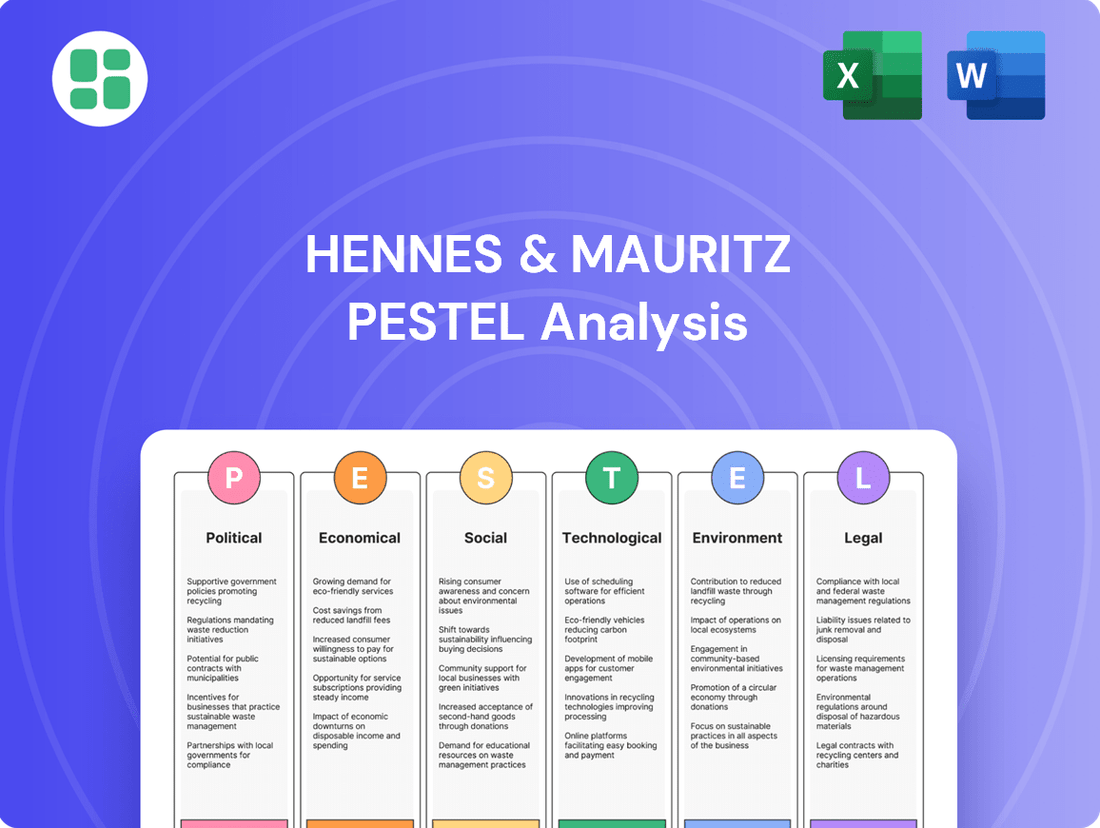

Hennes & Mauritz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hennes & Mauritz Bundle

Discover how political shifts, economic volatility, and evolving social trends are shaping Hennes & Mauritz's global strategy. Our PESTLE analysis dives deep into these external forces, offering critical intelligence for your own business planning. Unlock actionable insights and gain a competitive edge by downloading the full report today.

Political factors

Global geopolitical uncertainties, including ongoing conflicts and regional instability, continue to create significant headwinds for H&M's supply chain. For instance, disruptions in the Red Sea, a critical shipping route, have led to extended transit times and a notable increase in freight expenses for many retailers, including H&M, throughout late 2023 and into 2024. This directly impacts the cost of goods sold and can squeeze profit margins.

Trade tensions between major economic blocs also pose a risk. Tariffs or import restrictions imposed by governments can escalate the cost of sourcing materials and finished goods, potentially forcing H&M to either absorb these costs or pass them on to consumers, which could affect sales volume. The company's strategy involves closely monitoring these evolving trade landscapes to adapt sourcing and logistics proactively.

Governments globally are intensifying their oversight of labor conditions within international supply chains, demanding greater compliance with fair wage standards and secure workplaces. This trend directly impacts multinational retailers like H&M.

H&M has proactively addressed these concerns by reaffirming its dedication to worker welfare through updated pacts with both global and Swedish trade unions. These agreements are designed to safeguard the rights of more than one million individuals employed throughout H&M's extensive supply network.

Key initiatives include ensuring strict adherence to the labor laws of host countries and actively fostering an environment that supports collective bargaining. For instance, in 2024, H&M reported that 98% of its key suppliers had undergone social audits, with 95% demonstrating compliance with its code of conduct regarding labor practices.

