Huaneng Power International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huaneng Power International Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Huaneng Power International's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate this complex landscape. Gain a competitive edge by understanding these external forces. Download the full report now to unlock strategic insights.

Political factors

China's government is a major driver in the energy landscape, actively shaping development through ambitious renewable energy goals and carbon reduction targets. The nation's 2024-2025 Action Plan, for instance, targets non-fossil fuel power generation to constitute around 39% of the total by the end of 2025, directly impacting Huaneng's strategic investment and operational decisions.

Further policy evolution includes a move towards market-based pricing for new energy sources. This shift is expected to create new revenue stream dynamics for companies like Huaneng, as the energy market becomes more responsive to supply and demand principles.

Huaneng Power International, as a significant player in China's energy sector, is navigating a landscape shaped by ongoing State-Owned Enterprise (SOE) reforms. These reforms are designed to modernize governance structures, boost operational efficiency, and influence strategic investment choices, particularly in the crucial clean energy transition. For instance, the company's strategic adjustments, evidenced by recent board and leadership shifts, signal a clear commitment to clean energy, aligning with national directives and potentially unlocking new avenues for growth and investment.

China's unwavering commitment to energy security, underscored by the new Energy Law taking effect in January 2025, significantly shapes Huaneng Power International's strategic direction. This legislation champions a dual approach, prioritizing the rapid expansion of renewable energy capacity while concurrently reinforcing coal's role as a foundational energy pillar. This focus directly influences Huaneng's investment decisions, encouraging diversification into domestic, secure energy sources.

Global geopolitical shifts present a complex landscape for Huaneng. Heightened tensions can disrupt crucial fuel supply chains, potentially increasing operational costs for imported resources. Furthermore, these geopolitical dynamics can restrict access to advanced energy technologies, impacting the company's ability to innovate and maintain strategic international partnerships, which are vital for its long-term growth and operational efficiency.

Electricity Pricing Mechanisms

China's electricity pricing is undergoing a significant shift, moving away from fixed rates to market-based mechanisms for new energy sources starting June 2025. This reform is designed to boost market efficiency and could lead to more variable revenues for renewable energy projects. Existing projects, however, will continue to operate under their current compensation agreements.

Huaneng Power International needs to be agile, adjusting its sales and revenue management strategies to effectively navigate these evolving pricing structures. This transition is a key political factor influencing the company's operational and financial planning.

- Market-Based Pricing: Transition from fixed to market-based electricity pricing for new energy from June 2025.

- Revenue Impact: Potential for revenue fluctuations for renewable projects under new mechanisms.

- Existing Contracts: Current compensation rules remain in effect for existing projects.

- Strategic Adaptation: Huaneng must adapt sales strategies to changing pricing environments.

Subsidies and Incentives for Renewables

Government incentives and subsidies play a vital role in bolstering Huaneng's clean energy initiatives. Despite a move towards market-driven pricing, China's commitment to renewable energy is evident through continued support mechanisms like green electricity certificates. These policies are instrumental in shaping the financial feasibility and overall appeal of Huaneng's investments in wind and solar power generation.

For instance, China's national renewable energy targets for 2024-2025 are ambitious, aiming to further integrate renewables into the grid. The government has also been refining its subsidy structures, with a focus on reducing direct feed-in tariffs and promoting market mechanisms. This strategic shift, while presenting new challenges, also opens avenues for more sustainable and competitive renewable energy development.

- Green Electricity Certificates: These certificates provide a market-based incentive for renewable energy generation, allowing Huaneng to monetize the environmental attributes of its clean power output.

- National Targets: China's ongoing commitment to increasing the share of non-fossil fuels in its primary energy consumption, targeting a significant increase by 2025, directly benefits companies like Huaneng investing in renewables.

- Policy Evolution: The government's gradual phasing out of direct subsidies for new onshore wind and solar projects, while continuing support for offshore wind and distributed solar, influences Huaneng's strategic investment allocation.

China's energy policy is a significant political determinant for Huaneng Power International, with the government actively steering the sector towards decarbonization and energy security. The nation's commitment to increasing non-fossil fuel power generation to approximately 39% by the end of 2025, as outlined in its 2024-2025 Action Plan, directly influences Huaneng's investment priorities and operational strategies.

The ongoing reform of State-Owned Enterprises (SOEs) is also a key political factor, aimed at enhancing efficiency and governance, which is evident in Huaneng's leadership adjustments and strategic focus on clean energy development, aligning with national directives.

