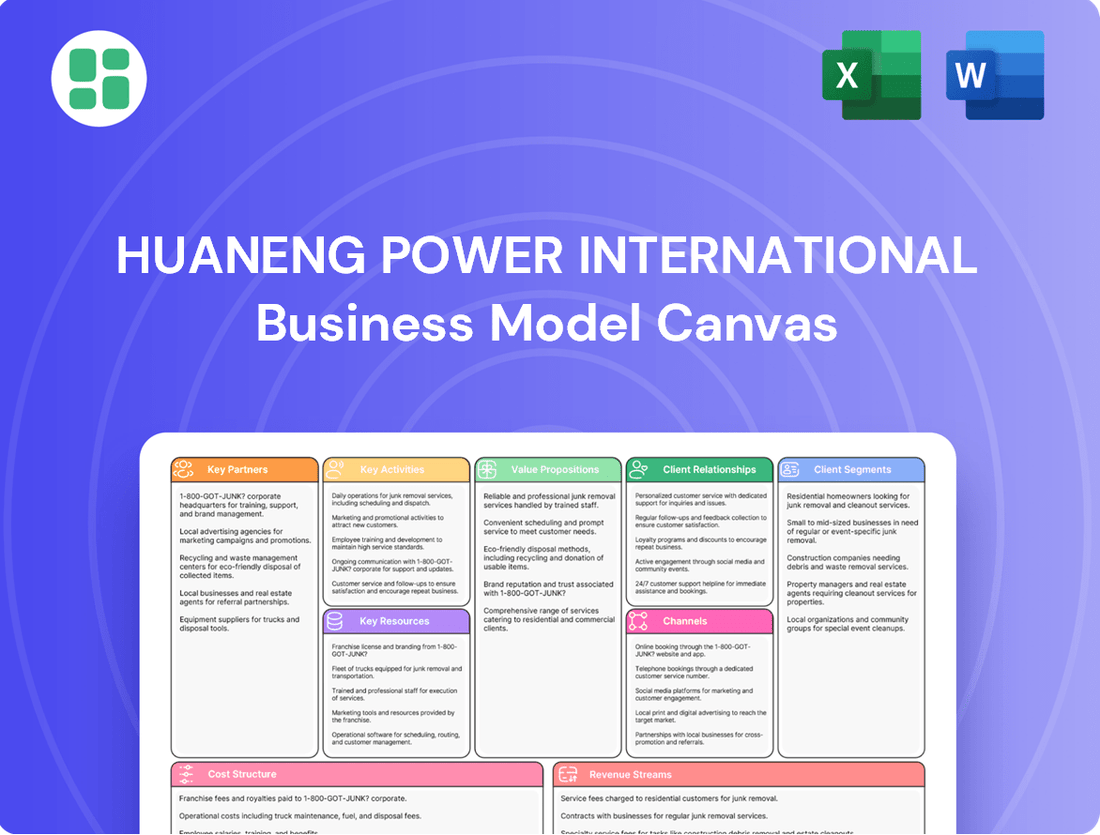

Huaneng Power International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huaneng Power International Bundle

Unlock the strategic blueprint behind Huaneng Power International’s success with our comprehensive Business Model Canvas. This detailed analysis reveals their key partners, value propositions, and revenue streams, offering invaluable insights into how they dominate the energy sector. Discover the core components that drive their operational efficiency and market expansion.

Partnerships

Huaneng Power International actively collaborates with Chinese government and regulatory bodies, such as the National Development and Reform Commission (NDRC) and the Ministry of Ecology and Environment. These partnerships are vital for securing operating licenses, navigating complex environmental compliance, and ensuring alignment with China's ambitious renewable energy targets, including the 2030 carbon peak and 2060 carbon neutrality goals.

Huaneng Power International's operations are deeply intertwined with its equipment and technology suppliers. These crucial partnerships provide the core components for its vast energy generation capabilities, from the massive turbines and boilers essential for its thermal power plants to the sophisticated components powering its growing renewable energy portfolio, including wind turbines and solar panels.

These collaborations are vital for securing access to the latest technological advancements and ensuring the efficiency and reliability of its diverse infrastructure. For instance, in 2023, the company continued to invest in upgrading its thermal power units with more efficient equipment, a process heavily reliant on its supplier relationships.

Huaneng Power International's fuel suppliers are critical partners, especially given its substantial reliance on coal. In 2023, coal accounted for approximately 60% of China's total energy consumption, and Huaneng, as a major player, directly benefits from strong relationships with coal producers to secure consistent and competitively priced fuel.

As Huaneng diversifies its energy sources, these partnerships extend to suppliers of natural gas and renewable energy components. This strategic approach ensures operational stability and cost management across its evolving portfolio, supporting its transition towards a more balanced energy mix.

Financial Institutions

Huaneng Power International heavily relies on collaborations with banks, investment firms, and other financial institutions. These partnerships are essential for securing the substantial project financing required for developing new power plants and acquiring existing assets. For instance, in 2023, Huaneng Power International successfully secured significant credit facilities from major Chinese banks to fund its ongoing expansion projects.

These financial relationships are crucial for managing the company's debt effectively and facilitating the capital expenditure necessary for growth. By leveraging these partnerships, Huaneng ensures its financial stability and supports its strategic growth initiatives in the competitive energy sector. The company's ability to access diverse funding sources, including bond issuances and syndicated loans, underscores the strength of its financial institution network.

Key aspects of these financial partnerships include:

- Project Financing: Securing loans and credit lines for the construction of new power generation facilities, including renewable energy projects.

- Debt Management: Structuring and managing the company's debt portfolio to optimize interest costs and maintain a healthy balance sheet.

- Capital Expenditure Support: Facilitating the funding for significant investments in plant upgrades, technology enhancements, and strategic acquisitions.

- Investment Relations: Working with investment firms and underwriters to manage equity and debt offerings, ensuring access to capital markets.

Engineering, Procurement, and Construction (EPC) Contractors

Huaneng Power International relies heavily on Engineering, Procurement, and Construction (EPC) contractors to bring its ambitious power generation projects to life. These partnerships are essential for managing the complexity and scale involved in developing everything from traditional thermal power stations to cutting-edge renewable energy facilities.

