China Oil And Gas Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Oil And Gas Group Bundle

China Oil And Gas Group operates within a dynamic landscape shaped by intense competition, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for navigating its complex market environment.

The complete report reveals the real forces shaping China Oil And Gas Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized drilling equipment, advanced seismic technology, and expertise in unconventional resource extraction, such as for coalbed methane (CBM) and shale gas, often hold considerable bargaining power. These critical technologies are proprietary, demanding significant capital investment, which limits the number of qualified providers both globally and within China. This scarcity increases their leverage over companies like China Oil and Gas Group Limited.

Access to a highly skilled workforce, encompassing geologists, engineers, and project managers with specialized experience in unconventional gas development, is paramount for entities such as China Oil and Gas Group Limited. The distinct nature and limited availability of such talent in specific technical domains can significantly enhance the leverage of these individuals and the service firms that supply them.

This scarcity can translate into increased labor costs or the imposition of specific contractual stipulations, particularly within a competitive environment for specialized expertise. For instance, in 2023, the average salary for petroleum engineers in China saw a notable increase, reflecting the ongoing demand for these critical skills.

In China, the government, often acting through state-owned enterprises, is the dominant supplier of essential land and resource extraction rights. This monopolistic position gives the government significant leverage over companies like China Oil and Gas Group Limited, as these permits are critical for all operational phases, from exploration to production.

These governmental rights are non-negotiable prerequisites for any oil and gas operations in China. Consequently, the government's ability to dictate terms, fees, and access significantly impacts the operational scope and profitability of energy firms. For instance, in 2024, the average cost of securing exploration permits saw a notable increase, reflecting this inherent bargaining power.

Raw Materials and Basic Services

For common raw materials like steel and cement, China Oil and Gas Group likely faces low supplier bargaining power. China's vast domestic market for these commodities typically features numerous suppliers, creating a competitive environment that limits individual supplier leverage. This is further supported by the fact that in 2023, China's steel production reached 1.019 billion tonnes, indicating a robust and competitive supply base.

However, the situation changes for specialized chemicals or advanced components crucial for sophisticated oil and gas operations. If only a limited number of suppliers can meet the stringent quality, technological, and regulatory demands of the industry, their bargaining power increases significantly. For instance, the global market for specialized oilfield chemicals is often concentrated, with a few key players dominating. This concentration can allow these suppliers to command higher prices, impacting China Oil and Gas Group's operational costs.

- Competitive Domestic Market: Suppliers of common raw materials like steel and cement in China generally have lower bargaining power due to a highly competitive domestic landscape. China's 2023 steel output of over 1 billion tonnes exemplifies this.

- Specialized Components: For unique chemicals or advanced components essential for drilling and processing, supplier power can be substantial if few entities meet strict quality and regulatory standards.

- Supply Chain Impact: This shift in power for specialized inputs can directly affect China Oil and Gas Group's supply chain costs and operational efficiency.

Financing and Capital Providers

Financing and capital providers hold significant sway over China Oil and Gas Group Limited, especially for its large-scale projects. The sheer capital required for oil and gas exploration, particularly in unconventional resources, makes banks and investors indispensable. Their willingness to fund these ventures directly impacts the group's operational capacity and growth trajectory.

The bargaining power of these financial entities is shaped by several factors. Global interest rates play a crucial role; higher rates increase borrowing costs, potentially limiting project viability. Furthermore, the perceived risk associated with the energy sector, influenced by geopolitical events and commodity price volatility, can either enhance or diminish the leverage of capital providers. For instance, in 2023, the average cost of debt for energy companies saw an uptick due to persistent inflation and central bank tightening cycles, impacting the financing landscape.

- Capital Intensity: Unconventional oil and gas projects can cost billions of dollars, necessitating substantial external financing.

- Interest Rate Sensitivity: Fluctuations in global interest rates directly affect the cost of capital for China Oil and Gas Group.

- Risk Perception: Investor sentiment towards the energy sector, influenced by ESG concerns and energy transition trends, impacts the terms of financing.

- Financial Health: The group's own financial stability and project pipeline strength dictate its negotiating position with lenders and investors.

