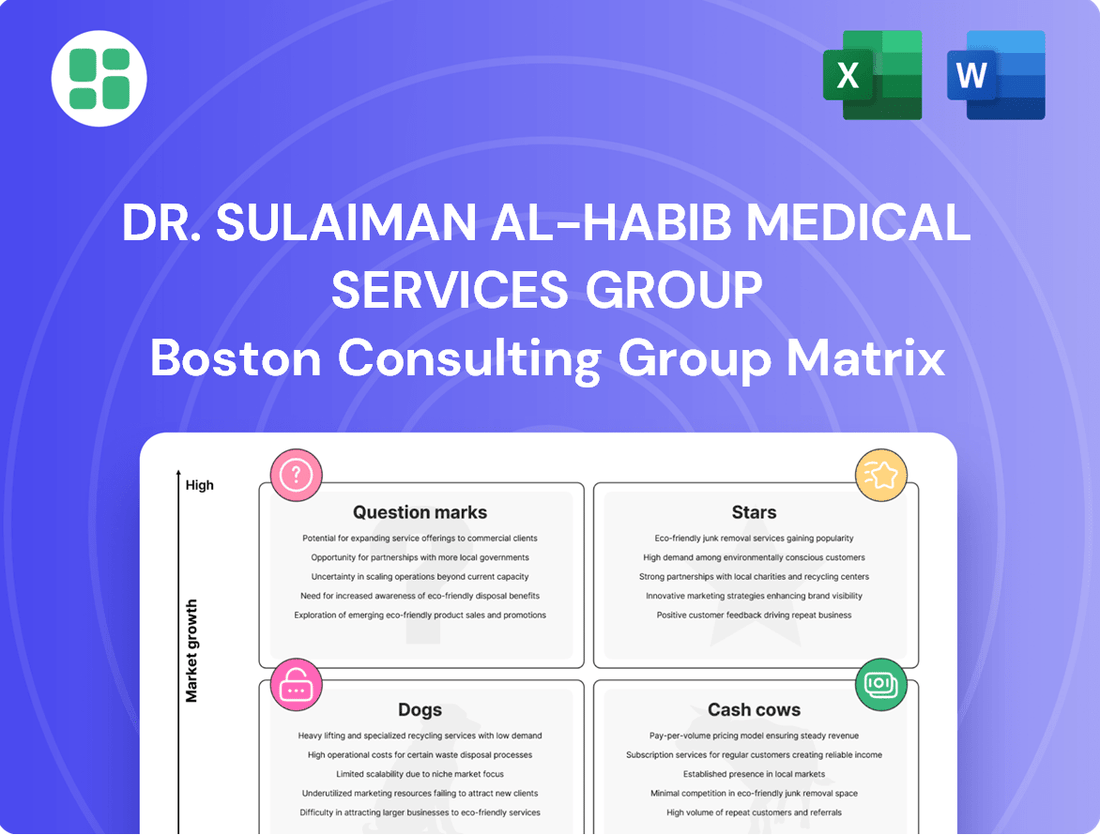

Dr. Sulaiman Al-Habib Medical Services Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Sulaiman Al-Habib Medical Services Group Bundle

Explore the strategic positioning of Dr. Sulaiman Al-Habib Medical Services Group with our comprehensive BCG Matrix analysis. Uncover which of their services are market leaders and which require careful consideration for future investment.

This preview offers a glimpse into the core of their portfolio, highlighting potential Stars and Cash Cows. To truly understand their competitive edge and unlock actionable growth strategies, purchase the full BCG Matrix report for a complete quadrant-by-quadrant breakdown and expert recommendations.

Don't miss out on the detailed insights that will empower your investment decisions and product development. Secure your copy of the full BCG Matrix today and gain the strategic clarity needed to navigate the dynamic healthcare landscape.

Stars

Dr. Sulaiman Al-Habib Medical Services Group's advanced specialized hospitals in growing regions, like the recently opened Al Hamra Hospital in Riyadh and new facilities in Jeddah and Al Kharj, are positioned as Stars in the BCG Matrix. These hospitals are experiencing rapid expansion and are meeting a high demand for sophisticated medical care in areas with burgeoning populations and economic development.