These collaborations ensure that projects are completed efficiently, adhering to strict timelines and budgetary constraints. For instance, in 2023, Huaneng continued its focus on large-scale projects, with EPC contractors playing a vital role in their successful delivery. The company's ongoing investments in new capacity, including significant expansions in wind and solar, underscore the critical nature of these relationships.

- Project Execution: EPC partners manage the entire lifecycle of power plant construction, from initial design to final commissioning.

- Cost and Time Efficiency: Their expertise helps Huaneng control project costs and meet completion deadlines.

- Technological Integration: EPC contractors bring specialized knowledge for integrating advanced technologies in new energy projects.

- Risk Mitigation: These partnerships help distribute project risks, ensuring smoother development processes.

Huaneng Power International's key partnerships extend to technology providers and research institutions, crucial for staying at the forefront of energy innovation. These collaborations facilitate the adoption of advanced technologies, such as supercritical and ultra-supercritical coal-fired power generation and the development of smart grid solutions. For example, in 2023, the company actively engaged with research bodies to explore and implement more efficient emission control technologies, aligning with stricter environmental regulations.

These alliances are instrumental in driving the company's transition towards cleaner energy sources and improving the efficiency of its existing assets. By partnering with leading equipment manufacturers and research centers, Huaneng ensures access to cutting-edge solutions for both thermal and renewable energy projects, enhancing operational performance and sustainability.

Huaneng Power International also cultivates strategic alliances with other energy companies and industrial partners, both domestically and internationally. These collaborations can involve joint ventures for large-scale projects, sharing of best practices, or co-investment in new energy infrastructure. Such partnerships are vital for expanding market reach, diversifying risk, and leveraging complementary expertise in the rapidly evolving energy landscape.

These strategic alliances are particularly important as Huaneng pursues its diversification strategy, including investments in offshore wind and hydrogen energy. For instance, in 2024, the company continued to explore opportunities for international cooperation to gain access to global markets and advanced renewable energy technologies.

| Partner Type | Role/Contribution | Example of Collaboration (2023-2024 Focus) |

|---|---|---|

| Government & Regulators | Licensing, policy alignment, environmental compliance | Securing permits for new renewable projects, adhering to carbon reduction targets |

| Equipment & Technology Suppliers | Providing core generation components, advanced technology integration | Upgrading thermal plant efficiency, sourcing advanced wind turbines |

| Fuel Suppliers | Ensuring consistent and cost-effective fuel supply | Securing coal and natural gas for thermal plants, supporting renewable energy component sourcing |

| Financial Institutions | Project financing, debt management, capital market access | Obtaining credit facilities for expansion, managing bond issuances |

| EPC Contractors | Project execution, cost/time efficiency, technological integration | Managing construction of new wind and solar farms, ensuring timely project delivery |

| Technology Providers & Research Institutions | Innovation, advanced technology adoption, efficiency improvements | Implementing advanced emission controls, exploring smart grid solutions |

| Other Energy Companies & Industrial Partners | Joint ventures, risk sharing, market expansion | Exploring international renewable energy projects, co-investing in new energy infrastructure |

What is included in the product

This Business Model Canvas provides a strategic overview of Huaneng Power International's operations, detailing its key customer segments, value propositions, and revenue streams within the power generation industry.

It offers a comprehensive analysis of Huaneng's operational framework, including its cost structure, key resources, and strategic partnerships, designed for informed decision-making and stakeholder communication.

Huaneng Power International's Business Model Canvas offers a clear, visual solution to the pain point of understanding complex energy sector strategies, providing a digestible one-page snapshot of their operations.

Activities

Huaneng Power International's key activities center on the development and construction of power plants. This involves a comprehensive process of identifying prime locations, meticulously designing, and then building new generation facilities. These projects span a diverse portfolio, encompassing traditional coal-fired plants alongside renewable sources like hydropower, wind, and solar energy.

The company actively pursues the expansion of its existing power generation capacities. Furthermore, Huaneng is committed to developing substantial clean energy bases. These strategic initiatives are being implemented across numerous regions within China and also extend to international markets, demonstrating a broad geographical reach.

In 2024, Huaneng Power International continued its robust development pipeline. For instance, the company reported significant progress in its renewable energy projects, with substantial additions to its installed wind and solar capacity, contributing to China's ongoing energy transition goals.

Huaneng Power International's core activity revolves around generating electricity across its diverse fleet of power plants, alongside producing heat. This dual focus necessitates optimizing the performance of its thermal power units while simultaneously scaling up output from its growing renewable energy sources to satisfy market demands.

In 2024, Huaneng Power International continued to leverage its extensive generation capacity. The company's operational strategy emphasizes maximizing the efficiency of its thermal power assets, which form a significant portion of its portfolio, while actively pursuing growth in wind and solar power to diversify its energy mix and meet evolving market needs.

Huaneng Power International is dedicated to the ceaseless operation and diligent upkeep of its extensive portfolio of power generation facilities. This core activity guarantees a consistent and dependable electricity supply to meet demand.

Ensuring maximum operational efficiency and prolonging the service life of its power assets are paramount. This involves a rigorous schedule of routine inspections, prompt repairs, and strategic technological enhancements to maintain peak performance.

In 2023, Huaneng Power International reported a total installed capacity of 222.5 gigawatts, underscoring the scale of its operational and maintenance responsibilities.

Fuel Procurement and Management

Huaneng Power International's core operations heavily rely on the strategic procurement and astute management of fuel, predominantly coal for its thermal power generation fleet. This activity is paramount for ensuring operational continuity and cost competitiveness.

The company actively engages in negotiating long-term supply contracts with domestic and international coal producers. This focus on securing reliable fuel sources is crucial for mitigating supply chain disruptions and maintaining a stable operational base. For instance, in 2023, Huaneng continued to diversify its fuel sources, including increased efforts in securing imported coal to supplement domestic supply and manage price volatility.

