Hotai Motor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hotai Motor Bundle

Navigate the complex external landscape impacting Hotai Motor with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are shaping the automotive giant's future. Gain the strategic foresight you need to make informed decisions and stay ahead of the curve. Download the full PESTLE analysis for actionable intelligence.

Political factors

Taiwan's Ministry of Economic Affairs (MOEA) is implementing new policies to boost the local automotive industry. These regulations mandate that both imported and locally assembled vehicles must increase their reliance on domestically produced parts to 35% within the next three years.

This strategic move is designed to shield local auto parts manufacturers from competitive pressures, especially those originating from China. Hotai Motor, a significant player with a 30% stake in Kuozui Motors, the local assembler of Toyota vehicles, has publicly stated its commitment to adhering to these new local content requirements.

Ongoing trade tensions, particularly concerning U.S. tariff policies and the potential for a future U.S. Trump administration's retaliatory tariffs, are fostering caution among Taiwanese consumers and influencing the automotive sector. These uncertainties might cause delays in new vehicle orders or deliveries, thereby impacting market stability.

Taiwan's strategic decision to restrict imports of Chinese-branded vehicles from third countries, driven by national security and industrial development objectives, further shapes the competitive landscape for automotive companies like Hotai Motor.

The Taiwanese government is actively encouraging new vehicle sales through various tax incentives. A notable measure is the reduction on freight tax for owners trading in older vehicles for newer models, a program currently set to run until January 7, 2026. This initiative aims to phase out older, less efficient cars and boost domestic demand for newer automobiles.

Further bolstering the electric vehicle sector, Taiwan has extended exemptions from both vehicle license tax and freight tax for Battery Electric Vehicles (BEVs) through the end of 2025. These policies are instrumental in stimulating consumer interest and adoption of cleaner transportation alternatives, directly impacting the automotive market's growth trajectory.

Political Stability and Geopolitical Risks

Global geopolitical risks, particularly heightened tensions across the Taiwan Strait, introduce significant uncertainty that could negatively impact the automotive market. Hotai Motor recognizes that such geopolitical instability can directly affect market stability and consumer behavior. For instance, the ongoing trade disputes and regional security concerns have historically led to fluctuations in foreign direct investment and consumer spending in affected areas.

This broader political environment directly influences consumer confidence and investment decisions within the region. As of early 2024, reports indicate that heightened geopolitical tensions have already contributed to a cautious approach from international investors in East Asian markets, with some sectors experiencing delayed or scaled-back expansion plans. This cautious sentiment can translate into reduced demand for big-ticket items like vehicles.

- Geopolitical Tensions: Increased risk of trade disruptions and supply chain vulnerabilities due to cross-strait relations.

- Consumer Confidence: Volatility in consumer sentiment directly linked to perceived regional stability, impacting vehicle purchasing decisions.

- Investment Climate: Unfavorable political factors can deter foreign and domestic investment in automotive manufacturing and sales infrastructure.

Electric Vehicle Promotion Policies

Taiwan's government is strongly backing electric vehicle adoption, targeting a complete switch to electric urban buses by 2030 and aiming for all new vehicle and motorcycle sales to be electric by 2040. This commitment is supported by the Ministry of Economic Affairs, which is rolling out subsidies for local EV manufacturing and crucial component innovation, alongside initiatives to stimulate domestic EV demand.

These policies directly benefit companies like Hotai Motor, encouraging their strategic moves to launch new electric and hybrid vehicle models and to build out Mobility as a Service (MaaS) platforms. For instance, Taiwan's Ministry of Transportation and Communications has allocated NT$1.3 billion (approximately US$40 million) in 2024 for EV bus subsidies, a significant push towards the 2030 goal.

- 2030: Target for full electrification of urban buses in Taiwan.

- 2040: Goal for 100% electric vehicle and motorcycle sales ratio.

- NT$1.3 billion: 2024 subsidy allocation for electric buses in Taiwan.

Taiwan's government is actively promoting electric vehicle (EV) adoption with ambitious targets, aiming for all new vehicle and motorcycle sales to be electric by 2040. This is supported by significant subsidies, with NT$1.3 billion allocated in 2024 for EV bus subsidies alone, fostering a favorable environment for companies like Hotai Motor to invest in EV technology and services.

New regulations mandate a 35% increase in domestically produced parts for both imported and locally assembled vehicles within three years, a move designed to bolster local auto parts manufacturers and potentially influence supply chain strategies for companies operating in Taiwan.

