Hewlett Packard Enterprise Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hewlett Packard Enterprise Bundle

Curious about Hewlett Packard Enterprise's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned across Stars, Cash Cows, Dogs, and Question Marks. Don't just wonder; gain actionable intelligence.

Purchase the full BCG Matrix for Hewlett Packard Enterprise to unlock a comprehensive quadrant-by-quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product development. Make informed decisions with confidence.

Stars

HPE GreenLake is a definite star in HPE's portfolio, demonstrating robust expansion. Its Annualized Revenue Run-Rate (ARR) surged by 46% year-over-year in Q2 FY2025, underscoring its importance as a strategic priority.

This as-a-service offering is perfectly positioned to capitalize on the increasing demand for hybrid cloud environments, a substantial market opportunity. The platform's widespread adoption, with over 37,000 customers, highlights its critical role in HPE's transition to more profitable, recurring revenue models.

Hewlett Packard Enterprise (HPE) is making significant strides in the booming High-Performance Computing (HPC) and Artificial Intelligence (AI) solutions market. Their AI systems revenue hit an impressive $1.5 billion in the fourth quarter of 2024, showing a robust 16% increase from the previous quarter. This growth underscores HPE's leadership in providing the essential infrastructure that powers advanced AI applications.

HPE's strategic focus on AI infrastructure and platform software is well-timed, given the escalating demand for AI capabilities across various industries. The company's strong presence in supercomputing further solidifies its position as a key player in this rapidly evolving technological landscape, enabling businesses to leverage the power of AI.

HPE's Intelligent Edge, powered by Aruba Networking, is a strong performer. In Q2 FY2025, this segment saw revenue climb by 7% year-over-year. Aruba's sustained leadership in enterprise wired and wireless LAN for 18 years underscores its significant market presence and competitive advantage.

The strategic acquisition of Juniper Networks is poised to further solidify HPE's standing in the rapidly expanding networking sector. This move is expected to enhance capabilities and market reach, contributing to continued growth and innovation within the Intelligent Edge portfolio.

Private Cloud AI

HPE Private Cloud AI, a joint venture with NVIDIA, represents a significant growth opportunity for Hewlett Packard Enterprise, positioned as a star in the BCG Matrix. This integrated solution offers businesses a straightforward path to implementing artificial intelligence within their own data centers, addressing the increasing demand for secure and controlled AI environments. The company saw substantial enterprise adoption of this offering throughout 2024, highlighting its market appeal.

HPE's strategic focus on this high-growth segment aims to streamline the complexities typically associated with AI deployment. By providing a turnkey solution, HPE is actively working to reduce the time it takes for customers to realize the benefits of AI, making it a key driver for future revenue. This commitment is reflected in the company's ongoing investments to enhance the platform's capabilities and accessibility.

- Market Traction: Enterprises showed strong interest in HPE Private Cloud AI in 2024, seeking on-premises AI solutions.

- Strategic Investment: HPE is prioritizing this segment to simplify AI adoption and accelerate customer value realization.

- NVIDIA Collaboration: The co-development with NVIDIA underscores the advanced, integrated nature of the offering.

- Growth Potential: Positioned as a star, HPE Private Cloud AI is expected to be a major contributor to the company's future growth.

HPE Alletra Storage MP

HPE is strategically repositioning its storage offerings under the GreenLake cloud umbrella, with the Alletra Storage MP architecture serving as the core. This consolidation aims to streamline operations and enhance customer experience by unifying management across diverse data environments.

The Alletra Storage MP platform is engineered for robust performance and significant scalability, crucial for meeting the demands of modern data-intensive workloads. For instance, the new Alletra Storage MP X10000 is demonstrating impressive capabilities, achieving industry-leading backup speeds, which is a key differentiator in the competitive storage market.

HPE's emphasis on disaggregated infrastructure and a unified cloud management approach for Alletra positions it favorably for future growth. This strategy is designed to adapt to the evolving storage landscape, where flexibility and cloud-native integration are paramount for success.

- HPE Alletra Storage MP: A Key Component of GreenLake Strategy

- Focus on High Performance and Scalability: Alletra Storage MP X10000 boasts industry-leading backup speeds.

