Horizon Robotics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Robotics Bundle

Horizon Robotics' position in the market is a fascinating study in growth and innovation. Understanding their product portfolio through the lens of the BCG Matrix reveals where their current strengths lie and where future opportunities might emerge. Are their AI chips Stars, poised for rapid growth, or Cash Cows, generating stable revenue?

This preview offers a glimpse, but to truly grasp Horizon Robotics' strategic landscape, you need the full picture. Purchase the complete BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions that will empower your own strategic planning.

Stars

The Horizon SuperDrive (HSD) is Horizon Robotics' advanced, all-encompassing autonomous driving system. It's engineered to handle diverse driving conditions, from city streets to highways and parking lots, aiming for a natural, human-like feel behind the wheel.

Unveiled in April 2024, HSD is slated for widespread production by Q3 2025. This cutting-edge solution has already garnered significant interest, securing nominations from several prominent automotive manufacturers.

The Journey 6 series, unveiled in April 2024, marks Horizon Robotics' pinnacle in AI chip technology, with production commencing in February 2025. These chips boast a formidable computing power spectrum, spanning from 10 TOPS to an impressive 560 TOPS.

This advanced hardware has garnered significant market acclaim, powering sophisticated intelligent driving systems for leading automotive manufacturers, including BYD and Li Auto, underscoring their pivotal role in the evolving automotive AI landscape.

Horizon Robotics stands as a formidable player in China's autonomous driving sector, securing the second spot among independent third-party AD solution providers. Their advanced algorithms and proprietary hardware are driving the smart vehicle revolution, with deployments increasing rapidly.

As of early 2024, Horizon Robotics has announced partnerships with over 20 automotive brands, highlighting the widespread adoption of their AD solutions. This growth reflects the increasing demand for sophisticated intelligent driving capabilities in the Chinese market.

Proprietary BPU Architecture and Software-Hardware Co-optimization

Horizon Robotics' proprietary BPU architecture, exemplified by the Nash BPU in their Journey 6 platform, is a cornerstone of their competitive advantage. This design prioritizes compute efficiency and adaptability, crucial for integrating cutting-edge AI algorithms in smart driving. The deep synergy between their custom hardware and optimized software allows for unparalleled performance gains and energy savings.

This software-hardware co-optimization directly translates into tangible benefits for autonomous driving systems. For instance, the Journey 6 BPU can achieve significantly higher TOPS per watt compared to general-purpose processors, a critical factor for in-vehicle power constraints. This efficiency is vital for handling complex sensor fusion and real-time decision-making required for advanced driver-assistance systems (ADAS) and autonomous driving.

- High Compute Efficiency: Horizon's BPU architecture delivers superior processing power per watt, enabling more complex AI models to run efficiently within vehicle power budgets.

- Flexibility for Evolving AI: The architecture is designed to be continuously updated and optimized, ensuring compatibility with the latest advancements in AI and machine learning algorithms for autonomous driving.

- Energy Savings: Co-optimization of hardware and software significantly reduces power consumption, a key consideration for electric vehicles and overall vehicle operational costs.

- Performance Advantage: This integrated approach results in faster inference times and more responsive intelligent vehicle features, enhancing safety and user experience.

Strategic OEM Partnerships for Next-Gen AD

Strategic OEM partnerships are a cornerstone for Horizon Robotics' next-generation Advanced Driver (AD) systems, positioning them favorably within the BCG Matrix. By the close of 2024, Horizon Robotics had solidified relationships with over 20 Original Equipment Manufacturer (OEM) brands. This extensive network translates into design wins for more than 310 car models, a testament to their growing influence and the trust placed in their technology by both established global automotive players and leading electric vehicle (EV) manufacturers.

These collaborations are not merely about expanding market reach; they are vital for accelerating innovation. By integrating Horizon's advanced AD solutions into a diverse array of vehicles, the company can refine its technology through real-world data and faster development cycles. The cumulative shipments of their Journey series processing hardware are projected to surpass 10 million units by 2025, indicating strong market adoption and a solid foundation for future growth.

