Dr. Sulaiman Al-Habib Medical Services Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Sulaiman Al-Habib Medical Services Group Bundle

Dr. Sulaiman Al-Habib Medical Services Group operates in a dynamic healthcare landscape where buyer power is significant due to patient choice and insurance coverage. The threat of new entrants is moderate, balanced by high capital requirements and regulatory hurdles, while the bargaining power of suppliers is also a key consideration.

The complete report reveals the real forces shaping Dr. Sulaiman Al-Habib Medical Services Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The specialized nature of medical equipment and advanced pharmaceutical products grants considerable power to their manufacturers. Dr. Sulaiman Al-Habib Medical Services Group's reliance on cutting-edge technology and patented drugs, often sourced from a select few global suppliers, significantly enhances their leverage over pricing and contract terms.

The critical need for these high-quality inputs to maintain superior patient care further amplifies the bargaining power of these suppliers. For instance, in 2024, the global medical devices market was valued at approximately $600 billion, with a significant portion driven by specialized, high-margin equipment.

The bargaining power of suppliers for Dr. Sulaiman Al-Habib Medical Services Group is significantly influenced by the scarcity and high demand for qualified medical professionals. Specialist doctors, surgeons, and experienced nurses are critical assets, and their specialized skills make them a powerful supplier group.

In 2024, the global shortage of healthcare professionals continued to be a major challenge, directly impacting recruitment costs for leading medical groups. Dr. Sulaiman Al-Habib Medical Services Group's commitment to high-quality care means they must compete for this limited talent pool, potentially driving up compensation and benefits, which enhances the bargaining power of these skilled individuals.

Suppliers of core IT infrastructure and specialized healthcare software systems hold significant bargaining power for Dr. Sulaiman Al-Habib Medical Services Group. The group's increasing reliance on advanced medical technologies and digitalization means dependence on these complex, often proprietary systems. This dependency creates high switching costs, making the company reliant on a limited number of vendors for crucial maintenance, upgrades, and ongoing support.

Supplier Power 4

Construction companies and real estate developers involved in building and expanding healthcare facilities, such as the new hospitals in Muhammadiyah and Al Kharj expected to launch operations in Q2 2025, hold significant power. Their ability to deliver specialized healthcare infrastructure on time and within budget directly impacts Al Habib's expansion plans. The specialized nature of healthcare construction means fewer qualified contractors are available, increasing their leverage.

The large-scale investment and specific requirements for healthcare infrastructure mean that the availability of qualified contractors and suitable land can significantly influence project timelines and costs. This was observed in regional logistical challenges that impacted supply chains for construction materials in 2024, highlighting the dependence on these suppliers.

- Limited Pool of Specialized Contractors: The need for expertise in healthcare facility construction restricts the number of viable construction partners, giving them greater bargaining power.

- Land Availability and Zoning: Securing appropriate land in strategic locations, along with navigating complex zoning regulations, can be a bottleneck controlled by real estate developers.

- Project Scale and Investment: The substantial capital required for new hospital builds means developers and construction firms are key partners whose terms can heavily influence project economics.

- Supply Chain Dependencies: Delays or cost increases from construction material suppliers, as seen in 2024 logistical issues, directly affect project execution and can be influenced by construction companies.

Supplier Power 5

The bargaining power of suppliers for Dr. Sulaiman Al-Habib Medical Services Group is influenced by market concentration. For instance, in specialized areas like advanced diagnostic equipment or unique surgical tools, a limited number of manufacturers can significantly increase their leverage. This concentration means fewer alternatives for the group, potentially leading to higher procurement costs.

When a few key suppliers dominate the market for essential, high-demand medical supplies, they gain substantial power to dictate terms and pricing. This directly affects the operational expenses of Dr. Sulaiman Al-Habib Medical Services Group, as seen in the global medical device market where consolidation has occurred in recent years. For example, the market for certain high-tech imaging equipment often features only a handful of global players, giving them considerable pricing power.