Geopolitical tensions, particularly across the Taiwan Strait, continue to create market uncertainty, potentially impacting consumer confidence and investment decisions within the automotive sector, as observed with cautious international investor sentiment in early 2024.

Government incentives, such as tax reductions for trading in older vehicles for newer models until January 7, 2026, and extended tax exemptions for Battery Electric Vehicles (BEVs) through the end of 2025, are designed to stimulate domestic demand and encourage the transition to more efficient and cleaner vehicles.

| Policy/Initiative | Target/Timeline | Financial Impact/Support |

|---|---|---|

| Local Content Mandate | 35% within 3 years | Boosts domestic parts manufacturers |

| EV Sales Goal | 100% electric by 2040 | Drives EV investment and adoption |

| EV Bus Subsidies | NT$1.3 billion (2024) | Accelerates urban transport electrification |

| Trade-in Incentive | Until January 7, 2026 | Stimulates new vehicle demand |

| BEV Tax Exemptions | Through end of 2025 | Encourages electric vehicle purchases |

What is included in the product

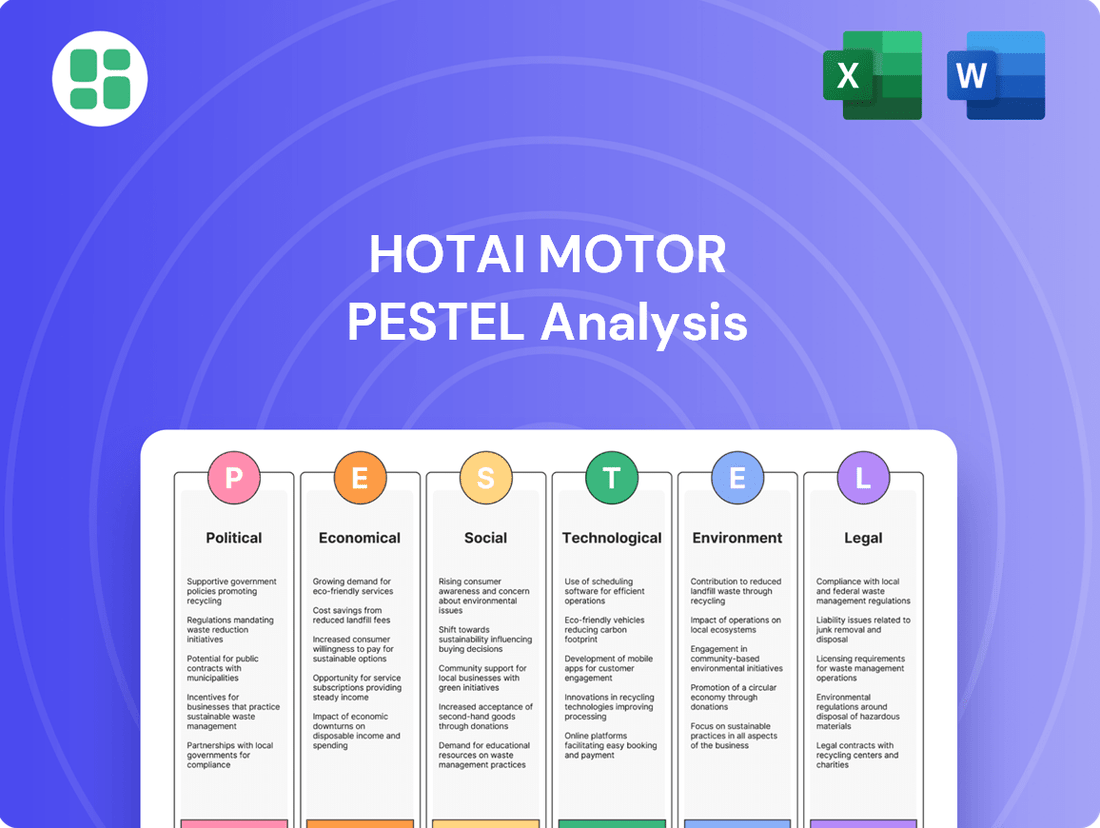

This PESTLE analysis offers a comprehensive examination of how external macro-environmental factors impact Hotai Motor, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying opportunities and threats within Hotai Motor's operating landscape.

Hotai Motor's PESTLE analysis offers a structured framework to proactively identify and mitigate external threats, thereby easing the burden of navigating complex market dynamics and fostering strategic resilience.

Economic factors

Taiwan's economy is on a strong upward trajectory, with the Executive Yuan projecting a robust GDP growth of 4.27% for 2024, followed by a still-healthy 3.29% in 2025. This expansion is largely fueled by the surging global demand for high-tech products, a sector where Taiwan holds a significant competitive advantage.