Furthermore, the Energy Law, effective January 2025, champions both renewable energy expansion and the continued role of coal, guiding Huaneng's diversified investment in secure domestic energy sources.

The shift towards market-based electricity pricing for new energy sources from June 2025 will necessitate strategic adaptation in revenue management for Huaneng, while existing contracts remain under current terms.

What is included in the product

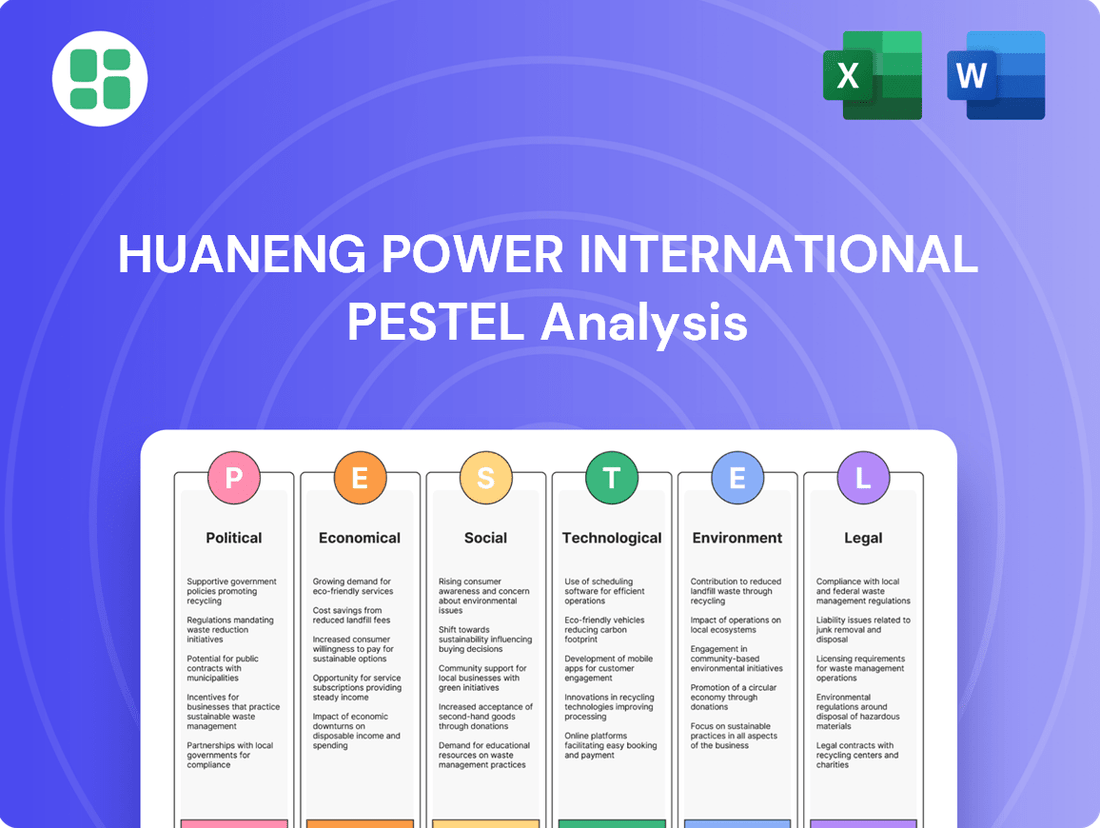

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces influencing Huaneng Power International, providing a comprehensive overview of its operating landscape.

It offers strategic insights for stakeholders by identifying key external drivers and their implications for Huaneng Power International's future growth and risk management.

A PESTLE analysis for Huaneng Power International provides a clear roadmap for navigating complex external factors, acting as a pain point reliever by offering strategic foresight and mitigating potential risks in policy, economic shifts, and technological advancements.

Economic factors

China's economy is expanding, and more people are moving to cities, which means more electricity is needed. This surge is fueled by technology, homes, and sophisticated factories. S&P Global Commodity Insights anticipates power demand will exceed 13,000 TWh by 2030, with a 6.3% annual growth rate expected through 2025.

Fluctuations in global commodity prices, particularly for coal, directly affect Huaneng Power International's operating expenses given its large fleet of coal-fired power plants. For instance, in early 2024, coal prices saw a notable decline, contributing to Huaneng's improved profitability, with the company reporting a significant increase in net profit for the first quarter of 2024 compared to the previous year. This highlights the sensitivity of their cost structure to fuel procurement strategies.