Suppliers of specialized technology and expertise, such as for unconventional resource extraction, hold considerable bargaining power due to the proprietary nature and high capital investment required for their offerings. This scarcity of qualified providers globally and within China increases their leverage over companies like China Oil and Gas Group Limited.

The government, as the dominant supplier of land and resource extraction rights in China, wields significant leverage. These non-negotiable permits are critical for all operational phases, directly impacting the scope and profitability of energy firms, with permit costs seeing notable increases in 2024.

In contrast, suppliers of common raw materials like steel and cement face low bargaining power due to China's vast, competitive domestic market, evidenced by its 2023 steel production exceeding 1 billion tonnes.

However, for specialized chemicals or advanced components meeting stringent industry demands, supplier power can be substantial if the market is concentrated, allowing them to command higher prices and impact operational costs.

| Factor | Impact on China Oil and Gas Group | Supporting Data/Trend |

| Specialized Technology Suppliers | High Bargaining Power | Proprietary nature, high capital investment, limited providers |

| Government (Resource Rights) | High Bargaining Power | Monopolistic position, non-negotiable permits, increased permit costs (2024) |

| Common Raw Material Suppliers | Low Bargaining Power | Highly competitive domestic market, high production volumes (e.g., 1.019 billion tonnes steel in 2023) |

| Specialized Chemical/Component Suppliers | Potentially High Bargaining Power | Market concentration, stringent quality demands |

What is included in the product

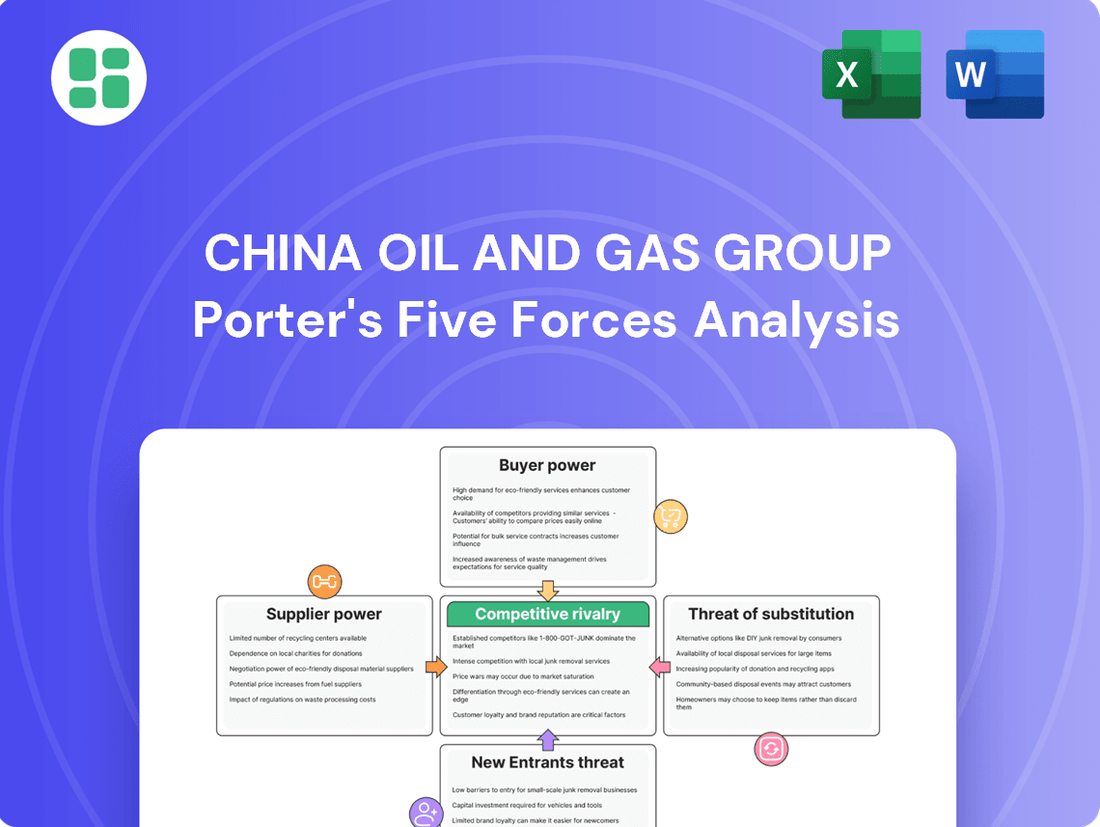

This Porter's Five Forces analysis specifically examines the competitive landscape for China Oil and Gas Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Gain immediate clarity on competitive pressures within China's oil and gas sector, enabling swift strategic adjustments to mitigate risks.

