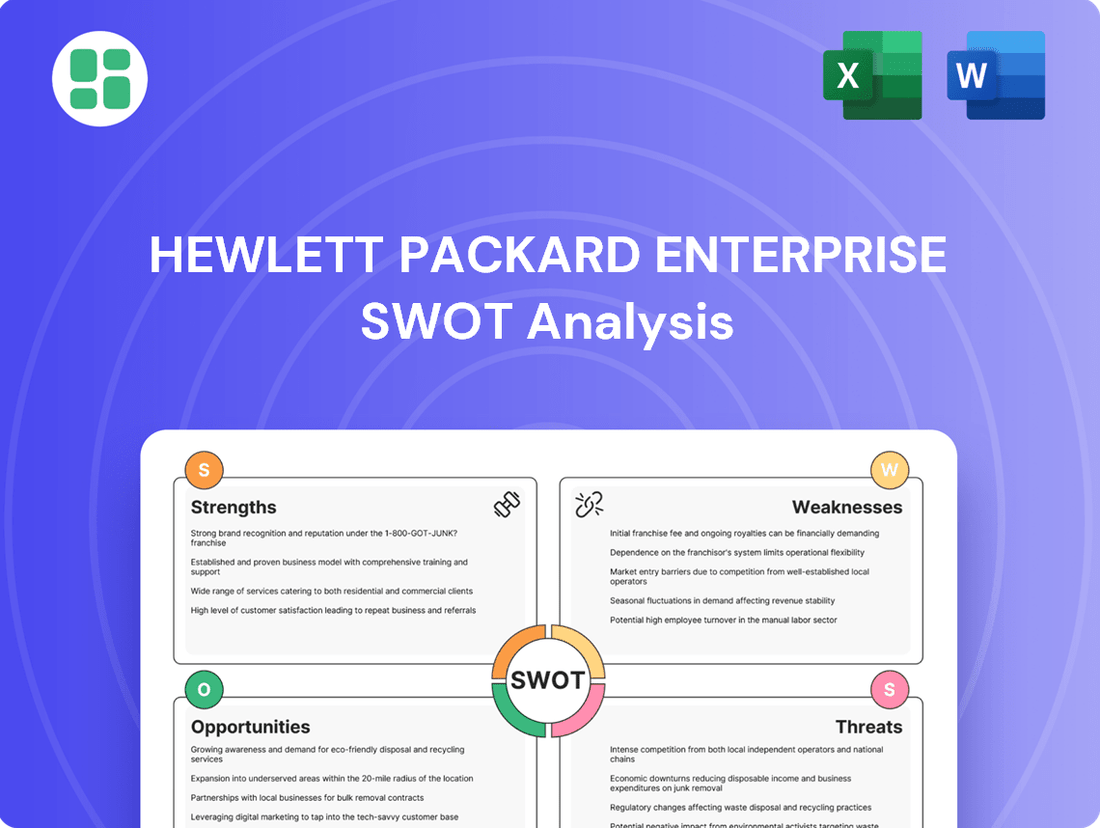

Hewlett Packard Enterprise SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hewlett Packard Enterprise Bundle

Hewlett Packard Enterprise (HPE) boasts significant strengths in its hybrid cloud solutions and strong enterprise relationships, but faces intense competition and the challenge of adapting to rapid technological shifts. Our full SWOT analysis dives deep into these dynamics, providing a comprehensive understanding of their market position and future outlook.

Want the full story behind HPE's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hewlett Packard Enterprise (HPE) leverages a deeply ingrained brand legacy, synonymous with technological innovation and unwavering reliability. This strong recognition is a significant asset in the competitive IT landscape.

HPE's global footprint is truly expansive, with operations in over 170 countries. This vast network is supported by a robust distribution system, enabling broad market penetration and consistent service delivery worldwide.

Hewlett Packard Enterprise (HPE) boasts a diverse product portfolio encompassing servers, storage, networking, software, and cloud services. This broad offering allows HPE to provide integrated solutions catering to a wide array of enterprise IT needs. For instance, in fiscal year 2023, HPE reported significant growth in its Intelligent Edge segment, demonstrating the strength of its diversified approach.

HPE's commitment to innovation is a significant strength, demonstrated by its substantial and consistent investment in research and development. This focus allows the company to stay ahead of the curve, developing advanced technologies that meet the dynamic needs of businesses.

The company’s strategic pivot towards areas like hybrid cloud, AI, and edge computing underscores its ability to adapt and capitalize on emerging market trends. For instance, in fiscal year 2023, HPE reported significant growth in its Intelligent Edge segment, highlighting the success of its R&D investments in driving new business opportunities.