While easing coal prices were beneficial in 2024, maintaining effective cost controls for fuel procurement remains a crucial ongoing challenge for Huaneng. The company’s ability to navigate these price volatilities is key to sustained financial performance. Furthermore, broader inflationary pressures can impact other operational costs, such as maintenance and labor, as well as the capital expenditure required for developing new power generation projects, potentially increasing project financing costs.

Huaneng Power International is planning substantial investments, earmarking over 50 billion yuan for new energy projects through 2025. Securing affordable financing, including potential capital injections from state-backed entities, is vital to support these ambitious clean energy initiatives.

The prevailing interest rate environment directly impacts Huaneng's borrowing costs. For instance, a 1% increase in interest rates on a 10 billion yuan debt could add 100 million yuan annually to interest expenses, affecting profitability and the viability of capital-intensive projects.

Electricity Tariffs and Revenue Stability

The shift towards market-based electricity pricing for new energy projects, including renewables, presents a significant challenge to revenue predictability for companies like Huaneng. While this reform aims to enhance market efficiency, it exposes new renewable assets to the volatility of market price fluctuations, potentially impacting revenue stability.

Huaneng's strategic management of its diverse energy portfolio, balancing traditional and renewable sources, will be crucial in navigating these evolving pricing mechanisms. Adapting to these reforms by optimizing asset deployment and exploring hedging strategies will be key to ensuring consistent and robust revenue streams in the coming years.

- Market-Based Pricing Impact: New renewable energy projects will see revenue tied more closely to market supply and demand, increasing exposure to price volatility.

- Revenue Stability Challenges: This transition necessitates proactive strategies to mitigate the impact of fluctuating market prices on earnings.

- Portfolio Optimization: Huaneng's success hinges on its ability to strategically manage its generation mix and adapt to pricing reforms.

- 2024/2025 Outlook: Continued regulatory evolution in electricity markets will shape the revenue landscape for Huaneng's new energy investments.

Impact of Energy Market Reforms

China's ongoing power market reforms are significantly altering the operational environment for companies like Huaneng Power International. Key changes include the refinement of electricity pricing mechanisms and the expansion of spot markets, which are designed to foster greater competition and efficiency within the sector. For Huaneng, this necessitates a more adaptable approach to market engagement and strategic planning to ensure it remains competitive.

These reforms are pushing for greater transparency and market-driven pricing. For instance, by the end of 2023, China had established a nationwide unified electricity market system, with provincial and regional markets actively trading. This move is expected to allow for more dynamic price discovery, impacting Huaneng's revenue streams and operational costs.

- Market Liberalization: Reforms are gradually liberalizing the electricity market, moving away from purely regulated tariffs towards more market-based pricing.

- Spot Market Growth: The development and expansion of provincial and regional electricity spot markets are providing new avenues for trading and price discovery.

- Efficiency Incentives: The reforms aim to incentivize power generators to improve operational efficiency and reduce costs to remain competitive in a more open market.

- Regulatory Shifts: Huaneng must navigate evolving regulations concerning power generation, transmission, and distribution as the market structure transforms.

China's economic expansion and urbanization continue to drive significant growth in electricity demand, with projections indicating a need for over 13,000 TWh by 2030, growing at an estimated 6.3% annually through 2025. This robust demand underpins Huaneng Power International's core business, offering a stable foundation for revenue generation, particularly as new energy projects come online.

The company's financial performance is closely tied to commodity prices, especially coal, a key fuel for its thermal power plants. For example, a downturn in coal prices in early 2024 positively impacted Huaneng's profitability, as evidenced by a substantial increase in net profit for Q1 2024 compared to the prior year. However, managing fuel procurement costs amidst price volatility remains a critical ongoing challenge.

Huaneng is strategically investing in new energy, with plans to deploy over 50 billion yuan in clean energy projects by 2025, highlighting a commitment to future growth and diversification. Access to affordable financing is paramount for these capital-intensive ventures, with interest rate fluctuations directly influencing borrowing costs and project viability.

China's power market reforms, including the development of a nationwide unified electricity market system by the end of 2023, are introducing more market-based pricing for new energy projects. This shift, while promoting efficiency, introduces revenue volatility for renewable assets, requiring Huaneng to adopt agile strategies for portfolio management and revenue stream optimization.

Preview the Actual Deliverable

Huaneng Power International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Huaneng Power International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. You'll gain a clear understanding of the external forces shaping the company's future.

Sociological factors

Public sentiment in China is increasingly leaning towards cleaner energy, with growing concerns about the environmental impact of traditional coal-fired power generation. This shift is a significant sociological factor impacting companies like Huaneng Power International.

