Huaneng Power International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huaneng Power International Bundle

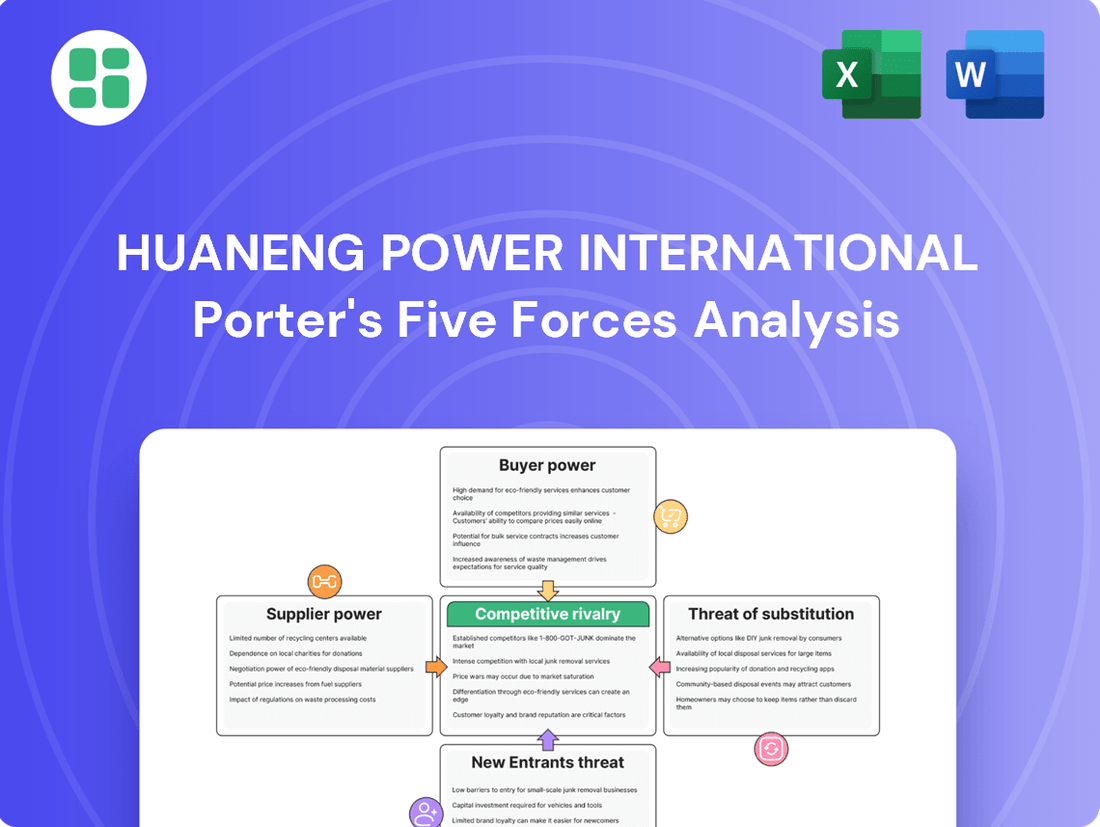

Huaneng Power International navigates a competitive landscape shaped by significant buyer power and moderate threats from new entrants. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Huaneng Power International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Huaneng Power International, a significant player in China's energy sector, faces considerable supplier bargaining power due to the concentrated nature of its critical input providers. The company's reliance on a limited number of coal suppliers within China, coupled with the global scarcity of manufacturers for specialized power generation equipment like advanced turbines and renewable energy components, grants these suppliers substantial leverage. For instance, in 2023, the price of thermal coal, a primary fuel for Huaneng, experienced volatility, directly impacting operational costs and reflecting the influence of key mining enterprises.

Huaneng Power International is actively reducing its dependence on coal by expanding its renewable energy sources like hydro, wind, and solar. This strategic shift directly counters the bargaining power of coal suppliers, as the company is no longer solely reliant on them for fuel. For instance, in 2023, Huaneng's non-coal power generation capacity continued to grow, representing a significant portion of its total installed capacity, a trend expected to accelerate through 2024.