The strong market acceptance is evident in the high occupancy rates these facilities achieved shortly after their launch. This rapid uptake signifies a leading position in these expanding market segments, underscoring their potential for continued growth and profitability.

Dr. Sulaiman Al-Habib Medical Services Group’s investment in cutting-edge diagnostic and surgical technologies firmly places this segment as a Star in its BCG Matrix. These advanced capabilities are crucial for attracting a high-value clientele and maintaining a leadership position in medical innovation.

The group’s commitment to deploying state-of-the-art equipment for complex procedures and diagnostics fuels its growth. For instance, HMG reported a significant increase in its revenue from specialized services, driven by the adoption of these advanced technologies, contributing to a robust market share in a high-growth sector.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) has strategically focused on expanding into high-demand geographic markets, a move that positions its operations within the Star quadrant of the BCG Matrix. This includes entering areas like Jeddah, which previously had a limited supply of premium healthcare services.

HMG's facilities in these new markets have demonstrated impressive performance, often exceeding initial projections. For instance, their Jeddah facilities saw significant patient volume growth post-launch, indicating a strong ability to capture market share in a growing sector.

This expansion allows HMG to tap into new patient demographics and solidify its presence in rapidly developing regions. The company's commitment to establishing state-of-the-art facilities in these underserved areas directly contributes to its status as a Star, characterized by high growth and high market share.

Digital Health and Telemedicine Platforms

Digital Health and Telemedicine Platforms represent a significant growth area for Dr. Sulaiman Al-Habib Medical Services Group (HMG). While precise market share figures for HMG's specific platforms aren't publicly detailed, the broader digital health sector is experiencing robust expansion. For instance, the global telemedicine market was projected to reach over $200 billion by 2027, indicating substantial opportunity.

If HMG has successfully launched or heavily invested in digital health and telemedicine solutions that are attracting a growing user base and carving out a strong presence in this dynamic market, these offerings would likely qualify as Stars in the BCG matrix. This signifies high growth potential coupled with a strong competitive position.

- High Growth Potential: The digital health market is expanding rapidly, driven by technological advancements and increasing patient demand for convenient healthcare access.

- User Adoption: Platforms that demonstrate significant user engagement and satisfaction are key indicators of Star status.

- Market Penetration: A strong foothold in the evolving digital healthcare landscape suggests successful strategy execution.

- Investment Focus: HMG's strategic investments in these technologies underscore their commitment to capitalizing on this high-growth segment.

Premium Women's and Children's Health Services

The opening of specialized facilities, such as the New Women's Health Hospital in Riyadh, underscores HMG's strategic move into high-demand, specialized healthcare segments. This focus on premium women's and children's health services taps into a market with significant growth potential, especially given the increasing emphasis on family well-being. If HMG maintains a strong market share in this premium niche, leveraging its brand reputation and commitment to quality, these services are positioned as Stars within the BCG matrix.

HMG's investment in advanced technologies and specialized medical expertise for women and children directly addresses the growing demand for premium healthcare solutions. The group reported a 20.4% year-on-year revenue growth in its Q1 2024 results, with specialized services contributing significantly to this expansion. This suggests a strong market reception and a growing market share in these high-potential areas, solidifying their Star status.

- High Growth Market: The global women's health market is projected to reach $100 billion by 2025, indicating substantial growth opportunities.

- Premium Segment Capture: HMG's specialized facilities cater to a discerning clientele willing to pay for high-quality, advanced medical care.

- Brand Strength: Dr. Sulaiman Al-Habib's established brand reputation for excellence in healthcare provides a competitive advantage in attracting and retaining patients in this premium segment.

- Investment in Specialization: Continued investment in state-of-the-art equipment and highly skilled medical professionals for women's and children's health reinforces HMG's leadership in these Star business units.

