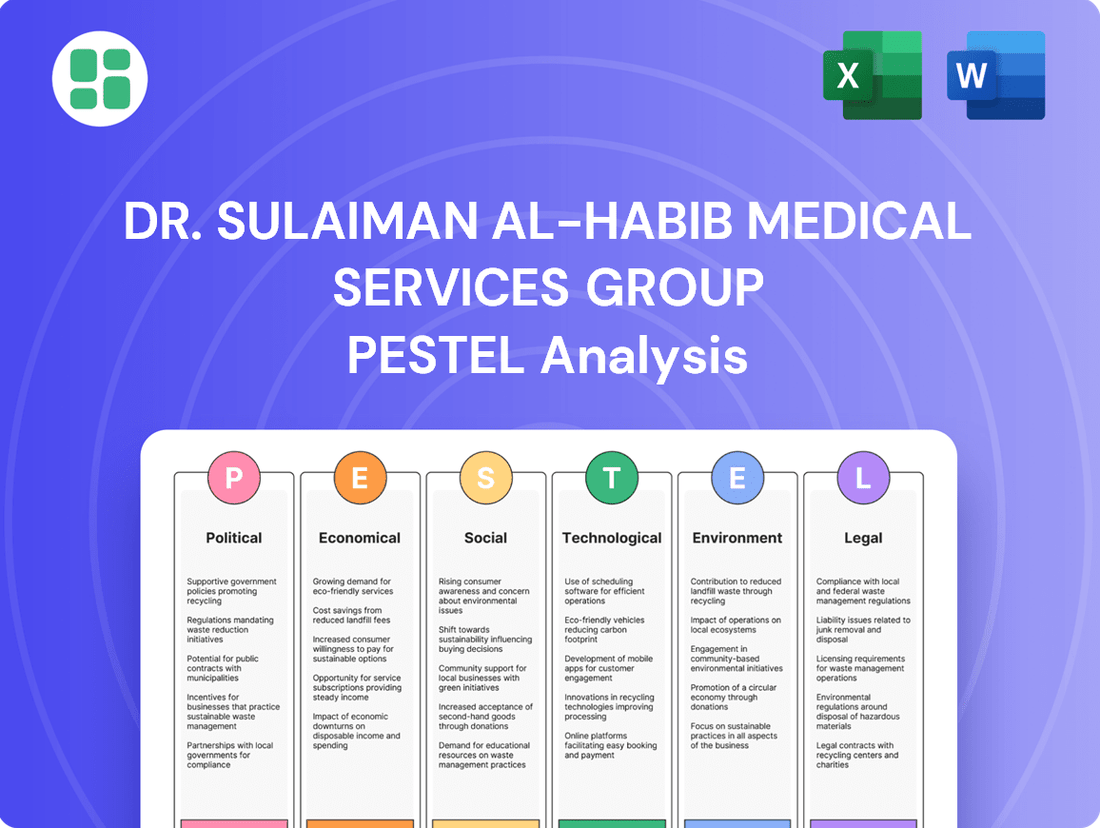

Dr. Sulaiman Al-Habib Medical Services Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Sulaiman Al-Habib Medical Services Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Dr. Sulaiman Al-Habib Medical Services Group's trajectory. This comprehensive PESTLE analysis provides the strategic foresight needed to navigate the dynamic healthcare landscape. Gain a competitive edge by understanding these external forces and their implications for your own market strategy. Download the full version now for actionable intelligence.

Political factors

The Saudi government's Vision 2030 places a significant focus on healthcare, with ambitious goals to boost private sector involvement and enhance the overall quality and accessibility of medical services. This strategic direction is particularly beneficial for companies like Dr. Sulaiman Al-Habib Medical Services Group (HMG).

As part of this transformation, the government intends to privatize a substantial portion of its hospitals and health facilities by 2030. This shift will see the government transition from being a direct service provider to primarily acting as a regulator, creating a more open market for private healthcare providers.

The Saudi government's Health Sector Transformation Program (HSTP), a cornerstone of Vision 2030, strongly encourages Public-Private Partnerships (PPPs) to boost healthcare infrastructure and operational efficiency. This initiative aims to modernize the sector and improve service delivery across the Kingdom.

Dr. Sulaiman Al-Habib Medical Services Group, as a prominent private healthcare provider, is well-positioned to capitalize on these PPPs. By engaging in these collaborations, the group can strategically expand its network and enhance its service portfolio, aligning with the national objective of increasing the private sector's contribution to healthcare provision.