- Disaggregated Infrastructure and Unified Cloud Management: Enhancing flexibility and operational efficiency.

- Positioned for Growth in Evolving Storage Market

HPE GreenLake continues to be a significant star in HPE's portfolio, showing impressive growth. Its Annualized Revenue Run-Rate (ARR) saw a 46% increase year-over-year in Q2 FY2025, highlighting its strategic importance. This as-a-service offering is well-positioned to capture the growing demand for hybrid cloud solutions, with over 37,000 customers already on board, reinforcing its role in HPE's shift towards recurring revenue.

Hewlett Packard Enterprise is also a star in the High-Performance Computing (HPC) and Artificial Intelligence (AI) sectors. In Q4 2024, their AI systems revenue reached $1.5 billion, a 16% jump from the prior quarter, demonstrating their leadership in providing essential AI infrastructure. This focus on AI infrastructure and platform software aligns perfectly with the escalating need for AI capabilities across industries.

HPE's Intelligent Edge, driven by Aruba Networking, is another star performer, with revenue up 7% year-over-year in Q2 FY2025. Aruba's consistent leadership in enterprise wired and wireless LAN for 18 years showcases its strong market standing. The pending acquisition of Juniper Networks is expected to further strengthen HPE's position in the expanding networking market.

HPE Private Cloud AI, developed with NVIDIA, is a key star, offering businesses a streamlined way to implement AI on-premises. Significant enterprise adoption was observed throughout 2024, validating its market appeal. This joint venture aims to simplify AI deployment complexities, reducing time-to-value for customers.

| HPE Portfolio Segment | BCG Category | Key Growth Drivers | Recent Performance Data (FY2024/FY2025) |

|---|---|---|---|

| HPE GreenLake | Star | Hybrid cloud demand, recurring revenue model, customer adoption | 46% YoY ARR growth (Q2 FY2025), 37,000+ customers |

| AI & HPC Solutions | Star | AI infrastructure demand, supercomputing leadership | $1.5 billion AI systems revenue (Q4 2024), 16% QoQ revenue increase |

| Intelligent Edge (Aruba) | Star | Enterprise networking demand, market leadership | 7% YoY revenue growth (Q2 FY2025), 18 years of LAN leadership |

| HPE Private Cloud AI | Star | On-premises AI adoption, NVIDIA partnership | Strong enterprise adoption in 2024 |