Despite the positive economic outlook, consumer confidence within the automotive sector is displaying a degree of caution. Recent months have seen a dip in new vehicle registrations, a trend attributed to lingering external uncertainties, such as potential trade tariffs, which can impact purchasing decisions for big-ticket items like cars.

The Executive Yuan anticipates Taiwan's inflation rate to remain below 2% for 2024, a figure that generally supports robust consumer purchasing power for significant expenditures like vehicles.

However, the global economic landscape presents a potential headwind. The ongoing uncertainty surrounding the timing and magnitude of potential policy interest rate hikes by major central banks could dampen consumer confidence and consequently impact car sales and the affordability of vehicle financing.

The Taiwanese automobile market is anticipated to reach approximately 465,000 units in 2025, mirroring the 2024 figures following a robust 2023. Hotai Motor, a key player, projects sales of 170,000 vehicles in 2024 and aims to maintain 165,000 units in 2025, solidifying its substantial market presence.

Despite a general slowdown in the broader market early in 2025, Hotai Motor's strong performance is driven by its Toyota and Lexus brands, which have both experienced notable sales growth, demonstrating resilience and brand strength.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly impact Hotai Motor. For instance, the Taiwanese dollar's performance against major currencies directly affects the cost of imported vehicles and components. In the third quarter of 2024, the average exchange rate stood at approximately 32.3 TWD per 1 USD.

A weaker TWD, like the observed rate, can increase the cost of vehicles and parts that Hotai Motor imports for brands such as Lexus. This makes imported luxury vehicles more expensive for consumers, potentially dampening sales volumes and impacting profit margins for the company.

- Impact on Import Costs: A weaker TWD (e.g., 32.3 TWD/USD in Q3 2024) increases the cost of imported vehicles and parts for Hotai Motor.

- Sales of Imported Brands: Higher import costs can make premium imported vehicles, like Lexus, less competitive, potentially reducing sales.

- Profitability: Increased cost of goods sold due to currency depreciation can squeeze profit margins if not passed on to consumers.

Availability of Financing and Insurance Services

Hotai Motor's operations are significantly intertwined with the availability and cost of financing and insurance. As a company offering auto financing and insurance through its subsidiaries, the prevailing interest rates and overall economic stability directly influence consumer demand for vehicles. For instance, in 2024, the Bank of Japan maintained its ultra-low interest rate policy, which generally supports more accessible auto financing, a positive for companies like Hotai Motor.

Hotai Insurance, a key component of the Hotai Financial Holdings group, released its sustainability report in 2024, highlighting its strategic focus on responsible business practices within the financial services sector. This indicates a commitment to long-term viability, which can translate into more stable and competitive insurance offerings that complement the vehicle sales business.

The accessibility of credit is a critical determinant for major purchases like automobiles. Fluctuations in lending standards and the cost of capital can either stimulate or dampen sales volumes for Hotai Motor.

- Financing Accessibility: Lower interest rates, as seen in many developed economies throughout 2024, generally encourage consumers to take out loans for vehicle purchases, thereby boosting sales.

- Insurance Costs: The price and availability of auto insurance, influenced by factors like claims history and regulatory environments, also impact a buyer's total cost of ownership and purchasing decisions.

- Subsidiary Performance: Hotai Insurance's 2024 sustainability report signals a forward-looking approach to financial services, potentially offering more attractive and stable insurance products.

- Economic Stability: A stable economic environment fosters consumer confidence, making individuals more willing to commit to long-term financial obligations like car loans.

Taiwan's economy is projected for strong growth, with GDP expected to expand by 4.27% in 2024 and 3.29% in 2025, driven by high-tech exports. While inflation is anticipated to remain below 2% in 2024, supporting purchasing power, global interest rate uncertainties could temper consumer confidence in the automotive sector.

The Taiwanese auto market is forecast to reach around 465,000 units in 2025, with Hotai Motor aiming for 170,000 units in 2024 and 165,000 in 2025, underscoring its market dominance. Despite general market softness early in 2025, Hotai's Toyota and Lexus brands show resilience, with notable sales growth.

Exchange rate volatility, such as the Q3 2024 average of 32.3 TWD per USD, impacts Hotai Motor by increasing the cost of imported vehicles and parts, potentially affecting sales of premium brands like Lexus and profit margins.