The government has set an ambitious target for the private sector to account for 65% of healthcare delivery by 2030. PPPs represent a critical mechanism for achieving this goal, offering opportunities for private entities like Al-Habib Medical to invest in and manage healthcare facilities, thereby improving accessibility and quality of care for the population.

Saudi Arabia's healthcare sector is experiencing significant regulatory evolution, a key aspect of Vision 2030 aiming to elevate standards to international benchmarks. This ongoing transformation necessitates continuous adaptation by healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group.

Key bodies such as the Ministry of Health (MoH), the Saudi Food and Drug Authority (SFDA), and the Saudi Commission for Health Specialties (SCFHS) are actively updating regulations. These updates are crucial for maintaining licensing and operational compliance, ensuring the highest quality and safety in healthcare delivery.

Saudization Requirements

Saudization requirements are set to intensify in the Saudi healthcare sector, with new mandates effective from 2025 targeting specific professions. This includes critical areas like medical laboratories, physiotherapy, radiology, and therapeutic nutrition, where increased localization will be enforced. Dr. Sulaiman Al-Habib Medical Services Group (HMG) must proactively adapt its human resource strategies to meet these evolving regulations.

The phased implementation across various cities and facilities means HMG needs a flexible approach to workforce planning. This presents both a challenge and an opportunity to develop local talent. For instance, by 2024, the Saudi Ministry of Human Resources and Social Development has already been focusing on increasing Saudization in several professional categories within the private sector, aiming to create more employment opportunities for Saudi nationals.

- Increased Saudization: Effective 2025, specific healthcare roles will face higher Saudization quotas.

- Phased Rollout: Implementation will occur gradually across different regions and HMG facilities.

- Workforce Strategy: HMG needs to strategically manage its talent acquisition and development to ensure compliance.

- Talent Development: Focus on training and upskilling Saudi nationals to fill these roles will be crucial for long-term success.

Health Insurance Regulations

The Council of Health Insurance (CHI) is actively broadening health insurance coverage across the nation. A significant development is the planned comprehensive public health insurance rollout, aiming to cover all citizens by 2026. This expansion is poised to create a substantial increase in demand for private healthcare services.

Furthermore, a new regulation effective from July 2025 mandates that all government healthcare facilities must establish contracts with health insurance companies. This policy shift is expected to drive greater reliance on private healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group (HMG).

- Increased Demand: The expanding insurance coverage will likely boost patient volumes for HMG, particularly for specialized treatments and advanced medical care.

- Government Facility Contracts: The mandate for government facilities to contract with insurers could lead to new partnership opportunities for HMG.

- Market Growth: These regulatory changes signal a growing healthcare market where private providers play a more integrated role.

The Saudi government's Vision 2030 actively promotes private sector participation in healthcare, aiming for it to constitute 65% of service delivery by 2030. This creates a favorable environment for Dr. Sulaiman Al-Habib Medical Services Group (HMG) to expand its operations and services through Public-Private Partnerships (PPPs).

Stricter Saudization mandates, effective from 2025, will require increased employment of Saudi nationals in specific healthcare roles, necessitating strategic workforce planning by HMG. Furthermore, a new regulation starting July 2025 mandates government healthcare facilities to contract with insurance companies, potentially increasing demand for private providers like HMG.

The planned comprehensive public health insurance rollout, targeting all citizens by 2026, is expected to significantly boost patient volumes and create new partnership opportunities for HMG within the evolving healthcare landscape.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Dr. Sulaiman Al-Habib Medical Services Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It is designed to equip stakeholders with actionable insights by identifying opportunities and threats, informed by current market trends and regulatory dynamics specific to the healthcare sector and its operating regions.

This PESTLE analysis for Dr. Sulaiman Al-Habib Medical Services Group acts as a pain point reliever by offering a clear, summarized version of external factors, making strategic discussions more efficient.

Economic factors

Saudi Arabia's commitment to healthcare is evident in its substantial government spending. The 2025 budget allocates SAR 260 billion ($69 billion) to healthcare and social development, mirroring the 2024 figure. This consistent, high-level investment creates a robust economic foundation for healthcare entities.

This sustained government expenditure offers a stable economic climate, enabling healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group (HMG) to confidently pursue growth. Such financial backing supports HMG's strategic investments in expanding its network of facilities and enhancing its service offerings.

