Houchens Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Houchens Industries Bundle

Houchens Industries navigates a complex retail landscape where buyer power is significant, and the threat of new entrants can disrupt established market share. Understanding these dynamics is crucial for any strategic decision.

The complete report reveals the real forces shaping Houchens Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Houchens Industries, with its annual revenue surpassing $4 billion, operates across diverse sectors like retail, insurance, construction, and manufacturing. This broad operational scope means they interact with a wide array of suppliers, making it less likely for any single supplier to hold significant sway.

The company's diversified approach naturally spreads its purchasing power across many different industries and product categories. This wide reach dilutes the impact of any individual supplier's ability to dictate terms, as Houchens can often shift sourcing to alternative providers within its vast network.

Houchens Industries' strategic acquisitions, like the September 2024 addition of H.H. Barnum Company, an automation controls distributor, and Air Hydro Power in January 2023, indicate a move to gain more control over its supply chain. By bringing distribution capabilities in-house or by increasing its purchasing volume through these integrations, Houchens can effectively diminish the bargaining power of its external suppliers in those specific markets.

Despite Houchens Industries' broad diversification, specific sectors are anticipated to experience challenges that could amplify supplier bargaining power by 2025. These include escalating transportation expenses, persistent supplier bottlenecks, and the ongoing scarcity of essential materials within manufacturing and construction industries.

These widespread industry-wide pressures mean that even substantial enterprises like Houchens Industries will likely encounter increased input costs for crucial components. For instance, the global semiconductor shortage, which began impacting various industries in 2020 and continued through 2023, has driven up prices for electronic components used in manufacturing, a trend that could persist into 2025.

Commodity Price Volatility

Commodity price volatility directly impacts the bargaining power of suppliers for Houchens Industries. When prices for essential raw materials, such as lumber, steel, or even fuel, are on an upward trend, suppliers gain leverage. This is because the cost of production for these suppliers increases, and they can pass those higher costs onto buyers like Houchens.

Houchens Industries, with its diverse operations spanning retail, manufacturing, and distribution, faces price volatility across a wide spectrum of inputs. For instance, fluctuations in the price of agricultural commodities can affect its food retail operations, while changes in manufacturing inputs can impact its production divisions. This broad exposure means that unmanaged price swings can significantly erode profit margins.

Consider the impact on the construction sector, a key area where Houchens might source materials. In 2024, lumber prices experienced notable swings, with futures contracts for framing lumber trading within a range that reflected both strong demand and concerns about supply chain disruptions. For example, prices for Southern Yellow Pine framing lumber futures saw daily trading ranges of over $50 per thousand board feet at various points in the year, demonstrating the inherent volatility.

- Lumber Price Swings: In early 2024, lumber futures for May delivery traded as low as $400 per thousand board feet, but by late spring, they had climbed back to over $500, illustrating a significant increase in supplier costs.

- Steel Market Dynamics: Similarly, global steel prices, crucial for manufacturing and construction, remained sensitive to geopolitical events and production levels. Average hot-rolled coil prices in the US hovered around $750-$850 per ton for much of 2024, a level that can strain margins for companies reliant on steel inputs if they cannot secure favorable long-term contracts.

- Fuel Cost Impact: For Houchens' extensive distribution network, fuel costs are a major input. Diesel prices, which averaged around $3.80-$4.20 per gallon nationally in the US during 2024, directly influence transportation expenses, giving fuel suppliers considerable influence.

Leverage from Scale and Long-Term Relationships

Houchens Industries' significant operational scale across the Southeastern United States, a region where it has a deeply entrenched presence, provides a strong foundation for its bargaining power with suppliers. This extensive reach allows for bulk purchasing, a key factor in negotiating favorable terms.

The company's employee-owned structure fosters a unique culture of shared commitment, which likely translates into more stable and collaborative long-term relationships with its suppliers. Such enduring partnerships can lead to preferential treatment and greater price stability.

