volume and 15% of international volume, underscores its market dominance.

This segment operates within a mature market, which limits aggressive growth but allows for consistent profit generation with minimal investment. Hengtong's established leadership ensures steady demand, making it a significant cash generator for the company.

The company's power cables for traditional grid infrastructure, covering voltages up to 500kV, also function as a Cash Cow. This segment benefits from ongoing electrification and grid upgrades, ensuring a predictable demand and stable cash flow due to Hengtong's strong market share and long-standing industry presence.

Hengtong's EPC turnkey services for established telecommunication and power transmission projects are another key Cash Cow. These services are highly profitable in mature markets due to operational efficiency and deep experience, leading to healthy profit margins and stable cash flow. For 2024, continued strong performance in infrastructure upgrades is anticipated.

| Segment | BCG Classification | Key Characteristics | 2023/2024 Relevance |

| Optical Fiber & Cable Manufacturing | Cash Cow | Largest in China, top 10 globally, mature market, high market share. | Supplies ~25% China domestic, ~15% international volume. Generates reliable cash flow. |

| Power Cables (Traditional Grid) | Cash Cow | Expertise up to 500kV, mature sector, consistent demand from grid upgrades. | Stable cash generation due to strong market share and loyal customer base. |

| EPC Turnkey Services | Cash Cow | Profitable in mature telecom/power projects, high efficiency, stable cash flow. | Expected strong performance in 2024 from infrastructure upgrades and maintenance. |

Preview = Final Product

Hengtong Optic-Electric BCG Matrix

The Hengtong Optic-Electric BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present; you will get the complete, analysis-ready report for immediate strategic application. You can confidently use this preview to assess the quality and depth of the insights provided, knowing the final version will be exactly the same. This ensures a seamless transition from preview to practical use, allowing you to leverage Hengtong Optic-Electric's market analysis without delay.

Dogs

Legacy copper-based telecommunication solutions, while still part of Hengtong Optic-Electric's offerings, are firmly positioned as Dogs in the BCG Matrix. The global market for copper in telecommunications is experiencing a significant downturn, with a projected compound annual growth rate (CAGR) of -2.5% from 2023 to 2028, as reported by Mordor Intelligence. This decline is driven by the industry's decisive move towards fiber optics, which offer vastly superior bandwidth and speed capabilities essential for modern digital infrastructure.

Products within this category likely exhibit a low market share within Hengtong's portfolio and operate in a market characterized by minimal growth. Consequently, these copper solutions may represent cash traps, demanding ongoing investment for maintenance or legacy support without generating substantial returns, thereby hindering capital allocation towards more promising growth areas.

Standardized, low-margin cable products represent a segment where Hengtong Optic-Electric might find its offerings categorized as a 'Dog' in the BCG Matrix. These are often basic or commodity-type cables sold in markets that are not growing much and are very competitive. It's tough to make these products stand out from competitors, leading to slim profit margins and a constant need to compete on price.

In 2023, the global optical fiber cable market, while experiencing growth, also saw intense price competition, particularly for standardized products. Companies in this space often operate with gross margins in the low to mid-teens, making significant market share gains challenging without aggressive pricing strategies. This can lead to capital being tied up in inventory and production without generating substantial returns, a hallmark of 'Dog' category assets.

Hengtong Optic-Electric's outdated manufacturing lines or technologies represent potential dogs in its BCG matrix. These are facilities or processes not aligned with the company's push for intelligent manufacturing and advanced solutions. They likely produce low-demand or inefficient products, leading to a low market share in stagnant market segments. For instance, if older fiber optic cable production lines are significantly less efficient than newer, automated ones, they could fall into this category, potentially incurring high operational costs without generating commensurate revenue.

Underperforming Regional Subsidiaries or Ventures

Underperforming regional subsidiaries or ventures within Hengtong Optic-Electric, particularly those operating in low-growth markets with limited local market share, would be categorized as dogs in the BCG matrix. These units often require significant investment to maintain operations but yield minimal returns, acting as a drain on resources. For instance, if a subsidiary in a mature, slow-growing telecommunications market consistently fails to secure substantial contracts, it would fit this profile.