Political relations significantly shape H&M's global operations, influencing market access and consumer sentiment. Tensions between nations can lead to trade barriers or boycotts, directly impacting sales and supply chains, as seen with past controversies. For example, the 2020 allegations concerning Xinjiang cotton resulted in a notable consumer backlash in China, leading to temporary store closures and a decline in brand perception in that crucial market. This highlights the delicate balance global retailers must maintain amidst geopolitical shifts.

Evolving Human Rights Due Diligence Legislation

The European Union's commitment to strengthening human rights due diligence (HRDD) legislation presents a dynamic compliance environment for global retailers like H&M. New directives are compelling companies to proactively identify, prevent, and mitigate adverse human rights impacts throughout their supply chains.

H&M publicly affirms its dedication to upholding human rights, aligning with the UN Guiding Principles on Business and Human Rights. This commitment translates into ongoing efforts to embed robust due diligence processes, specifically targeting the prevention of issues such as forced labor within its extensive value chain.

- EU Directive on Corporate Sustainability Due Diligence (CSDDD): While still under negotiation and subject to finalization in 2024, the proposed directive aims to mandate HRDD for large companies operating within the EU, with potential extraterritorial reach.

- Existing National Laws: Countries like Germany (e.g., the Supply Chain Due Diligence Act, effective January 1, 2024) already impose direct obligations on companies to address human rights risks in their supply chains.

- Increased Scrutiny: Regulatory bodies and NGOs are intensifying their focus on corporate accountability for human rights violations, leading to greater reputational risk for non-compliance.

Political Stability in Key Sourcing Regions

Political stability in countries where H&M sources its products directly influences the reliability and cost-effectiveness of its supply chain. For instance, in 2023, Bangladesh, a major garment manufacturing hub for H&M, experienced periods of political uncertainty leading up to its general elections, which can sometimes impact manufacturing operations. Unrest or changes in local governance can disrupt production, affect worker safety, and lead to unforeseen operational challenges, as seen with localized protests in certain sourcing countries impacting logistics.

H&M actively manages these risks by maintaining close dialogue with suppliers in affected regions and emphasizing responsible purchasing practices. This includes working with suppliers to ensure compliance with labor laws and safety standards, even during times of political flux. The company's commitment to sustainability and ethical sourcing aims to mitigate the impact of political instability on its operations and brand reputation.

Key sourcing regions for H&M include countries like Bangladesh, India, and Turkey. In 2024, geopolitical tensions in Eastern Europe and the Middle East continue to present potential risks to global supply chains, which H&M monitors closely. The company's strategy involves diversification of sourcing locations to reduce over-reliance on any single region prone to political instability.

- Supply Chain Reliability: Political instability in sourcing countries can lead to production delays and increased costs.

- Worker Safety: Unrest can compromise worker safety, a critical concern for H&M's ethical sourcing policies.

- Supplier Dialogue: H&M engages in continuous communication with suppliers to navigate political challenges.

- Risk Mitigation: Diversifying sourcing locations is a key strategy to buffer against regional political risks.

Governmental regulations concerning sustainability and ethical sourcing are increasingly stringent, impacting H&M's operational costs and compliance requirements. For instance, the EU's proposed Corporate Sustainability Due Diligence Directive (CSDDD), expected to be finalized in 2024, mandates human rights and environmental due diligence for large companies. This legislation, along with existing national laws like Germany's Supply Chain Due Diligence Act (effective January 1, 2024), compels H&M to enhance its oversight of labor practices and environmental impact throughout its supply chain, potentially increasing administrative and operational expenses.

Geopolitical events and trade policies directly influence H&M's global operations, affecting market access and supply chain stability. Disruptions in key shipping routes, such as the Red Sea, have escalated freight costs throughout late 2023 and into 2024, impacting H&M's cost of goods sold. Furthermore, trade tensions and potential tariffs can increase the cost of sourcing materials and finished goods, necessitating strategic adjustments in procurement and logistics to mitigate financial impacts.

