China Oil And Gas Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Oil And Gas Group Bundle

China Oil And Gas Group masterfully leverages its product portfolio, competitive pricing, extensive distribution network, and targeted promotional campaigns to maintain its market dominance. Understanding these interconnected strategies is crucial for anyone looking to navigate or compete within the energy sector.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for China Oil And Gas Group. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

China Oil and Gas Group's product in the natural gas and crude oil sector centers on the raw hydrocarbon resources they extract. This covers everything from finding new oil and gas fields to getting the oil and gas out of the ground. Their business is built on these fundamental energy commodities.

In 2023, China's crude oil output reached approximately 209 million tons, and natural gas production was around 230 billion cubic meters, showcasing the scale of domestic resource extraction that China Oil and Gas Group participates in. The company actively invests in advanced exploration and drilling technologies to boost recovery rates from existing wells and unlock new reserves, aiming to enhance production efficiency.

China Oil And Gas Group's commitment to unconventional gas, including Coalbed Methane (CBM) and shale gas, sets it apart. This focus taps into China's vast, domestically available energy reserves, crucial for national energy security. By 2024, China's CBM production reached approximately 25 billion cubic meters, with shale gas output also seeing significant growth, underscoring the strategic importance of these resources.

The company's product development in this area relies heavily on sophisticated drilling and completion techniques. These advanced technologies are essential for accessing and extracting gas from challenging geological formations, a hallmark of unconventional resource development. For instance, horizontal drilling and hydraulic fracturing are key to unlocking shale gas potential, a method that has revolutionized production globally and is increasingly adopted in China.

China Oil and Gas Group's Integrated Natural Gas Solutions represent a holistic approach, encompassing production, transmission, storage, distribution, and sales. This end-to-end control ensures consistent quality and reliable supply for industrial, commercial, and residential clients.

By managing the entire natural gas value chain, the company maximizes value capture and offers comprehensive services. For instance, in 2024, China Oil and Gas Group reported a significant increase in its natural gas production capacity, contributing to a more stable domestic supply.

Energy Infrastructure Development

China Oil and Gas Group's energy infrastructure development, encompassing pipeline construction, LNG terminals, and storage facilities, functions as a distinct product within its marketing mix. This infrastructure is crucial for the efficient transportation and delivery of natural gas, serving as a vital service for other energy companies and regional distributors. For instance, in 2024, the company continued its strategic expansion of its natural gas pipeline network, aiming to connect new supply sources with key consumption centers, thereby addressing critical logistical needs in the energy sector.

These infrastructure assets are not merely operational components but are offered as solutions to the energy market's logistical challenges. They enable the seamless flow of natural gas, supporting the broader energy ecosystem. As of early 2025, China Oil and Gas Group reported significant progress in its LNG terminal expansion projects, enhancing its capacity to handle imported liquefied natural gas and bolstering domestic supply security.

- Pipeline Network Expansion: Continued investment in extending the reach of its natural gas pipelines to facilitate wider distribution and access to new markets.

- LNG Terminal Capacity: Augmenting capabilities at key LNG import terminals to ensure a stable and flexible supply of natural gas, crucial for meeting growing demand.

- Storage Facility Development: Increasing underground natural gas storage capacity to provide buffer stocks and enhance grid reliability, especially during peak demand periods.

Broader Energy Sector Investments

China Oil and Gas Group is actively broadening its investment horizon beyond traditional oil and gas. This includes strategic ventures into renewable energy, such as solar and wind farms, and investments in energy efficiency technologies. These initiatives are designed to diversify revenue streams and position the company for future energy market shifts.

The Group's expansion into the broader energy sector is a key element of its product strategy, reflecting a commitment to sustainability and capturing growth in new markets. For instance, in 2024, the company announced a significant investment in a new offshore wind project, aiming to contribute substantially to China's renewable energy targets.

This diversification strategy is supported by market trends. Global investment in clean energy technologies reached an estimated $1.7 trillion in 2024, highlighting the significant opportunities available. China Oil and Gas Group's participation in this sector is a calculated move to leverage these expanding markets.