Accessible financing and stable insurance are crucial for Hotai Motor. Low interest rates in 2024 generally support auto loans, while Hotai Insurance's 2024 sustainability report indicates a focus on long-term financial viability.

| Economic Factor | Indicator/Trend | Impact on Hotai Motor |

| GDP Growth | Taiwan: 4.27% (2024), 3.29% (2025) | Positive for overall market demand and sales potential. |

| Inflation Rate | Taiwan: Below 2% (2024) | Supports consumer purchasing power for vehicles. |

| Interest Rates | Global uncertainty; generally low in developed economies (2024) | Lower rates can boost auto financing affordability; uncertainty can dampen confidence. |

| Exchange Rate | TWD vs. USD: ~32.3 (Q3 2024) | Weaker TWD increases import costs for vehicles and parts. |

| Automotive Market Size | Taiwan: ~465,000 units (2025) | Provides a stable market volume for Hotai Motor's sales targets. |

Full Version Awaits

Hotai Motor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hotai Motor provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and potential opportunities and threats relevant to Hotai Motor's business environment.

The content and structure shown in the preview is the same document you’ll download after payment. This analysis is crucial for stakeholders seeking to understand the external forces shaping Hotai Motor's future success and for developing robust business strategies.

Sociological factors

Consumer preferences in Taiwan are shifting, with a pronounced move towards Sports Utility Vehicles (SUVs). This trend is a significant factor shaping the automotive market, including the used car sector, where SUVs are anticipated to gain further traction due to their inherent practicality and ample interior space.

Hotai Motor is well-positioned to capitalize on this evolving consumer demand. The company’s strong portfolio features popular models like the Toyota Corolla Cross and RAV4, which consistently rank among Taiwan's top-selling passenger cars, directly reflecting and catering to this growing preference for SUVs.

Consumer preferences are increasingly leaning towards sustainable transportation, with a notable rise in demand for electric and hybrid vehicles. This shift is fueled by growing environmental awareness and supportive government incentives, making eco-friendly options more attractive to buyers. For instance, by the end of 2024, Taiwan's EV market saw a significant uptick in registrations, with electric models accounting for over 5% of new vehicle sales for the first time.

Despite a temporary slowdown in early 2025, the long-term outlook for alternative fuel vehicles in Taiwan remains robust. Government policies aimed at promoting green transportation and sustained consumer interest are expected to propel market expansion. Hotai Motor is actively responding to this trend by expanding its electric vehicle lineup, with new models like the Lexus RZ450e and Toyota bZ4X set to launch, catering to this evolving demand.

The digitalization of car buying in Taiwan is rapidly transforming consumer expectations. As of late 2024, a significant portion of car research and initial inquiries are happening online, with platforms offering virtual showrooms and transparent pricing gaining traction. This shift empowers consumers with information, forcing traditional dealerships like Hotai Motor to adapt their engagement strategies to meet demand for convenience and digital-first interactions.

Mobility as a Service (MaaS) Adoption

Societal trends are increasingly favoring flexible transportation over traditional car ownership, a key driver for Hotai Motor's strategic pivot. The company's investment in Mobility as a Service (MaaS) platforms like iRent (car rental) and yoxi (ride-hailing) directly addresses this evolving consumer preference. This shift necessitates Hotai's diversification beyond just selling vehicles to providing integrated mobility solutions that fit seamlessly into daily life.

Hotai's proactive engagement in the MaaS sector is a response to growing consumer demand for convenience and cost-effectiveness. For instance, the car rental market in Taiwan, a key operational area for Hotai, has seen steady growth, with iRent reporting a significant increase in user engagement and rental days throughout 2024. This indicates a strong societal acceptance of shared mobility options.

- Growing preference for flexible transport: Consumers are increasingly opting for pay-as-you-go or subscription-based mobility services over the long-term commitment of car ownership.

- Increased urbanisation: Denser urban environments often make car ownership less practical due to parking challenges and traffic congestion, boosting demand for alternative transport.

- Technological adoption: The widespread use of smartphones and digital platforms has made accessing and managing MaaS solutions intuitive and convenient for a broad demographic.

- Environmental consciousness: A segment of the population is choosing shared mobility as a more sustainable transportation choice, aligning with broader environmental concerns.

Brand Perception and Trust

Hotai Motor's enduring success as Taiwan's leading car distributor for over two decades directly reflects deep-seated consumer trust and a robust brand perception. This sustained market leadership, unbroken for 22 years, highlights a significant sociological factor: the strong loyalty consumers place in the brands Hotai represents, primarily Toyota and Lexus.

The company's consistent sales figures, even when the broader market experiences volatility, serve as a testament to its established reputation. Consumers perceive Hotai's offerings as reliable and high-quality, a perception built over years of dependable service and product performance. This trust translates into a predictable demand for their vehicles.

