HKT Trust and HKT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HKT Trust and HKT Bundle

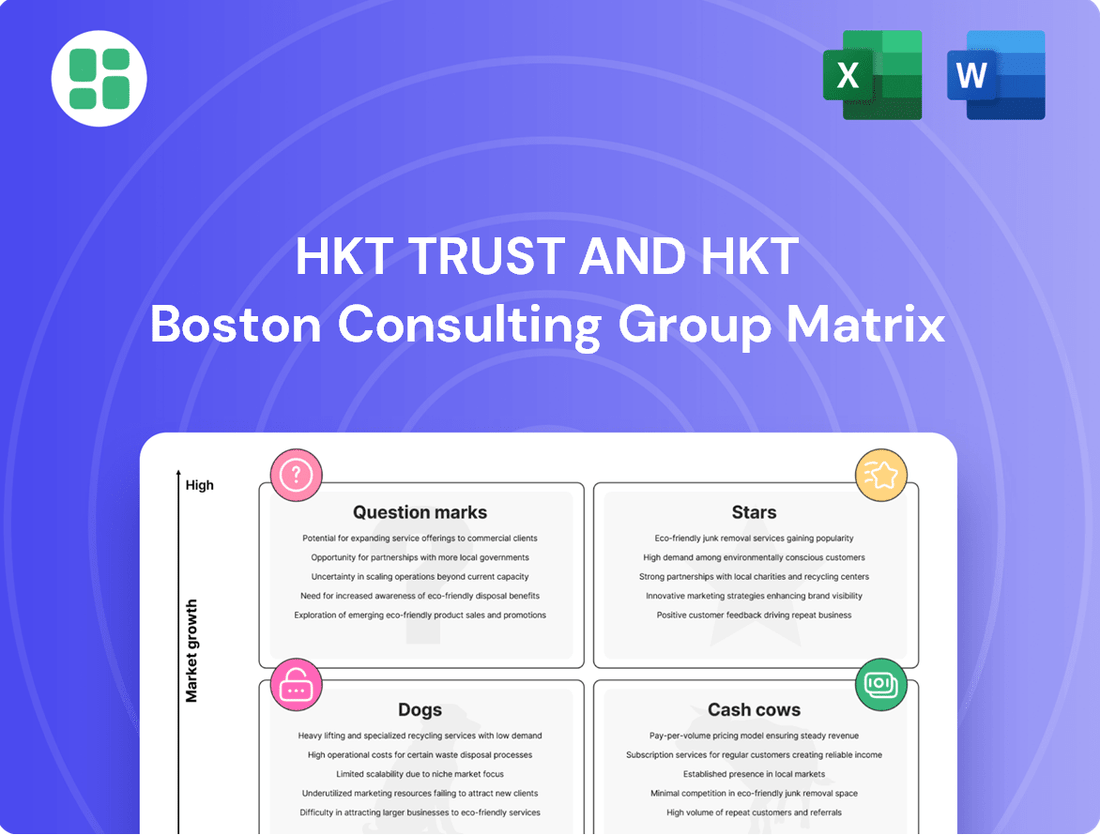

HKT Trust, a prominent telecommunications and digital services provider, operates within a dynamic market. Understanding its product portfolio through the lens of the BCG Matrix is crucial for strategic decision-making.

This preview offers a glimpse into HKT Trust's market position. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

HKT's 5G mobile services are a clear Star in their portfolio. The customer base experienced a substantial 25% surge in 2024, and this momentum continued with a 21% increase by mid-2025, bringing the total to over 1.89 million users.

This strong growth is further validated by the fact that more than half of HKT's post-paid customers have now transitioned to 5G plans, demonstrating robust market penetration and acceptance.

The segment benefits from higher Average Revenue Per User (ARPU) compared to 4G services, alongside a significant rebound in roaming revenue, solidifying HKT's leading position in this expanding market.

