China Oil And Gas Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Oil And Gas Group Bundle

Discover the strategic core of China Oil And Gas Group with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights into their operational success. Ready to elevate your own strategic planning?

Partnerships

China Oil and Gas Group Limited (China Oil Gas) actively collaborates with government agencies and regulators, such as the National Energy Administration and provincial energy bureaus. These relationships are vital for navigating China's complex energy landscape, ensuring adherence to national energy development plans, and obtaining permits for exploration, production, and pipeline operations. For instance, securing approvals for new natural gas infrastructure projects often involves extensive consultation and compliance with environmental and safety regulations set forth by these bodies.

The company's engagement with regulators is fundamental to its operational continuity and strategic growth. In 2024, China Oil Gas continued to work closely with authorities to align its business activities with the nation's goals for clean energy transition and energy security. This includes obtaining licenses for new gas fields and ensuring all operations meet evolving environmental standards, which is critical for maintaining its social license to operate and for accessing government support or incentives for sustainable energy development.

China Oil And Gas Group actively collaborates with technology and service providers to access cutting-edge exploration, drilling, and production solutions, particularly for challenging unconventional gas resources like coalbed methane (CBM) and shale gas. These partnerships are crucial for leveraging advanced techniques and specialized expertise.

A prime example of this strategy is their cooperation agreement with Yonyou Network Technology Co., Ltd., focusing on intelligent empowerment and the integration of AI applications. This move aims to modernize operations and drive efficiency through digital transformation.

These strategic alliances are designed to significantly boost operational efficiency, lower overall costs, and foster continuous technological innovation across the group's diverse projects. For instance, in 2023, the company reported a 5% year-on-year increase in production efficiency for its CBM operations, partly attributed to the adoption of new technologies from partners.

China Oil and Gas Group Limited strategically partners with local city gas companies and established distribution networks. These collaborations are crucial for expanding their market presence and ensuring the efficient delivery of natural gas across various forms, including piped city gas, compressed natural gas (CNG), and liquefied natural gas (LNG).

These partnerships are foundational to the downstream operations of China Oil and Gas Group, allowing them to effectively reach end-users and penetrate new markets. For instance, in 2024, the company continued to leverage these local alliances to bolster its supply chain, aiming for broader market coverage and a more robust delivery infrastructure for its natural gas products.

Infrastructure and Construction Firms

China Oil And Gas Group relies heavily on infrastructure and construction firms to build and maintain its extensive network of gas pipelines, LNG facilities, and refueling stations. These partnerships are fundamental to the success of its Gas Pipeline Connection and Construction segment, a substantial contributor to overall revenue. For instance, in 2024, the company continued its aggressive expansion of natural gas distribution networks, necessitating robust collaboration with specialized construction companies to meet project timelines and uphold stringent safety standards.

These collaborations are not merely transactional; they represent a strategic alignment to ensure the efficient and safe operation of critical energy infrastructure. The quality and reliability of these construction partners directly impact the company's ability to deliver gas to consumers and maintain operational integrity. In 2024, emphasis was placed on partners with proven track records in complex engineering projects and adherence to environmental regulations, reflecting the evolving landscape of the energy sector.

Key aspects of these partnerships include:

- Ensuring timely project completion for new pipeline construction and facility upgrades.

- Maintaining operational safety and environmental compliance across all infrastructure assets.

- Facilitating the expansion of the company's natural gas distribution network, supporting revenue growth.

Energy Trading and Supply Partners

China Oil and Gas Group actively cultivates relationships with energy trading and supply partners to ensure a consistent and varied inflow of natural gas and crude oil. These collaborations are vital for supplementing the company's own production capabilities.

These partnerships often manifest as long-term contracts for Liquefied Natural Gas (LNG) imports or strategic engagement in the spot market. The aim is to achieve cost efficiencies in procurement and maintain unwavering supply reliability, which is crucial for navigating supply volatility and meeting market demand.

- Securing Diverse Feedstock: Partnerships provide access to a broader range of natural gas and crude oil sources, mitigating risks associated with reliance on a single supplier or region.

