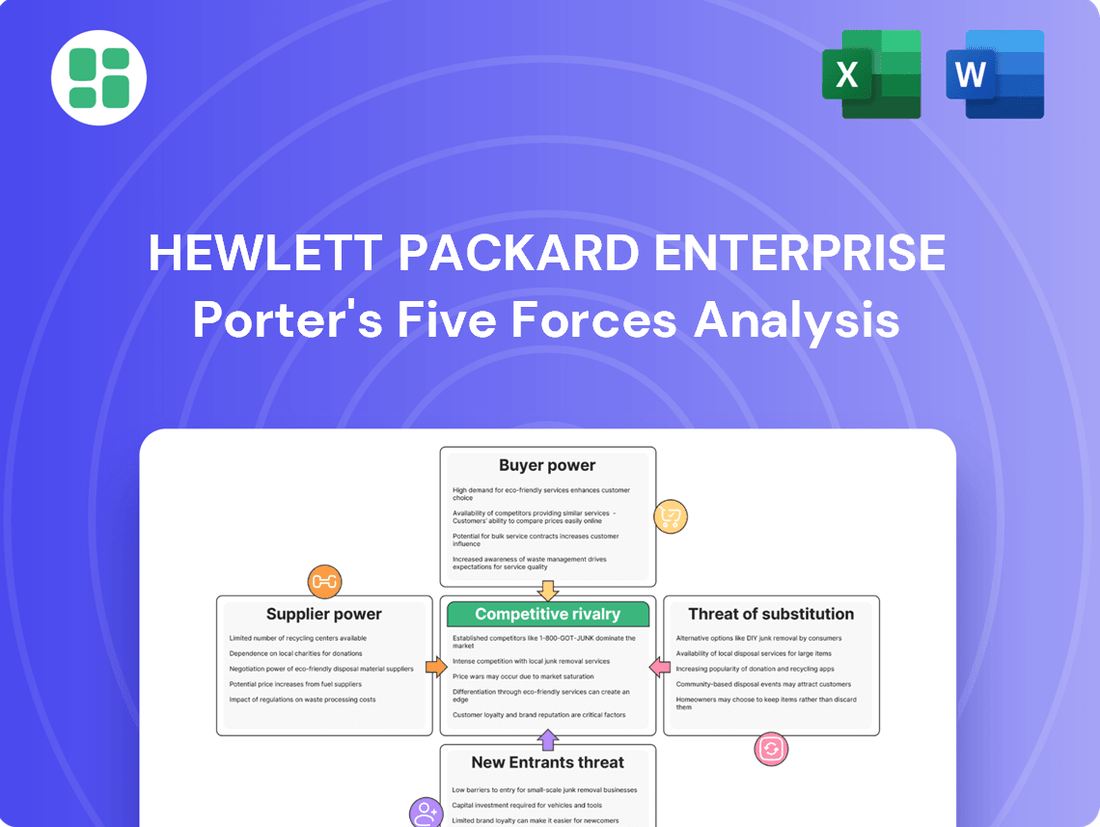

Hewlett Packard Enterprise Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hewlett Packard Enterprise Bundle

Hewlett Packard Enterprise (HPE) navigates a complex tech landscape where intense rivalry and the threat of substitutes significantly shape its market. Understanding the power of buyers and the influence of suppliers is crucial for strategic advantage. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hewlett Packard Enterprise’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hewlett Packard Enterprise (HPE) faces considerable supplier power due to the concentrated nature of semiconductor and specialized hardware manufacturing. Key suppliers such as TSMC and Intel hold dominant market positions, making their components indispensable for HPE's advanced computing and networking solutions.

This reliance on a few critical players means suppliers can exert significant influence, potentially impacting HPE's costs and product availability. For instance, the global semiconductor shortage experienced in recent years, particularly in 2021-2022, highlighted the vulnerability of companies like HPE to supply chain disruptions orchestrated by these concentrated suppliers.

