Hengtong Optic-Electric Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengtong Optic-Electric Bundle

Hengtong Optic-Electric faces significant competitive pressure from rivals, while the threat of new entrants is moderate due to high capital requirements. Buyer power is substantial, particularly from large telecommunication operators, and the availability of substitute technologies presents a growing challenge. Supplier power, while present, is somewhat mitigated by Hengtong's scale.

Ready to move beyond the basics? Get a full strategic breakdown of Hengtong Optic-Electric’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Hengtong Optic-Electric's reliance on specialized raw materials like high-purity silica for optical fibers and metals such as copper and aluminum for cables significantly impacts its bargaining power with suppliers. The availability and cost of these critical inputs directly affect production expenses and the final product's quality. For instance, Corning Inc., a major global supplier of optical fiber components, also drives innovation, giving it considerable leverage.

The market for highly specialized components, especially those critical for advanced optical fibers, often features a limited number of dominant suppliers. This concentration can significantly bolster their bargaining power, giving them considerable leverage over Hengtong Optic-Electric. For instance, if Hengtong relies on a few suppliers for specific rare earth elements used in high-performance fiber production, those suppliers can dictate terms.

High switching costs further amplify this supplier leverage. If Hengtong has invested heavily in qualifying a particular supplier's proprietary materials or if the integration process for new materials is lengthy and complex, moving to an alternative supplier becomes a costly and time-consuming endeavor. This lock-in effect strengthens the position of existing suppliers, even if the broader market for less specialized components, like standard power cables, is more fragmented.

Hengtong Optic-Electric may face significant costs if it needs to switch suppliers for specialized optical fibers or advanced polymer coatings. These switching costs can include the expense of re-tooling production lines, the time and resources required for re-certifying products with new materials, and ensuring that performance standards are maintained, potentially impacting production schedules and product quality.

Importance of Input to Product Quality

The quality of Hengtong Optic-Electric's products, such as optical fiber and power cables, is fundamentally tied to the raw materials they source. High-grade inputs directly translate into superior product performance, offering benefits like reduced signal loss and increased resilience, which are non-negotiable for critical infrastructure.

This reliance on premium inputs significantly bolsters the bargaining power of suppliers who can consistently deliver these essential materials. For instance, suppliers of high-purity silica for optical fibers or specialized polymers for cable insulation hold considerable sway.

- Supplier Dependence: Hengtong's commitment to advanced telecommunications and energy transmission necessitates raw materials with very specific, high-performance characteristics.

- Quality Impact: The performance metrics of Hengtong's fiber optic cables, such as attenuation levels, are directly influenced by the purity and consistency of the silica and other chemicals used.

- Market Dynamics: Suppliers of these specialized, high-quality inputs often operate in niche markets, limiting the number of viable alternatives and thereby increasing their leverage.

- Cost Implications: In 2024, the global demand for advanced materials in the fiber optics sector remained robust, potentially leading to price pressures from key suppliers due to their critical role in product efficacy.

Supplier's Ability to Forward Integrate

Suppliers of highly specialized components or unique technologies could potentially forward integrate into niche cable manufacturing segments, though this is less common for raw material providers. The substantial capital investment and existing market dominance in global cable production present considerable barriers to entry. For instance, in 2024, the average cost to build a new fiber optic cable manufacturing facility can range from tens to hundreds of millions of dollars, depending on scale and automation. Hengtong Optic-Electric's own strategic vertical integration in certain production stages might also serve to reduce the overall threat from suppliers attempting to move up the value chain.

The bargaining power of suppliers is influenced by their ability to forward integrate, meaning they could potentially start manufacturing the final product themselves. While raw material suppliers typically lack the expertise and capital for complex cable production, those providing specialized components or proprietary technologies might consider entering specific market niches. However, the sheer scale and technological sophistication required for global fiber optic cable manufacturing, a sector where Hengtong Optic-Electric is a major player, make such integration challenging. Hengtong's existing vertical integration, which includes raw material sourcing and advanced manufacturing processes, further solidifies its position and mitigates this supplier threat.

- Supplier Forward Integration: While rare for basic raw material suppliers, those with unique technologies could target niche cable segments.

- Capital Intensity Barrier: Establishing global cable manufacturing operations requires significant capital, deterring most suppliers.

- Hengtong's Mitigation: Hengtong's own vertical integration can reduce the impact of supplier attempts to move into their market.