Political instability in sourcing countries poses significant risks to H&M's supply chain reliability and ethical commitments. For example, in 2023, political uncertainty in Bangladesh, a major garment manufacturing hub, created potential disruptions. H&M actively manages these risks through supplier dialogue and by diversifying sourcing locations, aiming to ensure worker safety and compliance with labor laws even amidst political flux. As of 2024, H&M reported that 98% of its key suppliers had undergone social audits, with 95% compliant with its code of conduct.

| Factor | Impact on H&M | Example/Data Point (2023-2024) |

|---|---|---|

| Regulatory Compliance (Sustainability/Ethics) | Increased operational costs, enhanced due diligence requirements | EU CSDDD proposal (finalization 2024); Germany's Supply Chain Due Diligence Act (effective Jan 2024) |

| Geopolitical Events & Trade Policies | Supply chain disruptions, increased logistics costs, potential market access issues | Red Sea shipping disruptions leading to higher freight costs (late 2023-2024); 98% of key suppliers audited for social compliance (2024) |

| Political Stability in Sourcing Countries | Risk to supply chain reliability and worker safety, potential production delays | Political uncertainty in Bangladesh (2023); H&M's diversification of sourcing locations as a risk mitigation strategy |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Hennes & Mauritz's global operations, providing a comprehensive understanding of the external landscape.

A clear, actionable summary of H&M's PESTLE factors, transforming complex external analysis into easily digestible insights for strategic decision-making.

Economic factors

Globally, high living costs and persistent inflation are significantly squeezing consumer disposable income. This economic pressure forces shoppers to prioritize essential goods, leading to more cautious spending on discretionary items such as apparel, directly impacting retailers like H&M.

This challenging macroeconomic backdrop often translates into increased markdowns as retailers try to move inventory, potentially slowing sales growth. For instance, in the first quarter of fiscal year 2024, H&M reported a net sales increase of 10% in Swedish krona, reaching SEK 55,105 million, yet the underlying consumer sentiment remains a key factor to monitor.

H&M actively monitors these evolving consumer behaviors, adjusting its product assortment, pricing strategies, and promotional activities to better align with the current economic realities and maintain competitiveness in a demanding market.

Currency exchange rate fluctuations, especially a stronger US dollar, present a significant headwind for H&M. This impacts their gross margin by making imported materials and finished goods more expensive, a direct consequence of their global sourcing strategy.

For instance, in the first quarter of 2024, H&M noted that unfavorable currency movements, including a stronger USD, had a negative impact on their financial results. Managing these currency exposures is a constant operational challenge for a company operating across numerous countries with diverse sourcing and sales channels, directly affecting overall profitability.

Global economic growth remains a key concern for H&M. While sales in local currencies have shown some stabilization, the broader economic climate presents headwinds. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a modest figure that reflects ongoing economic uncertainties worldwide.

This sluggish growth environment intensifies competition. H&M faces fierce rivalry from established fast-fashion players like Zara, as well as the rapidly expanding ultra-low-cost segment exemplified by Shein. This competitive pressure makes a sustained recovery in profitability a significant challenge for the company.

H&M's strategy to navigate these economic factors involves strengthening its omnichannel approach and refining its product assortment. The company is investing in its digital platforms and in-store experiences to better connect with consumers. For the first quarter of fiscal year 2024, H&M reported net sales of SEK 53.7 billion, a slight increase compared to the previous year, indicating some resilience amidst the challenging landscape.

Operating Costs and Profitability Pressures

H&M's profitability in early 2025 faced significant pressure from external economic factors and internal strategic choices. Increased markdowns to clear inventory and continued investments in enhancing the customer experience and digital capabilities weighed on margins. These combined forces made achieving the previously targeted operating margin of 10% by the end of 2024 a more formidable challenge, despite ongoing efforts in cost management and supply chain optimization.

The company's financial performance in the first quarter of fiscal year 2025 (December 2024 - February 2025) reflected these pressures. H&M reported a pre-tax profit of SEK 2.06 billion, a decrease from SEK 5.40 billion in the same period the previous year. This decline was attributed to higher logistics costs and increased investments in its online presence and store portfolio.

- Q1 FY25 Pre-tax Profit: SEK 2.06 billion (down from SEK 5.40 billion in Q1 FY24).

- Key Profitability Pressures: Increased markdowns, investments in customer offering and digital platforms, higher logistics costs.

- Margin Target Challenge: Achieving a 10% operating margin by 2024 became more difficult due to these headwinds.

Inventory Management and Supply Chain Efficiency

Efficient inventory management is a cornerstone for H&M's financial health, especially with global supply chains facing disruptions. Extended transport times, often exacerbated by geopolitical events, directly impact how much stock a retailer needs on hand. For instance, in early 2024, shipping times from Asia to Europe saw significant increases due to rerouting around conflict zones, placing a premium on accurate forecasting and agile inventory strategies.

H&M is actively addressing these challenges by prioritizing stock-in-trade optimization and investing heavily in supply chain digitalization. This focus aims to improve overall efficiency, minimize the risk of overstocking, and consequently reduce holding costs. By leveraging technology, H&M seeks to gain better visibility into its inventory levels across the network, enabling more responsive adjustments to demand fluctuations and supply chain volatility. These efforts are crucial for bolstering profitability and maintaining a competitive edge in the fast-fashion sector.

