HKT Trust and HKT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HKT Trust and HKT Bundle

HKT Trust, a dominant force in Hong Kong's telecommunications and digital services landscape, boasts significant strengths like its extensive network infrastructure and loyal customer base. However, understanding the full scope of its opportunities and the potential threats it faces is crucial for informed decision-making.

Want the full story behind HKT Trust's competitive advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning, investment pitches, and in-depth market research.

Strengths

HKT commands a commanding position in Hong Kong's telecommunications landscape, evidenced by its consolidated broadband market leadership. As the city's sole true 5G provider, HKT has solidified its dominance in a critical growth area.

The company's strength lies in its remarkably comprehensive service portfolio. This includes essential fixed-line and mobile services, high-speed broadband internet, and a range of media entertainment solutions, effectively covering a wide spectrum of consumer and business demands.

This integrated offering allows HKT to serve as a one-stop shop for connectivity and entertainment needs, significantly reinforcing its entrenched market presence and customer loyalty.

HKT boasts a sophisticated and unified high-speed network infrastructure, a significant advantage in Hong Kong's competitive telecommunications landscape. This includes widespread fiber-to-the-home (FTTH) deployments and a prominent 5G network, ensuring robust connectivity for its customers.

The company's commitment to technological leadership is evident in its early adoption of advanced technologies. HKT was the first in Hong Kong to implement 50G PON technology, a testament to its forward-thinking approach. Furthermore, its launch of an 800G AI Superhighway service underscores its dedication to supporting the evolving demands of data-intensive applications and artificial intelligence.

HKT's enterprise business is a significant engine for growth, evidenced by over HK$5 billion in new project wins during 2024. This performance reflects an 11% year-on-year rise in contract value, highlighting strong demand for its services.

The company has strategically broadened its enterprise reach into mainland China, achieving an impressive 37% revenue growth in this key market. This expansion underscores HKT's ability to cater to diverse enterprise needs across different geographies.

HKT is recognized as a reliable partner for both public and private sector organizations, offering comprehensive solutions. These integrated offerings effectively leverage advanced technologies such as 5G, IoT, AI, cloud computing, and cybersecurity to meet evolving business requirements.

Healthy Financial Performance and Deleveraging

HKT Trust and HKT showcased impressive financial health, with total revenue reaching HKD 22.1 billion for the year ended December 31, 2024, and interim results for H1 2025 showing continued upward momentum. EBITDA also saw healthy growth, underscoring operational efficiency.

A key strength lies in the company's successful deleveraging efforts. By December 31, 2024, HKT's net debt-to-EBITDA ratio improved significantly to 2.9x, down from previous periods. This deleveraging enhances financial flexibility.

- Solid Revenue Growth: HKT reported HKD 22.1 billion in total revenue for FY2024, with positive interim results for H1 2025.

- Improved EBITDA: The company demonstrated robust EBITDA growth, indicating strong operational performance.

- Deleveraging Success: Net debt-to-EBITDA ratio reduced to 2.9x as of December 31, 2024, strengthening the balance sheet.

- Enhanced Financial Flexibility: The improved financial position allows HKT to better manage economic uncertainties and pursue strategic initiatives.

Customer Loyalty and Digital Ecosystem

HKT’s strength lies in its ability to cultivate deep customer loyalty, particularly evident through its expanding digital ecosystem. The company has seen a notable rise in its subscriber base for both mobile and broadband services, with significant growth in 5G subscriptions and Fiber-to-the-Home (FTTH) connections. This expansion is bolstered by The Club, HKT's loyalty program, which continues to attract more members, demonstrating high levels of customer engagement and retention.

Furthermore, HKT is strategically enhancing its digital offerings to create a more comprehensive customer experience. By broadening its portfolio to include e-commerce and fintech solutions, the company aims to foster stronger, long-term relationships with its customers. This integrated approach not only strengthens existing ties but also creates new avenues for revenue and deeper customer insights.

- Growing Subscriber Base: HKT's mobile and broadband segments continue to expand, with a particular emphasis on 5G adoption and FTTH deployment, indicating robust market penetration.

- Loyalty Program Success: The Club membership has seen substantial growth, reflecting effective customer engagement strategies and a strong propensity for repeat business.

- Digital Service Expansion: HKT is actively diversifying into e-commerce and fintech, aiming to create a more integrated and valuable digital ecosystem for its users.

