Houchens Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Houchens Industries Bundle

Houchens Industries' BCG Matrix offers a powerful lens to understand its diverse product portfolio. See which products are fueling growth and which might be holding the company back.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain actionable insights into market share and growth rates, empowering you to make informed strategic decisions for Houchens Industries.

Stars

Houchens Industries' strategic acquisitions in high-growth sectors, such as its September 2024 acquisition of H.H. Barnum Company, highlight a deliberate expansion into industrial manufacturing and distribution. These moves are designed to bolster its position in markets with substantial future potential.

Businesses like H.H. Barnum, often leaders in their specialized fields, represent a significant investment, consuming capital for ongoing expansion. However, they are positioned to deliver substantial returns, contributing to the long-term growth and diversification of Houchens' employee stock ownership plan (ESOP).

Houchens Industries' acquisition of H.H. Barnum Company, a key player in factory and warehouse automation controls distribution, strategically places it within a burgeoning market. This sector is experiencing significant growth, driven by technological innovation and the widespread pursuit of operational efficiency. For instance, the global industrial automation market was valued at approximately $220 billion in 2023 and is projected to reach over $340 billion by 2028, showcasing the immense potential.

This move into industrial automation and distribution is a smart play for Houchens. The increasing demand for automated solutions across manufacturing, logistics, and other sectors, fueled by the need for higher productivity and reduced labor costs, creates a fertile ground for expansion. The company's investment in this area could very well see it evolve from a question mark into a robust cash cow within its portfolio.

Houchens Industries' acquisition of Feeders Pet Supply in April 2023 signals a strategic push into the burgeoning specialty retail sector, specifically pet supplies. This market segment is experiencing robust expansion, fueled by a steady rise in pet ownership and a growing consumer willingness to spend on premium pet products and services. For instance, the U.S. pet industry expenditure reached an estimated $136.8 billion in 2022, with pet supplies and over-the-counter medications accounting for a significant portion, underscoring the market's strength.

Emerging Retail Formats and Geographic Expansion

Emerging retail formats and strategic geographic expansion are key drivers for Houchens Industries, particularly in the rapidly developing Southeastern United States. These new ventures aim to capture increasing market share by tapping into growing consumer bases. This strategy necessitates significant investment in promotion and infrastructure to achieve scalable growth.

Houchens Food Group's recent expansion into Indiana, with the acquisition of three new Save A Lot locations in May 2025, demonstrates this commitment to new market penetration. This move is designed to capitalize on the growth potential within these specific regions.

- New Save A Lot Locations: Houchens Food Group acquired three new Save A Lot stores in Indiana in May 2025.

- Geographic Focus: Expansion efforts are concentrated on rapidly developing areas, especially within the Southeastern United States.

- Investment Strategy: Significant capital is allocated to promotion and infrastructure to support the scaling of these new retail formats.

- Market Capture: The goal is to secure increasing market share by serving growing consumer bases in these expanded territories.

Innovation in Manufacturing & Distribution Capabilities

Investments in advanced manufacturing and distribution capabilities position Houchens Industries' subsidiaries for significant growth, potentially placing them in the Star quadrant of the BCG matrix. By embracing automation and supply chain optimization, these businesses can gain a distinct competitive advantage in expanding market segments.

Pan-Oston, a Houchens subsidiary, exemplifies this strategic approach. During a period of economic challenge in 2024, Pan-Oston successfully innovated and launched new product lines, demonstrating a strong capacity for adaptation and growth. This agility is crucial for businesses operating in dynamic markets.

- Pan-Oston's 2024 product line expansion highlights adaptability in manufacturing.

- Investments in automation and supply chain efficiency can create a competitive edge.

- These improvements are key indicators for Star quadrant placement in the BCG matrix.

- The company's ability to innovate during difficult economic periods suggests strong future growth potential.