HKT's enterprise solutions, encompassing AI, IoT, Cloud, and Cybersecurity, represent a significant growth engine. In 2024, local data revenue saw an 8% increase, underscoring the demand for these services.

The company secured substantial new project wins, exceeding HK$5 billion in 2024 and adding HK$2.2 billion in the second quarter of 2025. This robust performance highlights HKT's strong position in the digital transformation market.

HKT's strategy centers on delivering integrated fixed-mobile solutions, effectively leveraging advanced technologies like 5G, IoT, AI, cloud, and cybersecurity to meet evolving business needs.

Mainland China Enterprise Business is a key Star for HKT Trust, hitting its 2024 revenue goal of HK$1 billion with a remarkable 37% year-on-year increase. The segment continued its robust performance with 13% growth in the first half of 2025, showcasing its strong momentum.

HKT is strategically broadening its enterprise footprint from Hong Kong into mainland China, catering to businesses that are expanding both within the country and globally. This expansion taps into a dynamic market ripe with opportunities for HKT's tailored enterprise solutions.

High-Speed Fibre Broadband Upgrades (2.5G/5G/10G/50G PON)

HKT's commitment to advanced fibre broadband, especially its 2.5G service, is clearly paying off. Subscriber numbers for this premium offering have tripled, indicating a significant surge in demand and a strong market position. This growth also translates to an uplift in Average Revenue Per User (ARPU), demonstrating the profitability of these high-speed upgrades.

HKT's early adoption of cutting-edge technology, such as being the first in Hong Kong to implement 50G PON in March 2024, solidifies its leadership in ultra-high-speed connectivity. This strategic move positions HKT to capture the growing demand for increasingly faster internet speeds, particularly in the premium segment of the broadband market.

- 2.5G Service Growth: Subscriber numbers have tripled, showcasing rapid adoption.

- ARPU Uplift: Increased demand for high-speed services has positively impacted average revenue per user.

- 50G PON Leadership: HKT was the first in Hong Kong to adopt this technology in March 2024, setting a new benchmark for speed.

- Premium Segment Dominance: The company holds a strong market share in the growing demand for higher bandwidth services.

Now TV OTT Services

The refreshed Now OTT service, launched in January 2024, has demonstrated remarkable success, fueling a significant 15% subscriber growth for HKT Trust in 2024. This momentum continued into the first half of 2025, with a further 17% increase in subscribers.

This expansion of Now TV's installed base is particularly noteworthy given the highly competitive landscape of entertainment services. The strategic focus on delivering tailored sports and entertainment packages specifically for smart devices has positioned Now OTT as a key driver of growth within the dynamic media sector.

- Now OTT Service Launch: January 2024

- 2024 Subscriber Growth: 15%

- H1 2025 Subscriber Growth: 17%

- Strategic Focus: Tailored sports and entertainment for smart devices

HKT's 5G mobile services are a clear Star, with user numbers exceeding 1.89 million by mid-2025, following a 25% surge in 2024. Over half of its post-paid customers now use 5G, driving higher ARPU and a strong rebound in roaming revenue.

HKT's enterprise solutions, including AI and cloud services, are also Stars. In 2024, local data revenue grew 8%, with over HK$5 billion in new project wins that year, supplemented by HK$2.2 billion in Q2 2025.

The Mainland China Enterprise Business is another Star, achieving HK$1 billion in revenue in 2024, a 37% year-on-year increase, and continuing with 13% growth in the first half of 2025.

HKT's premium 2.5G fibre broadband service has seen subscriber numbers triple, boosting ARPU. The company’s early adoption of 50G PON in March 2024 further solidifies its leadership in high-speed connectivity.