Efficient fuel cost control is a key driver of profitability. Huaneng implements various strategies to optimize fuel consumption and manage procurement expenses. This includes leveraging economies of scale in purchasing and exploring more efficient transportation methods. In 2024, the company is expected to continue its focus on cost optimization initiatives within its fuel procurement operations, aiming to absorb any upward price pressures through operational efficiencies.

- Strategic Coal Sourcing: Huaneng prioritizes securing stable and cost-effective coal supplies through long-term contracts and diversified sourcing strategies, including imports.

- Supply Chain Security: Ensuring uninterrupted fuel availability for its thermal power plants is a critical aspect of managing operational risks.

- Cost Management Initiatives: The company actively pursues strategies to control fuel costs, such as optimizing procurement volumes and logistics, to maintain profitability.

- 2024 Outlook: Continued emphasis on fuel cost optimization and supply chain resilience remains a key focus for the company's operational planning in 2024.

Electricity Market Transactions and Sales

Huaneng Power International actively engages in electricity market transactions, strategically targeting key regions to enhance trading outcomes for its diverse energy portfolio, encompassing both coal-fired and renewable sources. This proactive market participation is crucial for optimizing revenue streams and adapting to evolving energy landscapes.

The company is committed to broadening its electricity sales market reach and reinforcing its brand presence. This dual approach aims to bolster sales revenue by increasing market share and fostering stronger customer relationships through a recognized and trusted brand.

- Market Participation: Huaneng actively trades electricity in key provincial markets, aiming to capitalize on price differentials and demand fluctuations.

- Sales Expansion: The company focuses on expanding its customer base for electricity sales, including industrial and commercial sectors.

- Brand Strengthening: Efforts are directed towards enhancing brand recognition and reliability to improve sales revenue and market competitiveness.

- Revenue Optimization: Through strategic market transactions and sales efforts, Huaneng seeks to maximize its overall electricity sales revenue.

Huaneng Power International's key activities revolve around the development, construction, and operation of power generation facilities. This includes a strong focus on expanding its renewable energy capacity, such as wind and solar, alongside maintaining its thermal power assets. The company also prioritizes efficient fuel procurement, predominantly coal, and actively participates in electricity market transactions to optimize revenue.

In 2024, Huaneng continued to bolster its renewable energy portfolio, reporting significant additions to installed wind and solar capacity, aligning with national clean energy targets. The company’s operational strategy in 2024 emphasized maximizing the efficiency of its thermal power plants while diversifying its energy mix.

Huaneng Power International's commitment to operational excellence is evident in its rigorous maintenance schedules and strategic upgrades to ensure asset longevity and peak performance. This dedication is crucial for maintaining a reliable electricity supply to meet market demands.

The company's fuel procurement strategy in 2024 focused on securing stable, cost-effective coal supplies through diversified sourcing, including imports, to mitigate price volatility and ensure supply chain security for its thermal fleet.

| Key Activity | Description | 2023/2024 Focus |

|---|---|---|

| Power Generation Development & Construction | Building new power plants, including renewables. | Expanding solar and wind capacity; progress on new projects. |

| Operation & Maintenance | Ensuring efficient and reliable operation of all power assets. | Maximizing thermal plant efficiency; asset upkeep. |

| Fuel Procurement & Management | Securing and managing fuel (primarily coal) for thermal plants. | Diversifying coal sources (including imports); cost optimization. |

| Electricity Market Transactions | Trading electricity to optimize revenue and market share. | Strategic participation in provincial markets; sales expansion. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Huaneng Power International that you are previewing is the exact document you will receive upon purchase. This means you're not looking at a sample or a mockup, but a direct snapshot of the comprehensive analysis that will be delivered to you. Once your order is complete, you will gain full access to this same, professionally structured and ready-to-use document, allowing you to immediately leverage its insights.

Resources

Huaneng Power International's most critical key resources are its vast network of power generation assets. These include a diverse mix of coal-fired, hydro, wind, and solar power plants strategically located across 26 provinces in China, along with international operations in Singapore and Pakistan.

As of the close of 2024, Huaneng Power International boasted a substantial controlled installed capacity totaling 145,125 MW. This extensive physical infrastructure forms the backbone of its operations, enabling large-scale energy production and supply.

Huaneng Power International's diversified energy portfolio is a cornerstone of its business model. By the close of 2024, approximately 35.82% of its total installed capacity was dedicated to low-carbon clean energy sources like wind and solar. This strategic diversification reduces dependency on any single energy source, a crucial advantage in today's dynamic energy landscape.

This shift towards renewables not only strengthens Huaneng's operational resilience but also positions it favorably within global green energy transition initiatives. The growing share of clean energy in its portfolio directly supports its commitment to sustainable development and aligns with evolving market demands for environmentally responsible power generation.

Huaneng Power International relies heavily on a highly skilled workforce, encompassing engineers, plant operators, and seasoned management. This human capital is fundamental to the company's success in developing, constructing, and efficiently operating its vast power generation infrastructure.

The technical proficiency of its employees is critical for maintaining the complex machinery and ensuring reliable power output. In 2023, Huaneng Power International reported having over 50,000 employees, a testament to the scale of its operations and the human resources required to manage them effectively.

Furthermore, experienced management expertise is indispensable for navigating the dynamic energy market, making strategic decisions, and driving innovation. This leadership ensures the company can adapt to evolving regulations and technological advancements in the power sector.

Technology and Intellectual Property

Huaneng Power International's commitment to technology and intellectual property is a cornerstone of its business model. The company consistently channels substantial investment into research and development, fostering the creation and adoption of cutting-edge technologies. This focus allows them to excel in areas such as highly efficient power generation, robust environmental protection measures, and the seamless integration of renewable energy sources into the grid.

Their technological prowess is evident in specific innovations. Huaneng has been a leader in developing and deploying ultra-large wind turbines, enhancing their capacity to harness wind power. Furthermore, they have pioneered near-zero pollutant emission systems for thermal power plants, significantly reducing their environmental footprint. These advancements not only improve operational efficiency but also align with global sustainability goals.