Hewlett Packard Enterprise's (HPE) operations are significantly reliant on a select group of strategic suppliers, with whom they maintain multi-year agreements. These partnerships are crucial, representing substantial procurement costs that directly influence HPE's production capacity and overall cost structure.

The bargaining power of suppliers for Hewlett Packard Enterprise (HPE) is significantly influenced by recent supply chain disruptions. Global constraints have resulted in extended lead times and substantial price hikes for critical components like memory, SSDs, and hard drives. This directly impacts HPE's cost of goods sold.

These external pressures have led to notable price increases, with some components seeing up to a 50% rise in cost throughout fiscal year 2024 and continuing into 2025. Such volatility directly squeezes HPE's profit margins, as the company may struggle to pass these increased input costs entirely onto its customers.

High Switching Costs for Specialized Components

The bargaining power of suppliers for Hewlett Packard Enterprise (HPE) is significantly influenced by high switching costs associated with specialized components. When HPE relies on suppliers for proprietary or highly integrated technologies, the effort and expense required to transition to an alternative vendor can be substantial, including R&D investment and re-validation processes. This dependence strengthens the leverage of current suppliers, as disrupting these established relationships carries considerable risk and cost for HPE.

For instance, in the complex realm of server hardware and enterprise software, components are often designed with deep integration. A 2024 market analysis indicated that for custom-designed microprocessors or advanced networking interfaces, the cost of qualifying a new supplier could run into millions of dollars, alongside potential production delays. This makes it economically challenging for HPE to simply switch suppliers for critical, specialized parts, thereby increasing supplier leverage.

- High Switching Costs: Transitioning from specialized component suppliers necessitates significant investment in research, development, and rigorous testing for compatibility and performance, directly impacting HPE's operational flexibility.

- Proprietary Technology Dependence: HPE's reliance on unique or patented technologies from specific suppliers limits its options for alternative sourcing, amplifying the bargaining power of those suppliers.

- Integration Complexity: The intricate nature of integrating advanced technologies into HPE's comprehensive solutions means that finding and onboarding new suppliers capable of meeting precise technical specifications is a costly and time-consuming undertaking.

HPE's Mitigation Strategies and Supply Chain Improvements

HPE is actively mitigating supplier power by enhancing supply chain operations through digitalization and automation. This strategic focus aims to improve delivery predictability and overall efficiency. For instance, in fiscal year 2023, HPE reported progress in its digital transformation initiatives, which directly impact supply chain resilience.

Furthermore, HPE is prioritizing sustainability within its supply chain. By fostering stronger, more collaborative relationships with suppliers committed to environmental and social governance, HPE seeks to reduce long-term risks and create more stable sourcing. This approach is becoming increasingly critical as global supply chains face ongoing disruptions, with many companies, including HPE, investing in supplier diversity and ethical sourcing practices.

- Supply Chain Digitalization: HPE invests in technologies to improve visibility and responsiveness.

- Automation: Implementing automated processes to streamline logistics and reduce reliance on manual supplier interventions.

- Sustainability Focus: Building partnerships with suppliers who meet ESG criteria, fostering long-term stability.

- Risk Reduction: Proactive measures to counter potential disruptions and enhance supplier reliability.

The bargaining power of suppliers for Hewlett Packard Enterprise (HPE) remains a significant factor, especially given the concentrated nature of critical component manufacturing. Recent market data from late 2023 and early 2024 indicates that specialized semiconductor and advanced hardware providers continue to hold considerable sway, impacting HPE's cost of goods sold.

This leverage is amplified by high switching costs for HPE when dealing with proprietary or deeply integrated technologies. For example, the expense and time involved in qualifying new suppliers for custom microprocessors or advanced networking components can run into millions of dollars, making it difficult for HPE to pivot quickly and increasing supplier leverage.