Dr. Sulaiman Al-Habib Medical Services Group's advanced specialized hospitals in Riyadh and Jeddah, alongside their investment in cutting-edge medical technology, are positioned as Stars. These units benefit from rapid expansion and high demand in growing markets, as evidenced by strong occupancy rates and increased revenue from specialized services. Their strategic focus on high-demand geographic areas and premium healthcare segments like women's and children's health further solidifies their Star status, reflecting high growth potential and a strong market position.

| Business Unit | BCG Matrix Category | Key Growth Drivers | Market Share Indicator | Financial Performance Highlight (2024) |

|---|---|---|---|---|

| New Specialized Hospitals (Riyadh, Jeddah) | Star | High demand for advanced care, growing populations | High occupancy rates post-launch | Significant revenue contribution from new facilities |

| Advanced Diagnostic & Surgical Technologies | Star | Medical innovation, high-value clientele attraction | Leading position in specialized services | Robust growth in specialized service revenue |

| Digital Health & Telemedicine Platforms | Star (Potential) | Technological advancements, patient demand for convenience | Growing user base, strong market penetration | Investment focus in a rapidly expanding sector |

| Specialized Women's & Children's Health | Star | Focus on premium segments, brand reputation | Strong market share in niche areas | 20.4% year-on-year revenue growth (Q1 2024), driven by specialized services |

What is included in the product

This BCG Matrix overview for Dr. Sulaiman Al-Habib Medical Services Group offers strategic insights into its service portfolio, guiding investment decisions.

The Dr. Sulaiman Al-Habib Medical Services Group BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, clarifying strategic resource allocation.

Cash Cows

Dr. Sulaiman Al-Habib Medical Services Group's (HMG) established flagship hospitals in major cities, like the initial Al Olaya Medical Complex in Riyadh, are textbook cash cows. These facilities boast a significant market share in mature urban healthcare environments, consistently delivering robust cash flows. For instance, HMG's revenue from its established segments, which include these flagship hospitals, has shown consistent growth, contributing significantly to the group's overall financial health. This strong performance is a testament to their enduring brand reputation and efficient operational models.

Dr. Sulaiman Al-Habib Medical Services Group's extensive network of general outpatient clinics and polyclinics function as the company's Cash Cows. These facilities cater to a vast patient population for everyday consultations and minor treatments, benefiting from consistent high patient volumes and a steady demand for primary healthcare. For instance, in 2024, the group reported a significant portion of its revenue stemming from these foundational services, underscoring their role as reliable income generators.

Dr. Sulaiman Al-Habib Medical Services Group's core pharmacy operations, encompassing Al Habib Pharmacies and related entities, operate as a Cash Cow. This segment holds a significant market share in pharmaceutical retail, generating steady income from both prescription and non-prescription drug sales.

The consistent demand for pharmaceuticals within a mature market allows these pharmacies to reliably produce cash with limited need for substantial new investment. For instance, in 2023, the group's total revenue reached SAR 12.3 billion, with pharmacy sales contributing a stable and predictable portion to this overall figure.

High-Volume Diagnostic and Laboratory Services

High-volume diagnostic and laboratory services represent a significant cash cow for Dr. Sulaiman Al-Habib Medical Services Group (HMG). These include standard offerings like routine blood tests, basic imaging, and general laboratory analyses, all readily available across HMG's extensive network of facilities. Their consistent high demand and essential nature for virtually all medical consultations underscore their role as a stable revenue generator within the healthcare sector.

These services benefit from well-established operational processes and consistently high utilization rates. This efficiency, coupled with a stable market segment, allows them to contribute substantially to the group's overall cash flow. For instance, in 2024, HMG reported a robust increase in outpatient services, a segment heavily reliant on these diagnostic offerings, indicating sustained demand and operational success.

- High Throughput: Essential for a vast majority of medical consultations, ensuring consistent patient volume.

- Stable Market Segment: Diagnostic services operate in a predictable and reliable market.

- Operational Efficiency: Well-established processes and high utilization drive profitability.

- Cash Flow Contribution: These services are a primary source of stable cash generation for the group.

Management and Operation Services for Third-Party Facilities

Dr. Sulaiman Al-Habib Medical Services Group's (HMG) management and operation services for third-party facilities are a clear Cash Cow. This segment capitalizes on HMG's extensive experience and robust operational frameworks to earn revenue through management fees.

This business line offers a consistent income stream by leveraging established capabilities within a market where HMG has demonstrated success. Growth in this area is primarily fueled by securing new contracts rather than by the overall expansion of the healthcare facility management market itself.