What is included in the product

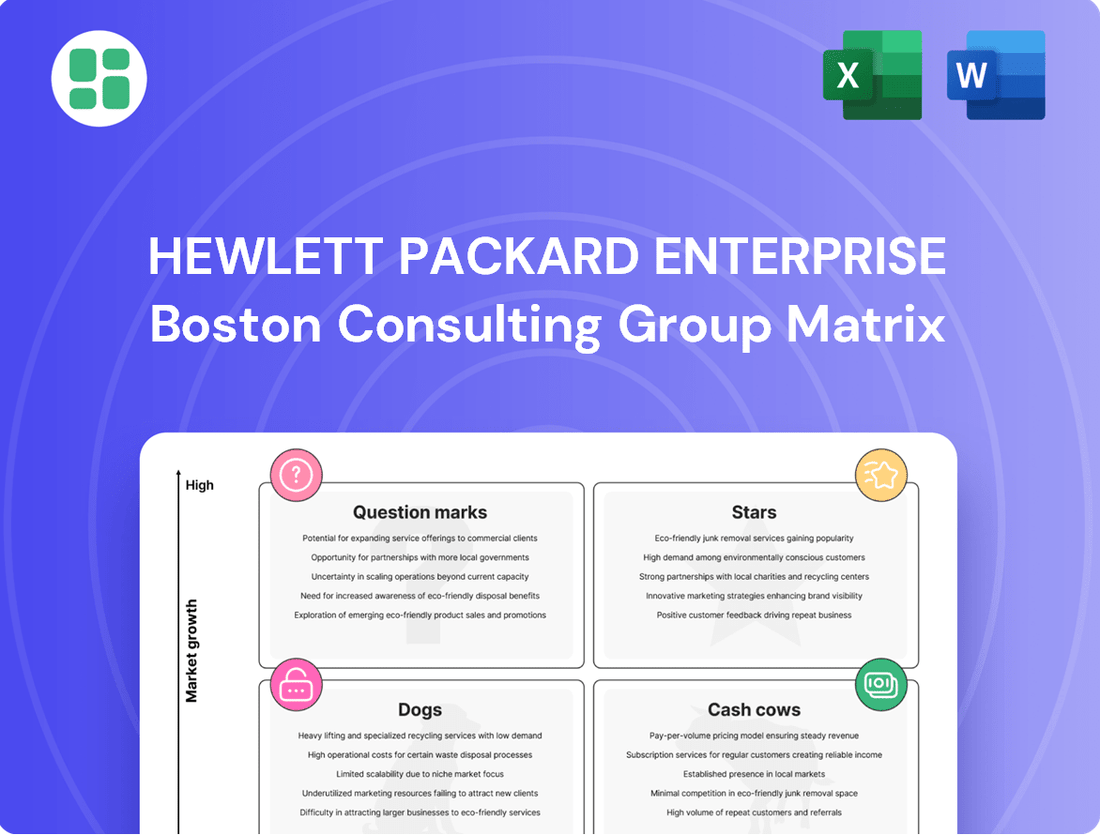

The Hewlett Packard Enterprise BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, identifying units for growth, divestment, or maintenance to optimize resource allocation.

A clear BCG Matrix visualizes HPE's portfolio, easing strategic decision-making and resource allocation.

Cash Cows

HPE's ProLiant servers are a classic example of a Cash Cow within the BCG matrix. This established product line consistently generates substantial revenue, as evidenced by HPE's server revenue reaching $4.1 billion in Q2 FY2025, a 6% increase year-over-year.

Despite potentially slower market growth compared to newer technologies, ProLiant's strong market position, holding an estimated 13% share in 2025, ensures a reliable and predictable income stream. The widespread adoption and loyal customer base contribute to this stability, allowing HPE to leverage these earnings for investment in other areas of its business.

Hewlett Packard Enterprise (HPE) commands a strong presence in the enterprise storage market with its diverse portfolio of traditional storage arrays. While the overall market is projected to grow at a moderate 8.7% CAGR from 2024 to 2025, HPE's established storage solutions are key cash cows, consistently delivering substantial and dependable revenue streams.

These mature offerings benefit from deeply entrenched customer loyalty and recurring revenue from support and maintenance agreements, ensuring their continued profitability for HPE.

IT Consulting and Support Services for existing infrastructure represent a significant cash cow for Hewlett Packard Enterprise. These services, often secured through long-term contracts for maintenance and support of HPE's installed base of traditional hardware and software, generate consistent, high-margin revenue. For example, HPE reported that its Pointnext Services division, which includes these offerings, generated approximately $3.5 billion in revenue in fiscal year 2023, demonstrating a stable income stream less susceptible to market fluctuations.

HPE Financial Services

HPE Financial Services operates as a Cash Cow within Hewlett Packard Enterprise's portfolio, generating consistent and reliable income through its financing and asset management offerings.

This segment is crucial for supporting HPE's core hardware and software businesses by providing flexible consumption models that facilitate customer adoption and upgrades.

In the second quarter of fiscal year 2025, HPE Financial Services achieved a revenue of $856 million, demonstrating stable performance with slight growth when currency fluctuations are excluded.

The segment consistently delivers a healthy return on equity, underscoring its role as a mature and profitable business unit for HPE.

- Stable Revenue Generation: HPE Financial Services contributes predictable income streams, acting as a financial engine for the broader organization.

- Support for Core Business: It facilitates sales of HPE's technology solutions by offering attractive financing options.

- Q2 FY2025 Performance: Revenue reached $856 million, indicating steady financial health.

- Profitability Metric: The segment maintains a strong return on equity, a key indicator of its cash-generating ability.

Networking Hardware (non-Aruba, traditional data center)

HPE's traditional data center networking hardware, distinct from the rapidly expanding Intelligent Edge and Aruba offerings, operates within a more mature market. While not experiencing the same explosive growth, this segment remains a significant contributor to HPE's revenue.

