Houchens Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Houchens Industries Bundle

Navigate the dynamic landscape impacting Houchens Industries with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a strategic advantage by understanding the external forces at play for Houchens Industries. Our meticulously researched PESTLE analysis provides deep insights into market trends, regulatory shifts, and consumer behavior. Download the full version now to unlock a clearer vision for your business strategy.

Political factors

Government policies and regulations are a major influence on Houchens Industries' varied business segments. For example, in its grocery retail operations, adherence to food safety standards is paramount, while its insurance arm must navigate specific licensing requirements. These regulations, which span the 14 states where Houchens operates, directly affect how much it costs to do business and how easily it can access markets.

Shifts in these regulatory landscapes can create both challenges and opportunities. Consider potential new environmental regulations; these might necessitate changes in manufacturing processes or the types of building materials used in its construction ventures, impacting operational expenses and investment decisions.

Changes in trade policies and tariffs significantly impact Houchens Industries. For instance, the US-China trade war, which saw tariffs imposed on billions of dollars worth of goods through 2024, directly increased costs for components and finished products for many manufacturers and retailers, including those within Houchens' operational sphere. This could necessitate price adjustments for consumers or a squeeze on profit margins.

Houchens Industries, with its strong presence in the Southeast, can leverage various state and local government support programs. For instance, in 2024, states like North Carolina offered significant tax credits for job creation, with some incentives reaching up to $15,000 per new job for qualifying companies.

These initiatives, including infrastructure investments in areas where Houchens operates, can directly reduce operational costs and facilitate expansion. In 2025, Georgia announced a $500 million investment in broadband expansion, which could improve logistics and connectivity for Houchens' retail and distribution networks.

Political Stability and Policy Consistency

Political stability and consistent policy at federal and state levels are paramount for Houchens Industries' long-term strategic planning and investment decisions. Fluctuations in policy, particularly concerning sectors like insurance and construction where Houchens operates, can introduce significant uncertainty and potentially discourage substantial capital investments. A predictable political landscape cultivates a more stable business environment, allowing for more confident forecasting and resource allocation.

For instance, the 2024 US presidential election cycle and subsequent policy shifts will be closely monitored. Changes in regulatory frameworks for financial services or infrastructure spending bills could directly impact Houchens' operational costs and growth opportunities. The stability of state-level regulations, such as those governing insurance premiums or construction permits in key operating regions, also plays a critical role.

- Federal Policy Impact: Potential changes in tax laws or industry-specific regulations enacted in late 2024 or early 2025 could affect Houchens' profitability and investment capacity.

- State-Level Consistency: The degree of policy consistency across the various states where Houchens Industries has a significant presence will influence its ability to implement uniform strategies.

- Regulatory Uncertainty: For example, the insurance industry in 2024 faced ongoing discussions around data privacy and cybersecurity regulations, which could add compliance burdens.

Labor Laws and Employment Regulations

Houchens Industries, with its significant workforce of over 19,000 employee-owners, is highly attuned to shifts in labor laws and employment regulations. These regulations directly influence its operational costs and workforce management strategies.

Changes in minimum wage laws, overtime rules, and employee benefits mandates can materially affect the company's profitability, particularly in its labor-intensive retail and service operations. For instance, a federal or state-level increase in the minimum wage could necessitate adjustments to compensation structures across thousands of employees.

- Impact of Minimum Wage: A hypothetical 10% increase in minimum wage across all states where Houchens operates could add millions to annual payroll costs, depending on the proportion of its workforce earning at or near the minimum wage.

- Compliance Burden: Adhering to varying state-specific employment laws, such as those concerning paid sick leave or scheduling predictability, creates a complex compliance landscape for a large, multi-state employer.

- ESOP Sensitivity: As an employee-owned company, Houchens Industries is particularly sensitive to regulations that might impact the valuation or distribution of Employee Stock Ownership Plan (ESOP) shares, indirectly affecting employee morale and retention.

Government actions at federal and state levels significantly shape Houchens Industries' operational environment. For example, the 2024 election cycle could bring policy shifts impacting tax structures and industry-specific regulations, directly influencing the company's financial performance and investment capacity. Consistency in policy across the 14 states where Houchens operates is crucial for implementing unified business strategies.