The company's intellectual property portfolio is a key asset, reflecting its dedication to innovation. This IP underpins their competitive advantage and provides a foundation for future growth and technological leadership in the energy sector. By protecting and leveraging these innovations, Huaneng secures its position in a rapidly evolving market.

- Research and Development Investment: Huaneng Power International consistently invests heavily in R&D, driving innovation in power generation and environmental technologies.

- Advanced Technologies: Key technological strengths include ultra-large wind turbines and near-zero pollutant emission systems for thermal power.

- Intellectual Property: The company possesses a robust portfolio of intellectual property, safeguarding its innovations and reinforcing its competitive edge.

Financial Capital and Access to Funding

Huaneng Power International's financial capital is a cornerstone of its business model. This includes substantial cash reserves, robust access to both domestic and international credit lines, and the capacity to issue bonds. These financial levers are essential for funding its extensive portfolio of large-scale power generation projects, strategic acquisitions, and day-to-day operational needs.

The company has a proven track record of successfully raising significant capital to fuel its strategic growth initiatives. For instance, in 2023, Huaneng Power International actively managed its financing, securing substantial funds to support its ongoing development and operational expenditures, demonstrating its financial strength and access to capital markets.

- Substantial Cash Reserves: Maintaining healthy cash reserves provides immediate liquidity for operational needs and opportunistic investments.

- Access to Credit Facilities: Strong relationships with domestic and international banks grant access to crucial credit lines, enabling the financing of major capital expenditures.

- Bond Issuance Capability: The ability to issue bonds allows Huaneng Power to tap into broader capital markets, securing long-term funding for its extensive project pipeline.

Huaneng Power International's key resources are its extensive power generation assets, a skilled workforce, technological innovation, and strong financial capital. Its vast network of diverse power plants, including coal, hydro, wind, and solar, forms the operational backbone. The company's financial strength, demonstrated by its ability to raise capital and maintain healthy cash reserves, is crucial for funding its large-scale projects and strategic growth.

By the end of 2024, Huaneng Power International managed a controlled installed capacity of 145,125 MW. This impressive figure underscores the scale of its physical infrastructure. Approximately 35.82% of this capacity was dedicated to clean energy sources like wind and solar by the close of 2024, highlighting a strategic diversification towards sustainability.

The company's human capital, comprising over 50,000 employees as of 2023, is vital for operating its complex infrastructure. Furthermore, Huaneng's commitment to R&D fuels innovation in areas such as ultra-large wind turbines and near-zero pollutant emission systems, supported by a robust intellectual property portfolio.

| Key Resource | Description | 2024 Data/Significance |

|---|---|---|

| Power Generation Assets | Diverse portfolio of coal, hydro, wind, and solar plants | 145,125 MW controlled installed capacity (end of 2024) |

| Clean Energy Mix | Focus on renewable energy sources | 35.82% of capacity from wind and solar (end of 2024) |

| Human Capital | Skilled workforce including engineers and operators | Over 50,000 employees (2023) |

| Technology & IP | R&D investment, advanced technologies, patents | Leader in ultra-large wind turbines and near-zero emission systems |

| Financial Capital | Cash reserves, credit access, bond issuance capability | Proven ability to raise significant capital for growth |

Value Propositions

Huaneng Power International delivers a foundational value proposition by ensuring a reliable and stable supply of electricity and heat, which is absolutely vital for China's ongoing industrial, commercial, and residential development. This consistent energy provision underpins the nation's economic activities and daily life.

The company's significant installed capacity, reaching approximately 239.3 GW by the end of 2023, and its commitment to operational efficiency are key drivers behind this energy security. This massive generation capability allows Huaneng to meet substantial demand across various sectors.

Huaneng Power International provides value by actively diversifying its energy generation mix. This includes a significant and increasing investment in renewable sources such as wind, solar, and hydropower. This strategic shift directly supports national environmental objectives and offers a cleaner energy alternative for consumers.

In 2023, Huaneng Power International reported that its installed capacity of clean energy, including renewables and nuclear power, reached 52.96 gigawatts. This represents a substantial portion of their total installed capacity, underscoring their commitment to a cleaner energy future and aligning with China's dual carbon goals.

Huaneng Power International is committed to cost-effective energy production by meticulously optimizing its fuel procurement strategies. For instance, in 2023, the company continued to leverage its scale and long-term contracts to secure coal at favorable prices, a key factor in maintaining competitive electricity rates.

Furthermore, Huaneng actively pursues operational efficiencies across its diverse power plant portfolio. By implementing advanced technologies and best practices, they have consistently improved heat rates and reduced auxiliary power consumption. This focus on efficiency directly translates into lower operating costs, allowing Huaneng to offer more affordable energy solutions to its customer base.

Technological Innovation and Efficiency

Huaneng Power International actively drives technological innovation to boost generation efficiency and minimize its environmental footprint. This focus delivers high-performance energy solutions that are also environmentally responsible.

Their investment in cutting-edge technologies, like ultra-large wind turbines and advanced low-pollutant emission systems, directly translates into value for customers and stakeholders. For instance, by the end of 2023, Huaneng's installed wind power capacity reached approximately 15.9 GW, a significant portion of which utilizes the latest turbine technology.

- Enhanced Energy Output: Advanced technologies allow for greater electricity generation from the same resources.

- Reduced Environmental Impact: Innovations in emission control systems lead to cleaner energy production.

- Operational Cost Savings: Improved efficiency can translate to lower fuel consumption and maintenance costs.

- Market Leadership: Commitment to innovation positions Huaneng as a forward-thinking energy provider.

Contribution to National Energy Strategy

Huaneng Power International, as a leading independent power producer, is a cornerstone of China's national energy strategy. Its substantial generation capacity directly bolsters national energy security by providing a reliable and abundant supply of electricity. In 2023, Huaneng Power International reported a total installed capacity of 239.7 gigawatts, underscoring its significant contribution to the nation's power grid.

The company's strategic investments are pivotal in supporting China's energy transition objectives, particularly its focus on cleaner energy sources. Huaneng is actively expanding its renewable energy portfolio, aligning with national targets to reduce carbon emissions and promote sustainable development. By the end of 2023, its installed capacity of new energy sources, including wind and solar, reached 70.9 gigawatts, representing a substantial portion of its total generation.

