Horizon Robotics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Robotics Bundle

Horizon Robotics faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being particularly impactful. Understanding these dynamics is crucial for any player in the AI chip industry.

The complete report reveals the real forces shaping Horizon Robotics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Horizon Robotics' reliance on a select group of advanced semiconductor foundries for its high-performance AI chips significantly amplifies supplier power. The extremely specialized nature and cutting-edge technological demands of manufacturing these chips mean only a handful of global foundries possess the capability. For instance, TSMC, a dominant player, commands a substantial portion of the advanced chip manufacturing market, often dictating terms due to limited alternatives for leading-edge production.

Horizon Robotics' reliance on critical intellectual property (IP) providers significantly shapes supplier power. The intricate design of advanced AI chips necessitates licensing essential components like CPU cores and GPU architectures from specialized third parties.

When these IP providers possess unique or hard-to-replicate technologies, their leverage over Horizon Robotics intensifies. This can translate into higher licensing fees and potential constraints on accessing the most advanced chip designs, directly impacting Horizon Robotics' product development and cost structure.

Changing a primary semiconductor foundry or a major IP provider presents significant hurdles for companies like Horizon Robotics. The process involves extensive redesign, rigorous re-validation, and potential re-tooling, all of which translate into substantial switching costs. These high costs inherently bolster the bargaining power of existing, trusted suppliers.

Specialized raw materials and components.

Horizon Robotics faces supplier bargaining power due to its reliance on specialized raw materials and components beyond chip manufacturing. This includes crucial elements for packaging and advanced testing equipment.

When these niche suppliers possess proprietary technologies or operate in markets with few competitors, their ability to dictate terms increases significantly. This can directly impact Horizon Robotics' supply chain reliability and overall production costs.

- Supplier Dependence: Horizon Robotics requires specialized materials and components for its AI chips.

- Niche Market Power: Suppliers with unique technologies or limited competition can command higher prices.

- Cost and Stability Impact: This power can affect Horizon Robotics' manufacturing costs and supply chain stability.

Geopolitical factors influencing supply chain.

Geopolitical factors are significantly reshaping the global semiconductor supply chain, directly impacting companies like Horizon Robotics. Trade restrictions and international relations can create volatility, potentially strengthening the bargaining power of suppliers in favored regions or those less affected by sanctions.

For Horizon Robotics, a company with operations in China and a global customer base, these geopolitical shifts introduce a complex dynamic. Governments imposing export controls or trade barriers can limit access to critical components, thereby increasing the leverage of unaffected or strategically positioned suppliers. This was evident in 2023 and early 2024, where certain nations implemented policies affecting advanced chip manufacturing and export, leading to price adjustments and longer lead times from specific suppliers.

- Increased Supplier Leverage: Geopolitical tensions can lead to a concentration of supply, giving dominant regional players more pricing power.

- Supply Chain Diversification Costs: Companies may face higher costs to diversify their supplier base away from politically sensitive regions.

- Impact on Innovation: Trade restrictions can hinder the free flow of technology and collaboration, potentially slowing down innovation cycles for AI chip developers.

Horizon Robotics' dependence on a few advanced semiconductor foundries, like TSMC, gives these suppliers significant bargaining power. The highly specialized nature of AI chip manufacturing means limited alternatives, allowing foundries to dictate terms and pricing. This was particularly evident in 2023 and early 2024, with reports indicating increased lead times and price adjustments from key foundries due to high demand and capacity constraints.

Furthermore, reliance on proprietary intellectual property (IP) from niche providers also strengthens supplier leverage. Companies like Horizon Robotics must license essential technologies, and when these IPs are unique or difficult to replicate, providers can command higher fees and influence design choices, impacting development timelines and costs.

