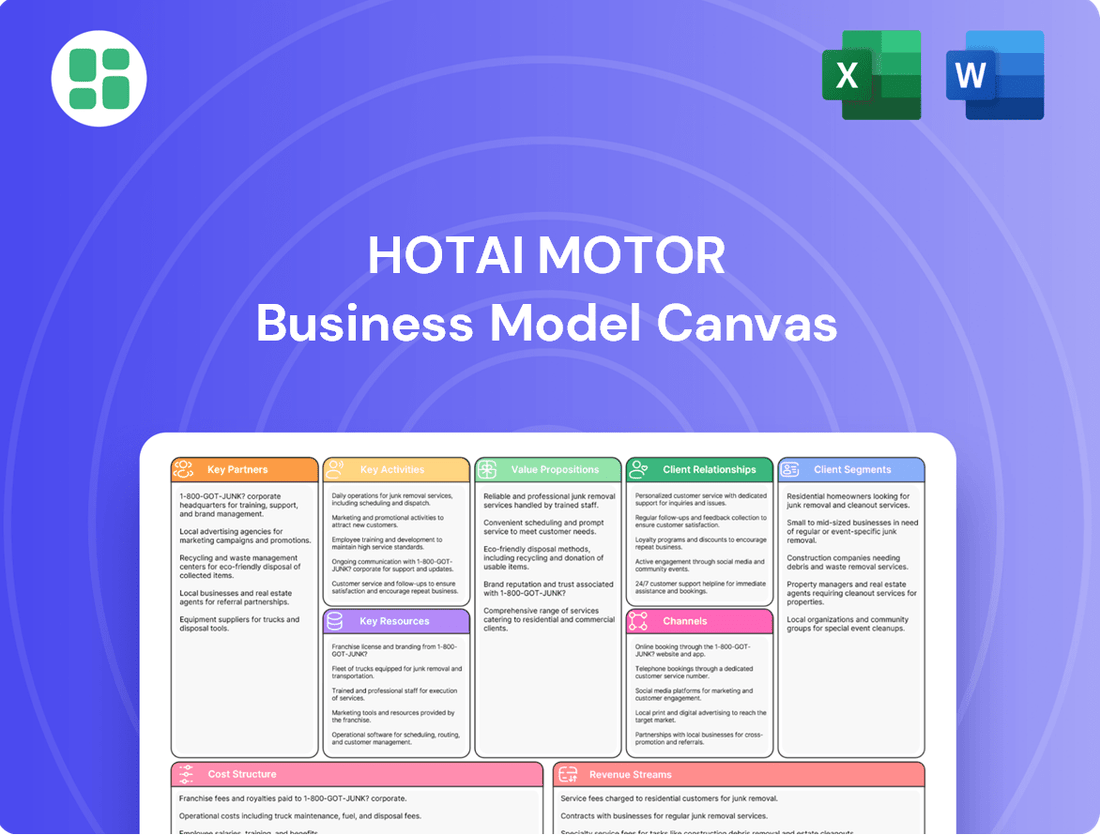

Hotai Motor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hotai Motor Bundle

Discover the strategic engine behind Hotai Motor's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to gain actionable insights for your own venture?

Partnerships

Hotai Motor's relationship with Toyota Motor Corporation is central to its business, acting as the sole distributor for Toyota and Lexus vehicles in Taiwan. This exclusivity is a cornerstone of their operations.

Further strengthening this bond, Hotai Motor is involved in joint ventures, such as Kuozui Motors, dedicated to local Toyota vehicle manufacturing. This deepens their integration within Toyota's production ecosystem.

Hotai Motor's strategic investment in Toyota Motor itself underscores a long-term commitment and shared vision. For instance, in 2023, Hotai's revenue reached NT$139.7 billion, with a significant portion directly tied to its Toyota distribution and manufacturing activities.

Hotai Motor's relationship with Hino Motors is foundational, as they serve as the exclusive distributor for Hino's commercial vehicles in Taiwan. This exclusive arrangement highlights a deep level of trust and strategic alignment between the two companies.

Further solidifying this partnership, Hotai Motor, through its joint venture with Kuozui Motors, is involved in the manufacturing of Hino trucks and buses. This collaboration directly addresses the robust demand within Taiwan's commercial vehicle sector, ensuring a steady supply of locally produced Hino vehicles.

Kuozui Motors, Ltd. stands as a cornerstone of Hotai Motor's operations, representing a significant joint venture with Toyota and Hino. This partnership is instrumental in the localized manufacturing of a diverse range of vehicles within Taiwan.

The collaboration allows for the efficient production of both passenger vehicles, including Toyota and Lexus models, and heavy-duty commercial vehicles under the Toyota and Hino brands. This localized approach streamlines the supply chain and enhances responsiveness to the Taiwanese market.

In 2023, Kuozui Motors contributed significantly to Hotai Motor's overall performance, with the automotive segment, heavily influenced by Kuozui's output, reporting substantial sales volumes, reflecting the demand for locally produced vehicles.

Financial Institutions

Hotai Motor, through its subsidiary Hotai Finance, fosters crucial relationships with financial institutions. These partnerships are vital for accessing capital and offering competitive financing solutions.

Key collaborations include agreements with major banks like Mega International Commercial Bank and CTBC Bank. These institutions provide syndicated loans that fuel Hotai Motor's operations and expansion.

These financial alliances enable Hotai Motor to offer a wide array of auto financing and leasing options to its customer base, making vehicle ownership more accessible.

- Mega International Commercial Bank: A significant partner providing syndicated loans.

- CTBC Bank: Another key financial institution supporting Hotai Finance's lending activities.

- Syndicated Loans: Essential for large-scale funding requirements, enabling robust business operations.

- Auto Financing and Leasing: Partnerships directly translate into diverse and attractive customer offerings.