The bargaining power of suppliers for Hengtong Optic-Electric is notably high due to the specialized nature of essential raw materials like high-purity silica and advanced polymers. Limited suppliers for these critical inputs, coupled with Hengtong's significant switching costs for re-tooling and product re-certification, further strengthen supplier leverage. In 2024, the robust global demand for advanced materials in the fiber optics sector meant suppliers could exert price pressures, directly impacting Hengtong's production expenses and product quality.

| Factor | Impact on Hengtong | 2024 Context |

|---|---|---|

| Specialized Raw Materials | High reliance on few suppliers | Limited availability of high-purity silica |

| Switching Costs | Expensive and time-consuming to change suppliers | Re-tooling and re-certification costs are substantial |

| Supplier Concentration | Niche markets with dominant players | Key component suppliers hold significant leverage |

| Quality Dependence | Product performance directly tied to input quality | Premium materials command higher prices |

What is included in the product

This analysis dissects the competitive forces impacting Hengtong Optic-Electric, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within the optical fiber and cable industry.

Instantly identify and address competitive threats by visualizing Hengtong Optic-Electric's Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Hengtong Optic-Electric's customer base is concentrated within major industries like telecommunications, power, and oil & gas. These sectors frequently involve national operators and large utility firms, who are significant purchasers of optical fiber and cable products.

These large-scale customers typically engage in substantial volume purchases for critical infrastructure projects. For instance, in 2023, global telecom infrastructure spending was projected to reach hundreds of billions of dollars, with major operators driving a significant portion of this investment, granting them considerable leverage in negotiations.

Furthermore, these buyers are often highly sophisticated, possessing in-depth technical knowledge and rigorous procurement processes. Their ability to negotiate favorable terms is amplified by their consistent demand and the potential to switch suppliers if pricing or terms are not met, directly impacting Hengtong's pricing power.

Customers in the telecommunications and power industries frequently purchase cables and integrated solutions in massive quantities. This is driven by the need for extensive network expansions and modernizations. For instance, in 2023, global telecommunications infrastructure spending was projected to reach hundreds of billions of dollars, with a significant portion allocated to fiber optic cable deployment.

These substantial order volumes grant customers considerable bargaining power. They can leverage their purchasing might to negotiate better prices, more favorable payment terms, and even demand customized product specifications from suppliers like Hengtong Optic-Electric. This can directly impact a supplier's profit margins.

While Hengtong Optic-Electric provides advanced, integrated solutions, certain cable segments face commoditization, increasing customer price sensitivity. This means that in some areas, buyers can exert more pressure on pricing due to readily available alternatives.

However, Hengtong's strong differentiation in specialized areas like submarine cables and ultra-low loss optical fibers significantly limits customer bargaining power. These high-tech products offer unique performance benefits that make direct price comparisons difficult.

Switching costs for customers are substantial, particularly for critical infrastructure projects. The need for re-certification and the potential for significant operational disruptions if a new supplier is introduced create a strong incentive for customers to remain with Hengtong.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Hengtong Optic-Electric, particularly in markets where fiber optic cables are viewed as a commodity. In highly competitive environments, buyers actively shop around for the best prices, which can put considerable pressure on Hengtong's profit margins. For instance, during periods of high supply or intense competition among manufacturers, customers might negotiate harder on price, potentially leading to lower sales revenue per unit.

However, this sensitivity isn't uniform across all product applications. For mission-critical infrastructure projects, such as those in telecommunications or national defense, where network uptime and data integrity are crucial, customers may prioritize performance and reliability over minor price differences. This allows Hengtong to command a premium for its advanced, high-quality products in these segments. In 2023, the global fiber optic cable market experienced growth, but pricing remained a key consideration for many purchasers.

- Price Sensitivity Impact: Intense competition can drive down prices for standard fiber optic cables, affecting Hengtong's revenue.

- Application Differentiation: Mission-critical applications allow for higher pricing due to a focus on reliability and performance.

- Market Dynamics: In 2023, the fiber optic cable market saw continued price competition, especially for less specialized products.

Customer Threat of Backward Integration

Large customers, such as major telecommunication companies and national power grid operators, often have substantial financial resources and the technical know-how to consider backward integration. This means they could potentially start manufacturing some of their own fiber optic cable requirements.