The Saudi healthcare sector has experienced a significant influx of private capital, with over $8 billion invested in more than 170 deals from 2020 through 2024. This robust investment climate is a direct result of supportive regulatory changes and the Kingdom's broader economic diversification agenda.

These favorable conditions are expected to continue attracting capital, enabling entities like HMG to pursue expansion initiatives. The recent allowance of up to 100% foreign ownership in hospitals and polyclinics further enhances the appeal for foreign direct investment, creating new avenues for growth and partnership.

Saudi Arabia's Vision 2030 is fostering a significant increase in disposable income, with projections indicating continued growth. This economic uplift, combined with a heightened public focus on well-being, is fueling a robust demand for sophisticated healthcare solutions.

As citizens become more health-conscious, they are increasingly seeking out specialized and preventative medical care. This trend directly supports companies like Dr. Sulaiman Al-Habib Medical Services Group (HMG), which is positioned to capitalize on this evolving consumer preference for proactive health management and tailored medical treatments.

For instance, HMG's investment in advanced medical technologies and specialized departments aligns perfectly with this rising demand. The group's commitment to high-quality, comprehensive care is a key differentiator in a market where consumers are willing to invest more in their personal health and longevity.

Inflationary Pressures and Operational Costs

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is navigating a landscape where robust healthcare sector growth is met with significant inflationary pressures on operational costs. These pressures could potentially impact the company's gross margins, particularly as it undertakes the extensive ramp-up of its new facilities. For instance, HMG's aggressive expansion, including a notable increase in bed capacity, directly translates to higher operating expenses and finance charges in the near to medium term. Analysts project these cost increases to begin stabilizing by 2027, offering a clearer path to improved profitability thereafter.

Key cost pressures impacting HMG's operations include:

- Increased Staffing Costs: Inflationary trends often drive up wages and benefits for medical professionals and support staff, a critical component of healthcare service delivery.

- Supply Chain Disruptions and Material Costs: The global economic environment in 2024 and 2025 has seen elevated costs for medical supplies, pharmaceuticals, and equipment due to supply chain vulnerabilities.

- Energy and Utility Expenses: Rising energy prices directly affect the operational costs of running extensive healthcare facilities, including HMG's new and existing sites.

Economic Diversification and Oil Price Stability

Saudi Arabia's Vision 2030 is actively steering the nation toward economic diversification, reducing its heavy reliance on oil. This strategic shift is particularly beneficial for sectors like healthcare, which is slated for significant expansion and investment. For Dr. Sulaiman Al-Habib Medical Services Group (HMG), this means a more stable operating environment.

While HMG's direct exposure to fluctuating oil prices is somewhat mitigated by its focus on essential services, the broader economic stability derived from diversification is crucial. A diversified economy typically translates into more predictable government spending on healthcare infrastructure and services, alongside enhanced consumer purchasing power and confidence. For instance, Saudi Arabia's non-oil GDP growth reached 4.2% in 2023, indicating progress in diversification efforts.

- Economic Diversification: Saudi Arabia's Vision 2030 aims to boost non-oil sectors, including healthcare, to create a more resilient economy.

- Reduced Oil Dependence: This lessens the impact of global oil price volatility on government revenue and overall economic stability.

- Healthcare Sector Growth: Diversification fosters consistent government investment and private sector participation in healthcare.

- Consumer Confidence: A stable, diversified economy generally supports higher consumer spending on healthcare services.

Saudi Arabia's economic trajectory, driven by Vision 2030, presents a dynamic environment for healthcare providers like HMG. Significant government investment, projected at SAR 260 billion for healthcare in 2025, underpins sector growth. Increased disposable income and a focus on well-being are also fueling demand for advanced medical services.

However, HMG faces inflationary pressures on operational costs, particularly staffing and supply chain expenses, with stabilization anticipated around 2027. Despite these challenges, the Kingdom's economic diversification away from oil is creating a more stable and predictable landscape for sustained healthcare sector expansion and investment.

| Economic Factor | 2024/2025 Data Point | Impact on HMG |

|---|---|---|

| Government Healthcare Spending | SAR 260 billion (2025 budget) | Provides a stable foundation and supports expansion initiatives. |

| Private Capital Investment (2020-2024) | Over $8 billion in 170+ deals | Indicates a strong investment climate, attracting further capital. |

| Disposable Income Growth | Projected continued growth | Drives increased demand for specialized healthcare services. |

| Inflationary Pressures | Elevated costs for staffing, supplies, energy | Potentially impacts gross margins during facility ramp-up. |

| Economic Diversification (Non-oil GDP Growth) | 4.2% in 2023 | Enhances overall economic stability and consumer confidence. |

Preview Before You Purchase

Dr. Sulaiman Al-Habib Medical Services Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Dr. Sulaiman Al-Habib Medical Services Group delves into political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. It provides a detailed understanding of the external forces shaping the healthcare landscape in which the group operates.