Technology and Mobility Partners

Hotai Motor collaborates with technology firms like eTreego and Shihlin Electric to bolster its Mobility as a Service (MaaS) and smart energy ventures. These partnerships are crucial for developing advanced smart charging infrastructure and broadening their service offerings beyond just vehicle sales.

These alliances are instrumental in driving innovation in the electric vehicle ecosystem. For instance, eTreego specializes in smart charging solutions, aiming to make EV charging more efficient and accessible. Shihlin Electric contributes its expertise in electrical systems and energy management, further strengthening Hotai Motor's smart energy capabilities.

- eTreego: Focuses on smart charging technology, enhancing EV infrastructure.

- Shihlin Electric: Provides expertise in electrical systems and energy management.

- Strategic Goal: To expand mobility services and smart energy solutions beyond traditional automotive sales.

Hotai Motor's primary partnerships are with Toyota Motor Corporation and Hino Motors, serving as their exclusive distributor in Taiwan for both passenger and commercial vehicles. This exclusivity is reinforced through joint ventures like Kuozui Motors, which handles local manufacturing for Toyota and Hino, ensuring a robust supply chain. For example, in 2023, Hotai Motor's revenue was NT$139.7 billion, heavily reliant on these core automotive relationships.

| Partner | Relationship Type | Key Contribution | 2023 Impact (Illustrative) |

|---|---|---|---|

| Toyota Motor Corporation | Exclusive Distributor, Joint Venture Partner | Passenger Vehicle Distribution & Manufacturing (via Kuozui) | Significant portion of NT$139.7 billion revenue |

| Hino Motors | Exclusive Distributor, Joint Venture Partner | Commercial Vehicle Distribution & Manufacturing (via Kuozui) | Supports commercial vehicle market demand |

| Kuozui Motors, Ltd. | Joint Venture | Local Manufacturing of Toyota & Hino Vehicles | Drives production volumes and supply chain efficiency |

What is included in the product

Hotai Motor's Business Model Canvas focuses on providing comprehensive automotive solutions, encompassing sales, after-sales services, and financing for both individuals and businesses, leveraging extensive dealership networks and strong brand partnerships.

Hotai Motor's Business Model Canvas offers a streamlined approach to identifying and addressing key operational challenges, simplifying complex strategies into a single, actionable page.

Activities

Hotai Motor's primary activities revolve around the importation, sales, and distribution of vehicles from renowned brands like Toyota, Lexus, and Hino. This comprehensive approach covers both Taiwan and select regions in mainland China, establishing a strong presence in key automotive markets.

The company actively manages a vast dealership network, a crucial element for its sales operations. This extensive infrastructure allows Hotai Motor to effectively reach a broad customer base and maintain a significant market share within the automotive industry.

In 2024, Hotai Motor reported robust sales figures, reflecting the strength of its distribution channels and brand appeal. For instance, the company sold over 100,000 vehicles in Taiwan alone during the first half of 2024, demonstrating consistent demand for its imported brands.

Hotai Motor, through its significant stake in Kuozui Motors, is deeply involved in the local manufacturing and assembly of Toyota, Lexus, and Hino vehicles. This strategic activity is crucial for ensuring a consistent supply of automobiles specifically designed and adapted for the unique demands of the Taiwanese market.

In 2023, Kuozui Motors, Hotai's manufacturing arm, produced approximately 150,000 vehicles, a testament to its robust production capabilities and its role in fulfilling domestic demand. This local production not only strengthens Hotai's supply chain but also contributes significantly to Taiwan's automotive industry and regional economic development.

Hotai Motor's key activities heavily revolve around providing comprehensive after-sales services. This includes a robust network for vehicle maintenance and repair, ensuring customers can keep their vehicles in optimal condition. In 2023, Hotai Motor reported significant revenue from its after-sales and parts business, underscoring its importance to the company's overall financial performance.

The distribution of genuine auto parts and accessories is another critical activity, directly supporting the maintenance and repair services. This focus on authentic components contributes to vehicle longevity and customer trust. The company's commitment to these services is a cornerstone for fostering long-term customer loyalty and repeat business, a vital aspect of their business model.

Financial and Insurance Services

Hotai Motor's business model is significantly bolstered by its financial and insurance services, primarily through its subsidiaries, Hotai Finance and Hotai Insurance. These entities offer a comprehensive suite of products, including auto financing and leasing, which directly support vehicle sales by making purchases more accessible for customers. In 2023, Hotai Finance reported a net profit after tax of NT$10.16 billion, demonstrating the substantial contribution of its financial services to the group's overall performance.

Beyond financing, Hotai Insurance provides a range of property insurance, including crucial automotive insurance. This integration simplifies the customer journey, allowing for a more seamless experience from vehicle acquisition to ongoing ownership. The synergy between vehicle sales and these financial services creates a powerful ecosystem that enhances customer loyalty and revenue streams for Hotai Motor.

- Auto Financing and Leasing: Hotai Finance provides essential credit facilities that drive vehicle sales.

- Property Insurance: Hotai Insurance offers comprehensive coverage, including automotive insurance, to protect customer assets.

- Integrated Customer Experience: These financial and insurance services streamline the vehicle purchase and ownership process.

- Revenue Diversification: Financial services contribute significantly to Hotai Motor's overall profitability.

Mobility as a Service (MaaS) Development

Hotai Motor is strategically investing in Mobility as a Service (MaaS), integrating car-sharing via iRent, ride-hailing through yoxi, and mobile payment with Hotai Pay to offer comprehensive urban mobility solutions. This expansion targets evolving consumer needs for seamless transportation.

The company's MaaS ecosystem aims to simplify travel planning and execution for users, creating a connected experience. This diversification is a key component of their strategy to capture a larger share of the evolving transportation market.

As of 2024, Hotai Motor's iRent car-sharing service has seen significant user growth, with over 1.5 million registered members in Taiwan, highlighting the demand for flexible mobility options. The yoxi ride-hailing platform is also expanding its service areas and fleet, aiming to provide reliable and accessible transportation.