The refreshed Now OTT service, launched in January 2024, has been a significant Star, driving 15% subscriber growth in 2024 and an additional 17% in the first half of 2025, with a focus on smart device packages.

| Category | Key Performance Indicator | 2024 Data | Mid-2025 Data | Key Driver |

|---|---|---|---|---|

| 5G Mobile | Total Users | N/A | Over 1.89 million | 25% growth in 2024, 21% growth H1 2025 |

| Enterprise Solutions | Local Data Revenue Growth | 8% | N/A | New project wins exceeding HK$5B (2024) + HK$2.2B (Q2 2025) |

| Mainland China Enterprise | Revenue | HK$1 billion | N/A | 37% YoY growth in 2024, 13% growth H1 2025 |

| 2.5G Fibre Broadband | Subscriber Growth | Tripled | N/A | Demand for premium high-speed services |

| Now OTT Service | Subscriber Growth | 15% | 17% (H1 2025) | Launch of refreshed service, tailored smart device packages |

What is included in the product

HKT Trust's BCG Matrix analyzes its diverse businesses, identifying units for investment, growth, or divestment.

The HKT Trust BCG Matrix provides a clear, visual pain point reliever by instantly categorizing each business unit, simplifying strategic decisions.

Cash Cows

HKT's core mobile post-paid services are a true cash cow, boasting a substantial and remarkably stable customer base. As of June 2025, this segment served 3.478 million users, demonstrating HKT's strong market presence.

The loyalty of these customers is evident in the low churn rate, which stood at a mere 0.7%. This stability translates directly into consistent and significant service revenue, forming a bedrock for HKT's financial health.

While the company actively pursues growth through 5G, it's the sheer volume of its established post-paid mobile customers that provides a reliable and predictable cash flow in what is now a mature market segment.

HKT's Basic Fibre-to-the-Home (FTTH) Broadband stands as a prime example of a cash cow within its portfolio. By mid-2025, HKT commands a consolidated market leadership in broadband, boasting 1.055 million FTTH connections, which translates to over 71% of its consumer broadband customer base.

This significant market penetration, driven by an extensive fiber network, ensures a consistent and predictable stream of recurring revenue. The enduring demand for dependable, high-speed internet services solidifies FTTH Broadband's position as a stable, high-market-share cash generator for HKT.

Traditional fixed-line voice and data services, a core component of HKT's Local Telecommunications Services, continue to be a significant revenue generator. Local Data Services, in particular, represents the largest portion of this segment's contribution.

Despite a decline in local telephony revenue, the overall fixed-line business remains vital, especially for enterprises. This segment offers a stable and predictable cash flow from a mature market, underpinning HKT's financial stability.

International Telecommunications Services (Core)

The International Telecommunications Services (Core) segment of HKT Trust demonstrated robust performance in 2024, generating HK$7,107 million in revenue. This figure underscores its position as a mature and significant contributor to the company’s overall financial health.

This segment plays a crucial role in enabling global connectivity, offering reliable voice and data services through an extensive international network. Its stability is a key asset, providing a consistent and predictable cash flow stream that HKT can leverage for investments in other areas of its business.

The consistent cash generation from International Telecommunications Services acts as a vital financial backbone, supporting HKT's strategic initiatives and growth ambitions. This stability is particularly valuable in the dynamic telecommunications landscape.

- Revenue: HK$7,107 million (Year ended December 31, 2024)

- Key Offering: Stable voice and data services via a comprehensive international network.

- Strategic Value: Provides consistent cash flow to support other business initiatives.

- Market Position: Mature and substantial revenue stream within HKT.

The Club Loyalty Platform

The Club, HKT's loyalty and rewards platform, has become a significant cash cow within its BCG matrix. As of early 2024, its membership base has surpassed 4 million individuals, showcasing robust customer acquisition and loyalty.

This platform is instrumental in driving repeat business and increasing customer lifetime value by fostering engagement across HKT's diverse service offerings. Its ability to connect a large consumer base with various merchants contributes to a stable and predictable revenue stream.

- Membership Growth: Over 4 million members by early 2024.

- Revenue Generation: Stable income from a large, active user base.

- Ecosystem Integration: Drives spending within HKT's services.

- Merchant Connectivity: Facilitates consumer access for partner businesses.