These entities represent a strategic challenge, consuming capital and management attention without contributing to Hengtong's overall growth or profitability. Their continued existence might be due to historical reasons or contractual obligations rather than current strategic value. Identifying and addressing these underperforming units is crucial for optimizing resource allocation.

- Low Market Share: Subsidiaries in regions like parts of Eastern Europe or certain developing African nations might exhibit low adoption rates for Hengtong's fiber optic products, failing to gain significant traction against established local players or alternative technologies.

- Low Market Growth: If Hengtong has ventures in mature markets where the demand for fiber optic infrastructure is saturated and growth has stagnated, these operations could become dogs if they cannot innovate or find new niches.

- Resource Drain: A specific example could be a joint venture in a region where regulatory hurdles or intense price competition have eroded profitability, leading to consistent net losses that require ongoing capital injections from the parent company.

Non-core, Divested or Stagnant Small Business Units

Hengtong Optic-Electric's diverse operations, encompassing areas like IoT, big data, e-commerce, and new materials, can house units that fall into the Dogs category. These are typically small business units or ventures that haven't achieved significant market traction or operate within highly competitive, slow-growing niche markets.

These "dog" units often represent a drain on resources, tying up capital with little prospect of substantial returns and holding a minimal market share. Their performance is characterized by low growth and low relative market share, making them candidates for divestiture or restructuring to free up capital for more promising ventures.

- Low Growth, Low Market Share: Units exhibiting stagnant sales and a negligible position within their respective markets.

- Divestiture Candidates: Businesses like the early 2024 sale of PT Voksel Electric Tbk shares exemplify the strategic decision to offload underperforming assets.

- Capital Drain: These segments often consume resources without generating commensurate profits or strategic advantages.

- Market Saturation: Operating in niche markets that are already crowded with established players and offer limited expansion opportunities.

Hengtong Optic-Electric's legacy copper-based telecommunication solutions are firmly positioned as Dogs in the BCG Matrix, facing a declining global market with a projected CAGR of -2.5% from 2023 to 2028. These offerings likely have a low market share and operate in a stagnant, competitive environment, potentially acting as cash traps that hinder investment in growth areas.

Standardized, low-margin cable products also fit the Dog category, characterized by intense price competition and slim profit margins, as evidenced by gross margins in the low to mid-teens for standardized optical fiber cables in 2023. Outdated manufacturing lines and underperforming regional subsidiaries in low-growth markets further exemplify these 'Dog' assets, consuming resources without significant returns.

In 2024, Hengtong's strategic divestiture of underperforming assets, such as the sale of PT Voksel Electric Tbk shares, highlights the approach to managing these low-growth, low-market-share units. These segments, often niche and saturated, represent a capital drain and are candidates for restructuring or divestiture to optimize resource allocation.

Question Marks

Hengtong Optic-Electric views Internet of Things (IoT) and Big Data as key growth areas, but their current market position in these rapidly expanding sectors is likely modest. Significant capital is needed for R&D and to build market presence against many rivals.

To avoid becoming a 'Dog' in the BCG matrix, Hengtong must rapidly increase customer adoption of its IoT and Big Data solutions. For instance, the global IoT market was projected to reach $1.1 trillion in 2024, highlighting the immense growth potential but also the intense competition.

Hengtong Optic-Electric's exploration into new materials signifies a strategic push into sectors with significant future promise, though these ventures are inherently capital-intensive and face the hurdle of unproven market demand and minimal current market penetration.

Investments in advanced material science, targeting future applications like aerospace composites or specialized conductive materials, demand considerable financial backing to transition from research and development to scalable commercialization.

For instance, the global advanced materials market, projected to reach over $400 billion by 2025, highlights the potential, but also the competitive landscape and R&D intensity that companies like Hengtong must navigate.

Hengtong is actively involved in hydrogen production and utilization projects, positioning itself within the clean energy sector. This emerging market, driven by global decarbonization trends, presents substantial growth potential, even if Hengtong's current market share is modest.

