HKT Trust and HKT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HKT Trust and HKT Bundle

HKT Trust, a dominant player in Hong Kong's telecommunications and digital services landscape, faces a dynamic competitive environment. Understanding the interplay of buyer power, supplier leverage, rivalry, and the threat of substitutes and new entrants is crucial for navigating this market.

The complete report reveals the real forces shaping HKT Trust’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications sector, including companies like HKT Trust, often depends on a small pool of highly specialized equipment manufacturers for essential network components. These suppliers, responsible for advanced technologies like 5G infrastructure and sophisticated data center hardware, hold considerable sway. For instance, the global market for 5G core network equipment is dominated by a few key players, limiting HKT's options when sourcing these critical, high-cost items.

HKT's significant investments in its core network infrastructure, particularly with the ongoing rollout of 5G and fiber optic technologies, create substantial switching costs. Once a vendor's proprietary technology or architecture is integrated, the financial and operational burden of migrating to a new supplier becomes immense. This includes expenses for new hardware, complex system integration, and retraining staff, effectively locking HKT into existing supplier relationships.

These high switching costs directly bolster the bargaining power of HKT's current infrastructure suppliers. For example, the substantial capital expenditure required for 5G deployment, which saw significant spectrum auctions and infrastructure build-out in 2024, means that vendors providing essential components like base stations and core network equipment hold considerable leverage. This is further amplified by the specialized nature of telecommunications technology, where interoperability and standards compliance are critical.

HKT's reliance on software and content providers is a key factor in its bargaining power. For instance, its extensive media entertainment services, which include popular streaming content, mean HKT is dependent on licensing agreements with major content creators. In 2024, the global digital content market continued its robust growth, with streaming services alone valued in the hundreds of billions of dollars, highlighting the significant leverage these content providers possess.

Furthermore, HKT's push into enterprise solutions and new digital ventures, including AI applications, requires specialized software and data. Companies offering unique AI algorithms or proprietary IT platforms can command strong positions, especially as HKT integrates these technologies into its core operations. The demand for advanced AI solutions in 2024 saw significant investment, with specialized providers of these technologies experiencing increased pricing power due to high demand and limited supply of expertise.

Access to Strategic Resources and Licenses

While not traditional suppliers, entities that control access to vital resources like spectrum licenses or rights-of-way for infrastructure can significantly influence HKT. These entities, often government bodies, act as de facto suppliers of essential inputs for telecommunications operations.

Government policies and the allocation processes for crucial resources like spectrum licenses can directly impact HKT's cost structure and operational flexibility. For instance, the awarding of new spectrum bands, such as the 6/7 GHz band in November 2024, can reshape the competitive landscape and influence the cost of acquiring these essential assets for all market participants.

- Spectrum Licenses: Government bodies manage and allocate spectrum, a critical resource for mobile network operation.

- Rights-of-Way: Access to physical infrastructure routes, often controlled by local authorities or utility companies, is vital for network expansion.

- Policy Influence: Government regulations and policy decisions regarding spectrum usage and infrastructure deployment can significantly impact operational costs and strategic planning.

- Market Dynamics: The availability and cost of spectrum, influenced by government allocation decisions, directly affect competition and investment decisions within the telecommunications sector.

Global Supply Chain Dynamics and Geopolitical Factors

The global telecommunications supply chain, particularly for advanced components like semiconductors, is susceptible to geopolitical shifts. For instance, the ongoing global semiconductor shortage, which saw lead times for some components extend significantly in 2023 and into 2024, directly impacts HKT's ability to secure necessary equipment. This scarcity can empower suppliers, allowing them to dictate higher prices and stricter terms.

Trade disputes and protectionist policies can further exacerbate these issues, leading to increased costs and potential delays for HKT. Recent geopolitical events have highlighted the fragility of these extended supply chains, forcing companies to re-evaluate sourcing strategies.

The push towards next-generation technologies like 6G necessitates access to highly specialized and often proprietary components. Suppliers of these cutting-edge technologies, especially those with limited competition, can wield considerable bargaining power.