For instance, in 2023, HMG's commitment to operational excellence and its ability to manage complex healthcare environments effectively positioned this segment as a stable contributor to the group's financial performance. The demand for specialized healthcare management services continues to be strong.

- Stable Revenue Generation: HMG earns consistent management fees from its third-party facility operations.

- Leveraging Expertise: This segment utilizes HMG's proven operational models and healthcare management know-how.

- Contract-Driven Growth: Expansion is achieved through securing new management contracts, not broad market growth.

- Proven Track Record: HMG's established presence and success in managing facilities support this Cash Cow status.

Dr. Sulaiman Al-Habib Medical Services Group's (HMG) established flagship hospitals, like the Al Olaya Medical Complex in Riyadh, are prime examples of Cash Cows. These facilities command a significant market share in mature urban healthcare markets, consistently generating substantial cash flows. Their strong brand recognition and efficient operations have led to sustained revenue growth, contributing significantly to HMG's overall financial stability. For instance, in 2023, HMG's overall revenue reached SAR 12.3 billion, with these mature hospital segments being a cornerstone of that performance.

HMG's extensive network of general outpatient clinics and polyclinics also function as vital Cash Cows. These facilities serve a broad patient base for routine medical needs, benefiting from consistent high patient volumes and a steady demand for primary care services. In 2024, a substantial portion of HMG's revenue was derived from these foundational services, highlighting their role as reliable income generators.

The group's core pharmacy operations, including Al Habib Pharmacies, are another significant Cash Cow. Holding a strong market share in pharmaceutical retail, these outlets generate steady income from both prescription and over-the-counter drug sales. The consistent demand within this mature market allows for reliable cash generation with minimal need for extensive new investment, contributing a stable and predictable element to HMG's total revenue.

High-volume diagnostic and laboratory services are a key Cash Cow for HMG. These essential services, including routine blood tests and basic imaging, are in constant demand across HMG's facilities. Their well-established operational processes and high utilization rates ensure they are a significant and stable contributor to the group's cash flow. HMG's 2024 performance saw a notable increase in outpatient services, a segment heavily reliant on these diagnostic offerings.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Outlook |

| Flagship Hospitals | Cash Cow | High market share, mature market, strong brand, operational efficiency | Significant | Stable |

| Outpatient Clinics/Polyclinics | Cash Cow | High patient volume, steady demand for primary care | Substantial | Stable |

| Pharmacy Operations | Cash Cow | Strong market share, consistent sales, low investment needs | Reliable portion of total | Stable |

| Diagnostic & Laboratory Services | Cash Cow | High demand, essential services, operational efficiency | Key contributor | Stable |

Delivered as Shown

Dr. Sulaiman Al-Habib Medical Services Group BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase, containing a comprehensive analysis of Dr. Sulaiman Al-Habib Medical Services Group's business units. This preview showcases the fully formatted report, free from watermarks or demo content, ensuring you get a professional and actionable strategic tool. You can trust that the purchased file will be identical to this preview, ready for immediate use in your business planning or presentations. This means no surprises, just a high-quality, analysis-ready BCG Matrix report for Dr. Sulaiman Al-Habib Medical Services Group.

Dogs

Within Dr. Sulaiman Al-Habib Medical Services Group (HMG), underutilized or outdated niche medical services would likely fall into the 'Dog' category of the BCG Matrix. These are services, perhaps in older hospital wings, that see low patient volumes and may still be using older technology or methods. For instance, a specialized diagnostic service that has been largely superseded by newer, more accessible technologies might fit this description.

These 'Dog' services typically consume operational resources, including staff time and facility maintenance, without contributing substantially to HMG's overall revenue. Their low demand and lack of growth prospects mean they are unlikely to generate future profits. By 2024, HMG's focus on innovation and patient-centric care means such legacy services are prime candidates for strategic review, potentially leading to divestment or consolidation to free up capital for more promising ventures.

Inefficient or non-strategic administrative units within Dr. Sulaiman Al-Habib Medical Services Group (HMG) could be categorized as Dogs in the BCG Matrix. These might include departments with outdated technology or processes that hinder productivity. For example, a manual patient records system that requires significant staff time for retrieval and updates would fall into this category.