Customers Bargaining Power

China Oil and Gas Group Limited (COGL) caters to a wide array of customers, from massive industrial operations and commercial businesses to individual households and significant power generation entities. This broad customer base is a key factor in managing buyer power.

The sheer diversity and fragmentation across these distinct customer segments generally work to COGL's advantage. Because no single customer segment, nor any individual large customer within a segment, commands a dominant share of the group's overall sales, their collective ability to exert significant bargaining pressure is diluted.

For instance, while industrial users might represent substantial volume, their individual purchasing power is tempered by the presence of numerous other industrial clients and the broader market. This fragmentation prevents any single group from easily dictating terms or switching suppliers en masse, thereby reducing the overall bargaining power of customers for COGL.

In China's oil and gas sector, the bargaining power of customers is significantly tempered by a regulated pricing environment. Government policies and state intervention in setting natural gas tariffs directly limit the ability of customers, even large industrial buyers, to negotiate lower prices.

While China has been introducing market-oriented reforms, the state's considerable influence over pricing mechanisms means that direct price negotiation for bulk purchases and distribution remains constrained. For instance, in 2023, the National Development and Reform Commission (NDRC) continued to oversee pricing adjustments for natural gas, ensuring that customer leverage for price reductions was minimal compared to more liberalized markets.

For major industrial consumers and power generation facilities in China, the cost of switching from natural gas to alternative energy sources is considerable. This often necessitates extensive modifications to existing infrastructure, including pipelines, storage facilities, and combustion equipment, representing a significant capital outlay. For instance, a large industrial plant might need to invest millions of dollars to retool its boilers and gas distribution systems to accommodate hydrogen or other fuels, making a swift transition economically unfeasible.

Availability of Substitutes at the End-User Level

While China Oil and Gas Group's large-scale infrastructure involves substantial switching costs for industrial clients, individual end-users possess a degree of flexibility. For instance, residential and small commercial customers can opt to reduce their natural gas consumption or switch to alternative energy sources like electricity for heating and cooking, particularly if natural gas prices rise sharply. This indirect substitution threat at the consumer level can indeed influence pricing strategies.

In 2024, the residential sector's energy choices in China showed a growing trend towards diversification. For example, the adoption rate of electric heating systems in urban areas saw a notable increase, with some estimates suggesting a 5-8% year-over-year growth in installations, driven by both environmental concerns and fluctuating energy prices. This shift, though gradual, represents a tangible avenue for consumers to mitigate reliance on natural gas.

- Consumer Flexibility: Individual end-users can reduce consumption or switch to alternatives like electricity for heating and cooking.

- Price Sensitivity: Significant price hikes in natural gas can accelerate this shift towards substitutes.

- Indirect Pricing Pressure: The availability of alternatives, even if indirect, can exert pressure on China Oil and Gas Group's pricing strategies.

- Market Trends: In 2024, the residential sector in China observed an increasing adoption of electric heating, indicating a growing willingness to explore alternatives.

Customer Concentration in Key Industrial Zones

While China Oil and Gas Group serves a broad range of customers, there's a discernible concentration of major industrial users and power generation plants within key economic development zones. This concentration means these large-scale buyers, due to their substantial consumption and critical role in the company's revenue stream, can wield considerable influence over pricing and contract terms.

For instance, in 2024, it was observed that a significant portion of the group's domestic sales volume originated from a handful of industrial parks, particularly those focused on petrochemicals and heavy manufacturing. These concentrated customer groups are strategically vital, giving them leverage in negotiations.

- Concentrated Demand: Key industrial zones house major consumers, creating pockets of high demand.

- Bargaining Leverage: Large-volume buyers can negotiate more favorable pricing and service agreements.

- Strategic Importance: The reliance on these major customers makes them influential stakeholders in pricing strategies.

