Horizon Robotics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Robotics Bundle

Horizon Robotics' marketing strategy is a masterclass in leveraging technology. Understand their innovative product development, strategic pricing models, expansive distribution networks, and targeted promotional campaigns.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Horizon Robotics. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Horizon Robotics' product strategy centers on its advanced AI chips, particularly the Journey series (Journey 2, 3, 5, and the upcoming Journey 6 variants like 6B, 6E, 6M, 6P). These chips are engineered for high performance and low power consumption, making them ideal for the demanding requirements of advanced driver-assistance systems (ADAS) and fully autonomous driving (AD).

The core of their product offering is the proprietary Brain Processing Unit (BPU) architecture, which enables efficient, real-time processing for intelligent vehicle perception and decision-making. This focus on specialized hardware for AI applications differentiates Horizon Robotics in a rapidly evolving automotive technology landscape, aiming to provide a competitive edge in the smart vehicle market.

Horizon Robotics' Full-Stack Smart Driving Solutions, epitomized by Horizon SuperDrive, represent a key element of their product strategy. This offering provides a complete system for autonomous driving, covering urban streets, highways, and parking maneuvers, showcasing a commitment to comprehensive functionality.

The core of SuperDrive’s appeal lies in Horizon’s unique software and hardware co-optimization, aiming to replicate a natural, human-like driving feel. This integration is crucial for user acceptance and the practical deployment of autonomous technology, setting it apart in a competitive market.

With mass production on the horizon, SuperDrive is slated for integration into vehicles starting in Q3 2025. This timeline indicates a significant push towards commercialization, with early market entry planned for the near future, positioning Horizon Robotics as a player ready to capitalize on the growing autonomous vehicle sector.

Horizon Robotics' product strategy centers on its Advanced Driver-Assistance Systems (ADAS) and Autonomous Driving (AD) offerings, notably Horizon Mono for front camera ADAS and Horizon Pilot for smart driving. These solutions are designed to elevate vehicle safety, driver convenience, and passenger comfort, aiming to equip every passenger vehicle with advanced driving capabilities.

In 2024, the global ADAS market is projected to reach over $40 billion, with a compound annual growth rate exceeding 15%, underscoring the significant demand for technologies like those offered by Horizon Robotics. The company's focus on integrating these sophisticated systems into mainstream vehicles positions it to capitalize on this expanding market.

Proprietary Technology Stack

Horizon Robotics' proprietary technology stack is central to its product strategy, featuring advanced Brain Processing Unit (BPU) architectures such as Nash and Bayes. This integrated hardware and software ecosystem is designed for high performance and adaptability in intelligent driving systems. The company's commitment to an open development environment is evident in tools like the Horizon OpenExplorer toolkit and TogetheROS middleware, fostering collaboration and customization among partners.

This technological foundation allows Horizon Robotics to offer flexible and powerful solutions for autonomous driving. In 2024, the company continued to emphasize its AI-centric approach, aiming to deliver efficient and scalable intelligent vehicle solutions. The integration of their BPU architecture with comprehensive software development kits empowers third-party developers to create tailored applications, driving innovation across the automotive sector.

Key components of the technology stack include:

- Proprietary BPU Architecture: Generations like Nash and Bayes provide specialized processing power for AI tasks in automotive applications.

- Horizon OpenExplorer Toolkit: A suite of software tools enabling partners to develop and integrate intelligent driving features.

- TogetheROS Middleware: Facilitates seamless communication and data flow within complex intelligent driving systems.

- Integrated Hardware and Software: A cohesive approach ensuring optimized performance, efficiency, and customization capabilities for intelligent driving solutions.

Tailored for Automotive and IoT

Horizon Robotics' product strategy is deeply rooted in its specialization for the automotive sector, while also extending its AI chip capabilities to smart Internet of Things (IoT) devices like surveillance cameras. This targeted approach ensures their technology aligns with the demanding requirements and high standards characteristic of the automotive industry, a sector known for its stringent safety and performance benchmarks.

Their dual focus allows Horizon Robotics to leverage its foundational AI computing expertise across a broader spectrum of intelligent devices. For instance, in 2024, the automotive AI chip market was projected to reach $10.5 billion, with significant growth driven by advanced driver-assistance systems (ADAS) and autonomous driving features. Horizon's ability to adapt its core technology for both passenger vehicles and other smart applications positions it well within this expanding market.