- Strategic OEM Partnerships: Over 20 OEM brands partnered by end of 2024.

- Market Penetration: Design wins secured for more than 310 car models.

- Innovation Acceleration: Crucial for faster integration and development of AD solutions.

- Shipment Growth: Journey series hardware cumulative shipments expected to exceed 10 million units in 2025.

Horizon Robotics' SuperDrive (HSD) system, powered by their advanced Journey 6 AI chips, positions them firmly in the Stars category of the BCG matrix. This is driven by their high market share in China's autonomous driving solutions and strong growth potential, evidenced by extensive OEM partnerships and increasing hardware shipments.

The company's commitment to innovation, particularly with their proprietary BPU architecture, ensures they remain competitive and adaptable in the rapidly evolving autonomous driving landscape.

By the end of 2024, Horizon Robotics had secured partnerships with over 20 automotive brands, leading to design wins for more than 310 car models. Their Journey series hardware shipments are projected to surpass 10 million units by 2025, reflecting robust market demand and a leading position.

| Metric | Value | Year |

|---|---|---|

| OEM Partnerships | Over 20 | 2024 |

| Car Model Design Wins | 310+ | 2024 |

| Journey Series Shipments (Projected) | 10 Million+ units | 2025 |

What is included in the product

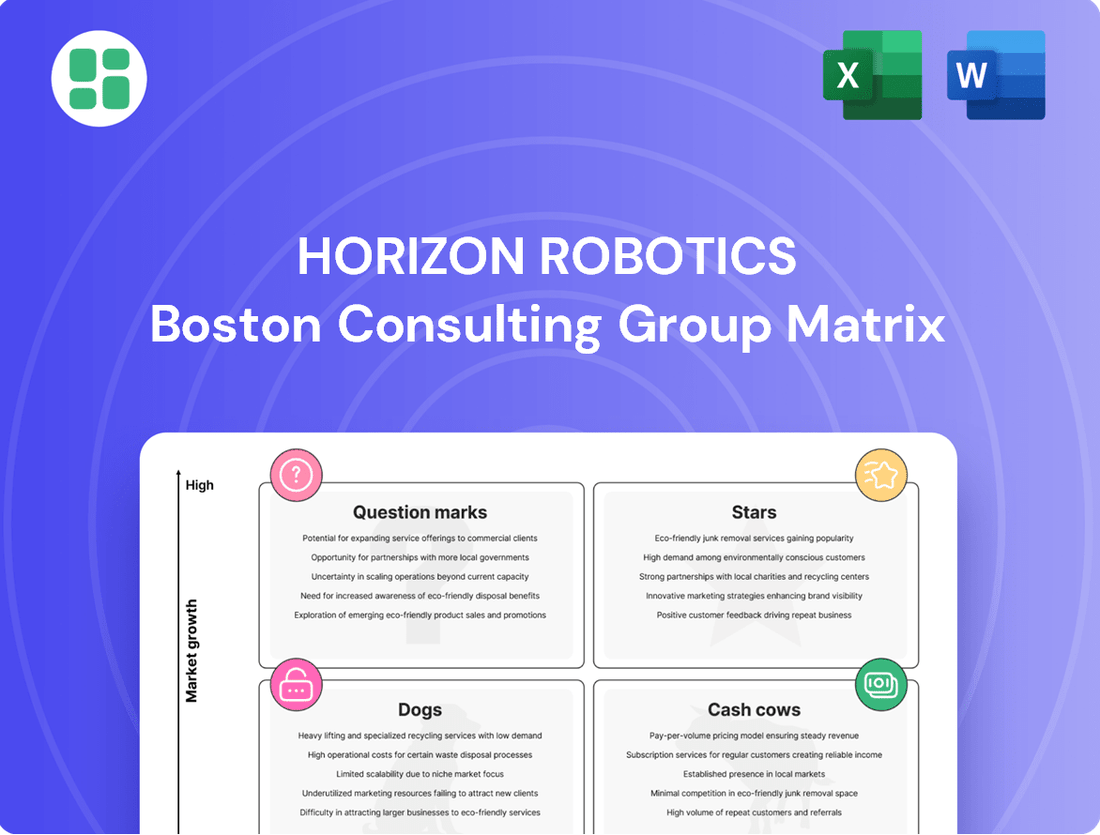

Horizon Robotics BCG Matrix analyzes its product portfolio's market share and growth rate.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Quickly identify Horizon Robotics' Stars, Cash Cows, Question Marks, and Dogs to strategically allocate resources and alleviate portfolio management pain.

