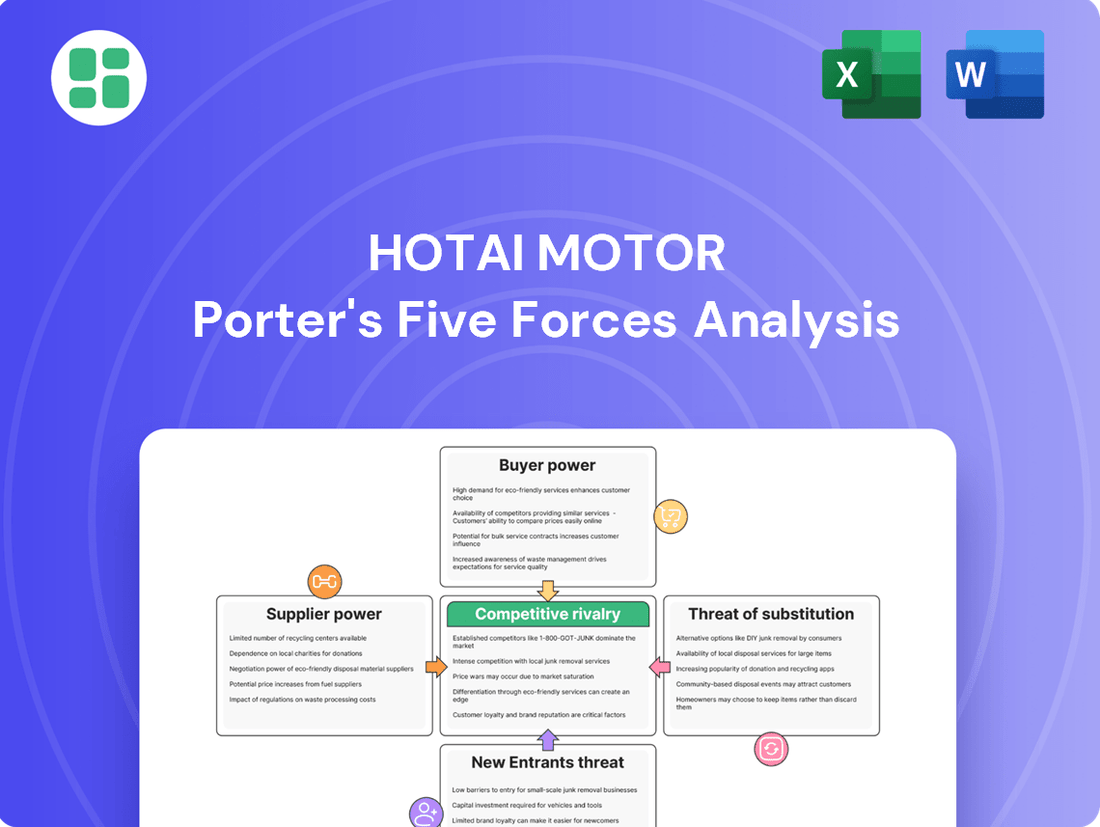

Hotai Motor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hotai Motor Bundle

Hotai Motor faces significant pressure from intense rivalry and the threat of new entrants in the competitive automotive market. Understanding buyer power and the availability of substitutes is crucial for navigating this landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hotai Motor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hotai Motor's reliance on exclusive import and distribution agreements with major automotive brands like Toyota, Lexus, and Hino is a critical factor influencing supplier bargaining power. This dependency means these manufacturers hold considerable sway over Hotai's core business operations and revenue generation.

In 2023, Toyota Motor Corporation, a key supplier for Hotai, reported global sales of over 11.2 million vehicles, highlighting its significant market presence. This scale and brand strength empower Toyota to dictate terms, impacting Hotai's product availability and pricing strategies.

The exclusivity of these agreements, a common practice in the automotive sector, further concentrates bargaining power with the suppliers. Hotai's inability to easily substitute these core brands means they have limited leverage to negotiate more favorable terms, directly affecting profitability.