Switching costs for Huaneng can be substantial, particularly for its established coal-fired power generation assets. These plants often rely on specific coal grades and require maintenance from specialized equipment manufacturers, making it costly and disruptive to change suppliers.

However, Huaneng's strategic pivot towards renewable energy offers a different landscape. For new solar and wind projects, the company benefits from a more globalized and competitive market for components like solar panels and wind turbines. This increased competition generally translates to lower switching costs for these newer, cleaner energy sources.

In 2024, Huaneng continued its significant investments in renewable energy, with a substantial portion of its new capacity additions coming from wind and solar. This diversification strategy inherently mitigates some of the supplier bargaining power associated with its legacy coal assets, by building flexibility into its future supply chains.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers for Huaneng Power International is somewhat constrained by the limited likelihood of forward integration. It's generally improbable for Huaneng's core suppliers, such as coal mining companies or equipment manufacturers, to move into large-scale electricity generation and distribution. This is due to the enormous capital needed, the intricate regulatory landscape, and the fact that China's power grid is largely controlled by the state. This significantly reduces a major avenue for suppliers to exert power.

While direct forward integration by primary suppliers is unlikely, some large state-owned enterprises in China may possess diversified energy interests. This diversification could potentially offer them leverage, although the direct threat of entering Huaneng's core business remains low. The immense scale and capital intensity of power generation act as a substantial barrier to entry for most suppliers.

- Limited Forward Integration: Primary suppliers like coal miners and equipment manufacturers face high barriers to entering electricity generation, due to capital, regulation, and state control of the grid.

- State Dominance: China's power sector is heavily state-regulated and dominated, making it difficult for private or supplier-driven entities to establish large-scale generation operations.

- Diversified Interests: Some large state-owned enterprises might have broader energy portfolios, which could indirectly influence their bargaining position, though not through direct forward integration into Huaneng's core operations.

- Capital Intensity: The sheer scale of investment required for power generation and distribution significantly deters most suppliers from attempting to integrate forward into Huaneng's market.

Importance of Huaneng to Suppliers

Huaneng Power International's immense scale as one of China's largest power generators, boasting a significant installed capacity, makes it a vital customer for many suppliers. This substantial purchasing volume inherently gives Huaneng leverage, as suppliers often depend on its business to maintain their own operational stability and growth. For instance, Huaneng's large-scale procurement tenders for essential components like photovoltaic (PV) modules underscore its considerable market influence.

The company's substantial demand for equipment and services means that suppliers prioritize securing contracts with Huaneng. This reliance can temper the suppliers' inherent bargaining power, as they are motivated to offer competitive terms to secure or retain Huaneng's business. Maintaining a strong relationship is therefore a key strategic consideration for these suppliers.

- Huaneng's Installed Capacity: As of the end of 2023, Huaneng Power International reported a total installed capacity of approximately 233.6 gigawatts (GW), highlighting its significant operational footprint.

- Procurement Scale: The company regularly issues large tenders for critical equipment, such as PV modules, with individual tenders often involving substantial quantities, demonstrating its purchasing power.

- Supplier Dependence: Many suppliers in the power generation sector derive a significant portion of their revenue from contracts with major players like Huaneng, making their relationship crucial for supplier stability.

The bargaining power of suppliers for Huaneng Power International is influenced by the concentration of its input providers and the switching costs involved. While Huaneng's scale provides leverage, its reliance on specialized equipment and specific coal grades can empower certain suppliers. However, Huaneng's strategic shift towards renewables is diversifying its supplier base and potentially lowering future switching costs.

Huaneng's significant installed capacity, reaching approximately 233.6 GW by the end of 2023, makes it a crucial customer for many suppliers, thus granting it considerable purchasing power. This is evident in its large-scale procurement tenders for essential components like photovoltaic (PV) modules. Suppliers often prioritize securing contracts with Huaneng to ensure their own operational stability and growth, which can temper their bargaining leverage.

| Supplier Type | Key Inputs/Equipment | Huaneng's Leverage Factor | Supplier Bargaining Power Factor |

|---|---|---|---|

| Coal Mining Companies | Thermal Coal | Large procurement volume | Concentration of suppliers, price volatility (e.g., 2023 coal price fluctuations) |

| Equipment Manufacturers | Turbines, PV modules, wind turbines | Significant demand for new projects | Specialization of equipment, global supply chain dynamics |

What is included in the product

This analysis of Huaneng Power International's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Effortlessly identify and address competitive threats by visualizing the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Huaneng Power International's customer base is highly concentrated, primarily consisting of large-scale electricity consumers. These include provincial grid operators and major industrial enterprises within China. This concentration means a few key buyers wield considerable influence.

