Hennes & Mauritz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hennes & Mauritz Bundle

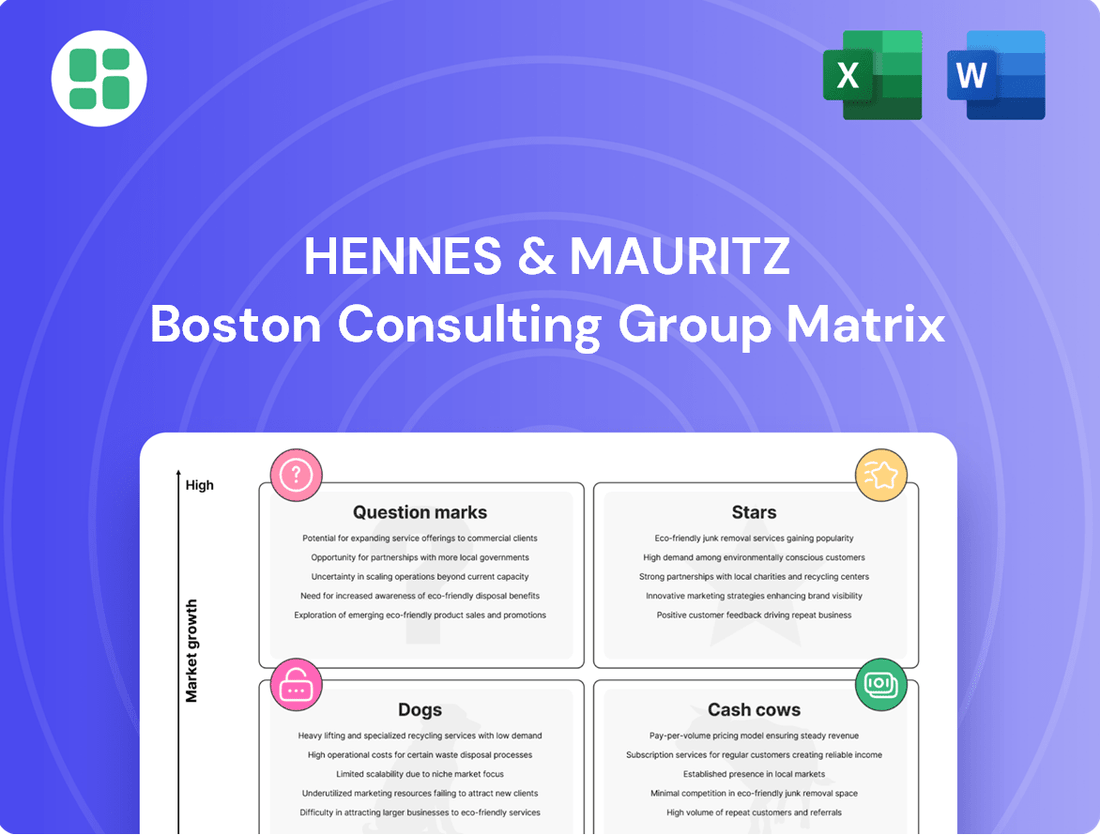

Curious about Hennes & Mauritz's product portfolio performance? Our BCG Matrix analysis reveals which brands are market leaders, which are cash generators, and which might be underperforming. Understanding these placements is crucial for strategic resource allocation and future growth.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for H&M.

Stars

H&M's online sales are a standout performer, consistently demonstrating robust growth and increasing market penetration. This digital channel is clearly a high-growth area for the company.

Significant investments in enhancing the online store experience have resonated well with customers, further fueling the positive momentum in this crucial sales channel.

In fiscal year 2024, online sales accounted for approximately 30% of H&M's total revenue, underscoring their substantial contribution and continued upward trajectory.

H&M's womenswear collections are shining stars in the company's portfolio. These collections have been particularly well-received, driving positive sales growth in recent quarters. For instance, in the first quarter of fiscal year 2024, H&M reported a net sales increase of 3% in Swedish krona, with womenswear being a significant contributor to this uplift.