HKT's core mobile post-paid services are a true cash cow, boasting a substantial and remarkably stable customer base. As of June 2025, this segment served 3.478 million users, demonstrating HKT's strong market presence and a low churn rate of 0.7%.

The Club, HKT's loyalty and rewards platform, has become a significant cash cow with over 4 million members by early 2024, driving repeat business and customer lifetime value through engagement across HKT's diverse service offerings.

HKT's Basic Fibre-to-the-Home (FTTH) Broadband, with 1.055 million connections as of mid-2025, solidifies its position as a cash generator due to high market penetration and consistent demand for high-speed internet.

Traditional fixed-line voice and data services, particularly Local Data Services, continue to provide a stable and predictable cash flow from a mature market, underpinning HKT's financial stability, especially for enterprise clients.

| Segment | Status in BCG Matrix | Key Metrics (as of mid-2025 unless specified) | Revenue Contribution (2024) |

|---|---|---|---|

| Mobile Post-paid Services | Cash Cow | 3.478 million users, 0.7% churn | Significant and stable service revenue |

| The Club (Loyalty Platform) | Cash Cow | >4 million members (early 2024) | Stable income from active user base, drives ecosystem spending |

| Basic FTTH Broadband | Cash Cow | 1.055 million connections, >71% of consumer broadband base | Recurring revenue from extensive fiber network |

| Fixed-line Voice & Data (Local) | Cash Cow | Largest portion of Local Telecommunications Services | Stable, predictable cash flow from mature market |

| International Telecommunications Services (Core) | Cash Cow | Extensive international network | HK$7,107 million |

What You See Is What You Get

HKT Trust and HKT BCG Matrix

The preview you are currently viewing is the exact HKT Trust BCG Matrix report you will receive upon purchase. This comprehensive document, meticulously prepared, offers a detailed strategic analysis of HKT Trust's business portfolio, presented in a clear and actionable format. You can be confident that the content and professional design you see now will be delivered to you without any alterations or watermarks, ready for immediate use in your strategic planning.

Dogs

Legacy fixed-line copper-based services represent a segment of HKT's operations that is experiencing a secular decline. As consumers increasingly adopt high-speed fibre broadband and advanced mobile services, the demand for traditional copper lines diminishes, positioning these offerings as low-growth, low-market-share products within the BCG matrix.

The ongoing maintenance of this aging copper infrastructure incurs significant operational costs for HKT. Given the declining revenue streams and the capital expenditure required to sustain these networks, these services can be characterized as cash traps. Strategic decisions to minimize investment or plan for their eventual phase-out are crucial for optimizing resource allocation and focusing on more promising growth areas.

HKT Trust's 2G/3G mobile subscriptions are firmly in the 'Dog' quadrant of the BCG Matrix. The continued migration to 5G and the widespread availability of 4G networks have led to a sharp decline in these older technologies. By September 2024, 3G subscriptions alone saw a 13.7% decrease, highlighting the shrinking market for these services.

This segment represents a low-growth, low-market-share area for HKT. The revenue generated from 2G/3G customers is minimal, making it a prime candidate for either divestiture or strategic network refarming to support more advanced technologies. Focusing resources on these legacy services would be inefficient given the market trends.

While HKT Trust saw overall revenue growth, the mobile product sales (hardware) segment experienced a slower pace of increase when excluding this category. This indicates that the direct sale of mobile devices is not a primary driver of high-margin revenue for the company.

This segment operates within a fiercely competitive retail landscape where differentiation is minimal. Consequently, it presents lower profitability compared to the more stable and recurring revenue streams derived from HKT's service offerings.

Outdated Traditional Pay TV Content/Channels

Within HKT Trust's Pay TV segment, Now TV faces the challenge of outdated traditional content. While the overall Pay TV business shows resilience, specific linear TV channels are experiencing a decline in viewership and revenue. This is largely due to the fierce competition from a growing array of free and paid entertainment options, including streaming services and on-demand content.