Hotai Motor's reliance on its principal manufacturers for genuine vehicle parts and specialized technology, particularly for maintenance and warranty, establishes a captive market for OEM components. This dependence significantly limits Hotai's flexibility to seek out more affordable alternatives, thereby granting vehicle manufacturers substantial power over pricing and the supply of these essential parts.

The Taiwanese government's directive in August 2024, mandating a specific percentage of domestically produced parts for cars sold in Taiwan, is poised to reshape the supply chain dynamics for local automotive manufacturing. This policy could potentially influence the availability and cost of components, impacting Hotai's sourcing strategies and the bargaining power of its local suppliers.

In the automotive sector, particularly for brands like Toyota and Lexus, distributors face substantial switching costs. These costs stem from significant investments in brand-specific infrastructure, specialized training for technicians, and dedicated marketing campaigns. For instance, a dealership might have millions invested in Toyota-specific diagnostic equipment and parts inventory.

Hotai Motor's deep-rooted partnerships and well-established distribution networks for these prominent automotive brands significantly amplify supplier bargaining power. Shifting to alternative vehicle suppliers would necessitate a complete overhaul of operations, incurring massive disruption and substantial capital expenditure, making such a move highly improbable and costly.

Integration of Financial Services

Hotai Motor's involvement in financial services, such as auto financing and insurance, introduces financial institutions as key suppliers. These entities, which provide credit lines and underwriting, can exert bargaining power, particularly for significant financing needs. In 2023, the automotive finance sector saw robust activity, with many institutions actively seeking to expand their market share through competitive lending rates, potentially increasing their leverage with large clients like Hotai.

- Financial Institutions as Suppliers: Banks and insurance companies that offer credit lines and underwriting services to Hotai Motor's financial services division.

- Potential for Supplier Leverage: Strong relationships with specific financial partners can give these suppliers some negotiation strength, especially for substantial financing requirements.

- Market Dynamics in 2023: The competitive landscape of auto financing in 2023, characterized by institutions vying for market share, suggests that suppliers may have had a degree of bargaining power due to the demand for their services.

Logistics and Raw Material Suppliers

Hotai Motor's reliance extends to logistics and raw material suppliers beyond vehicle manufacturers. While these suppliers are often fragmented, the bargaining power can increase for those providing critical components or specialized logistics, particularly during supply chain disruptions. For instance, the automotive industry has seen significant improvements in chip supply throughout 2024, easing some of these pressures.

The fragmentation of many raw material suppliers generally limits their individual power. However, if certain raw materials become scarce or are sourced from a limited number of global producers, their leverage can rise. Similarly, specialized logistics services, such as those for transporting oversized or sensitive auto parts, can command higher prices if alternatives are scarce.

- Fragmented Supplier Base: Many raw material and logistics providers operate in competitive markets, diluting individual supplier power.

- Critical Component Dependence: Suppliers of essential auto parts or specialized logistics services may wield more influence due to limited alternatives.

- Supply Chain Resilience: Events like the noted improvements in global chip supply in 2024 can shift bargaining power back towards buyers by increasing availability and reducing lead times.

Hotai Motor's bargaining power with suppliers is significantly constrained by its exclusive distribution agreements with major automotive brands like Toyota and Lexus. These manufacturers hold substantial leverage due to their brand strength and market dominance, influencing Hotai's product availability and pricing. The high switching costs associated with these partnerships, including investments in brand-specific infrastructure and training, further solidify supplier power.

| Supplier Type | Key Brands/Services | Supplier Bargaining Power Factors | Impact on Hotai Motor |

|---|---|---|---|

| Vehicle Manufacturers | Toyota, Lexus, Hino | Brand reputation, market share, exclusivity agreements, high switching costs for distributors | Dictates terms, product availability, pricing; limits negotiation leverage for Hotai |

| Financial Institutions | Banks, Insurance Companies | Market share in auto finance, competitive lending rates, financing needs | Can influence financing terms and credit availability for Hotai's financial services |

| Component/Parts Suppliers | OEM parts, specialized technology | Captive market for genuine parts, limited substitution options | Controls pricing and supply of essential components for maintenance and warranty |

| Logistics & Raw Materials | Specialized transport, critical components | Scarcity of materials, limited specialized logistics providers | Potential for higher costs during supply chain disruptions or for niche services |

What is included in the product

Hotai Motor's Five Forces Analysis unpacks the competitive intensity within the automotive industry, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a dynamic radar chart.