High switching costs for both foundries and IP providers further solidify supplier power. Horizon Robotics faces substantial expenses and risks associated with changing suppliers, including redesign, re-validation, and potential production delays, reinforcing the advantage of established relationships.

| Supplier Type | Key Characteristic | Impact on Horizon Robotics |

|---|---|---|

| Semiconductor Foundries | Advanced manufacturing capabilities, limited competition | Pricing power, potential lead time extensions, influence on production capacity |

| IP Providers | Unique, hard-to-replicate technologies | Higher licensing fees, potential constraints on accessing cutting-edge designs |

| Specialized Component Suppliers | Proprietary technologies, niche markets | Impact on manufacturing costs and supply chain stability |

What is included in the product

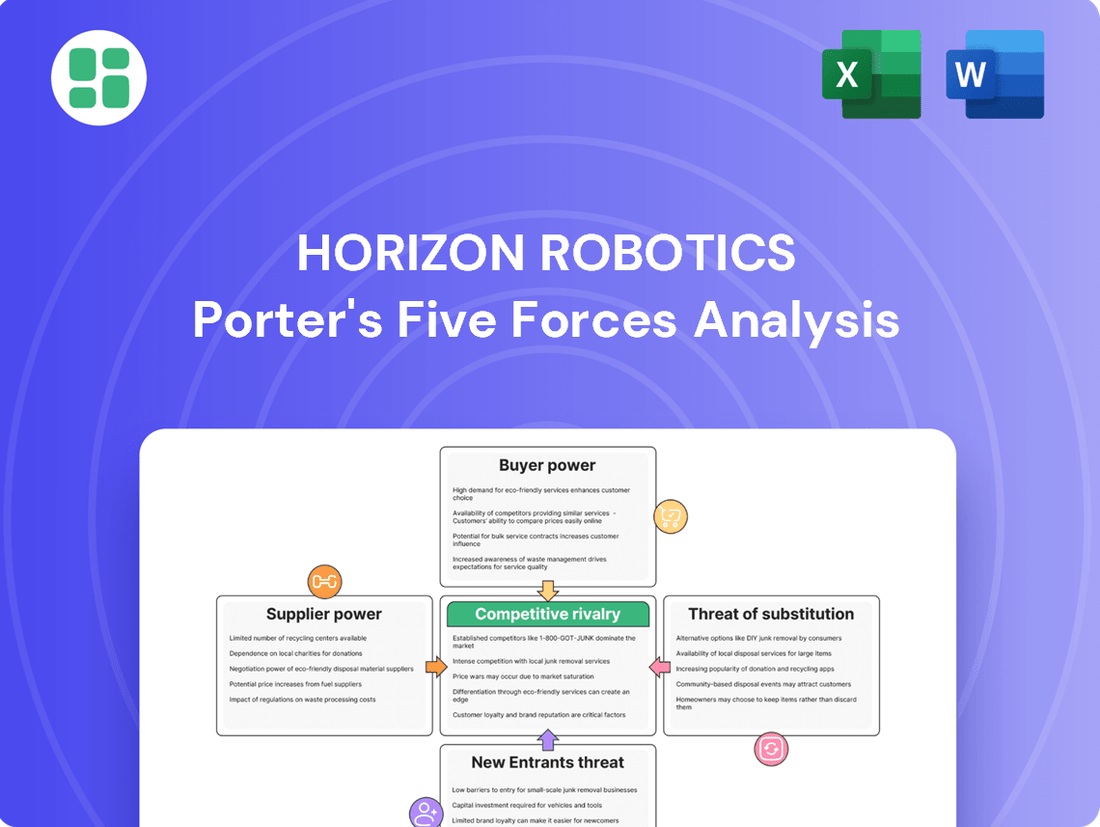

Horizon Robotics' Porter's Five Forces analysis reveals the intense competitive landscape of AI chip manufacturing, focusing on the bargaining power of buyers and suppliers, and the threat of new entrants in this rapidly evolving market.

Horizon Robotics' Porter's Five Forces Analysis provides a dynamic, interactive dashboard to visualize competitive intensity, allowing users to instantly identify and address key strategic pressures.