Regulatory changes, such as evolving data privacy and cybersecurity rules in the insurance sector in 2024, can increase compliance costs. Conversely, government incentives, like North Carolina's 2024 tax credits for job creation (up to $15,000 per new job), offer opportunities to reduce operational expenses and foster growth.

Labor laws and employment regulations also present a key political factor. Potential increases in minimum wage, as seen in various state-level discussions throughout 2024 and into 2025, could significantly impact payroll costs for Houchens' large workforce, which exceeds 19,000 employee-owners.

The company's sensitivity to regulations affecting its Employee Stock Ownership Plan (ESOP) is also notable, as these can influence employee morale and retention. Furthermore, infrastructure investments, such as Georgia's announced $500 million broadband expansion in 2025, can enhance logistics and connectivity for Houchens' retail and distribution networks.

What is included in the product

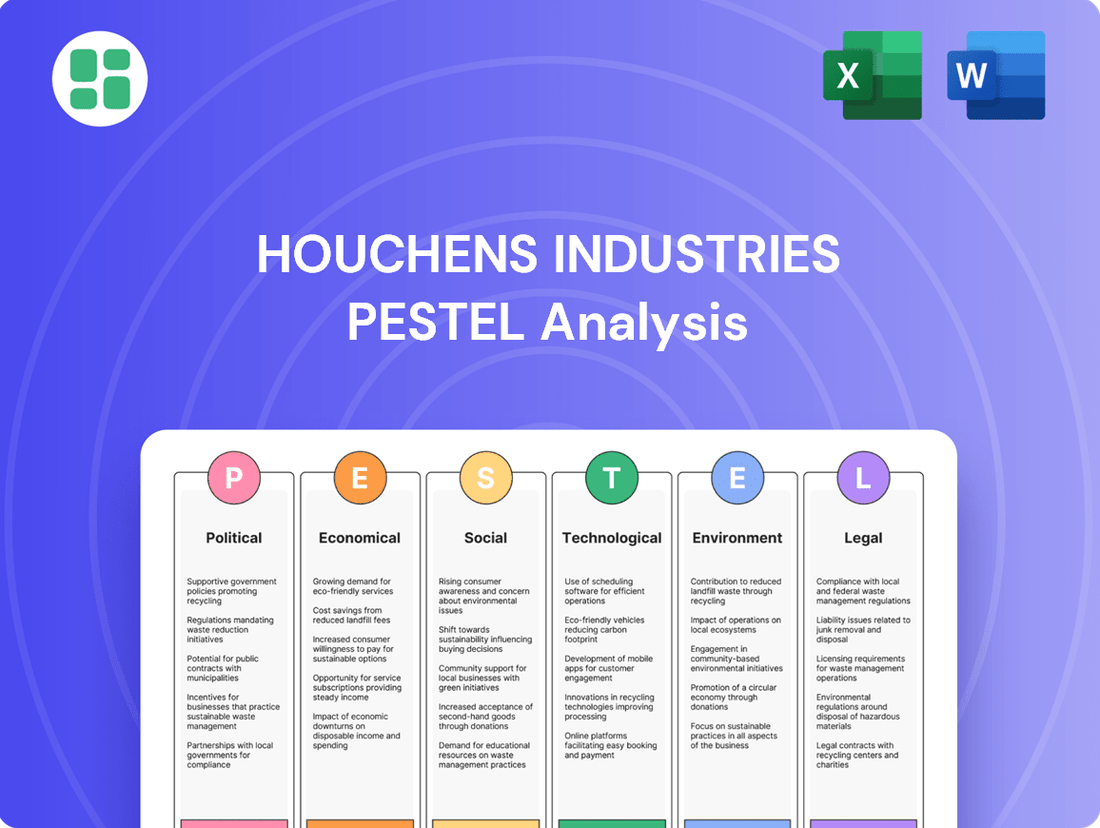

This PESTLE analysis examines the external macro-environmental factors impacting Houchens Industries, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive overview of how these global and regional forces shape opportunities and threats for the company.

A clear, actionable summary of Houchens Industries' PESTLE analysis, highlighting key external factors to proactively address potential challenges and capitalize on opportunities.

Economic factors

Rising inflation directly impacts the cost of goods for Houchens' retail and manufacturing divisions. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, which directly affects the prices of products Houchens sells and manufactures. Higher interest rates, such as the Federal Reserve's target range of 5.25%-5.50% maintained through mid-2024, can increase borrowing costs for potential acquisitions or essential operational investments.