Customers Bargaining Power

Customers in Taiwan's automotive market face a wealth of options, with brands like Honda, Hyundai, Mercedes-Benz, BMW, and Tesla readily available. This high degree of choice significantly amplifies their bargaining power.

Consumers are highly attuned to pricing, and the ongoing dialogue surrounding import tariffs further fuels their desire for competitive deals. This price sensitivity allows customers to readily compare vehicles and press for more favorable terms, directly impacting Hotai Motor's pricing strategies.

The sheer volume of readily available online information, including comparison websites and detailed automotive reviews, has dramatically amplified customer bargaining power. In 2024, consumers can effortlessly research vehicle specifications, compare pricing across dealerships, and scrutinize after-sales service quality. This heightened transparency allows buyers to enter negotiations armed with comprehensive data, enabling them to effectively pressure Hotai Motor's dealerships for more competitive terms and better deals.

While customers initially hold significant bargaining power due to the wide array of vehicle choices, switching costs can emerge from established service relationships and brand loyalty. For instance, a customer deeply integrated with a specific dealership's service network might face inconvenience when switching. In 2024, the automotive market saw continued emphasis on customer retention programs, highlighting the industry's awareness of these loyalty factors.

Influence of Market Trends (e.g., EVs)

The burgeoning electric vehicle (EV) market in Taiwan significantly amplifies customer bargaining power. As more EV models become available and consumer acceptance grows, buyers gain greater choice and can negotiate more favorable terms. This trend is further supported by expanding government incentives and a developing charging infrastructure, making EVs a more attractive and accessible option.

Customers are increasingly able to demand a wider array of EV choices and competitive pricing, directly challenging the market share of traditional internal combustion engine (ICE) vehicles. This shift forces manufacturers like Hotai Motor to adapt their strategies to meet evolving consumer preferences and competitive pressures.

- EV Market Growth in Taiwan: In 2023, EV sales in Taiwan saw substantial growth, with new registrations increasing by over 60% compared to the previous year, indicating strong market momentum and increasing consumer interest.

- Government Support: Taiwan's government has committed to substantial subsidies and tax breaks for EV purchases, further incentivizing adoption and signaling a long-term commitment to electrification.

- Charging Infrastructure Expansion: By the end of 2024, the number of public charging stations in Taiwan is projected to exceed 5,000, a significant increase from 2023, addressing a key concern for potential EV buyers.

- Increased Model Availability: Leading automakers are introducing more EV variants into the Taiwanese market throughout 2024, offering consumers a broader selection across different vehicle segments and price points.

Importance of After-Sales Service and Financing

Hotai Motor's commitment to after-sales service, including maintenance, auto financing, and insurance, is a key differentiator. However, this comprehensive offering also presents an opportunity for customers to exert bargaining power. By comparing the competitiveness of these bundled services with other providers, customers can influence pricing and terms.

The automotive market in 2024, particularly in Taiwan where Hotai Motor operates, sees a significant number of consumers actively seeking favorable financing arrangements. For instance, in 2023, the average auto loan interest rate in Taiwan hovered around 3-5%, but with increasing competition, consumers can often negotiate lower rates or seek out promotional offers. This readily available alternative financing means customers can effectively shop around, putting pressure on Hotai Motor to maintain attractive financing packages to retain their business.

- Customer Leverage: Customers can negotiate better terms on financing and insurance due to the availability of competing offers.

- Service Bundling Impact: While Hotai Motor bundles services, customers can still compare these packages against standalone options.

- Financing Competition: The presence of numerous auto financing providers empowers customers to seek the most advantageous loan terms.

- 2023 Data Point: Average auto loan interest rates in Taiwan were around 3-5% in 2023, highlighting the potential for negotiation.