- Market concentration in niche medical supplies grants suppliers greater power.

- Few suppliers for essential medical consumables can dictate terms and prices.

- This directly impacts Dr. Sulaiman Al-Habib Medical Services Group's operational costs.

- Global trends show consolidation in medical device markets, increasing supplier leverage.

The bargaining power of suppliers for Dr. Sulaiman Al-Habib Medical Services Group is considerable, particularly for specialized medical equipment and advanced pharmaceuticals. Reliance on a limited number of global manufacturers for cutting-edge technology and patented drugs grants these suppliers significant leverage over pricing and contract terms. The critical need for these high-quality inputs to maintain superior patient care further amplifies their power, as evidenced by the global medical devices market valued at approximately $600 billion in 2024.

Furthermore, the scarcity of qualified medical professionals, such as specialist doctors and experienced nurses, makes them a powerful supplier group. The ongoing global shortage of healthcare professionals in 2024 directly impacts recruitment costs, forcing groups like Al Habib to compete for limited talent, thereby increasing compensation and benefits, which in turn enhances the bargaining power of these skilled individuals.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Al Habib |

|---|---|---|

| Medical Equipment Manufacturers | Specialized nature, high R&D, limited global players | Higher procurement costs, dependence on technology updates |

| Pharmaceutical Companies | Patented drugs, regulatory approvals, limited alternatives | Increased drug expenses, reliance on specific treatment protocols |

| Skilled Medical Professionals | High demand, specialized skills, global shortages | Increased labor costs, competition for talent |

| IT Infrastructure Providers | Proprietary systems, high switching costs, integration complexity | Vendor lock-in, ongoing maintenance and upgrade expenses |

| Healthcare Construction Firms | Specialized expertise, project scale, limited qualified contractors | Project cost escalations, potential delays in facility expansion |