These established products maintain a solid market presence, serving a substantial installed base that relies on their dependable performance for existing infrastructure needs. For instance, in the fiscal year 2023, HPE reported its Networking segment revenue reached $3.5 billion, with traditional data center solutions forming a core part of this.

- Mature Market: Traditional data center networking is a stable but slower-growing sector compared to newer technologies.

- Steady Revenue: Despite lower growth, these products continue to generate consistent income for HPE.

- Installed Base: HPE supports a large existing customer base that requires ongoing maintenance and upgrades for their current networking setups.

HPE's established enterprise storage solutions are prime examples of Cash Cows. These mature offerings benefit from deeply entrenched customer loyalty and recurring revenue from support and maintenance agreements, ensuring their continued profitability for HPE.

IT Consulting and Support Services for existing infrastructure also represent a significant cash cow. These services, often secured through long-term contracts, generate consistent, high-margin revenue, with HPE's Pointnext Services division generating approximately $3.5 billion in fiscal year 2023.

HPE Financial Services acts as a Cash Cow, generating reliable income through financing and asset management, crucial for supporting core businesses. In Q2 FY2025, this segment achieved $856 million in revenue, demonstrating stable performance and a strong return on equity.

Traditional data center networking hardware, while in a mature market, remains a significant contributor. These established products serve a substantial installed base, with HPE's Networking segment revenue reaching $3.5 billion in fiscal year 2023.

| HPE Product Category | BCG Matrix Quadrant | Key Characteristics | Relevant Financial Data (FY2023/FY2025) |

|---|---|---|---|

| ProLiant Servers | Cash Cow | High market share, mature product, stable revenue | Q2 FY2025 Revenue: $4.1 billion (6% YoY increase); Estimated 13% market share in 2025 |

| Traditional Enterprise Storage | Cash Cow | Established solutions, customer loyalty, recurring revenue | Moderate market growth (8.7% CAGR 2024-2025) |

| IT Consulting & Support Services (Pointnext) | Cash Cow | Long-term contracts, high margins, stable income | FY2023 Revenue: ~$3.5 billion |

| HPE Financial Services | Cash Cow | Financing, asset management, supports core business | Q2 FY2025 Revenue: $856 million; Strong return on equity |

| Traditional Data Center Networking | Cash Cow | Mature market, dependable performance, large installed base | FY2023 Networking Segment Revenue: $3.5 billion |

What You’re Viewing Is Included

Hewlett Packard Enterprise BCG Matrix

The Hewlett Packard Enterprise BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, crafted by industry experts, provides an in-depth look at HPE's product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decision-making.

Dogs

Legacy UNIX servers, like HPE's Integrity line, are firmly positioned as Dogs in the BCG Matrix. The market for these proprietary systems has been shrinking for years as businesses shift to more flexible x86 architectures and cloud solutions. HPE's share in this segment is consequently low and diminishing, leading to minimal revenue generation.

While the LTO tape market saw a modest increase in 2024, primarily driven by archiving and backup needs, older tape storage solutions designed for primary data access have become largely irrelevant. These legacy systems struggle to compete with modern storage technologies for active data management.

Products in this category hold a negligible market share and are not considered strategic for contemporary data operations. Consequently, investment in these older tape solutions is minimal, making them candidates for divestiture or discontinuation.

Non-strategic, discontinued software licenses for Hewlett Packard Enterprise (HPE) represent assets with a low market share and limited growth potential. These often stem from past acquisitions that haven't been integrated into HPE's current strategic focus, such as the GreenLake platform. For instance, if a legacy software product from a 2018 acquisition, which accounted for less than 0.1% of HPE's software revenue in 2023, is no longer actively developed or marketed, it fits this description.

Undifferentiated Legacy Managed Services

Undifferentiated legacy managed services within Hewlett Packard Enterprise's portfolio, particularly those tied to aging technologies or highly commoditized offerings, could be categorized as dogs in the BCG matrix. These services likely face intense competition with little room for pricing power, leading to thin profit margins.