The Chinese power grid is largely dominated by a few state-owned entities. This structure grants these concentrated buyers significant bargaining power. They can effectively negotiate electricity prices and procurement terms with power generators like Huaneng.

For instance, in 2023, the top five provincial grid operators accounted for over 60% of Huaneng's electricity sales. This reliance on a limited number of large customers amplifies their ability to demand favorable pricing and contract conditions, thereby reducing Huaneng's pricing flexibility.

Electricity is a fundamental necessity, but for many, especially large industrial consumers and the national grid operator, it's also a commodity. This often translates to high price sensitivity. For instance, in 2023, industrial electricity consumption represented a significant portion of total demand in China, making these users particularly watchful of cost fluctuations.

Moreover, the Chinese regulatory environment significantly impacts pricing. Government agencies set or heavily influence electricity tariffs, which directly curtails Huaneng's pricing power. This regulatory oversight amplifies customer price sensitivity, as they are less exposed to market-driven price volatility and more to administered rates.

Customer switching costs for Huaneng Power International are generally high for most end-users. The integrated nature of China's national grid and regulated supply make it practically impossible for individual consumers to switch electricity providers.

For large industrial clients, however, some limited flexibility exists. These entities might explore negotiating direct power purchase agreements with generators or consider investing in their own distributed generation solutions, effectively creating an alternative sourcing option.

In 2024, China's electricity market continued to see policy shifts aimed at increasing marketization, but the fundamental infrastructure limitations for widespread customer switching remained.

Customer's Ability to Backward Integrate

Huaneng's customers generally find it impractical to backward integrate into large-scale power generation. The immense capital requirements, specialized technical knowledge, and complex regulatory hurdles for establishing and running power plants significantly limit this threat. This barrier effectively reduces the likelihood of customers becoming their own power suppliers, thereby strengthening Huaneng's position.

While full-scale backward integration is rare, some very large industrial entities might consider developing smaller, captive power generation facilities. This could be driven by specific energy needs or a desire for greater control over their power supply. However, these are typically niche scenarios and do not represent a widespread threat to Huaneng's core business model.

- High Capital Expenditure: Building a single large-scale power plant can cost billions of dollars, a prohibitive sum for most customers. For instance, a typical 1,000 MW coal-fired power plant in China could cost upwards of $1.5 billion USD as of recent estimates.

- Technical Expertise Gap: Operating power plants requires highly specialized engineering and operational skills, which most customer industries do not possess in-house.

- Regulatory Complexity: Obtaining permits and adhering to environmental and safety regulations for power generation is a significant undertaking, often requiring dedicated teams.

Availability of Information to Customers

Customers, particularly large industrial users and grid operators, now possess more data than ever about energy prices, generation capabilities, and market dynamics. This increased transparency, driven by regulatory efforts and market liberalization, significantly narrows the information gap that once favored power producers.

For instance, in 2024, many energy markets saw the widespread adoption of real-time pricing and data platforms, allowing consumers to track fluctuations and generation sources. This empowers them to make informed decisions and negotiate better terms, directly impacting Huaneng Power International's pricing power.

- Increased Transparency: Energy markets are becoming more open, giving customers better insights into pricing and generation.

- Reduced Information Asymmetry: Customers, especially large ones, can now access data previously held by utilities.

- Enhanced Negotiation Power: With more information, customers are better equipped to bargain for favorable electricity rates and contract terms.

Huaneng Power International faces significant customer bargaining power due to the concentrated nature of its buyer base, primarily provincial grid operators and large industrial clients in China. These entities, often state-owned, can leverage their scale to negotiate favorable electricity prices and contract terms. For example, in 2023, the top five provincial grid operators represented over 60% of Huaneng's electricity sales, underscoring their influence.