- Geopolitical Tensions: Events like the US-China trade tensions have impacted the availability and cost of electronic components, a critical input for HKT's network infrastructure.

- Supply Chain Disruptions: The semiconductor shortage, which persisted through 2023 and into 2024, led to extended lead times and price increases for essential network equipment.

- Technological Advancements: The development of 6G technology requires specialized components, concentrating power in the hands of a few key suppliers.

- Increased Component Costs: In 2024, the average selling price for certain advanced semiconductors saw an increase of up to 15% compared to 2023, directly affecting HKT's procurement costs.

HKT faces significant supplier bargaining power due to the concentrated nature of the telecommunications equipment market, particularly for advanced 5G and future 6G components. The high cost and complexity of integrating new technologies create substantial switching costs, locking HKT into existing vendor relationships. For instance, the 2024 global semiconductor market saw continued supply constraints for specialized chips, with prices for some advanced components increasing by up to 15% compared to 2023, directly empowering these suppliers.

| Supplier Type | Key Dependence | Impact on HKT | 2024 Data/Trend |

|---|---|---|---|

| Network Equipment Manufacturers | 5G/6G infrastructure, core network hardware | High switching costs, limited vendor choice | Semiconductor price increases (up to 15% for advanced chips) due to supply constraints |

| Content Providers | Media entertainment services, streaming content | Reliance on licensing agreements, pricing leverage | Global digital content market growth in hundreds of billions USD |

| Software/AI Solution Providers | Enterprise solutions, AI applications | Dependence on specialized algorithms and platforms | Increased demand and pricing power for AI solutions due to limited expertise |