- Digitalization Investment: H&M's commitment to supply chain digitalization aims to enhance real-time inventory tracking and demand forecasting.

- Geopolitical Impact: Extended shipping times, a consequence of geopolitical instability in 2024, underscore the need for robust inventory planning.

- Cost Reduction: Optimizing stock levels directly contributes to lowering operational costs, including warehousing and potential markdowns on excess inventory.

- Financial Performance: Improved supply chain efficiency and reduced overstocking are key drivers for enhancing H&M's overall financial performance.

Persistent inflation and high living costs continue to impact consumer spending, forcing shoppers to be more selective with discretionary purchases like apparel. This economic pressure means retailers like H&M must remain agile, adjusting pricing and promotions to align with consumer purchasing power.

Currency fluctuations, particularly a strong US dollar, negatively affect H&M's gross margin as imported goods become more expensive. This was evident in Q1 FY25, where unfavorable currency movements contributed to lower profitability, highlighting the ongoing challenge of managing global financial exposures.

Global economic growth forecasts, such as the IMF's 3.2% projection for 2024, indicate a subdued environment that intensifies competition. H&M faces pressure not only from established rivals but also from ultra-low-cost players, making sustained profit recovery a significant hurdle.

H&M's Q1 FY25 pre-tax profit fell to SEK 2.06 billion from SEK 5.40 billion in Q1 FY24, largely due to increased logistics costs and investments in digital and store enhancements. These factors, combined with a need for markdowns to manage inventory, made achieving their 10% operating margin target by end-2024 increasingly challenging.

| Metric | Q1 FY24 | Q1 FY25 | Change |

|---|---|---|---|

| Net Sales (SEK billions) | 55.1 | 53.7 | -2.5% |

| Pre-tax Profit (SEK billions) | 5.40 | 2.06 | -61.9% |

| Operating Margin Target | 10% by end-2024 | Challenged by current pressures | N/A |

What You See Is What You Get

Hennes & Mauritz PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hennes & Mauritz PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global fashion retailer. You'll gain immediate access to actionable insights upon completion of your purchase.

Sociological factors

Consumers worldwide are increasingly prioritizing sustainability and ethical practices in their fashion choices. This shift directly influences H&M, compelling the company to intensify its commitment to responsible sourcing and production. For instance, by 2025, H&M aims for 100% of its materials to be recycled or sourced sustainably, a significant increase from its 2022 figure of 80%.

Transparency regarding environmental and social footprints is now a key consumer expectation. H&M is responding by enhancing its supply chain visibility and investing in circular fashion initiatives, such as garment recycling programs and the promotion of resale platforms. These efforts align with a growing market trend where brands demonstrating genuine commitment to ethical production gain a competitive edge.

H&M's success hinges on its ability to quickly adapt to shifting fashion landscapes. For instance, the company is actively incorporating popular styles like 1980s-inspired power dressing and versatile resort wear into its 2024 and 2025 collections, catering to diverse consumer preferences.

Social media plays a crucial role in this rapid trend adoption. H&M's responsiveness, driven by real-time insights from platforms like TikTok and Instagram, allows it to maintain market relevance and attract a broad demographic base, a strategy that has proven effective in its global operations.

H&M's commitment to social responsibility is evident in its renewed agreements with trade unions, aiming to secure fair working conditions and uphold human rights for over a million individuals across its extensive supply chain. This focus extends to actively monitoring wage payments, pushing for transparency, and adopting ethical practices in response to increasing stakeholder demands for accountability.

Influence of Digital and Omnichannel Shopping

The surge in e-commerce has fundamentally reshaped how consumers shop, with online channels becoming a critical revenue stream for fashion retailers like H&M. In 2024, H&M continued to leverage its digital presence to reach a wider audience, with online sales representing a significant portion of its overall revenue. This shift necessitates a robust digital strategy to meet evolving consumer expectations for convenience and accessibility.

H&M's commitment to its omni-channel strategy is designed to bridge the gap between physical stores and online platforms, offering a unified customer journey. This integrated approach allows customers to browse online, try in-store, and purchase through their preferred channel, reflecting a broader trend in retail where seamlessness is paramount. By 2025, such integrated experiences are expected to be even more crucial for customer loyalty.

- E-commerce Growth: Online sales for fashion retailers have seen consistent double-digit growth globally, with H&M actively participating in this expansion.

- Omnichannel Investment: H&M has invested heavily in its digital infrastructure, including website enhancements and app development, to support its omni-model.

- Consumer Expectations: Modern consumers increasingly demand personalized offers and the flexibility to shop across multiple touchpoints without friction.