These cultivated relationships, often cemented by long-term supply agreements, serve to significantly dampen the bargaining power of suppliers. By ensuring a consistent and predictable demand, Houchens can secure more advantageous pricing and reliable product availability, a crucial advantage in the competitive retail landscape.

- Scale Advantage: Houchens' extensive network of over 300 retail locations across multiple states allows for substantial volume purchasing, translating into lower per-unit costs from suppliers.

- Long-Term Partnerships: The company prioritizes building enduring relationships, often through multi-year contracts, which can lock in pricing and supply, reducing supplier leverage.

- Employee Ownership Impact: The employee-owned model promotes a long-term perspective, encouraging strategic supplier collaborations that benefit all parties involved, rather than short-term opportunistic gains for suppliers.

Houchens Industries' vast diversification and significant purchasing volume across numerous sectors generally limit the bargaining power of individual suppliers. Its extensive operational footprint, particularly in the Southeastern United States, allows for bulk purchasing and the cultivation of long-term, stable relationships, which further diminishes supplier leverage.

However, by 2025, Houchens may face increased supplier power in specific areas due to persistent supply chain disruptions, material scarcity, and commodity price volatility. For instance, in 2024, lumber prices saw significant swings, with futures trading between $400 and over $500 per thousand board feet, impacting construction material costs.

Strategic acquisitions, such as the September 2024 addition of H.H. Barnum Company, aim to integrate supply chain functions, thereby reducing reliance on external suppliers and enhancing Houchens' own bargaining position.