While the high capital investment and intricate manufacturing processes involved make this a rare occurrence, the mere possibility of customers producing their own cables exerts pressure on suppliers like Hengtong Optic-Electric. This latent threat enhances the bargaining power of these significant buyers.

For instance, in 2024, major telecom infrastructure projects often involve billions of dollars in investment, giving these large entities the financial wherewithal to explore such vertical integration strategies if supplier pricing or terms become unfavorable. The complexity of optical fiber production, however, typically necessitates specialized knowledge and extensive R&D, acting as a barrier for most potential integrators.

- Customer Backward Integration Threat: Major telecom and power companies possess the financial capacity for vertical integration.

- Technical Feasibility: While technically possible, the complexity and capital intensity of cable manufacturing limit this threat.

- Market Dynamics: The potential for backward integration by large clients influences supplier pricing and negotiation leverage.

- Industry Barriers: High R&D and manufacturing expertise required for fiber optic cables act as a deterrent to customer integration.

Hengtong Optic-Electric's bargaining power with customers is influenced by buyer concentration and purchase volume. Large telecom operators and utility firms, key clients, often buy in bulk for major infrastructure projects, granting them negotiation leverage. For example, in 2023, global telecom infrastructure spending was projected to be in the hundreds of billions, with these large entities driving a significant portion of this demand.

These sophisticated buyers, with their technical expertise and rigorous procurement, can negotiate favorable terms. While Hengtong's specialized products like submarine cables limit customer price sensitivity, more commoditized cable segments face intense price competition. In 2023, the fiber optic cable market saw ongoing price pressures, particularly for standard products.

The potential for customers to backward integrate, though limited by high capital and technical barriers, also exerts pressure. Major telecom firms in 2024, undertaking multi-billion dollar projects, possess the financial capacity to explore this, influencing supplier negotiations.

| Factor | Impact on Hengtong | Supporting Data/Example |

| Customer Concentration | High (Major Telecoms, Utilities) | Key buyers account for substantial order volumes. |

| Purchase Volume | High | Drives significant negotiation power for bulk orders. |

| Customer Sophistication | High | Technical knowledge enhances negotiation leverage. |

| Price Sensitivity | Varies (High for commoditized, Low for specialized) | 2023 market saw price competition for standard cables. |

| Switching Costs | High | Operational disruptions deter frequent supplier changes. |

| Backward Integration Threat | Low but present | Major clients have financial capacity, but technical barriers exist. |