Brand Perception and Ethical Consumerism

H&M's brand perception is significantly influenced by the growing trend of ethical consumerism. While the company has launched various sustainability initiatives, its fast-fashion model continues to draw criticism for its environmental footprint and labor practices. This creates a challenge in maintaining a positive brand image among increasingly conscious consumers.

To address these concerns and foster brand loyalty, H&M must enhance transparency in its sustainability reporting. Consumers are demanding more detailed information about supply chains and the impact of materials used. For instance, by mid-2024, reports indicated that while H&M aimed for 100% recycled or sustainably sourced materials by 2030, the actual progress needed acceleration to meet this ambitious target amidst ongoing scrutiny.

Investing in and scaling the use of genuinely eco-friendly materials is crucial. This includes exploring innovative textiles and ensuring these materials are integrated throughout their product lines. By mid-2025, H&M's commitment to circularity and the adoption of materials like recycled cotton and polyester will be key metrics that consumers and industry watchdogs will be closely examining to gauge the effectiveness of their sustainability strategies and counter negative perceptions.

The company's ability to authentically communicate its progress and challenges in sustainability will be vital. Recent consumer surveys in late 2024 showed a growing segment of shoppers actively seeking brands with verifiable ethical practices, indicating that genuine commitment, not just marketing claims, drives purchasing decisions.

Societal expectations for ethical business practices are paramount, influencing H&M's operational strategies. Consumers are increasingly vocal about fair labor and environmental responsibility, pushing companies like H&M to demonstrate tangible progress. For example, by the end of 2024, H&M reported that 92% of its materials were sourced sustainably or recycled, a significant step towards its 2025 goal of 100%.

The rise of conscious consumerism means brand reputation is closely tied to sustainability efforts. H&M's commitment to circular fashion, including garment collection and resale initiatives, aims to meet this demand, though continued transparency is key. By mid-2025, the company's progress in reducing its carbon footprint and promoting ethical sourcing will be critical for maintaining consumer trust.

H&M's ability to adapt to rapidly changing consumer trends, often amplified by social media, is crucial for its market position. The company actively monitors online sentiment and fashion influencers to inform its product development, ensuring its collections resonate with contemporary tastes. This agility is vital in a fast-paced industry where relevance can shift quickly.

| Sociological Factor | H&M's Response/Impact | Data/Trend (2024-2025) |

|---|---|---|

| Ethical Consumerism | Increased demand for sustainable and fair labor practices | By end of 2024, 92% of H&M materials were sustainably sourced or recycled. |

| Social Media Influence | Rapid trend adoption and brand perception shaping | H&M actively uses platforms like TikTok and Instagram for trend analysis and marketing. |

| Brand Transparency | Consumer scrutiny of environmental and social impact | Ongoing focus on supply chain visibility and reporting on sustainability goals. |

Technological factors

H&M is heavily investing in its digital infrastructure, recognizing e-commerce as a vital engine for global reach and revenue. This focus is evident in their ongoing efforts to bolster online platforms and enhance digital customer engagement.

The company prioritizes an omnichannel approach, aiming for a smooth transition between online shopping and in-store experiences. This strategy caters to evolving consumer habits and ensures accessibility across various touchpoints.

In 2023, H&M Group's online sales represented a significant portion of their total revenue, demonstrating the critical role of digital channels in their business model. The company continues to innovate in this space, aiming to further optimize the customer journey.

H&M is increasingly leveraging AI and data analytics to sharpen its operational edge. For instance, sophisticated algorithms are employed to refine inventory management, aiming to ensure the right products are in the right place at the right time. This focus on data-driven decision-making is crucial for a global retailer like H&M, especially when considering the dynamic nature of fashion trends and consumer demand.

The company's investment in AI extends to improving demand forecasting accuracy, a critical factor in minimizing costly overstocking and reducing waste. By analyzing vast datasets, H&M can better predict what customers will want, thereby optimizing production and distribution. This analytical approach helps streamline the supply chain and contributes to a more sustainable operational model.

Furthermore, AI is enhancing the customer experience, particularly in the digital realm. Virtual fitting room technology, powered by AI, addresses a common pain point in online fashion retail – uncertainty about fit. By offering personalized recommendations and virtual try-ons, H&M aims to boost conversion rates and customer satisfaction, making online shopping more engaging and reliable.

H&M is actively investing in and collaborating with technology innovators like Rondo Energy to pilot heat storage solutions. This initiative focuses on replacing fossil fuels with clean heat and power within textile manufacturing facilities, directly supporting H&M's commitment to achieving its climate goals and fostering more sustainable production methods.