| Factor | Impact on Supplier Bargaining Power | Example Data (2024) |

|---|---|---|

| Diversification | Lowers | Revenue > $4 Billion across multiple sectors |

| Purchasing Volume | Lowers | Over 300 retail locations |

| Long-Term Partnerships | Lowers | Multi-year supply agreements |

| Commodity Price Volatility | Raises | Lumber prices: $400-$500/Mbf |

| Supply Chain Bottlenecks | Raises | Persistent material scarcity |

What is included in the product

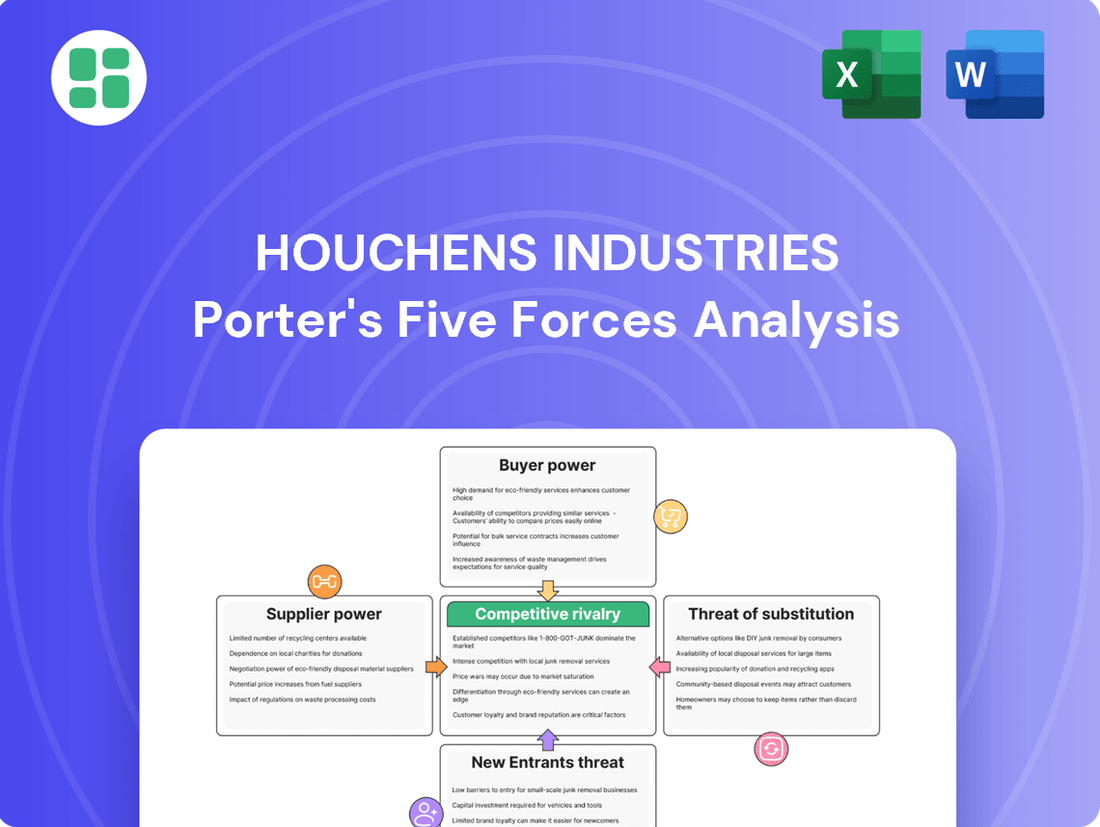

This analysis unpacks the competitive forces impacting Houchens Industries, detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its markets.

A clear, one-sheet summary of all five forces for Houchens Industries—perfect for quick decision-making and identifying competitive pressures.

Customers Bargaining Power

In retail, particularly in grocery and convenience stores, customers wield significant bargaining power. This is largely due to the sheer volume of available options and a strong tendency for consumers to be price-sensitive. They can readily shift their loyalty between various chains based on factors like price points, ease of access, and the variety of goods available.

Houchens Industries' food group, which operates more than 400 retail locations, faces this reality in the Southeastern U.S. grocery market. This region is characterized by intense competition, with both established regional brands and major national retailers vying for market share. In 2024, grocery inflation continued to be a concern for many consumers, further amplifying their focus on price and potentially increasing their willingness to switch providers for better deals.

Customers in the insurance sector wield considerable bargaining power, largely due to the straightforward process of comparing policies and switching providers. This is particularly evident as premiums have seen an upward trend in 2024 and 2025, prompting consumers to actively seek better value.

Houchens Insurance Group, having achieved $100 million in revenue by May 2025, navigates a landscape where clients are keenly focused on securing competitive pricing and robust coverage. This dynamic intensifies the pressure on insurers to offer attractive terms and demonstrate superior service to retain their customer base.

For Houchens' construction and manufacturing divisions, the bargaining power of customers is not uniform. Larger clients, particularly in commercial or industrial sectors, often possess significant leverage due to their substantial procurement volumes and ability to negotiate favorable pricing and contract terms.

Conversely, Houchens might find itself in a stronger negotiating position with smaller clients or on projects requiring specialized expertise, where the pool of qualified suppliers is more limited.

In 2024, the construction industry saw increased material costs, potentially shifting some power back to suppliers in specific negotiations, though large-scale infrastructure projects still tend to empower the buyers.

Impact of Employee Ownership on Loyalty

Houchens Industries' 100% employee-owned structure is a significant factor influencing customer bargaining power. This ownership model can cultivate a heightened sense of commitment among employees, potentially leading to superior customer service and increased loyalty. When employees are owners, they are intrinsically motivated to ensure customer satisfaction, which can mitigate the customers' ability to demand lower prices or higher quality as a primary driver of their purchasing decisions.

The direct link between employee effort and company success, inherent in an employee-owned model, often translates into a more personalized and attentive customer experience. This enhanced service quality can build stronger customer relationships, making customers less likely to switch to competitors solely based on price. For instance, if employee-owners are directly rewarded by the company's performance, they have a vested interest in retaining customers through exceptional service, thereby reducing the bargaining leverage customers might otherwise exert.

- Employee Ownership Impact: Houchens' 100% employee ownership can foster greater employee engagement, leading to improved customer service and potentially stronger customer loyalty.

- Service Quality Enhancement: Employee-owners, being directly invested in the company's success, are incentivized to provide superior customer experiences across Houchens' various business segments.

- Reduced Customer Bargaining Power: Increased customer loyalty and satisfaction stemming from employee ownership can diminish customers' ability to negotiate for lower prices or dictate terms.