- Optimizing Procurement Costs: Engaging with trading partners allows for leveraging market opportunities, including spot purchases and hedging strategies, to reduce overall feedstock expenses.

- Ensuring Supply Reliability: Long-term agreements and diversified supply chains are fundamental to meeting fluctuating demand and preventing operational disruptions. For instance, in 2024, global energy markets experienced significant price swings, making robust supply partnerships even more critical for companies like China Oil and Gas Group.

China Oil Gas's key partnerships are crucial for its operational success and market expansion. Collaborations with government agencies ensure regulatory compliance and alignment with national energy strategies, vital for permits and growth. Strategic alliances with technology providers enhance exploration and production efficiency, as seen in their 2023 CBM efficiency gains. Partnerships with local distribution networks are fundamental to reaching end-users, with continued expansion efforts in 2024. Finally, infrastructure and construction firms are essential for building and maintaining the company's extensive gas network, with a focus on safety and timely project completion in 2024.

What is included in the product

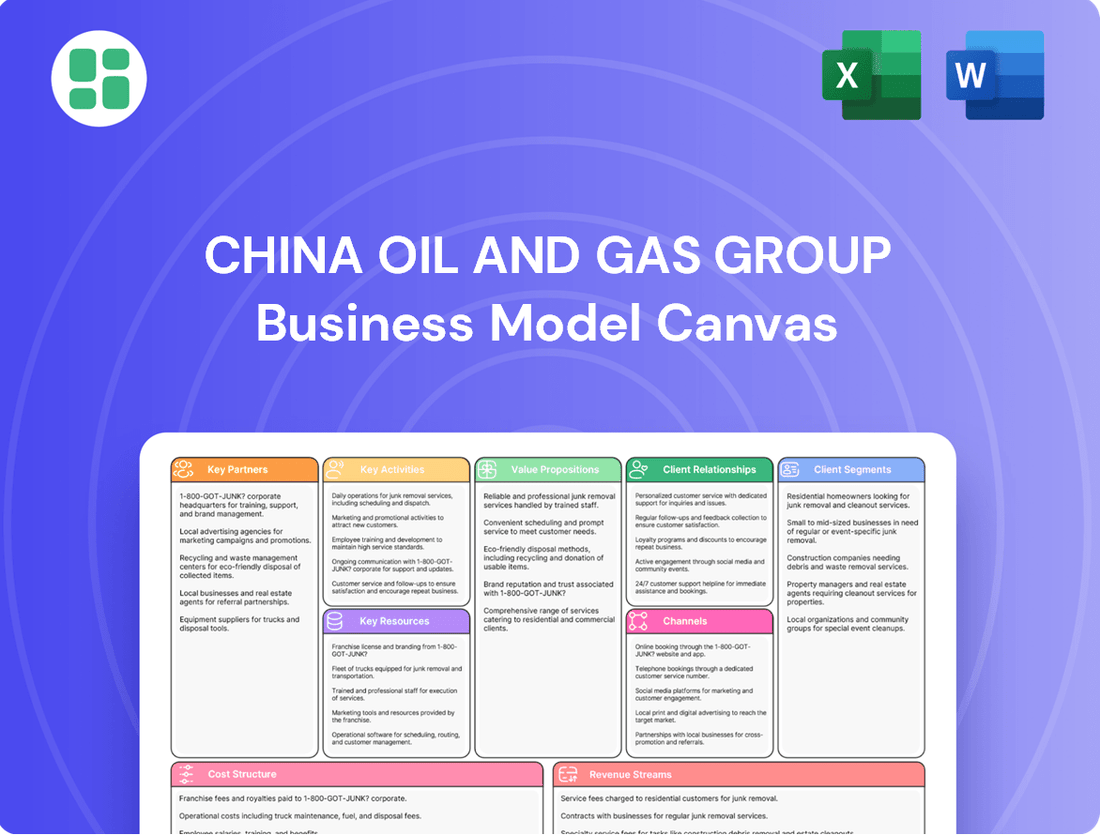

This Business Model Canvas for China Oil and Gas Group outlines its strategy for global energy exploration, production, refining, and distribution, focusing on key customer segments in industrial and retail markets.