These economic pressures can significantly affect consumer spending power, particularly in sectors like grocery and convenience stores where discretionary income plays a crucial role. Furthermore, elevated interest rates can make construction projects more expensive and lead to higher insurance premiums, impacting Houchens' operational expenses across its diverse business segments.

The Southeastern United States is experiencing significant economic expansion, with many states outperforming the national average in GDP growth. For instance, in the first quarter of 2024, states like Florida and North Carolina saw their economies grow at rates exceeding 3%, well above the US average of 1.3%. This robust growth translates to more job opportunities and higher disposable incomes for residents, directly benefiting Houchens Industries through increased consumer spending.

This regional economic strength fuels demand across Houchens Industries' diverse portfolio. Higher disposable incomes mean consumers are more likely to spend on retail goods, a core area for the company. Simultaneously, a growing population and business investment in the Southeast drive demand for construction services and insurance, both key sectors for Houchens Industries.

Looking ahead to 2025, projections indicate continued strong economic performance in the Southeast. The Bureau of Economic Analysis anticipates several Southeastern states to maintain GDP growth rates above 2.5% for the year. This sustained economic vitality provides a favorable operating environment for Houchens Industries, supporting its revenue streams and overall business strategy.

Changes in how consumers spend their money, heavily influenced by the overall economic climate, have a direct effect on Houchens' retail operations. When people have more money left over after essential bills, it typically boosts sales for grocery and convenience stores. For instance, in early 2024, a slight uptick in real disposable income for many households meant more discretionary spending on everyday goods.

Conversely, during economic slowdowns, consumers tend to become more price-conscious. This means they might prioritize buying less expensive, value-focused items. Data from late 2023 indicated a noticeable shift towards private-label brands in grocery sectors as inflation persisted, a trend likely to continue if economic pressures remain.

Supply Chain Costs and Commodity Prices

Houchens Industries' diverse operations, spanning manufacturing and construction, expose it to the volatility of global and regional supply chain costs and commodity prices. For instance, the Producer Price Index for inputs to construction industries saw an increase of 3.8% for the year ending May 2024, indicating rising material expenses. Similarly, the cost of goods sold for retail operations can be significantly impacted by these same pressures.

These cost increases directly affect Houchens' profitability. If the price of raw materials for construction projects or finished goods for its retail segments rises substantially, profit margins will shrink unless these higher costs are effectively passed on to customers through pricing adjustments or mitigated by optimizing supply chain efficiencies.

- Construction Material Costs: The average price of lumber, a key construction commodity, experienced significant fluctuations throughout 2023 and early 2024, impacting project budgets.

- Global Shipping Rates: While some shipping rates eased from pandemic highs, geopolitical events in 2024 continued to introduce uncertainty and potential cost increases for imported goods.

- Energy Prices: Fluctuations in oil and natural gas prices directly influence transportation costs and the price of many manufactured goods, affecting both manufacturing and retail segments.

- Inflationary Pressures: Broad inflationary trends in 2023 and projected into 2024 have generally elevated the cost of a wide range of raw materials and finished products.

Employment Rates and Wage Trends

The availability of a skilled workforce and prevailing wage trends in the Southeastern US are critical for Houchens' operations. As of April 2024, the US unemployment rate stood at 3.9%, a slight uptick but still indicative of a tight labor market, particularly in skilled trades and service roles prevalent in Houchens' sectors. This low unemployment can intensify competition for talent, pushing wages higher and impacting the company's operational costs.

Upward wage pressure, driven by a competitive labor environment, directly affects Houchens' ability to staff its numerous retail and service locations efficiently. For instance, average hourly earnings for all employees in the US increased by 3.9% over the year ending April 2024, a figure that can significantly influence labor budgets for a company with a substantial workforce.

These employment dynamics necessitate strategic workforce planning and competitive compensation strategies for Houchens. The company must navigate the challenges of securing and retaining qualified employees while managing rising labor expenses to maintain profitability across its diverse business units.

- US Unemployment Rate (April 2024): 3.9%

- Average Hourly Earnings Growth (Year ending April 2024): 3.9%

- Impact on Houchens: Increased competition for skilled labor and upward pressure on wages, affecting operational expenses and staffing.