Preview Before You Purchase

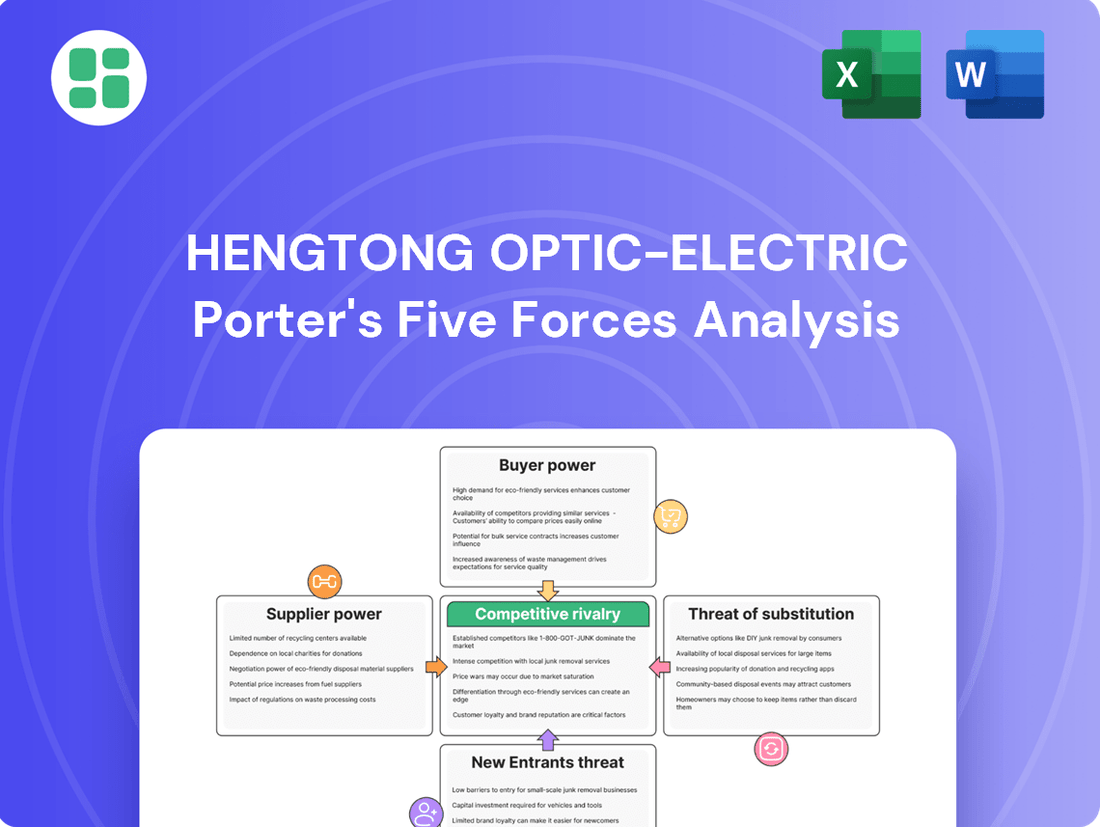

Hengtong Optic-Electric Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Hengtong Optic-Electric's Porter's Five Forces Analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within the optical fiber and cable industry.

Rivalry Among Competitors

The optical fiber, power cable, and submarine cable sectors are highly competitive, featuring numerous global and regional players. Hengtong Optic-Electric faces significant rivalry from established giants like Prysmian Group, Corning Inc., and Sumitomo Electric, alongside strong Asian competitors such as YOFC and ZTT Group. This crowded market, including players like NEC Corporation, means intense competition across all product segments.

The optical fiber and wire and cable markets are seeing robust growth, fueled by global demand for 5G infrastructure, cloud data centers, and offshore wind farms. For instance, the global submarine cable market alone was valued at approximately $20 billion in 2023 and is expected to grow substantially. This expansion, however, can sometimes outpace demand in specific product categories, creating periods of overcapacity.

This oversupply can intensify competition among major players like Hengtong Optic-Electric, leading to price wars, particularly in segments like standard optical fiber preforms. While the overall wire and cable market is projected for expansion, with some estimates suggesting a compound annual growth rate of around 4-5% through 2028 for certain segments, regional variations and specific product demands mean that not all areas experience uniform growth. This unevenness contributes to the competitive pressure.

The optical fiber cable industry, where Hengtong Optic-Electric operates, is characterized by significant fixed costs. These include substantial investments in research and development for next-generation fiber technologies, the acquisition and maintenance of highly specialized, automated manufacturing equipment, and the upkeep of large-scale production facilities. For instance, setting up a state-of-the-art optical fiber preform manufacturing line can easily run into tens or even hundreds of millions of dollars.

These high upfront investments, coupled with the specialized nature of the assets which have limited alternative uses, create formidable exit barriers. Companies that have invested heavily in these areas are strongly motivated to continue operating and competing, even in less favorable market conditions, to spread their fixed costs over a larger production volume and avoid realizing substantial losses on their specialized assets. This often leads to intensified competition as players strive to maintain market share and operational efficiency.

In 2023, the global optical fiber cable market was valued at approximately USD 25 billion, with major players like Hengtong Optic-Electric, Corning, and Prysmian heavily invested in advanced manufacturing. The ongoing demand for 5G infrastructure, data centers, and broadband expansion necessitates continuous capacity upgrades and technological innovation, further entrenching the high fixed cost structure and reinforcing the competitive intensity within the industry.

Product Differentiation and Innovation

Competitive rivalry in the fiber optic industry, including for companies like Hengtong Optic-Electric, is significantly fueled by product differentiation driven by relentless technological innovation. This isn't just about offering lower prices; it's about creating superior products that meet evolving market demands.

Hengtong Optic-Electric, for instance, demonstrates this commitment through substantial investments in research and development. These investments are aimed at pioneering advanced fiber optic technologies. Examples include the development of ultra-low loss fiber, which enhances signal transmission efficiency, and bend-insensitive fiber, crucial for complex network installations. Furthermore, their work on high-voltage direct current (HVDC) power cables showcases diversification into related, high-technology infrastructure solutions. This continuous innovation race is a defining characteristic of the competitive landscape, allowing companies to carve out market share and command premium pricing.

- R&D Investment: Hengtong Optic-Electric's commitment to innovation is reflected in its significant R&D expenditures, a key driver of competitive advantage.