- Supporting Energy Security: Huaneng's vast operational scale ensures a stable electricity supply, crucial for economic stability and national development.

- Driving Energy Transition: Significant investments in wind and solar power directly contribute to China's decarbonization goals.

- Infrastructure Development: The company's ongoing expansion and modernization of power generation facilities enhance the overall resilience and efficiency of the national energy infrastructure.

- Policy Alignment: Huaneng's business activities are closely aligned with government energy policies, facilitating the implementation of national energy objectives.

Huaneng Power International's value proposition centers on providing stable, cost-effective, and increasingly clean energy. Their extensive installed capacity, reaching 239.7 GW by the end of 2023, ensures reliable power for China's growth. Furthermore, their strategic diversification into renewables, with 70.9 GW of new energy capacity by end-2023, addresses environmental concerns and supports national decarbonization targets.

| Value Proposition Element | Description | Supporting Data (End of 2023) |

|---|---|---|

| Reliable Energy Supply | Ensuring consistent electricity and heat for industrial, commercial, and residential needs. | Total Installed Capacity: 239.7 GW |

| Cost-Effectiveness | Optimizing operations and fuel procurement for competitive energy pricing. | Continued favorable coal procurement strategies. |

| Clean Energy Transition | Expanding renewable energy sources to meet environmental goals. | New Energy Installed Capacity: 70.9 GW (including wind and solar) |

| Technological Advancement | Investing in efficient and environmentally responsible generation technologies. | Installed Wind Power Capacity: ~15.9 GW (utilizing advanced turbines) |

Customer Relationships

Huaneng Power International primarily secures its customer base through long-term contractual agreements, predominantly power purchase agreements (PPAs). These PPAs are typically established with major national and provincial grid operators, ensuring a consistent and predictable offtake for its generated electricity.

These long-term contracts are crucial for Huaneng's revenue stability, providing a predictable income stream that underpins its financial planning and investment decisions. For instance, in 2023, the company continued to leverage these stable agreements to manage its operational cash flows effectively.

Beyond grid operators, Huaneng also engages in similar long-term agreements with large industrial clients, such as major manufacturing enterprises. These direct contracts further diversify its customer portfolio and secure demand for its power output, contributing to overall business resilience.

Huaneng Power International places significant emphasis on regulatory compliance and reporting, understanding its critical role in maintaining operational legitimacy and stakeholder trust. This involves diligently adhering to China's evolving energy policies and stringent environmental standards, such as those governing emissions and water usage.

In 2024, the company continued its commitment to transparent reporting, submitting comprehensive data to bodies like the National Development and Reform Commission (NDRC) and the China Securities Regulatory Commission (CSRC). This meticulous approach ensures Huaneng operates within the legal frameworks and secures ongoing approvals for its power generation facilities, a key aspect of its customer relationships with governmental entities.

Huaneng Power International directly engages with large industrial enterprises and municipalities that require heat, offering tailored energy solutions. This approach ensures specific customer needs are met beyond standard grid supply, fostering strong, direct relationships.

In 2024, Huaneng Power International's commitment to direct sales and service for key accounts was evident in its continued focus on securing long-term power purchase agreements with major industrial clients. These agreements often include provisions for dedicated technical support and customized energy delivery, reflecting the high-value nature of these relationships.

Government Relations and Policy Advocacy

Huaneng Power International actively engages with government bodies to foster a supportive regulatory landscape. This involves participating in policy formulation and advocating for measures that benefit the power sector's sustainable growth. For instance, in 2023, the company contributed to discussions surrounding China's renewable energy targets, aiming to secure favorable policies for its expanding clean energy portfolio.

These relationships are crucial for navigating the complexities of the Chinese energy market, ensuring alignment with national strategic priorities such as energy security and carbon neutrality goals. By maintaining open communication channels, Huaneng Power International can proactively address potential regulatory challenges and capitalize on emerging opportunities.

Key aspects of this customer relationship include:

- Policy Advocacy: Engaging in dialogues with ministries and regulatory agencies to influence energy policy, particularly concerning pricing, grid access, and environmental standards.

- Strategic Alignment: Ensuring Huaneng's business strategies are in sync with national economic and environmental development plans, such as the 14th Five-Year Plan which emphasizes green development.

- Information Exchange: Providing data and insights to government bodies to support informed decision-making on energy infrastructure and market reforms.

Investor Relations and Transparency

Huaneng Power International prioritizes robust investor relations, cultivating trust through consistent and transparent communication with its varied investor base. This includes individual shareholders and large institutional players.

The company actively engages investors by:

- Providing detailed financial reports: Ensuring all financial disclosures are readily accessible and clearly presented.

- Conducting regular conference calls: Offering platforms for direct engagement and Q&A sessions with management.

- Participating in investor presentations: Showcasing company performance and future strategies at key industry events.

This commitment to transparency is crucial for attracting and retaining capital, supporting Huaneng Power International's ongoing development and expansion initiatives. For instance, in 2023, the company reported operating revenue of RMB 231.1 billion, underscoring its significant scale and the importance of maintaining investor confidence.

Huaneng Power International's customer relationships are built on long-term contracts, primarily with grid operators and large industrial clients, ensuring stable revenue streams. The company also directly engages with industrial and municipal customers for heat supply, offering tailored solutions. Maintaining strong relationships with government bodies through policy advocacy and information exchange is key to navigating the regulatory landscape and aligning with national energy strategies.

Investor relations are managed through transparent financial reporting, regular conference calls, and participation in industry events to foster trust and attract capital. In 2023, Huaneng reported operating revenue of RMB 231.1 billion, highlighting the importance of these relationships for its financial stability and growth.

| Customer Segment | Relationship Type | Key Engagement | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Grid Operators (National/Provincial) | Long-term PPAs | Consistent offtake, predictable revenue | High |

| Large Industrial Clients | Long-term PPAs, Direct Sales | Customized energy solutions, technical support | Significant |

| Industrial/Municipal (Heat Supply) | Direct Contracts | Tailored energy solutions | Growing |

| Government Bodies | Policy Advocacy, Information Exchange | Regulatory alignment, strategic planning | Indirect (enabling operations) |

| Investors | Transparent Communication | Financial reporting, conference calls | Capital provision |

Channels

Huaneng Power International primarily utilizes national and regional power grids as its core distribution channels, transmitting electricity generated from its numerous power plants across China to a vast customer base.