- Enhanced Customer Experience: The focus on value-added digital services is designed to improve overall customer satisfaction and build enduring relationships, driving long-term value.

HKT's market leadership in Hong Kong's telecommunications sector is a significant strength, underscored by its consolidated broadband dominance and status as the city's sole true 5G provider. This comprehensive service portfolio, spanning fixed-line, mobile, broadband, and media entertainment, positions HKT as a one-stop shop, fostering strong customer loyalty.

The company's robust network infrastructure, including extensive FTTH and a prominent 5G network, is a key advantage. HKT's commitment to technological innovation is evident in its early adoption of technologies like 50G PON and its launch of an 800G AI Superhighway service, ensuring it remains at the forefront of connectivity solutions.

HKT's enterprise segment is a powerful growth driver, marked by over HK$5 billion in new project wins in 2024, an 11% year-on-year increase in contract value. Strategic expansion into mainland China yielded a 37% revenue growth, showcasing its ability to serve diverse enterprise needs across regions.

Financially, HKT Trust and HKT reported HKD 22.1 billion in total revenue for FY2024, with positive interim results for H1 2025. The company successfully reduced its net debt-to-EBITDA ratio to 2.9x by December 31, 2024, enhancing financial flexibility and stability.

| Metric | FY2024 (as of Dec 31, 2024) | H1 2025 (Interim) |

|---|---|---|

| Total Revenue | HKD 22.1 billion | Positive Growth |

| Net Debt-to-EBITDA Ratio | 2.9x | N/A |

| Enterprise New Project Wins | > HKD 5 billion | N/A |

| Enterprise Mainland China Revenue Growth | 37% | N/A |

What is included in the product

Explores the strategic advantages and threats impacting HKT Trust and HKT’s success by detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable HKT Trust SWOT analysis to pinpoint and address strategic weaknesses, thereby relieving the pain of uncertainty.

Weaknesses

HKT operates in a Hong Kong telecommunications market known for its aggressive competition. Several well-established companies are constantly battling for customer acquisition and retention, which directly impacts HKT's market share.

This intense rivalry forces HKT to maintain competitive pricing, often squeezing profit margins. For instance, in 2023, the average revenue per user (ARPU) for mobile services in Hong Kong remained under pressure due to these competitive dynamics.

To stay ahead, HKT must consistently invest in new technologies and services, a costly endeavor. This continuous need for innovation and differentiation is crucial for HKT to sustain its market position against nimble competitors.

Despite ongoing diversification efforts, HKT's financial performance remains heavily anchored to its traditional fixed-line and pay-TV services. These legacy segments are confronting a long-term erosion of revenue as consumer habits shift towards over-the-top (OTT) streaming and mobile-centric content consumption. The company reported a decrease in local telephony services revenue in 2024, underscoring the persistent challenge of these evolving market dynamics.

HKT faces a significant challenge with high capital expenditure required for network upgrades. Keeping its infrastructure at the forefront, including the rollout of 5G and advanced fiber optic networks, necessitates substantial ongoing investment. For instance, in the fiscal year 2023, HKT reported capital expenditure of HK$3.5 billion, reflecting this commitment to network enhancement.

This continuous need for heavy investment, driven by rapid technological evolution in telecommunications, can put pressure on HKT's profitability and free cash flow. The company must balance these essential upgrades with maintaining financial health, a common hurdle for major telecom operators globally.

Sensitivity to Hong Kong's Economic Conditions

HKT Trust's reliance on Hong Kong's economy presents a significant weakness. As the territory's primary telecommunications provider, its financial results are intrinsically linked to the city's economic vitality. For instance, Hong Kong's GDP growth was projected to be around 2.5% to 3.5% in 2024, with similar moderate forecasts for 2025, reflecting ongoing global trade uncertainties and evolving consumer spending habits.

This economic sensitivity means that a downturn in Hong Kong can directly impact HKT's revenue streams. A less robust economic climate often translates to reduced discretionary spending by both individual consumers and businesses, potentially slowing down service adoption and upgrade cycles. This can hinder HKT's ability to achieve its growth targets.

- Economic Dependence: HKT's performance is heavily influenced by Hong Kong's economic conditions.

- 2024-2025 Outlook: Forecasts suggest moderate economic growth for Hong Kong, impacted by global trade and consumer behavior shifts.