What is included in the product

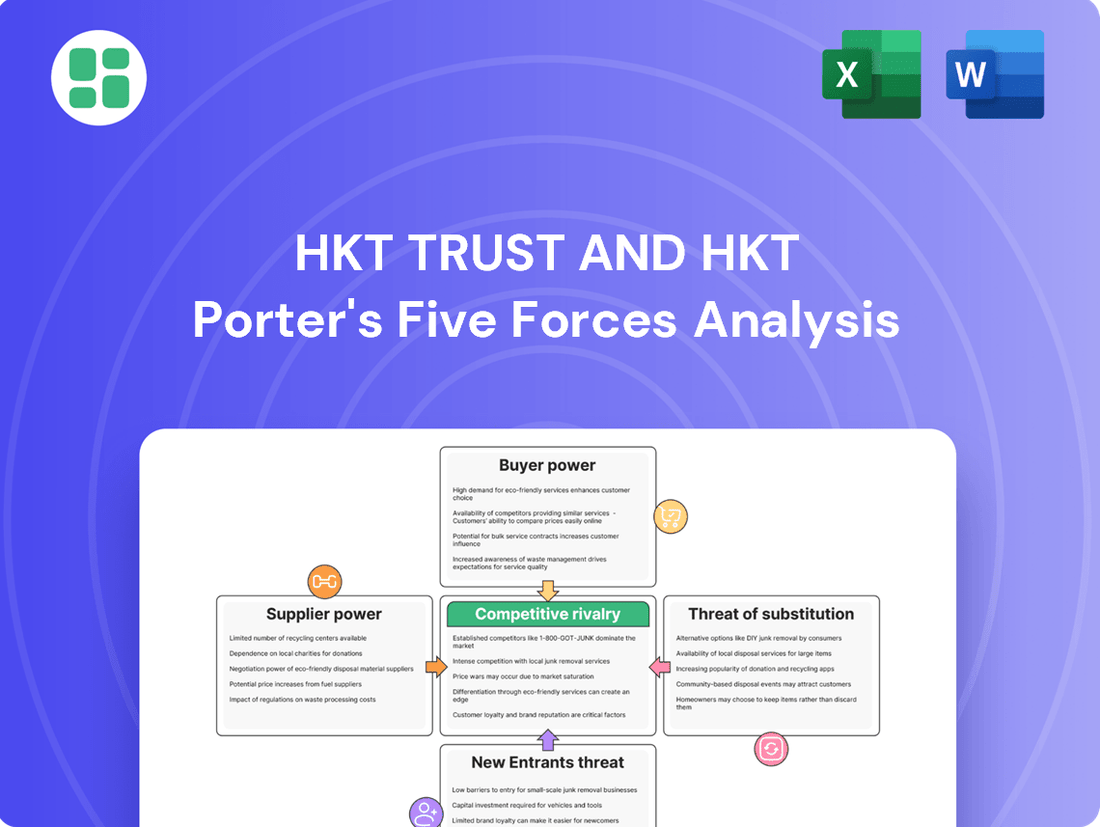

This Porter's Five Forces analysis of HKT Trust and HKT unpacks the competitive intensity, buyer and supplier power, threat of new entrants and substitutes within its telecommunications and digital services market.

Leverage HKT Trust's Porter's Five Forces analysis to pinpoint and alleviate competitive pressures, offering a clear, actionable roadmap for strategic advantage.

Customers Bargaining Power

Residential customers in Hong Kong, especially for mobile and broadband, are very sensitive to price. They actively hunt for the best deals, which puts pressure on HKT's pricing strategies. This means HKT often has to offer competitive rates and run promotions to keep customers.

The presence of numerous competitors in Hong Kong allows customers to easily switch providers based on price and promotions. For instance, HKT frequently employs aggressive promotional pricing for its broadband services to stay competitive in this dynamic market.

The Hong Kong telecommunications market is quite crowded, with several major companies like SmarTone, 3 Hong Kong, and China Mobile Hong Kong vying for customers. This means consumers have plenty of options when choosing a service provider.

With so many providers offering similar services, customers have significant bargaining power. They can easily switch to a competitor if they find better prices, improved service quality, or more attractive package deals, putting pressure on HKT to offer competitive value.

This intense competition necessitates that HKT continuously innovate and find ways to stand out from the crowd. Keeping customers happy and holding onto market share requires HKT to consistently deliver superior service and unique offerings.

For services like mobile, number portability, a feature widely adopted across Hong Kong, significantly lowers the barrier for customers to switch providers. This means a customer can keep their existing phone number even when moving to a different network, reducing a major point of friction and cost. For example, in 2023, Hong Kong saw millions of mobile number portability requests, indicating a dynamic market where customers are actively exploring alternatives.

Similarly, for broadband services, while there might be some initial setup or installation involved when changing providers, the overall cost and effort are often perceived as manageable. Customers can switch to gain access to better pricing, faster speeds, or improved customer service. This ease of switching directly enhances the bargaining power of customers, as they are not deeply entrenched or heavily penalized for leaving HKT's services, pushing HKT to focus on retaining its customer base through competitive offerings and superior service quality.

Demand for Bundled Services and Value-Added Offerings

Customers are increasingly looking for all-in-one packages, combining mobile, internet, and entertainment services. This trend, driven by a desire for convenience and cost efficiency, significantly influences their expectations from providers like HKT. HKT's strategy of offering converged connectivity and smart living solutions directly addresses this demand for bundled services.

- Bundled Demand: Customers actively seek integrated service packages, expecting a single provider to meet multiple connectivity and entertainment needs.

- Value Expectation: This bundling increases customer bargaining power as they anticipate competitive pricing and flexibility in customizing their service bundles.

- HKT's Response: HKT's focus on converged offerings and smart living solutions aims to capture this demand, positioning itself as a comprehensive service provider.

Sophisticated Business Customers with Specific Needs

Enterprise and business clients, a core segment for HKT, possess significant bargaining power due to their sophisticated and often highly specific demands for IT services, cloud solutions, and customized connectivity. These customers frequently leverage formal processes like Requests for Proposals (RFPs) and engage in rigorous contract negotiations, focusing on detailed service level agreements (SLAs) and precise pricing structures.

