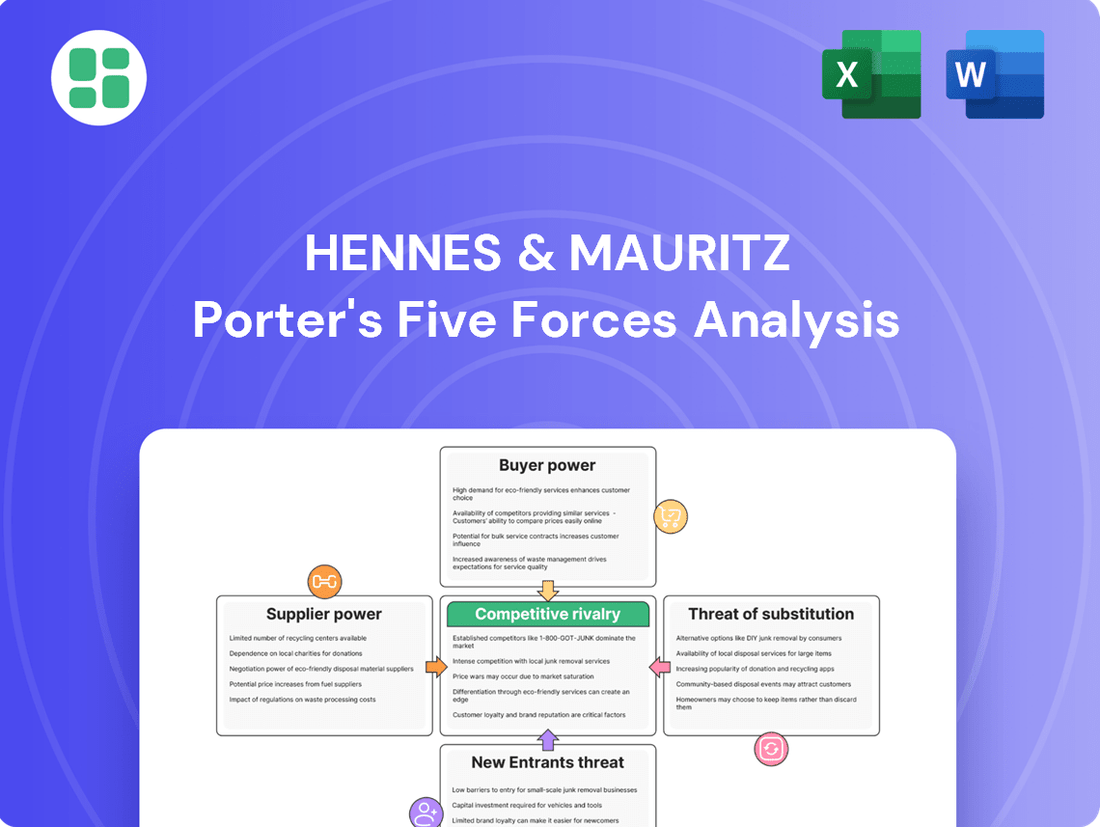

Hennes & Mauritz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hennes & Mauritz Bundle

Hennes & Mauritz (H&M) operates in a highly competitive fashion retail landscape where buyer power is significant due to numerous choices and price sensitivity. The threat of new entrants is moderate, as establishing a brand and supply chain requires substantial capital and expertise, yet online retail lowers some barriers. Intense rivalry among existing players like Zara and fast-fashion giants exerts considerable pressure on H&M's pricing and innovation strategies.

The complete Porter's Five Forces Analysis for H&M delves into the nuanced dynamics of supplier power, the ever-present threat of substitutes beyond traditional apparel, and the intricate competitive rivalry. This comprehensive report offers a granular view of the forces shaping H&M's strategic landscape, providing actionable insights for navigating its market. Unlock the full analysis to gain a deeper understanding of H&M's competitive positioning and future growth potential.

Suppliers Bargaining Power

Hennes & Mauritz (H&M) benefits from a widely dispersed supplier network, engaging with over 900 independent suppliers, predominantly located in Asia and Europe. This extensive base significantly dilutes the bargaining power of any single supplier, as H&M can readily shift production or sourcing to alternative partners. For instance, in 2023, H&M continued its strategy of diversifying its supplier base to mitigate risks associated with geopolitical instability and to secure competitive pricing, a trend that is expected to persist into 2024.