- Revenue Impact: Economic slowdowns can lead to cautious consumer and enterprise spending, affecting HKT's revenue.

Regulatory and Policy Challenges

HKT Trust operates within Hong Kong's telecommunications sector, which is subject to a robust regulatory environment. This includes strict licensing stipulations and numerous compliance mandates that can influence operational strategies and service rollouts. For instance, the Communications Authority (OFCA) actively oversees the industry, ensuring fair competition and consumer protection, which HKT must continually adhere to.

Potential shifts in regulatory policies or heightened oversight present a significant weakness. Such changes could impose further operational expenses, restrict HKT's agility in introducing innovative offerings, or introduce intricate hurdles in market penetration. The ongoing need to adapt to evolving regulations demands consistent investment in compliance and strategic planning to mitigate potential disruptions.

Navigating this complex regulatory terrain requires dedicated resources and vigilant monitoring. HKT's ability to anticipate and respond to policy adjustments directly impacts its capacity to maintain a competitive edge and achieve its growth objectives. The telecommunications sector in Hong Kong saw a total revenue of approximately HKD 61.6 billion in 2023, underscoring the market's scale and the importance of regulatory stability.

Key regulatory challenges for HKT include:

- License Renewal and Spectrum Allocation: The ongoing need to secure and renew operating licenses and spectrum rights, which are subject to regulatory review and potential changes in terms or costs.

- Interconnection and Access Regulations: Compliance with rules governing network access and interconnection with other service providers, which can impact pricing and service availability.

- Consumer Protection Measures: Adherence to regulations aimed at protecting consumers, such as data privacy laws and fair trading practices, which may require system upgrades or policy revisions.

- Emerging Technology Frameworks: Adapting to new regulatory frameworks for technologies like 5G and IoT, which are still developing and may introduce unforeseen compliance burdens.

HKT faces significant challenges due to the highly competitive nature of Hong Kong's telecommunications market. This intense rivalry necessitates continuous investment in technology and services to maintain market share, often pressuring profit margins.

The company's reliance on legacy fixed-line and pay-TV services, which are declining due to shifts towards OTT and mobile content, presents another weakness. This trend is evident in the reported decrease in local telephony services revenue in 2024.

Furthermore, HKT's substantial capital expenditure, such as the HK$3.5 billion spent in 2023 on network upgrades like 5G, strains profitability and free cash flow. This constant need for investment to keep pace with technological evolution is a persistent hurdle.

HKT's financial performance is also closely tied to Hong Kong's economic conditions, with moderate GDP growth forecasts for 2024-2025 indicating potential revenue impacts from economic slowdowns.

The company must also navigate a complex regulatory environment, including strict licensing and compliance mandates from bodies like OFCA, which can add operational costs and limit agility.