Such offerings would struggle to attract new customers or expand their market share, as clients increasingly seek more innovative and specialized solutions. In 2024, the IT managed services market saw continued pressure on legacy offerings, with many organizations looking to consolidate or migrate away from older infrastructure.

Consider these characteristics for such services:

- Low Market Growth: Demand for outdated technologies is typically stagnant or declining.

- Weak Competitive Position: Lack of unique features or value proposition makes it hard to stand out.

- Low Profitability: Commoditization drives down prices and erodes margins, impacting overall revenue contribution.

Specific End-of-Life Hardware Product Lines

Specific end-of-life hardware product lines, often outside the core ProLiant server offerings, represent a category within Hewlett Packard Enterprise's (HPE) BCG Matrix that has seen demand significantly wane. These products, while still potentially generating some revenue through support contracts and replacement parts, are not expected to see future growth. Their contribution to new sales is minimal.

These legacy systems, having reached their official end-of-life status, are characterized by a lack of new development and declining market relevance as newer, more advanced technologies emerge. For instance, certain older generations of storage arrays or networking equipment that predate current architectural standards would fall into this classification.

- Minimal New Sales: These product lines contribute very little to HPE's overall new revenue streams.

- Support and Replacement Focus: Revenue generation is primarily from ongoing support contracts and the sale of spare parts for existing installations.

- No Future Growth: Due to technological obsolescence and lack of investment in new features, these products have no anticipated market expansion.

- Strategic Divestment Consideration: Companies often evaluate the cost of maintaining support for such lines against potential divestment or managed phase-out strategies.

Hewlett Packard Enterprise's (HPE) "Dogs" are products or services with low market share in a low-growth industry. These are typically legacy offerings that no longer align with current market demands or HPE's strategic direction. Examples include older server lines, end-of-life hardware, and commoditized managed services.

These segments generate minimal revenue and often require continued investment for support, making them candidates for divestment or discontinuation. HPE's focus is on migrating customers to newer, more profitable solutions like GreenLake.

By 2024, the market for many legacy IT infrastructures continued to decline, with businesses prioritizing cloud-native solutions and modern architectures. This trend further solidifies the position of older HPE products as Dogs in the BCG matrix.

HPE's strategy involves managing the decline of these Dog products, often by offering migration paths to their more strategic portfolio. This approach aims to minimize losses while maximizing customer retention.

| Product Category | BCG Classification | Market Growth | HPE Market Share | Strategic Focus |

|---|---|---|---|---|

| Legacy UNIX Servers (e.g., Integrity) | Dog | Declining | Low & Diminishing | Migration to x86/Cloud |

| Older Tape Storage Solutions | Dog | Low (for primary access) | Negligible | Divestiture/Discontinuation |

| Non-strategic Discontinued Software | Dog | Very Low/None | < 0.1% (example) | Phase-out |

| Undifferentiated Legacy Managed Services | Dog | Stagnant/Declining | Low | Consolidation/Migration |

| End-of-Life Hardware (non-core) | Dog | Declining | Minimal | Support Contracts/Phase-out |

Question Marks

Hewlett Packard Enterprise (HPE) is heavily investing in the burgeoning field of quantum computing, recognizing its transformative potential. This includes significant R&D efforts and strategic collaborations, such as their partnership with NVIDIA and involvement in DARPA programs. These investments position HPE in a market characterized by immense future growth prospects but currently very low practical market share.

The quantum computing sector, while holding vast promise, is still in its infancy. HPE's commitment here reflects a long-term vision, requiring substantial capital outlay with the expectation of future, rather than immediate, returns. This places quantum computing initiatives squarely in the 'Question Marks' category of the BCG Matrix for HPE, demanding careful strategic management.

Hewlett Packard Enterprise (HPE) is actively expanding its AI software platforms and services beyond foundational infrastructure, introducing offerings like AI Governance and Enablement Hubs to capture evolving market demands. These solutions aim to help organizations manage and deploy AI responsibly.

Despite the AI software market's robust growth, projected to reach over $100 billion globally by 2028, HPE's specific software products are in the early stages of gaining traction. They face stiff competition from deeply entrenched players with established ecosystems and significant market share.