The strong market share within its category is a testament to H&M's brand appeal and its ability to quickly adapt to fashion trends. This responsiveness allows H&M to capture a significant portion of the market, solidifying its position. The company's continued investment in and focus on these core offerings are crucial for maintaining its star status and overall sales performance.

H&M is making substantial progress in sustainability, with 89% of materials recycled or sustainably sourced in 2024, nearing its 2025 target ahead of schedule.

Initiatives like expanding pre-owned offerings and the Sellpy platform cater to a rapidly growing eco-conscious consumer segment.

These efforts position H&M as a leader in sustainable fashion, driving future growth and market share in this critical area.

H&M Move

H&M Move, the company's activewear line, showed encouraging progress in the second quarter of 2025. This segment is capitalizing on the expanding active and athleisure wear market, demonstrating H&M's ability to gain ground. As a more recent strategic focus, its robust performance indicates successful market share acquisition within a rapidly growing sector.

The positive trajectory of H&M Move highlights a strategic expansion into a segment with significant consumer demand. This development is particularly noteworthy given the competitive landscape of activewear. The brand's growth here suggests a successful product offering and marketing strategy.

- H&M Move's Q2 2025 performance indicated positive development.

- The activewear segment is a growing market where H&M is gaining traction.

- This focus area is capturing market share in a high-growth category.

Expansion in High-Growth Digital Marketplaces

H&M is strategically expanding its presence on high-growth digital marketplaces. This includes ventures onto platforms like Douyin and Pinduoduo in China, Ajio.com in India, Trendyol.com in Turkey, and in Saudi Arabia.

While H&M's market share on these specific platforms may currently be small, the rapid expansion of these digital marketplaces presents substantial growth potential. For instance, China's e-commerce market is projected to reach over $3.7 trillion by 2025, with platforms like Douyin and Pinduoduo experiencing significant user growth.

This strategy is designed to tap into new customer demographics and broaden H&M's digital reach. The focus on these burgeoning online channels underscores a commitment to adapting to evolving consumer shopping habits and capturing future market share in key growth regions.

- Douyin and Pinduoduo in China: Targeting a vast and rapidly growing online consumer base.

- Ajio.com in India: Leveraging India's booming e-commerce sector, which saw online retail sales exceed $80 billion in 2023.

- Trendyol.com in Turkey and Saudi Arabia: Expanding into dynamic markets with increasing digital penetration and online shopping preferences.

H&M's online sales are a star performer, consistently demonstrating robust growth and increasing market penetration. This digital channel is clearly a high-growth area for the company, with significant investments in enhancing the online store experience resonating well with customers. In fiscal year 2024, online sales accounted for approximately 30% of H&M's total revenue, underscoring their substantial contribution and continued upward trajectory.

H&M's womenswear collections are shining stars in the company's portfolio, driving positive sales growth. In the first quarter of fiscal year 2024, H&M reported a net sales increase of 3% in Swedish krona, with womenswear being a significant contributor. The strong market share within its category is a testament to H&M's brand appeal and its ability to quickly adapt to fashion trends, solidifying its position.

H&M Move, the company's activewear line, showed encouraging progress in the second quarter of 2025, capitalizing on the expanding active and athleisure wear market. Its robust performance indicates successful market share acquisition within a rapidly growing sector, highlighting a strategic expansion into a segment with significant consumer demand.