Cash Cows

The Horizon Mono ADAS System has solidified its position as a Cash Cow within Horizon Robotics' product portfolio. In 2024, it achieved the leading market share in China's OEM ADAS sector, a testament to its robust performance and widespread adoption in a well-established market segment.

This strong market penetration translates into predictable and stable revenue streams. The system's proven capabilities in core Advanced Driver-Assistance Systems functionalities ensure consistent demand, making it a reliable contributor to Horizon Robotics' financial stability.

The Journey 5 series AI chips, featuring the Bayes BPU design finalized in 2021, are a significant revenue generator for Horizon Robotics. These chips are currently in mass production and are found in popular vehicle models like the Li Auto L9 Pro, demonstrating their market adoption and ongoing demand.

Despite the development of newer chips such as Journey 6, the Journey 5 series maintains its position as a cash cow. Its established presence in the automotive market ensures continued substantial revenue streams from a loyal customer base, solidifying its role within Horizon Robotics' product portfolio.

Horizon Robotics' earlier Journey series chips, specifically Journey 2 (released in 2019) and Journey 3 (released in 2020), are classified as cash cows. These chips are designed for basic Advanced Driver-Assistance Systems (ADAS), supporting Level 0 to Level 2 functionalities like active safety and assisted driving.

These older chip generations, requiring less computing power, are likely in a mature, high-volume market segment. This stability suggests they generate consistent and predictable cash flow for Horizon Robotics, a hallmark of a cash cow in the BCG matrix.

IP Licensing and Development Services

Horizon Robotics' IP licensing and development services represent a strong cash cow. In 2024, this segment brought in RMB 1,647.5 million, a remarkable 70.9% increase from the previous year. This robust growth underscores the segment's profitability and its crucial role in generating substantial cash flow for the company.

- High Revenue Growth: RMB 1,647.5 million generated in 2024, a 70.9% year-over-year increase.

- Profitability Driver: This segment contributes significantly to Horizon Robotics' overall profitability due to its high-margin nature.

- Cash Flow Generation: The substantial cash flow from IP licensing and development services supports ongoing operations and critical R&D investments.

- Strategic Importance: This segment acts as a stable income source, enabling further innovation and expansion in other business areas.

Overall ADAS Solutions Business

Horizon Robotics' overall ADAS solutions business is a significant cash cow, holding a dominant position in the Chinese market. By the close of 2024, this segment had secured over 40% of the Chinese OEM ADAS market share. This strong performance underscores the established nature and widespread adoption of their Advanced Driver-Assistance Systems technologies.

This established ADAS business remains a critical revenue generator for Horizon Robotics. Despite the rapid advancements and faster growth in higher-level autonomous driving solutions, the broader ADAS segment continues to provide substantial financial contributions, solidifying its cash cow status.

- Market Dominance: Over 40% share of the Chinese OEM ADAS market by the end of 2024.

- Revenue Contribution: Continues to be a major revenue driver for Horizon Robotics.

- Established Technology: Represents widely adopted and proven ADAS solutions.

Horizon Robotics' IP licensing and development services are a prime example of a cash cow, generating RMB 1,647.5 million in 2024, a substantial 70.9% increase year-over-year. This segment's high-margin nature makes it a significant profitability driver, providing stable income that fuels ongoing operations and critical research and development.

The Horizon Mono ADAS System also exemplifies a cash cow, holding the leading market share in China's OEM ADAS sector in 2024. This strong market penetration ensures predictable and stable revenue streams, as the system's proven capabilities in core ADAS functionalities drive consistent demand.