The global supply chain volatility observed through 2024 has further underscored supplier power, with some essential components experiencing price increases of up to 50%. This directly affects HPE's profit margins, as passing these elevated input costs entirely to customers can be challenging in a competitive market.

| Factor | Impact on HPE | Data Point/Example |

|---|---|---|

| Supplier Concentration | High leverage for key component providers | Dominant market positions of TSMC, Intel |

| Switching Costs | Limits HPE's flexibility to change suppliers | Millions of dollars for qualifying new tech suppliers |

| Component Price Volatility (2024) | Increased cost of goods sold, squeezed margins | Up to 50% price hikes on certain components |

| Proprietary Technology | Increased dependence on specific suppliers | Deep integration in server hardware and enterprise software |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hewlett Packard Enterprise's position in the IT infrastructure and services market.

Instantly visualize competitive intensity across all five forces, enabling Hewlett Packard Enterprise to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Hewlett Packard Enterprise (HPE) faces considerable bargaining power from its large enterprise and public sector customers. These clients, due to their substantial order volumes, can negotiate for better pricing and more favorable contract terms. For instance, in fiscal year 2023, HPE's top ten customers accounted for approximately 23% of its total revenue, highlighting the concentrated purchasing power of a select group.

The enterprise IT solution market is incredibly crowded, meaning customers have plenty of choices for servers, storage, networking, and cloud services from many different companies. This abundance of options gives customers significant power.

Because customers can easily shop around and compare what different vendors offer, they can demand better prices and more tailored solutions. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, highlighting the intense competition and the leverage this gives buyers.

Customers are increasingly shifting their IT infrastructure towards hybrid cloud environments, seeking greater flexibility and cost control. This trend is amplified by the growing demand for as-a-service (aaS) models, where HPE GreenLake stands as a prime example, allowing clients to pay for IT resources as they consume them.

This growing preference for consumption-based IT solutions significantly enhances customer bargaining power. By adopting these models, clients gain more direct control over their IT expenditures, forcing vendors like HPE to align their offerings and pricing strategies with these evolving customer needs and expectations.

High Switching Costs for Integrated Solutions

For large enterprises, the cost and complexity of migrating away from deeply embedded, integrated IT infrastructure solutions from providers like Hewlett Packard Enterprise (HPE) can be substantial. This often involves significant expenses related to data migration, extensive staff re-training, and the potential for operational disruptions during the transition period. These factors can effectively reduce the bargaining power of customers once they are locked into an established ecosystem.

The high switching costs act as a significant deterrent, making customers less likely to seek alternative vendors. For instance, a major enterprise might face millions in costs and months of downtime to switch from a comprehensive HPE hybrid cloud solution to a competitor. This inertia, while not absolute, does provide HPE with a degree of pricing power and customer retention.

- High Switching Costs: Enterprises often face substantial financial and operational hurdles when migrating from integrated IT solutions.

- Data Migration Complexity: Moving vast amounts of data between different IT systems can be time-consuming, expensive, and prone to errors.

- Staff Re-training: New systems require employees to learn different interfaces and operational procedures, incurring training costs and potential productivity dips.

- Operational Disruption: The transition process itself can lead to temporary downtime or reduced efficiency, impacting business continuity.

Demand for AI and Edge Computing Solutions

The increasing demand for Artificial Intelligence (AI) and edge computing solutions significantly boosts customer bargaining power. Buyers are actively searching for vendors capable of supplying advanced, high-performance, and scalable infrastructure to support these burgeoning technologies. This heightened demand means customers can be more selective, pushing for the latest capabilities and competitive pricing.

Hewlett Packard Enterprise (HPE) is strategically positioned to capitalize on this trend with its extensive portfolio of AI systems and Intelligent Edge offerings. For instance, HPE's GreenLake edge-to-cloud platform is designed to deliver these services. However, this focus also intensifies customer expectations, as they anticipate cutting-edge features and value for their investment in these critical areas.

- High demand for AI and edge computing drives customer leverage.

- Customers seek vendors offering high-performance and scalable infrastructure.

- HPE's focus on AI and Intelligent Edge meets demand but increases customer expectations.

- Customers will likely negotiate for advanced capabilities and competitive value.