H&M is strategically expanding its presence on high-growth digital marketplaces like Douyin and Pinduoduo in China, Ajio.com in India, and Trendyol.com in Turkey and Saudi Arabia. While market share on these platforms may be small, the rapid expansion of these digital marketplaces presents substantial growth potential, tapping into new customer demographics and broadening H&M's digital reach.

| Business Unit | BCG Category | Key Performance Indicators | 2024 Data/Outlook |

|---|---|---|---|

| Online Sales | Star | Revenue Growth, Market Penetration | Approx. 30% of total revenue in FY24; continued upward trajectory. |

| Womenswear Collections | Star | Sales Growth, Market Share | Significant contributor to 3% net sales increase (SEK) in Q1 FY24; strong brand appeal. |

| H&M Move (Activewear) | Question Mark/Star (emerging) | Market Share Acquisition, Segment Growth | Positive progress in Q2 2025; capitalizing on expanding athleisure market. |

| Digital Marketplaces Expansion | Question Mark | New Market Entry, User Growth Potential | Expansion into Douyin, Pinduoduo, Ajio.com, Trendyol.com; China e-commerce market projected over $3.7 trillion by 2025. |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for H&M's Stars, Cash Cows, Question Marks, and Dogs.

H&M's BCG Matrix offers a clear, one-page overview, relieving the pain of unclear strategic direction for each business unit.

Cash Cows

The core H&M brand, especially in established European markets like Germany and Poland, remains a significant revenue generator for the company. These mature regions, despite ongoing store portfolio adjustments, solidify H&M's stable market share.

These established European markets are crucial for H&M's financial stability, consistently delivering the cash flow needed to fund other business initiatives and cover operational expenses. For instance, in the first quarter of fiscal year 2024, H&M Group reported net sales of SEK 54,403 million, with a significant portion attributable to its European operations.

COS, as a higher-priced brand within the H&M Group, has demonstrated robust financial performance, acting as a significant contributor to the group's overall profitability. Its strategic positioning in the more premium segment of the fashion market underscores a loyal customer base and a solidified market presence within its specific niche.

This brand functions as a stable cash generator for H&M, benefiting from its well-established brand identity and sustained customer appeal. For instance, in the first quarter of 2024, H&M Group reported a pre-tax profit of SEK 2.08 billion, with brands like COS playing a crucial role in achieving these results through their consistent revenue streams.

H&M Home capitalizes on H&M's strong brand equity to offer stylish, budget-friendly home furnishings. This segment likely enjoys a significant market share in its accessible price category, benefiting from cross-promotional activities with the core fashion business.

The home goods division acts as a cash cow for Hennes & Mauritz, generating consistent revenue and broadening the company's overall product portfolio. For the fiscal year 2023, H&M Group reported a total net sales of SEK 236.0 billion, and while specific segment breakdowns for H&M Home are not always granularly disclosed, its contribution to overall profitability is understood to be substantial due to its established market position and efficient operational model.

Weekday Brand

Weekday, a key brand within the H&M Group, is strategically integrating with Monki, signaling its robust market position and established customer base. This consolidation aims to leverage synergies and enhance operational efficiency.

The brand's ongoing operations and its role in the expansion of H&M's multi-brand strategy underscore its stable market share among its target demographic. Weekday is positioned to generate consistent cash flow for the parent company.

- Market Presence: Weekday maintains a significant presence in key European markets, with a strong online and physical retail footprint.

- Integration Benefits: The integration with Monki is expected to streamline supply chains and marketing efforts, potentially boosting profitability.

- Cash Flow Generation: As a mature brand, Weekday is anticipated to contribute stable and predictable cash flows, characteristic of a Cash Cow in the BCG matrix.

- Target Demographic: Weekday primarily targets fashion-conscious young adults, a segment that continues to drive sales for the H&M Group.

Basic Apparel and Everyday Collections

H&M's basic apparel and everyday collections are the bedrock of its business, consistently driving sales. These are the go-to items for many consumers seeking affordable, fashionable basics for daily wear. This segment benefits from H&M's extensive global presence and its ability to offer competitive pricing, securing a substantial share in a well-established market.

These staple collections are reliable revenue streams for H&M. Their continuous demand stems from their role as essential wardrobe pieces. For instance, in fiscal year 2023, H&M Group reported a net sales increase of 6% in local currencies, with a significant portion attributed to these foundational offerings.