While the sheer number of suppliers limits individual leverage, H&M’s reliance on a select few for specialized fabrics or ethically sourced materials can create pockets of supplier power. The company's commitment to sustainability, for example, means certain certifications or material innovations might only be available from a limited number of approved vendors, granting them increased negotiation strength. This dynamic requires H&M to carefully manage relationships with these key partners to maintain favorable terms.

H&M's commitment to sustainability, aiming for 100% sustainably sourced materials by 2030, with 89% achieved in 2024, significantly boosts the bargaining power of suppliers who can meet these stringent criteria. This focus elevates suppliers with specialized capabilities, effectively narrowing the field of eligible partners and consequently increasing their leverage.

While H&M cultivates some enduring supplier partnerships, the fast-fashion model inherently features relatively low switching costs for basic apparel manufacturing. This accessibility to a wide array of manufacturers, particularly in emerging economies, effectively moderates the bargaining power of suppliers for conventional goods.

However, the equation shifts when considering specialized or sustainably sourced materials. The expense associated with transitioning to new suppliers for these specific components can be substantial, with industry estimates suggesting it can range from 8% to 12% of the overall contract value within the textile sector.

Supplier Dependence on H&M's Volume

H&M's immense production scale and worldwide presence make many of its suppliers heavily reliant on the company for a significant chunk of their revenue. This dependency can weaken suppliers' negotiating leverage, as the loss of H&M's business would severely impact their operations.

The sheer volume H&M moves is a critical factor. For instance, H&M's cost of sales was approximately $10.8 billion in 2024, underscoring the substantial business they provide to their suppliers.

- Supplier Reliance: Many suppliers depend on H&M for a large portion of their sales.

- Reduced Bargaining Power: This reliance limits suppliers' ability to demand higher prices or better terms.

- Financial Impact: Losing H&M as a client would be a major setback for dependent suppliers.

- Scale of Operations: H&M's 2024 cost of sales, around $10.8 billion, illustrates its significant purchasing power.

Risk of Forward Integration by Suppliers

While uncommon in the intricate fashion sector, a theoretical risk exists for suppliers to move into retail operations, thereby enhancing their leverage. This forward integration would mean suppliers taking over the selling of their products directly to consumers, bypassing brands like H&M.

However, the substantial financial outlay, the intricate process of building a recognizable brand, and the necessity of establishing extensive distribution channels make this a less likely scenario for H&M's suppliers. The fashion retail landscape demands significant investment in marketing, store management, and e-commerce infrastructure.

H&M's robust brand portfolio, which includes names like COS, Weekday, and Monki, alongside its well-developed omni-channel retail strategy, serves as a formidable barrier. This integrated approach, encompassing both online and physical stores, makes it difficult for suppliers to compete effectively if they were to attempt forward integration.

- Supplier Forward Integration Risk: While theoretically possible, suppliers integrating forward into fashion retail is a low probability threat for H&M.

- Barriers to Entry for Suppliers: Significant capital investment, brand development, and distribution network establishment are major hurdles for suppliers considering retail.

- H&M's Deterrents: H&M's strong brand portfolio and established omni-channel presence effectively discourage supplier forward integration.

H&M's expansive supplier base, exceeding 900 partners, predominantly in Asia and Europe, significantly diminishes individual supplier bargaining power. This broad network allows H&M to readily switch sourcing, a strategy reinforced in 2023 and continuing into 2024 to secure competitive pricing and mitigate risks. The company's 2024 cost of sales, around $10.8 billion, highlights its substantial purchasing volume, making suppliers reliant on H&M and thus limiting their leverage.

| Factor | H&M's Position | Supplier Bargaining Power |

|---|---|---|

| Number of Suppliers | Over 900, dispersed globally | Low for individual suppliers |

| Supplier Reliance on H&M | High for many | Reduced leverage for suppliers |

| H&M's Purchasing Scale | Significant (e.g., $10.8 billion cost of sales in 2024) | Weakens supplier price demands |

| Switching Costs (Basic Goods) | Low | Limited ability to dictate terms |

| Switching Costs (Specialty/Sustainable) | Moderate to High | Increased leverage for qualified suppliers |

What is included in the product

This analysis delves into the competitive forces impacting Hennes & Mauritz, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the fashion retail sector.

Effortlessly identify and mitigate competitive threats by visualizing H&M's industry landscape with a dynamic Porter's Five Forces analysis.