Stars in Houchens Industries' portfolio are characterized by their high market share in rapidly growing industries. Businesses like the H.H. Barnum Company, with its expansion into industrial automation, and Feeders Pet Supply, capitalizing on the booming pet industry, are prime examples. These ventures require significant investment to maintain their growth trajectory and competitive edge, but they are poised for substantial future returns.

| Subsidiary/Sector | Market Growth | Houchens' Market Share | Strategic Importance |

|---|---|---|---|

| H.H. Barnum (Industrial Automation) | High (projected >$340B by 2028) | Growing | Key growth driver, high potential returns |

| Feeders Pet Supply (Pet Supplies) | High (US market $136.8B in 2022) | Growing | Leveraging consumer spending trends |

| Pan-Oston (Manufacturing) | Moderate to High (innovation-driven) | Strong | Adaptability and new product development |

What is included in the product

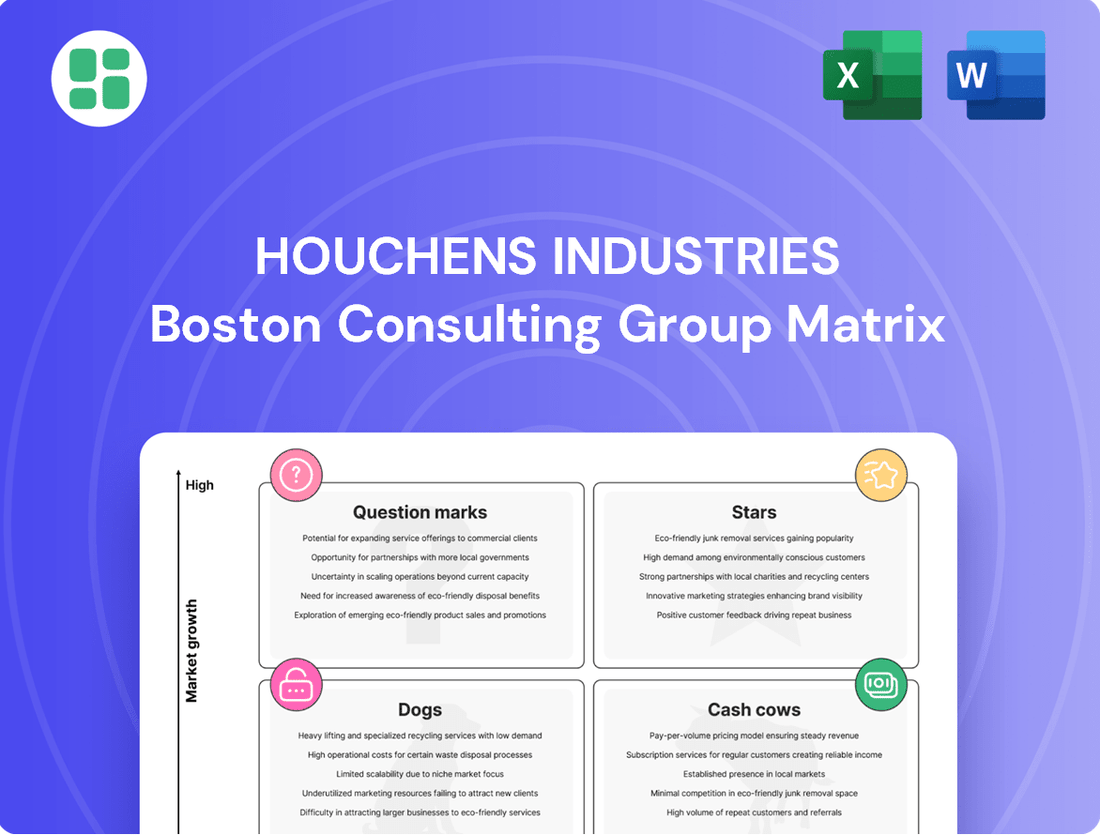

Houchens Industries' BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, identifying units for growth, harvesting, development, or divestment.

The Houchens Industries BCG Matrix provides a clear, actionable overview of business unit performance, alleviating the pain of uncertainty.

Cash Cows

Established grocery store chains like IGA, Food Giant, and Save-A-Lot, operated by Houchens Industries across numerous states, are prime examples of cash cows. Despite the mature, low-growth grocery market, these chains consistently generate significant cash flow. Their strong market share and loyal customer base mean they need minimal investment for continued success, freeing up capital for other business areas.