Preview Before You Purchase

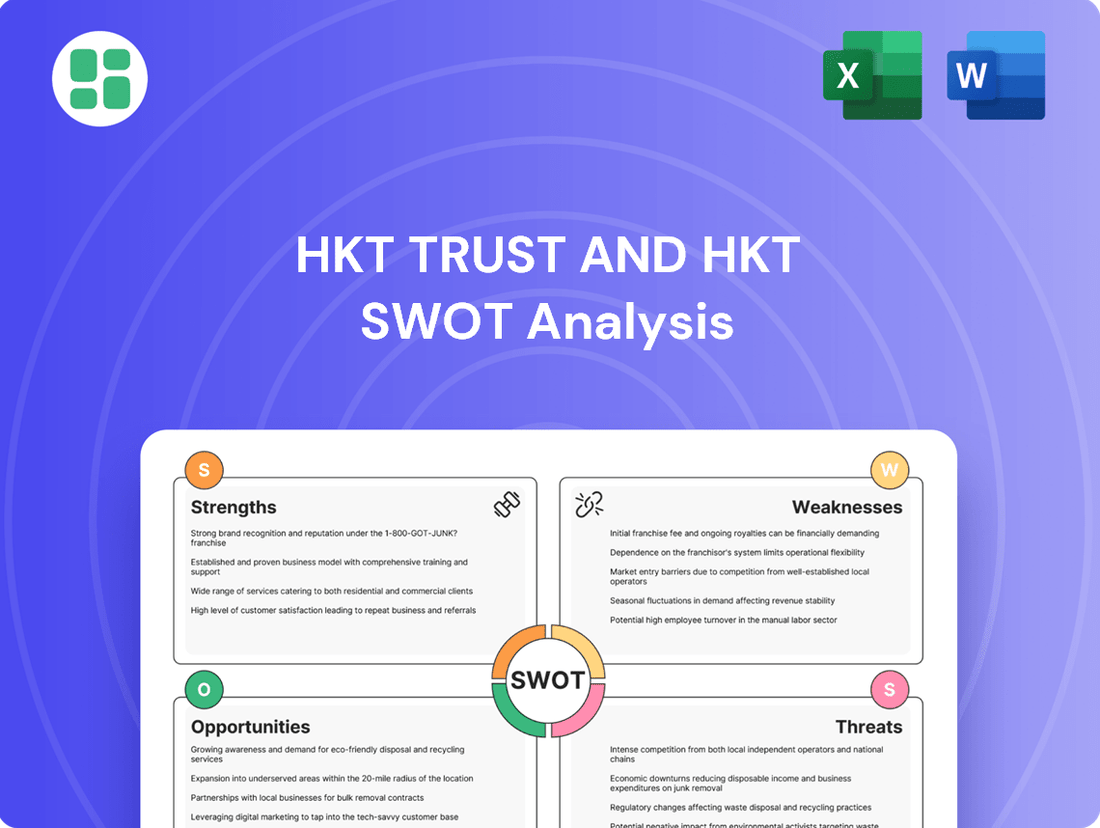

HKT Trust and HKT SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing an actual excerpt from the comprehensive HKT Trust and HKT SWOT Analysis. Purchase unlocks the entire in-depth version, providing a complete understanding of their strategic positioning.

Opportunities

The continued expansion of 5G networks and the introduction of next-generation technologies like 50G PON and the 800G AI Superhighway offer substantial growth avenues for HKT. These advancements are crucial for meeting escalating data demands and supporting sophisticated applications, directly translating into increased revenue potential for premium connectivity services.

HKT's strategic investments in these cutting-edge network infrastructures, such as their ongoing 5G network build-out and trials of advanced PON technologies, are designed to capitalize on this trend. For instance, by the end of 2024, HKT aimed to have its 5G network cover over 90% of Hong Kong's population, demonstrating a commitment to capturing market share in this rapidly evolving landscape.

The ongoing digital transformation across industries presents a prime opportunity for HKT's enterprise solutions. Businesses are increasingly seeking to boost efficiency and unlock new functionalities, directly benefiting HKT's offerings.

HKT's robust suite of AI-driven solutions, coupled with its expertise in IoT, cloud, and cybersecurity, positions it as a vital partner for companies navigating this shift. This expanded portfolio is poised to capture significant new projects, fueling growth in this segment.

HKT's enterprise business has seen significant traction in mainland China, with robust revenue growth reported throughout 2024. This expansion is particularly noteworthy as HKT is the first Hong Kong-funded telecom operator to receive approval for pilot operations of Value-Added Telecommunications services within the mainland.

This strategic foothold in China unlocks substantial cross-border business potential. HKT is now well-positioned to support mainland Chinese enterprises looking to expand their reach internationally, with a particular focus on facilitating their growth into Southeast Asian markets.

Leveraging AI for Enhanced Services and Efficiency

HKT's strategic integration of Artificial Intelligence (AI) offers a dual advantage: boosting operational efficiency and pioneering novel services. This AI deployment is key to personalizing customer interactions, streamlining business processes, and accelerating digital shifts across various sectors.

The impact of AI is already evident in HKT's performance. For instance, AI-driven initiatives have contributed to a notable increase in customer migrations to advanced 5G and 2.5G services, alongside measurable gains in overall productivity.

- Enhanced Customer Engagement: AI enables hyper-personalized service offerings, driving customer loyalty and increasing the uptake of premium services.

- Operational Optimization: AI tools are automating routine tasks and improving network management, leading to significant cost savings and faster issue resolution.

- New Service Development: HKT can leverage AI to create innovative solutions in areas like smart living, enterprise analytics, and cybersecurity, opening new revenue streams.

- Data-Driven Decision Making: AI's analytical capabilities provide deeper insights into market trends and customer behavior, informing strategic planning and resource allocation.