Customers Bargaining Power

Horizon Robotics' customer base in the automotive sector is notably concentrated. This means a few large players hold significant sway. For instance, major automotive OEMs and Tier 1 suppliers are the primary buyers of their autonomous driving chips.

Key customers like BYD and Li Auto are crucial for Horizon. Their substantial order volumes allow them to negotiate favorable pricing and demand tailored solutions. This concentration amplifies their bargaining power.

High integration costs for customers significantly limit their bargaining power with Horizon Robotics. Once an automotive OEM embeds Horizon's AI chips and software into their vehicle architectures, the expense and intricacy involved in migrating to an alternative supplier are substantial. This creates a considerable lock-in effect, making it economically unfeasible for customers to switch in the short term, thereby diminishing their leverage.

The increasing demand for highly customized AI solutions in the autonomous driving sector significantly influences customer bargaining power. Carmakers need tailored systems for diverse vehicle platforms and varying autonomy levels.

Horizon Robotics addresses this by offering integrated hardware-software platforms, a key factor in reducing customer leverage. Their success in securing design-wins for over 310 car models demonstrates their capability to deliver unique, optimized solutions that lock in customers and diminish their ability to negotiate aggressively on price or terms.

Importance of Horizon's technology to customer products.

Horizon Robotics' AI chips are essential for the advanced functionalities that define modern intelligent vehicles, such as real-time perception and autonomous driving. This critical reliance on Horizon's technology for core product differentiation significantly reduces the bargaining power of customers, as they depend on Horizon to deliver these indispensable capabilities.

The indispensable nature of Horizon's AI solutions means customers have limited leverage to negotiate terms. For instance, in 2024, the automotive industry's accelerated push towards higher levels of autonomous driving, as evidenced by increasing investment in ADAS (Advanced Driver-Assistance Systems) technologies, makes access to cutting-edge AI chips a competitive necessity.

- Horizon's AI chips are vital for enabling advanced automotive features.

- Customers' reliance on this technology limits their ability to dictate terms.

- The drive for autonomous driving in 2024 increases demand for such critical components.

Emergence of in-house chip development by large OEMs.

The trend of major original equipment manufacturers (OEMs) developing their own AI chips, particularly for autonomous driving systems, directly impacts the bargaining power of customers. Companies like Tesla have already invested significantly in custom silicon. This move allows them to tailor chip performance precisely to their needs, potentially reducing their dependence on external suppliers such as Horizon Robotics.

This in-house capability not only strengthens their negotiating position but also signals a potential shift from being mere customers to becoming direct competitors in the chip design space. For instance, Tesla's Dojo supercomputer, powered by custom AI chips, showcases their commitment to vertical integration in this critical technology area. As more automotive giants explore similar strategies, the leverage held by these large OEMs over chip providers is likely to increase.

- OEMs developing in-house AI chips reduces reliance on third-party suppliers.

- Tesla's investment in custom AI silicon for autonomous driving exemplifies this trend.

- Increased customer bargaining power arises from in-house chip development capabilities.

- Potential shift from customer to competitor for chip designers like Horizon Robotics.

Horizon Robotics' bargaining power with customers is influenced by the critical nature of its AI chips for autonomous driving. The high cost and complexity of integrating these specialized chips create significant customer lock-in, limiting their ability to switch suppliers easily. Furthermore, the automotive industry's intense focus on advancing autonomous capabilities in 2024, with substantial investments in ADAS, underscores the indispensable role of Horizon's technology, thereby diminishing customer leverage.

| Factor | Impact on Customer Bargaining Power | Data/Example |

|---|---|---|

| Customer Concentration | High | Major OEMs and Tier 1 suppliers are key buyers. |

| Switching Costs | Low | High integration costs for AI chips and software. |

| Product Differentiation | Low | Horizon's chips are vital for advanced autonomous features. |

| In-house Chip Development | Increasing | OEMs like Tesla developing custom AI silicon. |

What You See Is What You Get

Horizon Robotics Porter's Five Forces Analysis

This preview showcases the complete Horizon Robotics Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic insight.