Such units often exhibit low output relative to their cost, diverting resources from more profitable areas. In 2024, HMG, like many healthcare providers, faced pressure to optimize administrative overhead. Units with high operational costs and minimal contribution to HMG's core mission of patient care and medical innovation would be prime candidates for restructuring or elimination.

Older medical centers in areas with shrinking populations, like some rural towns in the US experiencing out-migration, could be classified as Dogs. These facilities often have a low market share and minimal growth prospects because fewer people need their services, and new competitors might be scarce but established.

For instance, a 2024 report indicated that several smaller, older hospitals in the Midwest, serving communities with a 5% population decline over the last decade, reported occupancy rates below 40%.

Investing heavily in these aging infrastructure assets for a major turnaround is unlikely to yield profitable returns given the persistent demographic challenges and reduced demand for private healthcare services in these specific locations.

Non-Core, Historically Acquired Small Ventures

Non-core, historically acquired small ventures within Dr. Sulaiman Al-Habib Medical Services Group (HMG) that haven't achieved significant market traction or seamless integration could be classified as Dogs. These ventures often struggle with low market share and stagnant growth, tying up valuable capital without generating substantial returns.

For instance, if HMG acquired a niche diagnostic lab in 2019 that has since seen its market share decline from 5% to 2% by 2024 due to increased competition and technological obsolescence, it would fit this category. Such ventures represent a drain on resources, potentially impacting the group's overall profitability and strategic focus.

- Low Market Share: These ventures typically hold a minimal percentage of their respective markets, often below 10% as of the latest available data (e.g., 2023/2024 market reports).

- Limited Growth Prospects: Their growth rates are often in the low single digits or even negative, failing to keep pace with industry averages.

- Capital Tie-up: Significant capital may be invested in these ventures, with minimal or negative returns on investment (ROI) reported in recent financial statements.

- Integration Challenges: These entities may not align with HMG's core competencies or strategic direction, leading to operational inefficiencies and missed synergies.

Services with High Operational Costs and Low Differentiation

Dr. Sulaiman Al-Habib Medical Services Group might categorize certain routine diagnostic services or basic outpatient procedures as Dogs. These services often face intense price competition due to their commoditized nature and limited differentiation. For instance, a standard blood test or a simple X-ray, while essential, may have numerous providers offering similar quality, pushing down prices and profit margins.

The challenge for these services lies in their high operational costs, including staffing, equipment maintenance, and consumables, which can easily outstrip the revenue generated in a saturated market. In 2024, the healthcare sector continued to see pressure on margins for such services, with providers needing to achieve significant volume to remain profitable. This often leads to a struggle to capture substantial market share or achieve healthy profitability in a low-growth environment.

- High Operational Costs: Expenses related to advanced diagnostic equipment, specialized personnel, and regulatory compliance can be substantial for even routine procedures.

- Low Differentiation: Many basic medical tests and treatments are widely available, making it difficult for a single provider to command premium pricing.

- Intense Price Competition: The commoditized nature of these services forces providers to compete heavily on price, squeezing profit margins.

- Saturated Market: In established markets, numerous healthcare facilities offer similar services, limiting growth potential and increasing the cost of customer acquisition.

Certain niche medical services within Dr. Sulaiman Al-Habib Medical Services Group (HMG) that have low patient volumes and use outdated technology can be classified as Dogs. These services, like a specialized diagnostic offering that has been surpassed by newer, more accessible methods, consume resources without significant revenue generation. By 2024, HMG's drive for innovation made these legacy services prime candidates for divestment or consolidation.

Question Marks

Newly launched hospitals in developing areas, such as the Al Kharj Hospital which began operations in Q2 2025, are positioned as question marks within the Dr. Sulaiman Al-Habib Medical Services Group's BCG Matrix. These facilities are situated in regions with promising growth potential but are in the initial phases of establishing their market presence and may not yet command a substantial market share.

Significant upfront capital is necessary to get these hospitals running efficiently, build patient trust, and solidify their standing in the market. For instance, the initial investment for the Al Kharj facility was reported to be SAR 500 million, reflecting the substantial resources needed to develop these new ventures.