- Automotive Focus: Development of AI chips specifically engineered for the rigorous demands of autonomous driving and ADAS in passenger vehicles.

- IoT Expansion: Application of AI computing expertise to smart IoT devices, including advanced surveillance cameras, broadening market reach.

- Synergistic Technology: Core AI capabilities are transferable, enabling efficient development and deployment across diverse intelligent hardware.

- Market Alignment: Products are designed to meet the specific, often stringent, technical specifications and safety standards of the automotive industry.

Horizon Robotics' product strategy is centered on its advanced AI chips, particularly the Journey series, designed for high-performance, low-power consumption in ADAS and autonomous driving. Their proprietary Brain Processing Unit (BPU) architecture, along with full-stack solutions like Horizon SuperDrive, offers a competitive edge by providing integrated hardware and software for intelligent vehicle perception and decision-making. The company aims for mass production integration of SuperDrive by Q3 2025, targeting broad adoption of advanced driving capabilities in passenger vehicles.

Horizon's product portfolio also includes Horizon Mono for front camera ADAS and Horizon Pilot for smart driving, enhancing vehicle safety and convenience. The company's technology stack, featuring BPU architectures like Nash and Bayes, coupled with tools like the OpenExplorer toolkit and TogetheROS middleware, fosters an open development environment for customization. This integrated approach allows Horizon Robotics to efficiently deliver scalable intelligent vehicle solutions, capitalizing on the significant growth in the automotive AI chip market, which was projected to reach $10.5 billion in 2024.

The company's specialization in automotive AI chips, alongside applications in smart IoT devices like surveillance cameras, demonstrates a synergistic technology approach. This dual focus allows Horizon to leverage its core AI computing expertise across diverse intelligent hardware, aligning its products with the stringent technical specifications and safety standards of the automotive industry. In 2024, the global ADAS market was projected to exceed $40 billion, with a CAGR over 15%, highlighting the substantial market opportunity for Horizon's offerings.

| Product Category | Key Features | Target Market | 2024/2025 Data Point | Strategic Importance |

|---|---|---|---|---|

| AI Chips (Journey Series) | High performance, low power consumption, BPU architecture | ADAS, Autonomous Driving | Automotive AI chip market projected at $10.5 billion in 2024 | Core technology enabling intelligent vehicle functions |

| Full-Stack Solutions (SuperDrive) | Integrated hardware/software, human-like driving feel | Autonomous Driving Systems | Mass production integration targeted for Q3 2025 | Comprehensive offering for autonomous vehicle deployment |

| ADAS/AD Software Solutions (Horizon Mono, Horizon Pilot) | Enhanced safety, driver convenience | Passenger Vehicles | Global ADAS market projected over $40 billion in 2024 (CAGR >15%) | Broadening market reach and vehicle feature enhancement |

| IoT AI Chips | Leveraging core AI capabilities | Smart Surveillance Cameras, IoT Devices | Synergistic application of AI expertise across diverse hardware | Market diversification and technology scalability |

What is included in the product

This analysis provides a comprehensive breakdown of Horizon Robotics' marketing strategies, examining their Product innovation, Pricing models, Place (distribution) channels, and Promotion tactics within the competitive AI hardware landscape.

It offers a data-driven overview of Horizon Robotics' marketing positioning, ideal for understanding their approach to product development, market penetration, and brand building.

Simplifies the complex marketing strategy of Horizon Robotics by presenting its 4Ps in a clear, actionable format, alleviating the pain of deciphering intricate plans.

Provides a concise, easy-to-understand overview of Horizon Robotics' marketing approach, relieving the burden of sifting through extensive documentation for key takeaways.

Place

Horizon Robotics focuses on a direct B2B sales approach, targeting major automotive manufacturers and Tier 1 suppliers. This strategy aims to embed their advanced AI solutions directly into vehicles, securing crucial design wins. For instance, by mid-2024, Horizon Robotics had announced collaborations with several leading global automakers, signaling significant traction in the OEM market.

Partnerships are central to Horizon Robotics' go-to-market strategy, fostering deep integration within the automotive ecosystem. These collaborations are essential for scaling their technology and ensuring widespread adoption across different vehicle platforms. The company's success in securing these strategic alliances directly impacts its revenue growth and market penetration in the competitive autonomous driving sector.

Horizon Robotics boasts a robust network, having partnered with over 20 Original Equipment Manufacturer (OEM) brands by the close of 2024, alongside more than 133 Tier 1 suppliers. This extensive ecosystem is vital for driving market penetration and ensuring broad adoption of its automotive intelligence solutions.