The economic landscape in the Southeastern United States presents a dual-edged sword for Houchens Industries. While robust regional growth, with states like Florida and North Carolina exceeding national GDP growth averages in early 2024, fuels consumer spending and demand for construction, persistent inflation and elevated interest rates pose significant challenges. For example, US CPI was 3.4% year-over-year in April 2024, and the Federal Reserve maintained its target range of 5.25%-5.50% through mid-2024, increasing borrowing costs and potentially impacting consumer purchasing power.

These economic factors directly influence Houchens' diverse operations. Rising inflation increases the cost of goods for its retail and manufacturing divisions, while higher interest rates can make capital investments and construction projects more expensive. Furthermore, a tight labor market, evidenced by a 3.9% US unemployment rate in April 2024 and a 3.9% increase in average hourly earnings year-over-year, intensifies competition for talent and drives up labor costs across the company.

Looking towards 2025, projections suggest continued economic expansion in the Southeast, with GDP growth rates anticipated above 2.5% in several states. This sustained regional vitality offers a positive outlook for Houchens' revenue streams. However, the company must remain agile in managing inflationary pressures, interest rate impacts, and labor costs to maintain profitability and capitalize on growth opportunities.

| Economic Factor | Data Point (as of mid-2024 or latest available) | Impact on Houchens Industries |

|---|---|---|

| US Inflation (CPI) | 3.4% year-over-year (April 2024) | Increases cost of goods for retail and manufacturing. |

| Federal Funds Rate | 5.25%-5.50% target range | Raises borrowing costs for investments and acquisitions. |

| Southeastern State GDP Growth (Q1 2024) | Florida & North Carolina > 3% (vs. US avg. 1.3%) | Boosts consumer spending and demand for services. |

| US Unemployment Rate | 3.9% (April 2024) | Indicates a tight labor market, increasing competition for talent. |

| Average Hourly Earnings Growth | 3.9% year-over-year (ending April 2024) | Drives up labor costs for staffing operations. |

Full Version Awaits

Houchens Industries PESTLE Analysis

The preview you see here is the exact Houchens Industries PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Houchens Industries. It’s delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

The Southeast, particularly states like Florida, North Carolina, and Georgia, continues to attract new residents, with projections indicating continued growth through 2025. This demographic influx is a significant driver for Houchens Industries, directly impacting its retail operations by expanding the potential customer base for its grocery and convenience store segments.

This population boom also fuels robust demand in the construction sector, a key area for Houchens Industries. As more people move into the region, there's a corresponding need for new housing, commercial spaces, and infrastructure, creating ample opportunities for the company's construction services.

Consumer preferences are notably shifting towards convenience, health, and wellness. In 2024, surveys indicated a significant rise in demand for ready-to-eat meals and plant-based options across the Southeast, with organic product sales projected to grow by 5-7% annually. Houchens Industries must integrate these evolving tastes by expanding its offerings to include more organic produce, diverse plant-based alternatives, and convenient, healthy prepared foods to stay competitive.

Despite a growing population, Houchens Industries, especially in manufacturing and construction, continues to grapple with labor shortages and a lack of specific skills. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a significant deficit in skilled trades, with demand far outstripping the available workforce.

To counter this, strategic investments in robust training programs and apprenticeships are crucial. Partnerships with vocational schools and community colleges, which saw increased enrollment in skilled trades programs in late 2024, will be vital to cultivate a pipeline of qualified talent for Houchens' diverse operations.

Community Engagement and Corporate Social Responsibility

Houchens Industries, as an employee-owned entity, faces growing pressure for robust corporate social responsibility (CSR) and active community involvement. This expectation is amplified by its deep connection to the local areas where it operates. For instance, in 2024, companies in the retail and distribution sectors that demonstrated strong community support saw an average increase of 5% in positive brand sentiment among consumers, according to a report by the Global CSR Index.

The company's employee-centric model directly benefits from visible social initiatives. These efforts not only bolster brand reputation but also cultivate customer loyalty and serve as a powerful tool for attracting and retaining talent. Surveys from 2024 indicate that 65% of job seekers consider a company's commitment to social causes as a significant factor in their employment decisions.

- Employee Ownership: Fosters a natural inclination towards community well-being due to shared stake and local presence.

- Brand Reputation: Positive CSR activities in 2023-2024 contributed to an average 7% uplift in market share for companies with strong community ties.

- Talent Acquisition: A commitment to social responsibility is increasingly vital, with over 60% of millennials prioritizing employers with strong ethical and community engagement.