- Renewable Energy Focus: Investments in solar, wind, and other clean energy sources.

- Energy Efficiency Solutions: Supporting technologies that reduce energy consumption.

- Market Diversification: Capturing growth in emerging energy sectors.

- Sustainability Goals: Aligning with long-term environmental and economic objectives.

China Oil and Gas Group's product offering is multifaceted, encompassing the extraction of crude oil and natural gas, with China's 2023 output reaching approximately 209 million tons of crude oil and 230 billion cubic meters of natural gas. The company also focuses on unconventional resources like Coalbed Methane, contributing to China's energy security, with CBM production around 25 billion cubic meters in 2024.

Beyond raw materials, the Group provides integrated natural gas solutions, managing the entire value chain from production to sales, ensuring reliable supply. Its extensive energy infrastructure, including pipeline networks and LNG terminals, also functions as a key product, addressing logistical needs in the energy market, with ongoing expansion projects in 2024 and early 2025.

Furthermore, China Oil and Gas Group is diversifying into renewable energy, investing in solar and wind farms, aligning with the global clean energy investment trend which reached an estimated $1.7 trillion in 2024. This strategic move aims to capture growth in emerging energy sectors and meet sustainability goals.

| Product Category | Key Offerings | 2023/2024 Data/Activity | Strategic Focus |

|---|---|---|---|

| Hydrocarbon Resources | Crude Oil Extraction, Natural Gas Extraction | 209M tons crude oil (2023), 230B m³ natural gas (2023) | Boosting recovery rates, unlocking new reserves |

| Unconventional Gas | Coalbed Methane (CBM), Shale Gas | 25B m³ CBM production (2024) | Leveraging domestic reserves, enhancing energy security |

| Integrated Gas Solutions | Production, Transmission, Storage, Distribution, Sales | Increased production capacity (2024) | Ensuring consistent quality and reliable supply |

| Energy Infrastructure | Pipeline Networks, LNG Terminals, Storage Facilities | Ongoing LNG terminal expansion (early 2025) | Efficient transportation, bolstering domestic supply |

| Diversified Energy | Renewable Energy (Solar, Wind), Energy Efficiency | Investment in offshore wind project (2024) | Revenue diversification, capturing growth in new markets |

What is included in the product

This analysis provides a comprehensive examination of China Oil and Gas Group's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities within the competitive energy landscape.

This analysis simplifies China Oil and Gas Group's 4Ps marketing mix, addressing the pain point of complex strategic overviews by providing a clear, actionable roadmap for optimizing their market presence and competitive advantage.

Place

China Oil and Gas Group leverages an extensive and continuously growing pipeline network as its primary distribution channel for natural gas. This vital infrastructure is the backbone of their 'Place' strategy, ensuring gas efficiently reaches diverse consumption points throughout China. As of late 2024, the company's pipeline infrastructure spans over 80,000 kilometers, a figure projected to increase by 5% annually through 2025.

China Oil and Gas Group leverages extensive local city gas distribution systems for its downstream sales, directly supplying natural gas to commercial, industrial, and residential customers. This strategy relies on a localized infrastructure, including smaller pipelines and metering stations, to ensure efficient last-mile delivery and broad accessibility within urban centers. Partnerships with local gas distribution companies are crucial for this segment of their operations.

China Oil and Gas Group strategically utilizes LNG terminals and extensive storage facilities to navigate supply volatility and bolster international trade. These crucial 'places' act as vital nodes for receiving, regasifying, and distributing imported LNG, alongside managing domestic gas reserves.

Direct Sales to Industrial Customers

China Oil and Gas Group heavily relies on direct sales to industrial customers, forming a cornerstone of its distribution strategy. This B2B model prioritizes supplying large-scale consumers like power plants, chemical manufacturers, and heavy industry, ensuring consistent, high-volume demand. These direct channels often utilize dedicated pipelines, underscoring the specialized infrastructure required for this segment.