Similarly, the Journey 5 series AI chips, currently in mass production and integrated into popular models like the Li Auto L9 Pro, continue to be a reliable revenue generator. Even with newer chip developments, Journey 5's established market presence guarantees continued substantial cash flow from a loyal customer base.

Horizon Robotics' overall ADAS solutions business, with over 40% of the Chinese OEM ADAS market share by the end of 2024, acts as a significant cash cow. This established business remains a critical revenue generator, providing substantial financial contributions that solidify its cash cow status.

| Product/Service | Market Position (2024) | Revenue Contribution (2024) | Key Characteristic |

| IP Licensing & Development Services | Strong Growth | RMB 1,647.5 million (+70.9% YoY) | High-margin, stable income |

| Horizon Mono ADAS System | Leading Market Share (China OEM ADAS) | Significant & Predictable | Proven capabilities, consistent demand |

| Journey 5 AI Chips | Mass Production, Integrated in Key Models | Substantial & Ongoing | Established market presence, loyal customer base |

| Overall ADAS Solutions | Dominant (40%+ China OEM ADAS Market Share) | Major Revenue Driver | Widely adopted, proven technology |

What You See Is What You Get

Horizon Robotics BCG Matrix

The Horizon Robotics BCG Matrix you are currently viewing is the definitive version you will receive upon purchase, offering a complete and unwatermarked analysis of their product portfolio. This preview accurately represents the final, professionally formatted document, ready for immediate strategic application without any demo content or hidden alterations. You can be confident that the insights and structure presented here are precisely what you'll download, empowering your decision-making with actionable intelligence on Horizon Robotics' market positioning. This is not a mockup; it is the actual, analysis-ready BCG Matrix report designed for clarity and immediate use in your business planning.

Dogs

Within Horizon Robotics' portfolio, niche, non-automotive legacy IoT solutions represent potential 'Dogs' in the BCG matrix. These are older product lines, perhaps focused on specific industrial or consumer applications, that have struggled to achieve widespread adoption or operate in highly saturated, low-growth segments. For instance, a legacy smart home device that never gained significant market share, or an industrial sensor solution for a declining manufacturing sector, would fit this description.

These 'Dog' categories often consume valuable research and development resources and marketing spend without yielding substantial returns. In 2024, companies often divest or phase out such offerings to reallocate capital to more promising growth areas. Without specific financial data for Horizon Robotics' legacy products, it's understood that their contribution to overall revenue would be minimal, potentially even negative when considering the costs associated with maintaining them.

These are the early chip designs from Horizon Robotics, like the first-generation Journey, that have been completely replaced by newer, more capable models. Think of them as the first drafts that paved the way for the final product but aren't used anymore.

Supporting these older architectures is costly, and with the Journey series now leading the charge, there's little to no new business coming from them. Horizon Robotics' focus has shifted entirely to its advanced Journey series, making these older chips a relic of past innovation.

Some early smart city initiatives or pilot projects that did not lead to scalable deployment or significant commercial contracts could be classified as Question Marks in the Horizon Robotics BCG Matrix. These ventures, while potentially innovative, might have consumed significant research and development and operational resources without achieving substantial market share or profitability for Horizon Robotics. For example, a pilot project in a mid-sized European city focusing on traffic management optimization in 2021, while demonstrating technical feasibility, failed to secure a follow-on contract due to high implementation costs and a lack of integration with existing city infrastructure.

Discontinued or Obsolete Software Versions

Discontinued or obsolete software versions within Horizon Robotics' portfolio, such as older iterations of their AI development platforms that are no longer supported or compatible with the latest chipsets, would fall into the Dogs category. These represent sunk costs, with minimal to no future revenue potential. For instance, a proprietary AI training software from 2020 that cannot leverage the enhanced processing power of Horizon Robotics' 2024-released DragonBoard 5.0 would be a prime example.

These outdated software assets are characterized by their inability to meet current market demands or integrate with newer hardware, leading to their discontinuation. They consume resources for maintenance without generating significant returns, a common trait of products in the Dogs quadrant of the BCG Matrix. Horizon Robotics might have seen a decline in adoption rates for these older versions, with user migration to newer, more capable software solutions.