Key collaborations include major automotive players like Volkswagen Group, through its CARIAD joint venture, and prominent Chinese automakers such as BYD, Li Auto, SAIC Motor, Geely, and GAC Group. Furthermore, partnerships with global Tier 1 suppliers like Bosch and DENSO underscore the company's commitment to integrating its technology across the automotive value chain.

Horizon Robotics boasts a commanding presence in the Chinese market, a critical factor in its marketing strategy. By the close of 2024, the company secured over 40% of the Chinese OEM ADAS market, solidifying its position as the second-largest independent third-party AD solution provider. This dominance is a testament to its effective localized strategies and robust relationships with domestic automakers.

The company's significant market penetration is further underscored by its impressive product delivery figures. By the end of 2024, Horizon Robotics had cumulatively delivered approximately 7.7 million sets of its advanced driver-assistance systems. This substantial volume highlights the trust and adoption of its technology by Chinese automotive manufacturers.

Global Expansion Initiatives

Horizon Robotics is strategically expanding its global footprint beyond its strong base in China. The company is actively pursuing international growth by forging partnerships with leading global automotive original equipment manufacturers (OEMs) and Tier 1 suppliers. This push is designed to introduce their sophisticated driving solutions to a broader international audience.

The company's first significant overseas mass production project is slated to commence in the first quarter of 2026. This initiative signals a tangible step in their global ambitions, aiming to diversify their customer portfolio and establish a presence in key international automotive markets.

- International Partnerships: Collaborating with global automotive OEMs and Tier 1 suppliers.

- First Overseas Mass Production: Scheduled for Q1 2026.

- Strategic Goal: To expand customer base and market reach for advanced driving solutions.

Strategic Joint Ventures

Horizon Robotics actively pursues strategic joint ventures to expand its market reach and enhance its product offerings. A prime example is Carizon, a collaboration with CARIAD, the software arm of Volkswagen Group, aimed at developing advanced driver-assistance systems (ADAS) and autonomous driving solutions specifically for the Chinese automotive market. This partnership, solidified in 2022, leverages Horizon Robotics' AI capabilities with CARIAD's software expertise.

Further strengthening its strategic alliances, Horizon Robotics has also partnered with automotive supplier Continental. These collaborations are crucial for tailoring advanced AI solutions to meet the unique demands of the Chinese automotive sector. By integrating its intelligent driving technologies with established industry players, Horizon Robotics solidifies its competitive standing and accelerates the adoption of its advanced automotive software and hardware.

These strategic partnerships are designed to achieve specific market objectives:

- Market Penetration: Gaining deeper access to the Chinese automotive market through established players like Volkswagen and Continental.

- Technology Integration: Seamlessly embedding Horizon Robotics' AI chips and software into vehicles produced by partners.

- Product Customization: Developing bespoke ADAS and autonomous driving solutions that cater to the specific needs and regulations of China.

- Shared Development Costs: Distributing the significant investment required for advanced automotive technology development.

Horizon Robotics' place strategy centers on deep integration within the automotive ecosystem, primarily through direct B2B sales and strategic partnerships. By mid-2024, they had secured collaborations with numerous global automakers and over 133 Tier 1 suppliers by year-end, demonstrating significant market penetration. Their focus on the Chinese market yielded over 40% of the OEM ADAS market share by late 2024, with approximately 7.7 million ADAS units delivered cumulatively by the end of that year.

| Market Focus | Key Partnerships (End of 2024) | Market Share (China ADAS) | Cumulative Deliveries (End of 2024) | Global Expansion Milestone |

|---|---|---|---|---|

| China Dominance | 20+ OEM Brands, 133+ Tier 1 Suppliers | 40%+ | ~7.7 Million ADAS Units | First Overseas Mass Production: Q1 2026 |