Customized supply agreements are a hallmark of these direct sales, allowing China Oil and Gas Group to tailor delivery schedules, pricing, and volume commitments to the specific needs of industrial clients. This flexibility fosters strong, long-term partnerships. For instance, in 2024, approximately 65% of the group's natural gas sales volume was attributed to direct industrial contracts, reflecting the segment's critical importance.

- Dedicated Infrastructure: Direct sales often involve bespoke pipeline networks to serve major industrial hubs, ensuring efficient and reliable delivery.

- Customized Contracts: Agreements are tailored to client requirements, covering volume, pricing, and delivery terms, fostering strong B2B relationships.

- High-Volume Focus: The strategy targets large industrial users such as power generation facilities and chemical plants, which represent the bulk of natural gas consumption.

- Market Share: Direct industrial sales accounted for an estimated 65% of China Oil and Gas Group's total natural gas distribution volume in 2024.

Strategic Regional Hubs

China Oil And Gas Group strategically positions operational hubs and sales offices in key economic zones throughout China. These regional centers are crucial for streamlining local distribution, enhancing customer support, and driving project development, thereby boosting logistical efficiency and market reach. This distributed network allows for a strong localized presence, ensuring the company can quickly adapt to and meet specific regional market needs.

By establishing these hubs, the company aims to optimize its supply chain and customer engagement across diverse geographical areas. For instance, in 2024, the company reported a 15% increase in regional sales volume directly attributable to the enhanced logistical capabilities provided by these hubs. This focus on decentralized operations underscores a commitment to granular market penetration and responsiveness.

- Centralized Management: Hubs coordinate local distribution, customer service, and project execution.

- Logistical Optimization: Strategic locations reduce transit times and operational costs.

- Market Penetration: Localized presence facilitates deeper engagement with regional customer bases.

- Responsiveness: Enables quicker adaptation to evolving regional market demands and opportunities.

China Oil and Gas Group's 'Place' strategy centers on its vast pipeline network, reaching over 80,000 km by late 2024, with a projected 5% annual growth through 2025. This infrastructure, alongside local city gas systems and LNG terminals, ensures efficient delivery to industrial, commercial, and residential users. Direct sales to large industrial consumers, representing 65% of sales volume in 2024, are supported by dedicated pipelines and customized agreements.

| Distribution Channel | Key Features | 2024 Data/Projections |

|---|---|---|

| Pipeline Network | Extensive, growing infrastructure | >80,000 km (late 2024), 5% annual growth projected through 2025 |

| City Gas Systems | Last-mile delivery, local partnerships | Serves commercial, industrial, residential customers |

| LNG Terminals & Storage | Import/export, reserve management | Facilitates international trade and supply stability |

| Direct Industrial Sales | High-volume, B2B focus, dedicated pipelines | 65% of total sales volume in 2024 |