This extensive grid infrastructure, a critical component of its business model, ensures widespread reach, connecting Huaneng's output to diverse end-users, from industrial complexes to residential areas.

In 2023, Huaneng Power International reported a total installed capacity of approximately 237.5 gigawatts, underscoring the sheer scale of its operations and its reliance on these interconnected grids for effective power delivery.

Huaneng Power International establishes direct supply lines to large industrial users, bypassing the general grid for customized, high-volume energy delivery. This ensures reliability and efficiency for major clients requiring substantial power or heat. For instance, in 2024, the company continued to serve key industrial parks and large manufacturing facilities with dedicated infrastructure, reflecting a strategic focus on stable, long-term power purchase agreements.

Government-mandated dispatch mechanisms are a vital channel for Huaneng Power International, dictating how its generated electricity reaches the grid. These systems ensure that power is allocated according to national and regional energy needs, playing a critical role in Huaneng's operational framework.

In 2023, China's electricity market saw continued emphasis on grid stability and efficient resource allocation. Huaneng, as a major player, adheres to these dispatch orders, which are crucial for integrating its diverse power sources, including coal, hydro, and renewables, into the national grid.

These mandated dispatches directly influence Huaneng's revenue streams by determining the volume of electricity sold and the prices it can command. The efficiency and fairness of these mechanisms are therefore key factors in Huaneng's financial performance and its ability to meet energy demand.

Company Sales and Marketing Teams

Huaneng Power International utilizes dedicated sales and marketing teams to directly engage with commercial and industrial clients for electricity and heat sales. These teams are crucial for building relationships, negotiating contracts, and ensuring ongoing service satisfaction.

In 2023, Huaneng Power International reported total operating revenue of RMB 236.7 billion, with a significant portion derived from its power generation and sales segments. The company's direct sales approach allows for tailored solutions and competitive pricing for its key customers.

- Direct Client Engagement: Sales teams actively pursue and manage relationships with large commercial and industrial users, understanding their specific energy needs.

- Contract Negotiation: These teams are responsible for structuring and finalizing power purchase agreements, ensuring mutually beneficial terms.

- Service Relationship Management: Post-contract, sales and marketing personnel maintain client satisfaction through responsive service and support.

- Market Expansion: The teams also identify and target new industrial and commercial opportunities to grow the company's customer base.

Investor Relations Platforms and Publications

Huaneng Power International leverages its official investor relations website as a primary communication hub, offering detailed financial reports, operational updates, and investor presentations. This digital platform ensures accessibility for its diverse investor base, from individual shareholders to institutional investors.

The company also utilizes prominent financial news platforms and public announcements on major stock exchanges to disseminate critical information. For instance, in 2024, Huaneng Power International made several key disclosures regarding its financial performance and strategic initiatives, impacting its share price and investor sentiment.

- Official Investor Relations Website: Central repository for all official disclosures and investor materials.

- Financial News Platforms: Broad dissemination of company news and performance data to a wider audience.

- Stock Exchange Announcements: Formal and timely communication of material information as required by regulatory bodies.

Huaneng Power International's channels extend beyond grid transmission to include direct supply lines for large industrial clients, ensuring tailored energy solutions. Additionally, government-mandated dispatch mechanisms are crucial for allocating power according to national needs, directly impacting sales volumes and pricing. The company also employs dedicated sales teams for direct engagement with commercial and industrial customers, fostering relationships and negotiating contracts.

| Channel Type | Description | 2023/2024 Data Point |

|---|---|---|

| Power Grids | National and regional grid infrastructure for broad electricity distribution. | Installed capacity of 237.5 GW in 2023. |

| Direct Industrial Supply | Dedicated lines to large industrial users for high-volume, reliable delivery. | Continued service to key industrial parks and manufacturing facilities in 2024. |

| Government Dispatch | Mandated allocation of generated electricity based on national energy requirements. | Adherence to dispatch orders crucial for integrating diverse power sources in 2023. |

| Direct Sales Teams | Personalized engagement with commercial and industrial clients for electricity and heat sales. | Significant portion of RMB 236.7 billion total operating revenue (2023) derived from power sales. |

| Investor Relations | Official website and financial platforms for shareholder communication and disclosures. | Key disclosures on financial performance and strategic initiatives in 2024. |

Customer Segments

State Grid Corporation of China and its provincial subsidiaries are Huaneng Power International's primary customers. These state-owned enterprises are responsible for the transmission and distribution of electricity across the nation, purchasing power in massive quantities from generators like Huaneng.

In 2023, China's electricity consumption reached approximately 9.5 trillion kilowatt-hours, with State Grid alone managing over 88% of the country's power transmission network. Huaneng, as a major independent power producer, directly supplies a significant portion of this demand to these grid operators.

Regional grid operators, often provincial-level branches of State Grid or other authorized entities, also represent a crucial customer segment. They manage the localized distribution of electricity, ensuring power reaches industrial, commercial, and residential users within their specific geographic areas.

Large industrial enterprises, such as major manufacturing plants and sprawling industrial complexes, are a core customer segment for Huaneng Power International. These entities have a critical need for substantial and dependable electricity and heat, often sourced directly from Huaneng's power generation facilities.

These relationships are characterized by robust, long-term contractual agreements, ensuring a stable revenue stream for Huaneng and a predictable energy supply for the industrial clients. For instance, in 2023, Huaneng Power International's revenue from industrial customers constituted a significant portion of its overall earnings, reflecting the importance of this segment.

Commercial businesses, such as office towers and shopping malls, are significant indirect consumers of electricity. These establishments rely on Huaneng Power International's generated power, which is distributed through the national and regional grid infrastructure. In 2024, the commercial sector accounted for a substantial portion of electricity demand, reflecting its critical role in the economy.