The commodity nature of electricity and high customer price sensitivity, particularly among industrial users who constituted a substantial portion of demand in 2023, further empower these buyers. Government-regulated tariffs also limit Huaneng's pricing flexibility, as customers are less exposed to market-driven volatility. While switching costs are high for most, large industrial customers may explore limited alternatives like direct power purchase agreements or captive generation, though these are niche scenarios.

Increased transparency in the energy market, with platforms offering real-time pricing and generation data in 2024, has also narrowed the information gap, enhancing customer negotiation leverage. Customers can now access data previously held by utilities, allowing them to bargain more effectively for better rates and contract conditions.

| Factor | Impact on Huaneng | 2023/2024 Data/Observation |

| Customer Concentration | High Bargaining Power | Top 5 provincial grid operators accounted for >60% of sales in 2023. |

| Price Sensitivity | Reduced Pricing Flexibility | Industrial users are cost-conscious; electricity is a commodity. |

| Switching Costs | Generally High, but limited for large industrials | Limited alternatives for most; niche options for large clients. |

| Information Asymmetry | Decreased Leverage for Huaneng | Real-time data platforms in 2024 empower informed negotiation. |

Full Version Awaits

Huaneng Power International Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Huaneng Power International's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive assessment provides actionable insights into the strategic positioning of Huaneng Power International within the global energy sector.

Rivalry Among Competitors

Huaneng Power International operates within China's vast power generation sector, a landscape populated by numerous large state-owned enterprises (SOEs) and independent power producers. This sheer volume of significant players, beyond just Huaneng, fuels a highly competitive environment. For instance, in 2023, China's total installed power generation capacity reached approximately 2,920 gigawatts, with major SOEs like China Datang Corporation, China Huadian Corporation, and China Power Investment Corporation holding substantial portions of this capacity, directly challenging Huaneng for market share and new development projects.

China's power industry is experiencing robust growth, fueled by ongoing economic development and a rising demand for electricity. By the close of 2024, the nation's total installed power generation capacity is projected to surpass 3,400 GW, with expectations to exceed 3,600 GW by 2025. This expansion presents significant opportunities for market participants.

However, this growth is accompanied by intensified competition, particularly within the clean energy sector. The rapid build-out of renewable energy sources, with solar and wind capacity alone reaching an impressive 1,407 GW by the end of 2024, has already surpassed targets set for 2030. This surge in green energy capacity creates a more crowded competitive landscape for companies like Huaneng Power International.

Electricity, for the most part, is a commodity, making it tough for companies like Huaneng Power International to stand out based on product features alone. This often pushes competition towards price and dependable service delivery.

In 2024, the global electricity market continues to grapple with this, with price often being the primary deciding factor for many consumers, particularly in regulated sectors. While Huaneng is investing in cleaner energy sources, which does offer a degree of differentiation, the fundamental nature of electricity as a utility means its core offering remains largely similar across providers.

High Fixed Costs and Exit Barriers

The power generation sector, including companies like Huaneng Power International, is characterized by substantial upfront investments in infrastructure. These capital expenditures, often running into billions of dollars for a single power plant, translate into very high fixed costs. For instance, the construction of a new coal-fired power plant in China can cost upwards of $1 billion USD, and offshore wind farms can exceed $2 billion USD.

These high fixed costs, combined with the critical nature of energy provision and the specialized assets involved, erect significant exit barriers. Companies find it extremely difficult and costly to divest themselves of these assets, making them more inclined to continue operating and competing even when market conditions are unfavorable. This often leads to prolonged periods of intense rivalry as firms fight to cover their fixed operational expenses.

- High Capital Intensity: Power generation requires massive, long-term investments in plants and equipment, creating a capital-intensive industry.

- Significant Exit Barriers: Specialized infrastructure and the strategic importance of energy supply make it difficult and expensive for companies to leave the market.

- Intensified Rivalry: The combination of high fixed costs and exit barriers encourages existing players to remain competitive, even during economic downturns, thus increasing rivalry among them.

Strategic Stakes

For major players like Huaneng Power International, the strategic stakes are incredibly high. As state-backed entities or critical contributors to national energy security and carbon neutrality objectives, their actions have significant national implications.