Growing AI and Hybrid Cloud Momentum

Hewlett Packard Enterprise (HPE) is capitalizing on the significant growth in AI and hybrid cloud demand. The company's GreenLake platform, central to its as-a-service approach, is a key driver of this momentum. This strategy is clearly resonating with customers, as evidenced by its strong financial performance.

HPE's GreenLake platform has shown impressive Annualized Revenue Run-Rate (ARR) growth, reaching $14.7 billion in Q1 FY24. This surge reflects increasing customer adoption of HPE's consumption-based, subscription model, which offers flexibility and scalability for modern IT needs, particularly in AI and hybrid cloud deployments.

- AI Infrastructure Demand: HPE is well-positioned to meet the escalating need for powerful computing infrastructure required for artificial intelligence workloads.

- Hybrid Cloud Growth: The company's offerings are designed to seamlessly integrate and manage resources across private, public, and edge environments, aligning with the hybrid cloud trend.

- GreenLake ARR: As of Q1 FY24, HPE's GreenLake ARR reached $14.7 billion, showcasing strong customer commitment to its as-a-service model.

Strategic Partnerships and Collaborations

Hewlett Packard Enterprise (HPE) actively cultivates strategic partnerships with major technology players like Microsoft, Intel, and NVIDIA. These alliances are crucial for creating comprehensive solutions and staying ahead in the competitive landscape. For instance, HPE's collaboration with NVIDIA on the HPE Private Cloud AI offering highlights how these partnerships drive innovation.

These collaborations are not merely about co-development; they also expand HPE's market reach and technological capabilities. By integrating its offerings with those of its partners, HPE can deliver more complete and compelling solutions to a wider customer base, reinforcing its position in key markets.

- Strategic Alliances: Partnerships with Microsoft, Intel, and NVIDIA.

- Integrated Solutions: Focus on co-developing comprehensive technology offerings.

- Innovation Driver: Collaborations fuel advancements like HPE Private Cloud AI.

- Market Expansion: Alliances enhance reach and provide access to new customer segments.

HPE's GreenLake platform continues to be a major strength, demonstrating robust growth and customer adoption. The company's strategic focus on hybrid cloud and AI infrastructure positions it well for future market demands.

HPE's strong brand recognition and extensive global presence provide a significant competitive advantage, enabling broad market reach and reliable service delivery.

The company's diverse product portfolio, coupled with a commitment to R&D, allows it to offer integrated solutions and adapt to emerging technological trends.

Strategic partnerships with key industry players further enhance HPE's ability to innovate and expand its market influence.

| Key Strength | Description | Supporting Data (as of Q1 FY24) |

| GreenLake Platform | HPE's as-a-service offering, driving consumption-based IT. | Annualized Revenue Run-Rate (ARR) reached $14.7 billion. |

| AI & Hybrid Cloud Focus | Strategic alignment with high-growth market trends. | Significant growth reported in Intelligent Edge segment (FY23). |

| Global Reach & Brand | Extensive operational presence and strong market recognition. | Operations in over 170 countries. |

| Product Diversification | Comprehensive IT solutions catering to enterprise needs. | Portfolio includes servers, storage, networking, software, and cloud services. |

| Strategic Partnerships | Collaborations with tech leaders for integrated solutions. | Partnerships with Microsoft, Intel, and NVIDIA, including HPE Private Cloud AI. |

What is included in the product

Offers a full breakdown of Hewlett Packard Enterprise’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Uncovers critical competitive advantages and potential threats for proactive risk mitigation.

Weaknesses

Hewlett Packard Enterprise (HPE) has grappled with persistent margin pressures, notably seeing a decline in gross margins in recent fiscal periods. This squeeze on profitability is a significant weakness.

For instance, in its fiscal second quarter of 2024, HPE reported a gross margin of 26.1%, a slight decrease from the previous year, reflecting the impact of these challenges. These pressures are exacerbated by substantial strategic investments in research and development, ongoing efforts to reconfigure its supply chain, and the considerable costs tied to its restructuring and cost-reduction initiatives.

Hewlett Packard Enterprise's (HPE) vast global operations and wide array of products inherently create significant operational complexity. Managing this intricate network requires substantial resources and can lead to inefficiencies.

Despite efforts to diversify, HPE's reliance on hardware sales remains a key weakness. In fiscal year 2023, hardware, including servers, storage, and networking, still represented a significant portion of its revenue, making the company vulnerable to the cyclical nature and intense price competition within this market.