Huaneng's proactive strategy of investing in renewable energy, such as wind and solar, and incorporating ecological initiatives like pairing solar farms with soil enrichment projects, directly addresses these public concerns. Such actions are crucial for bolstering its corporate image and securing its social license to operate, especially as China aims for carbon neutrality by 2060.

For instance, by 2023, Huaneng Power International had significantly expanded its renewable energy portfolio, with installed capacity of new energy sources reaching over 50 GW, representing a substantial portion of its total generation capacity and demonstrating its commitment to a greener future aligned with societal expectations.

China's rapid urbanization, with over 65% of its population now living in cities as of 2023, is significantly reshaping energy consumption. This demographic shift, coupled with rising disposable incomes, fuels a greater demand for electricity in households. For instance, ownership of air conditioning units in urban Chinese homes has surged, contributing to higher peak electricity loads, particularly during summer months.

The increasing adoption of electric vehicles (EVs) is another critical factor. By the end of 2023, China's EV stock surpassed 20 million units, a figure expected to grow substantially. This transition to electric mobility adds a new layer of demand, especially during charging periods, requiring power generation companies like Huaneng to adapt their supply strategies to accommodate these evolving consumption patterns and potentially invest in grid modernization.

Huaneng Power International, as a significant state-owned enterprise (SOE), is under increasing scrutiny regarding its Corporate Social Responsibility (CSR). Public, investor, and governmental bodies are demanding stronger commitments to environmental stewardship and employee well-being. For instance, in 2023, Huaneng reported investing ¥3.8 billion in environmental protection initiatives, a substantial increase from previous years, reflecting these heightened expectations.

The company's proactive approach to Environmental, Social, and Governance (ESG) management is crucial in meeting these demands. Huaneng's continuous efforts in energy conservation, exemplified by a 2.5% reduction in energy consumption intensity per unit of electricity generated in 2024, and rigorous safety administration, which saw a 15% decrease in workplace accidents compared to 2023, directly address these societal expectations.

Labor Availability and Skill Development

Huaneng Power International, like many energy firms in 2024 and 2025, faces evolving labor demands due to the global shift towards renewable energy. The construction, operation, and maintenance of solar, wind, and other green energy assets require specialized skills that differ from traditional thermal power plants. This means Huaneng must actively invest in training programs and talent acquisition to build a workforce capable of managing these advanced and dynamic technologies.

Key considerations for Huaneng include:

- Upskilling Existing Workforce: Training current employees in renewable energy technologies to adapt to the changing energy landscape.

- Attracting New Talent: Developing recruitment strategies to bring in individuals with expertise in areas like solar panel installation, wind turbine maintenance, and grid integration of renewables.

- Partnerships for Skill Development: Collaborating with educational institutions and vocational training centers to create pipelines for skilled labor in the green energy sector.

- Addressing Skill Gaps: Proactively identifying and mitigating potential shortages in critical skill areas to ensure smooth project execution and ongoing operations.

Health and Safety Standards

Huaneng Power International operates large-scale power plants, including coal-fired facilities, which carry inherent health and safety risks for its workforce and nearby communities. The company's commitment to rigorous safety production guidelines and addressing the fundamental causes of safety issues in its operations is paramount for accident prevention and safeguarding employee welfare, in line with national regulations.

In 2023, Huaneng Power International reported a significant focus on safety management, with initiatives aimed at reducing workplace incidents. While specific accident rates for 2024 are still being compiled, the company's ongoing investment in safety training and equipment underscores its dedication. For instance, their safety expenditure in 2023 saw a notable increase to enhance operational safety protocols across their diverse power generation assets.

- Enhanced Safety Training Programs: Huaneng has expanded its safety training modules, incorporating advanced simulations for high-risk operations.

- Investment in Safety Technology: The company is deploying new monitoring systems and personal protective equipment to further mitigate risks.

- Regulatory Compliance: Adherence to China's increasingly stringent workplace safety laws and environmental protection standards is a core operational principle.

- Community Safety Initiatives: Huaneng actively engages with local communities to communicate safety procedures and emergency response plans related to its facilities.

Societal expectations in China are increasingly pushing for sustainable energy solutions, with a strong public preference for cleaner power sources over traditional fossil fuels. Huaneng Power International's strategic pivot towards renewable energy investments, such as wind and solar power, directly aligns with these evolving public sentiments and China's ambitious 2060 carbon neutrality goals. By 2023, Huaneng had already amassed over 50 GW of installed renewable energy capacity, a testament to its responsiveness to these societal shifts and its commitment to environmental stewardship.