Their substantial spending capacity, coupled with deep technical knowledge, allows them to exert considerable influence. This is particularly evident as the demand for advanced solutions like AI integration and robust cybersecurity escalates. For instance, in 2023, HKT reported that its Enterprise segment revenue reached HK$18.6 billion, highlighting the financial weight of these customers.

- Sophisticated Demands: Businesses require tailored IT, cloud, and connectivity solutions, often with exacting specifications.

- RFP and Negotiation Power: The use of RFPs and contract negotiations empowers customers to secure favorable terms.

- Spending Power and Expertise: Large enterprise budgets and technical acumen amplify their ability to negotiate.

- Market Trends Influence: Growing needs in AI and cybersecurity further enhance customer leverage for specialized services.

The bargaining power of customers for HKT is significant, driven by a highly competitive market and the ease with which consumers can switch providers. This is particularly true for residential mobile and broadband services where price sensitivity is high. For instance, the prevalence of number portability in Hong Kong, with millions of requests annually, underscores how easily customers can change networks, directly impacting HKT's customer retention strategies and forcing competitive pricing. Furthermore, the increasing demand for bundled services means customers expect integrated packages at competitive prices, amplifying their leverage.

Enterprise clients also wield substantial bargaining power, often utilizing formal procurement processes like RFPs and detailed contract negotiations to secure favorable terms for sophisticated IT and connectivity solutions. Their large spending capacity, exemplified by HKT's Enterprise segment revenue reaching HK$18.6 billion in 2023, combined with technical expertise, allows them to exert considerable influence, especially concerning advanced services like AI and cybersecurity.

| Factor | Impact on HKT | Supporting Data/Observation |

| Price Sensitivity (Residential) | High Pressure on Pricing | Customers actively seek best deals; HKT employs aggressive promotional pricing for broadband. |

| Ease of Switching (Mobile) | Lowers Customer Loyalty Barriers | Millions of mobile number portability requests annually in Hong Kong. |

| Bundled Service Demand | Drives Integrated Offerings | Customers seek convenience and cost efficiency from single providers. |

| Sophisticated Demands (Enterprise) | Requires Tailored Solutions | Businesses use RFPs and negotiate detailed SLAs for IT, cloud, and connectivity. |

| Enterprise Spending Power | Amplifies Negotiation Leverage | HKT's Enterprise segment revenue was HK$18.6 billion in 2023. |

Preview the Actual Deliverable

HKT Trust and HKT Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It contains a comprehensive HKT Trust overview and a detailed Porter's Five Forces analysis, providing critical insights into the company's competitive landscape and strategic positioning.

Rivalry Among Competitors

The Hong Kong telecommunications landscape is dominated by a handful of established operators, including SmarTone, 3 Hong Kong, China Mobile Hong Kong, HKBN, and HKT. This oligopolistic structure means that moves by one company significantly impact the others, fueling fierce competition for customers across all service areas.

HKT, while a market leader, contends with robust rivalry from these entrenched competitors. For instance, in 2023, the mobile market saw intense promotional activity, with major players offering aggressive data plans and device subsidies to capture subscribers, directly impacting average revenue per user for all operators.

Competitors in Hong Kong's telecommunications sector, particularly in mobile and broadband, frequently engage in aggressive pricing wars. This involves offering heavily discounted plans, attractive promotional bundles, and enticing limited-time offers to capture market share. For instance, during 2024, numerous providers rolled out substantial discounts on 5G plans and bundled broadband services, often exceeding 30% off standard rates for the first year. This intense price competition directly impacts profitability across the industry, forcing all participants, including HKT, to constantly evaluate and adjust their own pricing structures to remain competitive and retain their customer base.

The mobile and broadband sectors in Hong Kong are incredibly crowded. By the close of 2024, the territory boasted nearly 28 million mobile subscriptions, reflecting a very high penetration rate. This intense saturation means companies are fighting hard for every new customer and aggressively trying to win over existing ones from rivals.

This fierce competition centers on several key areas: network speed, the extent of coverage, service reliability, and the appeal of extra services. HKT, like its competitors, must constantly invest in improving its network infrastructure and enhancing its service packages to stay ahead. This includes a strong focus on accelerating 5G network upgrades to meet evolving customer demands for faster and more dependable connectivity.