- Product Advancement: The company actively develops cutting-edge products like ultra-low loss fiber and bend-insensitive fiber to meet stringent network performance requirements.

- Market Differentiation: Technological advancements in areas such as HVDC power cables allow Hengtong to differentiate its offerings beyond mere price competition.

- Innovation as a Strategy: The ongoing pursuit of technological breakthroughs is central to Hengtong's strategy for gaining and maintaining a competitive edge in the global market.

Geopolitical Influences and Trade Barriers

Geopolitical tensions significantly impact the competitive rivalry for companies like Hengtong Optic-Electric. For instance, the U.S. Federal Communications Commission (FCC) ban on Chinese technology in undersea cables, enacted in 2020 and continuing to influence market access, directly alters the competitive landscape. This ban favors regional suppliers and complicates global supply chains, intensifying competition among those who can still operate freely in certain markets.

Trade barriers and tariffs further exacerbate this rivalry. In 2024, ongoing trade disputes between major economic blocs continue to affect the cost of importing components and finished goods. This encourages localized manufacturing and can lead to price wars as companies try to absorb or pass on these increased costs, thereby heightening competition among international players vying for market share.

- U.S. FCC Ban: The FCC's ongoing restrictions on certain Chinese telecommunications equipment, including in undersea cable projects, directly limit market access for companies like Hengtong Optic-Electric in specific regions.

- Tariff Impacts (2024): Global trade policies and tariffs continue to influence the cost of raw materials and finished optical fiber products, impacting pricing strategies and competitive positioning.

- Regionalization of Supply Chains: Geopolitical factors are driving a trend towards more localized manufacturing and supply chains, creating new competitive dynamics and potentially increasing rivalry within specific geographic markets.

Competitive rivalry within the optical fiber and cable industry remains intense, driven by a large number of global and regional players. Hengtong Optic-Electric faces strong competition from established companies like Prysmian Group and Corning Inc., as well as significant Asian competitors such as YOFC and ZTT Group. This crowded market, with numerous participants, ensures fierce competition across all product segments.

The industry experiences periods of overcapacity, particularly in standard optical fiber preforms, which can trigger price wars. While the overall market shows robust growth, fueled by 5G, data centers, and offshore wind, uneven regional growth and specific product demand fluctuations intensify competitive pressures. For instance, the global submarine cable market reached approximately $20 billion in 2023, indicating substantial investment and thus, competition.

High fixed costs associated with R&D, specialized manufacturing equipment, and large-scale facilities create significant exit barriers, compelling companies to compete aggressively to spread costs. Hengtong's substantial R&D investments in advanced technologies like ultra-low loss fiber and bend-insensitive fiber are crucial for differentiation. Geopolitical factors, including the U.S. FCC ban on certain Chinese technology in undersea cables and ongoing trade tariffs in 2024, further complicate market access and intensify regional competition.

SSubstitutes Threaten

Wireless technologies like 5G and satellite internet are emerging as significant substitutes for traditional fiber optic networks. These wireless solutions can provide robust connectivity, especially in areas where laying fiber is cost-prohibitive or logistically challenging. For instance, Starlink, SpaceX's satellite internet service, aims to offer high-speed broadband globally, directly competing with fixed-line providers in underserved regions.

While fiber optic cables still hold an advantage in terms of raw bandwidth and latency for fixed applications, the increasing capabilities of 5G networks and the expanding reach of satellite internet present a tangible threat. The convenience and rapid deployment of wireless solutions can appeal to a broad customer base, potentially diverting demand away from fiber, particularly for mobile and less data-intensive fixed connections.

The increasing adoption of distributed energy resources (DERs) like rooftop solar and battery storage presents a significant threat of substitution for traditional power transmission infrastructure. These localized solutions reduce the demand for extensive new long-distance power cables, as seen in the growing residential solar market. By 2024, the global distributed generation market is projected to reach hundreds of billions of dollars, indicating a substantial shift away from centralized power generation and its associated transmission needs.

The rise of advanced grid-enhancing technologies (GETs) presents a significant threat of substitutes for traditional power transmission infrastructure, impacting demand for products like power cables. GETs, such as dynamic line ratings and smart grid deployments, allow for more efficient use of existing transmission lines. For instance, dynamic line ratings can increase the capacity of existing lines by up to 30% by accounting for real-time environmental conditions, thereby reducing the immediate need for new line construction.