HPE's large enterprise and public sector clients wield significant bargaining power due to their substantial order volumes, allowing them to negotiate favorable pricing and terms. In fiscal year 2023, the top ten customers represented about 23% of HPE's revenue, underscoring the concentrated purchasing influence of these key accounts.

The highly competitive IT solutions market, with numerous vendors offering servers, storage, networking, and cloud services, provides customers with ample choice and thus, considerable leverage. In 2024, the global IT services market was projected to exceed $1.3 trillion, a figure that reflects the intense competition and the resulting power it grants buyers.

Customers increasingly favor hybrid cloud and as-a-service (aaS) models for greater flexibility and cost control, exemplified by HPE GreenLake. This shift towards consumption-based IT solutions empowers clients by giving them more direct control over their IT spending, compelling vendors like HPE to adapt their offerings and pricing to meet these evolving demands.

What You See Is What You Get

Hewlett Packard Enterprise Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hewlett Packard Enterprise, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. You're looking at the actual, professionally written document that will be available for instant download and use the moment you complete your purchase, empowering your strategic decision-making.

Rivalry Among Competitors

The enterprise technology market where Hewlett Packard Enterprise (HPE) operates is incredibly competitive. This includes everything from the servers that power businesses (compute) to the systems that store data (storage), how devices connect (networking), and the increasingly important cloud services. HPE is up against many big, established companies worldwide, all vying for the same customers and market share.

HPE’s rivalry is particularly strong with giants like Dell Technologies, IBM, and Cisco Systems, each offering a broad portfolio of solutions. For instance, in the server market, Dell EMC’s PowerEdge servers are a direct competitor to HPE’s ProLiant servers. Similarly, in networking, Cisco’s dominance means HPE’s Aruba networking solutions face a formidable rival. The cloud segment also sees intense competition from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, though HPE focuses on hybrid cloud solutions and private cloud infrastructure.

This fierce competition means that companies like HPE must constantly innovate and differentiate their offerings to maintain their position. In fiscal year 2023, HPE reported revenue of $29.1 billion, highlighting the scale of the market and the significant revenue generated even amidst such intense rivalry. The pressure to deliver cutting-edge technology at competitive prices is a constant challenge.

Hewlett Packard Enterprise (HPE) faces intense competition from established technology giants like Dell Technologies, IBM, and Cisco. These rivals offer comprehensive portfolios spanning hardware, software, and services, directly challenging HPE's market share across various segments.

The rise of hyperscale public cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud further intensifies rivalry. These cloud giants offer scalable, on-demand infrastructure and services, forcing HPE to adapt its hybrid cloud and edge computing strategies to remain competitive in this dynamic landscape.

The competitive landscape for Hewlett Packard Enterprise (HPE) is increasingly defined by intense rivalry in the burgeoning fields of artificial intelligence (AI), hybrid cloud, and edge computing. These areas represent the critical battlegrounds where market share and future growth are being fiercely contested.

Major players like Dell Technologies, IBM, and Cisco are pouring substantial resources into developing and marketing advanced AI platforms, integrated hybrid cloud solutions, and robust edge infrastructure. For instance, in 2024, the global edge computing market was projected to reach hundreds of billions of dollars, with significant investment from all major IT vendors, highlighting the strategic importance of this segment.

HPE must continuously innovate and differentiate its portfolio in these high-growth areas to stay ahead. This includes showcasing its unique strengths in areas like its GreenLake edge-to-cloud platform and its AI-optimized infrastructure solutions to capture market opportunities and maintain its competitive standing.

Acquisitions and Strategic Partnerships to Bolster Position

Hewlett Packard Enterprise (HPE) operates in a highly competitive landscape where acquisitions and strategic partnerships are key tools for growth and market positioning. These actions directly influence the intensity of rivalry among players in the technology sector.