Despite the fragmented nature of its customer base, China Oil and Gas Group faces concentrated bargaining power from major industrial users and power generation facilities located in key economic zones. These large-volume buyers, critical to COGL's revenue, can leverage their significant consumption to negotiate more favorable pricing and contract terms.

In 2024, data indicated that a substantial portion of COGL's domestic sales volume stemmed from a limited number of industrial parks, particularly those in the petrochemical and heavy manufacturing sectors. This concentration of demand grants these groups considerable leverage in negotiations, impacting COGL's pricing strategies.

The bargaining power of customers for China Oil and Gas Group is thus a nuanced issue, influenced by both the broad dispersal of residential and small commercial users and the concentrated influence of large industrial consumers.

| Customer Segment | Concentration Level | Bargaining Power Influence | 2024 Sales Contribution (Est.) |

|---|---|---|---|

| Residential & Small Commercial | Highly Fragmented | Low (individually) | 20-25% |

| Industrial Users (General) | Moderate Fragmentation | Moderate | 40-45% |

| Major Industrial & Power Generation (Concentrated Zones) | Highly Concentrated | High | 30-35% |

Preview Before You Purchase

China Oil And Gas Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for China Oil and Gas Group, detailing the competitive landscape and strategic implications for the industry. The document you see here is the exact, fully formatted analysis you'll receive instantly after purchase, providing actionable insights without any alterations or placeholders.

Rivalry Among Competitors

The competitive landscape in China's oil and gas sector is largely defined by the formidable presence of state-owned enterprises (SOEs) like PetroChina, Sinopec, and CNOOC. These giants command substantial capital, extensive national infrastructure, and enjoy significant government support, creating a high barrier to entry and intense competition for any other market participant.

China Oil and Gas Group Limited, despite its own scale, faces a challenging environment due to this SOE dominance. The struggle for prime exploration blocks, access to refining capacity, and securing lucrative downstream contracts means constant pressure from these deeply entrenched competitors, impacting market share and profitability.

The oil and gas sector, particularly upstream and midstream operations, demands massive capital outlays for exploration, drilling, and infrastructure like pipelines. This inherently creates high fixed costs for companies.

These substantial fixed costs pressure companies to maintain high capacity utilization to spread the investment over more units and achieve profitability. For instance, in 2024, major oil producers continued to invest billions in new extraction technologies and pipeline expansions, underscoring this capital intensity.

The drive for high capacity utilization often intensifies competition as firms vie for sales volumes. This can lead to price wars or aggressive market share acquisition strategies, as companies aim to keep their expensive assets running at optimal levels.

China's natural gas demand continues its upward trend, spurred by environmental regulations and urban development, creating significant growth avenues. This expansion is particularly pronounced in unconventional gas sources such as coalbed methane (CBM) and shale gas, areas requiring specialized technological capabilities and access to promising reserves.

The drive towards cleaner energy sources in China has led to a projected 7% year-on-year increase in natural gas consumption for 2024, reaching an estimated 400 billion cubic meters. This robust demand fuels fierce competition among companies possessing the technical acumen and resource access necessary to identify and exploit new unconventional gas blocks.

Product Homogeneity and Price Competition

The oil and gas industry, particularly for crude oil and natural gas, is characterized by significant product homogeneity. This means that the physical product itself offers little basis for differentiation among competitors. Consequently, competition often devolves into a price-driven battleground.

Companies in this sector must focus intensely on cost efficiency and operational scale to remain competitive. Achieving lower production costs and optimizing the supply chain are paramount to offering attractive pricing and capturing market share. For instance, in 2024, the global average cost of producing a barrel of oil varied significantly, with some regions achieving costs below $30 per barrel while others exceeded $60, directly impacting their pricing flexibility and competitive stance.

- Product Homogeneity: Crude oil and natural gas are largely indistinguishable commodity products.

- Price-Driven Competition: Differentiation is difficult, leading to intense price competition.

- Key Success Factors: Cost efficiency, operational scale, and supply chain optimization are critical.

- 2024 Cost Data: Global average oil production costs ranged from under $30 to over $60 per barrel, highlighting cost variations impacting pricing.