- 22 Years of Market Dominance: Hotai Motor has consistently held the top position in Taiwan's automotive distribution market.

- Brand Loyalty: This long-standing leadership points to significant consumer trust and loyalty towards Toyota and Lexus.

- Resilience in Sales: Hotai's ability to maintain strong sales performance during market downturns underscores the perceived reliability of its brands.

Societal trends are increasingly favoring flexible transportation over traditional car ownership, a key driver for Hotai Motor's strategic pivot. The company's investment in Mobility as a Service (MaaS) platforms like iRent (car rental) and yoxi (ride-hailing) directly addresses this evolving consumer preference, indicating a strong societal acceptance of shared mobility options as evidenced by iRent's increased user engagement throughout 2024.

Hotai Motor's enduring success as Taiwan's leading car distributor for over two decades directly reflects deep-seated consumer trust and a robust brand perception, with 22 years of market dominance pointing to significant consumer loyalty towards Toyota and Lexus.

Consumer preferences are increasingly leaning towards sustainable transportation, with a notable rise in demand for electric and hybrid vehicles, fueled by growing environmental awareness and supportive government incentives, making eco-friendly options more attractive to buyers.

The digitalization of car buying in Taiwan is rapidly transforming consumer expectations, with a significant portion of car research and initial inquiries happening online by late 2024, forcing dealerships to adapt to digital-first interactions.

Technological factors

The automotive sector is rapidly evolving with significant strides in electric vehicle (EV) technology. Improvements in battery range, charging speeds, and overall performance are reshaping consumer expectations and market demand.

Hotai Motor is actively responding to this trend by launching new battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Examples include the Toyota bZ4X and Lexus RZ450e, alongside the Toyota Prius PHEV, demonstrating a commitment to this technological shift.

The automotive sector is rapidly advancing with autonomous driving and connected car technologies. By 2024, the global market for advanced driver-assistance systems (ADAS) was projected to reach over $40 billion, indicating a strong consumer demand for enhanced safety and convenience features.

Hotai Motor, like its competitors, faces the imperative to integrate these sophisticated systems into its vehicle lineup. This includes not only advanced driver-assistance systems (ADAS) but also robust connectivity features, essential for maintaining market relevance and competitiveness in the evolving automotive landscape.

Hotai Group is actively digitizing its sales and after-sales services, exemplified by the launch of its online platform, 'Hotai Go.' This move acknowledges the growing consumer preference for digital engagement in vehicle purchases and ongoing customer relationship management.

The company is also bolstering digital payment solutions like 'Hotai Pay' and loyalty programs such as 'Hotai Points.' These initiatives are crucial for adapting to a market where digital channels are increasingly vital for transactions, financing, and fostering long-term customer loyalty, fundamentally reshaping traditional automotive retail.

Hydrogen Fuel Cell Technology

Hotai Motor is set to launch Toyota's H2 City Gold electric bus, powered by hydrogen, in late 2024. This move directly supports government initiatives to electrify urban bus fleets, showcasing a growing commitment to sustainable transportation solutions. This adoption signifies a strategic diversification beyond battery electric vehicles, embracing hydrogen fuel cell technology as a key alternative.

The global hydrogen fuel cell market is experiencing significant growth, projected to reach approximately USD 13.3 billion by 2028, with a compound annual growth rate (CAGR) of 22.1% from 2023 to 2028. This expansion is driven by increasing environmental regulations and the demand for zero-emission vehicles across various sectors, including public transportation.

Key developments in hydrogen fuel cell technology relevant to Hotai Motor include:

- Advancements in Fuel Cell Stack Durability: Leading manufacturers are improving the lifespan and performance of fuel cell stacks, making them more viable for commercial applications like buses. For instance, Ballard Power Systems reported achieving over 30,000 hours of operation in some heavy-duty applications by early 2024.

- Hydrogen Infrastructure Expansion: Governments and private entities are investing in building hydrogen refueling stations. South Korea, a key market for automotive manufacturers, aims to have 660 hydrogen refueling stations operational by 2030, supporting the widespread adoption of hydrogen vehicles.

- Cost Reduction Efforts: While still a developing technology, efforts are underway to reduce the manufacturing costs of fuel cells and hydrogen production. This includes exploring new materials and more efficient production processes, which is crucial for making hydrogen buses cost-competitive with traditional diesel or battery-electric alternatives.