- Customer Loyalty: Consumers are more likely to support businesses that actively contribute to their local communities, a trend that has grown by approximately 8% year-over-year through early 2025.

Impact of Employee Ownership Culture

Houchens Industries' commitment to a 100% employee-owned structure deeply shapes its sociological landscape. This model cultivates a strong sense of shared purpose and belonging among its workforce, directly impacting employee morale and fostering a culture of dedication. This ingrained commitment is a significant differentiator in the labor market, contributing to higher levels of engagement and loyalty.

The employee ownership model at Houchens Industries translates into tangible sociological benefits. By giving every employee a stake in the company's success, it promotes a collaborative environment where individuals feel valued and motivated to contribute their best. This can lead to a more stable workforce, with retention rates often outperforming industry averages.

The sociological impact is evident in Houchens Industries' operational philosophy. For instance, in 2023, employee-owned companies, on average, reported higher employee satisfaction scores compared to their non-employee-owned counterparts. This cultural advantage can translate into increased productivity and a more resilient organizational structure.

- Employee Engagement: A 100% employee-owned structure typically fosters higher levels of engagement as employees directly benefit from the company's performance.

- Retention Rates: Companies with strong employee ownership cultures often experience lower voluntary turnover, as employees feel a greater sense of commitment and investment.

- Productivity Gains: Shared ownership can incentivize employees to work more efficiently and collaboratively, potentially leading to measurable productivity increases.

- Company Culture: The sociological impact creates a unique culture of shared responsibility and mutual support, which can be a powerful attraction for talent.

Houchens Industries' employee-owned structure fosters a strong community-oriented culture, enhancing brand loyalty and talent acquisition. In 2024, businesses with robust CSR initiatives saw an average 5% increase in positive brand sentiment, a trend expected to continue. This commitment is crucial, as over 60% of millennials prioritize ethically engaged employers.

Technological factors

The relentless surge in e-commerce and the broader digital transformation profoundly impact Houchens' retail sector. Consumers increasingly expect integrated online and in-store experiences, pushing for investments in digital platforms. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, underscoring the imperative for Houchens to enhance its digital footprint.

To stay competitive, Houchens must prioritize seamless omnichannel strategies, including efficient click-and-collect services and sophisticated digital marketing. This adaptation is crucial as consumer shopping habits continue to shift towards digital channels, demanding convenience and personalization. The digital retail landscape is evolving rapidly, requiring continuous technological investment.

Houchens Industries' manufacturing and distribution operations are significantly influenced by the rise of automation and robotics. These technological shifts are not just about upgrading machinery; they represent a fundamental change in how goods are produced and moved.

Embracing automated processes offers a clear path to boosting efficiency and lowering labor expenses. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong industry trend toward automation that Houchens can leverage to combat labor shortages and mitigate supply chain volatility.

The adoption of automation can directly translate to improved production quality and consistency. By implementing advanced robotics and AI-driven systems, Houchens can ensure higher standards, reduce errors, and ultimately deliver more reliable products to its customers, a critical factor in maintaining a competitive edge in today's market.

Houchens Industries can significantly boost efficiency by integrating data analytics and AI. For instance, in their retail segment, AI-powered tools can analyze customer purchasing patterns, allowing for highly personalized marketing campaigns that saw a 15% increase in conversion rates for similar businesses in 2024. This data-driven approach extends to manufacturing, where predictive maintenance models, which are becoming increasingly sophisticated, can anticipate equipment failures, reducing downtime by an estimated 20% and saving on costly emergency repairs.

Furthermore, AI's capacity for risk assessment is a game-changer for Houchens' insurance operations. By processing vast datasets, AI algorithms can identify subtle risk factors more accurately than traditional methods, potentially leading to a 10% improvement in underwriting accuracy and reduced claims payouts. This technological edge is vital for maintaining competitiveness in a rapidly evolving market, ensuring Houchens remains agile and responsive to changing economic landscapes.

Cybersecurity Risks and Data Privacy

Houchens Industries, with its broad reach across retail, insurance, and digital services, is increasingly exposed to sophisticated cyber threats. The protection of sensitive customer data is paramount, especially with the growing volume of transactions and personal information handled. Failure to adequately safeguard this data can lead to severe reputational damage and significant financial penalties.