What You See Is What You Get

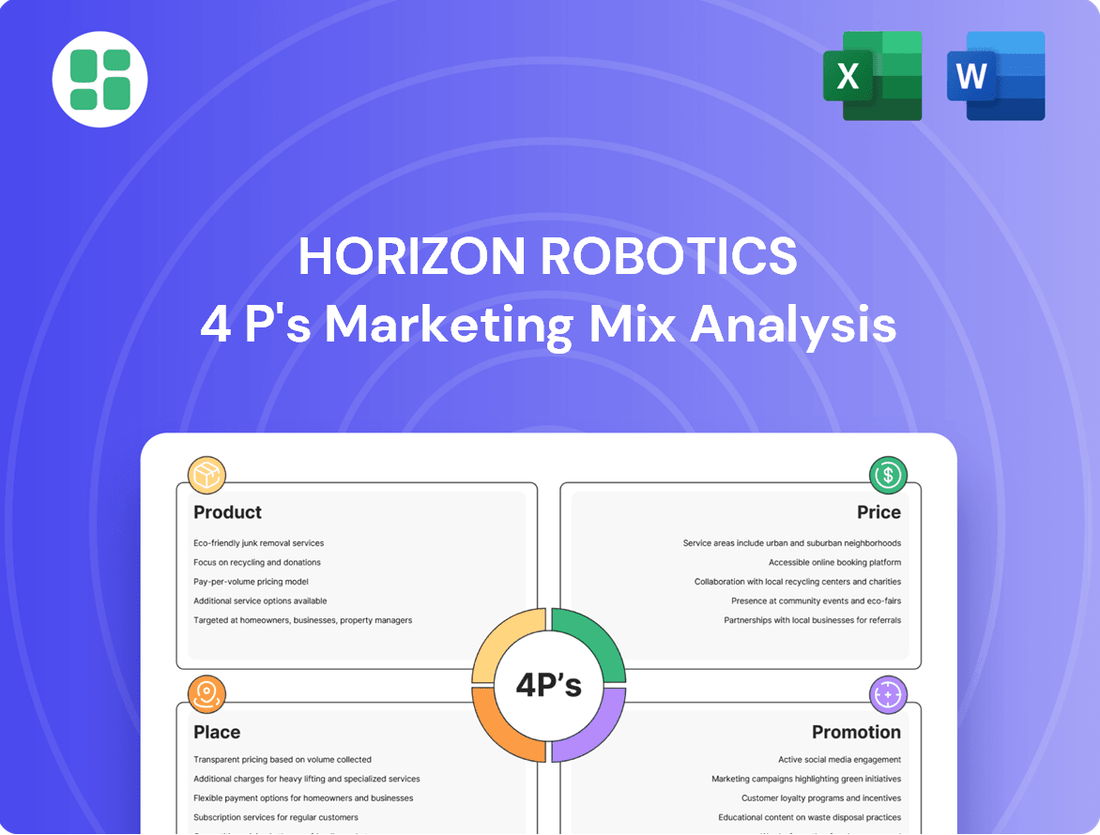

Horizon Robotics 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Horizon Robotics 4P's Marketing Mix Analysis you'll receive instantly after purchase. You can confidently review the full content, knowing there are no hidden surprises or missing sections. This is the exact document, ready for your immediate use and strategic planning.

Promotion

Horizon Robotics leverages regular product launch events as a key promotional strategy. These events are crucial for unveiling new technologies and solutions to a wide audience, including potential investors, partners, and customers.

The 2024 Product Launch Event was a significant milestone, introducing groundbreaking products like Horizon SuperDrive and the Journey 6 series. This event generated substantial buzz, highlighting the company's commitment to pushing the boundaries of AI in automotive applications.

Further demonstrating this commitment, the 2025 Annual Product Launch Event announced the mass production rollout of their HSD urban driving assistance system. Such events not only showcase innovation but also solidify Horizon Robotics' position as a leader in the autonomous driving sector.

Horizon Robotics strategically uses press releases and official announcements to showcase its key partnerships. Collaborations with automotive giants like Bosch and DENSO are prominently featured, emphasizing the integration of Horizon's smart driving technology into upcoming vehicle models.

These announcements serve a crucial role in the Promotion aspect of their marketing mix, highlighting the company's expanding influence within the smart driving ecosystem. For instance, the ongoing development and integration of their Journey series chips with partners are frequently communicated, reinforcing their market credibility and expanding their reach.

Horizon Robotics leverages industry exhibitions like IAA Mobility as a key component of its promotion strategy. These events are vital for showcasing their production-grade driving assistance solutions directly to a global audience.

While specific 2025 exhibition plans are not yet finalized, Horizon Robotics' consistent participation in major forums underscores their commitment to industry engagement. For instance, their presence at IAA Mobility 2023 highlighted their advancements in intelligent driving, a critical step in building brand awareness.