HPE's Edge-as-a-Service, extending beyond core networking, presents a question mark. While Aruba's established presence is a strength, venturing into new, niche applications and vertical markets where HPE is still building its footprint requires significant investment and market penetration.

These innovative edge services are positioned in a high-growth sector, with the global edge computing market projected to reach $266.1 billion by 2027, growing at a CAGR of 37.4% from 2020. However, achieving substantial market share in these emerging areas will necessitate focused adoption strategies and substantial go-to-market efforts.

HPE VM Essentials

HPE VM Essentials, introduced in late 2024 and early 2025, represents HPE's latest move in virtualization management, focusing on cost reduction and simplified operations within its hybrid cloud strategy. This offering directly addresses the increasing market demand for more economical virtualization solutions, a key driver for its potential growth.

As a new entrant, HPE VM Essentials is positioned as a potential 'star' in the BCG matrix, requiring significant market penetration to achieve this status. The company's objective is to capture a substantial share of the virtualization management market, which is projected to see continued expansion through 2025 and beyond.

- Market Focus: HPE VM Essentials targets the growing need for cost-effective virtualization management, aiming to reduce VM licensing expenses for businesses.

- Launch Timeline: Introduced in late 2024 and early 2025, it's a recent addition to HPE's hybrid cloud portfolio.

- BCG Positioning: As a new product, it's classified as a 'question mark' that needs rapid market share growth to transition into a 'star' performer.

- Strategic Goal: The primary aim is to simplify VM management and lower operational costs for customers, thereby gaining competitive advantage.

Private 5G Solutions

Hewlett Packard Enterprise (HPE) is making a strategic move into the burgeoning private 5G market, particularly for enterprise wireless solutions, by acquiring Athonet. This sector is experiencing rapid expansion, fueled by the increasing demand for industrial Internet of Things (IoT) applications and services that require ultra-low latency.

While the private 5G market is a high-growth area, HPE is currently in the initial phases of building its presence and capturing market share. It faces competition from established, specialized players who already have a strong foothold in this niche.

- Market Growth: The global private wireless market, including private 5G, is projected to reach $10.1 billion by 2028, growing at a compound annual growth rate (CAGR) of 38.9% from 2023 to 2028, according to MarketsandMarkets.

- HPE's Position: HPE's acquisition of Athonet in late 2022 positions it to capitalize on this growth, offering integrated solutions for enterprises seeking enhanced connectivity and operational efficiency.

- Competitive Landscape: Key competitors in the private 5G space include companies like Nokia, Ericsson, and various system integrators, presenting a challenge for HPE to quickly establish significant market dominance.

HPE's quantum computing initiatives and AI software platforms are prime examples of Question Marks. These ventures are in nascent, high-growth markets, demanding substantial investment for future returns, with current market share yet to be solidified.

The company's Edge-as-a-Service offerings and its recent foray into private 5G, following the Athonet acquisition, also fall into this category. While positioned in rapidly expanding sectors, HPE is still building its presence and faces established competitors, necessitating strategic market penetration efforts.

HPE VM Essentials, launched in late 2024, is another Question Mark. It requires significant market adoption to achieve 'star' status in the virtualization management space, aiming to simplify operations and reduce costs for customers.

| Initiative | Market Potential | HPE's Current Position | BCG Category | Key Challenge |

| Quantum Computing | High Growth, Transformative | Early Stage, Low Market Share | Question Mark | Significant R&D Investment, Long-Term Returns |

| AI Software Platforms | Projected >$100B by 2028 | Emerging, Facing Established Players | Question Mark | Gaining Traction Against Incumbents |

| Edge-as-a-Service | CAGR 37.4% (2020-2027) | Building Footprint in Niche Areas | Question Mark | Market Penetration in New Verticals |

| Private 5G | CAGR 38.9% (2023-2028) | Acquisition of Athonet, Initial Phase | Question Mark | Establishing Dominance Against Specialists |

| VM Essentials | Growing Demand for Cost-Effective Solutions | Late 2024/Early 2025 Launch | Question Mark | Achieving Rapid Market Share Growth |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from HPE's financial reports, market share analysis, and industry growth forecasts to provide strategic clarity.