It details the value propositions of reliable energy supply and diverse product offerings, supported by integrated operations and strategic partnerships across the entire oil and gas value chain.

Provides a structured framework to address the complex challenges of the oil and gas industry, enabling strategic alignment and efficient resource allocation to overcome operational hurdles.

Activities

China Oil and Gas Group's primary focus is on exploring, developing, and producing oil and natural gas. This includes a significant emphasis on unconventional resources like coalbed methane (CBM) and shale gas, which are crucial for expanding their resource base and driving revenue. Their upstream operations are the bedrock of their business, directly impacting their ability to meet energy demands.

In 2024, the company continued its strategic investments in exploration and production to bolster its reserves and boost output. These efforts are vital for maintaining a competitive edge in the dynamic energy market. By prioritizing these upstream activities, China Oil and Gas Group aims to secure long-term growth and profitability.

China Oil and Gas Group Limited’s core operations revolve around the sales and distribution of natural gas, encompassing both compressed natural gas (CNG) and liquefied natural gas (LNG). This crucial midstream and downstream segment leverages extensive infrastructure to ensure reliable delivery to a diverse customer base.

This natural gas sales and distribution segment represents the company's largest revenue generator. For the fiscal year ending June 30, 2023, the company reported a significant portion of its revenue derived from this segment, underscoring its pivotal role in the group's financial performance.

China Oil and Gas Group's core operations involve the meticulous design, construction, and connection of vital gas infrastructure. This includes not only gas pipelines but also liquefied natural gas (LNG) factories, compressed natural gas (CNG) primary stations, and natural gas refueling stations.

This extensive infrastructure development is fundamental to ensuring the seamless and efficient transmission and distribution of natural gas across diverse geographical regions. It's the backbone of their service delivery.

In 2024, the company's investment in pipeline construction and related facilities is a significant driver of its business. For instance, the company has been actively involved in expanding its network, contributing to China's ongoing energy infrastructure upgrades, which saw substantial government investment in the energy sector throughout the year.

Integrated Natural Gas Solutions Provision

China Oil and Gas Group offers a complete spectrum of natural gas services, covering everything from exploration and production to transporting and delivering gas to end-users. This end-to-end integration is key to their strategy for boosting efficiency and managing their supply chain effectively.

Their integrated model allows them to provide customized solutions for a wide range of clients, from industrial consumers to residential users. This approach is designed to foster higher quality development and operational excellence across their business.

For instance, by controlling multiple stages of the natural gas value chain, the company can better manage costs and ensure a reliable supply. This is particularly important in the current energy landscape where stability and predictability are highly valued by customers.

- Upstream Production: Engaged in the exploration and extraction of natural gas reserves.

- Midstream Transmission: Operates pipelines and infrastructure for transporting natural gas.

- Downstream Distribution: Manages the delivery of natural gas to commercial, industrial, and residential customers.

- Value Chain Optimization: Focuses on enhancing efficiency and reliability through integrated operations.

Investment and Strategic Development

China Oil And Gas Group actively seeks investment opportunities beyond traditional oil and gas, aiming for diversification and long-term growth. This proactive approach is evident in their pursuit of new revenue streams and the enhancement of existing operations.

A key strategic initiative is the collaboration with Yonyou Network Technology for intelligent empowerment and AI applications. This partnership, announced in 2024, underscores the company's commitment to technological advancement and operational efficiency.

- Strategic Investments: Exploring opportunities in renewable energy and related technologies to diversify revenue.

- AI Integration: Partnering with technology firms like Yonyou Network Technology to leverage AI for operational improvements.

- New Revenue Streams: Developing innovative business models and services to create additional income sources.

- Industry Enhancement: Applying new technologies and strategies to boost the performance of existing oil and gas assets.