Convergence of Services Blurring Traditional Lines

The competitive landscape for HKT is intensifying as traditional telecommunications boundaries dissolve. Providers are increasingly offering bundled packages that combine fixed-line, mobile, broadband, and media entertainment services. This convergence means HKT faces competition not just from other telcos but also from standalone players in the media streaming and IT services sectors, such as Netflix and various cloud-based solution providers.

This expanded competitive arena necessitates that HKT effectively integrate its diverse service portfolio. For instance, HKT's Now OTT service competes directly with global streaming giants, requiring a strong content offering and user experience. The company must also contend with IT service providers who offer integrated communication and entertainment solutions, further blurring the lines of traditional telecom competition.

- Broadening Competition: HKT now competes with a wider array of companies beyond traditional telcos, including media streaming platforms and IT service providers.

- Service Integration: The company must seamlessly integrate its fixed-line, mobile, broadband, and entertainment services to remain competitive.

- Example: Now OTT: HKT's Now OTT service directly challenges established global streaming services, demanding a robust content strategy and user engagement.

- Market Dynamics: This convergence expands the competitive battleground, forcing HKT to innovate across multiple service categories simultaneously.

Innovation and Differentiation in New Digital Areas

As traditional telecom services mature, the competitive rivalry intensifies in new digital arenas like e-commerce, digital ventures, and fintech. Competitors are channeling significant investments into these emerging sectors to unlock new revenue streams and carve out unique market positions. HKT's strategic focus on innovation, particularly in areas like its enterprise solutions, AI applications, and fintech initiatives, is paramount for sustained growth and maintaining its competitive advantage.

HKT's commitment to digital innovation is evident in its ongoing investments. For instance, in 2024, the company continued to expand its digital offerings, aiming to capture a larger share of the burgeoning digital economy. This strategic pivot reflects a broader industry trend where telecom operators are transforming into diversified digital service providers.

- Digital Ventures: HKT is actively developing and acquiring digital platforms to enhance its ecosystem and customer engagement.

- Fintech Integration: The company is exploring and implementing fintech solutions to offer integrated financial services to its customer base.

- AI Applications: HKT is leveraging Artificial Intelligence to improve its service delivery, personalize customer experiences, and create new business opportunities.

- Enterprise Solutions: A significant part of HKT's differentiation strategy involves providing advanced digital solutions and connectivity for businesses.

Competitive rivalry for HKT is exceptionally high in Hong Kong's saturated telecommunications market. The presence of established players like SmarTone and 3 Hong Kong forces HKT into aggressive pricing strategies, as evidenced by widespread 5G plan discounts exceeding 30% in 2024. This intense competition extends beyond traditional services into digital arenas like e-commerce and fintech, where HKT must innovate to maintain its edge.

The market's high mobile penetration, nearing 28 million subscriptions by the end of 2024, fuels a constant battle for customer acquisition and retention. HKT's strategy involves not only network improvements but also service integration, offering bundled packages that challenge competitors across fixed-line, mobile, broadband, and entertainment sectors. This broadens the competitive landscape, forcing HKT to compete with media streaming services and IT providers as well.

| Competitor | Key Competitive Focus | 2024 Market Activity Example |

|---|---|---|

| SmarTone | Aggressive data plans, device subsidies | Promotional 5G plans with significant first-year discounts |

| 3 Hong Kong | Bundled services (broadband, mobile) | Offering attractive limited-time bundles to capture market share |

| China Mobile Hong Kong | Network expansion and 5G rollout | Continued investment in 5G infrastructure to enhance coverage |

| HKBN | Value-driven pricing, integrated solutions | Aggressive pricing on broadband and mobile packages |

SSubstitutes Threaten

The threat of substitutes for traditional communication services offered by HKT is substantial, primarily driven by Over-The-Top (OTT) applications. Services like WhatsApp, WeChat, Zoom, and FaceTime offer compelling free or low-cost alternatives to HKT's core voice and SMS offerings.