- Obsolete AI Development Software: Older versions of proprietary AI training software that lack compatibility with current Horizon Robotics hardware, such as the DragonBoard 5.0 released in 2024.

- Discontinued Driver Packages: Software drivers for AI chips that are no longer updated or supported due to being superseded by newer, more efficient driver versions.

- Legacy SDKs: Software Development Kits that have been phased out because their functionalities are now integrated into more comprehensive and advanced platforms, rendering them redundant.

Unsuccessful Ventures into Non-Core AI Applications

Horizon Robotics has historically explored AI applications beyond its core automotive and IoT strengths, but these ventures have yet to gain significant traction. For instance, their foray into AI for smart city infrastructure, while conceptually promising, faced intense competition and struggled to carve out a substantial market share. The initial investment in these non-core areas did not yield the expected product lines with sustainable growth.

These less successful ventures represent areas where Horizon Robotics’ core competencies in AI for specific, high-demand sectors like autonomous driving did not directly translate into competitive advantages. For example, their attempts to leverage AI for personalized retail analytics, a sector with established players, proved challenging. The company's strategic focus remains on solidifying its leadership in its primary markets.

- Struggles in Smart City AI: Difficulty in achieving competitive market share in AI solutions for smart city infrastructure.

- Challenges in Retail Analytics: Limited success in developing viable product lines for AI-driven retail analytics due to existing market competition.

- Investment vs. Return: Initial investments in these non-core AI applications did not result in sustainable growth or viable product lines.

Horizon Robotics' "Dogs" are essentially older, less successful product lines or ventures that consume resources without generating significant returns. This includes discontinued software, obsolete chip designs like early Journey models, and non-core AI applications that failed to gain market traction. For instance, legacy IoT solutions in saturated markets or pilot projects that didn't scale represent these low-growth, low-market-share offerings.

These products are characterized by minimal revenue contribution and often require ongoing maintenance costs. In 2024, Horizon Robotics likely focuses on divesting or phasing out such offerings to reallocate capital towards its more promising, high-growth areas like the advanced Journey series automotive chips.

The company's strategic shift means these older technologies are being phased out, with little to no new business generated from them. Supporting these legacy assets is cost-ineffective compared to the potential returns from newer, more advanced product lines.

Consider the example of discontinued driver packages for AI chips; these are no longer updated or supported because newer, more efficient versions have been released. Similarly, legacy SDKs are phased out as their functionalities are integrated into more comprehensive, advanced platforms, rendering them redundant.

Question Marks

Horizon Robotics aims to leverage its AI computing expertise beyond the automotive sector, targeting diverse robotics applications. This strategic pivot includes expanding into high-growth areas such as elderly care, home services, agriculture, manufacturing, and logistics.

These new markets represent significant opportunities for Horizon, though their current market share is low, classifying them as question marks in a BCG matrix. This necessitates substantial investment to build a strong presence and achieve market leadership.

The global robotics market is projected for robust growth, with the service robotics segment, encompassing healthcare and logistics, expected to reach approximately $40 billion by 2027, according to some industry forecasts. This underscores the potential for Horizon's expansion efforts.

Horizon Robotics is venturing into next-generation smart city infrastructure, moving beyond current IoT solutions. Their high-performance AI chips are designed to tackle complex urban management tasks like advanced traffic optimization and city-wide surveillance. This represents a significant growth opportunity, though Horizon Robotics is still building its presence and market share in this emerging sector.

While Horizon Robotics is known for its automotive AI chips, their low-power, high-performance solutions are well-suited for non-automotive sectors like industrial automation, healthcare, and future 6G networks. These markets represent significant growth opportunities, though Horizon's current market share is likely minimal, demanding considerable investment to challenge existing leaders.

International Market Expansion for Autonomous Driving Solutions

Horizon Robotics' expansion into North America and Europe for its autonomous driving solutions represents a classic Question Mark in the BCG Matrix. While China is a stronghold, these new territories offer immense growth prospects, estimated to be substantial as global adoption of autonomous technology accelerates. For instance, the global autonomous vehicle market was projected to reach over $200 billion by 2030, with North America and Europe being key drivers.