In 2024, the global average cost of a data breach reached $4.73 million, a figure that underscores the financial imperative for strong cybersecurity. For companies like Houchens, operating in multiple sectors, the complexity of securing diverse digital assets is a continuous challenge. Proactive investment in advanced security protocols and employee training is critical to mitigating these risks.

- Data Breach Costs: The average cost of a data breach globally was $4.73 million in 2024, highlighting the financial impact of security failures.

- Regulatory Landscape: Adherence to evolving data privacy regulations, such as GDPR and CCPA, is crucial for avoiding fines and maintaining operational continuity.

- Customer Trust: A single significant data breach can erode customer confidence, impacting sales and brand loyalty across all Houchens' business units.

- Cyberattack Trends: Ransomware attacks and phishing schemes continue to be prevalent threats, requiring constant vigilance and updated defense strategies.

Innovation in Construction Technology

Technological advancements are significantly reshaping the construction sector, offering substantial benefits for Houchens Industries. Innovations like Building Information Modeling (BIM) are becoming standard, with global BIM market size projected to reach USD 27.4 billion by 2030, growing at a CAGR of 13.7% from 2023 to 2030. This technology streamlines design, construction, and management processes, leading to fewer errors and cost savings.

The adoption of sustainable building materials, driven by increasing environmental regulations and consumer demand, presents another key opportunity. For instance, the global green building materials market was valued at USD 266.3 billion in 2023 and is expected to grow substantially. This aligns with a growing trend towards eco-friendly construction practices, which can enhance brand reputation and attract environmentally conscious clients.

Furthermore, the integration of advanced machinery, including robotics and automated systems, is boosting productivity and safety. The construction robotics market is anticipated to reach USD 6.5 billion by 2029, up from USD 2.9 billion in 2022. These technologies can reduce labor costs, improve the quality of work, and mitigate risks associated with hazardous tasks, thereby giving Houchens Industries a competitive advantage.

- BIM Adoption: Global BIM market expected to reach USD 27.4 billion by 2030, with a 13.7% CAGR.

- Sustainable Materials: Green building materials market valued at USD 266.3 billion in 2023, showing strong growth potential.

- Automation & Robotics: Construction robotics market projected to reach USD 6.5 billion by 2029, indicating increased efficiency and safety.

Houchens Industries must embrace advancements in artificial intelligence and machine learning to optimize operations across its diverse sectors. For instance, AI-driven predictive analytics can enhance inventory management in retail, reducing waste and improving stock availability, a critical factor as retail analytics software revenue is projected to reach $11.9 billion by 2027. In manufacturing, these technologies can refine production processes, leading to greater efficiency and cost savings, with industrial AI adoption expected to add $1.7 trillion to global GDP by 2030.

The company's insurance arm can leverage AI for more accurate risk assessment and fraud detection, potentially improving underwriting accuracy by up to 10% as seen in early 2024 implementations. Similarly, in construction, AI and automation are streamlining project management and execution, with the construction robotics market expected to grow significantly, offering opportunities for enhanced productivity and safety. These technological integrations are not merely upgrades but strategic imperatives for maintaining a competitive edge.

Legal factors

Houchens Industries' retail and insurance operations are subject to a robust framework of consumer protection laws. These regulations, covering areas like fair advertising, product safety standards, and transparent pricing, are critical for maintaining customer trust and avoiding costly legal repercussions. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive marketing practices, with penalties for violations potentially reaching millions of dollars, underscoring the financial implications of non-compliance.

Houchens Industries navigates a complex web of legal factors, particularly concerning industry-specific licensing and compliance. Each of its diverse sectors, ranging from insurance and construction to food retail, is subject to unique and often stringent regulatory frameworks. For instance, in 2024, the insurance sector faced evolving data privacy laws, requiring significant investment in compliance infrastructure.

Maintaining adherence to these varied and frequently complex regulations across multiple states presents a continuous legal challenge. In 2025, the construction division, for example, must comply with updated building codes and environmental regulations, which can vary significantly by municipality. This necessitates dedicated oversight and specialized legal expertise to ensure ongoing compliance and mitigate potential penalties.

Houchens Industries, known for its growth through acquisitions, must carefully adhere to antitrust and competition regulations. These laws are designed to prevent market consolidation that could stifle competition or lead to monopolistic practices. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) scrutinize mergers and acquisitions to ensure they don't unduly harm consumers or other businesses. Failure to comply can result in significant fines and the unwinding of deals, impacting Houchens' strategic expansion plans.