- Policy Support and Incentives: Many countries are offering subsidies and tax credits for the purchase of fuel cell vehicles and the development of hydrogen infrastructure. For example, the European Union's Hydrogen Strategy aims to deploy 6 GW of renewable electrolysers by 2024 and up to 40 GW by 2030, fostering a supportive ecosystem for hydrogen technologies.

Supply Chain Technology and Resilience

The automotive sector's vulnerability to disruptions, particularly the widespread chip shortages experienced during the COVID-19 pandemic, underscored the critical importance of robust and resilient supply chains. Hotai Motor's positive outlook on stable automobile production, driven by an easing of these component constraints, points directly to the impact of technological advancements in managing these complex networks.

Technological factors are fundamentally reshaping how companies like Hotai Motor navigate supply chain challenges. Improvements in areas like real-time tracking, predictive analytics for inventory management, and advanced manufacturing techniques are not just optimizing current operations but are building a more adaptable framework for future uncertainties. For instance, the semiconductor industry, a key bottleneck, saw global chip production capacity increase, with significant investments in new fabrication plants expected to bolster supply through 2025.

- Enhanced Visibility: Technologies like IoT sensors and blockchain offer unprecedented real-time visibility into inventory levels and shipment statuses across the entire supply chain, allowing for quicker identification and mitigation of potential bottlenecks.

- Predictive Analytics: AI and machine learning are being deployed to forecast demand more accurately and anticipate supply disruptions, enabling proactive adjustments to production and sourcing strategies.

- Advanced Manufacturing: Innovations such as 3D printing and flexible manufacturing lines can reduce reliance on single-source components and allow for more agile production responses to component availability.

- Supplier Collaboration Platforms: Digital platforms facilitate seamless communication and data sharing between Hotai Motor and its suppliers, fostering greater transparency and collaborative problem-solving.

Technological advancements are driving Hotai Motor's strategic direction, particularly in the burgeoning electric vehicle (EV) market. The company is actively introducing battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), such as the Toyota bZ4X and Lexus RZ450e, to meet growing consumer demand for sustainable transportation. By late 2024, Hotai Motor is also set to launch Toyota's H2 City Gold electric bus, powered by hydrogen, aligning with government efforts to electrify public transport fleets.

The integration of autonomous driving and connected car technologies is another key technological factor. The global market for advanced driver-assistance systems (ADAS) was projected to exceed $40 billion in 2024, highlighting the consumer appetite for enhanced vehicle safety and connectivity. Hotai Motor is responding by incorporating these sophisticated systems into its vehicle offerings to maintain competitiveness.

Digitalization is transforming Hotai Motor's customer engagement. The launch of its online platform, 'Hotai Go,' along with digital payment solutions like 'Hotai Pay' and loyalty programs, reflects a strategic adaptation to consumer preferences for digital interactions in sales and after-sales services. These initiatives are crucial for building customer loyalty in an increasingly digital automotive retail landscape.

Supply chain resilience is also being bolstered by technology. Innovations in real-time tracking, predictive analytics, and advanced manufacturing are enhancing Hotai Motor's ability to manage complex networks and mitigate disruptions. Investments in new semiconductor fabrication plants, expected to increase global chip production capacity through 2025, are particularly relevant in easing component constraints.

| Technology Area | Hotai Motor's Response/Initiative | Market Trend/Data Point |

|---|---|---|

| Electric Vehicles (EVs) | Launch of BEVs (Toyota bZ4X, Lexus RZ450e) and PHEVs (Toyota Prius PHEV) | Growing consumer demand for sustainable transportation. |

| Hydrogen Fuel Cell Technology | Planned launch of Toyota H2 City Gold electric bus (late 2024) | Global hydrogen fuel cell market projected to reach approx. USD 13.3 billion by 2028 (CAGR 22.1% from 2023-2028). |

| Autonomous & Connected Cars | Integration of ADAS and connectivity features | Global ADAS market projected to exceed $40 billion in 2024. |

| Digitalization | 'Hotai Go' online platform, 'Hotai Pay', 'Hotai Points' loyalty program | Increasing consumer preference for digital engagement in vehicle purchases and services. |

| Supply Chain Management | Leveraging IoT, AI, and advanced manufacturing for resilience | Increased global chip production capacity expected through 2025 to address shortages. |

Legal factors

Taiwan's automotive sector is subject to dynamic legal shifts, particularly concerning vehicle safety. Amendments to regulations for components like tires are ongoing, incorporating international benchmarks for rolling sound emission, wet grip braking, and rolling resistance. For instance, recent updates in 2024 have tightened these specific performance metrics, requiring manufacturers to demonstrate enhanced safety and environmental considerations.