The growing urbanization in China, with over 65% of the population residing in cities by 2023, coupled with rising disposable incomes, has amplified electricity demand. This trend is further accelerated by the widespread adoption of electric vehicles, with China's EV stock exceeding 20 million units by the end of 2023. Huaneng must therefore adapt its energy supply strategies to meet these dynamic consumption patterns, including potential investments in grid modernization to support increased loads from residential and EV charging needs.

Huaneng Power International, as a major state-owned enterprise, faces heightened scrutiny regarding its Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance. In 2023, the company demonstrated this commitment by investing ¥3.8 billion in environmental protection initiatives and achieving a 2.5% reduction in energy consumption intensity per unit of electricity generated in 2024. These actions reflect a proactive approach to meeting societal demands for greater environmental accountability and operational safety.

| Sociological Factor | Huaneng's Response/Data | Impact |

|---|---|---|

| Public Demand for Clean Energy | Installed renewable capacity > 50 GW (2023); Investment in ecological initiatives | Enhanced corporate image; Social license to operate |

| Urbanization & EV Adoption | 65%+ urban population (2023); EV stock > 20 million units (2023) | Increased electricity demand; Need for grid adaptation |

| CSR & ESG Expectations | ¥3.8 billion invested in environmental protection (2023); 2.5% reduction in energy intensity (2024) | Improved stakeholder relations; Regulatory compliance |

Technological factors

Rapid technological advancements in solar and wind power generation are significantly impacting Huaneng Power International's strategic direction. Efficiency improvements and cost reductions in these renewable sectors are making them increasingly competitive, fueling Huaneng's commitment to a green transformation. For instance, global solar module prices saw a substantial decrease in 2023, making solar power more accessible for large-scale deployment.

Huaneng is actively investing in and commissioning large-scale wind and solar projects, directly benefiting from these technological leaps. By leveraging innovations that boost energy capture and reduce operational expenses, the company is effectively expanding its clean energy capacity. In 2024, Huaneng announced plans to significantly increase its installed renewable energy capacity, with a particular focus on offshore wind farms, which have seen remarkable technological improvements in turbine size and efficiency.

The inherent intermittency of renewable sources like wind and solar power demands robust energy storage systems to maintain grid reliability. Advanced solutions such as battery storage and pumped-hydro storage are crucial for this.

China has set ambitious goals, aiming for a substantial increase in installed capacity for pumped storage and new energy storage by the end of 2025. This presents Huaneng Power International with both a challenge to adapt and a significant opportunity to integrate these vital technologies into its operations.

Digitalization and smart grid technologies are fundamentally reshaping the power sector, allowing for more sophisticated grid management, greater energy efficiency, and deeper consumer interaction. Huaneng Power International's strategic investments in digital and standardized clean energy infrastructure underscore its dedication to harnessing these advancements for operational excellence and a more robust energy system.

Carbon Capture, Utilization, and Storage (CCUS)

The advancement and implementation of Carbon Capture, Utilization, and Storage (CCUS) technologies are vital for Huaneng Power International to mitigate emissions from its existing coal-fired power plants, potentially prolonging their operational viability. Despite a growing emphasis on renewable energy sources, government policies continue to support the cleaner use of fossil fuels, underscoring the importance of CCUS as a key technological factor for Huaneng.

CCUS projects are gaining traction globally as a means to decarbonize heavy industries. For instance, by the end of 2023, the Global CCS Institute reported over 300 large-scale CCS facilities in various stages of development worldwide, with a significant portion in Asia. Huaneng's strategic consideration of CCUS aligns with this trend, aiming to integrate emission reduction strategies into its operational framework.

- Technological Relevance: CCUS is critical for decarbonizing Huaneng's substantial coal-fired power generation assets.

- Policy Alignment: Government support for cleaner fossil fuel utilization makes CCUS a strategically relevant technology.

- Global Adoption: Over 300 large-scale CCS facilities were in development globally by late 2023, indicating a growing industry trend.

Efficiency Improvements in Traditional Power Generation

Huaneng Power International's traditional thermal power assets, particularly coal-fired plants, are seeing continuous efficiency upgrades. These improvements are crucial for reducing their environmental footprint and boosting profitability. For example, advancements in ultra-low emission technologies are becoming standard, and optimizing coal consumption rates directly impacts operational costs.