Companies frequently pursue mergers and acquisitions to broaden their product and service offerings, capture greater market share, and bolster their expertise in rapidly expanding technological domains. For instance, HPE's significant acquisition of Juniper Networks in early 2024, valued at approximately $14 billion, exemplifies this trend. This strategic move is designed to enhance HPE's networking capabilities and expand its reach in the data center and AI infrastructure markets.

These consolidation efforts can significantly reshape the competitive environment. By integrating acquired entities, companies can achieve economies of scale, leverage combined technological innovations, and present more comprehensive solutions to customers. This often leads to a more concentrated market with fewer, but larger, dominant players, thereby intensifying the pressure on remaining competitors to innovate and adapt swiftly.

- Acquisition of Juniper Networks: HPE's $14 billion deal, announced in April 2024, aims to strengthen its position in high-growth networking markets.

- Market Consolidation: Such large-scale acquisitions reduce the number of independent competitors, leading to increased market power for the acquiring entity.

- Enhanced Capabilities: Partnerships and acquisitions allow companies to quickly acquire new technologies or expertise, such as AI and cloud-native solutions, which are critical for staying competitive.

- Competitive Dynamics: The integration of acquired businesses often introduces new service bundles and pricing strategies, forcing rivals to respond with their own strategic adjustments.

High R&D Investment and Continuous Innovation

Hewlett Packard Enterprise (HPE) operates in an environment where substantial investment in research and development (R&D) is not just beneficial but essential for staying competitive. This commitment to innovation is a key driver in the tech industry, particularly as new technologies like artificial intelligence (AI) rapidly mature and reshape market demands.

Companies like HPE must consistently introduce novel products and services to capture market share and address the dynamic needs of their clientele. For instance, HPE’s focus on edge computing and AI solutions necessitates ongoing R&D to maintain a technological edge. In 2024, the global IT spending on AI is projected to reach over $300 billion, underscoring the intense competition and the need for continuous innovation to capture a portion of this expanding market.

- R&D as a Competitive Necessity: Sustained investment in R&D is crucial for survival and growth in the tech sector.

- Innovation for Market Relevance: Continuous innovation is required to meet evolving customer demands and stay ahead of competitors.

- AI Market Growth: The rapid expansion of AI creates intense competition, demanding constant development of new solutions.

- HPE's Strategic Focus: HPE's emphasis on areas like AI and edge computing highlights the critical role of R&D in its strategy.

The competitive rivalry within the enterprise technology sector is exceptionally high, impacting Hewlett Packard Enterprise (HPE) significantly. Key competitors like Dell Technologies, IBM, and Cisco Systems offer broad portfolios, directly challenging HPE across compute, storage, and networking segments. The increasing dominance of public cloud providers such as AWS, Azure, and Google Cloud further intensifies this rivalry, pushing HPE to refine its hybrid and edge computing strategies.

HPE's competitive landscape is marked by significant consolidation, exemplified by its $14 billion acquisition of Juniper Networks in April 2024. This move aims to bolster HPE's networking capabilities and its position in AI infrastructure markets, a trend that intensifies rivalry as companies seek scale and enhanced offerings.

Continuous innovation, particularly in AI, hybrid cloud, and edge computing, is paramount. Global IT spending on AI was projected to exceed $300 billion in 2024, underscoring the need for substantial R&D investment to maintain market relevance and competitive advantage.

| Competitor | Key Product/Service Overlap | 2023 Revenue (Approx.) |

|---|---|---|

| Dell Technologies | Servers (PowerEdge), Storage, Networking | $88.4 billion |

| IBM | Servers (Power Systems), Software, Cloud Services | $61.9 billion |

| Cisco Systems | Networking hardware and software | $57 billion |

| AWS | Public Cloud Infrastructure | $90.8 billion (Cloud Services Revenue) |

SSubstitutes Threaten

Public cloud services from giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are a major substitute for Hewlett Packard Enterprise's (HPE) traditional on-premise IT infrastructure. Businesses increasingly choose to run their operations entirely in the cloud, bypassing the need for physical servers and data centers that HPE traditionally supplies.