These OTT platforms directly erode HKT's reliance on traditional communication revenue. For instance, mobile voice service revenue for many telecommunication companies, including those facing similar pressures to HKT, is projected to see a decline between 2024 and 2029 due to this shift. While HKT can capitalize on increased data consumption, the direct monetization of voice and SMS is continuously challenged.

The threat of substitutes for HKT's traditional pay-TV services is significant, driven by the proliferation of global and regional streaming platforms. Services like Netflix, Disney+, and YouTube, alongside local alternatives, provide extensive on-demand content, directly challenging HKT's media entertainment offerings. This shift is evident as consumers increasingly ditch traditional bundled TV packages for the flexibility and perceived value of subscription-based streaming.

In Hong Kong, this trend is expected to lead to a decline in pay-TV revenue for providers like HKT. For instance, while specific 2024 figures for HKT's pay-TV revenue decline due to streaming are not yet fully reported, the broader industry trend indicates a clear substitution effect. HKT's own introduction of its Now OTT service is a direct strategic maneuver to counter this growing threat by offering a competitive streaming alternative.

The increasing prevalence of public Wi-Fi in Hong Kong, coupled with personal hotspots and Wi-Fi sharing, presents a significant threat of substitutes for HKT's mobile data services. In 2024, the number of public Wi-Fi hotspots across the city continued to grow, offering a readily available alternative for data access, especially in densely populated urban centers like Central and Tsim Sha Tsui. This widespread availability can diminish the reliance on mobile data plans for everyday internet use, particularly for activities like browsing or social media, thereby pressuring HKT to differentiate its offerings beyond basic connectivity.

Cloud-Based Solutions Replacing On-Premise IT Services

The increasing adoption of cloud-based solutions presents a significant threat of substitution for HKT's traditional on-premise IT services. Enterprise customers are increasingly migrating their IT infrastructure to public cloud platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud due to their scalability, flexibility, and often lower total cost of ownership compared to maintaining on-premise data centers. For instance, global spending on public cloud services was projected to reach over $600 billion in 2024, highlighting the strong market shift away from traditional IT models.

This trend directly impacts HKT's revenue streams from managed IT services and infrastructure. As businesses opt for cloud alternatives, the demand for HKT's legacy on-premise solutions diminishes. This necessitates a strategic pivot for HKT to incorporate cloud-agnostic strategies and offer hybrid cloud solutions that integrate with major cloud providers, ensuring continued relevance and service delivery in a rapidly evolving technological landscape.

- Cloud Adoption Growth: Global public cloud spending is on an upward trajectory, with significant growth anticipated through 2024 and beyond.

- Cost-Effectiveness: Cloud solutions often offer a more predictable and potentially lower cost structure for businesses compared to capital expenditures on on-premise hardware and maintenance.

- Scalability and Flexibility: The ability to scale IT resources up or down rapidly in response to business needs is a key driver for cloud adoption, a benefit difficult to match with on-premise infrastructure.

- HKT's Strategic Response: HKT must continue to develop and promote hybrid cloud offerings and robust connectivity solutions to major cloud providers to mitigate this substitution threat.

Alternative Payment Methods and Digital Platforms

HKT's digital payment and financial services encounter significant competition from a broad spectrum of alternative payment methods and digital platforms within the dynamic fintech landscape. This includes established e-wallets like Alipay and PayMe, as well as a growing number of emerging digital banking platforms that offer specialized financial solutions.

Hong Kong's fintech sector is experiencing robust growth, evidenced by the presence of over 1,100 companies, many of which are virtual banks and licensed virtual asset trading platforms. This proliferation of options means consumers and businesses have a wide array of choices for their transaction and financial service needs.

To effectively compete, HKT's fintech ventures must consistently deliver superior convenience, robust security measures, and seamless integration across their service offerings to attract and retain users in this competitive environment.

- Competition: HKT faces pressure from numerous alternative payment methods and digital platforms.