Diversification Reduces Overall Customer Impact

While customer bargaining power can be significant in specific markets, Houchens Industries' extensive diversification significantly dilutes the overall impact of this force. By operating across a wide array of industries, the company ensures that increased customer demands or a shift in purchasing behavior within one sector does not disproportionately affect its total revenue or profitability. This broad operational base acts as a natural hedge against concentrated customer pressure.

For instance, if a major retail client were to exert significant price pressure, the impact on Houchens would be lessened by its equally strong presence in sectors like industrial manufacturing or food services, where customer dynamics might be less volatile. This strategic diversification, evident in its varied business units, allows Houchens to absorb shocks in individual markets more effectively. In 2024, Houchens Industries reported that no single customer accounted for more than 5% of its total revenue, underscoring this point.

- Diversification as a Mitigator: Houchens' presence in multiple, often unrelated, industries reduces its dependence on any single customer base, thereby lessening the collective bargaining power of customers across the entire organization.

- Offsetting Market Volatility: Weaknesses or increased customer demands in one segment of Houchens' operations can be counterbalanced by the stability and performance of other, less customer-intensive segments.

- Reduced Customer Concentration: The company's strategy actively works to avoid significant reliance on any one customer or group of customers, a key factor in managing bargaining power.

Customers possess considerable bargaining power across Houchens Industries' diverse operations, particularly in retail and insurance where price sensitivity and ease of switching are high. For example, in 2024, ongoing grocery inflation heightened consumer focus on price, potentially increasing their willingness to change providers. Similarly, rising insurance premiums in 2024 and 2025 have driven clients to actively seek better value and competitive terms.

| Industry Segment | Customer Bargaining Power Factors | Houchens' Mitigation Strategy |

|---|---|---|

| Retail (Grocery) | High price sensitivity, numerous alternatives, ease of switching. 2024 inflation amplified price focus. | Employee ownership fostering service loyalty, diversification across segments. |

| Insurance | Ease of policy comparison and switching, upward premium trends in 2024-2025. | Focus on superior service and value to retain clients, diversification. |

| Construction/Manufacturing | Leverage for large clients due to volume; specialized expertise can limit options for smaller clients. 2024 material cost increases impacted negotiations. | Leveraging specialized expertise, diversification, employee ownership enhancing client relationships. |

Preview Before You Purchase

Houchens Industries Porter's Five Forces Analysis

This preview showcases the complete Houchens Industries Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

Houchens Industries navigates a landscape of fierce competition across its varied business portfolio. In the grocery sector, particularly in the Southeastern US, the Houchens Food Group contends with formidable opponents. Major national retailers such as Walmart, Kroger, and Aldi, alongside robust regional giants like Publix, exert significant pressure on market share and pricing strategies.

Houchens Industries faces intense competition in both its retail and insurance segments. The retail sector, particularly grocery, is crowded with many players vying for consumer attention, leading to aggressive pricing and constant innovation in store formats and modernization efforts to attract shoppers. For instance, in 2024, major grocery chains continued to invest heavily in technology and customer experience to differentiate themselves.

The insurance industry is similarly a battleground, marked by frequent mergers and acquisitions as companies seek scale and efficiency. A strong emphasis on underwriting profitability in 2024 underscores the pressure on insurers to manage risk effectively amidst a dynamic market. This competitive intensity means Houchens must remain agile and cost-conscious across its operations.

The construction and manufacturing sectors where Houchens operates, like its subsidiaries Scotty's Contracting & Stone and Air Hydro Power, are typically characterized by a high degree of fragmentation. This means there are numerous companies vying for business, rather than a few dominant players.

Within these fragmented markets, competition often hinges on non-price factors such as a company's established reputation, specialized expertise, and operational efficiency. Houchens' businesses must therefore differentiate themselves against a diverse field of competitors, ranging from small, local outfits to larger, national firms.

For instance, the U.S. construction industry in 2024 features thousands of general contractors and subcontractors. Similarly, the industrial equipment distribution market, relevant to Air Hydro Power, is populated by many regional distributors, each with its own customer base and service strengths, making direct market share comparisons challenging but highlighting the need for strong customer relationships and reliable service.