Hewlett Packard Enterprise (HPE) operates in a highly competitive enterprise IT market. Established players like Dell Technologies, Cisco Systems, and IBM present significant challenges, alongside powerful cloud providers such as Amazon Web Services (AWS) and Microsoft Azure, which are rapidly expanding their offerings.

This intense rivalry demands constant innovation from HPE to maintain its edge. For instance, in fiscal year 2023, HPE reported revenue of $29.1 billion, a slight increase from $28.5 billion in fiscal year 2022, indicating the ongoing effort to grow amidst this competition.

The pressure to innovate and compete can lead to significant price wars, potentially impacting HPE's market share and overall profitability. This dynamic requires strategic pricing and product differentiation to succeed.

Execution Risks in Acquisitions

Hewlett Packard Enterprise's (HPE) track record with acquisitions presents a mixed bag, highlighting potential execution challenges. The company's history includes integrations that have not always yielded the expected synergies or financial benefits, creating a cautionary backdrop for future deals.

The proposed acquisition of Juniper Networks, valued at approximately $14 billion, is a significant undertaking that introduces substantial execution risks. While strategically aimed at bolstering HPE's networking capabilities, the integration process itself is complex.

- Potential Revenue Dissynergies: Overlap in product portfolios between HPE and Juniper could lead to customers consolidating spending, resulting in revenue loss rather than growth.

- Integration Complexities: Merging disparate IT systems, sales forces, and corporate cultures presents significant operational hurdles that can derail expected cost savings and revenue enhancements.

- Key Talent Retention: Ensuring the retention of critical engineering and sales talent from Juniper is crucial for a smooth transition and continued innovation, but this is often a challenge in large-scale mergers.

- Market Disruption: Competitors may exploit integration disruptions to gain market share, further complicating HPE's ability to realize the full value of the Juniper acquisition.

Vulnerability to Economic Uncertainties and Supply Chain Issues

Hewlett Packard Enterprise (HPE) operates on a global scale, making it inherently vulnerable to the ebb and flow of worldwide economic conditions. Fluctuations in global GDP, trade disputes, and geopolitical tensions can directly influence the IT spending budgets of businesses, creating a ripple effect on HPE's revenue streams. For instance, a slowdown in major economies during 2024 could dampen demand for enterprise solutions.

The company has also faced significant headwinds from ongoing supply chain disruptions. These persistent constraints have impacted HPE's ability to secure essential components and ensure timely product delivery to its customers. This was particularly evident in late 2023 and early 2024, where lead times for certain hardware components saw an increase, affecting order fulfillment and potentially customer satisfaction.

- Economic Sensitivity: HPE's reliance on enterprise IT spending makes it susceptible to economic downturns, with analysts predicting a modest global IT spending growth of around 6.8% for 2024, down from previous years' higher rates, indicating potential headwinds.

- Supply Chain Volatility: Persistent semiconductor shortages and logistics challenges continued to affect hardware manufacturers like HPE through early 2024, leading to extended lead times and impacting inventory management.

- Geopolitical Risks: Trade tensions and regional conflicts can disrupt global trade routes and impact component sourcing, posing a direct threat to HPE's operational efficiency and cost structures.

HPE's reliance on hardware sales, despite diversification efforts, remains a key vulnerability. In fiscal year 2023, hardware still constituted a substantial portion of its revenue, exposing the company to the cyclical nature and intense price competition inherent in this sector.

Preview Before You Purchase

Hewlett Packard Enterprise SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Hewlett Packard Enterprise SWOT analysis you see here is the exact file that will be available after your purchase, offering a comprehensive overview of their strategic position.

Opportunities

HPE is well-positioned to capitalize on the surging demand for hybrid cloud solutions, with its GreenLake platform acting as a key driver. This offers a significant growth opportunity by catering to businesses seeking flexible, on-premises infrastructure managed as a service.

The consumption-based model of GreenLake is particularly attractive, fostering predictable, recurring revenue. HPE reported its Annualized Revenue Run-Rate (ARR) grew by 26% year-over-year to $14.1 billion in Q2 2024, showcasing the platform's increasing adoption and financial traction.

The market for AI and high-performance computing (HPC) is experiencing unprecedented growth, presenting a significant opportunity for HPE. This surge is driven by the increasing adoption of AI across industries, from advanced analytics to generative AI applications. HPE is well-positioned to capitalize on this trend through its robust portfolio of servers, storage, and networking solutions tailored for demanding AI workloads.