Sociological factors

Saudi Arabia's demographic landscape is shifting, with the population aged 65 and over expected to reach 9% by 2030. This aging trend, coupled with a rise in chronic conditions such as diabetes and hypertension, is significantly increasing the need for specialized healthcare. This presents a clear opportunity for Al-Habib Medical Services Group (HMG) to enhance its services in geriatrics, rehabilitation, and chronic disease management.

Saudi Arabia's population is increasingly prioritizing health, with a notable surge in demand for preventive care. This trend is driven by robust government campaigns and widespread media coverage promoting healthier lifestyles. For instance, the Ministry of Health's initiatives have significantly boosted public engagement in wellness programs and regular check-ups.

This heightened health consciousness translates directly into a greater demand for routine medical examinations and diagnostic screenings. Dr. Sulaiman Al-Habib Medical Services Group (HMG) is well-positioned to leverage this shift by expanding its offerings of comprehensive health check-up packages and proactive wellness programs, aligning with the public’s growing desire for preventative health solutions.

The Saudi population's demand for high-quality and specialized healthcare is on the rise, fueled by growing expectations and the government's commitment to improving health outcomes. This trend is evident as the Kingdom continues to invest heavily in its healthcare sector, aiming to become a regional hub for medical tourism and advanced treatments.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is strategically positioned to capitalize on this evolving demand. HMG's reputation for delivering superior healthcare services and its investment in cutting-edge medical technologies align perfectly with patient preferences for premium and specialized care. For instance, in 2023, HMG reported a significant increase in patient visits to its specialized clinics, reflecting this market shift.

Lifestyle Changes and Urbanization

Urbanization is a significant driver of lifestyle changes, leading to increased demand for specialized healthcare services. As more people move to cities, sedentary lifestyles and dietary shifts contribute to a rise in non-communicable diseases, such as diabetes and cardiovascular conditions. This trend directly fuels the need for advanced medical facilities and accessible healthcare solutions within urban hubs.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is strategically positioned to capitalize on these demographic shifts. Their expansion efforts, particularly in major Saudi Arabian cities like Riyadh and Jeddah, are designed to meet the growing healthcare needs of an increasingly urbanized population. For instance, HMG's presence in Riyadh, the capital and most populous city, allows them to serve a vast segment of the population experiencing these lifestyle-related health challenges.

- Urban Population Growth: Saudi Arabia's urban population has been steadily increasing, with projections indicating continued growth, placing greater demand on city-based healthcare infrastructure.

- Lifestyle Disease Prevalence: Studies indicate a rising prevalence of lifestyle-related diseases in Saudi Arabia, such as obesity and diabetes, which are often exacerbated by urbanization. For example, the prevalence of diabetes in Saudi Arabia was estimated at over 17% in recent years, a figure that is expected to remain a significant public health concern.

- HMG's Urban Footprint: HMG operates multiple facilities in key urban centers, including several hospitals and medical centers in Riyadh and Jeddah, directly addressing the concentrated demand for healthcare in these areas.

- Demand for Specialized Care: Urbanization often correlates with a demand for more specialized medical services, which HMG's comprehensive offerings are equipped to provide.

Workforce Development and Skill Shortages

Despite ongoing initiatives, the Saudi Arabian healthcare sector continues to grapple with significant workforce shortages. This persistent challenge underscores the critical need for sustained investment in both the training of new healthcare professionals and the recruitment of experienced talent to meet growing demand.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is proactively addressing these skill gaps through strategic collaborations. For instance, their partnership with UCL Global Business School for Health is designed to foster the development of highly capable leaders and proficient staff members. This initiative is crucial for ensuring a consistent pipeline of qualified individuals.

The Kingdom's Vision 2030 emphasizes localization and the development of a skilled workforce. In 2023, Saudi Arabia's healthcare expenditure reached approximately SAR 88.6 billion, highlighting the sector's economic importance and the demand for qualified personnel to manage these investments effectively. HMG's focus on talent development aligns directly with these national objectives.