The demand from retail centers and service industries for reliable power is constant, underpinning their daily operations. Huaneng Power International's contribution to meeting this demand is vital, ensuring businesses can function without interruption. This indirect customer segment represents a stable and growing market for electricity providers.

Residential Consumers

Individual households represent a vast, albeit indirect, customer base for Huaneng Power International. Their daily lives are powered by the electricity Huaneng generates, flowing through the national grid to reach their homes.

Huaneng Power International's substantial generation capacity, which in 2023 reached 258.3 gigawatts of installed capacity, directly fuels the electricity supply that reaches millions of residential consumers across China. This contribution is fundamental to the consistent availability of power for domestic use.

- Indirect Beneficiaries: Residential consumers benefit from Huaneng's electricity through their local utility providers.

- Grid Dependence: The reliability of residential power supply is directly linked to the output of major generators like Huaneng.

- 2023 Output Impact: Huaneng's 2023 electricity production played a crucial role in meeting the energy demands of households nationwide.

Local Governments and Municipalities

Local governments and municipalities represent a significant customer segment for Huaneng Power International, especially concerning its co-generation facilities. These entities often procure heat supply services to bolster their urban heating networks, directly contributing to public infrastructure and resident comfort. For instance, in 2023, Huaneng's combined heat and power (CHP) plants played a crucial role in supplying thermal energy to various cities, enhancing energy efficiency and reducing local pollution.

These municipal customers rely on Huaneng for a stable and reliable source of heat, which is essential for residential heating, commercial buildings, and even industrial processes within their jurisdictions. The integration of co-generation technology allows for the efficient utilization of fuel, producing both electricity and heat, thereby offering a cost-effective and environmentally friendlier solution for urban energy needs.

- Urban Heating Networks: Municipalities purchase thermal energy from Huaneng's CHP plants to distribute to residential and commercial areas.

- Public Infrastructure Support: Huaneng's heat supply contributes to the modernization and efficiency of city-wide heating systems.

- Environmental Benefits: By utilizing CHP, municipalities can reduce reliance on less efficient individual heating systems, leading to lower emissions.

Huaneng Power International serves a diverse customer base, primarily State Grid Corporation of China and its provincial subsidiaries, which are the backbone of the nation's electricity transmission. In 2023, China's total electricity consumption neared 9.5 trillion kWh, with State Grid managing over 88% of transmission. Huaneng directly supplies a significant portion of this to these grid operators. Large industrial enterprises are also key clients, requiring substantial and dependable power, often through long-term contracts. For example, Huaneng's industrial revenue formed a notable part of its 2023 earnings. Commercial businesses and individual households are crucial indirect consumers, relying on Huaneng's generation to power their daily activities. Huaneng's installed capacity reached 258.3 GW in 2023, directly impacting millions of residential users.

| Customer Segment | Description | 2023/2024 Relevance |

|---|---|---|

| State Grid & Subsidiaries | Primary purchasers of bulk electricity for transmission. | Managed >88% of China's power transmission in 2023. |

| Large Industrial Enterprises | Direct consumers needing high, reliable power. | Significant revenue source for Huaneng in 2023. |

| Commercial Businesses | Indirect consumers via grid distribution. | Substantial electricity demand in 2024. |

| Individual Households | Vast indirect consumer base. | Powered by Huaneng's 258.3 GW capacity (2023). |

| Local Governments/Municipalities | Purchasers of heat from CHP plants. | Supplied urban heating networks in 2023. |

Cost Structure

Fuel costs, primarily for coal, represent the largest expense in Huaneng Power International's cost structure. In 2023, the company's cost of fuel and purchased electricity was approximately RMB 140.5 billion, a significant portion of its total operating expenses.

The company's profitability is highly sensitive to changes in coal prices, which can be influenced by supply and demand dynamics, government policies, and international market conditions. For instance, a 10% increase in coal prices could substantially impact Huaneng's bottom line.

Huaneng Power International's capital expenditure is substantial, primarily driven by the development and construction of new power generation facilities. This includes significant investments in both traditional thermal power plants and a growing portfolio of renewable energy projects, such as wind and solar farms.

In 2023, Huaneng Power International reported capital expenditures of approximately RMB 37.5 billion (roughly $5.2 billion USD), with a notable portion allocated to expanding its clean energy capacity. This ongoing investment is vital for modernizing its existing infrastructure and increasing overall power generation capacity to meet rising energy demands.

Operation and Maintenance (O&M) expenses are a significant component of Huaneng Power International's cost structure. These ongoing costs cover the essential upkeep of their vast network of power generation facilities, ensuring efficient and reliable energy production.

In 2023, Huaneng Power International reported O&M expenses of approximately RMB 37.9 billion. This figure reflects the substantial investment required for regular repairs, servicing of critical equipment, and specialized technical support across their diverse power plant portfolio, which includes thermal, hydro, and renewable energy sources.

Financing Costs

Huaneng Power International, like many in the power generation sector, faces significant financing costs due to its capital-intensive operations. These costs primarily stem from interest payments on the substantial debt used to fund its extensive infrastructure and ongoing development projects.

As of the first half of 2024, Huaneng Power International reported interest expenses on its borrowings. For instance, in the first half of 2024, the company's interest expenses amounted to approximately RMB 7.18 billion. This figure highlights the ongoing financial commitment required to service its debt obligations.

- Interest Expense: RMB 7.18 billion in H1 2024.

- Debt Servicing: Significant portion of costs dedicated to managing loans and bonds.

- Capital Intensity: High upfront investment in power generation facilities necessitates substantial financing.

Labor Costs

Huaneng Power International's labor costs are a significant component of its overall expenses. These costs encompass salaries, wages, benefits, and other personnel-related expenditures for its extensive workforce. This includes the engineers who design and maintain power facilities, the technicians who operate and repair equipment, the administrative staff managing operations, and the plant operators ensuring continuous power generation.