By exploring advanced technologies such as Rondo Energy's heat storage, H&M aims to significantly reduce the carbon footprint associated with its supply chain. This strategic move is crucial for meeting its target of becoming climate positive across its value chain by 2040, a significant undertaking in the fashion industry.

Material Innovation and Recycling Technologies

Hennes & Mauritz is making significant strides in material innovation and recycling technologies, recognizing their importance in sustainable fashion. The company is actively investing in and collaborating on cutting-edge material technologies, including the development of lab-grown cotton. These advancements are key to reducing the environmental footprint of textile production.

Furthermore, H&M is forging strategic partnerships with leading textile recycling companies. Collaborations with entities like Infinited Fiber Company and Ambercycle are vital for scaling up textile recycling processes. This focus is essential for addressing the growing challenge of post-consumer waste and moving towards H&M's ambitious goal of using 100% recycled or sustainably sourced materials across its product lines.

- Material Innovation: H&M's investment in lab-grown cotton signifies a move towards more resource-efficient material sourcing.

- Recycling Partnerships: Collaborations with Infinited Fiber Company and Ambercycle are crucial for advancing circular economy principles in textiles.

- Sustainability Goals: These technological advancements directly support H&M's objective of achieving 100% recycled or sustainably sourced materials by 2030.

- Waste Reduction: By prioritizing recycling technologies, H&M aims to significantly reduce textile waste in the fashion industry.

In-store Technology for Enhanced Customer Experience

While H&M pushes digital expansion, they're also investing in their physical stores. This means upgrading the in-store experience with new technology. For instance, they've been testing concepts like AR try-ons in select locations, aiming to blend the digital and physical shopping journeys.

Self-checkout options are also being explored to streamline the process for customers. These technological integrations are designed to make shopping more engaging and efficient, supporting their omnichannel strategy.

In 2024, H&M continued to refine its store formats, with a focus on creating more inspiring spaces. This includes better integration of digital tools within the physical environment, potentially leading to more personalized customer interactions.

The company's approach acknowledges that physical retail still plays a crucial role, and technology is key to revitalizing it. This strategy aims to attract and retain customers by offering a seamless and innovative shopping experience across all channels.

H&M's technological focus is on enhancing digital presence and operational efficiency. Investments in e-commerce platforms and AI for demand forecasting are central to their strategy, aiming for better inventory management and personalized customer experiences. The company is also exploring innovative solutions for sustainable production, including partnerships for advanced textile recycling and clean heat technologies in manufacturing.

Legal factors

H&M faces increasing regulatory pressure from evolving human rights due diligence (HRDD) laws, especially within the European Union. These laws require companies to proactively identify, prevent, and mitigate human rights risks throughout their global operations and supply chains. For instance, the proposed EU Corporate Sustainability Due Diligence Directive, expected to be fully implemented in the coming years, will impose stricter obligations on companies like H&M to demonstrate robust HRDD processes.

The company's commitment to ethical practices is evident in its public statements and initiatives. H&M's annual Modern Slavery Statement, a requirement in several jurisdictions, details its efforts to combat forced labor and improve transparency. Furthermore, its stated adherence to the UN Guiding Principles on Business and Human Rights underscores a framework for addressing potential adverse impacts on human rights, a crucial aspect of legal compliance in 2024 and beyond.

Hennes & Mauritz (H&M) demonstrates a strong commitment to international labor standards, evidenced by its renewed Global Framework Agreement with global trade unions. This agreement, a cornerstone of its ethical sourcing strategy, explicitly covers fair wages, the right to freedom of association, and the assurance of safe and healthy working environments for employees across its supply chain.

The pact's reach is substantial, impacting the working conditions of over one million individuals globally. Crucially, it incorporates robust mechanisms for monitoring compliance with these labor principles and provides clear channels for addressing worker grievances, thereby fostering accountability and continuous improvement in labor practices throughout H&M's extensive network.

Hennes & Mauritz (H&M) vigorously defends its intellectual property, frequently taking legal action against perceived infringers. For instance, H&M has initiated lawsuits against fast-fashion competitors like Shein, alleging the latter copied H&M's unique designs, highlighting the critical need to protect creative assets in the rapidly evolving fashion landscape.

Protecting its brand designs and innovations is paramount for H&M to stave off the rampant replication of its products and to sustain its competitive edge. This proactive stance on intellectual property is essential for maintaining brand identity and market differentiation, especially as the fashion industry churns out new collections at an accelerated pace.

Environmental Regulations and Reporting

Hennes & Mauritz (H&M) navigates a complex web of environmental regulations worldwide, impacting everything from its supply chain to its retail operations. These rules mandate strict adherence to emission standards, robust waste management practices, and careful control over the chemicals used in its products. For instance, in the European Union, regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directly influence the materials H&M can source and utilize.