This elevated importance fuels aggressive competition. Companies vie fiercely for new projects, capacity expansion opportunities, and market share, often with substantial government backing in the form of policies and financing.

- High Strategic Stakes: Huaneng Power International, like many of its peers, operates in a sector vital for national energy security and achieving carbon neutrality targets.

- Aggressive Competition: The drive for new projects and market share is intense, with companies actively seeking to expand their operational footprint.

- Government Support: State backing often translates into favorable policies and access to financing, intensifying the competitive landscape.

- Market Share Focus: Companies are driven to secure a larger portion of the energy market, particularly as the energy transition accelerates.

The competitive rivalry within China's power sector, where Huaneng Power International operates, is intense due to the presence of numerous large state-owned enterprises and independent power producers. This fierce competition is further amplified by the commodity nature of electricity, pushing firms to compete primarily on price and service reliability. With China's installed power generation capacity projected to exceed 3,400 GW by the end of 2024, the market is crowded with major players vying for market share and development opportunities, particularly in the rapidly expanding clean energy segment.

| Competitor | Approximate Installed Capacity (GW) - 2023 | Focus Areas |

|---|---|---|

| China Datang Corporation | ~200 GW | Coal, Renewables, Hydropower |

| China Huadian Corporation | ~190 GW | Coal, Hydropower, Renewables |

| China Power Investment Corporation (now SPIC) | ~180 GW | Coal, Hydropower, Renewables, Nuclear |

| Huaneng Power International | ~230 GW | Coal, Renewables, Hydropower |

SSubstitutes Threaten

Distributed energy generation, like rooftop solar, is the main substitute for electricity from large power plants. This sector saw significant growth, with global solar capacity reaching over 1,300 GW by the end of 2023, according to the International Energy Agency.

While these alternatives are expanding, they currently don't fully replace the consistent, baseload power provided by major utilities such as Huaneng Power International. For instance, intermittent solar generation still requires grid backup for reliability, limiting its immediate impact as a complete substitute.

The price and performance of substitutes for traditional power generation, such as distributed solar, are rapidly improving. Declining costs for solar photovoltaic (PV) modules, a trend that continued strongly into 2024, coupled with supportive government incentives, are making these alternatives increasingly competitive. For instance, by the end of 2023, the global average cost for utility-scale solar PV had fallen by over 80% compared to a decade prior.

China's commitment to expanding renewable energy consumption, outlined in its national plans, further enhances the viability of substitutes. These initiatives aim to significantly increase the share of renewables in the energy mix, directly challenging the market position of incumbent power providers like Huaneng Power International.

Customer propensity to substitute for Huaneng Power International's services is shaped by several key drivers. Energy independence aspirations, growing environmental consciousness, and the allure of economic incentives all play a significant role in how readily customers consider alternatives.

While large industrial users might investigate self-generation options to enhance reliability or achieve cost efficiencies, this remains a niche consideration. For instance, in 2024, while distributed solar installations saw growth, they still accounted for a small fraction of overall energy consumption for major industries compared to grid reliance.

The overwhelming majority of residential and commercial customers, however, continue to be dependent on the stability and convenience of grid electricity. This reliance limits their practical ability to substitute away from traditional power providers like Huaneng Power International, especially given the significant upfront investment and technical expertise required for alternative energy solutions.

Technological Advancements in Substitutes

Technological advancements are significantly bolstering the threat of substitutes for traditional power generation. Innovations in energy storage, such as improvements in battery density and cost reductions, make intermittent renewables more reliable. For instance, by the end of 2023, global energy storage capacity reached over 250 GW, a substantial increase from previous years, indicating a growing market for these alternatives.

Smart grid technologies and distributed generation solutions, like rooftop solar, are also increasing consumer energy self-sufficiency. These systems allow individuals and businesses to generate and manage their own power, lessening their dependence on large, centralized power plants. By early 2024, the installed capacity of distributed solar power globally continued its upward trajectory, demonstrating a tangible shift in energy consumption patterns.

- Energy Storage Advancements: Innovations in battery technology are making energy storage more cost-effective and efficient, supporting renewable energy integration.

- Smart Grid Development: The rollout of smart grids enhances the management and utilization of decentralized energy resources, improving grid flexibility.