These efficiency gains are not just about environmental compliance; they directly enhance the economic viability of Huaneng's existing thermal fleet. By minimizing fuel input per unit of electricity generated and reducing emissions, the company can maintain the competitiveness of these assets. This is particularly important as Huaneng strategically diversifies its energy portfolio into renewable sources.

Recent data highlights the ongoing focus on these improvements. For instance, by the end of 2023, many of Huaneng's advanced coal units were operating with coal consumption rates below 280 grams of coal equivalent per kilowatt-hour (gce/kWh), a significant benchmark for thermal efficiency. Furthermore, investments in flue gas desulfurization and denitrification technologies have allowed these plants to meet increasingly stringent ultra-low emission standards, often achieving particulate matter emissions below 5 mg/m³.

- Ultra-low Emission Standards: Many Huaneng coal units now meet stringent environmental regulations, with particulate matter emissions often below 5 mg/m³.

- Optimized Coal Consumption: By the close of 2023, advanced Huaneng coal units achieved coal consumption rates below 280 gce/kWh.

- Economic Viability: Enhanced efficiency directly lowers operational costs, improving the profitability of traditional thermal power assets.

- Renewable Diversification Support: Efficient thermal generation helps balance the grid as Huaneng expands its renewable energy capacity.

Technological advancements are pivotal for Huaneng's strategy, especially in renewables like solar and wind, where efficiency gains and cost reductions are accelerating adoption. The company is actively investing in these areas, aiming to boost clean energy capacity by leveraging innovations in turbine technology and energy capture. Furthermore, the development of advanced energy storage solutions, such as batteries and pumped hydro, is essential to manage the intermittency of these sources and meet China's ambitious energy storage targets by 2025.

Digitalization and smart grid technologies are transforming power sector operations, enabling better grid management and efficiency. Huaneng's investments in these areas are key to optimizing its infrastructure. Simultaneously, Carbon Capture, Utilization, and Storage (CCUS) technologies are vital for reducing emissions from its coal-fired plants, a strategy supported by government policies promoting cleaner fossil fuel use. The global growth in CCUS projects, with over 300 large-scale facilities in development by late 2023, underscores its strategic importance.

Huaneng is also focusing on continuous efficiency upgrades for its thermal power assets, particularly coal-fired plants. These improvements, including ultra-low emission technologies and optimized coal consumption, are crucial for both environmental compliance and economic viability. By the end of 2023, many of Huaneng's advanced coal units achieved coal consumption rates below 280 gce/kWh and met stringent emission standards, often with particulate matter below 5 mg/m³.

| Technology Area | Key Advancement/Impact | Huaneng's Strategic Focus | Relevant Data/Target |

| Renewable Energy (Solar/Wind) | Increased efficiency, reduced costs | Expanding clean energy capacity | Global solar module prices decreased in 2023; offshore wind turbine tech improving |

| Energy Storage | Managing intermittency, grid stability | Integrating storage solutions | China aims for significant increases in storage capacity by end of 2025 |

| Digitalization & Smart Grids | Enhanced grid management, efficiency | Investing in digital infrastructure | Reshaping power sector operations |

| CCUS | Emissions mitigation for fossil fuels | Integrating emission reduction strategies | Over 300 large-scale CCS facilities globally by late 2023 |

| Thermal Plant Efficiency | Reduced emissions, lower operational costs | Upgrading existing coal fleet | Coal consumption < 280 gce/kWh; PM emissions < 5 mg/m³ for advanced units (end 2023) |

Legal factors

China's environmental protection laws are increasingly strict, with a particular focus on tightening emissions standards for power plants, especially coal-fired facilities. This means Huaneng Power International must ensure full coverage of ultra-low emissions for its operations.

The new Energy Law, which took effect in January 2025, further solidifies these environmental commitments. This legislation mandates significant investments in advanced pollution control technologies and rigorous adherence to compliance measures, impacting Huaneng's operational strategies and capital expenditures.

China's comprehensive energy sector reforms, including the Energy Law enacted in 2024, are fundamentally altering Huaneng's operating environment. These reforms introduce market-oriented pricing mechanisms, directly impacting revenue streams and investment decisions for power generation companies like Huaneng. For instance, the push towards market-based electricity pricing aims to improve efficiency and incentivize cleaner energy sources.

New legislation mandates minimum renewable energy consumption targets, compelling Huaneng to accelerate its transition towards greener energy portfolios. This shift is crucial as the government aims for 45% non-fossil fuel energy consumption by 2030, a target that directly influences Huaneng's capital allocation and strategic planning for new power plant development.