These exhibitions offer invaluable opportunities for Horizon Robotics to foster direct relationships with potential partners, customers, and key industry influencers. Such interactions are crucial for driving sales and solidifying their market position in the competitive autonomous driving sector.

Investor Relations and Financial Reporting

Following its Hong Kong Stock Exchange listing in October 2024, Horizon Robotics is committed to transparent investor relations and diligent financial reporting. The company regularly publishes its annual financial reports and convenes Annual General Meetings (AGMs) to engage with stakeholders.

These efforts highlight Horizon Robotics' solid financial trajectory, evidenced by significant growth in key metrics. For instance, the company reported a substantial increase in revenue and gross profit for the fiscal year 2024, demonstrating its operational strength and market position.

This commitment to transparency is crucial for fostering investor confidence and attracting continued capital. Key financial highlights for 2024 include:

- Revenue Growth: Horizon Robotics achieved a significant year-over-year revenue increase in 2024.

- Gross Profit Expansion: The company also saw a notable rise in its gross profit for the same period.

- Investor Engagement: Regular AGMs and report releases underscore a proactive approach to stakeholder communication.

- Market Confidence: This transparency aims to build trust and encourage further investment in the company's future.

Thought Leadership and Industry Vision

Horizon Robotics actively cultivates thought leadership, with CEO Yu Kai and other executives frequently articulating their vision for autonomous driving and smart mobility. This public discourse highlights the increasing sophistication of autonomous driving technology and the indispensable role of high-performance chips in its advancement.

This strategic emphasis on sharing insights positions Horizon Robotics as a forward-thinking innovator and a critical facilitator in the ongoing evolution of intelligent vehicles. For instance, in 2024, the company continued to emphasize its commitment to pushing the boundaries of AI computing for automotive applications, aligning with industry trends towards more complex and capable autonomous systems.

- Industry Vision: CEO Yu Kai frequently shares insights on the future of autonomous driving and smart mobility.

- Technological Emphasis: Key messages highlight the maturation of autonomous driving tech and the need for high-power chips.

- Market Positioning: This thought leadership establishes Horizon Robotics as an innovator and enabler in the intelligent vehicle sector.

- 2024 Focus: The company continued to champion AI computing for automotive applications, reflecting industry demand for advanced solutions.

Horizon Robotics actively promotes its innovations through product launch events, showcasing new technologies like the Horizon SuperDrive and Journey 6 series in 2024, and the HSD urban driving assistance system's mass production rollout in 2025. Strategic partnerships with industry leaders such as Bosch and DENSO are highlighted via press releases, reinforcing their market credibility and expanding their reach in the smart driving ecosystem.

The company also engages directly with a global audience at industry exhibitions like IAA Mobility, fostering relationships with potential partners and customers. Following its October 2024 listing, Horizon Robotics prioritizes transparent investor relations, publishing financial reports and holding AGMs, which in 2024 showed significant revenue and gross profit increases, bolstering investor confidence.

Horizon Robotics cultivates thought leadership through executive insights, particularly from CEO Yu Kai, emphasizing the critical role of high-performance chips in advancing autonomous driving technology. This strategic communication reinforces their position as innovators in the intelligent vehicle sector, with a continued 2024 focus on AI computing for automotive applications.

Price

Horizon Robotics utilizes a hybrid revenue model, generating income from both the sale of its advanced AI chips and significant contributions from licensing agreements and associated services. This dual approach diversifies its income streams and enhances financial resilience.

The company experienced a notable surge in its licensing and services segment during 2024, with revenue climbing an impressive 70.9% compared to the previous year. This substantial growth highlights Horizon Robotics' strategic focus on monetizing its intellectual property and expanding its software-as-a-service offerings.

Horizon Robotics' pricing strategy is firmly rooted in the value its advanced AI computing solutions deliver, emphasizing both high performance and energy efficiency. This approach ensures that customers recognize the tangible benefits of their technology.

The company is committed to making its cutting-edge AI accessible, aiming for cost-effectiveness to drive mass adoption of advanced driving systems. This delicate balance between innovation and affordability is key to their market penetration.

By strategically pricing their offerings, Horizon Robotics positions itself as a strong competitor, especially within the high-volume, mass-market automotive segment where cost is a significant consideration for widespread implementation.

Horizon Robotics is strategically pricing its AI chips to directly challenge established global players, particularly Nvidia, within the crucial Chinese automotive market. This competitive positioning is key to their strategy, offering a more accessible yet powerful alternative.