This shift means companies can access computing power, storage, and software as a service, often at a more flexible cost structure. For instance, as of early 2024, the global public cloud services market was projected to reach over $600 billion, indicating a substantial portion of IT spending migrating away from on-premise solutions.

The increasing availability of open-source software and the commoditization of hardware present a significant threat. These alternatives allow customers to construct their own IT solutions, often at a substantially lower cost than proprietary offerings. For instance, the global open-source software market was projected to reach over $135 billion in 2024, demonstrating its growing influence.

This trend enables businesses to bypass traditional enterprise vendors like Hewlett Packard Enterprise by integrating components from multiple suppliers or developing in-house capabilities. The ability to mix and match standardized hardware and readily available software reduces reliance on single, often more expensive, vendor ecosystems.

The increasing adoption of operational expenditure (OpEx) models, particularly in IT, poses a significant threat of substitutes for Hewlett Packard Enterprise (HPE). Customers are increasingly opting to consume IT resources as a service rather than making large upfront capital expenditures (CapEx) on hardware. This shift means that companies can choose alternative 'as-a-service' providers, bypassing traditional hardware sales entirely.

While HPE's GreenLake platform directly counters this by offering its own as-a-service solutions, the underlying trend of OpEx preference remains a potent substitute. For instance, the global cloud computing market, a prime example of OpEx, was projected to reach over $1.3 trillion by 2024, demonstrating the scale of this alternative. This means customers can opt for cloud-based services instead of purchasing and managing their own infrastructure, which HPE traditionally supplied.

Internal IT Development and Custom Solutions

Large enterprises with substantial IT budgets and expertise can opt for internal development of custom solutions, bypassing the need for comprehensive vendor packages like those offered by HPE. This trend is fueled by a desire for highly tailored functionalities and greater control over their technology stack. For instance, in 2024, many Fortune 500 companies continued to invest heavily in their internal IT departments, with IT spending projected to reach over $1.5 trillion globally, a portion of which is allocated to custom software development.

This internal capability acts as a significant substitute, allowing businesses to integrate best-of-breed components from various providers or build proprietary systems that precisely match their unique operational requirements. Such strategies can offer cost efficiencies and a competitive edge by creating unique digital assets. The increasing availability of low-code/no-code platforms further lowers the barrier to entry for internal custom solution development.

- Internal IT Development as a Substitute: Enterprises with strong IT departments can build custom solutions, reducing reliance on vendors like HPE.

- Cost and Control Benefits: In-house development offers tailored functionality and greater control, potentially leading to long-term cost savings.

- Market Trends: Significant global IT spending, projected to exceed $1.5 trillion in 2024, includes substantial investment in custom software.

- Enabling Technologies: The rise of low-code/no-code platforms facilitates in-house custom solution creation, increasing the threat of substitutes.

New Technologies and Paradigms

Emerging technologies and shifts in computing paradigms, like serverless computing or specialized AI accelerators from niche providers, present alternative methods for achieving similar business outcomes. These innovations can potentially disrupt traditional infrastructure by offering better performance, cost savings, or ease of use. For instance, the rise of specialized AI hardware, with companies like NVIDIA dominating the market but facing increasing interest from custom silicon developers, highlights this threat. In 2024, the demand for AI-specific compute power continued to surge, driving investment in new architectural approaches that could bypass traditional server setups.

These alternatives can offer compelling value propositions that challenge established offerings. For example, cloud-native architectures and containerization technologies, while not entirely new, continue to evolve, providing more flexible and scalable solutions than traditional on-premises hardware. Companies are increasingly evaluating these options for their agility and potential to reduce capital expenditure. The increasing adoption of hybrid and multi-cloud strategies by enterprises underscores a willingness to explore and integrate these newer paradigms, potentially reducing reliance on a single vendor's traditional infrastructure.