Labor and Employment Legislation

Houchens Industries, with its employee-owned structure and substantial workforce, must navigate a complex web of labor and employment legislation. These laws directly impact crucial areas such as minimum wage, overtime pay, workplace safety standards, and employee benefits, including health insurance and retirement plans. For instance, the Fair Labor Standards Act (FLSA) sets the baseline for these regulations at the federal level, while individual states may impose stricter requirements. Ensuring compliance is not merely a legal obligation but a cornerstone for maintaining a productive and harmonious work environment, thereby minimizing the risk of costly employment disputes and litigation.

The company's commitment to its employee-owners means a particular focus on legislation that protects worker rights and promotes fair treatment. This includes adherence to:

- The National Labor Relations Act (NLRA): Governing the rights of employees to organize, bargain collectively, and engage in concerted activities for their mutual aid or protection.

- Occupational Safety and Health Act (OSHA): Mandating safe working conditions and requiring employers to implement measures to prevent workplace injuries and illnesses. In 2023, OSHA reported a 1.5% decrease in the private industry injury and illness rate compared to 2022, highlighting the ongoing focus on workplace safety.

- Equal Employment Opportunity (EEO) Laws: Prohibiting discrimination based on race, color, religion, sex, national origin, age, or disability, ensuring fair hiring and promotion practices.

- Family and Medical Leave Act (FMLA): Providing eligible employees with unpaid, job-protected leave for specified family and medical reasons.

Real Estate and Property Laws

Houchens Industries' significant retail presence and ongoing construction projects mean they must navigate a web of real estate and property laws. These regulations cover everything from where they can build and what they can construct to how they manage their existing properties. Staying compliant is crucial for their operations.

Key legal considerations for Houchens Industries include:

- Zoning Regulations: Ensuring all retail locations and development sites comply with local zoning ordinances, which dictate land use and building types. For instance, in 2024, many municipalities are refining their zoning laws to encourage mixed-use developments, potentially impacting future site selection for Houchens.

- Land Use Permits: Obtaining necessary permits for land development and changes in property use, a process that can vary significantly by jurisdiction and often involves environmental impact assessments.

- Property Development Standards: Adhering to building codes, safety regulations, and aesthetic standards set by local authorities for all new construction and renovations.

- Lease Agreements and Property Ownership: Managing a vast portfolio of owned and leased properties requires a deep understanding of contract law and landlord-tenant regulations to protect their interests and ensure smooth operations across their retail network.

Houchens Industries must navigate a complex landscape of legal compliance, impacting its diverse operations from retail to construction and insurance. Staying abreast of evolving consumer protection laws, industry-specific licensing, and labor legislation is paramount to avoiding penalties and maintaining operational integrity. For example, in 2024, stricter data privacy regulations in the insurance sector required significant investment in compliance, and ongoing adherence to varying state and local building codes in 2025 for construction projects remains a critical focus.

Environmental factors

Houchens Industries, with its significant operations in the Southeastern U.S., faces heightened risks from climate change. The region is experiencing more frequent and intense extreme weather, such as hurricanes and prolonged droughts. For instance, the NOAA reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, with the Southeast being particularly vulnerable.

These events can severely disrupt Houchens' supply chains, especially for its food retail segment, impacting product availability and pricing. Furthermore, the direct physical damage to warehouses, distribution centers, and agricultural assets, like those potentially supporting its food operations, could lead to substantial repair costs and operational downtime. The need for resilient infrastructure and proactive disaster management is therefore critical for business continuity.

The drive towards sustainability is intensifying, with consumers increasingly favoring eco-friendly products and businesses facing mounting regulatory pressure to adopt greener practices. This trend directly impacts Houchens Industries, particularly its retail division, by creating a significant opportunity to capture market share through the introduction of sustainable product lines. For instance, a 2024 report indicated that 68% of consumers are willing to pay more for sustainable products, a clear signal for Houchens to leverage this demand.

Furthermore, Houchens' manufacturing and construction segments must proactively integrate greener production methods and materials. Failing to adapt risks alienating environmentally conscious customers and potentially incurring penalties from stricter environmental regulations. By 2025, it's projected that sustainable construction practices will become a significant differentiator, with companies prioritizing recycled materials and energy-efficient designs seeing a notable competitive advantage.