HMG's commitment to workforce development is evident in their efforts to:

- Enhance leadership capabilities through specialized programs.

- Improve the skill sets of existing healthcare staff.

- Attract and retain top talent within the medical field.

- Address specific skill shortages in specialized medical areas.

Saudi Arabia's demographic trends, including an aging population and a growing preference for preventive healthcare, create a strong demand for specialized medical services. This shift, coupled with increasing urbanization, fuels the need for advanced healthcare facilities in major cities.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is well-positioned to meet these evolving societal needs. Their strategic expansion into urban centers and focus on specialized care, such as geriatrics and chronic disease management, directly addresses these growing demands. For instance, HMG's 2023 performance showed a notable increase in specialized clinic visits, reflecting this market alignment.

The emphasis on health and wellness, promoted by government initiatives, further boosts the demand for routine check-ups and diagnostic services. HMG's proactive approach in offering comprehensive health packages aligns perfectly with this societal push towards preventative health, ensuring they cater to a health-conscious population.

Technological factors

Saudi Arabia is making substantial investments in digital health, dedicating $1.5 billion to initiatives like telemedicine, AI diagnostics, and electronic health records. The goal is to fully integrate public and private health systems by 2030, a significant push towards a digitally enabled healthcare landscape.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is at the forefront of this digital revolution. Their recent implementation of the AuxQ robotic system for intelligent diagnostics exemplifies their commitment to leveraging cutting-edge technology. This adoption is designed to boost efficiency and elevate the standard of patient care.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) actively incorporates advanced medical technologies, such as state-of-the-art diagnostic equipment and robotic surgery systems, into its operations. This strategic focus on technological integration allows HMG to offer highly specialized and precise patient care, differentiating it in the market.

The rapid pace of innovation in medical devices and diagnostic tools necessitates continuous capital expenditure. For instance, HMG's commitment to staying at the forefront of medical advancements means substantial and ongoing investments in upgrading and acquiring the latest equipment to ensure the highest quality of care and maintain its competitive advantage.

The Saudi Arabian healthcare landscape is rapidly embracing Artificial Intelligence, with significant advancements in diagnostics and treatment optimization. HMG is actively integrating advanced AI modules, especially in predictive analytics, to refine patient care.

By harnessing data from wearable health devices, HMG aims to proactively identify potential health concerns and improve patient outcomes. This strategic adoption of AI reflects a broader trend in the region toward data-driven healthcare solutions.

Electronic Medical Records (EMR) and Data Integration

Saudi Arabia's mandate for Electronic Medical Records (EMR) adoption, including interoperability with national platforms like NABIDH, significantly impacts healthcare providers. Dr. Sulaiman Al-Habib Medical Services Group (HMG) is actively investing in its digital health infrastructure to ensure seamless data integration, a move that is critical for operational efficiency and enhanced patient care. This digital transformation is not just about compliance; it's about building a unified health record system that can interact with the wider national healthcare ecosystem.

HMG's strategic focus on digital health infrastructure and unified health records is directly tied to improving patient outcomes and streamlining internal processes. For instance, the integration with NABIDH allows for better data sharing and analysis, potentially leading to faster diagnoses and more personalized treatment plans. By 2024, the Saudi government aimed for a significant portion of healthcare providers to be compliant with EMR standards, pushing entities like HMG to accelerate their digital transformation efforts.

- Mandatory EMR Adoption: Saudi Arabia's regulatory push for EMR systems is a key technological driver.

- NABIDH Interoperability: Connecting with national platforms like NABIDH is essential for data exchange.

- Digital Health Investment: HMG's commitment to digital infrastructure supports unified health records.

- Improved Patient Outcomes: Integrated EMRs are vital for enhancing care quality and operational efficiency.

Health Tech Innovation and Partnerships

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is a key player in advancing health technology, demonstrated by its Innovation Growth Hub (HIGH). This initiative actively supports the development of new healthcare solutions. In 2024, HMG announced a significant partnership with NLC Health Ventures, a prominent health tech venture builder, to co-invest in and accelerate promising health tech startups. This collaboration is designed to bring cutting-edge innovations to market faster, enhancing patient care and operational efficiency within the healthcare sector.