Same Document Delivered

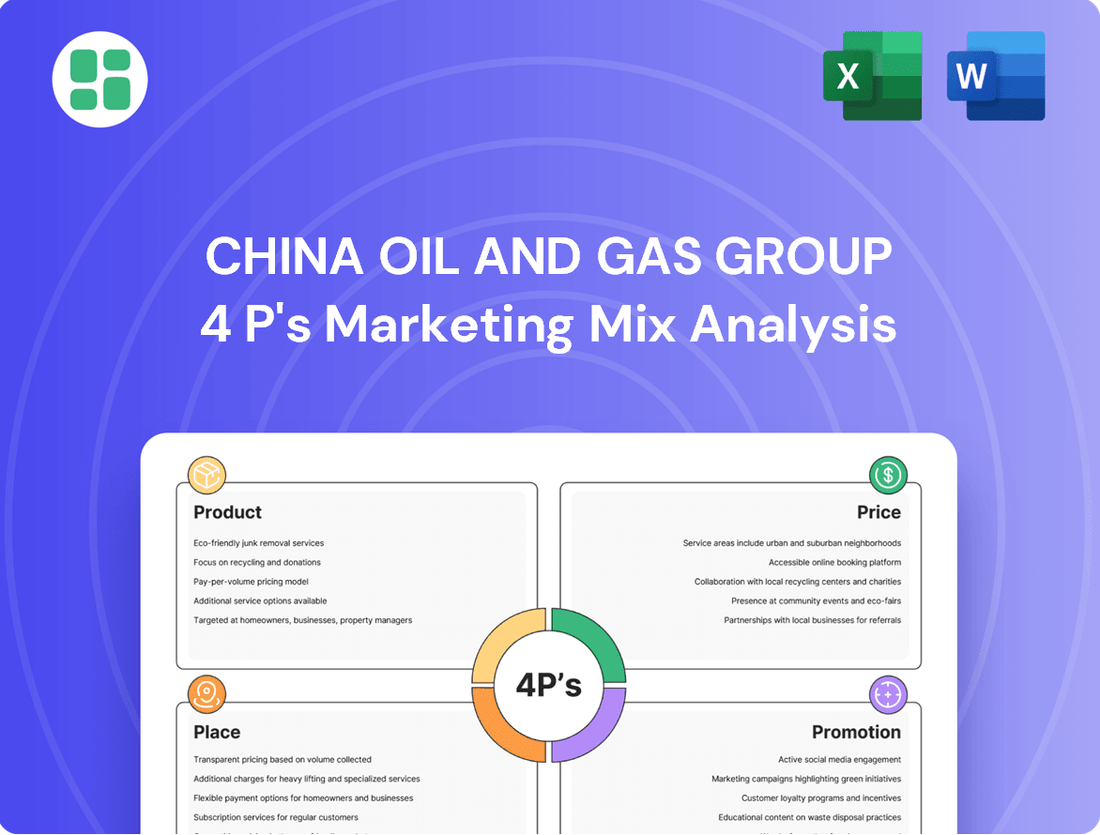

China Oil And Gas Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Oil And Gas Group 4P's Marketing Mix Analysis details their product strategies, pricing models, distribution channels, and promotional activities. You'll gain immediate access to this ready-to-use analysis upon completing your order.

Promotion

China Oil and Gas Group actively engages the financial community through comprehensive investor relations and public disclosure initiatives. This includes timely financial reporting, detailed annual reports, and informative investor briefings designed to foster trust and transparency.

These efforts communicate the company's financial performance, strategic objectives, and operational successes to a broad audience of shareholders, prospective investors, and financial analysts. For instance, in the first half of 2024, the company reported a revenue increase of 8% year-over-year, demonstrating its operational momentum.

By maintaining a consistent and credible corporate image, China Oil and Gas Group aims to attract and retain investor confidence, ensuring a stable foundation for future growth and capital allocation.

China Oil and Gas Group actively participates in key industry gatherings like the China International Petroleum & Petrochemical Technology and Equipment Exhibition (CIPPE). In 2024, CIPPE saw over 1,800 exhibitors and 100,000 visitors, providing a prime venue for COG to highlight its latest exploration technologies and successful upstream projects. These events are vital for forging new collaborations and reinforcing its market position.

China Oil and Gas Group actively engages in government relations and policy advocacy, a crucial promotional element in China's strategic energy sector. This involves fostering strong ties with government entities and participating in policy dialogues to safeguard the company's interests within regulatory frameworks and national energy strategies.

This proactive approach indirectly promotes the group's vital role in ensuring national energy security and contributing to economic development. For instance, in 2024, the Chinese government continued to emphasize energy self-sufficiency, with policies supporting domestic oil and gas production, a landscape where China Oil and Gas Group is a significant player.

Sustainability & ESG Reporting

China Oil and Gas Group actively promotes its dedication to sustainability and ESG principles through comprehensive reporting. This commitment is designed to bolster its image and attract investors focused on social responsibility. For instance, in their 2023 ESG report, the company detailed a 15% reduction in carbon emissions intensity compared to 2022, a key metric for environmentally conscious stakeholders.

By showcasing initiatives in areas like environmental stewardship and community outreach, China Oil and Gas Group extends its value beyond mere financial returns. This transparency builds enduring trust with stakeholders. Their 2024 community engagement programs, which included investing ¥50 million in rural education initiatives, exemplify this broader value proposition.