What is included in the product

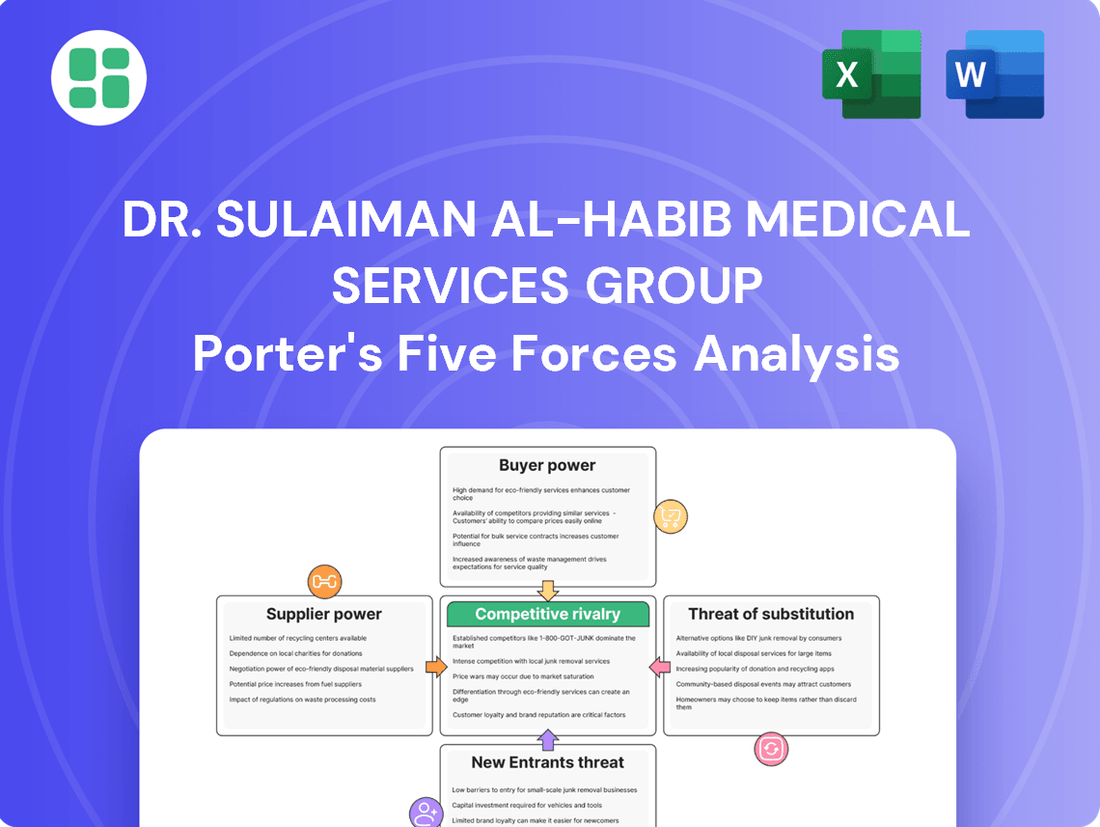

This analysis dissects the competitive forces impacting Dr. Sulaiman Al-Habib Medical Services Group, focusing on supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare sector.

A clear, one-sheet summary of all five forces—perfect for quick decision-making regarding competitive pressures and opportunities for Dr. Sulaiman Al-Habib Medical Services Group.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing the competitive landscape for Dr. Sulaiman Al-Habib Medical Services Group.

Customers Bargaining Power

The bargaining power of customers is a key factor for Dr. Sulaiman Al-Habib Medical Services Group. Large insurance companies and government healthcare programs wield significant influence due to the sheer volume of patients they represent and their ability to negotiate reimbursement rates. This power is amplified by the ongoing expansion of mandatory health insurance in Saudi Arabia, which aims to cover all citizens by 2026, thereby increasing the leverage of these major payers over private healthcare providers.

Individual patients typically possess limited direct bargaining power with Dr. Sulaiman Al-Habib Medical Services Group, especially for essential or emergency treatments. However, their influence grows for elective procedures where they can more readily compare options and seek competitive pricing or value-added services.

Dr. Sulaiman Al-Habib Medical Services Group's robust brand equity and commitment to advanced medical technology significantly diminish customer bargaining power. Patients often prioritize the perceived quality of care and positive patient outcomes, making them less sensitive to price alone. For instance, in 2023, the group reported a revenue of SAR 11,488 million, reflecting strong patient trust and demand for their specialized services.

The bargaining power of customers for Dr. Sulaiman Al-Habib Medical Services Group is influenced by the availability of alternative healthcare providers. Patients have choices, including public hospitals and other private medical groups, which can shift power towards them. This is particularly true for those seeking more cost-effective or general medical services.

While Dr. Sulaiman Al-Habib Medical Services Group boasts specialized care and advanced facilities, a competitive market means patients can explore options that better fit their budget or specific needs. For instance, in 2023, Saudi Arabia's healthcare sector saw significant growth, with increased investment in both public and private facilities, offering a wider array of choices for consumers.

Bargaining Power 4

The bargaining power of customers within the healthcare sector, particularly for groups like Dr. Sulaiman Al-Habib Medical Services Group, is on the rise. Increased health awareness and readily available online information empower patients to research conditions, treatments, and providers more thoroughly. This means they are less likely to accept services at face value and more inclined to compare options based on quality, outcomes, and cost.

This heightened customer awareness translates into greater price sensitivity. Patients are increasingly demanding to understand the value they receive for their healthcare expenditure. Providers are thus compelled to clearly articulate the benefits of their services, often backed by data on patient satisfaction and clinical results, to justify their pricing structures and maintain competitiveness.

For Dr. Sulaiman Al-Habib Medical Services Group, this trend is evidenced by several factors. For instance, a significant portion of their revenue comes from self-paying patients or those with private insurance who have greater discretion in choosing providers. In 2023, the group reported revenue of SAR 11.1 billion, a substantial portion of which is influenced by patient choice and their perception of value.