This strategic focus on innovation and partnerships directly supports Saudi Arabia's Vision 2030 objectives, which emphasize digital transformation and the modernization of healthcare services. By fostering a dynamic ecosystem for health tech, HMG is contributing to the Kingdom's ambition to become a global leader in healthcare innovation. The group's commitment is reflected in its active engagement with a pipeline of novel technologies and business models aimed at revolutionizing healthcare delivery.

- Innovation Growth Hub (HIGH): HMG's dedicated platform for nurturing new health tech ideas.

- NLC Health Ventures Partnership: A strategic alliance to co-invest and accelerate health tech ventures, active as of 2024.

- Vision 2030 Alignment: HMG's initiatives directly contribute to the Kingdom's digital health and healthcare modernization goals.

- Global Health Tech Acceleration: The aim is to speed up the adoption of transformative health technologies worldwide.

Saudi Arabia's investment of $1.5 billion in digital health by 2030 fuels advancements like AI diagnostics and telemedicine, with a goal to integrate public and private systems. HMG is actively integrating advanced AI, particularly in predictive analytics, to refine patient care and leverage data from wearable devices for proactive health management.

HMG's Innovation Growth Hub (HIGH), partnered with NLC Health Ventures since 2024, actively fosters health tech startups, aligning with Vision 2030's digital transformation goals. This focus on innovation and partnerships aims to accelerate the adoption of cutting-edge healthcare solutions, enhancing patient care and operational efficiency.

| Technology Area | HMG Initiative/Adoption | Impact/Goal | Relevant Data/Year |

|---|---|---|---|

| Digital Health Investment | AuxQ robotic system for diagnostics | Boost efficiency, elevate patient care | Saudi Arabia: $1.5 billion by 2030 |

| AI in Healthcare | AI modules for predictive analytics | Refine patient care, improve outcomes | Active integration by HMG |

| Electronic Medical Records (EMR) | Integration with NABIDH | Seamless data integration, operational efficiency | Saudi EMR adoption mandate |

| Health Tech Innovation | Innovation Growth Hub (HIGH), NLC Ventures partnership | Accelerate health tech startups, align with Vision 2030 | Partnership active since 2024 |

Legal factors

The Private Health Institutions Law is crucial for Dr. Sulaiman Al-Habib Medical Services Group (HMG), dictating how its clinics and hospitals operate in Saudi Arabia. Recent updates for 2024-2025 are particularly significant, mandating the adoption of Electronic Medical Records (EMR) and introducing tougher penalties for those not complying. HMG's ability to secure and maintain its operational licenses hinges on its ongoing commitment to these evolving legal requirements.

The Health Law in Saudi Arabia, specifically the Health Specialties Law, clearly outlines patient rights, emphasizing access to their medical information, the utmost confidentiality of their data, and the necessity of informed consent for any procedures. This legal framework is paramount for healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group (HMG).

HMG, by its nature, deals with highly sensitive personal health information. Consequently, the group must adhere to rigorous data privacy regulations, including those mandated by the Saudi Health Information Exchange (HIE) and the National Cybersecurity Authority (NCA). The increasing reliance on digital health platforms and the widespread use of Electronic Health Records (EHRs) amplify the need for robust cybersecurity measures to prevent data breaches and ensure patient confidentiality. For instance, the Kingdom's Vision 2030 includes significant investments in digital transformation within healthcare, making compliance with these evolving standards a continuous operational imperative for HMG.

Saudi labor laws, especially the enhanced Saudization mandates for healthcare roles set to take effect in 2025, significantly shape HMG's approach to hiring and staffing. For instance, a 2023 report indicated that the healthcare sector was targeted for increased nationalization, with specific professions facing higher quotas.

HMG must meticulously adhere to these evolving regulations to ensure full compliance. This involves strategic workforce planning to integrate qualified Saudi nationals while maintaining the high standards of medical expertise and diversity essential for patient care.

Drug and Medical Device Regulation

The Saudi Food and Drug Authority (SFDA) plays a critical role in overseeing the healthcare landscape, focusing on pharmaceutical products, biologics, and medical devices. Recent reforms by the SFDA aim to accelerate the approval process for innovative treatments and bolster post-market surveillance, ensuring ongoing safety and efficacy. For Dr. Sulaiman Al-Habib Medical Services Group (HMG), adherence to these evolving SFDA regulations is paramount. HMG must meticulously ensure that every drug and medical device utilized within its hospitals and clinics meets the stringent standards set forth by the SFDA. This commitment is essential for maintaining patient safety and regulatory compliance, particularly as the SFDA continues to update its guidelines to align with global best practices.