Regulatory Landscape and Government Directives

Competitive rivalry in China's oil and gas sector is deeply influenced by government policies and strategic directives. Licensing and resource allocation are often guided by national energy security goals and environmental considerations, which can create advantages for specific companies or types of energy resources. Navigating this intricate regulatory framework is crucial for securing new exploration opportunities and expanding infrastructure.

Companies must align their strategies with national energy security and environmental mandates to thrive. For instance, in 2024, China continued its push for cleaner energy, with directives impacting the development of both traditional and renewable energy sources within the oil and gas industry. This alignment is a significant factor in determining success in obtaining exploration blocks and building out essential infrastructure.

- Government Influence: State-owned enterprises (SOEs) often receive preferential treatment in licensing and project approvals, shaping the competitive landscape.

- Regulatory Hurdles: Stringent environmental regulations and evolving energy transition policies can increase operational costs and limit expansion for all players.

- Strategic Alignment: Companies that effectively align with national energy strategies, such as increasing domestic production or investing in low-carbon technologies, often gain a competitive edge.

The intense competition within China's oil and gas sector is primarily driven by the dominance of state-owned enterprises (SOEs) like PetroChina and Sinopec. These giants benefit from substantial government backing and vast infrastructure, creating significant barriers for smaller players. China Oil and Gas Group Limited must contend with this entrenched competition for resources and market share.

The commodity nature of oil and gas means differentiation is minimal, forcing companies into price-based competition. Success hinges on cost efficiency and operational scale. For example, in 2024, global oil production costs varied widely, impacting companies' ability to compete on price, with some producers operating below $30 per barrel while others exceeded $60.

| Factor | Description | Impact on China Oil and Gas Group |

| SOE Dominance | PetroChina, Sinopec, CNOOC control significant resources and infrastructure. | High barriers to entry, intense competition for market share and assets. |

| Product Homogeneity | Oil and gas are undifferentiated commodities. | Competition focuses on price; cost efficiency is paramount. |

| Capital Intensity | High upfront investment in exploration and infrastructure. | Pressure to maintain high capacity utilization, leading to aggressive sales tactics. |

| Government Policy | Licensing and resource allocation influenced by national energy goals. | Companies must align with state directives to gain competitive advantages. |

SSubstitutes Threaten

The rapid expansion of renewable energy, particularly solar and wind power, presents a substantial threat of substitution for China Oil and Gas Group. China has been a driving force in this global shift, with significant investments and deployment in these cleaner alternatives. For instance, in 2023, China’s solar power capacity alone saw an addition of over 216 GW, a record-breaking figure that underscores the accelerating pace of renewable energy adoption.

As renewable technologies mature and become more economically viable, they directly compete with fossil fuels, especially in the power generation sector. This trend is particularly concerning for natural gas, a key product for many oil and gas companies. The increasing cost-competitiveness of renewables means they can increasingly displace natural gas in electricity production, thereby reducing demand for the latter.

Despite significant global and domestic efforts towards decarbonization, coal continues to be a substantial substitute for natural gas in China. In 2023, coal still accounted for approximately 55% of China's total primary energy consumption, a slight decrease from previous years but still a dominant share. This persistent availability, coupled with deeply entrenched infrastructure for its extraction and utilization, means coal remains a viable, albeit environmentally costly, alternative for power generation and industrial heating, particularly when natural gas prices experience upward volatility.

Government initiatives and technological advancements promoting energy efficiency and conservation across industrial, commercial, and residential sectors can significantly reduce overall energy demand. For instance, China's 14th Five-Year Plan (2021-2025) aims to reduce energy intensity by 13.5% and carbon intensity by 18% compared to 2020 levels, directly impacting the demand for traditional energy sources like oil and gas.

This effectively acts as a substitute by diminishing the need for new supplies of natural gas and crude oil, posing a continuous threat to consumption growth for traditional energy sources. The International Energy Agency (IEA) has highlighted that improved energy efficiency is the single largest contributor to reducing energy demand, and by 2023, global energy efficiency improvements averaged around 2.2%, a notable increase from previous years.