Customers Bargaining Power

Customers in the fast-fashion sector, including H&M's clientele, exhibit significant price sensitivity. They can readily switch between brands without incurring substantial costs, making them powerful negotiators. This dynamic means H&M must continuously offer competitive prices and rapidly update its fashion collections to retain its customer base.

The ease of online price comparison significantly amplifies customer bargaining power. Globally, approximately 70% of consumers research products online before making a purchase, enabling them to identify the best deals. This transparency forces retailers like H&M to remain vigilant about their pricing strategies and product assortment.

The relentless speed of fashion trends, amplified by social media and influential figures, grants consumers substantial leverage in shaping demand. H&M faces pressure to adapt swiftly to these shifting tastes, as shoppers can easily pivot to brands offering the newest styles, impacting sales volumes significantly.

Brands like Shein exemplify this by expertly utilizing social media to introduce trending styles within days, often at lower price points, directly challenging established players. This dynamic means H&M's ability to quickly translate online buzz into available inventory is crucial for maintaining customer loyalty and market share.

The fast-fashion landscape is incredibly crowded, with brands like Zara, ASOS, and Boohoo offering similar styles and price points. This saturation means customers have a plethora of options readily available.

This abundance directly translates to increased bargaining power for consumers. If H&M's prices are too high or their selection isn't to a customer's liking, they can easily switch to a competitor. For instance, Shein has captured a significant 50% of the US fast fashion market, demonstrating the ease with which consumers can find alternatives.

Growing Demand for Sustainability and Ethics

Consumers are increasingly prioritizing sustainability and ethical practices when making purchasing decisions. This growing awareness empowers customers to select brands that align with their values, directly influencing the demand for eco-friendly and transparent fashion. H&M, recognizing this trend, has been investing in initiatives to meet these expectations.

- Consumer Awareness: A significant portion of consumers now actively seek information about a brand's environmental footprint and labor practices.

- Brand Loyalty: Brands demonstrating a commitment to sustainability often foster stronger customer loyalty among eco-conscious demographics.

- H&M's Initiatives: H&M's 2024 sustainability report detailed progress in increasing the use of recycled materials, aiming for 100% recycled or sustainably sourced materials by 2030.

- Impact on Bargaining Power: This demand shift grants customers greater leverage, as they can choose to patronize or boycott brands based on their sustainability performance, forcing companies to adapt.

Omni-channel Shopping Experience

H&M's commitment to an integrated omni-channel shopping experience significantly influences customer bargaining power. By offering seamless transitions between its extensive online platforms and physical retail stores, complemented by services like click-and-collect and easy returns, H&M enhances customer convenience and choice. This robust omni-channel strategy, with online sales representing approximately 30% of total sales in 2024, provides customers with greater flexibility and leverage.

This seamless integration across touchpoints, while strengthening the overall brand experience, inherently empowers customers. They can easily compare prices, access product information, and switch between channels based on their preferences and perceived value. This increased control and accessibility directly translate to a higher bargaining power for consumers interacting with H&M.

- Omni-channel Integration: H&M's strategy connects online and physical stores, offering services like click-and-collect.

- Customer Convenience: This approach provides customers with enhanced choice and flexibility in their shopping journey.

- Increased Bargaining Power: Seamless cross-channel options empower customers by giving them more control and comparison opportunities.

- 2024 Sales Data: Approximately 30% of H&M's sales were generated online in 2024, highlighting the importance of digital channels.

The bargaining power of customers for H&M is considerable, driven by price sensitivity and the ease of switching brands in the competitive fast-fashion market. With numerous alternatives available, consumers can readily compare prices and styles, forcing H&M to maintain competitive pricing and a rapid product turnover. This dynamic is further amplified by the transparency afforded by online price comparison tools, which are utilized by a vast majority of shoppers to find the best deals.

| Factor | Impact on H&M | Supporting Data/Trend |

|---|---|---|

| Price Sensitivity | High | Customers readily switch for better prices. |

| Availability of Alternatives | High | Crowded market with brands like Zara, ASOS, Shein. |

| Online Price Comparison | Significant | ~70% of consumers research online before purchase. |

| Trend Responsiveness | Crucial | Social media drives rapid style adoption. |

| Sustainability Awareness | Growing | H&M aims for 100% recycled/sustainable materials by 2030. |

Preview the Actual Deliverable

Hennes & Mauritz Porter's Five Forces Analysis

This preview displays the complete Hennes & Mauritz Porter's Five Forces Analysis, meaning the document you see here is precisely the same comprehensive report you will receive immediately after purchase. You can be confident that no placeholders or sample sections are included; what you're previewing is the final, professionally formatted analysis, ready for your immediate use and download. This ensures you get exactly what you need to understand H&M's competitive landscape without any surprises.