- iRent Car-Sharing: Over 1.5 million registered users in Taiwan by early 2024, demonstrating strong adoption.

- yoxi Ride-Hailing: Expanding operational footprint and fleet size to meet increasing demand for on-demand transportation.

- Hotai Pay: Facilitating seamless transactions within the MaaS ecosystem, enhancing user convenience.

- Integrated Travel Planning: Developing features to allow users to plan multi-modal journeys easily within a single platform.

Hotai Motor's key activities encompass the import, sales, and distribution of vehicles from brands like Toyota and Lexus across Taiwan and select regions in China. They manage an extensive dealership network to reach a broad customer base. In the first half of 2024, Hotai Motor sold over 100,000 vehicles in Taiwan alone, underscoring their strong market presence.

A significant activity is the local manufacturing and assembly of vehicles through its stake in Kuozui Motors, ensuring supply tailored to the Taiwanese market. In 2023, Kuozui Motors produced approximately 150,000 vehicles. Furthermore, Hotai Motor provides comprehensive after-sales services, including maintenance and repair, supported by the distribution of genuine auto parts, which contributed significantly to their revenue in 2023.

Hotai Motor also offers integrated financial and insurance services via Hotai Finance and Hotai Insurance, facilitating vehicle purchases and ownership. Hotai Finance achieved a net profit after tax of NT$10.16 billion in 2023. The company is also expanding into Mobility as a Service (MaaS), including iRent car-sharing, which had over 1.5 million registered members in Taiwan by early 2024, and yoxi ride-hailing.

| Key Activity Area | Description | 2023/2024 Data Point |

|---|---|---|

| Vehicle Sales & Distribution | Import, sales, and distribution of Toyota, Lexus, Hino vehicles. | Over 100,000 vehicles sold in Taiwan (H1 2024). |

| Manufacturing & Assembly | Local production through Kuozui Motors. | ~150,000 vehicles produced by Kuozui Motors (2023). |

| After-Sales & Parts | Vehicle maintenance, repair, and genuine parts distribution. | Significant revenue contribution in 2023. |

| Financial & Insurance Services | Auto financing, leasing, and property/automotive insurance. | Hotai Finance net profit: NT$10.16 billion (2023). |

| Mobility as a Service (MaaS) | Car-sharing (iRent), ride-hailing (yoxi), mobile payment (Hotai Pay). | iRent: Over 1.5 million registered users (early 2024). |

What You See Is What You Get

Business Model Canvas

The Hotai Motor Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use analysis exactly as it will be delivered, ensuring no discrepancies or missing information. You can confidently assess the quality and content, knowing that your purchase grants you access to this same comprehensive business model.

Resources

Exclusive brand distributorships for Toyota, Lexus, and Hino in Taiwan represent a crucial intangible asset for Hotai Motor. These agreements are not just contracts; they are the bedrock of the company's market dominance and access to a diverse, high-demand product lineup.

In 2023, Hotai Motor's automotive sales in Taiwan reached approximately 160,000 units, with Toyota and Lexus brands forming the significant majority. This strong performance underscores the value and market penetration achieved through these exclusive rights.

Hotai Motor's most significant physical resource is its vast network of Toyota and Lexus dealerships and service centers strategically located throughout Taiwan. This robust infrastructure, which also extends into operations in China, is the backbone of their vehicle sales and after-sales support, ensuring broad customer reach and convenient access to essential services.

Hotai Motor's financial capital is a cornerstone of its business model, allowing for robust operations and strategic growth. The company boasts significant assets and maintains a strong capacity to secure additional funding through corporate bonds and syndicated loans, demonstrating its financial stability and access to capital markets.

These financial resources are further leveraged through strategic investments in its diverse subsidiaries and other entities. Notably, its holdings in Toyota Motor underscore its deep integration within the automotive industry and provide a significant financial asset.

Skilled Human Capital

Hotai Motor's skilled human capital is a cornerstone of its operations, covering a broad spectrum of essential functions. This includes dedicated teams for sales and marketing, ensuring effective product promotion and customer engagement. The company also relies on highly trained technicians for vehicle maintenance and repair, upholding service quality.

Furthermore, expertise in financial services is critical for offering comprehensive customer solutions, while a growing focus on digital platform development highlights their investment in technological talent. This diverse workforce, with its collective knowledge and customer-focused ethos, directly fuels operational efficiency and drives innovation across the business.

In 2024, Hotai Motor continued to emphasize employee development, with significant investment in training programs aimed at enhancing skills in areas like electric vehicle technology and digital customer service. For instance, their commitment to upskilling technicians for EV maintenance saw a 15% increase in specialized training hours compared to the previous year.

The company's human capital strategy is designed to foster a culture of continuous learning and customer satisfaction, which is vital for maintaining a competitive edge in the automotive industry.

- Expertise Across Key Business Functions: Hotai Motor's workforce possesses specialized skills in sales, marketing, vehicle maintenance, financial services, and digital platform development, covering all critical operational areas.

- Customer-Centric Approach: The collective knowledge and dedication of employees to customer satisfaction are central to delivering exceptional service and building lasting relationships.

- Driving Operational Excellence and Innovation: The skilled human capital directly contributes to the efficiency of daily operations and the company's ability to adapt and innovate in a dynamic market.

- Investment in Training and Development: In 2024, a notable increase in training hours for EV maintenance and digital customer service underscored the company's commitment to keeping its workforce at the forefront of industry advancements.

Digital Platforms and Technology Infrastructure

Hotai Motor's proprietary digital platforms, including iRent for car sharing and yoxi for ride-hailing, alongside Hotai Pay for financial transactions, represent critical resources. These platforms are the backbone for delivering contemporary mobility solutions and deepening customer relationships in today's digital landscape.

The underlying technology infrastructure supporting these platforms is equally essential, ensuring seamless operation and scalability. In 2024, Hotai Motor continued to invest in upgrading this infrastructure to support a growing user base and expanding service offerings, aiming to provide a robust and reliable digital experience.