The bargaining power of customers for Hotai Motor is substantial, driven by a highly competitive market with numerous brands and readily available information. Consumers in Taiwan can easily compare prices, specifications, and after-sales services online, empowering them to negotiate better deals. The growing EV market further amplifies this power, with increasing model availability and government incentives making electric vehicles a more attractive alternative, forcing Hotai Motor to remain competitive.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Availability of Substitutes | High | Numerous automotive brands available in Taiwan. |

| Price Sensitivity | High | Consumers actively seek competitive pricing and deals. |

| Information Availability | High | Online resources facilitate easy comparison of vehicles and services. |

| Switching Costs | Moderate | Brand loyalty and service relationships can influence switching. |

| EV Market Growth | Increasing | Expansion of EV options and incentives boosts consumer choice. |

Preview the Actual Deliverable

Hotai Motor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Hotai Motor Porter's Five Forces Analysis you see here details the competitive landscape, including threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the automotive industry. This fully formatted and ready-to-use analysis will equip you with critical insights into Hotai Motor's strategic positioning.

Rivalry Among Competitors

Hotai Motor enjoys a commanding presence in Taiwan, holding a substantial 30.6% market share in December 2024 and an impressive 46.6% by January 2025, largely due to its strong Toyota and Lexus brands. This dominance, however, exists within a fiercely contested automotive landscape.

The Taiwanese market is crowded with formidable competitors, including well-established brands such as Honda, Hyundai, Mercedes-Benz, and BMW, all actively seeking to capture a larger portion of consumer demand. The increasing presence of electric vehicle manufacturers like Tesla further intensifies this rivalry, pushing all players to innovate and adapt.

The Taiwanese automotive market is facing headwinds, with a 4.0% contraction in 2024 and a significant 14.3% decline in the first half of 2025. This slowdown, driven by consumer caution and uncertainty surrounding US tariffs, is intensifying competitive rivalry. As the market shrinks, companies like Hotai Motor are compelled to engage in more aggressive promotional activities and price competition to capture market share.

Competitive rivalry in the automotive sector is intense, fueled by a relentless cycle of product innovation and the introduction of new vehicle models. Hotai Motor, a key player, strategically counters this by consistently launching updated Toyota and Lexus models, with a notable focus on electric vehicles (EVs) to stay ahead of market trends and consumer demand.

Competitors are equally aggressive, frequently unveiling new vehicles and employing attractive promotional offers. This dynamic environment compels Hotai Motor to continuously differentiate its offerings through advanced features, cutting-edge technology, and competitive pricing strategies to capture and retain market share.

Competition in Adjacent Segments

Hotai Motor’s competitive landscape isn't confined to just new vehicle sales. The company actively competes in the used car market, auto parts distribution, and financial services sectors. This broad involvement means Hotai encounters rivals ranging from independent used car dealerships to financial institutions providing auto loans and insurance.

In 2024, the used car market continued to be a significant battleground. For instance, the average price of a used car in Taiwan saw fluctuations, with some segments experiencing increases due to supply chain issues impacting new car inventory. Hotai’s strategy here involves leveraging its brand reputation and certified pre-owned programs to attract discerning buyers.

The auto parts distribution segment also presents its own set of competitors. Hotai faces pressure from both authorized dealerships of other brands and independent aftermarket suppliers. In 2024, the demand for genuine parts remained strong, but the availability of affordable aftermarket alternatives continued to challenge market share.

- Used Car Market: Competition from independent dealers and online platforms.

- Auto Parts: Rivalry from authorized dealerships of other brands and independent aftermarket suppliers.

- Financial Services: Competition from banks and other financial institutions offering auto loans and insurance.

- Diversified Threat: Hotai's broad operational scope means it must contend with specialized competitors in each adjacent segment.

Impact of Electric Vehicle Growth

The burgeoning electric vehicle (EV) market is significantly intensifying competitive rivalry for Hotai Motor. With EV registrations soaring by 53.3% in 2024, the landscape is rapidly evolving. This growth presents both opportunities for Hotai's new electric models and heightened competition from established EV leaders and emerging domestic players.

Hotai faces robust competition from brands like Tesla, which continues to dominate market share, and aggressive domestic manufacturers such as Luxgen, which are also expanding their EV offerings. This dual pressure from global EV pioneers and agile local competitors means Hotai must navigate a more crowded and dynamic market than ever before.