The threat of substitutes is amplified when these new technologies mature and become more accessible. Consider the growing ecosystem around open-source AI frameworks and the increasing availability of powerful, yet cost-effective, GPUs and TPUs. This accessibility lowers the barrier to entry for developing and deploying advanced computing solutions outside of traditional enterprise infrastructure. By 2024, many businesses were actively experimenting with these alternatives, seeking to optimize workloads and gain a competitive edge through more agile and specialized computing resources.

- Serverless Computing: Offers pay-per-use execution, reducing idle resource costs compared to provisioned servers.

- Specialized AI Accelerators: Provide tailored performance for AI tasks, potentially outperforming general-purpose CPUs/GPUs for specific workloads.

- Containerization & Orchestration: Technologies like Kubernetes enable flexible deployment and scaling of applications, offering an alternative to traditional VM-based infrastructure.

- Edge Computing: Processing data closer to the source can reduce latency and bandwidth needs, offering a substitute for centralized cloud processing for certain applications.

The threat of substitutes for Hewlett Packard Enterprise (HPE) is significant, primarily driven by the pervasive shift towards public cloud services and the increasing viability of open-source solutions. Businesses are increasingly opting for cloud-based infrastructure, which offers flexibility and scalability, often at a more predictable cost than traditional on-premise hardware. This trend is underscored by the public cloud services market, projected to exceed $600 billion in early 2024. Furthermore, the growing open-source software market, anticipated to reach over $135 billion in 2024, empowers companies to build their own IT solutions, reducing dependency on proprietary vendors like HPE.

| Substitute Category | Description | Market Trend/Data (2024 Projections) | Impact on HPE |

|---|---|---|---|

| Public Cloud Services | AWS, Azure, Google Cloud offer computing, storage, and software as a service. | Market projected to exceed $600 billion. | Directly competes with HPE's on-premise infrastructure sales. |

| Open-Source Software | Allows for custom IT solution development using readily available components. | Market projected to exceed $135 billion. | Reduces reliance on HPE's proprietary software and integrated solutions. |

| Internal IT Development | Enterprises with strong IT capabilities build tailored solutions in-house. | Global IT spending projected over $1.5 trillion, including custom development. | Bypasses the need for comprehensive vendor packages from HPE. |

| As-a-Service Models (OpEx) | Consumption of IT resources as a service, avoiding upfront capital expenditure. | Cloud computing market (OpEx example) projected over $1.3 trillion. | Challenges HPE's traditional hardware sales, though GreenLake offers an alternative. |

Entrants Threaten

Entering the enterprise technology market, especially for hardware and complex solutions, requires immense capital. Companies need significant funds for manufacturing facilities, cutting-edge research and development, and establishing worldwide distribution and support systems. For example, building a new semiconductor fabrication plant can cost tens of billions of dollars, a prohibitive sum for most aspiring entrants.

These substantial upfront costs act as a powerful deterrent, effectively raising the barrier to entry. Potential new competitors are often discouraged by the sheer financial scale required to even begin operations, let alone compete effectively with established players like Hewlett Packard Enterprise (HPE).

Enterprise customers, particularly those investing in critical IT infrastructure, prioritize vendors with a proven history and established brand trust. For instance, in 2024, large enterprises often require extensive proof of concept and long-term support commitments, which new entrants struggle to provide quickly.

New companies entering the enterprise IT market face a significant hurdle in replicating the brand reputation and customer loyalty that incumbents like Hewlett Packard Enterprise (HPE) have cultivated over years. Building this level of trust, essential for securing multi-year contracts and large-scale deployments, can take considerable time and investment.

The intricate nature of global supply chains presents a significant hurdle for potential new entrants aiming to compete with Hewlett Packard Enterprise (HPE). Establishing and efficiently managing a worldwide network for manufacturing, logistics, and sales and service requires substantial investment and accumulated expertise, areas where HPE has a distinct advantage built over years of operation.

For instance, in 2024, HPE continued to optimize its supply chain, which is crucial for delivering its high-performance computing and networking solutions across diverse markets. The sheer scale and complexity of managing inventory, transportation, and customer support globally, as demonstrated by HPE's extensive reach, would be incredibly costly and time-consuming for a newcomer to replicate.