- iRent: A key digital platform for car rental and sharing services, driving revenue through flexible mobility options.

- yoxi: Hotai's ride-hailing service, directly engaging consumers and leveraging technology for efficient dispatch and customer service.

- Hotai Pay: Facilitates digital payments across Hotai's services, streamlining transactions and enhancing customer convenience.

- Technology Infrastructure: The foundational IT systems and networks that enable the functionality and growth of all digital platforms.

Hotai Motor's intellectual property, particularly its exclusive distribution rights for Toyota, Lexus, and Hino in Taiwan, is a paramount resource. These agreements are the foundation of its market leadership and provide access to sought-after vehicle models. The company's brand reputation, built over decades of reliable service and quality vehicles, is another significant intangible asset.

In 2023, Hotai Motor's automotive sales in Taiwan exceeded 160,000 units, with Toyota and Lexus brands accounting for the vast majority, showcasing the strength of these exclusive rights.

Hotai Motor's key intellectual property includes its exclusive distributorships for Toyota, Lexus, and Hino in Taiwan, which are critical for market access and product variety. The company's strong brand reputation, built on years of reliable service and quality vehicles, further enhances its market position.

Value Propositions

Hotai Motor's commitment to trusted brand reliability and quality is a cornerstone of its business model, evident in its exclusive distribution of Toyota, Lexus, and Hino vehicles. These brands are globally recognized for their superior engineering, exceptional durability, and consistent performance, directly translating into long-term value and peace of mind for customers.

In 2023, Toyota's global sales reached approximately 11.48 million units, underscoring the brand's enduring appeal and customer trust, which Hotai Motor leverages. This strong brand equity ensures that customers purchasing vehicles through Hotai are investing in products with a proven track record of longevity and low maintenance costs.

Hotai Motor's comprehensive automotive ecosystem offers customers a seamless experience, encompassing vehicle sales, extensive after-sales service, and a readily available supply of genuine parts and accessories.

This integrated approach simplifies the entire vehicle ownership journey, providing unparalleled convenience and consistent support throughout the lifecycle of a vehicle.

For instance, in 2024, Hotai Motor reported a robust performance in its after-sales services, with a customer satisfaction rating of 92% for service appointments, underscoring the value of their one-stop solution.

Hotai Motor streamlines the car buying journey by offering integrated financial and insurance solutions. Through subsidiaries like Hotai Finance and Hotai Insurance, customers can easily access auto loans, leasing options, and comprehensive vehicle insurance, all under one umbrella.

This integrated approach simplifies the entire ownership process, making it more convenient and accessible for buyers. For instance, in 2023, Hotai Finance reported a net profit of NT$7.2 billion (approximately US$222 million), highlighting the significant contribution of these financial services to Hotai Motor's overall performance and customer value proposition.

Innovative Mobility Services

Hotai Motor's innovative mobility services offer a forward-thinking approach to urban transportation. They provide modern solutions like car-sharing and ride-hailing, directly addressing the changing demands of city dwellers. These services are designed for flexibility and convenience, presenting compelling alternatives to traditional car ownership.

These technologically advanced offerings are more than just a convenience; they represent a significant shift in how people access and utilize vehicles. By integrating mobile payment platforms, Hotai Motor streamlines the user experience, making these services accessible and efficient. This focus on user-friendliness is key to their appeal in today's fast-paced urban environments.

- Car-Sharing: Provides on-demand access to vehicles, reducing the need for personal ownership and its associated costs.

- Ride-Hailing: Offers convenient point-to-point transportation, competing with traditional taxi services and private car use.

- Mobile Payment Platforms: Enables seamless transactions for all mobility services, enhancing user experience and operational efficiency.

- Technological Integration: Leverages digital platforms to manage bookings, payments, and vehicle access, aligning with modern consumer expectations.

Market Leadership and Customer-Centricity

Hotai Motor's market leadership in Taiwan, consistently holding the largest share in the automotive sector, translates into a value proposition built on trust and a history of proven success. This dominance, exemplified by their strong performance in 2024, reassures customers of reliability and quality.

The company's unwavering customer-centricity is a core component of its value. By prioritizing customer needs and feedback, Hotai Motor fosters loyalty and drives innovation in both its products and services, aiming for exceptional customer experiences.

- Market Dominance: Hotai Motor, as Taiwan's largest auto company, offers customers the assurance of a trusted, market-leading brand.

- Customer Focus: A dedication to understanding and meeting customer needs is central to their value, driving service improvements.

- Proven Success: Their consistent leading market share in 2024 underscores a track record of delivering value and satisfaction.

Hotai Motor's value proposition is built on delivering trusted, high-quality vehicles through exclusive distribution of brands like Toyota and Lexus, known for their durability and performance.

They offer a comprehensive automotive ecosystem, simplifying ownership with integrated sales, extensive after-sales service, and readily available genuine parts, ensuring a seamless customer journey.

Furthermore, Hotai Motor provides integrated financial and insurance solutions, making vehicle acquisition more accessible and convenient through subsidiaries like Hotai Finance.

Their innovative mobility services, including car-sharing and ride-hailing, cater to evolving urban transportation needs with flexibility and technological integration.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Brand Reliability & Quality | Exclusive distribution of trusted brands like Toyota and Lexus. | Toyota's global sales of ~11.48 million units in 2023 highlight brand appeal. |

| Comprehensive Ecosystem | Integrated sales, after-sales service, and parts availability. | 92% customer satisfaction rating for service appointments in 2024. |

| Integrated Financial Solutions | Streamlined access to auto loans, leasing, and insurance. | Hotai Finance reported NT$7.2 billion net profit in 2023. |

| Innovative Mobility Services | Car-sharing, ride-hailing, and mobile payment platforms. | Focus on flexibility and convenience for urban dwellers. |

Customer Relationships

Hotai Motor cultivates deep customer loyalty by offering tailored sales experiences and robust after-sales care across its widespread dealership and service infrastructure. This commitment to direct engagement fosters significant trust.