Alternative Cable Materials and Designs

Innovations in cable materials and designs present a significant threat of substitution for traditional fiber optic cables. For instance, advancements like Belden's OptiTuff Mini Fiber Cable offer alternatives that provide comparable performance to metal-armored or non-armored fiber products.

These newer designs often boast advantages such as lighter weight, smaller diameters, and potential cost savings, making them attractive substitutes. This directly impacts Hengtong Optic-Electric's product development strategies and market share as customers consider these alternative solutions.

- Lighter Weight: Reduces installation complexity and shipping costs.

- Smaller Diameter: Allows for higher fiber density in conduits.

- Cost Savings: Potential for lower material and installation expenses.

- Performance Parity: Offers comparable data transmission capabilities to existing options.

Hybrid Connectivity Solutions

The rise of hybrid connectivity solutions presents a significant threat of substitutes for traditional fiber optic offerings. These integrated systems, often combining fiber with wireless or satellite technologies, provide adaptable and scalable network infrastructures.

While not always a direct replacement for the core fiber optic cable itself, these hybrid models can influence demand for specific cable types. For instance, a network might opt for a less robust fiber backbone if it's supplemented by high-speed wireless for last-mile delivery, thereby altering the purchasing calculus for raw fiber.

The market is actively moving towards these blended approaches. By 2024, the global market for hybrid cloud services, which often necessitates hybrid connectivity, was projected to reach hundreds of billions of dollars, indicating a strong trend towards integrated solutions across various technology sectors.

- Hybrid solutions integrate fiber with technologies like 5G and satellite.

- This integration can reduce demand for certain types of fiber optic cables.

- The growing adoption of hybrid cloud services underscores this trend.

The threat of substitutes for Hengtong Optic-Electric primarily stems from the growing capabilities of wireless technologies and alternative infrastructure solutions. While fiber optics offer superior bandwidth and latency for many applications, advancements in 5G, satellite internet, and grid-enhancing technologies can fulfill similar connectivity needs, especially in specific use cases or regions.

For instance, the global market for fixed wireless access (FWA), a direct competitor to fixed-line broadband, was projected to exceed $70 billion by 2024, highlighting a significant shift in consumer and business preferences towards wireless alternatives. Similarly, the increasing deployment of grid-enhancing technologies (GETs) allows for more efficient use of existing power transmission infrastructure, potentially reducing the demand for new fiber optic cables in the energy sector.

| Substitute Technology | Key Benefits | Impact on Fiber Demand |

|---|---|---|

| 5G & Satellite Internet | Ubiquitous coverage, rapid deployment, mobility | Reduces demand for fiber in certain last-mile and mobile applications |

| Grid-Enhancing Technologies (GETs) | Increased capacity of existing lines, reduced need for new infrastructure | Decreases demand for new power transmission cables |

| Advanced Cable Materials | Lighter weight, smaller diameter, cost savings | Offers alternative solutions with comparable performance |

Entrants Threaten

The optical fiber, power cable, and submarine cable manufacturing sectors require substantial upfront capital. This includes significant investment in research and development, specialized production facilities, and state-of-the-art machinery. For example, establishing a submarine cable manufacturing plant alone can necessitate hundreds of millions of dollars, presenting a substantial hurdle for any newcomers.

Established players like Hengtong Optic-Electric leverage significant economies of scale in production and global distribution. For instance, in 2023, Hengtong's revenue reached RMB 50.6 billion, indicative of its vast operational capacity. New entrants would find it challenging to replicate these cost efficiencies, making it difficult to compete on price from the outset.

The experience curve in manufacturing advanced optical cables also acts as a barrier. Hengtong's years of operational expertise translate into optimized processes and lower per-unit costs. A new competitor would require substantial investment and time to achieve comparable manufacturing proficiency, further deterring entry.

The optical fiber and high-voltage cable industry is built on intricate, proprietary technologies and a vast amount of intellectual property. Companies like Hengtong Optic-Electric invest heavily in research and development to create advanced designs, making it tough for newcomers to compete without substantial resources and specialized knowledge. For instance, the ongoing development in 5G infrastructure and renewable energy transmission demands continuous innovation in fiber optic and cable technology, areas where established players hold significant patent protection.