Rivalry Among Competitors

Horizon Robotics operates in a fiercely competitive landscape, directly challenged by global semiconductor behemoths like NVIDIA, Qualcomm, and Intel, particularly through Intel's Mobileye division. These established giants command substantial financial resources and boast advanced research and development capabilities, giving them a significant edge in innovation and market penetration across diverse AI computing sectors. For instance, NVIDIA's dominance in AI hardware, with its GPUs powering much of the world's AI training and inference, presents a formidable barrier.

These competitors offer a broad spectrum of AI chips and integrated platforms that directly vie for market share in critical areas such as autonomous driving and the Internet of Things (IoT). Qualcomm's Snapdragon platform, for example, is widely adopted in automotive applications, providing a comprehensive solution that rivals Horizon's offerings. The sheer scale of these players means they can invest heavily in next-generation technologies and establish deep relationships with automotive manufacturers and other key industry partners.

Horizon Robotics faces intense competition within China's AI chip sector. Major domestic players like Huawei, Cambricon, and Black Sesame Technologies are actively competing for dominance in areas such as autonomous driving and edge AI solutions. These local companies often leverage significant government backing and a nuanced understanding of China's specific market needs.

The AI chip sector is locked in a relentless 'compute arms race,' driven by substantial R&D outlays and swift technological evolution. Companies like Horizon Robotics must pour significant resources into creating chips that are not only more powerful but also more energy-efficient and economical to stay ahead.

This intense innovation cycle means that the lifespan of cutting-edge AI chips can be remarkably short. For instance, advancements in neural processing units (NPUs) are happening at an unprecedented speed, with new architectures and performance benchmarks emerging annually, demanding continuous investment to avoid obsolescence.

Differentiation through integrated hardware-software solutions.

Horizon Robotics tackles competitive rivalry by offering integrated hardware-software solutions, moving beyond mere chip performance. Their approach emphasizes creating comprehensive platforms, such as the Journey series for autonomous driving and the SuperDrive system, designed to streamline the development process for automotive manufacturers. This focus on complete solutions aims to build a sticky ecosystem, making it harder for competitors to unbundle their offerings.

This strategy directly addresses the intense competition in the automotive AI chip market. For instance, in 2023, Horizon Robotics announced collaborations with several major automakers, including SAIC Motor and BYD, highlighting their success in embedding their integrated solutions. By providing a more complete package, they aim to reduce the integration complexity for car companies, fostering deeper partnerships and potentially higher switching costs.

- Integrated Solutions: Horizon Robotics offers complete hardware-software platforms, not just individual chips.

- Ecosystem Development: They focus on building an ecosystem around their solutions to increase customer stickiness.

- Reduced Development Hurdles: Their integrated approach aims to simplify the process for car manufacturers.

- Strategic Partnerships: Collaborations with major automakers like SAIC and BYD demonstrate market traction for their differentiated strategy.

Strategic partnerships and ecosystem building.

Strategic partnerships and ecosystem building are crucial for success in the autonomous driving sector. Horizon Robotics has actively pursued collaborations with major automotive players to solidify its market position. In 2024, the company continued to strengthen its ties with leading automotive OEMs and Tier 1 suppliers.

These alliances are vital for securing design wins and expanding market penetration. Horizon Robotics' partnerships include significant names such as Volkswagen (CARIAD), Bosch, DENSO, BYD, and Li Auto. These collaborations allow Horizon to integrate its advanced AI solutions into a wider range of vehicles.

- Volkswagen (CARIAD): Collaboration to integrate Horizon's ADAS solutions into future VW models.

- Bosch & DENSO: Partnerships for joint development and supply of automotive electronics.

- BYD & Li Auto: Integration of Horizon's chips into their electric vehicle platforms.