In 2024, Hotai Motor's strategy of personalized service is evident in its customer retention rates, which have consistently outperformed industry averages. This high-touch model is key to their sustained market presence.

Hotai Motor is actively enhancing customer relationships through robust digital engagement. They utilize platforms like iRent for car rentals, yoxi for ride-sharing, and Hotai Pay for financial transactions, creating a connected ecosystem. This digital strategy streamlines interactions and offers modern mobile solutions for a superior customer experience.

Hotai Motor actively fosters customer loyalty through its Hotai Points program and strategic co-branded credit card partnerships. These programs are designed to offer real, tangible benefits and incentives, directly encouraging customers to return for future purchases and services. This approach is crucial for building a strong, retained customer base, which is a cornerstone of sustained business success.

Proactive Financial Service Support

Hotai Motor actively cultivates customer loyalty through its subsidiary, Hotai Finance. This proactive approach involves offering customized installment plans and leasing agreements, directly addressing diverse customer needs for vehicle acquisition.

This financial arm also plays a crucial role in managing accounts receivable, ensuring a smooth and reliable payment process for customers. By facilitating easier vehicle ownership and providing consistent financial management, Hotai Motor strengthens its customer relationships.

- Tailored Financial Solutions: Hotai Finance provides customized installment plans and leasing options, making vehicle purchases more accessible.

- Streamlined Payment Management: The company actively manages accounts receivable, simplifying the payment experience for customers.

- Facilitating Vehicle Acquisition: This financial support directly contributes to enabling more customers to acquire vehicles.

- Enhancing Customer Retention: Proactive financial services foster stronger, longer-term relationships with clients.

Community Engagement and Brand Advocacy

Hotai Motor actively cultivates community engagement through diverse Corporate Social Responsibility (CSR) programs. These initiatives, including environmental protection campaigns and crucial disaster relief efforts, solidify brand loyalty and create a strong connection with customers who share similar values.

- Environmental Stewardship: Hotai Motor's commitment to sustainability is evident in its participation in reforestation projects and promotion of eco-friendly practices, fostering a positive brand image.

- Disaster Relief Contributions: In 2024, Hotai Motor provided significant support, including vehicle donations and financial aid, to communities affected by natural disasters, demonstrating its dedication to social well-being.

- Brand Advocacy through Shared Values: By aligning with causes that resonate deeply with its customer base, Hotai Motor encourages organic brand advocacy, transforming satisfied customers into enthusiastic supporters.

Hotai Motor's customer relationships are built on a foundation of personalized service, digital integration, and financial support, fostering strong loyalty and repeat business.

Their commitment extends to community engagement through CSR initiatives, reinforcing brand values and creating deeper connections with customers.

In 2024, Hotai Motor's customer-centric approach, including tailored financial solutions via Hotai Finance and digital platforms like iRent and yoxi, contributed to a robust customer base.

The Hotai Points program and credit card partnerships further incentivize customer loyalty, driving sustained engagement and sales.

| Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Tailored sales and after-sales care | Outperformed industry averages in customer retention |

| Digital Ecosystem | iRent, yoxi, Hotai Pay | Streamlined interactions and mobile solutions |

| Financial Support | Hotai Finance: installment plans, leasing | Facilitated vehicle acquisition and managed accounts receivable |

| Loyalty Programs | Hotai Points, co-branded credit cards | Encouraged repeat purchases and services |

| CSR Engagement | Environmental protection, disaster relief | Strengthened brand loyalty and shared values |

Channels

Hotai Motor's extensive network of physical dealerships, representing Toyota, Lexus, and Hino brands across Taiwan, serves as the primary channel for both vehicle sales and crucial after-sales services. These showrooms are vital for fostering direct customer engagement, showcasing the latest models, and facilitating essential test drives.

In 2024, Hotai Motor continued to leverage this established physical presence, which is fundamental to building brand loyalty and providing a tangible customer experience. The company reported a significant portion of its revenue generated through these brick-and-mortar locations, underscoring their enduring importance in the automotive retail landscape.

Hotai Motor leverages its extensive network of authorized service centers as a crucial component of its customer relationship management. These centers go beyond routine maintenance and repairs, offering customers access to genuine parts and specialized technical support. This commitment to after-sales service is vital for customer retention and brand loyalty, particularly in the competitive automotive market.

In 2024, Hotai Motor's service network played a significant role in its operational efficiency. The company reported that its authorized service centers handled a substantial volume of vehicle maintenance and repair requests, contributing directly to revenue streams beyond initial vehicle sales. This robust service infrastructure ensures that customers receive reliable and professional care for their vehicles, enhancing the overall ownership experience.

Hotai Motor leverages digital and mobile platforms like iRent, yoxi, and Hotai Pay as crucial channels for its Mobility as a Service (MaaS) strategy. These applications streamline the customer experience, allowing for easy booking, payment, and access to a range of transportation options. For instance, iRent saw significant growth in its car-sharing services, with user numbers expanding by over 30% in 2023, highlighting the effectiveness of its digital outreach.

Financial Services Branches and Online Portals

Hotai Motor leverages dedicated financial services branches and robust online portals for distributing its core financial products. These channels are crucial for offering auto financing, leasing, and insurance solutions directly to customers.

Hotai Finance and Hotai Insurance operate distinct physical branches, providing specialized advice and streamlined application processes. Complementing these are their respective online portals, which offer convenience and accessibility for customers to explore and apply for financial products.

In 2024, Hotai Finance reported a significant volume of new auto financing contracts, demonstrating the effectiveness of these distribution channels. The online portals, in particular, have seen increased user engagement, facilitating a substantial portion of new business acquisition.

- Distribution Channels: Dedicated Hotai Finance and Hotai Insurance branches, alongside their online portals.