- Increased Information Access: Patients can easily compare treatment costs and quality metrics across different hospitals and clinics.

- Focus on Patient Outcomes: Customers are increasingly prioritizing providers with proven track records and positive patient testimonials.

- Demand for Transparency: There's a growing expectation for clear pricing and detailed explanations of medical procedures and their associated costs.

- Price Sensitivity: While quality is paramount, patients are more likely to consider cost when making healthcare decisions, especially for elective procedures.

Bargaining Power 5

The bargaining power of customers for Dr. Sulaiman Al-Habib Medical Services Group is influenced by rising healthcare costs and medical inflation across the GCC. This trend heightens price sensitivity, especially for individuals with limited insurance or for services not fully covered. Consequently, healthcare providers face pressure to optimize costs and implement competitive pricing to attract and retain patients.

This dynamic can lead to increased patient demand for transparency in billing and a greater willingness to compare providers based on cost-effectiveness. For instance, in 2024, healthcare expenditure in Saudi Arabia, a key market for Al-Habib, continued its upward trajectory, driven by factors like an aging population and advancements in medical technology, which directly impacts patient out-of-pocket expenses.

- Increased Price Sensitivity: Rising medical inflation in the GCC makes patients more aware of costs, particularly for elective procedures or services with high co-pays.

- Demand for Value: Customers are more likely to seek providers offering a strong balance of quality care and competitive pricing, potentially switching if better value is perceived elsewhere.

- Impact of Insurance: The extent of insurance coverage significantly shapes a customer's bargaining power; those with comprehensive plans have less direct financial pressure.

- Provider Response: Healthcare groups like Al-Habib must focus on operational efficiency and transparent pricing strategies to mitigate the impact of customer price sensitivity.

The bargaining power of customers for Dr. Sulaiman Al-Habib Medical Services Group is moderate and influenced by several factors. While brand reputation and specialized services reduce this power, increased information access and price sensitivity empower patients, especially for elective procedures.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Information Access & Transparency | Increases power | Patients actively compare costs and quality online; demand for clear billing. |

| Price Sensitivity | Increases power | Rising healthcare costs and medical inflation in GCC drive patients to seek value. |

| Brand Equity & Quality Perception | Decreases power | Dr. Sulaiman Al-Habib's strong brand and advanced technology attract patients prioritizing outcomes. |

| Availability of Alternatives | Increases power | Competition from public hospitals and other private groups offers patient choice. |

Same Document Delivered

Dr. Sulaiman Al-Habib Medical Services Group Porter's Five Forces Analysis

This preview displays the complete Dr. Sulaiman Al-Habib Medical Services Group Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the healthcare sector. You will receive this exact, professionally formatted document immediately upon purchase, ensuring no discrepancies or missing information. This detailed analysis will equip you with critical insights into the industry's landscape and the group's strategic positioning.

Rivalry Among Competitors

The competitive rivalry within the Saudi Arabian healthcare sector is intensifying. Dr. Sulaiman Al-Habib Medical Services Group faces significant competition from established private hospital groups like National Medical Care (Care), Fakeeh Care Group (Fakeeh), and Mouwasat Medical Services Co. (Mouwasat), all of whom are actively expanding their operations to capture market share.

This heightened competition is fueled by the Saudi healthcare market's robust growth, projected to reach SAR 120 billion by 2027, according to some market forecasts. Factors such as a growing population, an aging demographic, and an increasing incidence of chronic diseases are driving demand, creating an attractive environment for further investment and expansion by all major players.

The competition for top medical professionals is fierce, directly impacting the quality of care Dr. Sulaiman Al-Habib Medical Services Group can offer. In 2023, the Saudi Arabian healthcare market saw significant growth, with private sector expansion intensifying the race for specialized doctors and nurses, potentially driving up labor costs for established players.