Mature Convenience Store Networks represent Houchens Industries' Cash Cows. With over 400 retail locations, the company holds a substantial position in this stable, albeit mature, market.

These established convenience stores generate a consistent revenue stream due to their strong local customer base and efficient operational models.

This stability allows for robust cash flow generation, requiring minimal additional investment for maintenance or growth, thus supporting other ventures within the company's portfolio.

Houchens Insurance Group (HIG) stands as a robust Cash Cow within Houchens Industries, recently surpassing $100 million in revenue as of May 2025. This significant milestone underscores its position as a major player, ranking as the 45th largest agency nationally according to Insurance Journal in 2023.

Operating within the insurance sector, a mature yet indispensable market, HIG commands a substantial market share. Its established presence and diverse clientele contribute to its consistent financial performance, making it a reliable generator of substantial cash flow that can be strategically allocated to fuel growth in other company ventures.

Long-Standing Construction Divisions

Subsidiaries like Scotty's Contracting & Stone and Stewart Richey, deeply rooted in the construction sector, exemplify Houchens Industries' long-standing Cash Cows. These entities are characterized by their maturity, operating in established markets where they likely hold significant regional sway.

Their strong market positions translate into a consistent flow of reliable contracts, underpinning their role as steady profit generators. The established reputations and enduring client relationships cultivated over years of operation ensure predictable cash generation, minimizing the need for substantial investment in aggressive market share expansion.

- Scotty's Contracting & Stone: A mature player in the construction materials and services market.

- Stewart Richey: Another established subsidiary contributing stable revenue from its construction operations.

- Regional Dominance: These companies benefit from strong footholds in their respective geographical markets.

- Consistent Cash Flow: Their mature business models generate reliable profits with limited reinvestment needs.

Traditional Manufacturing & Distribution Operations

Traditional manufacturing and distribution operations within Houchens Industries, like Stephens Pipe & Steel or Tampico, are prime examples of Cash Cows. These businesses operate in mature, stable markets where their long-standing presence has secured a high market share.

Their established operations and efficient production processes allow them to generate consistent, predictable cash flows. Importantly, these units typically require minimal reinvestment for growth, as their markets are not expanding rapidly, making them reliable sources of capital for the broader company.

- Stable Markets: Businesses like Stephens Pipe & Steel benefit from consistent demand in sectors like infrastructure and construction, which are less prone to rapid shifts.

- High Market Share: Decades of operation have allowed these entities to build strong brand recognition and customer loyalty, solidifying their dominant positions.

- Predictable Cash Flows: The mature nature of their industries translates into reliable revenue streams, unaffected by the volatility of emerging markets.

- Low Reinvestment Needs: Unlike growth-oriented businesses, these Cash Cows primarily focus on maintaining their current operational efficiency rather than significant expansion, freeing up capital.

Cash Cows within Houchens Industries represent established businesses with significant market share in mature, low-growth sectors. These operations consistently generate substantial cash flow with minimal need for reinvestment, providing vital capital for other ventures. Examples include their grocery chains, convenience stores, insurance services, construction subsidiaries, and traditional manufacturing units.

| Business Unit | Sector | Market Position | Cash Flow Generation | Reinvestment Needs |

|---|---|---|---|---|

| Grocery Chains (IGA, Food Giant, Save-A-Lot) | Retail Grocery | Strong Regional Market Share | High & Consistent | Low |

| Convenience Stores | Retail Convenience | Substantial National Presence (400+ locations) | High & Consistent | Low |

| Houchens Insurance Group (HIG) | Insurance Services | 45th Largest Agency Nationally (2023), $100M+ Revenue (May 2025) | Very High & Consistent | Low |

| Construction Subsidiaries (Scotty's, Stewart Richey) | Construction & Materials | Significant Regional Sway | High & Consistent | Low |

| Manufacturing & Distribution (Stephens Pipe & Steel, Tampico) | Manufacturing/Distribution | High Market Share in Stable Markets | High & Consistent | Low |

What You See Is What You Get

Houchens Industries BCG Matrix

The Houchens Industries BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report ready for your strategic planning needs. You can confidently use this preview as an accurate representation of the comprehensive BCG Matrix analysis you'll gain access to immediately after completing your purchase. This ensures you know precisely what you're investing in – a valuable tool for understanding Houchens Industries' product portfolio and market positions.