These less popular channels, often catering to niche audiences, risk becoming cash traps. If they can't attract or keep a substantial viewership, they drain resources without generating sufficient returns. This situation necessitates a strategic review of HKT's content portfolio to ensure it remains relevant and profitable in the evolving media landscape.

- Declining Viewership: Specific traditional channels within Now TV are seeing reduced viewership numbers, a trend amplified by the proliferation of alternative entertainment platforms.

- Revenue Impact: The drop in viewership directly affects the revenue generated by these underperforming channels, potentially turning them into financial burdens.

- Competition: Intense competition from streaming giants and other digital entertainment providers is a primary driver for the declining appeal of traditional Pay TV content.

- Content Strategy Re-evaluation: HKT must consider updating or phasing out outdated content to avoid these channels becoming cash traps and to optimize resource allocation.

Non-strategic, Low-Margin IT Reselling

Non-strategic, low-margin IT reselling within HKT, if not directly tied to advanced solutions like AI or IoT, likely faces intense competition in a commoditized market. This segment, characterized by low market share and thin profit margins, represents an inefficient allocation of resources when compared to HKT's focus on higher-value, strategic growth areas.

For instance, in 2023, the global IT hardware resale market saw significant price pressures, with average profit margins for general hardware reselling often hovering between 1-5%. This contrasts sharply with the potential margins in specialized cloud services or managed IoT deployments, which can reach 15-30% or higher.

- Market Saturation: General IT hardware and software reselling is a crowded space, leading to price wars and reduced profitability.

- Low Differentiation: Products offered in this segment often lack unique features, making it difficult to command premium pricing.

- Resource Drain: Investing in low-margin reselling diverts capital and attention from more promising, high-growth strategic initiatives within HKT.

- Limited Scalability: The profit potential for basic reselling is capped by volume, unlike the recurring revenue models of strategic, integrated solutions.

HKT Trust's legacy fixed-line copper-based services and 2G/3G mobile subscriptions are classic examples of 'Dogs' in the BCG Matrix. These segments are characterized by low growth and low market share, demanding significant maintenance costs without substantial returns. For instance, 3G subscriptions alone saw a 13.7% decrease by September 2024, underscoring the shrinking demand.

Similarly, certain linear TV channels within Now TV and non-strategic IT reselling also fall into the 'Dog' category. These areas suffer from declining viewership, intense competition, and commoditized markets, leading to low margins and inefficient resource allocation. The global IT hardware resale market, for example, saw profit margins between 1-5% in 2023, highlighting the limited profitability.

These 'Dog' segments represent cash traps for HKT, draining resources that could be better invested in high-growth areas like 5G services or advanced IT solutions. A strategic approach involving divestiture, network refarming, or phasing out these offerings is essential for optimizing HKT's overall portfolio performance and maximizing shareholder value.

Question Marks

Anchorpoint Financial, a new venture launched in August 2025 as a collaboration between HKT Trust, Animoca Brands, and Standard Chartered, is positioned to issue regulated stablecoins within Hong Kong's developing regulatory framework. This initiative targets a high-growth, innovative sector that is still in its early stages.

Currently, Anchorpoint Financial holds a minimal market share due to its recent operational commencement. The venture requires substantial capital investment for development and to meet stringent regulatory compliance standards.

Despite the initial resource demands, Anchorpoint Financial possesses the potential to evolve into a market leader, or a 'Star' in the BCG matrix, contingent on successful market adoption and strong growth in the regulated stablecoin space.

HKT's introduction of Asia's first 800Gbps AI Superhighway in 2025 positions it to capture a significant share of the burgeoning AI and supercomputing market. This private, fiber-based network promises ultra-fast, low-latency connections crucial for demanding AI workloads.

While the AI infrastructure market is experiencing rapid growth, HKT's AI Superhighway is a novel offering with currently low market penetration. This presents a challenge, necessitating considerable investment to build brand recognition and secure market share in this specialized, high-demand sector.

HKT is making significant strides in integrating AI, including generative AI, into its enterprise solutions, targeting a high-growth market. This strategic push aims to offer advanced AI-powered services to businesses, reflecting a forward-looking approach to technological adoption.