This intense rivalry for talent means that retaining experienced staff is as crucial as attracting new ones. High turnover rates can disrupt patient care continuity and increase recruitment expenses, a challenge faced by leading healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group as they navigate a dynamic labor market.

Dr. Sulaiman Al-Habib Medical Services Group differentiates itself through specialized services, cutting-edge medical technologies, and an exceptional patient experience. This focus on quality and innovation is crucial in a market where rivals are also investing heavily in advanced treatments and patient care.

The group actively leverages advanced medical technologies and a highly qualified medical staff to maintain its competitive edge. For instance, in 2023, the company reported a significant increase in its investment in medical equipment and technology, aiming to stay ahead of competitors who are also enhancing their service offerings.

Competitive Rivalry 4

Saudi Arabia's Vision 2030 is actively encouraging privatization within its healthcare sector, aiming to boost private sector bed capacity. This policy directly fuels competitive rivalry, as established groups like Dr. Sulaiman Al-Habib Medical Services Group face increased pressure from both existing private entities and new entrants eager to capture market share and participate in privatization opportunities. The drive to expand private healthcare infrastructure means more competition for patients and resources.

The intensified competition is evident as private healthcare providers actively seek to expand their footprint and service offerings. For instance, the Saudi government has set targets to increase the private sector's contribution to total healthcare expenditure. By 2023, the private sector's share of healthcare expenditure was projected to reach 40%, up from approximately 30% in previous years, indicating a significant shift that heightens rivalry among all players, including Dr. Sulaiman Al-Habib.

This strategic redirection creates a dynamic environment where companies must innovate and optimize operations to maintain and grow their market position. The privatization push means that companies are not only competing for patients but also for the potential to acquire or manage government-owned facilities, further escalating the stakes in this increasingly competitive landscape.

- Increased Private Sector Bed Capacity: Vision 2030 aims to significantly increase the private sector's share of total healthcare bed capacity.

- Vying for Market Share: Private healthcare operators are actively competing to gain a larger portion of the growing private healthcare market.

- Privatization Deal Opportunities: The privatization initiatives present opportunities for acquisition and management of government facilities, intensifying competition for these deals.

- Heightened Competitive Intensity: Established players like Dr. Sulaiman Al-Habib face a more competitive environment due to these policy changes and market dynamics.

Competitive Rivalry 5

The healthcare sector, particularly for entities like Dr. Sulaiman Al-Habib Medical Services Group, is characterized by intense competitive rivalry. This stems significantly from the substantial fixed costs inherent in operating hospitals and advanced medical facilities. These costs encompass everything from the physical infrastructure and sophisticated medical equipment to the highly compensated specialized medical professionals. For instance, in 2024, the capital expenditure for establishing a new, state-of-the-art hospital can easily run into hundreds of millions of dollars, creating a high barrier to entry but also immense pressure on existing players.

These high fixed costs create a powerful incentive for all competitors to maximize their operational efficiency by filling bed capacity and ensuring consistent patient volumes. This drive to maintain high utilization rates fuels aggressive marketing campaigns and continuous service expansion as providers vie for market share. In 2023, the Saudi Arabian healthcare market alone saw significant investment in expanding services and facilities, with several major players announcing new projects and acquisitions to bolster their competitive positions.

- High Fixed Costs: Hospitals require massive upfront investment in infrastructure, technology, and skilled personnel.

- Capacity Utilization Pressure: Competitors are driven to fill beds and services to cover these fixed costs, leading to aggressive strategies.

- Aggressive Marketing & Expansion: To capture patient volume, providers engage in intense marketing and expand their service offerings.

- Market Share Focus: The need to achieve economies of scale intensifies the battle for market dominance.

The competitive rivalry within the Saudi healthcare sector is intense, with Dr. Sulaiman Al-Habib Medical Services Group facing strong competition from established players like National Medical Care, Fakeeh Care Group, and Mouwasat Medical Services. This rivalry is amplified by the robust growth of the Saudi healthcare market, which is projected to reach SAR 120 billion by 2027, driven by population growth and increasing chronic diseases.