Hotai Motor, as a significant player in Taiwan's automotive market, must meticulously ensure that all its imported and locally assembled vehicles adhere to these increasingly stringent safety and performance standards. This proactive compliance is crucial for market access and maintaining consumer trust, especially as Taiwan aims to harmonize its regulations with global automotive safety frameworks.

New traffic regulations set to launch in 2025 will implement more rigorous exhaust certification systems for motorbikes, signaling a nationwide push for stricter emission controls across all vehicle types. Hotai Motor, a key importer and distributor in Taiwan, must proactively ensure its entire vehicle inventory complies with existing and upcoming environmental emission standards.

Consumer protection laws are a significant factor for Hotai Motor, impacting everything from how they advertise vehicles to the terms of their warranties. These regulations, which vary by region but generally focus on fair dealing and product safety, directly influence Hotai's customer service standards and the transparency of their sales processes. For instance, in 2024, stricter regulations around vehicle emissions and fuel efficiency standards were being implemented across many markets, requiring automakers like Hotai to invest heavily in compliance and potentially adjust their product offerings.

Import and Assembly Regulations

New import and assembly regulations in Taiwan are significantly shaping the automotive landscape. A key policy mandates that imported vehicles must progressively increase their locally sourced parts content to 35% within three years. This initiative aims to foster fair competition and bolster Taiwan's domestic auto parts manufacturing sector.

Further complicating matters, Taiwan maintains a strict prohibition on the direct import of fully assembled vehicles originating from China. Additionally, there are restrictions on Chinese-branded vehicles entering Taiwan from third countries. These regulations directly influence Hotai Motor's strategic decisions regarding vehicle sourcing, supply chain management, and assembly operations within the Taiwanese market.

- Local Content Mandate: Imported vehicles must reach 35% local parts by 2027.

- China Import Ban: Fully assembled vehicles from China are prohibited.

- Third-Country Restrictions: Chinese-branded vehicles from other nations face import limitations.

Data Privacy and Digital Service Laws

Hotai Motor's digital services, like Hotai Go, iRent, and yoxi, operate within Taiwan's robust data privacy framework, primarily governed by the Personal Data Protection Act (PDPA). This legislation mandates strict protocols for collecting, processing, and storing user information, requiring explicit consent and clear transparency. Failure to comply can result in significant penalties, impacting customer trust and operational continuity.

The increasing volume of data generated by these digital platforms necessitates continuous vigilance regarding data security. As of late 2024, global data breaches have highlighted the critical importance of cybersecurity investments. Hotai Motor must ensure its systems are equipped to prevent unauthorized access and data leaks, aligning with evolving regulatory expectations and consumer demands for privacy protection.

Key legal considerations for Hotai Motor include:

- Compliance with Taiwan's Personal Data Protection Act (PDPA): Ensuring all data handling practices align with PDPA requirements for consent, purpose limitation, and data minimization.

- Cross-border data transfer regulations: Adhering to rules governing the transfer of personal data outside of Taiwan, should cloud services or international partners be involved.

- Cybersecurity standards and incident reporting: Implementing strong security measures and having clear protocols for reporting data breaches to relevant authorities, as mandated by law.

- Consumer rights and data access requests: Establishing procedures to manage customer requests for data access, correction, or deletion, as stipulated by privacy laws.

Taiwan's legal landscape for automotive imports and local content is evolving, with a mandate for imported vehicles to reach 35% local parts content by 2027. Furthermore, direct imports of fully assembled vehicles from China, as well as Chinese-branded vehicles from third countries, remain prohibited, directly impacting Hotai Motor's sourcing and supply chain strategies.

Environmental factors

Taiwan is committed to achieving net-zero emissions by 2050, a significant national objective that influences various industries, including automotive. This commitment is driving policies and incentives aimed at promoting cleaner transportation, such as electric vehicles (EVs) and hydrogen fuel cell technology.

Hotai Motor is strategically aligning with these environmental mandates. The company has been expanding its portfolio to include more hybrid and electric vehicle models, responding directly to the growing demand and regulatory push for sustainable mobility solutions.

Further demonstrating its commitment, Hotai Motor has invested in energy companies like He Jun Energy, focusing on solar power generation. This diversification into renewable energy underscores their proactive approach to contributing to Taiwan's net-zero targets and building a more sustainable business model.

Consumer demand for eco-friendly vehicles is a significant environmental factor influencing the automotive industry. Growing environmental awareness has led to a surge in interest for fuel-efficient, hybrid, and electric vehicles (EVs). This trend is projected to continue its upward trajectory, with global EV sales expected to reach approximately 25 million units in 2025, a substantial increase from around 10 million in 2023.