- EV Market Expansion: 2024 saw a substantial 53.3% surge in electric vehicle registrations, indicating a decisive shift in consumer preference and industry focus.

- Key Competitors: Hotai competes directly with global EV leader Tesla and increasingly with domestic brands like Luxgen, which are actively developing and promoting their electric lineups.

- Traditional Market Overlap: The growth of EVs adds another layer of rivalry to the existing competition within the traditional internal combustion engine vehicle market, forcing Hotai to manage a dual competitive strategy.

Hotai Motor operates in a highly competitive Taiwanese automotive market, facing pressure from established global brands and emerging EV players. The market contraction in 2024 and early 2025 intensifies this rivalry, pushing companies towards aggressive pricing and promotions to secure market share.

The competition extends beyond new vehicle sales to used cars, auto parts, and financial services, requiring Hotai to contend with specialized rivals in each segment. The rapid growth of the EV market, marked by a 53.3% increase in registrations in 2024, further escalates competition from leaders like Tesla and domestic manufacturers like Luxgen.

| Market Segment | Key Competitors | Competitive Intensity |

| New Vehicles | Honda, Hyundai, Mercedes-Benz, BMW | High |

| Electric Vehicles | Tesla, Luxgen | Very High |

| Used Cars | Independent Dealers, Online Platforms | High |

| Auto Parts | Other Brand Dealerships, Aftermarket Suppliers | Moderate to High |

| Financial Services | Banks, Other Financial Institutions | High |

SSubstitutes Threaten

For individual consumers in Taiwan, the threat of substitutes to private vehicle ownership is significant. The island boasts a well-developed public transportation network, including extensive train, bus, and MRT systems. In 2023, Taiwan's railway network transported over 240 million passengers, highlighting its extensive reach and utility.

Ride-sharing services like Uber and local alternatives are also increasingly prevalent, offering convenient and often cost-effective alternatives to car ownership, especially in densely populated urban centers. This accessibility directly challenges the need for individuals to purchase and maintain private vehicles, impacting demand for new cars.

The rise of micro-mobility options like electric scooters and shared bicycles offers alternatives for short urban trips. While not directly replacing new vehicle purchases for Hotai Motor, these services can reduce the frequency of personal vehicle use, potentially impacting longer-term replacement cycles.

Car-sharing platforms also provide substitute mobility, especially for infrequent drivers or those needing a vehicle for specific occasions. This trend could subtly shift consumer attitudes towards vehicle ownership, though Hotai's focus on new vehicle sales remains its core business.

In 2024, the electric scooter market saw significant growth, with global sales projected to reach over 30 million units. Similarly, car-sharing services continued to expand their fleets and user bases, indicating a growing consumer comfort with alternative transportation models.

For Hino commercial vehicles, substitutes like rail and shipping pose a threat, particularly for long-haul or bulk freight. In 2024, the global freight transport market saw continued investment in intermodal solutions, with rail freight volume in the US increasing by an estimated 1.5% year-over-year, showcasing its growing efficiency for certain cargo types.

While road transport remains dominant for last-mile delivery and flexible routing, significant cost reductions or efficiency improvements in rail and maritime shipping could divert freight volume. For instance, advancements in port infrastructure and containerization technology continue to make shipping more competitive for international trade, potentially impacting demand for long-distance trucking fleets.

Shift to Mobility-as-a-Service (MaaS)

The burgeoning Mobility-as-a-Service (MaaS) trend presents a significant threat of substitution for traditional vehicle ownership models, impacting companies like Hotai Motor. As customers increasingly embrace integrated transportation solutions, the demand for personal vehicle purchases could wane.

Hotai Motor's own investment in MaaS initiatives, such as ride-sharing and subscription services, can be viewed as a proactive strategy to mitigate this substitution threat. By offering these alternative mobility options, the company aims to capture a share of this evolving market rather than being solely reliant on vehicle sales.

The success of MaaS could fundamentally alter revenue streams, shifting focus from one-time vehicle sales to recurring service fees. For instance, by 2024, the global MaaS market was projected to reach hundreds of billions of dollars, indicating a substantial shift in consumer preferences and potential revenue displacement for traditional automakers.