HMG's operational framework is directly impacted by the SFDA's regulatory directives. For instance, the SFDA's efforts to streamline the registration of new medical devices, which saw a notable acceleration in processing times in 2024, directly benefits HMG by providing quicker access to advanced medical technologies. Conversely, any lapse in compliance with SFDA mandates, such as improper handling or documentation of regulated products, could lead to significant penalties, operational disruptions, and reputational damage. HMG's proactive approach to regulatory compliance, including robust internal auditing and training programs, is therefore a cornerstone of its strategy to navigate the legal and operational complexities of the Saudi healthcare market.

- SFDA Reforms: The SFDA has been actively implementing reforms to enhance the efficiency of drug and medical device registration and approval processes.

- HMG Compliance: HMG must ensure all procured pharmaceuticals and medical devices comply with SFDA regulations, including stringent quality and safety standards.

- Market Access: SFDA's streamlined processes can expedite HMG's access to new and innovative medical technologies, enhancing patient care.

- Risk Management: Non-compliance with SFDA regulations can result in severe penalties, affecting HMG's operations and financial performance.

Health Insurance Mandates and Compliance

The Council of Health Insurance (CHI) in Saudi Arabia is actively shaping the healthcare landscape through its mandates. A key development is the expansion of public health insurance coverage, which necessitates that all government healthcare facilities establish contracts with health insurers. This shift is crucial for entities like Dr. Sulaiman Al-Habib Medical Services Group (HMG) to navigate the evolving insurance frameworks.

HMG must prioritize compliance with these updated regulations to ensure seamless operations and efficient patient billing. The CHI's push for digital claims processing standards, for instance, requires HMG to adapt its systems. By adhering to these digital requirements, HMG can streamline its administrative processes and maintain strong relationships with both government entities and private insurers, thereby supporting its financial health and operational efficiency.

- Mandated Coverage Expansion: The CHI's drive to broaden public health insurance coverage impacts all healthcare providers, including HMG, by requiring partnerships with insurers.

- Digital Claims Processing: Compliance with evolving digital claims processing standards is essential for HMG to maintain efficient patient billing and administrative workflows.

- Regulatory Adherence: HMG's ability to adapt to and comply with these expanding insurance frameworks directly influences its operational stability and financial performance.

The legal landscape for Dr. Sulaiman Al-Habib Medical Services Group (HMG) is dynamic, with Saudi labor laws, particularly concerning Saudization, presenting a significant factor. By 2025, enhanced mandates are expected to increase the proportion of Saudi nationals in healthcare roles, impacting HMG's recruitment and retention strategies. For example, a 2023 report highlighted targeted nationalization efforts in the healthcare sector, with specific professions facing higher quotas.

Furthermore, evolving regulations from the Saudi Food and Drug Authority (SFDA) are critical. The SFDA's ongoing reforms aim to expedite approvals for new treatments and bolster post-market surveillance. HMG must ensure all its medical supplies and pharmaceuticals meet these stringent SFDA standards, a commitment vital for patient safety and compliance. In 2024, the SFDA reported a notable acceleration in the processing times for new medical device registrations, potentially benefiting HMG's access to advanced technologies.

The Council of Health Insurance (CHI) also plays a pivotal role, with a growing emphasis on expanding public health insurance coverage. This necessitates that healthcare providers like HMG establish contracts with health insurers and adapt to digital claims processing standards. HMG's adherence to these CHI mandates is crucial for efficient operations and financial stability.

Environmental factors

Healthcare facilities, including those operated by Dr. Sulaiman Al-Habib Medical Services Group (HMG), generate substantial volumes of medical waste. This necessitates stringent adherence to environmental regulations governing its safe collection, treatment, and disposal. For instance, Saudi Arabia's Ministry of Environment, Water and Agriculture sets forth detailed guidelines for hazardous waste management, which directly impacts HMG's operational procedures.

HMG must maintain robust waste management protocols to ensure compliance with these national environmental standards. This includes investing in advanced treatment technologies and secure disposal methods to minimize its ecological footprint. Failure to comply can result in significant fines and reputational damage, underscoring the critical importance of these regulations.

Hospitals are inherently energy-intensive, making energy consumption a critical environmental factor for Dr. Sulaiman Al-Habib Medical Services Group (HMG). In 2023, healthcare facilities globally accounted for a significant portion of commercial building energy use, often exceeding 2-3% of total national electricity consumption.