- Market Growth: Hong Kong's fintech sector hosts over 1,100 companies, including virtual banks.

- Consumer Choice: Users have many options for transactions, demanding superior service from HKT.

The threat of substitutes for HKT's traditional communication services, such as voice and SMS, remains high due to the widespread adoption of Over-The-Top (OTT) applications like WhatsApp and WeChat. These platforms offer free or low-cost alternatives that directly impact HKT's revenue from these legacy services, a trend observed across the telecommunications industry. While HKT benefits from increased data usage, the direct monetization of voice and SMS is increasingly challenged by these substitutes.

Similarly, HKT's pay-TV services face substantial substitution from global and regional streaming platforms like Netflix and Disney+. Consumers are increasingly opting for the flexibility and extensive content libraries of these services over traditional bundled TV packages. This shift is expected to continue impacting pay-TV revenue for providers in Hong Kong, prompting HKT to develop its own OTT offerings to compete.

The rise of public Wi-Fi and personal hotspots in Hong Kong presents a substitute for HKT's mobile data services, especially in urban areas. This widespread availability of alternative internet access can reduce reliance on mobile data plans for everyday browsing and social media activities. HKT needs to focus on differentiating its mobile data offerings beyond basic connectivity to counter this trend.

HKT's digital payment and financial services are also under pressure from numerous fintech alternatives, including e-wallets and virtual banks. Hong Kong's burgeoning fintech sector, with over 1,100 companies, offers consumers a wide array of choices for transactions and financial solutions. To remain competitive, HKT must emphasize superior convenience, security, and seamless integration in its financial service offerings.

Entrants Threaten

The telecommunications industry, particularly for a comprehensive service provider like HKT, demands substantial upfront investment in network infrastructure. This includes the creation and upkeep of fixed-line, mobile, and broadband networks, which are critical for service delivery.

Acquiring necessary radio spectrum, deploying fiber optic cables, and expanding 5G capabilities represent significant financial hurdles for any new company looking to enter the market. These high capital requirements act as a strong deterrent, effectively shielding established players such as HKT from immediate competition.

In 2023, the telecommunications sector saw capital expenditure totaling approximately HK$5.8 billion. This figure underscores the ongoing and substantial investment required for technological advancements like 5G and fiber network expansion, further solidifying the barriers to entry.

The telecommunications sector in Hong Kong is a heavily regulated arena, demanding a suite of licenses, permits, and strict adherence to operational standards from any company wishing to compete. This intricate web of regulatory approvals is not only time-consuming but also a significant financial undertaking, effectively acting as a formidable barrier to entry for potential new players.

For instance, obtaining a Public Non-exclusive Telecommunications Services Licence, a fundamental requirement, involves a rigorous application process with the Communications Authority. The complexity and cost associated with navigating these requirements significantly limit the number of new entrants, thereby bolstering market stability for incumbents like HKT.

Established players like HKT have cultivated significant brand loyalty and extensive customer bases, making it challenging for newcomers. By the end of 2024, HKT boasted over 1 million Fiber-to-the-Home (FTTH) connections and 1.747 million 5G customers, demonstrating a deep-rooted presence.

New entrants must overcome this inertia, often requiring substantial investment in marketing and aggressive pricing strategies to attract customers away from trusted, long-standing providers.

Potential for Disruptive Technologies or Business Models

Even with substantial infrastructure costs, new competitors could emerge by utilizing disruptive technologies like satellite internet or novel IoT networks. These innovations might allow new entrants to offer services without replicating HKT's extensive physical network. For instance, the continued development of 6G and AI could pave the way for players to introduce unique services by bypassing traditional infrastructure in certain segments.

The telecommunications landscape is constantly evolving. Companies that can effectively leverage emerging technologies or adopt entirely new business models pose a threat. Consider the rise of Mobile Virtual Network Operators (MVNOs) that focus on highly specific market niches, or platform-based aggregators that bundle digital services. These models can bypass the need for heavy capital expenditure on physical infrastructure, presenting a different competitive dynamic.