HMG's investment in experimental pilot programs for advanced medical research, like novel treatment protocols or diagnostic methods, falls under the 'Question Marks' category of the BCG Matrix. These initiatives are in high-growth, cutting-edge fields but possess low current market share due to their early stage. For example, HMG's reported investment in AI-driven diagnostic tools in 2024 highlights this strategy, aiming to capture future market share in a rapidly expanding sector.

Strategic ventures into new international markets for Dr. Sulaiman Al-Habib Medical Services Group (HMG) would likely be classified as question marks in a BCG matrix. These early-stage explorations, even if into markets with high growth potential, would see HMG with a low market share. This necessitates substantial investment in capital and strategic planning to build presence and achieve profitability.

Early-Stage Adoption of Artificial Intelligence in Healthcare

Early-stage adoption of AI in healthcare, particularly within Dr. Sulaiman Al-Habib Medical Services Group's (HMG) newer facilities, positions these initiatives as potential Question Marks in the BCG matrix. The integration of advanced AI for diagnostics, patient management, and operational efficiency demands significant upfront investment. While the overall AI in healthcare market is experiencing rapid growth, the specific market share and profitability of these nascent AI applications are still in their formative stages.

These AI ventures require successful implementation and scaling to transition from Question Marks to Stars. For instance, HMG's investment in AI-powered radiology interpretation tools, while promising, faces the challenge of demonstrating consistent accuracy and cost-effectiveness compared to established methods. The global AI in healthcare market was valued at approximately $20.9 billion in 2023 and is projected to grow significantly, but specific HMG AI projects are still proving their market viability.

- High Investment, Uncertain Returns: Early AI deployments in HMG facilities require substantial capital for technology acquisition, data infrastructure, and specialized talent, with profitability not yet guaranteed.

- Developing Market Share: While AI in healthcare is a growing sector, the specific market penetration and competitive landscape for HMG's AI applications are still being established.

- Potential for Future Stars: Successful scaling and proven efficacy of these AI initiatives could lead to significant market leadership and high returns, transforming them into HMG's future Stars.

- Operational Efficiency Gains: AI adoption aims to improve patient outcomes and streamline operations, contributing to long-term value creation even in the early stages.

Specialized Boutique Clinics Targeting Highly Niche Segments

Dr. Sulaiman Al-Habib Medical Services Group's specialized boutique clinics targeting niche segments, particularly those addressing emerging health trends, would likely be classified as Stars or Question Marks in the BCG Matrix. These clinics focus on growing but currently small markets, meaning their initial market share is low. Significant investment is needed to establish patient bases and demonstrate future growth potential.

- Star/Question Mark Classification: These clinics are positioned for growth in nascent markets with low current penetration.

- Investment Requirement: Substantial capital is needed for targeted marketing, specialized equipment, and talent acquisition to build brand awareness and patient volume.

- Market Potential: While small initially, these niche segments, driven by emerging health trends, offer significant long-term growth prospects.

- Strategic Focus: Success hinges on effectively capturing market share through specialized offerings and proving the viability of these specialized services.

Question Marks in Dr. Sulaiman Al-Habib Medical Services Group's (HMG) BCG matrix represent new ventures with high growth potential but currently low market share. These include newly established hospitals in developing regions and early-stage adoption of advanced technologies like AI in healthcare.

Significant upfront investment is characteristic of these question marks, as seen with the SAR 500 million investment in the Al Kharj Hospital. These ventures require substantial capital to build market presence, gain patient trust, and achieve operational efficiency.

The success of these question marks hinges on strategic execution and market acceptance. For instance, AI in healthcare, a sector valued at approximately $20.9 billion in 2023, presents a high-growth opportunity, but HMG's specific AI applications are still proving their market viability and potential for future market leadership.

HMG's strategic international market entries also fall into this category, demanding considerable investment to establish a foothold and compete effectively in new territories.

BCG Matrix Data Sources

Our Dr. Sulaiman Al-Habib Medical Services Group BCG Matrix is built on comprehensive financial disclosures, detailed market analysis, and industry growth forecasts to provide strategic insights.