Dogs

Underperforming niche retail outlets within Houchens Industries' broader portfolio, particularly those within the Houchens Food Group, would likely be classified as Dogs in a BCG Matrix analysis. These are typically individual stores or small, localized chains operating in areas with declining populations or facing overwhelming competition from larger, more established players. For instance, a small convenience store in a rural town experiencing significant out-migration would fit this description.

These outlets are characterized by their low market share within their specific niche and their operation in stagnant or shrinking local markets. In 2024, many such smaller, independent retailers have faced heightened pressure from inflation and shifting consumer habits, making it even harder to achieve profitability. A specific example might be a specialty food shop in a downtown area that has seen a substantial decrease in foot traffic due to remote work trends, leading to a significant drop in sales compared to previous years.

The strategic recommendation for these Dog assets is typically divestiture or a substantial restructuring effort. Houchens Industries would likely explore selling these underperforming units to another entity that might see potential for turnaround, or consider closing them if the operational costs and lack of growth prospects outweigh any potential salvage value. For example, if a particular niche clothing boutique consistently reported losses exceeding 15% year-over-year, and there was no clear path to market share growth, closure would be a probable outcome.

Manufacturing operations at Houchens Industries that utilize obsolete technology or offer product lines no longer aligned with current market demands would be classified as Dogs. These segments typically hold a low market share within a slow-growing industry, meaning they consume valuable resources without yielding substantial profits. For instance, a legacy textile division relying on outdated looms might fall into this category, especially if the apparel market has shifted towards synthetic blends and faster fashion cycles.

In 2024, companies with significant exposure to legacy manufacturing processes often face challenges. For example, the automotive sector has seen a clear division, with traditional internal combustion engine component manufacturers struggling to adapt compared to those investing in electric vehicle technology. A plant producing older model car parts, if it were part of Houchens Industries, would likely represent a Dog, characterized by declining demand and high operational costs due to inefficient machinery.

Investing in costly turnaround strategies for such outdated facilities or product lines is generally not recommended. Instead, the focus is often on divesting these assets or phasing them out to reallocate capital towards more promising growth areas within the company. This strategic pruning allows Houchens Industries to optimize its portfolio and concentrate on segments with higher potential for innovation and market expansion.

Within Houchens Industries, certain niche service offerings have struggled to gain significant market traction, placing them in the Dogs quadrant of the BCG Matrix. These services often operate in saturated or declining markets, facing intense competition that stifles growth and cash generation. For example, a hypothetical legacy IT support service for a shrinking industry might have seen its market share dwindle to less than 2% by the end of 2024, yielding minimal returns on investment and tying up valuable capital.

Acquired Businesses Failing Integration

Acquired businesses that falter in integration and consistently miss projections can become significant burdens for Houchens Industries. These units, often characterized by low market share and an unclear route to profitability, represent potential cash traps within the BCG matrix. For instance, if an acquired retail chain, despite significant investment, fails to align its operational systems with Houchens' existing infrastructure, it might struggle to achieve economies of scale.

Such underperforming acquisitions can drain resources without delivering expected returns. In 2024, the average integration cost for acquisitions exceeding $100 million has been reported to be around 15-20% of the deal value, highlighting the financial risk involved when integration efforts are unsuccessful.

- Struggling Integration: Acquired businesses that do not merge smoothly with Houchens' existing operations, leading to inefficiencies and increased costs.

- Underperformance: Entities failing to meet initial financial projections and growth targets post-acquisition.

- Low Market Share: These businesses often operate in crowded or declining markets, making it difficult to gain traction and achieve significant sales.

- Cash Drain: Without a clear path to profitability, these units consume capital that could be better allocated to more promising ventures within Houchens' portfolio.