- Foundational Offering: Affordable, trend-conscious basic apparel and everyday collections for all demographics.

- Market Position: High-volume, staple items in a large, mature market, benefiting from widespread appeal and competitive pricing.

- Financial Contribution: Consistent cash generators due to continuous consumer demand for essentials, contributing significantly to overall sales growth.

H&M's core brand, particularly in its established European markets, acts as a significant cash cow. These regions, such as Germany and Poland, contribute substantially to the company's revenue and provide the stable cash flow needed to support other ventures. For the first quarter of fiscal year 2024, H&M Group reported net sales of SEK 54,403 million, with a notable portion originating from these mature European operations.

The COS brand, positioned in the more premium segment, also functions as a reliable cash generator for H&M. Its strong brand identity and loyal customer base ensure consistent revenue streams, contributing significantly to overall profitability. In Q1 2024, H&M Group's pre-tax profit reached SEK 2.08 billion, with brands like COS playing a vital role in this financial performance.

H&M Home leverages the parent company's brand equity to offer accessible home furnishings, solidifying its position as a cash cow. This segment benefits from cross-promotional activities and a strong market share in its price category. While specific segment data for H&M Home isn't always detailed, its contribution to the H&M Group's total net sales of SEK 236.0 billion in fiscal year 2023 is understood to be substantial due to efficient operations and established market presence.

Weekday, as a mature brand within the H&M Group, also contributes stable cash flows. Its integration with Monki is designed to enhance operational efficiency and leverage synergies. Weekday's significant presence in key European markets and its appeal to fashion-conscious young adults underscore its role as a predictable revenue generator for the company.

Delivered as Shown

Hennes & Mauritz BCG Matrix

The Hennes & Mauritz BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, just the comprehensive strategic analysis ready for immediate application. You're not looking at a mockup; this is the actual document, meticulously crafted for clarity and professional use in your business planning.

Dogs

H&M's strategy involves closing underperforming physical stores, especially in mature markets. This move reflects a need to streamline operations and focus on more profitable ventures. For instance, H&M reported a net decrease in stores in its 2023 fiscal year, a trend continuing from previous years as it adapts to changing consumer habits.

Monki, operating as a standalone physical retail brand within the Hennes & Mauritz (H&M) group, has been categorized as a potential 'dog' in the BCG Matrix. This classification stems from its struggles, evidenced by reported wind-down costs associated with its physical stores and a strategic pivot to integrate its operations into Weekday stores and online platforms.

The decision to phase out Monki's independent physical footprint indicates a low market share and limited growth prospects in the physical retail space. For instance, H&M Group's financial reports for 2023 highlighted the costs associated with restructuring its brands, with Monki's store closures contributing to this. This move reflects a broader trend of retailers re-evaluating their physical store portfolios in favor of more agile, digitally integrated models.

Afound, H&M Group's outlet concept, is being wound down, signaling a strategic exit from a business unit with low market share and limited growth potential. This move underscores H&M's focus on optimizing its portfolio by divesting underperforming ventures.

The closure of Afound signifies a strategic decision to reallocate resources away from ventures that are not meeting profitability or growth objectives. Such closures often indicate that the business unit was not generating sufficient returns to justify continued investment.

Afound likely represented a cash trap for the H&M Group, consuming capital without delivering the expected returns. By exiting this concept, the company aims to free up capital for more promising initiatives within its brand portfolio.

Specific Geographical Regions with Sales Declines

In the fiscal year 2024, H&M encountered sales headwinds in several key geographical areas. The Nordics, a traditional stronghold, and significant markets in North and South America, experienced weaker growth or outright declines. This trend suggests a potential shift in consumer behavior, with inflationary pressures prompting shoppers in these regions to seek out more budget-friendly options.

These specific geographical segments, where H&M's market performance has faltered, warrant a close strategic examination. The company's market share and growth trajectory in these areas have stagnated or reversed, indicating a need for a thorough re-evaluation of its market approach.