Horizon Robotics faces intense competition from global tech giants like NVIDIA and Qualcomm, as well as strong domestic rivals such as Huawei and Cambricon within China. These competitors boast significant R&D budgets and established market presence, particularly in autonomous driving and edge AI. The rapid pace of innovation in AI chips necessitates continuous, substantial investment to maintain competitiveness.

Horizon differentiates itself by offering integrated hardware-software solutions, aiming to reduce development complexity for automotive manufacturers. This strategy is evident in their partnerships with major players like Volkswagen, BYD, and Li Auto, securing design wins and expanding market reach. By focusing on complete platforms, Horizon seeks to create a more robust ecosystem and increase customer loyalty.

| Competitor | Key Offerings | 2024 Focus Areas |

|---|---|---|

| NVIDIA | AI GPUs, DRIVE platform | High-performance autonomous driving, AI infrastructure |

| Qualcomm | Snapdragon Ride, AI chips | Automotive connectivity, ADAS, infotainment |

| Huawei | Ascend AI chips, MDC platform | Autonomous driving, smart vehicles, edge computing |

| Cambricon | AI processors, edge AI solutions | Smart manufacturing, intelligent transportation |

| Horizon Robotics | Journey series, SuperDrive | ADAS, autonomous driving, integrated solutions |

SSubstitutes Threaten

While dedicated AI accelerators are gaining traction, powerful general-purpose CPUs and GPUs, particularly those from NVIDIA and AMD, remain viable substitutes for many AI workloads. In 2024, the sheer processing power available in high-end GPUs, coupled with advancements in AI frameworks like TensorFlow and PyTorch, allows them to competently handle both AI training and inference, especially for less compute-intensive edge applications or when development flexibility is paramount.

Field-Programmable Gate Arrays (FPGAs) present a significant threat of substitution for custom AI solutions, particularly in niche or early-stage development. Their inherent programmability allows for tailored acceleration of specific AI algorithms, offering an alternative to Application-Specific Integrated Circuits (ASICs) when high customization is paramount.

While FPGAs may not match the raw performance or power efficiency of ASICs for large-scale, mass-produced AI deployments, they serve as a compelling substitute for prototyping and specialized, lower-volume applications. For instance, companies developing novel AI architectures or requiring rapid iteration cycles might opt for FPGAs, as seen in some advanced driver-assistance systems (ADAS) development where flexibility is key.

Cloud-based AI processing presents a viable substitute for Horizon Robotics' edge AI solutions in applications where real-time, low-latency performance isn't critical. For instance, many IoT devices and some automotive functions can leverage cloud computing for AI tasks, especially if consistent connectivity is available and immediate responses are not paramount. This offers an alternative for manufacturers looking to manage processing power and costs differently.

Alternative sensing and decision-making technologies.

The threat of substitutes for Horizon Robotics' core offerings in autonomous driving is significant, particularly from alternative sensing and decision-making technologies. Advances in sensor fusion, combining data from multiple sources like improved cameras, radar, and even novel ultrasonic sensors, could offer comparable environmental perception with potentially lower computational demands than advanced AI processing alone. For instance, by 2024, the automotive sensor market is projected to reach over $30 billion, with continuous innovation driving down costs and improving performance across various sensor types.

Furthermore, the development of simpler, rule-based or more deterministic decision-making algorithms that require less intensive AI training and processing power could emerge as viable substitutes. If these less complex systems can achieve acceptable safety standards and performance metrics for certain autonomous driving functions, they could erode the market share for more sophisticated, AI-dependent solutions. The increasing focus on functional safety (ISO 26262) also encourages the exploration of diverse approaches to decision-making, not solely reliant on cutting-edge AI.

- Emerging Sensor Technologies: Innovations in high-resolution cameras, advanced radar, and potentially solid-state LiDAR are improving environmental perception capabilities.