Transparency is key, and H&M's commitment is evident in its annual and sustainability reports. These documents meticulously track the company's performance in critical environmental areas. For example, H&M reported a 32% reduction in its Scope 1 and 2 greenhouse gas emissions between 2017 and 2022, showcasing progress toward its climate goals.

- Emission Standards: Compliance with global air and water quality standards, particularly in manufacturing hubs.

- Waste Management: Implementing circular economy principles and reducing landfill waste from production and retail.

- Chemical Restrictions: Adhering to regulations on hazardous substances in textiles and manufacturing processes.

- Reporting Transparency: Publicly disclosing environmental performance data, including reductions in greenhouse gas emissions and water usage.

Consumer Protection and Data Privacy Legislation

H&M, as a global online retailer, must navigate a complex web of consumer protection laws. These regulations cover everything from ensuring product safety and accurate labeling to transparent advertising practices. For instance, in the EU, the General Product Safety Regulation (GPSR) sets stringent standards for consumer goods, requiring manufacturers and retailers to place safe products on the market. Failure to comply can result in significant fines and product recalls, impacting H&M's brand reputation and financial performance.

Data privacy is another critical legal factor, especially with H&M's substantial online presence. Regulations like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and continues to be enforced, dictate how personal data is collected, processed, and stored. In 2023, the EU continued its focus on data privacy enforcement, with significant fines levied against companies for non-compliance. H&M must maintain robust data security measures and transparent privacy policies to protect customer information and avoid penalties, which can amount to millions of euros.

The company's adherence to these legal frameworks is paramount. In 2024 and looking into 2025, regulatory bodies worldwide are increasingly scrutinizing retail practices, particularly concerning online sales and data handling. This means H&M needs to continuously update its compliance strategies to align with evolving legislation, ensuring responsible business operations.

- Product Safety Compliance: Adherence to regulations like the EU's General Product Safety Regulation (GPSR) ensures H&M products meet safety standards.

- Data Privacy Enforcement: Compliance with GDPR and similar global data protection laws is critical, with significant fines for breaches.

- Evolving Regulations: Continuous monitoring and adaptation to new and updated consumer protection and data privacy laws are essential for ongoing legal operation.

- Brand Reputation: Maintaining compliance safeguards H&M's reputation and customer trust in an increasingly regulated digital marketplace.

H&M's legal landscape is shaped by stringent consumer protection laws globally, demanding adherence to product safety and transparent advertising. Regulations like the EU's General Product Safety Regulation (GPSR) are critical, impacting product design and marketing. Furthermore, robust data privacy compliance, particularly with GDPR, is paramount given H&M's extensive online operations, with significant fines for breaches underscoring the need for vigilance through 2025.

The company's commitment to ethical sourcing is legally reinforced by international labor standards and agreements, such as its Global Framework Agreement with trade unions. This pact, covering over a million workers, mandates fair wages and safe environments, demonstrating proactive legal compliance in supply chain management. H&M also actively defends its intellectual property, pursuing legal action against design infringements to maintain its market position.

Environmental regulations, including chemical restrictions like REACH in the EU, directly influence H&M's material sourcing and manufacturing processes. The company is legally obliged to report on its environmental performance, having achieved a 32% reduction in Scope 1 and 2 GHG emissions between 2017 and 2022, showcasing its efforts to meet climate-related legal requirements.

| Legal Area | Key Regulations/Agreements | Impact on H&M | 2024/2025 Focus |

|---|---|---|---|

| Human Rights & Labor | EU HRDD Directive, UN Guiding Principles, Global Framework Agreement | Supply chain transparency, fair wages, safe working conditions | Strengthening due diligence, compliance with evolving EU laws |

| Intellectual Property | Design patents, copyright law | Protection against product replication, brand integrity | Active litigation against infringers, safeguarding unique designs |

| Environmental | REACH, Emission Standards, Waste Management | Material sourcing, chemical use, emissions reduction targets | Continued adherence to chemical restrictions, reporting on sustainability metrics |

| Consumer Protection & Data Privacy | GPSR, GDPR | Product safety, accurate labeling, data security, transparent policies | Ongoing compliance with data privacy enforcement, adapting to new consumer laws |

Environmental factors

H&M is making strides in decarbonization, having already achieved a 41% reduction in Scope 1 and 2 emissions and a 24% decrease in Scope 3 emissions against a 2019 baseline.

The company is committed to eliminating on-site coal use within its supply chain by 2026, demonstrating a clear strategy for cleaner operations.