Smart City Development Initiatives

HKT's deep involvement in Hong Kong's smart city development presents a significant opportunity. The company is leveraging its advanced Internet of Things (IoT) infrastructure to integrate intelligent systems across critical sectors like public services, transportation, and urban planning. This strategic alignment with the government's smart city agenda opens doors for securing new, large-scale projects and forging valuable partnerships.

By actively contributing to Hong Kong's technological evolution through smart city initiatives, HKT is not only solidifying its position as a key player in the city's digital transformation but also creating robust avenues for future revenue generation. For instance, HKT's role in deploying 5G networks, a foundational element for smart city solutions, is expected to see continued investment and expansion. The Hong Kong government has allocated significant resources to smart city projects, with a focus on areas like smart mobility and smart living, directly benefiting HKT's service offerings.

- Expansion into new smart city projects

- Partnerships with government and private sector entities

- Growth in IoT and intelligent system deployment

- Increased revenue from smart city-related services

HKT's expansion into mainland China, particularly its approval for pilot operations of Value-Added Telecommunications services, is a significant growth driver. This strategic move allows HKT to tap into a vast market and support Chinese enterprises expanding internationally, especially into Southeast Asia.

The ongoing digital transformation across industries, coupled with HKT's robust suite of AI-driven solutions, IoT, cloud, and cybersecurity expertise, positions it to capture substantial new enterprise projects. This is further bolstered by the company's commitment to 5G network expansion, with aims to cover over 90% of Hong Kong's population by the end of 2024.

HKT's active participation in Hong Kong's smart city development, leveraging its IoT infrastructure, opens doors for large-scale projects and partnerships. This aligns with government initiatives in smart mobility and living, creating new revenue streams from smart city-related services.

| Opportunity Area | Key Enabler | 2024/2025 Outlook |

|---|---|---|

| 5G & Next-Gen Connectivity | 50G PON, 800G AI Superhighway | Increased demand for premium connectivity services, driving revenue growth. |

| Enterprise Digital Transformation | AI, IoT, Cloud, Cybersecurity Solutions | Capture new projects as businesses seek efficiency and new functionalities. |

| Mainland China Expansion | Value-Added Telecommunications Services Approval | Significant cross-border business potential, supporting Chinese enterprises' international growth. |

| Smart City Development | IoT Infrastructure, 5G Deployment | Secure large-scale projects and partnerships, generating revenue from smart city services. |

Threats

The Hong Kong telecommunications market is intensely competitive, with established players like China Mobile Hong Kong and SmarTone constantly vying for market share. This rivalry often leads to aggressive pricing strategies, directly impacting HKT's average revenue per user (ARPU). For instance, in the first half of 2024, the overall ARPU for the industry saw a slight dip, underscoring the persistent price pressure.

This ongoing competition forces HKT to invest heavily in network upgrades and new service offerings to differentiate itself. Failure to innovate or maintain competitive pricing could result in customer churn, further eroding profit margins. The need for continuous investment in 5G expansion and fiber broadband, coupled with price sensitivity among consumers, creates a challenging environment for maintaining profitability.

The telecommunications sector is a hotbed of constant technological change, with new innovations emerging at a breakneck pace. HKT Trust must remain agile, as failing to adapt to these shifts, including evolving industry standards and novel business approaches, could significantly erode its market standing and competitive edge.

For instance, the ongoing rollout and adoption of 5G technology, coupled with the development of future 6G standards, requires continuous and significant capital expenditure. In 2023, major telecom operators globally invested billions in network upgrades, highlighting the substantial R&D commitment needed to stay relevant.

Without swift adoption of cutting-edge technologies and a willingness to embrace new business models, HKT Trust risks falling behind competitors who are quicker to innovate, potentially leading to a loss of market share and reduced revenue streams.

The economic outlook for Hong Kong and mainland China signals potential for slower growth, directly impacting HKT's revenue streams. Geopolitical uncertainties further exacerbate this, potentially dampening both consumer and enterprise spending on telecommunications services. For instance, a projected slowdown in China's GDP growth for 2024, estimated around 4.5% by many institutions, could translate to reduced demand for HKT's offerings in that market.

Global trade headwinds and shifts in consumer spending patterns, driven by factors like inflation and interest rate hikes, pose significant threats. Hong Kong's economy, while showing resilience, faces the challenge of prolonged high interest rates, which could curb investment and discretionary spending on advanced telecommunications. This environment necessitates careful management of operational costs and strategic pricing to maintain profitability.