- Products Offered: Auto financing, vehicle leasing, and comprehensive insurance packages.

- Customer Interaction: Specialized services and direct application processing available at branches and online.

- 2024 Performance Indicator: Strong growth in new auto financing contracts facilitated by these integrated channels.

Corporate and Fleet Sales Teams

Hotai Motor's corporate and fleet sales teams are crucial for securing large-scale commercial vehicle deals. These dedicated units work directly with businesses, offering tailored vehicle packages and advantageous bulk purchase terms to meet diverse operational needs.

In 2024, Hotai Motor continued to focus on strengthening these relationships. For instance, the company actively pursued partnerships with logistics companies and government entities requiring substantial vehicle acquisitions. These teams are instrumental in understanding specific client requirements, from vehicle specifications to financing and after-sales support, ensuring a comprehensive solution.

- Customized Solutions: Teams develop vehicle configurations and service plans specifically for corporate clients' operational demands.

- Bulk Purchasing: Facilitating significant discounts and streamlined acquisition processes for large fleet orders.

- Relationship Management: Building long-term partnerships through dedicated account management and ongoing support.

- Market Penetration: Targeting key sectors like delivery services, public transportation, and construction for significant market share growth.

Hotai Motor's channels extend beyond physical dealerships to encompass a robust digital ecosystem and specialized financial services. These diverse touchpoints are designed to cater to different customer needs, from vehicle purchase and maintenance to mobility solutions and financing.

The company's Mobility as a Service (MaaS) platforms, including iRent and yoxi, saw continued user growth in 2024, reflecting a strong shift towards convenient, on-demand transportation. This digital-first approach complements their traditional sales channels, broadening Hotai's market reach and customer engagement.

Hotai Finance and Hotai Insurance channels, both online and through physical branches, are critical for capturing value beyond the initial vehicle sale. In 2024, these financial services reported a significant increase in new auto financing contracts, demonstrating their integral role in the overall business model.

| Channel Type | Key Offerings | 2024 Focus/Performance |

|---|---|---|

| Physical Dealerships | Vehicle Sales (Toyota, Lexus, Hino), Test Drives, After-Sales Service | Continued primary revenue driver; strong customer engagement |

| Authorized Service Centers | Maintenance, Repairs, Genuine Parts, Technical Support | High volume of service requests; revenue diversification |

| Digital/MaaS Platforms (iRent, yoxi) | Car Sharing, Ride-Hailing, Mobility Solutions | User base expansion exceeding 30% in 2023; growing digital engagement |

| Financial Services (Hotai Finance, Hotai Insurance) | Auto Financing, Leasing, Insurance | Significant growth in new auto financing contracts; increased online portal engagement |

| Corporate & Fleet Sales Teams | Bulk Vehicle Purchases, Tailored Packages for Businesses | Securing large-scale commercial deals; strengthening business partnerships |

Customer Segments

Individual car buyers represent a substantial portion of Hotai Motor's customer base, with a strong preference for Toyota vehicles due to their renowned reliability and fuel efficiency. This mass-market segment prioritizes practical, family-oriented cars that offer good value for money. In 2024, the average transaction price for a new passenger vehicle in Taiwan hovered around NT$900,000, a figure that aligns with the affordability expectations of these buyers.

Brand reputation is a critical factor for these consumers, and Toyota's consistent high rankings in customer satisfaction surveys, particularly in areas like durability and resale value, heavily influence their purchasing decisions. Furthermore, the extensive network of service centers across Taiwan ensures convenient maintenance and repair, a key consideration for individuals seeking long-term vehicle ownership and peace of mind.

Luxury Vehicle Consumers are discerning individuals who place a high value on premium features, cutting-edge technology, and the prestige associated with a brand. Hotai Motor caters to this segment primarily through its Lexus offerings, recognizing their desire for sophisticated design and superior performance.

These consumers are not just looking for transportation; they are seeking an exclusive ownership experience that reflects their status and taste. In 2024, the global luxury car market continued its robust growth, with brands like Lexus reporting strong sales figures, underscoring the significant demand within this segment for vehicles that offer both advanced engineering and an elevated sense of arrival.

Commercial and fleet operators, including businesses and logistics companies, represent a crucial customer segment for Hotai Motor. These clients rely on robust vehicles like Hino trucks and buses for their daily operations. In 2024, the demand for commercial vehicles remained strong, driven by e-commerce growth and infrastructure projects.

These operators prioritize vehicles offering high payload capacity and unwavering operational reliability to minimize downtime and maximize efficiency. Hotai Motor's commitment to providing comprehensive after-sales support, including maintenance and parts availability, directly addresses these critical needs, ensuring their fleets remain productive.

Existing Vehicle Owners

Existing vehicle owners represent a vital customer segment for Hotai Motor, generating consistent revenue through after-sales services. This group relies on Hotai for essential maintenance, repairs, and the purchase of genuine parts and accessories, ensuring their vehicles remain in optimal condition. In 2024, Hotai Motor continued to focus on enhancing customer loyalty and maximizing lifetime value from this segment.

This segment is critical for building recurring revenue streams, with owners regularly needing scheduled maintenance and potential upgrades. Hotai's strategy often involves targeted promotions and service packages designed to encourage repeat business and foster brand loyalty. For instance, many automotive groups, including those similar to Hotai, aim to achieve over 70% of their profit from after-sales services.

- Recurring Revenue: Existing owners drive consistent income through scheduled maintenance, repairs, and the purchase of genuine parts.

- Loyalty Programs: Hotai likely implements loyalty programs to incentivize repeat visits for servicing and accessory purchases.

- Accessory Sales: This segment is a prime target for upselling genuine accessories, enhancing vehicle functionality and aesthetics.

- Insurance Services: Offering vehicle insurance renewals and claims processing further solidifies the relationship and revenue from existing owners.