Rivalry Among Competitors

The fast-fashion arena is crowded, with numerous global and local players vying for consumer attention, intensifying competitive rivalry. H&M faces fierce competition from direct fast-fashion counterparts such as Zara and Shein, as well as established casualwear brands and increasingly influential online-only retailers. This saturation makes significant market share expansion a considerable hurdle for all participants.

While H&M cultivates a degree of loyalty within its established customer base, the wider fashion industry is characterized by a notable lack of deep consumer allegiance. This means shoppers frequently prioritize factors like affordability, the latest styles, and overall perceived value over sticking with a single brand. For instance, a 2024 report indicated that over 60% of apparel purchases are influenced by promotions and sales, underscoring this price sensitivity.

Consequently, H&M must continually adapt and refresh its product lines to capture and retain customer attention. The intense competition means that failing to stay ahead of rapidly changing trends or offer compelling price points can quickly lead to customers defecting to rival retailers. This dynamic necessitates a proactive approach to design, sourcing, and marketing to maintain relevance in a fickle market.

The fast fashion landscape is defined by intense competition, where aggressive pricing and swift product launches are paramount. H&M faces pressure to match rivals who prioritize speed and affordability, a characteristic exemplified by companies like Shein. This dynamic necessitates constant acceleration in product development and supply chain agility.

The core of fast fashion is the rapid delivery of on-trend, budget-friendly apparel. This translates into fierce price wars and incredibly short product lifecycles among industry players. H&M must therefore continually enhance its product development timelines and supply chain efficiency to remain competitive against businesses known for their ultra-low prices and quick adoption of emerging trends. The industry itself operates at a breakneck pace, with over 52 'micro-seasons' occurring annually, demanding constant innovation and responsiveness.

Online Dominance and Digital Transformation

The fashion retail landscape is increasingly shaped by online dominance, with social media and e-commerce platforms fueling intense competition. Online-only brands present a formidable challenge to established players like H&M.

H&M is actively addressing this by investing significantly in its digital transformation. This includes enhancing its e-commerce capabilities and strengthening its omnichannel strategy to provide a seamless customer experience across all touchpoints. In 2024, online sales represented over 30% of H&M's total revenue, highlighting the critical importance of this digital push.

- Increased Competition: Social media and e-commerce platforms have lowered barriers to entry, allowing agile online-only competitors to gain market share rapidly.

- Digital Investment: H&M's commitment to digital transformation is crucial for staying competitive, aiming to improve online presence and customer engagement.

- Omnichannel Strategy: Integrating online and physical store experiences is key to meeting evolving consumer expectations for convenience and accessibility.

- Online Sales Growth: The significant portion of sales generated online in 2024 underscores the strategic imperative for H&M to excel in the digital realm.

Differentiating Through Sustainability and Quality

H&M is increasingly distinguishing itself in a crowded market by moving beyond just competitive pricing. The company is focusing on enhancing product quality and integrating sustainable practices into its operations. This strategic shift is designed to attract consumers who value both style and ethical considerations, a growing segment of the market.

This emphasis on sustainability and quality is crucial for H&M to stand out against competitors. For instance, in 2023, H&M Group reported that 83% of its materials were sourced from more sustainable options, a significant step towards its 2030 goal of using 100% recycled or sustainably sourced materials. This commitment resonates with a consumer base increasingly concerned about the environmental impact of their purchases.

- Enhanced Quality Focus: H&M is investing in better materials and construction to improve product durability and appeal.

- Sustainability Initiatives: The company is actively pursuing goals for recycled and sustainably sourced materials, aiming for 100% by 2030.

- Brand Collaborations: Strategic partnerships continue to be a tool for H&M to create unique offerings and attract new customer segments.

- Consumer Demand Shift: There's a clear market trend showing consumers are willing to pay more for products that align with their values regarding sustainability and ethical production.