Regulatory Changes and Increased Compliance Burden

Changes in telecommunications regulations, data privacy laws, or new licensing requirements in Hong Kong and mainland China could significantly increase compliance costs and operational restrictions for HKT. For instance, the Personal Data (Privacy) Ordinance in Hong Kong, and similar evolving regulations in mainland China, necessitate ongoing investment in data security and privacy protocols. These regulatory shifts can also reshape the competitive environment, potentially creating advantages for new market entrants or placing limitations on HKT's existing service portfolios.

HKT must navigate a complex and evolving regulatory landscape. For example, in 2023, the Hong Kong government continued to emphasize cybersecurity and data protection measures, requiring companies like HKT to adapt their systems and processes. Furthermore, potential changes in spectrum allocation or pricing in either market could impact HKT's operational costs and strategic planning.

- Increased Compliance Costs: Adapting to new data privacy laws, such as potential updates to Hong Kong's PDPO or mainland China's PIPL, requires substantial investment in technology and personnel.

- Operational Restrictions: New licensing requirements or changes in service mandates could limit HKT's ability to offer certain services or expand into new areas.

- Competitive Landscape Shifts: Evolving telecommunications regulations might favor new entrants or impose specific obligations on incumbent operators, impacting HKT's market position.

- Cross-Border Regulatory Challenges: HKT's operations spanning Hong Kong and mainland China expose it to differing and potentially conflicting regulatory frameworks, demanding careful management.

Cybersecurity Risks and Data Privacy Concerns

HKT, as a major player in telecommunications and digital services, confronts escalating cybersecurity risks and data privacy concerns. The increasing sophistication of cyber threats means a breach could result in substantial financial penalties, reputational damage, and a critical loss of customer confidence. For instance, in 2023, global cybersecurity spending was projected to reach over $200 billion, highlighting the scale of this challenge.

The potential impact of a data leak for a company like HKT is immense. Beyond direct financial costs associated with incident response and regulatory fines, the long-term erosion of trust can significantly affect customer retention and acquisition. Companies are increasingly investing in advanced security protocols to mitigate these threats, with the global data privacy management market expected to grow substantially in the coming years.

- Cybersecurity Threats: HKT must continuously adapt to evolving cyberattack vectors, including ransomware, phishing, and distributed denial-of-service (DDoS) attacks.

- Data Privacy Compliance: Adherence to stringent data protection regulations, such as GDPR and similar regional laws, is crucial to avoid significant fines and legal repercussions.

- Reputational Impact: A single major data breach can severely damage HKT's brand image and customer loyalty, impacting future revenue streams.

- Financial Exposure: The costs associated with data breaches can include investigation, remediation, legal fees, and potential compensation to affected individuals.

HKT faces intense competition, particularly from players like China Mobile Hong Kong and SmarTone, which can drive down average revenue per user (ARPU). This necessitates significant investment in network upgrades and new services to stay competitive, as seen with the global telecom industry's substantial capital expenditure on 5G expansion. Failure to innovate or offer competitive pricing could lead to customer churn and reduced profitability.

The rapid pace of technological change in telecommunications requires HKT to be agile. The ongoing transition to 5G and the development of future 6G standards demand continuous, considerable capital investment, with global operators investing billions in network upgrades in 2023. Without swift adoption of new technologies and business models, HKT risks losing market share to more innovative competitors.

Economic slowdowns in Hong Kong and mainland China, coupled with geopolitical uncertainties, pose a threat to HKT's revenue. For example, a projected 4.5% GDP growth for China in 2024 could mean reduced demand for telecom services. Additionally, global trade headwinds and inflation-driven consumer spending shifts, exacerbated by high interest rates in Hong Kong, require careful cost management and strategic pricing.

Evolving regulatory landscapes in Hong Kong and mainland China present compliance challenges and potential operational restrictions. New data privacy laws and cybersecurity mandates require ongoing investment, as highlighted by the continuous emphasis on these measures by the Hong Kong government in 2023. Changes in spectrum allocation or pricing could also impact HKT's operational costs.

SWOT Analysis Data Sources

This analysis leverages a robust combination of HKT Trust's official financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded and data-driven strategic assessment.