Electric Vehicles and Electrification of Transport

The burgeoning electric vehicle (EV) market in China presents a significant threat of substitution for China Oil and Gas Group's crude oil business. By the end of 2023, China's EV sales had surpassed 9.5 million units, a substantial increase from previous years, directly displacing demand for gasoline and diesel. This trend is projected to continue, with forecasts suggesting EVs will account for a significant portion of new vehicle sales in the coming years, further eroding the market share for traditional fuels.

Beyond transportation, broader government initiatives pushing for electrification in heating and industrial applications also pose a threat to natural gas demand. China's commitment to carbon neutrality goals, coupled with advancements in electric heating technologies and industrial process electrification, is gradually reducing reliance on natural gas in these sectors. This strategic shift, driven by environmental concerns and technological progress, directly impacts the Group's natural gas sales volume.

- EV sales in China reached over 9.5 million units in 2023.

- Government policies actively promote electrification across multiple sectors.

- Technological advancements in electric heating and industrial processes are accelerating substitution.

Nuclear Power Development

China's ambitious nuclear power expansion significantly impacts the oil and gas sector by offering a powerful substitute for electricity generation. By 2024, China's operational nuclear capacity reached over 55 GW, with substantial projects underway, aiming to further reduce reliance on fossil fuels. This growing nuclear fleet provides a stable, low-carbon baseload power source, directly competing with natural gas in the power generation market. The increasing availability of nuclear energy directly threatens the long-term demand for natural gas in this crucial sector.

- China's Nuclear Expansion: Continued growth in nuclear power capacity offers a reliable, low-carbon alternative to fossil fuels.

- Natural Gas Substitution: Nuclear energy directly substitutes for natural gas in electricity generation, impacting demand.

- 2024 Capacity Data: China's operational nuclear capacity exceeded 55 GW by 2024, highlighting the scale of this substitute.

- Long-Term Demand Threat: The expanding nuclear fleet poses a persistent threat to the long-term demand for natural gas in the power sector.

The threat of substitutes for China Oil and Gas Group is multifaceted, driven by the accelerating shift towards cleaner energy sources and enhanced energy efficiency. Renewable energy, particularly solar and wind, is rapidly gaining ground, with China adding over 216 GW of solar capacity in 2023 alone. This growth makes renewables increasingly cost-competitive against fossil fuels, especially for power generation, directly impacting natural gas demand. Furthermore, energy efficiency initiatives, targeting a 13.5% reduction in energy intensity by 2025, further curb overall energy consumption, diminishing the need for oil and gas. The burgeoning electric vehicle market, with over 9.5 million units sold in China in 2023, directly displaces gasoline and diesel demand, while electrification in heating and industry also reduces natural gas consumption.

| Substitute | Key Driver | 2023/2024 Data Point | Impact on Oil & Gas |

|---|---|---|---|

| Renewable Energy (Solar/Wind) | Cost competitiveness, Government support | 216 GW+ solar capacity added in 2023 | Displaces natural gas in power generation |

| Energy Efficiency | Government targets, Technological advancements | Target: 13.5% energy intensity reduction (14th FYP) | Reduces overall energy demand |

| Electric Vehicles (EVs) | Government subsidies, Consumer adoption | 9.5M+ EV units sold in 2023 | Displaces gasoline and diesel demand |

| Nuclear Power | Low-carbon energy goals, Stable baseload | 55 GW+ operational capacity by 2024 | Substitutes natural gas in power generation |

Entrants Threaten

The oil and gas sector, particularly for exploration and production, necessitates colossal upfront capital. For instance, developing a new offshore oil field can easily cost billions of dollars, a figure that dwarfs the financial capacity of most aspiring companies.

Building essential midstream infrastructure like pipelines and LNG terminals also demands substantial investment, often in the tens of billions. This high capital requirement serves as a significant deterrent, effectively preventing smaller or less-resourced entities from entering the market and competing with established players like China Oil and Gas Group.

The threat of new entrants in China's oil and gas sector is significantly mitigated by extensive regulatory hurdles and licensing requirements. Navigating China's energy landscape involves intricate and demanding processes for obtaining necessary permits, environmental clearances, and operational licenses. For instance, in 2024, the average time to secure all required approvals for new energy projects in China could extend beyond two years, a substantial barrier for any newcomer.