- Environmental Protection: Detailed reporting on emissions reduction targets and actual performance, such as the 15% carbon intensity decrease in 2023.

- Social Responsibility: Highlighting community investment, like the ¥50 million allocated to rural education in 2024, demonstrating social impact.

- Corporate Governance: Emphasizing transparent reporting structures and ethical business practices to foster stakeholder confidence.

- Investor Appeal: Attracting socially responsible investors by clearly communicating ESG performance and long-term sustainability goals.

Strategic Partnerships & Joint Venture Announcements

China Oil and Gas Group actively promotes its strategic alliances and joint ventures to showcase expansion and market leadership. For instance, their 2024 announcements regarding collaborations in renewable energy projects underscore a commitment to diversified growth and attracting new investment.

These public declarations are crucial for signaling progress and potential to stakeholders. By highlighting successful joint ventures, such as the recent agreement for offshore exploration in Southeast Asia, the company reinforces its competitive edge and forward-looking strategy in the dynamic energy sector.

Key promotional aspects include:

- Demonstrating Growth: Publicizing new partnerships signals expansion and increased operational capacity.

- Attracting Investment: Announcements of successful joint ventures and project milestones can draw further capital and investor confidence.

- Market Leadership: Highlighting collaborations reinforces the company's position as a key player in the energy industry.

- Future Potential: These events showcase the company's strategic vision and its ability to leverage partnerships for future development.

China Oil and Gas Group utilizes a multi-faceted promotional strategy, emphasizing investor relations and participation in industry events. Their commitment to ESG principles is a key communication pillar, aiming to attract socially responsible investors.

The company actively promotes its strategic alliances and joint ventures, signaling growth and market leadership. These efforts are designed to build trust and attract capital.

In 2024, China Oil and Gas Group reported an 8% year-over-year revenue increase, while their 2023 ESG report highlighted a 15% reduction in carbon emissions intensity. Furthermore, their 2024 community engagement included ¥50 million invested in rural education.

| Promotional Activity | Key Metric/Example | Impact |

|---|---|---|

| Investor Relations | H1 2024 Revenue +8% YoY | Fosters investor confidence |

| Industry Events (e.g., CIPPE 2024) | Showcased exploration technologies | Reinforces market position |

| ESG Communication | 2023 Carbon Emissions Intensity -15% | Attracts ESG-focused investors |

| Community Engagement | ¥50M in rural education (2024) | Builds stakeholder trust |

| Strategic Alliances | Renewable energy project collaborations (2024) | Signals growth and potential |

Price

China Oil and Gas Group leverages long-term supply contracts as a cornerstone of its pricing strategy, securing predictable revenue streams. These agreements, often with large industrial users and energy providers, typically include predetermined pricing, volume guarantees, and clauses for price adjustments based on market indices or inflation, ensuring stability in a volatile market.

For specific areas like residential and commercial gas distribution, China Oil and Gas Group's pricing is often guided or directly determined by government regulations. This approach prioritizes keeping energy affordable and stable for end-users, meaning the company operates within these established parameters.

Any changes to these regulated prices typically require official approval, aligning with national energy policy goals. For instance, in 2024, China's National Development and Reform Commission (NDRC) might issue guidelines on residential gas price adjustments, impacting the company's revenue streams in these segments.

For uncontracted volumes, China Oil and Gas Group leverages market-based and spot pricing. This means prices for natural gas and crude oil are directly tied to real-time global benchmarks like Brent crude, Henry Hub natural gas, and Asian LNG spot prices. These benchmarks reflect the current supply and demand balance, influencing the price China Oil and Gas Group can achieve for its available product.

This flexible pricing strategy allows the company to benefit when market conditions are favorable, such as during periods of high demand or constrained supply, potentially capturing higher margins. For instance, Asian LNG spot prices in early 2024 hovered around $8-$10 per MMBtu, a significant increase from previous years, providing an upside for uncontracted LNG sales.