Strong Brand Loyalty and Established Relationships

Hengtong Optic-Electric, along with other established players in the fiber optic cable and telecommunications equipment industry, has successfully fostered deep-seated relationships and trust with key clients. These clients frequently include major telecommunication operators, national power grid companies, and various government agencies responsible for critical infrastructure development.

For any new company attempting to enter this market, overcoming the entrenched loyalty and established trust that incumbents like Hengtong enjoy presents a formidable barrier. Building comparable brand recognition and a solid reputation, especially when vying for large-scale, vital projects, requires substantial time, investment, and a proven track record.

- Established Customer Base: Hengtong's existing contracts and long-term partnerships with major telecom and utility providers create a significant hurdle for new entrants.

- Brand Reputation: Decades of reliable service and product delivery have cemented Hengtong's brand as a trusted supplier in critical infrastructure sectors.

- Project Scale: Newcomers would struggle to match the capacity and experience needed to secure and execute the massive, complex projects typically awarded to incumbents.

- Switching Costs: For large organizations, the cost and risk associated with switching from a proven supplier to an unproven one are substantial deterrents.

Rigorous Regulatory Hurdles and Certifications

The production and deployment of optical fiber, power, and submarine cables face significant barriers due to rigorous industry standards and lengthy certification processes. These requirements are particularly stringent for critical infrastructure projects, making it difficult for new players to enter the market. For instance, in 2024, obtaining necessary approvals for large-scale telecommunications or energy grid upgrades can take over a year, demanding substantial investment in compliance and testing.

Navigating these complex regulatory landscapes and securing the required certifications represents a high barrier to entry for potential new competitors in the cable manufacturing and deployment sector.

- Stringent Industry Standards: Compliance with international and national standards (e.g., IEC, ITU-T) is mandatory.

- Lengthy Certification Processes: Obtaining product and project-specific certifications can take months to years.

- Critical Infrastructure Focus: Projects involving national telecommunications or power grids require extensive vetting and approvals.

- High Compliance Costs: New entrants must invest heavily in meeting these regulatory and certification demands.

The threat of new entrants for Hengtong Optic-Electric is generally low due to high capital requirements, established economies of scale, and technological complexities. For example, the significant investment needed for submarine cable manufacturing, often in the hundreds of millions of dollars, deters many potential competitors. Furthermore, Hengtong's 2023 revenue of RMB 50.6 billion illustrates its vast operational capacity, making it difficult for newcomers to match its cost efficiencies.

Proprietary technology and extensive intellectual property also serve as substantial barriers. Hengtong's continuous investment in R&D for advancements in 5G and renewable energy transmission ensures it maintains a technological edge, protected by patents. New entrants would need considerable resources and specialized knowledge to overcome this innovation gap.

Entrenched customer relationships and brand loyalty further solidify Hengtong's market position. Securing large-scale projects with major telecommunication operators and power grid companies requires a proven track record and established trust, which new companies lack. The switching costs for these critical infrastructure clients are also high, adding another layer of deterrence.

Finally, stringent industry standards and lengthy certification processes create significant hurdles. In 2024, obtaining necessary approvals for critical infrastructure projects can take over a year, demanding substantial investment in compliance and testing, which new entrants may struggle to afford or navigate efficiently.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

| Capital Requirements | High upfront investment in R&D, facilities, and machinery. | Significant deterrent due to the sheer financial outlay. | Submarine cable plant costs can exceed hundreds of millions of dollars. |

| Economies of Scale | Established players benefit from lower per-unit costs due to high production volumes. | New entrants struggle to compete on price initially. | Hengtong's 2023 revenue of RMB 50.6 billion indicates large-scale operations. |

| Technology & IP | Proprietary designs and patents create a competitive advantage. | New entrants need substantial R&D investment and expertise to catch up. | Continuous innovation in 5G and renewable energy demands advanced, protected technologies. |

| Customer Relationships & Brand Loyalty | Long-standing trust and contracts with key clients. | Difficult for new players to gain access to major projects and secure initial business. | Key clients include major telecom operators and national power grid companies. |

| Regulatory & Certification Hurdles | Rigorous industry standards and lengthy approval processes. | Adds significant time, cost, and complexity for market entry. | 2024 certifications for critical infrastructure can take over a year. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hengtong Optic-Electric draws from a comprehensive set of data sources including the company's annual reports, industry-specific market research from firms like Omdia and IHS Markit, and global economic indicators from sources like the World Bank.