- Nordic Markets: Reported weaker growth in FY2024.

- North America: Experienced sales declines in FY2024.

- South America: Also saw weaker growth or declines in FY2024.

- Consumer Behavior: Inflationary challenges leading consumers to favor cheaper alternatives in affected regions.

Older, Less Responsive Inventory

Hennes & Mauritz (H&M) has grappled with a growing volume of older, less responsive inventory. This situation often necessitates significant markdowns to clear stock, a direct consequence of external economic pressures and rapidly shifting consumer preferences. For example, in the first quarter of 2024, H&M reported a 10% increase in its inventory value year-on-year, reaching SEK 46.5 billion (approximately $4.4 billion USD), indicating a challenge in moving goods efficiently.

These less responsive items, often those not aligning with current fashion trends or hampered by supply chain delays, can be categorized as 'dogs' within the BCG matrix framework. Their profitability is significantly eroded by the holding costs associated with warehousing and the reduced margins from necessary price reductions. This ties up valuable capital that could be allocated to more promising product lines.

- Inventory Challenges: H&M's inventory levels have been a point of concern, with a notable increase in older stock requiring clearance.

- Markdown Impact: The need to discount these items directly impacts profit margins, turning them into less profitable assets.

- Cash Consumption: Holding costs for unsold merchandise and the reduced revenue from markdowns drain the company's cash flow.

- Strategic Implications: Identifying and managing these 'dog' products is crucial for optimizing capital allocation and improving overall financial performance.

In the H&M Group's portfolio, brands or concepts exhibiting low market share and slow growth are considered 'dogs'. These units often consume resources without generating significant returns, prompting strategic reviews for potential divestment or restructuring.

Monki's physical retail operations and Afound's outlet concept are prime examples of H&M's 'dogs'. Both have faced strategic wind-downs or integration into other formats, reflecting their underperformance in their respective market segments.

Geographical regions like the Nordics and the Americas have shown weaker growth for H&M in 2024, suggesting that in these areas, the company might be facing 'dog' like market conditions, requiring careful strategic adjustments.

H&M's increasing inventory, particularly older stock, represents another 'dog' element. This inventory ties up capital and often requires markdowns, directly impacting profitability and cash flow.

| Category | H&M Group Example | Market Share | Growth Rate | Strategic Action |

| Brand/Concept | Monki (Physical Stores) | Low | Slow/Declining | Wind-down/Integration |

| Brand/Concept | Afound | Low | Slow | Winding Down |

| Geographical Market | Nordics, Americas | Stagnant/Declining | Weak/Negative | Re-evaluation Needed |

| Product Category | Older, Less Responsive Inventory | N/A | N/A | Markdowns/Clearance |

Question Marks

H&M's expansion into markets like Brazil, El Salvador, and Paraguay represents a strategic push into regions with substantial growth potential. For instance, Brazil's fashion retail market is projected to reach approximately $78 billion by 2027, indicating a fertile ground for new entrants. These emerging markets are characterized by a low current market share for H&M but offer significant upside, aligning with the characteristics of a question mark in the BCG matrix.

The company's planned entry into Brazil in late 2025, El Salvador in 2025, and Paraguay in 2026, along with explorations into Venezuela, signifies a commitment to high-growth territories. While initial investments are substantial, the success of these ventures hinges on H&M's ability to quickly gain traction and scale its operations effectively. The fashion market in Latin America, for example, saw a notable increase in online sales in 2024, a trend H&M will likely leverage.

H&M Beauty, a newer venture for the fashion giant, is positioned to capitalize on its established brand loyalty within the dynamic beauty industry. This segment operates in a high-growth market but faces stiff competition from established players, meaning H&M Beauty is still building its presence and market share. Significant ongoing investment in product innovation, marketing campaigns, and expanding its distribution network is crucial for H&M Beauty to ascend to a more dominant market position.