Geographically Limited or Overly Saturated Small-Format Stores

Geographically limited or overly saturated small-format stores often fall into the Dogs category within the BCG Matrix. These businesses, like many small convenience stores or hybrid grocery formats, can struggle if they are situated in areas already crowded with similar establishments or in regions experiencing population decline. For example, a small convenience store in a neighborhood with three other similar stores and a shrinking customer base might find it difficult to gain significant market share or see substantial growth.

These stores typically exhibit low market share coupled with limited growth prospects. Consequently, maintaining their profitability can demand a disproportionate amount of resources and effort compared to the returns they generate. In 2024, the convenience store sector, while generally resilient, faced challenges from rising operating costs and increased competition, especially from larger chains expanding their smaller format offerings.

- Low Market Share: Many small-format stores in saturated markets struggle to capture a significant portion of local sales, often operating with less than a 5% market share within their immediate vicinity.

- Limited Growth Potential: In areas with declining populations, such as some rural towns or inner-city neighborhoods experiencing outward migration, the potential for sales growth is inherently restricted.

- High Operational Effort: Maintaining profitability for these stores can be a constant battle against rising labor costs and inventory management challenges, often requiring extensive owner involvement.

- Break-Even Operations: The primary objective for many of these "dog" stores becomes simply to break even, covering their operational costs without generating substantial profits, reflecting their challenging market position.

Dogs within Houchens Industries' portfolio represent underperforming units with low market share in slow-growth or declining markets. These often include niche retail outlets, legacy manufacturing divisions, or struggling acquired businesses. For instance, a small, independent grocery store in a rural area with a shrinking population would be a prime example of a Dog.

In 2024, many such businesses faced increased pressure from inflation and evolving consumer preferences, exacerbating their low market share and profitability challenges. A hypothetical example could be a specialty electronics repair shop that has seen demand plummet due to the widespread adoption of integrated device warranties, operating with a market share below 3% in its niche.

The strategic approach for these Dog assets typically involves divestiture, closure, or a significant restructuring to cut losses and reallocate capital. For example, a Houchens Industries division focused on producing outdated office furniture, if it consistently operated at a loss and had negligible market growth, would likely be a candidate for sale or liquidation.

| Category | Characteristic | Example within Houchens Industries | 2024 Market Trend Impact | Strategic Action |

| Dogs | Low Market Share, Low Growth | Small, rural convenience store | Increased competition from larger chains' smaller formats | Divestiture or Closure |

| Dogs | Low Market Share, Low Growth | Legacy textile manufacturing plant | Shift in consumer demand towards synthetic and fast fashion | Divestiture or Closure |

| Dogs | Low Market Share, Low Growth | Acquired niche retail chain failing integration | High integration costs and operational inefficiencies | Divestiture or Closure |

Question Marks

Houchens Industries, with its broad reach, might explore new tech ventures in retail and services. Think about cutting-edge e-commerce tools or smart supply chain management systems. These are areas with huge growth possibilities, but they're just starting out and don't have a big piece of the market yet.

These new tech ventures, like AI-powered customer service bots or advanced inventory management software, would likely be classified as question marks in the BCG matrix. They operate in rapidly expanding markets, reflecting the ongoing digital transformation in retail and services. For example, the global e-commerce market was projected to reach over $6.3 trillion in 2023, with significant growth expected from new technologies.

Such ventures demand considerable initial investment for research, development, and market penetration. While they offer the promise of high future returns, their current market share is typically small as they establish themselves. This investment profile is characteristic of question marks, requiring careful management and strategic decisions to determine if they can become stars or if they should be divested.

Expanding into untapped geographic markets represents a classic "question mark" opportunity for Houchens Industries. These ventures, aiming for new regions beyond their core Southeastern U.S. footprint, promise substantial growth potential. For instance, entering a new state like Texas or California could tap into millions of new customers, but Houchens would start with a negligible market share and face the uphill battle of building brand awareness against established competitors.

The initial investment required for such expansion, including setting up new distribution networks, marketing campaigns, and potentially new store formats, would likely be significant. In 2024, the cost of establishing a new retail presence in a major metropolitan area can easily run into millions of dollars per location, impacting short-term profitability. This high investment coupled with low initial market penetration defines the "question mark" status, where success is uncertain but the potential rewards are high.