- Distributed Generation Growth: Rooftop solar and other localized power sources empower consumers to generate their own electricity, reducing reliance on traditional utilities.

- Increased Feasibility: These technological leaps make alternative energy solutions increasingly practical and attractive, posing a growing threat to established power providers.

Regulatory and Policy Support for Substitutes

The Chinese government's strong push for renewable energy directly fuels the threat of substitutes for traditional power generators like Huaneng Power International. Ambitious targets, such as aiming for non-fossil fuel sources to account for approximately 80% of primary energy consumption by 2060, underscore this commitment.

Policies favoring distributed generation and energy efficiency are accelerating the adoption of alternatives. For instance, China's National Energy Administration has been actively promoting rooftop solar installations and smart grid technologies, which allow consumers to generate and manage their own power, thereby reducing reliance on large, centralized power plants.

The concept of a 'new power system' being developed in China further supports substitutes by integrating advanced technologies and flexible resources. This system aims to accommodate a higher penetration of renewables and digital solutions, potentially diminishing the market share of conventional power generation. In 2023, China's installed renewable energy capacity reached 1.5 billion kilowatts, a significant increase that highlights the growing momentum of these substitutes.

- Government Mandates: China's national energy strategy prioritizes renewable energy growth, setting clear targets for its expansion.

- Policy Incentives: Subsidies and favorable regulations for distributed solar, wind power, and energy storage technologies encourage their adoption.

- Technological Advancements: Ongoing improvements in renewable energy efficiency and grid integration technologies make substitutes more competitive.

- Market Reforms: The development of a new power system emphasizes flexibility and market-based mechanisms, which can benefit distributed and renewable energy sources.

The threat of substitutes for Huaneng Power International is growing, driven by advancements in distributed energy generation like rooftop solar. Global solar capacity surpassed 1,300 GW by the end of 2023, with costs continuing to fall, making alternatives more competitive. While these substitutes are expanding, they still face challenges in fully replacing the consistent power provided by large utilities.

Technological progress in energy storage, with global capacity exceeding 250 GW by late 2023, is enhancing the reliability of intermittent renewables. Smart grid development further supports decentralized energy resources, allowing consumers greater energy self-sufficiency. This trend is amplified by China's strong policy support for renewables, aiming for non-fossil fuels to reach 80% of primary energy consumption by 2060.

| Substitute Type | Key Driver | 2023/2024 Data Point |

|---|---|---|

| Distributed Solar | Declining Costs & Government Incentives | Global solar capacity > 1,300 GW (end 2023); Utility-scale solar PV costs down >80% in a decade. |

| Energy Storage | Improved Battery Technology & Efficiency | Global energy storage capacity > 250 GW (end 2023). |

| Smart Grid Technologies | Enhanced Grid Flexibility & Consumer Self-Sufficiency | Continued global rollout and adoption of smart meters and grid management systems. |

Entrants Threaten

The power generation sector is inherently capital-intensive, demanding substantial upfront investments for land acquisition, constructing power plants, and acquiring specialized equipment. For instance, building a new large-scale solar farm can easily cost hundreds of millions of dollars, while a nuclear power plant can run into tens of billions. This immense financial hurdle acts as a significant deterrent for new companies looking to enter the market, particularly for large-scale conventional or renewable energy projects.

The Chinese power sector presents significant barriers to entry due to stringent regulatory requirements. New entrants must navigate a complex web of permits, licenses, and evolving environmental standards, which can be costly and time-consuming to obtain.

The recently enacted Energy Law, effective from January 2025, further solidifies these hurdles. While it aims to bolster energy security and encourage renewable energy growth, its emphasis on controlled development and intricate approval processes makes it exceptionally difficult for new companies to establish a foothold in the market.

New entrants to China's power sector face substantial hurdles in securing grid access, a critical component for any power generation business. The national grid is largely controlled by state-owned enterprises, making it difficult for new players to establish seamless and reliable connections. This control significantly limits the ability of new entrants to transmit their generated electricity to consumers.