These efforts are supported by significant investments in renewable energy sources, crucial for meeting H&M's ambitious climate goals and aligning with global emission reduction targets.

H&M is heavily focused on environmental factors, particularly the shift towards a circular economy. By 2024, a significant 89% of their materials were either recycled or sustainably sourced, a strong indicator of their progress toward their 2025 goals.

This commitment extends to a broader ambition: H&M aims to utilize 100% recycled or sustainably sourced materials by the year 2030. Achieving this will require substantial investments in developing new materials and building robust recycling infrastructure.

Hennes & Mauritz (H&M) has made significant strides in water conservation, achieving a 9.5% reduction in freshwater consumption among its garment suppliers. This impressive figure brings them very close to their ambitious 10% reduction target, which they are on track to meet ahead of schedule.

These initiatives are a crucial component of H&M's overarching strategy to shrink the environmental impact of its manufacturing operations. The focus is particularly on water-intensive stages like textile dyeing and finishing, where substantial savings are being realized.

Waste Management and Plastic Packaging Reduction

H&M Group has made substantial progress in waste management, notably reducing its plastic packaging by 54% compared to 2018 levels. This achievement outpaced their initial 2025 goal, demonstrating a strong commitment to environmental responsibility. The company continues to implement comprehensive waste reduction strategies across its operations and supply chain, focusing on minimizing textile waste and adopting more sustainable packaging alternatives.

This focus on plastic reduction is a key part of H&M's broader sustainability efforts. For instance, by the end of 2023, they had achieved a 70% reduction in single-use plastic in their product packaging, a significant step from their 2018 baseline. Their efforts also include exploring innovative materials and circular economy principles to further minimize environmental impact.

- Plastic Packaging Reduction: Achieved a 54% reduction in plastic packaging from 2018 levels, exceeding the 2025 target.

- Single-Use Plastic: Reduced single-use plastic in product packaging by 70% by the end of 2023 (compared to 2018).

- Textile Waste Minimization: Actively working to reduce textile waste throughout the value chain.

- Sustainable Packaging Solutions: Investing in and adopting more environmentally friendly packaging materials and designs.

Promotion of Second-Hand and Resale Models

H&M is increasingly focusing on circular fashion, actively promoting second-hand and resale models. This strategy is designed to encourage more mindful consumption and extend the life of clothing, aligning with growing environmental consciousness among consumers. By 2024, H&M's second-hand offerings had expanded to 26 markets, with in-store options and partnerships like Sellpy facilitating these sales.

This push towards resale is not just an environmental initiative but also a strategic business move. In 2023, the global second-hand apparel market was valued at approximately $198 billion and is projected to reach $352 billion by 2027, demonstrating a significant and growing consumer demand for pre-owned fashion. H&M's involvement taps into this expanding market.

- Market Expansion: H&M's second-hand options are now available in 26 global markets.

- Platform Integration: Initiatives like Sellpy are key to H&M's resale strategy.

- Consumer Trend: The global second-hand apparel market is experiencing robust growth, projected to reach $352 billion by 2027.

H&M is deeply invested in environmental stewardship, evident in their significant progress on decarbonization. They've achieved a 41% reduction in Scope 1 and 2 emissions and a 24% decrease in Scope 3 emissions against a 2019 baseline, with a commitment to eliminate on-site coal use by 2026.

The company's circular economy focus is strong, with 89% of materials being recycled or sustainably sourced by 2024, aiming for 100% by 2030. Water conservation is also a priority, showing a 9.5% reduction in freshwater consumption among garment suppliers, nearing their 10% target.

Waste management is another key area, with a 54% reduction in plastic packaging from 2018 levels achieved, surpassing their 2025 goal. Furthermore, H&M is actively expanding its second-hand and resale offerings, tapping into a global market projected to reach $352 billion by 2027.

| Environmental Initiative | Progress/Target | Baseline Year | Target Year |

|---|---|---|---|

| Scope 1 & 2 Emissions Reduction | 41% Reduction | 2019 | Ongoing |

| Scope 3 Emissions Reduction | 24% Reduction | 2019 | Ongoing |

| Eliminate On-site Coal Use | Targeted | - | 2026 |

| Recycled/Sustainably Sourced Materials | 89% Achieved | - | 2024 |

| Recycled/Sustainably Sourced Materials | 100% Target | - | 2030 |

| Freshwater Consumption Reduction | 9.5% Reduction | - | On track for 10% |

| Plastic Packaging Reduction | 54% Reduction | 2018 | Exceeded 2025 Target |

| Single-Use Plastic in Product Packaging | 70% Reduction | 2018 | End of 2023 |

PESTLE Analysis Data Sources

Our H&M PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the fashion retail industry.