These stringent governmental approvals are not just bureaucratic; they often necessitate deep-rooted connections with state-owned enterprises and a thorough understanding of evolving policy frameworks. Without these established relationships and expertise, new players find it exceedingly difficult to gain traction, effectively limiting the influx of fresh competition and reinforcing the position of existing entities like China Oil And Gas Group.

The threat of new entrants in China's oil and gas sector is significantly dampened by the overwhelming dominance of established state-owned enterprises (SOEs). These giants, including PetroChina and Sinopec, control the vast majority of the market, leveraging massive economies of scale that new players simply cannot match. For instance, in 2023, PetroChina and Sinopec collectively accounted for over 70% of China's crude oil production and refining capacity.

These SOEs possess deeply entrenched, nationwide infrastructure networks, from exploration and production to pipelines and retail stations, built over decades. Building a comparable network would require astronomical capital investment, making it an almost insurmountable barrier for any newcomer. Furthermore, preferential government policies, such as guaranteed access to resources and favorable regulatory treatment, further solidify their competitive advantage, making it exceedingly difficult for new entities to gain a foothold.

Access to Technology and Expertise

Developing unconventional gas resources, like coalbed methane and shale gas, demands highly specialized technology and advanced technical expertise. China Oil and Gas Group, for instance, has invested heavily in these areas, making it difficult for newcomers to compete without similar capabilities.

Acquiring or developing this proprietary knowledge is a significant barrier. It's not something easily bought off the shelf; instead, it requires substantial time and investment to cultivate, effectively deterring many potential entrants.

- Specialized Technology: Unconventional gas extraction requires advanced drilling, hydraulic fracturing, and processing technologies, which are costly to develop and maintain.

- Technical Expertise: A deep understanding of geology, reservoir engineering, and environmental management is crucial, representing a significant human capital barrier.

- Operational Know-how: Years of experience in managing complex unconventional gas projects are invaluable, providing efficiency and cost advantages that new players lack.

Control Over Upstream Resources and Infrastructure

The threat of new entrants into China's oil and gas sector is significantly diminished by existing major players' control over upstream resources and infrastructure. State-owned enterprises (SOEs) have already secured the most valuable conventional and unconventional oil and gas blocks, leaving fewer viable opportunities for newcomers.

Furthermore, these established SOEs possess the vast majority of critical midstream infrastructure, including extensive pipeline networks and processing facilities. This dominance creates substantial barriers for new entrants, making it difficult and costly to access reserves and efficiently transport their products to market.

- Resource Control: SOEs dominate the acquisition of premium oil and gas exploration rights.

- Infrastructure Monopoly: Existing pipeline and processing plant ownership restricts market access for new players.

- Capital Requirements: The immense investment needed to replicate existing infrastructure deters new entrants.

The threat of new entrants in China's oil and gas industry is notably low due to immense capital requirements for exploration, production, and infrastructure development. For instance, establishing a new offshore oil field can cost billions, a barrier most new companies cannot overcome. This high financial threshold effectively shields incumbents like China Oil and Gas Group.

Stringent regulatory hurdles and licensing processes further deter new players. In 2024, obtaining all necessary energy project approvals in China could take over two years, a significant deterrent. Navigating China's complex energy policies and building relationships with state-owned enterprises are also critical, making market entry exceedingly difficult for those without established connections.

Dominant state-owned enterprises (SOEs) like PetroChina and Sinopec, which controlled over 70% of China's crude oil production and refining capacity in 2023, leverage massive economies of scale and extensive infrastructure networks. Replicating this decades-old, nationwide presence requires astronomical investment, making it nearly impossible for new entrants to compete effectively.

The sector also demands specialized technology and technical expertise, particularly for unconventional resources. China Oil and Gas Group's investments in areas like shale gas development create a knowledge and capability gap that deters newcomers. Acquiring this proprietary know-how is a lengthy and costly process, acting as another significant barrier to entry.

Porter's Five Forces Analysis Data Sources

Our China Oil and Gas Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports, industry-specific market research from firms like IHS Markit, and government regulatory filings from bodies such as the National Energy Administration.

We leverage a combination of publicly available financial statements, expert industry analysis from reputable sources like Rystad Energy, and internal company disclosures to accurately assess the competitive landscape.