- Alternative Decision-Making Algorithms: Simpler, potentially less AI-intensive algorithms could offer comparable safety and performance for specific autonomous driving tasks.

- Market Trends: The automotive sensor market's growth to over $30 billion by 2024 highlights the rapid pace of technological advancement and cost reduction in sensing.

- Functional Safety Standards: Requirements like ISO 26262 encourage exploration of diverse decision-making approaches, potentially favoring less complex solutions.

Software-only AI solutions running on existing hardware.

The rise of software-only AI solutions that can operate on existing, general-purpose hardware presents a significant threat to specialized AI chip providers like Horizon Robotics. For many Internet of Things (IoT) applications, particularly those that are not computationally intensive, the performance offered by these software solutions might be adequate, negating the need for dedicated AI accelerators.

This trend could directly impact Horizon's market share, especially in cost-sensitive segments where the added expense of specialized hardware might be difficult to justify if comparable performance is achievable through software optimization. For instance, in 2024, the global AI chip market saw continued growth, but there was also a noticeable increase in the optimization of AI algorithms for CPUs and GPUs, making them more competitive in certain use cases.

- Software-only AI can reduce the need for specialized AI hardware in less demanding IoT applications.

- This poses a threat to Horizon Robotics by potentially lowering demand for their specialized chips.

- Cost-sensitive market segments are particularly vulnerable to this substitution effect.

- Advancements in software optimization for general-purpose processors are making them increasingly viable alternatives.

The threat of substitutes for Horizon Robotics' AI solutions is multifaceted, encompassing general-purpose computing hardware, alternative sensing technologies, and software-only AI approaches. High-performance CPUs and GPUs from companies like NVIDIA and AMD remain strong contenders, especially for flexible development and less demanding edge applications. Their continued advancements in 2024 mean they can competently handle many AI training and inference tasks.

FPGAs offer a customizable alternative for specialized or early-stage AI development, providing tailored acceleration for specific algorithms. While not always matching ASICs in raw performance or efficiency for mass deployment, they are valuable for prototyping and niche applications, such as in the development of advanced driver-assistance systems (ADAS) where flexibility is key.

Cloud-based AI processing also serves as a substitute for edge solutions when real-time, low-latency performance isn't critical, allowing devices to offload computation. Furthermore, advancements in sensor fusion and simpler, rule-based decision-making algorithms could reduce reliance on complex AI processing for autonomous driving functions. The automotive sensor market's projected growth to over $30 billion by 2024 underscores the rapid innovation and cost reduction in sensing technologies, which can also act as substitutes.

The increasing sophistication of software-only AI solutions running on general-purpose hardware poses a direct threat, particularly in cost-sensitive IoT segments. As AI algorithms become more optimized for CPUs and GPUs, they can offer adequate performance, diminishing the need for specialized AI accelerators and potentially impacting Horizon Robotics' market share.

Entrants Threaten

Developing cutting-edge AI chips for autonomous vehicles and smart IoT demands substantial upfront capital. Horizon Robotics, like its peers, faces significant financial hurdles in R&D, design software, IP licensing, and securing foundry capacity. For instance, the global semiconductor industry saw capital expenditures exceeding $150 billion in 2023 alone, underscoring the immense investment needed to even enter this space.

The need for deep technical expertise and talent represents a significant barrier to entry for new competitors in the AI chip market. Designing and optimizing AI chips, along with their associated software, requires highly specialized engineers skilled in AI algorithms, chip architecture, and embedded systems. For instance, in 2024, the global shortage of AI engineers was estimated to be in the millions, making it difficult for new firms to assemble the necessary teams.

Horizon Robotics has cemented strong ties with leading automotive original equipment manufacturers (OEMs) and Tier 1 suppliers, evidenced by a significant number of design-wins. These deep integrations represent a substantial barrier for newcomers aiming to penetrate the market.