These international markets demand significant upfront investment. Horizon Robotics will need to navigate complex regulatory landscapes, establish local partnerships with automakers and technology providers, and tailor its solutions to diverse consumer preferences and road infrastructures. The cost of research and development for localization, coupled with marketing and sales efforts, will be considerable, impacting short-term profitability.

Key considerations for Horizon Robotics' international push include:

- Market Entry Strategy: Identifying the most viable entry points, whether through direct sales, joint ventures, or licensing agreements, will be crucial.

- Regulatory Compliance: Understanding and adhering to varying safety standards and legal frameworks in North America (e.g., NHTSA) and Europe (e.g., UNECE regulations) is paramount.

- Partnership Development: Collaborating with established automotive manufacturers in these regions can significantly de-risk expansion and accelerate market penetration.

- Technological Adaptation: Localizing software, sensor calibration, and mapping data to suit regional driving conditions and user expectations is essential for success.

Integration of Generative AI in Robotics and Industrial Automation

Generative AI is revolutionizing robotics by enabling enhanced precision, adaptability, and versatility in industrial automation. This technology allows robots to learn and adapt to new tasks and environments more efficiently, moving beyond pre-programmed routines. For instance, generative AI can optimize robot path planning in real-time, reducing cycle times and improving energy efficiency, a critical factor in the increasingly competitive manufacturing sector.

Horizon Robotics' commitment to advanced AI algorithms positions them to potentially capitalize on this burgeoning market. While their specific market share in generative AI-powered robotics is still emerging, the company's R&D efforts are geared towards developing sophisticated AI solutions. The global industrial robotics market, valued at approximately $50 billion in 2023, is expected to see significant growth driven by AI integration, with some projections indicating a compound annual growth rate (CAGR) of over 15% in the coming years.

- Enhanced Robot Capabilities: Generative AI allows robots to learn and adapt, improving their ability to handle complex or unpredictable tasks.

- Market Potential: The integration of generative AI into robotics is a rapidly growing segment within the broader industrial automation market.

- Horizon Robotics' Position: Horizon Robotics' focus on AI R&D could establish them as a key player, though their current market share in this specific application is still developing.

- Industry Growth: The industrial robotics market is projected for substantial growth, with AI being a significant catalyst for this expansion.

Horizon Robotics' expansion into new, high-growth sectors like elderly care, home services, and agriculture positions these ventures as Question Marks in the BCG Matrix. Despite significant market potential, Horizon's current market share in these areas is nascent, demanding substantial investment to gain traction and compete effectively.

The global service robotics market, a key area for Horizon's diversification, was projected to reach around $40 billion by 2027, highlighting the opportunity. However, entering these diverse markets requires navigating unique challenges, from regulatory hurdles in healthcare to adoption rates in agriculture, necessitating strategic capital allocation.

Horizon's foray into smart city infrastructure and next-generation AI chips for urban management also represents a Question Mark. While the potential for advanced traffic optimization and surveillance is vast, Horizon is still establishing its footprint and market share in this emerging technological frontier.

The company's strategic move into North America and Europe for autonomous driving solutions is another clear Question Mark. Although China is a strong base, these new territories offer immense growth prospects, with the global autonomous vehicle market anticipated to exceed $200 billion by 2030, with North America and Europe as primary growth engines.

| Sector | BCG Status | Market Potential | Horizon's Share | Investment Need |

| Elderly Care Robotics | Question Mark | High | Low | High |

| Home Services Robotics | Question Mark | High | Low | High |

| Agriculture Robotics | Question Mark | High | Low | High |

| Smart City Infrastructure | Question Mark | Very High | Emerging | High |

| Autonomous Driving (NA/EU) | Question Mark | Very High | Emerging | Very High |

BCG Matrix Data Sources

Our Horizon Robotics BCG Matrix is built on comprehensive market data, integrating financial filings, industry analysis, and competitive intelligence to provide strategic clarity.