Competitive rivalry within the fast-fashion sector remains exceptionally high, with H&M contending against a multitude of global and local brands. Key competitors like Zara and Shein, alongside numerous online-only retailers, constantly challenge H&M's market position through aggressive pricing and rapid trend adoption. This intense competition means that customer loyalty is often fluid, with shoppers frequently prioritizing price and style over brand allegiance, as evidenced by over 60% of apparel purchases being influenced by promotions in 2024.

H&M's strategic response involves not only digital transformation, with online sales accounting for over 30% of revenue in 2024, but also a focus on enhancing product quality and sustainability. By investing in better materials and sourcing, aiming for 100% recycled or sustainably sourced materials by 2030, H&M seeks to differentiate itself and appeal to a growing segment of environmentally conscious consumers. This dual approach of digital prowess and ethical differentiation is critical for navigating the hyper-competitive fast-fashion landscape.

| Competitor | Key Differentiator | 2024 Market Share (Est.) | Key Strategy |

|---|---|---|---|

| Zara | Trend responsiveness, in-house design | 10-12% | Rapid product cycles, prime store locations |

| Shein | Ultra-low pricing, vast online selection | 15-18% | Aggressive social media marketing, direct-to-consumer model |

| Boohoo | Affordable online fashion, influencer marketing | 3-5% | Targeted digital advertising, rapid product drops |

| H&M | Sustainability focus, brand collaborations | 8-10% | Omnichannel experience, digital investment, quality improvement |

SSubstitutes Threaten

The burgeoning second-hand and resale market poses a considerable threat to traditional fashion retailers like H&M. Consumers are increasingly drawn to pre-owned clothing, vintage finds, and resale platforms, seeking affordability, unique styles, and more sustainable shopping choices. This trend directly competes with the demand for new fast-fashion items.

The global second-hand apparel market is experiencing robust growth, with projections indicating it could reach $350 billion by 2027. This expansion highlights a significant shift in consumer behavior, favoring circular economy principles over constant new purchases. Platforms like Depop, Vinted, and ThredUp have gained substantial traction, offering consumers an accessible way to buy and sell used clothing.

H&M is actively addressing this substitute threat by engaging with the resale market. The company's investment in and ownership of Sellpy, a leading European online second-hand platform, demonstrates a strategic move to capture value from this growing segment. Furthermore, H&M has expanded its own pre-owned offerings to 26 markets, directly participating in and benefiting from the resale trend, thereby mitigating the direct loss of sales to these alternative channels.

The growing consumer demand for sustainable and ethical fashion presents a significant threat of substitutes for H&M. As awareness of fast fashion's environmental toll and labor practices increases, shoppers are increasingly turning to brands that prioritize slow fashion, organic materials, and transparent supply chains. For example, in 2024, the global sustainable fashion market was projected to reach over $10 billion, indicating a substantial shift in consumer preferences.

Consumers increasingly seek unique styles and ways to reduce waste, leading them to DIY clothing, upcycling, or customized apparel. These alternatives, while currently a smaller segment, directly substitute for mass-produced fast fashion. For instance, the resale market for clothing, which often involves upcycling or unique finds, saw significant growth. In 2023, the global secondhand apparel market was valued at approximately $190 billion and is projected to reach $350 billion by 2027, indicating a growing consumer preference for individualized and sustainable fashion options.

H&M is actively responding to this trend by experimenting with customization services within some of its revamped store locations. This strategic move aims to cater to the growing consumer desire for personalization and unique fashion pieces, directly addressing the threat posed by DIY and custom apparel alternatives.

Rental and Subscription Fashion Models

The rise of rental and subscription fashion models presents a significant threat of substitutes for Hennes & Mauritz. These services allow consumers to access a variety of clothing for a recurring fee, bypassing the need to buy new items frequently. This is particularly attractive to those who value variety and sustainability.

The appeal of these models is growing, driven by changing consumer preferences and a desire for more sustainable consumption patterns. For instance, Rent the Runway, a prominent player, reported a significant increase in its subscriber base in recent years, indicating a shift in how consumers approach fashion acquisition.

- Growing Market: The global online clothing rental market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years.

- Consumer Appeal: These models cater to a desire for novelty and reduce the perceived commitment and cost associated with owning a large, diverse wardrobe.

- Sustainability Focus: Many consumers, especially younger demographics, are increasingly drawn to rental services as a more environmentally conscious alternative to fast fashion.