In 2023, Huaneng Power International reported substantial personnel expenses. For instance, the company's employee benefits and social security contributions amounted to approximately RMB 2.5 billion. This figure highlights the considerable investment in its human capital, which is essential for the safe and efficient operation of its numerous power plants across China.

- Salaries and Wages: Direct compensation for all employees, from entry-level operators to senior management.

- Employee Benefits: Includes health insurance, retirement plans, and other welfare programs provided to staff.

- Training and Development: Investments in upskilling the workforce to manage advanced power generation technologies.

- Personnel-Related Expenses: Covers recruitment, onboarding, and other administrative costs associated with managing a large workforce.

Huaneng Power International's cost structure is dominated by fuel, representing the largest expense. Capital expenditures for new facilities, especially renewables, are substantial. Operation and maintenance costs ensure the smooth running of its diverse power assets.

Financing costs, driven by debt for infrastructure, are also a key outlay, alongside significant labor expenses for its large workforce.

| Cost Component | 2023 (RMB Billion) | H1 2024 (RMB Billion) |

|---|---|---|

| Fuel and Purchased Electricity | 140.5 | N/A |

| Capital Expenditures | 37.5 | N/A |

| Operation & Maintenance | 37.9 | N/A |

| Personnel Expenses (Employee Benefits) | 2.5 | N/A |

| Interest Expense | N/A | 7.18 |

Revenue Streams

Huaneng Power International's core revenue generation relies heavily on selling electricity in bulk to national and regional grid operators. This is the bedrock of its financial operations.

In 2024, this segment represented a substantial portion of its overall operating income, reflecting its critical role in supplying power to the national grid. For instance, electricity sales are the primary driver of revenue, with the company consistently reporting significant contributions from this stream in its financial disclosures.

Huaneng Power International also brings in money by selling heat, not just electricity. This is especially true for their thermal power plants that can do both, often called co-generation plants.

They sell this heat to a variety of customers. This includes industrial businesses that need it for their processes, commercial buildings like offices and malls, and even residential areas for heating homes. This strategy helps to diversify their income, making them less reliant solely on electricity sales.

For instance, in 2023, Huaneng Power International reported that its thermal power segment, which includes these heat sales, contributed significantly to its overall revenue. While specific figures for heat sales alone are often bundled, the company's continued investment in and operation of co-generation facilities underscores the importance of this revenue stream.

Huaneng Power International earns revenue through capacity charges, essentially payments for keeping generation capacity available to the grid. This ensures they have power ready when needed, even if not constantly dispatched.

These capacity charges are crucial for grid stability, as they compensate power producers for maintaining readiness. In 2023, Huaneng Power International reported substantial revenue, and a portion of this is directly attributable to these availability payments, reflecting their role in grid reliability.

Furthermore, the company generates income by providing ancillary services. These services are vital for maintaining the grid's frequency and voltage within acceptable limits, ensuring a smooth and consistent power supply for consumers.

Renewable Energy Subsidies and Incentives

Huaneng Power International benefits significantly from government support for its clean energy initiatives. Revenue streams are bolstered by subsidies, feed-in tariffs, and various incentives designed to encourage the growth of its wind and solar power projects.

These financial mechanisms are crucial for making renewable energy development economically viable and supporting the expansion of Huaneng's clean energy portfolio. For instance, in 2023, China's renewable energy sector continued to see substantial investment, with the government actively promoting solar and wind power development through policy support.

- Government Subsidies: Direct financial support from national and local governments for renewable energy generation.

- Feed-in Tariffs (FiTs): Guaranteed prices paid to renewable energy producers for the electricity they feed into the grid, often above market rates.

- Tax Credits and Exemptions: Reductions in tax liabilities or exemptions from certain taxes for companies investing in and operating renewable energy assets.

- Renewable Energy Certificates (RECs): Marketable instruments representing the environmental attributes of renewable energy generation, which can be sold to utilities or other entities to meet their renewable energy obligations.

International Operations Revenue

Huaneng Power International's international operations are a significant revenue driver, with power generation and sales in key overseas markets contributing to its consolidated financial performance. For instance, its investments in Singapore and Pakistan represent substantial income streams from electricity sales in these regions.

These international ventures allow the company to diversify its revenue base beyond its domestic operations. In 2023, Huaneng Power International reported that its overseas power generation assets played a crucial role in its overall revenue structure, although specific segment reporting for international operations revenue is often embedded within broader financial disclosures.

- Overseas Power Generation: Revenue derived from selling electricity produced by power plants located outside of mainland China.

- Key Markets: Operations in countries like Singapore and Pakistan are notable contributors.

- Consolidated Impact: International revenue forms a part of the company's total operating revenue, enhancing its financial stability.

Beyond bulk electricity sales, Huaneng Power International diversifies revenue through selling thermal energy to industrial and commercial clients, enhancing its income stability. This co-generation capability, particularly from its thermal plants, provides a valuable secondary revenue stream.

Capacity charges are another key revenue source, compensating Huaneng for maintaining power generation readiness for grid operators, crucial for grid reliability. In 2023, these availability payments contributed meaningfully to its overall financial performance.

Government incentives, including subsidies and feed-in tariffs for renewable energy projects, significantly bolster revenue. These policies are vital for the economic viability of its wind and solar ventures, with the company actively expanding its clean energy portfolio.

International operations, such as power generation in Singapore and Pakistan, represent a growing revenue segment, contributing to the company's diversified income base and overall financial strength.

| Revenue Stream | Description | 2023 Relevance |

|---|---|---|

| Electricity Sales | Bulk sales to national/regional grid operators | Primary revenue driver |

| Thermal Energy Sales | Heat sales from co-generation plants | Diversifies income, supports industrial/commercial clients |

| Capacity Charges | Payments for maintaining generation readiness | Contributes to revenue, ensures grid stability |

| Government Incentives | Subsidies, FiTs for renewables | Supports clean energy growth, enhances profitability |

| International Operations | Power generation/sales abroad | Diversifies revenue base, key markets include Singapore and Pakistan |

Business Model Canvas Data Sources

The Huaneng Power International Business Model Canvas is built using financial disclosures, operational performance data, and market research reports. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's strategic positioning.