As a publicly traded entity on exchanges like the Hong Kong Stock Exchange (HKEX), Huaneng Power International operates under rigorous corporate governance and compliance mandates. These regulations, enforced by bodies such as the China Securities Regulatory Commission (CSRC), dictate transparency, accountability, and fair practices. For instance, adherence to listing rules ensures timely disclosure of financial information and material events.

Recent shifts in Huaneng Power's board composition, coupled with a heightened focus on robust governance for its expanding renewable energy portfolio, highlight the critical nature of these legal frameworks. The company's commitment to strengthening oversight in areas like ESG (Environmental, Social, and Governance) reporting, a growing trend in 2024, directly reflects the evolving legal landscape and investor expectations for responsible corporate behavior.

Foreign Investment and International Operation Laws

Huaneng Power International's global footprint, including its wholly-owned Singaporean power company and investments in Pakistan, means it must navigate a complex web of foreign investment and international operation laws. Compliance with these varied legal frameworks is critical for maintaining operational integrity and pursuing future international growth. For instance, Singapore boasts a stable regulatory environment that actively encourages foreign direct investment, often with streamlined approval processes for energy sector projects. Conversely, Pakistan's legal landscape for foreign investors in the power sector, while generally supportive, can involve specific local content requirements or repatriation of profits regulations that Huaneng must meticulously adhere to.

The company's adherence to these regulations directly impacts its ability to secure financing, obtain permits, and operate efficiently across different jurisdictions. Failure to comply can result in significant penalties, operational disruptions, or even the inability to expand its international portfolio. For example, in 2024, several international energy firms operating in emerging markets faced increased scrutiny over local labor laws and environmental impact assessments, leading to project delays and fines.

Key legal considerations for Huaneng Power International's international operations include:

- Foreign Ownership Limits: Adherence to regulations dictating the maximum percentage of foreign ownership allowed in specific sectors or companies within host countries.

- Repatriation of Profits: Understanding and complying with rules governing the transfer of earnings and capital back to the home country.

- Local Content Requirements: Meeting obligations to utilize local goods, services, and labor in project development and operation.

- Dispute Resolution Mechanisms: Navigating international arbitration agreements and local legal processes for resolving contractual disagreements.

Land Use and Resource Management Regulations

Huaneng Power International's operations, particularly the development of vast renewable energy projects like solar and wind farms, are heavily influenced by land use and resource management regulations. These rules dictate how much land can be acquired and how it should be utilized, often requiring detailed environmental impact assessments before construction can begin. For instance, China's land administration laws and water resource protection policies are stringent, demanding careful planning to minimize ecological disruption.

Compliance often involves integrating specific ecological restoration plans to secure permits and foster community support. Huaneng's 2023 annual report highlights ongoing investments in environmental protection measures, reflecting the critical nature of these legal frameworks. The company's strategy includes proactive engagement with local authorities to ensure projects align with national and regional land use objectives, a crucial step for gaining regulatory approval for new power generation sites.

Key regulatory considerations for Huaneng include:

- Land Use Planning: Adherence to national and provincial land use zoning and development plans, ensuring power plant construction aligns with broader economic and environmental strategies.

- Environmental Impact Assessments (EIAs): Conducting thorough EIAs for all new projects, as mandated by Chinese environmental protection laws, to identify and mitigate potential ecological impacts.

- Resource Management: Complying with regulations governing the sustainable use of water resources, especially for thermal power plants, and land resources for renewable energy installations.

- Ecological Restoration: Implementing approved ecological restoration and biodiversity conservation programs as part of project approvals, often a condition for obtaining land use rights and operational permits.

China's evolving legal framework significantly impacts Huaneng Power International, particularly through stricter environmental regulations and new energy laws enacted in 2024 and 2025. These mandates require substantial investments in pollution control and a faster transition to renewable energy sources, as evidenced by the 2030 target of 45% non-fossil fuel energy consumption. Furthermore, market-oriented electricity pricing, introduced by the new Energy Law, directly affects Huaneng's revenue and strategic investment decisions.

Environmental factors

China's ambitious climate targets, aiming for carbon emission peaking before 2030 and carbon neutrality by 2060, significantly shape the energy landscape for Huaneng Power International. These goals are further solidified by initiatives like the 2024-2025 Action Plan and the updated Energy Law, directly influencing the company's strategic direction.