Luxury and Designer Brands (Accessible Lines)

Accessible lines from luxury and designer brands present a significant threat of substitution. Even though they operate at a different price point, these offerings can attract consumers who prioritize perceived quality, distinctive design, or the prestige associated with a higher-end brand. This dynamic is particularly relevant as fast fashion initially disrupted the traditional luxury market, and now, the boundaries between segments are increasingly blurred, with consumers actively seeking value across various tiers.

For instance, in 2024, brands like Michael Kors, Coach, and Kate Spade have continued to expand their more affordable diffusion lines. These lines allow consumers to access elements of luxury styling and branding at a more accessible price, directly competing with mid-tier fashion retailers. The global accessible luxury market was valued at approximately $250 billion in 2023, and projections indicate continued growth, underscoring the competitive pressure these brands exert.

- Accessible Luxury Brands: Companies like Michael Kors, Coach, and Kate Spade offer more affordable product lines that mimic the style and perceived quality of high-end fashion.

- Consumer Behavior Shift: Consumers are increasingly willing to trade down for perceived value, making accessible luxury lines a viable substitute for traditional mid-tier offerings.

- Market Growth: The accessible luxury sector experienced significant growth in 2023 and is expected to continue expanding, indicating a sustained threat to brands not participating in this segment.

The growing demand for sustainable and ethical fashion directly substitutes for H&M's fast-fashion model. As consumers become more aware of the environmental and social impact of their clothing choices, they increasingly opt for brands prioritizing slow fashion, organic materials, and transparent supply chains. The global sustainable fashion market's projected growth to over $10 billion in 2024 underscores this significant shift in consumer preferences.

DIY, upcycling, and customized apparel offer unique alternatives to mass-produced fast fashion, catering to consumers seeking individuality and waste reduction. The significant growth of the resale market, valued at approximately $190 billion in 2023 and projected to reach $350 billion by 2027, highlights a growing consumer preference for personalized and sustainable fashion options.

Rental and subscription fashion services provide a compelling substitute by offering variety and access to clothing without the need for frequent purchases, appealing to sustainability-conscious consumers. The online clothing rental market's projected compound annual growth rate of over 10% indicates a growing consumer preference for these flexible and eco-friendly fashion acquisition models.

Accessible luxury brands, such as Michael Kors and Coach, with their diffusion lines, pose a threat by offering elements of high-end styling and branding at more attainable price points. The accessible luxury market, valued at approximately $250 billion in 2023, continues to grow, attracting consumers who seek perceived value and aspirational brands.

| Substitute Type | Market Size/Growth Indicator | Impact on H&M |

|---|---|---|

| Second-hand/Resale Market | Valued at ~$190B in 2023, projected to reach $350B by 2027 | Direct competition for new garment sales; H&M's investment in Sellpy mitigates some impact. |

| Sustainable/Ethical Fashion | Global market projected to exceed $10B in 2024 | Shifts consumer preference away from fast fashion's environmental footprint. |

| Rental/Subscription Services | CAGR projected >10% for online clothing rental | Reduces the need for frequent new purchases, appealing to variety and sustainability. |

| Accessible Luxury Brands | Accessible luxury market valued at ~$250B in 2023 | Attracts consumers seeking aspirational brands and perceived quality at lower price points than traditional luxury. |

Entrants Threaten

The apparel industry, especially fast fashion, requires relatively low technical expertise. This, coupled with the widespread availability of e-commerce, significantly lowers the barrier to entry for new businesses. Companies can now launch online stores with minimal upfront investment in physical retail space, making it easier than ever for aspiring entrepreneurs to compete.

The growth of direct-to-consumer (DTC) models further amplifies this threat. For instance, in 2024, the global e-commerce market for apparel continued its upward trajectory, with projections indicating substantial growth. This accessibility means that a new online-only brand can emerge and gain traction quickly, directly challenging established players like H&M by offering unique styles or competitive pricing without the overhead of brick-and-mortar operations.

While opening a small boutique might seem accessible, truly challenging a global giant like H&M necessitates significant financial backing. This capital is crucial for everything from securing large-scale manufacturing to launching impactful advertising campaigns and cultivating a recognizable brand identity. For instance, in 2024, the fast fashion industry continues to see massive marketing spend, with major players dedicating hundreds of millions to reach consumers worldwide.