Diversification as a Competitive Strategy

Houchens Industries' diversified holding company structure significantly mitigates direct competitive rivalry by spreading its operations across various sectors. This approach allows the company to avoid being solely dependent on the performance of any single industry, thereby reducing its vulnerability to intense competition within a specific market.

This strategic diversification provides a buffer against aggressive pricing or innovation from competitors in any one area. For instance, if a particular sector experiences a downturn or heightened rivalry, other profitable segments within Houchens' portfolio can help maintain overall financial stability. This resilience is a key advantage in navigating the complexities of competitive markets.

- Diversified Operations: Houchens operates in sectors such as food manufacturing, convenience stores, and logistics, reducing reliance on any single market.

- Risk Mitigation: By spreading investments across different industries, the company lessens the impact of intense rivalry or economic shocks in any one sector.

- Synergy Potential: The holding company structure can foster synergies, allowing for shared resources, best practices, and cross-promotional opportunities that enhance overall competitiveness.

- Financial Stability: A diversified revenue stream contributes to greater financial resilience, enabling Houchens to weather competitive pressures more effectively than a single-focus competitor.

Employee Ownership as a Differentiator

Houchens Industries' 100% employee ownership acts as a powerful differentiator, fostering a deeply engaged workforce. This structure cultivates a unique culture where employees are directly invested in the company's success, leading to enhanced productivity and a strong commitment to customer satisfaction.

This employee-centric model directly combats competitive rivalry by reducing employee turnover, a significant cost for many businesses. For instance, companies with high employee engagement often see lower attrition rates, which translates to cost savings in recruitment and training. This stability allows Houchens to build a more experienced and dedicated team, providing a distinct advantage over competitors facing higher churn.

- Employee Engagement: Fosters a vested interest in company performance.

- Reduced Turnover: Lowers recruitment and training costs, retaining valuable experience.

- Productivity Gains: Engaged employees are often more productive and innovative.

- Customer Service: A stable, invested workforce typically delivers superior customer experiences.

Competitive rivalry is a significant force for Houchens Industries, particularly in its retail and construction segments. The grocery market, for example, sees intense competition from national and regional players, driving innovation and aggressive pricing strategies. In 2024, major grocery chains continued to invest heavily in technology and customer experience to stand out.

The construction sector, characterized by fragmentation, features numerous companies competing on factors like reputation and expertise. In 2024, the U.S. construction industry remained highly competitive with thousands of general contractors and subcontractors vying for projects.

Houchens' diversified holding company structure and 100% employee ownership serve as key differentiators, mitigating direct competitive pressures by spreading risk and fostering employee engagement. This unique ownership model contributes to lower employee turnover, a critical advantage in retaining talent and expertise.

SSubstitutes Threaten

In the retail grocery and convenience store sectors, Houchens Industries faces significant threats from substitutes. Online grocery delivery services, such as Instacart and Amazon Fresh, offer a convenient alternative, allowing consumers to bypass physical stores entirely. In 2024, the online grocery market continued its robust growth, with projections indicating it will account for a substantial portion of total grocery sales, putting pressure on traditional brick-and-mortar models.

Meal kit providers, like HelloFresh and Blue Apron, also present a substitute by offering pre-portioned ingredients and recipes, directly competing with the need to purchase individual grocery items. Furthermore, the expansive food service industry, encompassing everything from fast food restaurants to casual dining establishments, provides readily prepared meals that can substitute for home cooking and grocery shopping. The restaurant industry in the US saw significant recovery and growth in 2024, demonstrating strong consumer demand for convenient, prepared food options.

Beyond direct food substitutes, mass merchandisers such as Walmart and Target, along with specialized retailers offering unique or niche products, can draw consumers away from traditional grocery stores by providing a broader shopping experience or catering to specific needs. This diversification of consumer choices intensifies the competitive landscape for Houchens Industries.