H&M's circular business models, such as the Sellpy resale platform and other pre-owned initiatives, are strategically positioned within the burgeoning market for sustainable consumption. While this market is experiencing significant growth, these specific ventures are still in their formative stages, actively working to build scale and capture market share.

These circular efforts represent a commitment to sustainability, yet they necessitate ongoing investment to mature and achieve profitability. Without sustained capital infusion and strategic development, there's a risk they could stagnate and potentially become Stars or even Dogs within the BCG matrix framework.

Advanced Technology Integration

H&M's strategic integration of advanced technology, such as AI-powered recommendations and its acquisition of Voyado, positions it to significantly enhance customer engagement and streamline operations. This investment in modernizing the shopping experience and supply chain management reflects a forward-looking approach to future growth. While these technological initiatives are still in their early stages of development and implementation, their potential impact on market share and efficiency is substantial, classifying them as question marks within the BCG matrix – high potential, but currently low market share.

- AI-Powered Personalization: H&M is leveraging AI to offer tailored product recommendations, aiming to increase conversion rates and customer loyalty.

- Supply Chain Optimization: Investments in technology are designed to improve inventory management, logistics, and overall supply chain efficiency, reducing costs and lead times.

- Voyado Acquisition: This strategic move is expected to bolster H&M's capabilities in data-driven marketing and customer experience personalization, driving future revenue streams.

- Early Stage Impact: Despite significant investment, the full market impact and return on these technological advancements are still being realized, indicating a phase of development rather than established market dominance.

ARKET Brand Expansion

ARKET, a relatively new entrant in the H&M Group's portfolio, is on a significant expansion trajectory. In 2024, the brand launched in Spain, Poland, and Italy, marking a strategic push into key European markets. This expansion continues into 2025 with planned openings in Norway, Austria, Greece, and Ireland.

While ARKET aims to capture the growing segment of consumers prioritizing sustainability and quality, its market share in these newly entered regions is still in its nascent stages. The brand's growth hinges on substantial investment to build brand awareness and secure a competitive foothold.

- ARKET's 2024 Expansion: Spain, Poland, Italy.

- ARKET's 2025 Planned Expansion: Norway, Austria, Greece, Ireland.

- Target Market: Conscious consumers seeking quality and sustainability.

- Strategic Challenge: Building market share in new territories requires significant investment.

Question Marks represent H&M's ventures with high growth potential but currently low market share, requiring careful observation and investment. These are areas where H&M is establishing a presence, such as new geographical markets or nascent business segments. The success of these ventures is uncertain, and they demand significant capital and strategic focus to determine if they will evolve into Stars or falter.

H&M's expansion into new territories like Brazil, El Salvador, and Paraguay, alongside its newer ventures like H&M Beauty and circular business models, exemplify these Question Marks. The company is investing heavily to gain traction in these high-growth but competitive landscapes. The outcome of these investments will dictate their future position within the BCG matrix.

The strategic integration of technologies like AI and the acquisition of Voyado also fall into this category. While these initiatives aim to enhance customer experience and operational efficiency, their market impact is still developing. H&M must carefully manage these investments to foster growth and avoid becoming a Dog.

ARKET's expansion into new European markets in 2024 and 2025 also positions it as a Question Mark. Despite its focus on conscious consumers, ARKET needs substantial investment to build brand recognition and market share in these territories.

| Venture | Market Growth Potential | Current Market Share | Strategic Focus | Potential Outcome |

|---|---|---|---|---|

| Brazil Expansion | High | Low | Market Penetration, Brand Building | Star or Dog |

| H&M Beauty | High | Low | Product Development, Marketing | Star or Dog |

| Circular Business Models (e.g., Sellpy) | High | Low | Scale, Profitability | Star or Dog |

| AI & Voyado Integration | High | Low | Customer Engagement, Efficiency | Star or Dog |

| ARKET Expansion (New Markets) | High | Low | Brand Awareness, Market Share | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including H&M's financial reports, market share data, and industry growth rates, to accurately position each business unit.