Hotai Motor is actively responding to this shift by broadening its range of greener vehicle options. The company is investing in the development and promotion of plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs). This strategic expansion aims to meet the evolving preferences of consumers who are increasingly prioritizing sustainable mobility solutions.

The automotive sector, including companies like Hotai Motor, grapples with securing critical raw materials for electric vehicle batteries and other advanced components. This scarcity directly impacts production costs and supply chain stability.

Hotai Motor's commitment to sustainability, as detailed in its 2023 ESG report, highlights a strategic focus on responsible sourcing and optimizing resource efficiency across its operations. This includes exploring alternative materials and strengthening supplier relationships to mitigate risks associated with resource availability.

Waste Management and Recycling Regulations

Environmental regulations are increasingly targeting the end-of-life management of vehicles, emphasizing the recycling and responsible disposal of components like automotive parts and batteries. These evolving rules necessitate significant adaptation from major industry participants.

Hotai Motor, being a substantial entity in the automotive sector, must meticulously comply with these directives. This likely translates into strategic investments in recycling infrastructure or the formation of key partnerships to manage vehicle lifecycles effectively. For instance, the European Union's End-of-Life Vehicles (ELV) Directive, updated in 2023, mandates higher recycling rates and restricts hazardous substances, impacting global supply chains and operational strategies for companies like Hotai.

- Increased focus on vehicle recycling rates

- Stricter rules on hazardous material content in vehicles

- Potential for investment in specialized recycling facilities

- Need for robust partnerships with waste management providers

Corporate Social Responsibility and ESG Reporting

Hotai Motor actively embeds Environmental, Social, and Governance (ESG) principles into its core business strategy, a commitment recognized through various sustainability awards. The company transparently communicates its progress via published sustainability reports, detailing initiatives like the Taiwan Indigenous Wildlife Conservation Program and extensive public welfare activities. This focus on ESG not only enhances corporate reputation but also aligns with growing investor and consumer demand for responsible business practices.

In 2023, Hotai Motor continued its dedication to environmental stewardship, with specific programs aimed at biodiversity preservation and reducing its ecological footprint. Their commitment to social responsibility is evident through consistent investment in community development and employee well-being, fostering a positive societal impact. The company's governance structure emphasizes ethical conduct and transparency, crucial for long-term stakeholder trust and value creation.

Key ESG highlights for Hotai Motor include:

- Environmental Conservation: Ongoing support for the Taiwan Indigenous Wildlife Conservation Program, contributing to biodiversity.

- Social Responsibility: Significant investment in public welfare activities and community engagement programs.

- Governance: Commitment to transparent reporting and ethical business practices.

- Recognition: Receipt of multiple sustainability awards validating their ESG efforts.

Taiwan's commitment to net-zero emissions by 2050 is a major environmental driver, pushing for cleaner transportation and influencing Hotai Motor's strategy. The company is expanding its EV and hybrid offerings and investing in renewable energy, like solar power through He Jun Energy, to align with these national goals.

Consumer demand for eco-friendly vehicles is surging, with global EV sales projected to reach approximately 25 million units by 2025. Hotai Motor is responding by increasing its range of PHEVs and BEVs to cater to this growing market preference for sustainable mobility.

The automotive sector faces challenges with raw material scarcity for EV batteries, impacting production costs and supply chains. Hotai Motor's 2023 ESG report emphasizes responsible sourcing and resource efficiency to mitigate these risks.

Stricter environmental regulations are emerging for vehicle end-of-life management, particularly concerning battery recycling. For instance, the EU's updated ELV Directive (2023) mandates higher recycling rates and limits hazardous substances, requiring adaptation from companies like Hotai Motor.

| Environmental Factor | Impact on Hotai Motor | Key Data/Initiatives |

|---|---|---|

| Net-Zero Targets | Drives shift to EVs and hybrids; investment in renewables. | Taiwan's 2050 net-zero goal; Hotai's investment in He Jun Energy. |

| Consumer Demand | Increased sales of eco-friendly vehicles. | Global EV sales projected at 25 million units in 2025. |

| Resource Scarcity | Supply chain and cost pressures for EV components. | Hotai's focus on responsible sourcing and resource efficiency (2023 ESG report). |

| End-of-Life Regulations | Need for compliance with recycling and disposal rules. | EU ELV Directive (updated 2023) mandates higher recycling rates. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hotai Motor is built on a robust foundation of data from official government publications, leading automotive industry reports, and reputable economic and market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.