For instance, in 2024, the expansion of renewable energy projects, while a national priority, still encountered delays in grid integration. These delays are often attributed to the complex approval processes and the need for significant infrastructure upgrades to accommodate new capacity, especially from intermittent sources like solar and wind. Ensuring sufficient transmission capacity is a major capital expenditure and a protracted undertaking.

Economies of Scale

Huaneng Power International, like other established utilities, enjoys substantial economies of scale. This means they can spread their fixed costs, such as building and maintaining power plants, over a much larger output. For instance, in 2023, Huaneng Power International reported total assets of ¥787.6 billion, reflecting its massive operational footprint.

Newcomers face a significant hurdle in matching these cost efficiencies. To compete, they would need to make massive upfront investments to build a comparable scale of operations, which is a considerable barrier to entry. Without this scale, their per-unit costs for fuel procurement, plant operation, and maintenance would be considerably higher than those of incumbents like Huaneng.

This cost disadvantage makes it difficult for new entrants to offer competitive pricing, thereby limiting the threat they pose. The sheer capital required to achieve scale essentially acts as a protective moat for existing, large-scale power generators.

- Economies of Scale: Established players like Huaneng Power International leverage significant cost advantages due to their large operational capacity in procurement, operations, and maintenance.

- Capital Investment Barrier: New entrants require substantial initial investment to achieve comparable cost efficiencies, presenting a high barrier to entry.

- Cost Disadvantage for Newcomers: Without achieving similar scale, new entrants face higher per-unit costs, hindering their ability to compete on price.

- Asset Base: Huaneng Power International's total assets of ¥787.6 billion as of 2023 underscore the scale advantage incumbents possess.

Incumbency Advantages and Brand Loyalty

Existing power producers like Huaneng Power International leverage significant incumbency advantages. These include deeply entrenched relationships with government regulators, financial institutions, and large industrial customers, built over years of operation. For instance, by the end of 2023, Huaneng Power International reported total assets of approximately RMB 990 billion, showcasing its substantial established infrastructure.

While direct brand loyalty in the electricity sector differs from consumer goods, the proven track record, operational efficiency, and extensive existing infrastructure of incumbents like Huaneng present a substantial hurdle for new entrants. This reliability and established presence translate into a lower perceived risk for customers, making it difficult for newcomers to gain market share quickly.

- Incumbency Advantage: Established relationships with government and financial institutions foster favorable operating conditions.

- Brand Loyalty (Reliability): Proven operational history and infrastructure build trust and reduce perceived risk for customers.

- Infrastructure Barrier: The sheer scale of existing power generation and distribution networks is a significant capital and time investment for new players.

- Regulatory Familiarity: Incumbents possess deep understanding and experience navigating complex energy regulations, a hurdle for new entrants.

The threat of new entrants for Huaneng Power International is generally low. The immense capital required for power plant construction, exceeding hundreds of millions for solar and billions for nuclear, creates a significant financial barrier. Furthermore, navigating China's complex regulatory landscape, including permits and evolving environmental standards, presents substantial time and cost challenges for newcomers. The recent Energy Law, effective January 2025, further tightens development controls, making market entry exceptionally difficult.

Securing grid access is another major obstacle, as the national grid is largely controlled by state-owned enterprises, complicating reliable transmission for new players. For example, in 2024, renewable energy projects faced grid integration delays due to complex approvals and infrastructure upgrade needs. This difficulty in connecting to the grid significantly limits the ability of new entrants to deliver their power to consumers.

Economies of scale enjoyed by incumbents like Huaneng Power International, evidenced by its 2023 total assets of ¥787.6 billion, mean new entrants struggle to match cost efficiencies. Without comparable scale, their per-unit costs for operations and maintenance are higher, hindering competitive pricing. This cost disadvantage, coupled with the need for massive upfront investment to achieve scale, acts as a strong deterrent.

Incumbency advantages, including established relationships with regulators and customers, and a proven track record, further reduce the threat. Huaneng's substantial infrastructure, with total assets nearing RMB 990 billion by the end of 2023, provides a reliability advantage that new entrants find difficult to replicate quickly.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Huaneng Power International is built upon a foundation of publicly available information, including the company's annual reports and SEC filings. We supplement this with data from reputable industry research firms and economic databases to provide a comprehensive view of the competitive landscape.