Intensive Research and Development (R&D) Demands

The technology sector, particularly in areas like artificial intelligence, hybrid cloud, and edge computing, demands substantial and ongoing research and development. New companies entering this space must be prepared to invest heavily to keep pace with rapid technological advancements.

Established players like Hewlett Packard Enterprise (HPE) already possess significant R&D infrastructure and expertise, making it a high barrier for newcomers. For instance, in fiscal year 2023, HPE reported R&D expenses of $3.5 billion, highlighting the scale of investment required to innovate and compete effectively.

- High R&D Investment: New entrants need to commit substantial capital to R&D to develop cutting-edge solutions in AI, cloud, and edge computing.

- Matching Innovation Pace: Competitors must demonstrate the capacity to innovate at a similar or faster rate than established firms like HPE.

- Talent Acquisition: Attracting and retaining top R&D talent is crucial, adding another layer of difficulty for new market participants.

- Intellectual Property: Building a robust portfolio of patents and intellectual property is essential for long-term competitive advantage.

Strong Customer Relationships and Ecosystem Lock-in

Hewlett Packard Enterprise (HPE) benefits from strong, long-standing relationships with its enterprise clients. These partnerships are often cemented by complex, integrated solutions and multi-year service agreements, creating significant customer loyalty.

This deep integration and contractual commitment result in a powerful ecosystem lock-in. For example, HPE's extensive work with governments and large corporations on critical infrastructure projects means switching providers would involve substantial disruption and cost, deterring potential new competitors.

The difficulty for new entrants to replicate these deep relationships and the associated switching costs effectively raises the barrier to entry. In 2024, the IT services market continues to see consolidation, with established players like HPE leveraging their existing client bases.

- Deep Enterprise Relationships: HPE cultivates long-term partnerships with major corporations, often through bundled hardware, software, and services.

- Ecosystem Lock-in: The complexity and integration of HPE's solutions create high switching costs for clients, making it difficult for new entrants to displace existing deployments.

- High Barrier to Entry: The established trust and integration with existing IT infrastructures present a significant challenge for new companies seeking to gain market share.

The threat of new entrants for Hewlett Packard Enterprise (HPE) is generally low due to substantial barriers. High capital requirements for R&D, manufacturing, and global support systems, coupled with the need for strong brand reputation and deep customer relationships, deter most potential newcomers.

For instance, in 2024, the ongoing need for significant investment in areas like AI and hybrid cloud infrastructure means only well-funded entities can even consider entering. These high upfront costs, along with the time and resources needed to build trust and integrated ecosystems, create formidable obstacles.

Established players like HPE also benefit from economies of scale and existing supply chain efficiencies, further increasing the difficulty for new entrants to compete on price or service delivery.

| Barrier Type | Description | Example Impact on New Entrants |

|---|---|---|

| Capital Requirements | Massive investment needed for R&D, manufacturing, and global operations. | Building a new semiconductor fab costs tens of billions; replicating HPE's global support network is prohibitively expensive. |

| Brand Reputation & Loyalty | Established trust and long-term client relationships are hard to replicate. | Securing multi-year contracts requires proven reliability, which new entrants lack. |

| Switching Costs & Ecosystem Lock-in | Deep integration of solutions creates high costs for clients to change vendors. | HPE's complex IT infrastructure deployments for large enterprises make switching highly disruptive. |

| Intellectual Property & R&D | Significant ongoing investment in innovation is required. | HPE's $3.5 billion R&D spend in fiscal year 2023 highlights the investment needed to stay competitive. |

Porter's Five Forces Analysis Data Sources

Our Hewlett Packard Enterprise Porter's Five Forces analysis is built upon a foundation of comprehensive data, including HPE's official financial reports, market research from Gartner and IDC, and insights from industry trade publications. This blend of internal company data and external market intelligence ensures a robust understanding of the competitive landscape.