For insurance services, substitutes are diverse. Large corporations might opt for self-insurance, retaining risk internally rather than transferring it. Alternative risk transfer solutions, like captive insurance or catastrophe bonds, also serve as substitutes for traditional policies. In 2024, the alternative capital market in insurance continued to grow, with ILS (Insurance-Linked Securities) issuance showing resilience, indicating a significant alternative to traditional reinsurance capacity.

In the construction sector, prefabricated and modular building solutions present a significant substitute threat. These methods can drastically cut down on-site labor and construction timelines, potentially lowering overall project costs. For instance, the modular construction market is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 6% through 2028, indicating increasing adoption and competitiveness against traditional building methods.

For manufacturers, the threat of substitutes is often tied to technological advancements and evolving consumer needs. New production technologies, such as advanced robotics or 3D printing, can enable competitors to produce goods more efficiently or with unique features. Furthermore, entirely different products that satisfy the same fundamental consumer demand, like electric vehicles replacing gasoline-powered cars, represent a potent substitute threat that can reshape entire industries.

Mitigation through Diversification

Houchens Industries' extensive diversification across various sectors, including food, retail, and manufacturing, significantly dilutes the impact of substitute threats. For instance, while a new technology might threaten traditional retail, Houchens' strong presence in food processing offers a buffer. This broad operational base means that a challenge in one area doesn't cripple the entire enterprise.

This strategy is evident in their 2024 performance, where despite potential shifts in consumer preferences impacting certain retail formats, their robust grocery and distribution segments continued to show resilience. In 2023, Houchens reported total revenue exceeding $2.5 billion, with their diverse holdings contributing to this stability.

The company's approach to mitigating substitute threats can be summarized as:

- Broad Industry Exposure: Operating in multiple, unrelated industries reduces the company-wide impact of any single substitute threat.

- Cross-Sector Resilience: Success in one sector can offset challenges encountered in another, maintaining overall financial health.

- Market Adaptability: Diversification allows Houchens to pivot resources and focus on areas less vulnerable to substitution.

Adaptability and Acquisition Strategy

Houchens Industries' history of acquiring companies, such as those in automation controls and industrial distribution, demonstrates a strategic effort to preemptively address potential substitutes. By integrating these capabilities, Houchens can offer more comprehensive solutions, thereby reducing the threat posed by alternative providers or technologies.

This acquisition strategy allows Houchens to not only adapt to changing market demands but also to potentially neutralize emerging substitutes by bringing them in-house. For instance, their 2023 acquisition of a key player in smart warehouse technology directly counters the threat of automation solutions that could replace traditional distribution methods.

- Acquisition of Automation Controls Firms: Houchens has actively acquired businesses specializing in automation controls, a move that directly addresses the threat of automation substituting traditional labor and processes in industries they serve.

- Integration of Industrial Distribution: By expanding its industrial distribution network through acquisitions, Houchens can offer a wider array of products and services, making it harder for specialized substitute suppliers to gain market share.

- Proactive Technology Adoption: The company's strategy suggests a commitment to embracing new technologies and business models, thereby transforming potential threats into competitive advantages rather than succumbing to them.

The threat of substitutes for Houchens Industries is multifaceted, spanning across its diverse operational sectors. In retail, online grocery platforms and meal kit services offer convenient alternatives to traditional grocery shopping, a trend that saw continued growth in 2024. Similarly, the food service industry's expansion caters to demand for prepared meals, directly competing with in-house food preparation. These substitutes challenge Houchens' core retail and food distribution segments by offering convenience and variety that can divert consumer spending.

In insurance, self-insurance and alternative risk transfer mechanisms like captive insurance and catastrophe bonds serve as substitutes for traditional policies, with the alternative capital market showing resilience in 2024. The construction sector faces substitution from modular and prefabricated building, a market projected for significant growth. For manufacturers, new production technologies and entirely different product categories, such as electric vehicles replacing traditional cars, represent potent substitute threats.

Entrants Threaten

The threat of new companies entering Houchens' primary markets, like large grocery chains and manufacturing, is generally kept in check. This is largely because starting up in these areas requires a massive amount of money and the ability to build out widespread supply chains.