HMG can strategically focus on adopting advanced energy-efficient technologies across its operations. This includes upgrading to LED lighting, optimizing HVAC systems, and implementing smart building management systems. For instance, investing in energy-efficient medical equipment can lead to substantial savings; a modern MRI machine might consume 20-30% less energy than an older model.

Furthermore, embracing sustainable building practices for both new constructions and renovations is vital. This could involve better insulation, solar panel installations, and water conservation measures. By reducing its environmental footprint through these initiatives, HMG not only lowers operational costs but also reinforces its commitment to broader sustainability goals, which is increasingly important to stakeholders.

Water scarcity is a pressing environmental concern in the Middle East, impacting regions where Dr. Sulaiman Al-Habib Medical Services Group (HMG) operates. HMG's extensive network of hospitals and clinics, with their high-tech equipment and daily operations, naturally demand significant water resources.

Recognizing this, HMG has been actively pursuing water conservation strategies. For instance, in 2023, the group continued to invest in advanced water-saving technologies across its facilities. These efforts include upgrading to low-flow fixtures and implementing sophisticated wastewater recycling systems, which can reduce overall water consumption by an estimated 15-20% in comparable healthcare settings.

Environmental Health and Infection Control

Maintaining a pristine and secure environment within healthcare settings is paramount for the well-being of both patients and staff. This directly influences infection control measures and overall public health outcomes. For Dr. Sulaiman Al-Habib Medical Services Group (HMG), adhering to rigorous environmental health standards and protocols is non-negotiable to prevent the transmission of infections and foster a conducive healing atmosphere.

HMG's commitment to environmental health is reflected in its operational practices. For instance, in 2023, the group reported a significant focus on waste management, with over 95% of medical waste being disposed of according to international safety standards. This dedication is crucial in mitigating the risk of hospital-acquired infections (HAIs).

The group's proactive approach includes regular environmental monitoring and sanitation programs. These initiatives are designed to identify and address potential environmental hazards swiftly. HMG's investment in advanced sterilization technologies further underscores its commitment to creating a safe healing environment, a critical factor in patient recovery and trust.

- Environmental Health Focus: HMG prioritizes stringent adherence to environmental health guidelines to safeguard patients and staff.

- Infection Control: Strict protocols are in place to prevent the spread of infections within all HMG facilities.

- Waste Management: In 2023, HMG achieved over 95% compliance in safe medical waste disposal, aligning with global best practices.

- Sanitation and Monitoring: Regular environmental assessments and advanced sterilization technologies are employed to maintain a healthy healing environment.

Climate Change Impact on Public Health

Climate change poses a significant, albeit indirect, threat to public health, potentially driving demand for healthcare services. For instance, rising global temperatures have been linked to an increased incidence of vector-borne diseases like dengue fever and malaria, as warmer climates expand the geographic range of disease-carrying insects. The World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea, and heat stress alone.

Extreme weather events, such as heatwaves and floods, exacerbated by climate change, also directly impact public health. These events can lead to injuries, fatalities, and the spread of waterborne diseases. In 2024, several regions experienced unprecedented heatwaves, straining emergency services and increasing hospital admissions for heat-related illnesses. As a prominent healthcare provider, Dr. Sulaiman Al-Habib Medical Services Group (HMG) should proactively develop long-term strategies to address these evolving public health challenges.

HMG's adaptation strategies could include:

- Investing in advanced diagnostics and treatment protocols for climate-sensitive diseases.

- Developing robust emergency response plans for extreme weather events, including surge capacity for medical facilities.

- Enhancing public health education campaigns on climate-related health risks and preventive measures.

- Exploring telemedicine solutions to extend healthcare access during climate-induced disruptions.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) faces significant environmental considerations, particularly concerning waste management and water usage. The group must adhere to strict Saudi Arabian environmental regulations for hazardous waste, investing in advanced treatment and disposal methods to minimize ecological impact. HMG's operations are also water-intensive, necessitating proactive conservation strategies like upgrading to low-flow fixtures and implementing wastewater recycling, which can reduce consumption by 15-20%.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dr. Sulaiman Al-Habib Medical Services Group is grounded in data from official Saudi government publications, reports from the Saudi Ministry of Health, and reputable financial news outlets. We also incorporate insights from international healthcare industry analyses and economic indicators.