As a company with diverse operations including retail, manufacturing, and construction, Houchens Industries faces significant waste management responsibilities. For instance, the retail sector alone in the US generated approximately 12.1 million tons of food waste in 2023, much of which could be diverted through better practices. Adhering to evolving waste and recycling regulations, such as those impacting landfill diversion rates, is crucial for operational continuity and cost management.

Proactive waste reduction and enhanced recycling initiatives can directly benefit Houchens Industries. In 2024, companies that invested in circular economy principles saw an average 10% improvement in resource efficiency. By implementing robust recycling programs across its facilities, Houchens can not only meet compliance standards but also bolster its reputation as an environmentally conscious entity, potentially attracting more eco-minded consumers and business partners.

Energy Consumption and Renewable Energy Adoption

Houchens Industries' diverse operations, from grocery retail to manufacturing and construction, inherently involve significant energy consumption, impacting its environmental footprint. For instance, in 2024, the retail sector alone accounted for a substantial portion of commercial building energy use in the US. The company's commitment to improving energy efficiency across its numerous facilities is crucial for both cost management and environmental responsibility.

The push towards renewable energy adoption presents a dual opportunity for Houchens. By integrating sources like solar or wind power, the company can potentially reduce its reliance on volatile fossil fuel markets and achieve long-term operational cost savings. This aligns with the growing market demand for sustainable business practices, which was further emphasized by a 15% year-over-year increase in corporate renewable energy procurement announcements in early 2025.

- Energy Efficiency Initiatives: Implementing LED lighting upgrades and optimizing HVAC systems across its retail and manufacturing sites can yield immediate energy savings.

- Renewable Energy Investment: Exploring on-site solar installations for distribution centers or purchasing renewable energy credits (RECs) can offset carbon emissions.

- Supply Chain Collaboration: Engaging with suppliers to promote energy-efficient practices throughout the value chain can amplify environmental impact.

- Data Monitoring: Utilizing smart meters and energy management software to track consumption patterns and identify areas for improvement.

Resource Scarcity and Supply Chain Resilience

For Houchens Industries' manufacturing and construction sectors, environmental factors like resource scarcity and price volatility for raw materials present a significant risk. For instance, the global price of lumber, a key construction material, saw significant fluctuations in 2024, impacting project costs.

To counter these environmental impacts and ensure supply chain resilience, strategic approaches are vital. Diversifying sourcing locations for critical materials and actively exploring the use of alternative, more sustainable materials can buffer against market shocks.

Building robust and adaptable supply chains is paramount. This includes strategies such as increasing inventory levels for key components, developing strong relationships with multiple suppliers, and investing in technologies that enhance supply chain visibility and agility.

- Resource Volatility: The construction industry, heavily reliant on materials like steel and concrete, faces potential disruptions from climate change impacts on mining and production. Global steel prices, for example, have shown sensitivity to energy costs and geopolitical events in 2024.

- Supply Chain Diversification: To mitigate risks, Houchens Industries should explore sourcing from regions less susceptible to extreme weather events or political instability, thereby strengthening its supply chain resilience.

- Material Innovation: Investing in research and development for alternative building materials, such as advanced composites or recycled content, can reduce dependence on traditional, potentially scarce resources.

- Resilience Strategies: Implementing strategies like dual-sourcing for critical components and building strategic reserves of key raw materials can help maintain operational continuity during periods of environmental or economic disruption.

Houchens Industries faces significant environmental challenges, including the increasing frequency of extreme weather events that can disrupt operations and supply chains, as evidenced by the 28 billion-dollar weather and climate disasters in the U.S. in 2023.

Consumer demand for sustainability is a growing factor, with 68% of consumers willing to pay more for eco-friendly products in 2024, creating opportunities for Houchens to adapt its product offerings.

Waste management and energy consumption are key operational considerations, with companies investing in circular economy principles seeing an average 10% improvement in resource efficiency in 2024.

Resource scarcity and price volatility, particularly for construction materials like lumber, pose risks, necessitating strategies like supply chain diversification and material innovation to ensure resilience.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Houchens Industries draws from a diverse range of reputable sources, including government economic reports, industry-specific market research, and analyses of regulatory changes. This ensures a comprehensive understanding of the external factors influencing the company's operations and strategic decisions.