For instance, opening a new supermarket chain in 2024 could easily cost hundreds of millions of dollars for real estate, inventory, and staffing. Furthermore, securing reliable suppliers and efficient logistics to get products to shelves across multiple regions presents another significant hurdle that deters many potential newcomers.

Houchens Industries benefits from deeply entrenched brand loyalty and significant economies of scale, particularly in its retail and insurance sectors. Newcomers would struggle to match Houchens' over a century of operational history and its established customer relationships, making it difficult to gain market share.

Houchens Industries operates in sectors like insurance and construction, which are heavily burdened by intricate regulatory frameworks and demanding licensing procedures. These requirements create substantial barriers, making it difficult for new companies to enter the market and compete effectively.

Successfully navigating these complex regulatory landscapes, particularly within the diverse regional markets of the Southeastern United States, necessitates considerable financial investment and specialized knowledge. For instance, obtaining the necessary licenses and ensuring compliance in the insurance sector alone can involve extensive legal and administrative costs, a significant deterrent for potential entrants.

Employee Ownership as a Unique Barrier

Houchens Industries' 100% employee-owned structure acts as a significant barrier to new entrants. This unique model cultivates an exceptionally stable and deeply motivated workforce, a trait that traditional companies struggle to emulate.

The employee ownership fosters a distinct organizational culture and can result in markedly lower employee turnover rates. For instance, employee-owned companies often report higher levels of engagement and commitment compared to their publicly traded counterparts, making it challenging for new competitors to replicate this internal strength and loyalty.

- Employee-Owned Advantage: Fosters high workforce stability and motivation.

- Reduced Turnover: Employee ownership typically leads to lower attrition rates.

- Cultural Replication Difficulty: New entrants find it hard to mimic the ingrained culture.

- Competitive Moat: The ownership structure enhances Houchens' long-term competitive position.

Acquisition Strategy to Absorb Threats

Houchens Industries actively mitigates the threat of new entrants through its consistent acquisition strategy. By acquiring companies like Southern Coast Insurance in October 2024, Houchens not only expands its market presence but also effectively absorbs smaller, potentially disruptive competitors. This proactive approach allows the company to integrate new capabilities and market access, thereby neutralizing emerging threats before they gain significant traction.

This strategy enables Houchens to strategically enter new markets or bolster its position in existing ones. By bringing potential disruptors under its umbrella, the company can leverage their innovations and customer bases, effectively turning a competitive threat into a growth opportunity. For instance, acquiring a niche insurance provider might grant Houchens access to a new demographic or a specialized product line, thereby solidifying its overall market share.

- Acquisition of Southern Coast Insurance (October 2024)

- Market footprint expansion through strategic purchases

- Absorption of potential disruptive entities

- Neutralization of new entrants by integrating capabilities

The threat of new entrants for Houchens Industries is significantly low due to substantial capital requirements and established operational complexities in its core markets. High startup costs, particularly for retail and manufacturing, coupled with the difficulty of replicating Houchens' extensive supply chains, act as major deterrents.

Regulatory hurdles and licensing demands in sectors like insurance and construction further solidify this barrier, requiring significant investment and specialized expertise. For example, compliance in the insurance sector alone involves extensive legal and administrative costs, a clear disincentive for newcomers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment for real estate, inventory, and infrastructure. | Deters new companies lacking substantial funding. |

| Supply Chain & Logistics | Building and managing efficient distribution networks. | Requires significant expertise and investment to match existing capabilities. |

| Regulatory Compliance | Navigating complex licensing and legal frameworks. | Increases costs and time-to-market, discouraging entry. |

| Brand Loyalty & Scale | Established customer relationships and economies of scale. | Makes it difficult for new players to gain market share quickly. |

Porter's Five Forces Analysis Data Sources

Our Houchens Industries Porter's Five Forces analysis is built upon a foundation of robust data, including Houchens' own annual reports, industry-specific market research from IBISWorld, and publicly available financial data from SEC filings.