- MaaS Market Growth: The global MaaS market is experiencing rapid expansion, with projections indicating significant growth through 2025 and beyond, directly impacting traditional automotive sales models.

- Hotai's MaaS Ventures: Hotai Motor is actively developing its own MaaS platforms, aiming to retain customer loyalty and capture new revenue streams within the changing mobility landscape.

- Shift in Consumer Behavior: A growing segment of consumers, particularly in urban areas, are prioritizing convenience and cost-effectiveness, leading them to favor MaaS over personal vehicle ownership.

- Revenue Model Transformation: The rise of MaaS necessitates a strategic pivot for automotive companies, moving from a product-centric sales model to a service-centric subscription and usage-based revenue approach.

Durability and Longevity of Existing Vehicles

The increasing durability and longevity of modern vehicles, particularly those from brands like Toyota and Lexus, directly impacts the threat of substitutes. Consumers are finding they can hold onto their cars for significantly longer periods, often exceeding 10 years, which reduces the demand for new vehicle purchases. This trend effectively substitutes a new car purchase with the extended use of an existing vehicle, thereby weakening the bargaining power of new car manufacturers and dealerships.

In 2023, the average age of vehicles on U.S. roads reached a record high of 12.5 years, indicating a strong trend towards longer vehicle ownership. This extended lifespan means consumers are less frequently in the market for a new car, making the option of simply keeping and maintaining their current vehicle a potent substitute for many potential buyers.

- Extended Vehicle Lifespans: Modern vehicles, including those offered by Hotai Motor, are built to last, often for well over a decade with proper maintenance.

- Reduced Purchase Frequency: This enhanced durability means consumers delay purchasing new vehicles, opting instead to repair and maintain their existing ones.

- Cost-Effectiveness: For many consumers, the cost of maintaining an older vehicle is significantly lower than the depreciation and payments associated with a new car, making it a compelling substitute.

- Market Trend: The average age of vehicles on the road continues to climb, a testament to the increasing longevity and consumer preference for extending the life of their current automobiles.

The threat of substitutes for Hotai Motor is multifaceted, encompassing both personal and commercial mobility solutions. For consumers, well-developed public transport systems and the growing adoption of ride-sharing and micro-mobility services offer viable alternatives to private vehicle ownership. In 2023, Taiwan's railway network alone carried over 240 million passengers, underscoring the strength of these substitutes.

For commercial clients, rail and shipping services present significant substitutes for long-haul freight, particularly as intermodal solutions gain traction. The global freight transport market's continued investment in efficiency for these modes, with US rail freight volume estimated to increase by 1.5% year-over-year in 2024, highlights their competitive edge.

The increasing longevity of modern vehicles is another critical substitute. With the average age of vehicles on U.S. roads reaching a record 12.5 years in 2023, consumers increasingly opt to maintain existing cars rather than purchase new ones, directly impacting Hotai's core sales business.

Entrants Threaten

The automotive distribution sector, including that of Hotai Motor, demands immense capital. Establishing dealerships, service centers, stocking inventory, and executing marketing campaigns requires billions. For instance, setting up a single new dealership can cost millions, making it a formidable hurdle for potential newcomers.

Hotai Motor's established and widespread dealership network across Taiwan presents another significant barrier. Replicating this extensive reach, built over years, would involve enormous investment in real estate, infrastructure, and brand building, making it exceptionally difficult and expensive for new entrants to compete effectively.

Hotai Motor benefits significantly from the strong brand loyalty and established reputations of Toyota, Lexus, and Hino in Taiwan. These brands have spent decades building trust through consistent quality, reliability, and excellent resale value. For instance, Toyota consistently ranks among the top automotive brands in Taiwan by market share, often exceeding 30% in recent years, demonstrating deep consumer preference. Any new entrant would face a substantial hurdle in replicating this level of brand equity and customer devotion, which acts as a powerful barrier.

The automotive sector faces a gauntlet of regulations, from stringent safety and environmental mandates to complex import duties. For instance, Taiwan imposes a 17.5% tariff on automobiles, alongside a 5% import tax, significantly increasing the cost for newcomers. These extensive regulatory frameworks and the need for specialized licenses act as formidable barriers, particularly for international companies looking to enter the market.