Displacing these entrenched relationships and convincing customers to adopt unproven technologies is a formidable challenge for new entrants. The automotive sector's lengthy development and validation processes, often spanning several years, further amplify this difficulty, making it hard for new players to gain traction.

Intellectual property and patent protection.

The AI chip market is characterized by its deep reliance on intellectual property, with companies like Horizon Robotics investing heavily in patent portfolios to safeguard their core technologies. New entrants face a substantial barrier in this environment, needing to either innovate and develop their own unique IP or negotiate licensing agreements for existing technologies, a process that can be both time-consuming and costly.

This intricate IP landscape significantly deters potential competitors. For instance, the sheer volume of patents held by established players can make it difficult for newcomers to operate without infringing on existing rights. This often necessitates significant upfront investment in legal counsel and patent analysis, adding to the already high capital requirements of entering the AI chip manufacturing sector.

- Patent Portfolio Strength: Companies in the AI chip sector often possess thousands of patents covering various aspects of chip design, architecture, and manufacturing processes.

- Licensing Costs: Securing licenses for essential patented technologies can represent a substantial operational expense for new entrants, potentially running into millions of dollars annually.

- R&D Investment: Developing proprietary IP requires significant and sustained investment in research and development, a commitment that not all potential new entrants can afford.

- Legal Challenges: Navigating potential patent infringement lawsuits can be a major deterrent, requiring deep pockets and robust legal defenses.

Regulatory hurdles and safety standards, especially in automotive.

The threat of new entrants for Horizon Robotics is significantly influenced by the demanding regulatory landscape and safety standards inherent in the autonomous driving sector. New companies must navigate complex certification processes and demonstrate unwavering adherence to automotive-grade reliability. This often involves substantial investment in research, development, and rigorous testing to meet these stringent requirements, creating a considerable barrier to entry.

For instance, the development and deployment of autonomous driving systems require compliance with various national and international safety regulations. In 2024, many regions continued to refine their frameworks for autonomous vehicle testing and deployment, with a particular focus on ensuring public safety. Companies like Horizon Robotics, already established in this space, have invested years and significant capital in achieving these compliance milestones, making it a daunting challenge for newcomers to match their current standing.

- Stringent Safety Regulations: Autonomous driving systems face rigorous safety and performance standards, such as ISO 26262 for functional safety, which new entrants must meet.

- Costly Certification: Obtaining necessary certifications for autonomous driving technology is a time-consuming and expensive process, often requiring extensive validation and testing.

- Automotive-Grade Reliability: New entrants must prove their technology can achieve the high levels of reliability and durability expected in the automotive industry, a significant hurdle compared to consumer electronics.

The AI chip market, particularly for automotive applications, presents a formidable barrier to new entrants due to extremely high capital requirements. Developing advanced AI chips requires massive investment in R&D, sophisticated design tools, and securing manufacturing capacity, with global semiconductor capital expenditures exceeding $150 billion in 2023 alone. This financial hurdle makes it exceptionally difficult for new companies to even begin competing.

The need for specialized talent and deep technical expertise further limits new entrants. The AI chip sector demands engineers with advanced skills in AI, chip architecture, and embedded systems, and the global shortage of AI engineers in 2024, estimated in the millions, makes assembling a competent team a significant challenge for newcomers.

Horizon Robotics' established relationships with automotive OEMs and Tier 1 suppliers, secured through numerous design wins, create a substantial barrier for any new player attempting to enter the market. The lengthy validation cycles in the automotive industry mean that displacing these entrenched partnerships and convincing customers to adopt unproven technologies is a daunting task.

Intellectual property is another critical barrier, with companies like Horizon Robotics investing heavily in patent portfolios. New entrants must either develop their own unique IP or license existing technologies, both of which are costly and time-consuming endeavors, further deterring competition.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Horizon Robotics is built upon a foundation of comprehensive data, including financial statements from public filings, market research reports from leading firms, and industry-specific trade publications. This blend ensures a robust understanding of competitive dynamics.