The intelligent green electricity-based hydrogen energy solutions represent a nascent but rapidly expanding market. While Hengtong's current market share may be low, the global push for decarbonization fuels enormous potential for this sector. For instance, the International Energy Agency reported in 2024 that global renewable energy capacity additions reached a record 510 gigawatts in 2023, highlighting the increasing demand for clean energy solutions like green hydrogen.

These initiatives are capital-intensive, necessitating significant investment to scale operations and secure a competitive position. Companies like Hengtong must allocate substantial resources to research, development, and infrastructure to tap into this high-growth, albeit competitive, emerging sector.

Next-Generation 5G and Beyond 5G Infrastructure Components

Hengtong Optic-Electric's potential in next-generation 5G and beyond 5G infrastructure components positions it as a contender for a Star in the BCG Matrix. These advanced segments, including components for millimeter-wave (mmWave) 5G deployment and early-stage research into 6G technologies, represent significant growth opportunities. For instance, the global 5G infrastructure market was valued at approximately $50 billion in 2023 and is projected to grow at a CAGR of over 30% through 2030, driven by increased data demand and new applications.

To solidify its Star status, Hengtong must demonstrate rapid innovation and market penetration in these cutting-edge areas. Success hinges on developing and commercializing specialized fiber optic cables optimized for higher frequencies, advanced antenna solutions, and critical components for network densification. Companies that can effectively address the evolving technical demands of 5G, such as lower latency and higher bandwidth, are poised for substantial market share gains.

- Market Growth: The global 5G infrastructure market is experiencing robust expansion, with projections indicating continued strong growth into the next decade.

- Technological Advancements: Key areas for Hengtong include developing solutions for mmWave frequencies and emerging 6G technologies, which require specialized components.

- Competitive Landscape: This sector is highly competitive, demanding continuous innovation and strategic investments to capture market share and establish leadership.

- Hengtong's Opportunity: By focusing on these high-growth, technology-intensive segments, Hengtong can transition its offerings into a Star, driving future revenue and profitability.

Smart City and Connected Infrastructure Solutions

Hengtong Optic-Electric's foray into 'intelligent communities' signals a strategic move into the burgeoning smart city market, a sector characterized by rapid expansion and intense competition. This positioning suggests the company is currently operating with a relatively low market share in this dynamic and fragmented landscape.

The smart city sector, projected to reach over $2.5 trillion globally by 2026, demands substantial investment in integrated solutions, strategic alliances, and demonstrable pilot projects to carve out a significant competitive niche. Hengtong's commitment to these areas will be crucial for its success.

- Market Entry: Hengtong's focus on 'intelligent communities' indicates an entry into the high-growth smart city market.

- Current Position: Given the sector's fragmentation, Hengtong likely holds a low current market share.

- Growth Strategy: Success requires significant investment in integrated solutions, partnerships, and pilot projects.

- Market Dynamics: The global smart city market is expanding rapidly, with significant opportunities and challenges for new entrants.

Hengtong Optic-Electric's ventures into IoT, Big Data, and new materials likely place them in the Question Mark category. These are high-growth areas, but the company's current market share is probably small, requiring significant investment to compete.

To move these segments out of Question Marks and towards Stars, Hengtong needs to accelerate customer adoption and technological leadership. The global IoT market's projected $1.1 trillion value in 2024 underscores the opportunity, but also the intense competition requiring strategic focus.

Similarly, their investments in advanced materials, while promising for markets potentially exceeding $400 billion by 2025, demand substantial R&D and commercialization efforts to gain traction against established players.

The company's engagement in hydrogen energy solutions also fits the Question Mark profile. While clean energy is a rapidly expanding sector, with renewable capacity additions hitting records in 2023 as reported by the IEA, Hengtong's current market share in this nascent field is likely minimal, necessitating considerable capital for scaling and market penetration.

BCG Matrix Data Sources

Our Hengtong Optic-Electric BCG Matrix leverages comprehensive data, including financial statements, market research reports, and industry growth forecasts, to accurately position each business unit.