Access to Supply Chains and Dealer Agreements

Hotai Motor's strong hold on exclusive or favorable distribution agreements with major global automotive manufacturers presents a significant barrier. Newcomers find it challenging to secure partnerships with key brands, as most are already aligned with established players like Hotai. This makes it difficult for new entrants to build a diverse and competitive product portfolio, a crucial element for market entry and success.

The difficulty in accessing established dealer networks further compounds the threat. Hotai Motor, having cultivated long-standing relationships, benefits from extensive reach and customer penetration. New entrants would face considerable hurdles in replicating this infrastructure, impacting their ability to efficiently distribute vehicles and service customers.

- Limited Access to Key Brands: As of early 2024, major automotive manufacturers like Toyota, Lexus, and Honda, which Hotai Motor represents, typically enter into long-term, exclusive distribution agreements, making it nearly impossible for new competitors to secure similar partnerships.

- Established Dealer Networks: Hotai Motor's extensive network of dealerships across Taiwan, built over decades, provides a significant competitive advantage. For instance, in 2023, Hotai reported over 100 dealership locations, a scale difficult for a new entrant to match quickly.

- Product Portfolio Acquisition: The ability to offer a wide range of popular and reliable vehicles, such as those from Toyota, is a major draw for consumers. New entrants would struggle to quickly assemble a comparable product offering, especially given the capital-intensive nature of automotive manufacturing and distribution agreements.

Emergence of Electric Vehicle Startups

The threat of new entrants in the automotive sector, particularly concerning Hotai Motor, is evolving with the surge in electric vehicle (EV) startups. While established players benefit from high capital requirements and brand loyalty, the EV revolution has opened doors for nimble, tech-savvy companies, including some based in Taiwan.

These new entrants, often supported by significant investment from technology conglomerates like Foxconn, are leveraging EV technology to challenge traditional automakers. They can bypass some legacy infrastructure costs and focus on direct-to-consumer sales models and innovative product designs. For instance, by July 2024, companies like BYD, a major EV player, continued to expand their global presence, demonstrating the potential for new entrants to gain significant market share.

- EV Startups Leverage Technology: Companies like Foxconn's MIH consortium are enabling EV startups by providing a flexible, open platform for vehicle development, potentially lowering R&D costs and time-to-market.

- Direct-to-Consumer Models: Many EV startups are adopting online sales and direct delivery, circumventing traditional dealership networks that Hotai Motor relies on.

- Brand Building Challenges: Despite technological advantages, these new entrants still face the significant hurdle of building brand trust and recognition against established automotive giants.

- Infrastructure Dependence: The reliance on charging infrastructure, still under development in many regions, presents a shared challenge and opportunity for both incumbents and new entrants.

The threat of new entrants for Hotai Motor is generally low due to substantial capital requirements for dealerships and inventory, along with the immense challenge of replicating its extensive, established dealer network. Furthermore, the strong brand loyalty associated with Toyota, Lexus, and Hino, cultivated over decades, acts as a significant barrier, as evidenced by Toyota's consistent market share exceeding 30% in Taiwan. Regulatory hurdles, including import tariffs and licensing, also deter newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | Establishing dealerships, service centers, and inventory requires billions. | High barrier; significant financial resources needed. | Setting up a single dealership can cost millions. |

| Distribution Network | Hotai's widespread network of over 100 dealerships across Taiwan. | Difficult and costly to replicate reach and customer penetration. | Hotai's extensive reach built over decades. |

| Brand Loyalty & Equity | Strong customer preference for Toyota, Lexus, Hino due to quality and reliability. | Challenging to build comparable trust and customer devotion. | Toyota's market share often exceeding 30% in Taiwan. |

| Regulatory Environment | Stringent safety, environmental regulations, import duties. | Increases cost and complexity for market entry. | Taiwan's 17.5% tariff and 5% import tax on automobiles. |

| Exclusive Distribution Agreements | Favorable partnerships with major global manufacturers. | Limited access to desirable vehicle brands for new players. | Long-term, exclusive agreements are standard for key brands. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hotai Motor leverages data from company annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of the competitive landscape.