The competition for skilled medical professionals is particularly fierce, impacting the quality of care and driving up labor costs. For instance, in 2023, private sector expansion in Saudi Arabia intensified the race for specialized doctors and nurses. This necessitates a strong focus on retaining experienced staff to ensure continuity of care and manage recruitment expenses effectively.

Dr. Sulaiman Al-Habib differentiates itself through specialized services, advanced medical technology, and a superior patient experience, crucial strategies in a market where rivals are also investing heavily. The group's 2023 investments in medical equipment and technology underscore this commitment to staying ahead. Furthermore, Saudi Vision 2030's push for healthcare privatization, aiming to increase private sector bed capacity, intensifies competition for both patients and potential government facility acquisitions.

The high fixed costs associated with operating hospitals, estimated at hundreds of millions of dollars for a new facility in 2024, compel all providers to maximize capacity utilization through aggressive marketing and service expansion. This pressure to fill beds and services fuels the battle for market share, as seen in the significant investments announced by major players in 2023 to expand their presence and offerings.

| Competitor | Market Share (Est. 2023) | Key Strengths | Recent Expansion/Investment |

|---|---|---|---|

| National Medical Care (Care) | Significant | Established network, strong brand recognition | Ongoing facility upgrades and service diversification |

| Fakeeh Care Group (Fakeeh) | Significant | Specialized medical centers, international affiliations | Expansion into new regions, investment in advanced diagnostics |

| Mouwasat Medical Services Co. (Mouwasat) | Significant | Integrated healthcare services, focus on quality | New hospital openings, technology adoption |

| Dr. Sulaiman Al-Habib Medical Services Group | Leading | Specialized services, advanced technology, patient experience | Increased investment in medical equipment and technology |

SSubstitutes Threaten

Telemedicine and digital health solutions represent an escalating threat, especially for routine appointments and managing ongoing health conditions. Saudi Arabia's commitment to digital transformation, including AI in diagnostics, means virtual care offers convenience and affordability, potentially drawing patients away from brick-and-mortar facilities.

Home healthcare services are emerging as a significant substitute for traditional inpatient and outpatient medical care, particularly for segments like the elderly or individuals needing continuous support. This trend is driven by a growing preference for comfort and convenience, directly impacting the demand for hospital-centric services.

The market for home healthcare is expanding rapidly. For instance, the global home healthcare market was valued at approximately USD 345.7 billion in 2023 and is projected to reach USD 600 billion by 2030, indicating a strong growth trajectory. This expansion means more patients may opt for care at home, reducing reliance on brick-and-mortar facilities for certain treatments and monitoring.

Preventative care and wellness programs are gaining significant traction, driven by heightened public health awareness. These initiatives aim to proactively reduce the incidence of diseases, thereby lessening the long-term demand for acute medical interventions and hospital treatments.

While these programs don't directly substitute for critical care services, a robust shift towards prevention could lead to a decrease in the need for certain hospital-based procedures over time. For instance, the global wellness market was valued at approximately $4.5 trillion in 2023, indicating a substantial investment in health maintenance.

Threat of Substitutes 4

Medical tourism presents a significant substitute threat to Dr. Sulaiman Al-Habib Medical Services Group. Patients seeking specialized treatments or more affordable options may travel internationally, especially for complex procedures. This global competition remains a factor even as Saudi Arabia's healthcare sector advances.

The accessibility of advanced medical procedures in other countries means patients have choices beyond domestic providers. For instance, in 2023, global medical tourism expenditure was estimated to be in the tens of billions of dollars, indicating a substantial market where patients actively seek alternatives. This trend affects all healthcare providers, including those in Saudi Arabia.

- Global Competition: Patients can access treatments abroad, particularly for specialized or cost-sensitive procedures.