Urban Mobility Service Users

Urban Mobility Service Users represent a growing demographic that values flexibility and convenience over traditional car ownership. This segment actively uses services like iRent for car-sharing and yoxi for ride-hailing, prioritizing on-demand access and seamless digital experiences. In 2024, the global mobility-as-a-service (MaaS) market was projected to reach over $100 billion, highlighting the significant shift towards these user preferences.

These users are typically tech-savvy and appreciate integrated platforms that simplify trip planning and payment. They are often found in densely populated urban areas where parking and vehicle maintenance can be burdensome. The convenience of accessing a vehicle or a ride precisely when needed, without the long-term commitment of ownership, is a key driver for this segment. For instance, iRent reported a significant increase in its user base in major Taiwanese cities throughout 2023 and early 2024, indicating strong adoption.

- Prioritize Convenience: Seek on-demand access to transportation, reducing the need for personal vehicle ownership.

- Embrace Digital Platforms: Rely on mobile apps for booking, payment, and managing their mobility services.

- Value Flexibility: Prefer pay-per-use models that offer adaptable transportation solutions for varying needs.

- Urban Dwellers: Primarily located in cities where these services are readily available and offer a practical alternative to traditional commuting.

Hotai Motor serves a diverse range of customers, from individual car buyers seeking reliable Toyota vehicles to affluent consumers drawn to Lexus luxury. Commercial entities and fleet operators depend on Hino's robust trucks and buses for their operational needs. Furthermore, existing vehicle owners represent a crucial segment for after-sales services and parts, while urban mobility users increasingly favor flexible, on-demand solutions like iRent and yoxi.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Individual Car Buyers | Value reliability, fuel efficiency, and affordability. Prefer Toyota. | Average new passenger vehicle price in Taiwan ~NT$900,000. |

| Luxury Vehicle Consumers | Seek premium features, advanced technology, and brand prestige. Favor Lexus. | Global luxury car market shows robust growth; Lexus reports strong sales. |

| Commercial & Fleet Operators | Prioritize durability, payload capacity, and operational reliability for Hino vehicles. | Demand for commercial vehicles strong due to e-commerce and infrastructure. |

| Existing Vehicle Owners | Drive recurring revenue through maintenance, repairs, and parts. | Aim for over 70% profit from after-sales services in automotive groups. |

| Urban Mobility Service Users | Value flexibility, convenience, and digital experiences via car-sharing/ride-hailing. | MaaS market projected to exceed $100 billion globally. iRent user base growing. |

Cost Structure

Vehicle procurement and manufacturing represent a substantial portion of Hotai Motor's expenses. The cost of importing vehicles from Toyota, Lexus, and Hino, coupled with the manufacturing outlays through its Kuozui Motors joint venture, forms a significant cost driver. These manufacturing costs encompass raw materials, labor, and factory overheads, directly impacting the company's profitability.

Hotai Motor's cost structure heavily features sales, marketing, and distribution expenses. These are crucial for maintaining their extensive dealership network and driving vehicle sales. In 2024, for instance, significant investments were made in advertising campaigns and promotional events to boost brand visibility and attract customers.

The operational costs associated with managing a vast dealership network, including salaries for sales staff and showroom maintenance, represent a substantial portion of these expenses. Furthermore, the logistics and transportation costs for distributing vehicles across their service areas are considerable, directly impacting the overall cost of sales.

Personnel and labor costs are a significant component of Hotai Motor's expense structure. This includes salaries, comprehensive benefits packages, and ongoing training programs for a substantial workforce. These employees are spread across various critical departments, including sales, after-sales service, administration, and finance, all of which are essential for delivering Hotai's wide array of automotive services.

Human capital is truly the backbone of Hotai's operations, underpinning its ability to offer diverse and high-quality customer experiences. For instance, in 2023, the automotive industry, in general, saw wage increases driven by demand for skilled technicians and sales professionals, a trend likely reflected in Hotai's own personnel expenditures.

Financial Services and Insurance Operating Costs

Hotai Finance and Hotai Insurance incur significant operating costs. These include expenses related to loan processing, rigorous risk assessment for new and existing loans, and the management of non-performing loans, which can tie up capital and require recovery efforts. Furthermore, the company must budget for the payout of insurance claims, a core function of its insurance arm.

Regulatory compliance and meeting capital requirements are also substantial cost drivers. These are essential for maintaining operational licenses and financial stability within the highly regulated financial services sector. For instance, in 2024, financial institutions globally faced increased scrutiny on capital adequacy ratios, directly impacting operational budgets.

- Loan Processing & Risk Assessment: Costs associated with evaluating creditworthiness and managing loan portfolios.

- Non-Performing Loan Management: Expenses incurred in recovering defaulted loans.

- Insurance Claim Payouts: Direct costs of settling claims filed by policyholders.

- Regulatory Compliance & Capital Requirements: Expenditures for adhering to financial regulations and maintaining solvency.

Technology and Infrastructure Investment

Hotai Motor's commitment to advancing mobility solutions necessitates significant expenditure in technology and infrastructure. This investment is crucial for developing and maintaining their digital platforms, particularly those supporting Mobility as a Service (MaaS) offerings.

The company allocates substantial resources towards IT infrastructure, encompassing everything from cloud computing services to robust data management systems. Continuous technological upgrades are a core component, ensuring their systems remain competitive and efficient in the rapidly evolving automotive and mobility sectors.

Key cost drivers within this category include:

- Software Development: Costs associated with creating and refining proprietary applications for MaaS, customer relationship management, and internal operations.

- Data Management & Analytics: Expenses related to storing, processing, and analyzing vast amounts of data generated from vehicle usage, customer interactions, and operational performance. For instance, in 2024, companies in the automotive tech sector saw R&D spending increase by an average of 15% year-over-year, with a significant portion directed towards data infrastructure.

- Cybersecurity: Investments in protecting digital assets and customer data from evolving cyber threats, a critical aspect for any technology-reliant business.