While the market for AI-driven enterprise solutions is expanding rapidly, HKT's position in this nascent segment is still solidifying. The company is investing heavily to foster innovation and secure new clients in this competitive landscape.

Specific New Digital Ventures/E-commerce Initiatives

HKT is actively diversifying beyond its core telecommunications and loyalty services by venturing into new digital territories, including e-commerce and other digital initiatives. These new ventures, while tapping into potentially high-growth markets, are in their nascent stages, often characterized by a low initial market share.

For instance, HKT's e-commerce platforms, such as its marketplace for electronics and lifestyle goods, are designed to capture a share of the rapidly expanding online retail sector. In 2023, Hong Kong’s e-commerce sales reached an estimated HK$100 billion, indicating a significant opportunity. However, these new digital ventures require substantial investment in marketing and platform development to gain traction and compete effectively against established players.

- E-commerce Expansion: HKT is investing in online marketplaces and digital retail solutions to capitalize on the growing trend of online shopping.

- Digital Ventures: The company is exploring new digital services and platforms, potentially in areas like digital content, fintech, or smart living solutions.

- Market Position: These new initiatives likely represent Question Marks on the BCG matrix, possessing high growth potential but currently holding a low market share, necessitating strategic investment for growth.

Emerging IoT Vertical Solutions

HKT is actively integrating Internet of Things (IoT) technology into its enterprise offerings, tailoring solutions for sectors such as healthcare, public utilities, and hospitality. This strategic focus aims to address specific industry needs with connected devices and data analytics.

While the overall IoT market is experiencing robust growth, with global spending projected to reach over $1.1 trillion in 2024, HKT's foothold in these nascent, specialized IoT verticals may still be developing. The company's position within these niche segments will be crucial for future expansion.

To capitalize on these emerging opportunities and gain substantial market share in a diverse and expanding landscape, HKT's IoT vertical solutions necessitate ongoing investment in research and development, alongside the cultivation of key strategic alliances. This approach is vital for navigating a fragmented but promising market.

- Healthcare: IoT solutions for remote patient monitoring and asset tracking.

- Public Utilities: Smart metering and grid management systems.

- Hospitality: Connected room services and guest experience enhancements.

HKT's foray into e-commerce and other digital initiatives represents a strategic diversification. These ventures, while targeting high-growth markets like Hong Kong's estimated HK$100 billion e-commerce sales in 2023, currently hold low market share. They require significant investment to compete with established players, positioning them as potential Question Marks on the BCG matrix.

The company's IoT solutions for sectors like healthcare and public utilities also fall into this category. Despite the global IoT market's projected over $1.1 trillion spending in 2024, HKT's penetration in these specialized verticals is developing. Continued investment in R&D and strategic alliances are key to capturing market share.

Similarly, Anchorpoint Financial, a new venture in regulated stablecoins, has minimal market share but high growth potential, contingent on market adoption. HKT's AI Superhighway, while innovative, also faces the challenge of low market penetration in a rapidly growing AI infrastructure market.

| Venture Area | Market Growth Potential | Current Market Share | BCG Classification | Strategic Imperative |

| E-commerce & Digital Ventures | High (HK$100B 2023 e-commerce market) | Low | Question Mark | Invest for growth, build brand |

| IoT Solutions (Healthcare, Utilities) | High (>$1.1T global IoT spending 2024) | Developing | Question Mark | R&D, strategic alliances |

| Anchorpoint Financial (Stablecoins) | High (emerging regulatory space) | Minimal | Question Mark | Market adoption, regulatory compliance |

| AI Superhighway | Very High (burgeoning AI market) | Low | Question Mark | Brand building, market penetration |

BCG Matrix Data Sources

Our HKT Trust BCG Matrix leverages comprehensive financial disclosures, market share data, and industry growth forecasts. This is further enriched by expert analysis and competitor benchmarking for strategic clarity.