Newcomers must achieve rapid growth to gain economies of scale and cost efficiencies. Without this, they simply cannot match the competitive pricing and operational advantages that H&M has built through its established global supply chain and production infrastructure. This scale is vital for absorbing the costs associated with sourcing materials, manufacturing garments, and distributing them across numerous markets.

H&M's deeply entrenched and highly efficient global supply chain and distribution network, honed over decades, presents a formidable obstacle for any aspiring new entrant. This intricate web of operations, which ensures products reach consumers quickly and cost-effectively, is not easily replicated. For instance, in 2023, H&M reported a significant portion of its inventory turnover, underscoring the speed and efficiency of its logistics.

Strong Brand Recognition and Customer Loyalty

H&M's established brand recognition acts as a significant barrier to entry. New competitors must invest heavily to build comparable awareness and trust, a costly endeavor in the fast-fashion landscape. This strong brand equity, cultivated over decades, makes it difficult for newcomers to swiftly gain traction and market share against a well-known entity.

While the fast-fashion sector can see fickle customer loyalty, H&M's strategic approach of managing a portfolio of brands, such as COS, Monki, and & Other Stories, helps to mitigate this. This diversification allows them to appeal to different customer segments and price points, fostering a more robust and retained customer base that new entrants would struggle to replicate quickly.

In 2023, H&M Group's net sales reached SEK 236,034 million (approximately USD 22.5 billion), underscoring the scale of its operations and the financial muscle required for a new entrant to compete effectively. This financial scale, coupled with brand recognition, presents a formidable challenge.

- Brand Recognition: H&M's global presence and marketing efforts have cemented its position as a household name in fashion.

- Customer Loyalty: Despite the nature of fast fashion, H&M's multi-brand strategy fosters a degree of loyalty by catering to diverse tastes.

- Marketing Investment: New entrants face substantial marketing costs to achieve comparable brand visibility and customer acquisition.

- Economies of Scale: H&M's large operational scale provides cost advantages that are difficult for smaller, newer companies to match.

Aggressive Marketing and Innovation by Incumbents

H&M and other established fashion retailers actively deter new entrants by deploying robust marketing strategies and consistently innovating. For instance, H&M's commitment to sustainability, including its garment collection program and increased use of recycled materials, serves as a differentiator that new, smaller competitors may struggle to replicate quickly. This ongoing investment in brand image and product evolution raises the barrier to entry.

The threat of new entrants is further mitigated by incumbents' rapid adoption of new business models. H&M's exploration of the second-hand market, such as through partnerships or internal initiatives, directly competes with potential new entrants focused on resale. This proactive diversification makes it more challenging for newcomers to carve out a niche.

- Aggressive Marketing: H&M invested €1.7 billion in marketing and advertising in 2023, aiming to maintain brand visibility and customer loyalty against potential disruptors.

- Product Innovation: The company launched its Conscious Choice collection in Spring 2024, featuring items made with at least 50% more sustainable materials, signaling a commitment to evolving consumer demands.

- Business Model Adaptation: H&M's expansion into rental services and its continued focus on digital channels and personalized shopping experiences create a more integrated customer journey that new entrants must contend with.

While the fast fashion industry has a relatively low technical barrier to entry, particularly with the rise of e-commerce, significant financial capital is needed to truly compete. New entrants must invest heavily in marketing and brand building to challenge established players like H&M, which spent approximately USD 22.5 billion in net sales in 2023. This scale of investment, coupled with H&M's efficient global supply chain and strong brand recognition, makes it difficult for newcomers to achieve economies of scale and offer competitive pricing.

| Factor | Impact on H&M | New Entrant Challenge |

|---|---|---|

| Capital Requirements | High, enabling large-scale operations and marketing. | Significant hurdle; requires substantial funding for market entry and growth. |

| Brand Recognition | Strong global presence and established trust. | Requires extensive marketing spend to build comparable awareness. |

| Economies of Scale | Cost advantages from large-scale production and sourcing. | Difficult to achieve initially, leading to higher per-unit costs. |

| Supply Chain Efficiency | Decades of optimization for speed and cost-effectiveness. | Complex and costly to replicate; H&M's inventory turnover in 2023 highlights this efficiency. |

Porter's Five Forces Analysis Data Sources

Our H&M Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate data from competitor announcements and trade publications to capture current market dynamics and strategic positioning.