By emphasizing high utilization efficiency alongside robust computing power, Horizon Robotics achieves a price point that is attractive to manufacturers seeking cost-effective AI solutions. This dual focus on performance and affordability is a significant driver for market share acquisition.

In 2024, the demand for advanced automotive AI chips is soaring, with the global market projected to reach over $20 billion by 2027. Horizon Robotics' competitive pricing strategy is designed to capture a substantial portion of this growth, especially as Chinese automakers increasingly prioritize domestic suppliers.

Long-Term Partnership Pricing

Horizon Robotics' pricing strategy for its long-term partnerships is intrinsically tied to its business-to-business (B2B) model. Recognizing the need for deep technological integration with Original Equipment Manufacturers (OEMs) and Tier 1 suppliers, pricing is rarely a one-size-fits-all approach.

Instead, it typically involves highly customized agreements. These contracts are meticulously crafted to reflect the specific needs and scale of each partnership, often incorporating volume-based discounts that incentivize larger deployments. The aim is to foster enduring relationships that secure design wins across a multitude of vehicle models, thereby guaranteeing consistent revenue streams for Horizon Robotics over extended periods.

For instance, in 2024, automotive chip suppliers often negotiate multi-year deals with car manufacturers. These agreements can span 3-5 years, with pricing tiers adjusted based on projected unit volumes. Horizon Robotics' approach likely mirrors this, focusing on securing commitments that underpin their technological adoption in the automotive sector.

- Customized Agreements: Pricing tailored to individual OEM and Tier 1 supplier needs, reflecting the bespoke nature of automotive integration.

- Volume Discounts: Tiered pricing structures that reduce per-unit costs as order volumes increase, encouraging broader adoption.

- Long-Term Contracts: Agreements designed to ensure sustained revenue by locking in partnerships for multiple vehicle production cycles, often 3-5 years.

- Design Win Focus: Pricing strategies are geared towards securing early integration into new vehicle platforms, a critical factor for future market share.

Anticipated Profitability and Growth

Horizon Robotics is projected to achieve profitability in 2024, marking a significant turnaround. The company anticipates a substantial 68.3% surge in gross profit compared to the prior year, indicating a robust improvement in operational efficiency and pricing power.

This financial resurgence is further bolstered by expectations of strong revenue growth in 2025. This anticipated expansion is largely attributed to the increasing market acceptance and implementation of their advanced driving systems, suggesting their pricing is competitive and attractive to a growing customer base.

- Projected 2024 Profitability: Horizon Robotics is set to return to profitability.

- Gross Profit Growth: Anticipated 68.3% increase in gross profit for 2024.

- 2025 Revenue Outlook: Strong revenue growth expected, driven by advanced driving system adoption.

- Strategic Alignment: Share incentive plans aim to foster employee commitment and shareholder value.

Horizon Robotics' pricing strategy is designed to balance high-performance AI solutions with market accessibility, particularly in the competitive automotive sector. The company leverages a value-based approach, ensuring customers recognize the tangible benefits of their technology, such as energy efficiency and robust computing power. This strategy is crucial for driving mass adoption of advanced driving systems.

The company's pricing is also tailored for B2B partnerships, often involving customized agreements with volume-based discounts to secure long-term commitments from OEMs and Tier 1 suppliers. This focus on design wins and multi-year contracts, typically 3-5 years, underpins their revenue stability.

In 2024, Horizon Robotics is poised for profitability, with a projected 68.3% surge in gross profit. This financial improvement, coupled with strong revenue growth expectations for 2025 driven by advanced driving system adoption, underscores the effectiveness of their pricing in a rapidly expanding market.

| Pricing Strategy Element | Description | Impact |

|---|---|---|

| Value-Based Pricing | Reflects high performance and energy efficiency of AI chips. | Enhances customer recognition of benefits. |

| B2B Customization | Tailored agreements for OEMs and Tier 1 suppliers. | Secures long-term partnerships and design wins. |

| Volume Discounts | Tiered pricing based on order volume. | Incentivizes larger deployments and broader adoption. |

| Competitive Positioning | Challenging established players like Nvidia in the Chinese market. | Offers accessible yet powerful AI alternatives. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Horizon Robotics is grounded in comprehensive data, including official company disclosures, investor reports, and detailed product specifications. We also leverage industry-specific market research and competitive intelligence to ensure a robust understanding of their strategic positioning.