- Disruptive Technologies: Satellite internet and advanced IoT networks can offer alternative connectivity solutions, potentially bypassing traditional terrestrial infrastructure.

- New Business Models: MVNOs with niche offerings and platform-based digital service aggregators can enter the market with lower overheads.

- Emerging Standards: The advancement of 6G technology and AI may enable new players to offer innovative services, potentially circumventing existing network limitations.

- Example of Disruption: Starlink's satellite broadband service, launched in 2020, demonstrates how new technologies can create alternative pathways for internet access, impacting traditional providers.

Expansion of Foreign Tech Companies into Digital Services

As HKT diversifies into areas like e-commerce and fintech, the threat of foreign tech giants entering Hong Kong's digital services market is substantial. Companies such as Alibaba and Tencent, with their massive user bases and extensive digital ecosystems, already have a strong presence in the region and could easily expand their offerings to directly compete with HKT's new ventures. For instance, Alibaba's e-commerce platform, Tmall, already holds a significant share of online retail in Hong Kong, and its fintech arm, Ant Group, is a major player in digital payments across Asia.

These global players benefit from immense financial resources, advanced technological capabilities, and established brand loyalty, allowing them to absorb initial losses and aggressively capture market share. Hong Kong's status as a burgeoning fintech hub further amplifies this threat, attracting a multitude of international firms eager to tap into its sophisticated financial infrastructure and consumer base. In 2023, the fintech sector in Hong Kong saw significant investment, with over US$1.5 billion raised by local startups alone, indicating a highly competitive landscape.

- Foreign Tech Giants' Resources: Companies like Alibaba and Tencent possess vast financial reserves and established digital ecosystems, enabling them to outspend and out-innovate local players in new digital service areas.

- Brand Recognition and Ecosystems: Their strong global brand recognition and integrated digital platforms provide a significant advantage, making it easier to attract and retain customers for new HKT competitors.

- Hong Kong's Fintech Hub Status: The city's growing importance as a financial technology center attracts international investment and competition, increasing the likelihood of new, well-funded entrants challenging HKT.

- Market Penetration Potential: Existing market share in related sectors, such as e-commerce, allows these foreign companies to leverage their customer base for rapid expansion into new digital services.

The threat of new entrants for HKT is moderate, primarily due to the substantial capital investment required for network infrastructure and regulatory hurdles. However, disruptive technologies and new business models present a growing challenge, allowing nimble players to enter specific market segments with lower upfront costs.

While HKT's established customer base and brand loyalty offer a strong defense, the evolving digital landscape and the potential for foreign tech giants to leverage their vast resources and ecosystems into new service areas, such as e-commerce and fintech, pose a significant competitive threat.

In 2023, the telecommunications sector's capital expenditure, around HK$5.8 billion, highlights the ongoing investment needed. Furthermore, Hong Kong's fintech sector attracted over US$1.5 billion in investment in the same year, signaling a dynamic and potentially competitive environment for HKT's diversification efforts.

| Factor | Impact on HKT | Mitigation Strategies |

|---|---|---|

| High Capital Requirements | Moderate Threat (Deters broad entry) | Focus on efficient network upgrades, strategic partnerships. |

| Regulatory Hurdles | Low Threat (Established compliance) | Maintain strong relationships with regulators, proactive compliance. |

| Disruptive Technologies/New Models | Emerging Threat (Niche competition) | Invest in R&D, explore agile partnerships, monitor emerging tech. |

| Established Brand/Customer Base | Low Threat (Strong retention) | Enhance customer loyalty programs, personalized service offerings. |

| Foreign Tech Giants' Entry | Significant Emerging Threat (Diversified services) | Strengthen digital ecosystem, strategic acquisitions, focus on unique value propositions. |

Porter's Five Forces Analysis Data Sources

Our HKT Trust and HKT Porter's Five Forces analysis is built upon a robust foundation of data, drawing from HKT's official annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry research firms, financial news outlets, and market data providers to ensure a comprehensive understanding of the competitive landscape.