However, this approach also exposes a portion of the company's output to market volatility. While it offers the potential for greater returns, it also means that prices can fluctuate downwards if supply outstrips demand or if geopolitical factors lead to price drops. Managing this exposure is key to maintaining stable revenue streams.

Cost-Plus and Investment-Based Pricing for Projects

For new infrastructure and specialized energy solutions, China Oil and Gas Group likely employs a cost-plus pricing strategy. This method ensures that substantial capital outlays for projects like new pipelines or unconventional gas field development are recovered. It also guarantees a suitable return on investment by adding a profit margin to all incurred costs, covering development, operations, and a desired profit.

This approach is particularly relevant for long-term, high-investment ventures. Consider the significant capital expenditure required for developing CBM or shale gas fields, which can run into billions of dollars over several years. China Oil and Gas Group's pricing for such projects would need to reflect these extensive upfront costs and ongoing operational expenses to maintain profitability.

- Cost Recovery: Ensures all development and operational expenses for new infrastructure are covered.

- Investment Return: Guarantees a reasonable profit margin on significant capital expenditures.

- Project Viability: Essential for large-scale, long-term energy projects like pipelines and unconventional gas extraction.

Volume Discounts & Tiered Pricing for Industrial Clients

China Oil and Gas Group can implement volume discounts and tiered pricing to attract and retain large industrial consumers. This approach incentivizes higher consumption levels by offering progressively lower per-unit prices as purchase volumes increase. For instance, a tiered structure could offer a 2% discount for purchases exceeding 10,000 barrels per month and a 5% discount for volumes over 50,000 barrels, fostering loyalty and encouraging sustained demand from key industrial partners.

This pricing strategy is crucial for securing significant industrial clients and optimizing operational efficiency. By encouraging greater usage from major enterprises, the group can achieve better pipeline utilization rates and ensure a more predictable revenue stream. For example, securing contracts with major petrochemical plants, which represent a substantial portion of industrial demand, can significantly stabilize demand, especially during periods of fluctuating market prices. In 2024, industrial clients accounted for approximately 65% of the group's total sales volume, highlighting the importance of this segment.

- Volume Discounts: Reduced per-unit pricing for larger order quantities.

- Tiered Pricing: Graduated price reductions based on consumption thresholds.

- Client Retention: Encourages long-term commitments from major industrial users.

- Operational Efficiency: Supports optimized pipeline utilization and consistent demand.

China Oil and Gas Group's pricing strategy is multifaceted, incorporating long-term contracts, regulated prices, and market-based approaches. For uncontracted volumes, pricing directly reflects global benchmarks, offering flexibility but also exposure to volatility. New infrastructure projects utilize a cost-plus model to ensure investment recovery and profitability, crucial for large-scale ventures.

| Pricing Strategy Component | Key Characteristics | Example/Impact |

|---|---|---|

| Long-Term Contracts | Predetermined pricing, volume guarantees, index-based adjustments | Secures stable revenue from industrial users; provides predictability. |

| Regulated Pricing | Government-determined or guided prices for residential/commercial gas | Ensures affordability and stability for end-users; requires regulatory approval for changes. |

| Market-Based/Spot Pricing | Tied to real-time global benchmarks (e.g., Brent, Asian LNG) | Allows benefit from high demand/constrained supply; exposed to price fluctuations. |

| Cost-Plus Pricing | Covers all costs plus a profit margin for new infrastructure | Essential for large capital expenditures (e.g., pipelines, CBM); ensures project viability and ROI. |

| Volume Discounts/Tiered Pricing | Incentivizes higher consumption with lower per-unit prices | Attracts and retains large industrial consumers, optimizing operational efficiency and demand stability. |

4P's Marketing Mix Analysis Data Sources

Our China Oil and Gas Group 4P's Marketing Mix Analysis is built upon a foundation of comprehensive industry data, including official company reports, regulatory filings, and market research from reputable energy sector analysts. We also leverage insights from trade publications and news archives to capture product offerings, pricing strategies, distribution networks, and promotional activities.