- Cost Sensitivity: Lower treatment costs in certain countries act as a powerful incentive for medical tourism.

- Service Specialization: Highly niche or advanced medical services offered elsewhere can draw patients away.

Threat of Substitutes 5

While serious medical conditions necessitate professional care, alternative medicine and self-treatment options present a degree of substitution for Dr. Sulaiman Al-Habib Medical Services Group, particularly for minor ailments. These alternatives, though not typically replacing core medical services, can influence patient choices for less critical health concerns.

The growing market for health and wellness products, such as vitamins and supplements, also acts as a substitute. For instance, in 2024, the global dietary supplements market was valued at over $170 billion, indicating a significant consumer trend towards self-management of certain health aspects, potentially reducing the frequency of visits for less severe issues.

- Alternative medicine and self-treatment: While not a direct replacement for serious conditions, these can substitute for minor ailments or complement conventional treatments.

- Health and wellness products: The expanding market for supplements and wellness items, valued at over $170 billion globally in 2024, can reduce reliance on medical consultations for certain health concerns.

- Patient self-education: Increased access to health information online empowers patients to manage minor issues independently, potentially impacting demand for routine check-ups.

Telemedicine and home healthcare services present a growing threat by offering convenient and potentially lower-cost alternatives to traditional hospital visits. The global home healthcare market's projected growth to USD 600 billion by 2030 underscores this shift. Furthermore, the substantial USD 4.5 trillion global wellness market in 2023 highlights a trend towards preventative care that could reduce demand for acute medical interventions.

| Substitute Category | Key Trend/Driver | Market Data Point (Approximate) |

|---|---|---|

| Telemedicine/Digital Health | Convenience, AI in diagnostics | Growing adoption in routine care |

| Home Healthcare | Preference for comfort, aging population | Global market valued at USD 345.7 billion in 2023 |

| Preventative Care/Wellness | Increased health awareness | Global wellness market valued at USD 4.5 trillion in 2023 |

Entrants Threaten

The healthcare sector, particularly for a group like Dr. Sulaiman Al-Habib Medical Services Group, faces a significant threat from new entrants due to the immense capital required. Establishing modern hospitals, advanced diagnostic centers, and acquiring cutting-edge medical equipment demands hundreds of millions, if not billions, of Saudi Riyals. This high barrier effectively deters many potential competitors from entering the market.

For instance, Al-Habib's own expansion projects, such as the development of new facilities, often involve capital expenditures in the hundreds of millions of SAR. This ongoing investment in infrastructure and technology by established players like Al-Habib further solidifies their position and raises the bar for any aspiring new entrants, making it exceptionally challenging to compete on a comparable scale.

The threat of new entrants in the Saudi healthcare market, particularly for a player like Dr. Sulaiman Al-Habib Medical Services Group (HMG), is significantly mitigated by stringent regulatory requirements. Obtaining the necessary licenses, accreditations, and ensuring compliance with health and safety standards presents a substantial hurdle. For instance, the Q2 2025 operational launch of new HMG hospitals underscores the lengthy and complex approval processes new entities would face.

The healthcare sector, particularly for specialized medical services, presents a high barrier to entry for new players. Attracting and retaining a highly qualified and specialized medical workforce is a critical challenge. For instance, in 2024, the global shortage of physicians, especially in specialized fields, continued to be a significant concern, impacting recruitment efforts for all healthcare providers.

Established entities like Dr. Sulaiman Al-Habib Medical Services Group leverage their existing robust networks and strong reputation to attract and retain top medical talent. This established employer brand makes it considerably more difficult for new entrants to compete for skilled professionals, thereby limiting the threat of new competition.

Threat of New Entrants 4

The healthcare sector demands significant capital investment for state-of-the-art facilities and advanced medical technology, creating a substantial financial hurdle for potential new entrants. Dr. Sulaiman Al-Habib Medical Services Group's established infrastructure and ongoing investment in cutting-edge equipment provide a competitive advantage that new players would struggle to replicate quickly.