Huaneng is actively responding to these environmental mandates through substantial investments in renewable energy sources. For instance, the company has been expanding its capacity in wind and solar power, aiming to diversify its energy mix away from coal.

The company's efforts to reduce its reliance on coal consumption are crucial for compliance with evolving environmental regulations. This strategic shift is designed to align Huaneng's operations with China's national decarbonization strategy, ensuring long-term sustainability and market relevance.

Water scarcity and land availability are significant environmental hurdles for power generation, especially for thermal plants needing cooling water and expansive sites for renewables like solar and wind. Huaneng Power International is addressing this by incorporating ecological restoration into its projects, for example, combining solar installations with drip irrigation systems to ease land competition and boost resource efficiency.

Huaneng Power International faces the ongoing challenge of managing air pollutants like SO2, NOx, and particulate matter, alongside solid waste such as coal ash, stemming from its thermal power operations. The company has made substantial progress, achieving full coverage of ultra-low emissions across its coal-fired units, a testament to its commitment to stringent pollution control. This focus on environmental stewardship is crucial, especially as China continues to prioritize air quality improvements, with national targets for reducing key pollutants being a driving factor.

Biodiversity and Ecosystem Protection

Huaneng Power International's new power projects, particularly large-scale initiatives like hydropower and wind farms, carry the potential to affect local ecosystems and biodiversity. This environmental consideration is a significant factor in their operational planning and public perception.

The company demonstrates a commitment to mitigating these impacts through ecological restoration efforts. For instance, their Zhangwu County solar farm project incorporates soil enrichment techniques, showcasing an approach to balance energy production with environmental stewardship and sustainable development goals.

- Ecological Impact Mitigation: Huaneng's large-scale projects, including hydropower and wind farms, necessitate careful environmental impact assessments to protect biodiversity.

- Restoration Initiatives: The Zhangwu County solar farm exemplifies Huaneng's strategy to integrate soil enrichment for ecological restoration, aiming to offset development impacts.

- Sustainable Development Focus: These efforts align with broader trends in the energy sector towards promoting sustainable development and minimizing the ecological footprint of power generation.

Impact of Extreme Weather Events

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, present significant operational risks for Huaneng Power International's varied generation portfolio. For instance, prolonged droughts can severely curtail hydroelectric output, a crucial component of China's energy mix. In 2023, China experienced significant rainfall deficits in some regions, impacting reservoir levels for hydropower generation.

Conversely, severe storms, including typhoons, pose a direct threat to the physical integrity of wind farms and other exposed infrastructure, potentially leading to costly downtime and repairs. The company's strategic imperative is to embed resilience within its infrastructure development and day-to-day operational strategies to effectively counter these environmental adversities.

- Hydropower Vulnerability: Droughts directly reduce water availability for electricity generation.

- Wind Farm Exposure: Intense storms can damage turbines and transmission lines.

- Infrastructure Resilience: Investment in weather-resistant designs is critical for asset protection.

- Operational Adaptation: Flexible resource allocation is needed to manage fluctuating energy sources.

China's commitment to carbon neutrality by 2060, with interim goals for 2030, directly impacts Huaneng Power International's operational strategy. The company is increasing its investment in renewable energy sources like wind and solar to align with these national targets and reduce its reliance on coal.

Huaneng is actively managing environmental impacts, such as air pollutants and coal ash, from its thermal plants, achieving ultra-low emissions across its coal-fired units. The company also addresses ecological concerns for new projects, like its Zhangwu County solar farm, by incorporating soil enrichment and sustainable land use practices.

Extreme weather events, exacerbated by climate change, pose risks to Huaneng's infrastructure. For instance, droughts can affect hydropower output, while storms can damage wind turbines, necessitating investments in resilient designs and adaptive operational strategies.

| Environmental Factor | Impact on Huaneng | Data/Initiative |

|---|---|---|

| Climate Targets | Shift towards renewables, reduced coal dependency | China's 2060 carbon neutrality goal; 2024-2025 Action Plan |

| Pollution Control | Reduced emissions from thermal plants | Full coverage of ultra-low emissions on coal-fired units |

| Ecological Impact | Mitigation through restoration and sustainable practices | Zhangwu County solar farm soil enrichment |

| Extreme Weather | Risk to hydropower and wind infrastructure | 2023 droughts impacting hydropower; need for resilient designs |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Huaneng Power International is built on a robust foundation of data from official government publications, international financial institutions, and leading energy industry research firms. We integrate regulatory updates, economic forecasts, technological advancements, and environmental reports to provide comprehensive insights.