Houchens Industries might explore experimental retail concepts like curated subscription boxes for niche food items or pop-up shops focused on local artisanal products. These ventures target growing segments such as personalized e-commerce and experiential retail but currently hold minimal market share, reflecting their status as potential question marks.

Significant investment in marketing to build brand awareness and in adaptable infrastructure to test different store layouts and operational models would be crucial for these experimental formats. For instance, a pilot program for a "farm-to-table" express grocery concept in a densely populated urban area could require substantial upfront costs for sourcing and logistics, aiming to capture a share of the rapidly expanding fresh food market, which saw a global growth of over 10% in 2024.

Recently Acquired Smaller Companies with Growth Potential

Within Houchens Industries' portfolio, recently acquired smaller companies with growth potential would be categorized as Question Marks. These entities are typically found in fast-paced, expanding markets but haven't yet established a dominant market share. Think of a niche manufacturing operation in a cutting-edge sector or a new service business with a truly novel approach.

These Question Marks require substantial cash infusions to fuel their expansion and secure market penetration. Their success hinges on their ability to capture market share and evolve into Stars. For instance, a recently acquired startup specializing in advanced robotics components, operating within a market projected to grow by 25% annually through 2028, might fit this profile. While currently a small player, its innovative technology positions it for significant future growth if market adoption accelerates as anticipated.

- High Market Growth: Operating in sectors experiencing rapid expansion, such as advanced materials or specialized software solutions.

- Low Relative Market Share: Despite operating in a growing market, these companies have not yet achieved a leading position.

- High Cash Consumption: Significant investment is needed for research and development, marketing, and scaling operations to compete effectively.

- Potential for Star Status: Successful strategic execution and market acceptance could elevate these companies to Star status, generating substantial future returns.

Strategic Investments in Niche, Evolving Industries

Houchens Industries strategically targets niche, evolving industries, seeking early market entry in rapidly changing sectors. These investments, often in emerging manufacturing or specialized services, represent high-risk, high-reward opportunities. While current market share might be minimal, the potential for substantial market growth demands rigorous evaluation for ongoing investment or potential divestment.

For instance, consider the burgeoning field of advanced materials manufacturing. Companies in this space might have only a 2% market share in 2024, but the industry itself is projected to grow at a compound annual growth rate of 15% through 2030, reaching an estimated $200 billion globally. This aligns with the 'Question Mark' profile, requiring careful analysis of competitive dynamics and technological advancements before committing significant capital.

- Niche Industry Focus: Targeting sectors with high growth potential but low current market penetration.

- Disruption & Evolution: Investing in industries undergoing rapid technological change or market shifts.

- Risk-Reward Profile: Acknowledging high initial risk coupled with the potential for significant future returns.

- Strategic Evaluation: Continuous assessment of market position and growth trajectory to inform investment decisions.

Question Marks within Houchens Industries represent ventures in high-growth markets with low current market share. These opportunities demand significant investment to build market presence and require careful strategic management to determine their future potential. Without successful development, they risk becoming Dogs or being divested.

These ventures are characterized by their need for substantial capital to fund research, development, and market penetration efforts. For example, a new technology startup in the renewable energy sector might have a minimal market share in 2024 but operate within an industry projected to grow by over 20% annually. This high investment and uncertain future return profile are hallmarks of a Question Mark.

The strategic decision for Question Marks involves either investing heavily to increase market share and potentially become a Star, or divesting if the outlook remains unfavorable. This careful balancing act is crucial for optimizing the overall portfolio's performance and resource allocation.

| Venture Type | Market Growth Rate (Est. 2024) | Current Market Share (Est. 2024) | Cash Flow | Strategic Outlook |

|---|---|---|---|---|

| New E-commerce Tech | 15% | 3% | Negative | Invest to gain market share or divest |

| Experimental Retail Concept | 12% | 1% | Negative | Invest to refine offering or divest |

| Acquired Niche Manufacturing | 25% | 2% | Negative | Invest for scaling or divest |

BCG Matrix Data Sources

Our Houchens Industries BCG Matrix leverages a robust data foundation, integrating internal financial performance metrics with external market research, competitor analysis, and industry growth projections.