- IT Infrastructure Maintenance & Upgrades: Ongoing costs for hardware, software licenses, network maintenance, and periodic system overhauls to ensure optimal performance and scalability.

Hotai Motor's cost structure is dominated by vehicle procurement and manufacturing, including import costs and joint venture production expenses. Sales, marketing, and distribution are also significant, with substantial investments in advertising and dealership network operations. Personnel costs, encompassing salaries and benefits for a large workforce, are a core expense, as are the operating costs of its finance and insurance arms, including loan processing and claim payouts.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Vehicle Procurement & Manufacturing | Importing vehicles, raw materials, labor, factory overheads | Continued substantial investment in securing vehicle supply chains. |

| Sales, Marketing & Distribution | Dealership network, advertising, promotions, logistics | Increased spending on digital marketing and customer engagement initiatives. |

| Personnel & Labor Costs | Salaries, benefits, training for diverse workforce | Ongoing focus on talent retention and development in a competitive market. |

| Finance & Insurance Operations | Loan processing, risk assessment, claim payouts, regulatory compliance | Adherence to evolving financial regulations and capital adequacy requirements. |

| Technology & Infrastructure | Software development, data management, cybersecurity, IT upgrades | Investment in digital platforms to support Mobility as a Service (MaaS) expansion. |

Revenue Streams

Hotai Motor's core revenue generation stems from the sale of new vehicles, primarily Toyota, Lexus, and Hino brands. This encompasses a broad customer base, from individual car buyers to large fleet operators and businesses requiring commercial vehicles.

In 2023, Hotai Motor reported significant new vehicle sales figures, contributing substantially to its overall financial performance. For instance, the company's robust sales in Taiwan, a key market, underscore the importance of this revenue stream.

Hotai Motor generates significant recurring revenue through its after-sales service and parts sales. This includes essential vehicle maintenance, repair services, and the sale of genuine auto parts and accessories, fostering long-term customer loyalty and consistent profitability.

In 2024, Hotai Motor's commitment to after-sales support is a key differentiator. For instance, their extensive network of service centers ensures convenient access for customers, driving repeat business. This segment is vital for maintaining customer relationships and ensuring the longevity of their vehicle ownership experience.

Hotai Finance is a significant revenue generator for Hotai Motor, primarily through interest earned on installment sales and vehicle loans. In 2023, Hotai Finance reported a net profit of NT$10.6 billion, showcasing the profitability of its financing operations which directly support the company's core automotive sales.

Leasing fees also contribute to this income stream, offering a recurring revenue source that complements direct vehicle purchases. This financial services arm acts as a crucial enabler for customers, making vehicle acquisition more accessible and thus bolstering overall sales volume for Hotai Motor.

Insurance Premiums

Hotai Insurance is a key revenue generator, collecting premiums from a wide array of property and casualty insurance policies, with a significant focus on vehicle insurance. This diversification not only bolsters Hotai Motor's financial stability but also creates a synergistic relationship with its core automotive business, offering customers a comprehensive service package.

In 2024, the insurance segment demonstrated robust performance. For instance, Hotai Financial Holdings, which oversees insurance operations, reported substantial premium income. This segment’s contribution is crucial, as it provides a predictable and recurring revenue stream that can help offset the cyclical nature of the automotive sales market.

- Vehicle Insurance Premiums: A primary income source derived from policies covering cars, trucks, and other vehicles.

- Property & Casualty Insurance: Revenue from policies protecting against damage to property and liability for accidents.

- Synergistic Revenue: Premiums often arise from vehicles sold through Hotai Motor, creating an integrated value chain.

- Financial Stability: Insurance premiums contribute a stable, recurring income, enhancing overall business resilience.

Mobility as a Service (MaaS) Fees

Hotai Motor is tapping into the growing Mobility as a Service (MaaS) sector, generating revenue through its car-sharing platform, iRent, and ride-hailing service, yoxi. These emerging streams are becoming increasingly significant as the company broadens its MaaS ecosystem.

- iRent Car-Sharing: Fees collected from users for rental periods and mileage.

- yoxi Ride-Hailing: Commissions earned on each ride completed through the platform.

- Subscription Packages: Potential for recurring revenue through bundled mobility services.

While specific 2024 figures for MaaS revenue are still being consolidated, the broader trend in the MaaS market indicates substantial growth. For instance, the global MaaS market was projected to reach over $150 billion by 2024, highlighting the potential for Hotai's ventures in this space.

Hotai Motor's revenue streams are multifaceted, extending beyond new vehicle sales to include vital financial and service-based income. In 2023, Hotai Finance reported a net profit of NT$10.6 billion, underscoring the financial services arm's profitability through installment sales and vehicle loans. This financial segment is crucial, as it not only generates income but also facilitates vehicle purchases, creating a synergistic loop with the core automotive business.

| Revenue Stream | Description | 2023 Highlight | 2024 Focus |

|---|---|---|---|

| New Vehicle Sales | Primary revenue from Toyota, Lexus, Hino brands. | Significant contribution to overall performance in key markets like Taiwan. | Continued market penetration and sales volume growth. |

| After-Sales & Parts | Maintenance, repair services, and genuine parts sales. | Fosters customer loyalty and consistent profitability. | Enhancing service network convenience and customer experience. |

| Hotai Finance | Interest from installment sales and vehicle loans. | Net profit of NT$10.6 billion. | Expanding financing options to support vehicle sales. |

| Hotai Insurance | Premiums from vehicle and property/casualty insurance. | Provides stable, recurring income. | Leveraging insurance to complement automotive sales. |

| Mobility as a Service (MaaS) | Car-sharing (iRent) and ride-hailing (yoxi). | Emerging streams showing growth potential. | Expanding MaaS ecosystem and user base. |

Business Model Canvas Data Sources

The Hotai Motor Business Model Canvas is built upon comprehensive market research, internal financial data, and operational performance metrics. These sources ensure each block reflects current industry trends and company capabilities.