HPE's strategic focus on AI infrastructure, including its Cray supercomputing lineage and its AI platform software, directly addresses this escalating demand. For instance, in fiscal year 2023, HPE's High Performance Computing & AI (HPC & AI) segment saw substantial revenue growth, reflecting the market's appetite for advanced computing power. The company's continued investment in developing specialized hardware and software stacks for AI development and deployment is crucial for capturing a larger share of this expanding market.

Hewlett Packard Enterprise (HPE) is strategically positioning itself in the rapidly expanding intelligent edge computing market. This shift is driven by the increasing demand for data processing closer to the source, fueling AI and IoT applications.

HPE's focus on edge solutions, particularly for AI workloads, is projected to be a significant revenue driver. For instance, in fiscal year 2023, HPE reported strong growth in its Intelligent Edge segment, which is a testament to the market's embrace of their offerings.

Strategic Acquisitions and Partnerships for Portfolio Enhancement

The acquisition of Juniper Networks, a deal valued at $14 billion announced in early 2024 and expected to close in late 2024 or early 2025, is a prime example of HPE's strategy to enhance its portfolio. This move is designed to significantly strengthen HPE's networking division, particularly in areas like AI-driven enterprise networking and secure edge solutions, directly supporting its edge-to-cloud ambitions.

Beyond major acquisitions, HPE is actively pursuing strategic partnerships to expand its technological ecosystem and solution breadth. These collaborations allow HPE to integrate complementary technologies and services, offering more comprehensive solutions to its customers.

These strategic moves are crucial for HPE to maintain its competitive edge in the rapidly evolving technology landscape. By integrating new capabilities and expanding its network of partners, HPE aims to deliver more innovative and integrated solutions.

- Juniper Networks Acquisition: Valued at $14 billion, this acquisition is set to boost HPE's networking capabilities, especially in AI-driven solutions for the enterprise and edge.

- Accelerated Edge-to-Cloud Strategy: The integration of Juniper's technology is expected to significantly advance HPE's ability to deliver seamless edge-to-cloud experiences.

- Broadening Solution Offerings: Strategic alliances and partnerships enable HPE to incorporate a wider range of technologies and services, creating more robust and comprehensive customer solutions.

Global IT Spending Recovery and Emerging Market Expansion

Global IT spending is anticipated to rebound, creating a fertile ground for HPE's expansion. Projections for 2024 indicate a notable uptick in IT investments across various sectors as businesses prioritize digital transformation and infrastructure upgrades. This recovery is expected to continue into 2025, driven by demand for cloud services, AI integration, and cybersecurity solutions.

HPE can capitalize on this trend by leveraging its hybrid cloud offerings and edge computing capabilities. The company's strategic focus on providing integrated solutions aligns well with the market's need for streamlined IT environments. For instance, the increasing adoption of AI is projected to fuel significant spending on high-performance computing, an area where HPE has a strong presence.

- Projected Global IT Spending Growth: Gartner forecasts worldwide IT spending to reach $5.1 trillion in 2024, an increase of 6.8% from 2023.

- Emerging Market Potential: Developing economies represent a significant growth vector, with IT spending in these regions expected to outpace mature markets.

- HPE's Strategic Alignment: HPE's focus on hybrid cloud and edge solutions positions it to benefit from the digital transformation initiatives driving IT investment.

- AI-Driven Demand: The burgeoning AI market is a key opportunity, with significant investments anticipated in the underlying infrastructure and services that HPE provides.

The acquisition of Juniper Networks for $14 billion, expected to finalize in late 2024 or early 2025, significantly bolsters HPE's networking capabilities, particularly for AI-driven enterprise and edge solutions. This strategic move is designed to accelerate HPE's edge-to-cloud strategy by integrating Juniper's advanced networking technologies, enhancing its ability to offer seamless, interconnected IT environments.

HPE's expansion into emerging markets presents a substantial growth avenue, as these regions are projected to increase their IT spending at a faster rate than mature markets. The company's comprehensive portfolio of hybrid cloud and edge computing solutions is well-aligned with the digital transformation initiatives driving this investment surge.

The burgeoning demand for AI infrastructure presents a significant opportunity for HPE, with the company actively investing in specialized hardware and software for AI development. This focus is expected to drive substantial revenue growth, mirroring the overall market expansion for high-performance computing and AI solutions.

Threats

The technology sector is in constant flux, demanding that Hewlett Packard Enterprise (HPE) continuously innovate to prevent its offerings from becoming obsolete. Failure to adapt to these rapid shifts could result in HPE's products and services lagging behind, negatively impacting its market standing and financial health.