Building a strong brand reputation and patient trust in healthcare is a lengthy process, requiring years of consistent, high-quality service delivery. Dr. Sulaiman Al-Habib Medical Services Group has cultivated this credibility, fostering patient loyalty that acts as a significant barrier to entry for newcomers who lack an established track record and patient confidence.

- High Capital Requirements: Establishing a new hospital or clinic necessitates substantial upfront investment in infrastructure, equipment, and staffing, often running into hundreds of millions of dollars.

- Brand Loyalty and Trust: Patient preference for established, reputable providers like Dr. Sulaiman Al-Habib Medical Services Group, built on years of positive patient outcomes and experiences, makes it difficult for new entrants to attract a significant patient base.

- Regulatory Hurdles: Obtaining necessary licenses, accreditations, and complying with stringent healthcare regulations can be a complex and time-consuming process for new entities.

Threat of New Entrants 5

The threat of new entrants for Dr. Sulaiman Al-Habib Medical Services Group is relatively low, largely due to significant barriers to entry. Established players benefit from substantial economies of scale in procuring medical supplies, pharmaceuticals, and advanced technology. For instance, large hospital groups can negotiate better prices due to higher purchase volumes, a feat difficult for new, smaller entities to replicate.

Furthermore, operational efficiencies gained through integrated supply chains and centralized management offer a distinct cost advantage. A new entrant would find it challenging to match these cost efficiencies without achieving considerable patient volumes and establishing robust, integrated operational frameworks. This financial hurdle, coupled with the need for significant capital investment in facilities and technology, deters many potential competitors.

The regulatory landscape and the need for accreditations also present a formidable challenge. Obtaining necessary licenses, certifications, and accreditations requires time, expertise, and substantial investment, further solidifying the position of existing, well-established healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group.

- Economies of Scale: Large healthcare groups leverage bulk purchasing power for medical supplies, pharmaceuticals, and technology, leading to lower per-unit costs compared to new entrants.

- Operational Efficiency: Established providers benefit from integrated supply chains and optimized operational processes, creating cost advantages that are hard for newcomers to achieve.

- Capital Investment: The substantial capital required for building and equipping modern healthcare facilities acts as a significant barrier to entry.

- Regulatory Hurdles: Navigating complex licensing, accreditation, and compliance requirements demands significant time, resources, and expertise, posing a challenge for new market participants.

The threat of new entrants for Dr. Sulaiman Al-Habib Medical Services Group (HMG) is considerably low due to substantial barriers. High capital requirements for state-of-the-art facilities, often in the hundreds of millions of Saudi Riyals, deter many. Furthermore, stringent regulatory approvals and the lengthy process of building brand trust and patient loyalty present significant hurdles for newcomers. Established players like HMG also benefit from strong economies of scale in procurement and operational efficiencies, making it difficult for new entities to compete on cost.

| Barrier Type | Description | Impact on New Entrants | Example for HMG (2024/2025) |

|---|---|---|---|

| Capital Investment | High costs for hospitals, equipment, technology | Significant deterrent | HMG's ongoing expansion projects involve capital expenditures in the hundreds of millions of SAR. |

| Regulatory Compliance | Licensing, accreditations, health standards | Time-consuming and resource-intensive | Complex approval processes for new facility launches, like HMG's Q2 2025 operational start. |

| Brand Reputation & Trust | Years of quality service delivery | Difficult to replicate quickly | HMG's established credibility fosters patient loyalty. |

| Economies of Scale | Bulk purchasing power for supplies and tech | Cost advantage over new entrants | Large groups like HMG negotiate better prices due to higher volumes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dr. Sulaiman Al-Habib Medical Services Group is built upon a robust foundation of data, including the group's official annual reports, investor presentations, and publicly available financial statements. We supplement this with insights from reputable healthcare industry research reports and market intelligence platforms to provide a comprehensive view of the competitive landscape.