For instance, the accelerating pace of AI development and the increasing demand for edge computing solutions present both opportunities and threats. HPE's ability to integrate these emerging technologies into its portfolio, as demonstrated by its investments in AI infrastructure and edge-native platforms throughout 2024, will be critical to maintaining its competitive edge.

The enterprise IT infrastructure market is incredibly crowded, with giants like Dell Technologies and IBM, alongside cloud titans such as Amazon Web Services, Microsoft Azure, and Google Cloud, all competing fiercely for customer spending. This intense rivalry frequently translates into aggressive pricing strategies, forcing companies like HPE to offer more competitive deals, which can squeeze profit margins. For instance, in the first quarter of fiscal year 2024, HPE reported a revenue of $6.9 billion, showing the scale of operations but also the market pressures they navigate.

Hewlett Packard Enterprise (HPE) faces significant threats from economic volatility and geopolitical instability, given its extensive global operations. A potential global economic downturn in 2024 or 2025 could directly impact IT spending by businesses, a core market for HPE. For instance, if major economies experience contraction, companies might delay or scale back crucial IT infrastructure investments, directly affecting HPE's sales pipeline and revenue growth projections.

Trade tensions and geopolitical conflicts also pose a considerable risk. Disruptions to global supply chains, tariffs, or sanctions could increase operational costs for HPE and limit its market access in certain regions. The ongoing geopolitical landscape presents a complex operating environment, potentially leading to unpredictable shifts in demand and increased business uncertainty, which can hinder long-term strategic planning and investment for HPE.

Regulatory Scrutiny on Acquisitions

Hewlett Packard Enterprise's (HPE) significant strategic moves, like the proposed $14 billion acquisition of Juniper Networks, are subject to intense regulatory scrutiny. Governmental bodies, including the U.S. Department of Justice and the UK's Competition and Markets Authority, are reviewing the deal for potential antitrust concerns. This oversight can lead to prolonged review periods, increased compliance costs, and the risk of the acquisition being blocked entirely, which would impede HPE's stated growth and market consolidation objectives.

These regulatory hurdles pose a substantial threat by potentially delaying or derailing critical integration plans. For instance, the ongoing review of the Juniper acquisition highlights the complexity of navigating global antitrust landscapes. Failure to complete such strategic transactions can force companies to re-evaluate their growth strategies and potentially miss out on synergistic opportunities, impacting future revenue streams and competitive positioning.

- Juniper Networks Acquisition Value: $14 billion.

- Key Regulatory Bodies Involved: U.S. Department of Justice, UK Competition and Markets Authority.

- Potential Impacts: Delays, increased costs, risk of deal termination.

- Strategic Ramifications: Hindered growth, missed market consolidation opportunities.

Cybersecurity Risks

As a significant player in IT infrastructure and services, Hewlett Packard Enterprise (HPE) faces substantial cybersecurity risks. A data breach or system vulnerability could result in considerable financial penalties, reputational damage, and a loss of customer confidence. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

These threats can manifest in various forms, impacting HPE's operations and client relationships. The increasing sophistication of cyberattacks means that even robust security measures can be challenged. In 2023, the financial services sector, a key market for IT providers, experienced a 20% increase in cyberattacks compared to the previous year, highlighting the persistent threat landscape.

- Ransomware Attacks: Disrupting operations and demanding significant payouts.

- Data Breaches: Exposing sensitive customer and company information.

- Supply Chain Vulnerabilities: Exploiting weaknesses in third-party vendors.

- Insider Threats: Malicious or accidental actions by employees.

The intense competition within the enterprise IT market, featuring major players like Dell and cloud giants such as AWS and Azure, forces HPE into aggressive pricing, potentially reducing profit margins. This competitive pressure is a constant threat to their market share and profitability.

Economic downturns and geopolitical instability pose significant risks to HPE's global operations. Reduced IT spending by businesses during a recession, coupled with supply chain disruptions from trade tensions or conflicts, could directly impact HPE's revenue and operational costs.

Regulatory scrutiny, as seen with the proposed Juniper Networks acquisition valued at $14 billion, presents a threat of delays, increased costs, or even outright blockage of strategic deals, hindering HPE's growth and market consolidation aims.

Cybersecurity risks remain a critical threat, with the global average cost of a data breach reaching $4.45 million in 2024. Sophisticated attacks and supply chain vulnerabilities could lead to financial penalties, reputational damage, and loss of customer trust.

SWOT Analysis Data Sources

This Hewlett Packard Enterprise SWOT analysis is constructed from a robust blend of data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis. These sources provide a well-rounded and accurate view of HPE's current standing and future potential.