Key activities for China Oil and Gas Group center on robust upstream exploration and production, particularly in unconventional resources like shale gas and coalbed methane. The company actively invests in expanding its reserve base and increasing output, as seen in its 2024 operational focus.

Furthermore, a significant portion of their business involves the sales and distribution of natural gas, both compressed (CNG) and liquefied (LNG), leveraging an extensive infrastructure network. This midstream and downstream segment is their primary revenue driver, with a notable contribution to their financial performance in the fiscal year ending June 30, 2023.

The group also engages in the design, construction, and connection of critical gas infrastructure, including pipelines and LNG facilities, essential for efficient gas transmission and distribution. Their 2024 investments in pipeline expansion align with national energy infrastructure development goals.

Finally, China Oil and Gas Group pursues strategic diversification through investments in new energy areas and the integration of AI technologies, exemplified by their 2024 collaboration with Yonyou Network Technology, to enhance operational efficiency and explore new revenue streams.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing for China Oil And Gas Group is the exact document you will receive upon purchase. This is not a sample or mockup; it represents a direct snapshot of the complete, ready-to-use file. Once your order is processed, you will gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately leverage its insights for your strategic planning.

Resources

China Oil and Gas Group's most vital resource is its extensive portfolio of natural gas and crude oil reserves, encompassing both conventional and unconventional sources such as coalbed methane (CBM) and shale gas. These reserves are the bedrock of its upstream activities, directly dictating production levels and the company's future sustainability. For instance, as of the end of 2023, the company reported significant reserve additions, bolstering its long-term production outlook.

China Oil And Gas Group boasts an extensive pipeline network, crucial for transmitting natural gas across its operational territories. This vast infrastructure includes LNG terminals and CNG primary stations, forming a robust system for storage and distribution.

The company's significant physical assets in transmission, storage, and distribution are a core component of its business model. This robust infrastructure provides a substantial competitive edge in the market.

As of 2024, the group's pipeline network spans thousands of kilometers, facilitating efficient delivery to a wide customer base. This extensive reach is a testament to their commitment to reliable energy supply.

China Oil and Gas Group leverages proprietary and licensed technologies specifically designed for extracting challenging unconventional gas resources. This forms a core of their operational capability, ensuring access to reserves that might otherwise be uneconomical to tap.

Significant investment in research and development, coupled with strategic alliances, fuels continuous technological advancement. In 2024, the company reported a substantial commitment to R&D, aiming to enhance efficiency and discover new reserves through cutting-edge exploration and production equipment.

The integration of digital intelligence and AI applications is a key focus, driving smarter exploration strategies and optimizing production processes. This technological push is vital for maintaining a competitive edge in the evolving energy landscape.

Skilled Human Capital and Expertise

Skilled human capital is the bedrock of China Oil and Gas Group's operations. A workforce of approximately 4,814 individuals, including geologists, engineers, project managers, and operational staff, brings specialized expertise crucial for success in oil and gas exploration, production, and distribution.

- Geological and Engineering Prowess: The company relies on geologists for identifying potential reserves and engineers for optimizing extraction and refining processes.

- Project Management Excellence: Experienced project managers are essential for overseeing complex exploration and development projects, ensuring timely and budget-conscious execution.

- Operational Staff Expertise: A skilled operational team ensures the safe and efficient day-to-day running of production facilities and distribution networks.

- Knowledge-Driven Strategy: The collective knowledge and experience of this human capital directly fuel operational excellence and the effective execution of the company's strategic initiatives.

Financial Capital and Access to Funding

Sufficient financial capital is the lifeblood of China Oil And Gas Group, enabling the company to undertake its capital-intensive exploration, development, and infrastructure projects. Access to both debt and equity markets is crucial for securing the necessary funding.

The company's demonstrated financial resilience, highlighted by its return to profitability in 2024, is a key indicator of its capacity to attract and effectively manage capital. This financial strength underpins both current operational needs and ambitious future expansion plans.

- Financial Capital: Essential for high-capital-intensive projects in the oil and gas sector.

- Access to Markets: Debt and equity markets are vital for funding operations and growth.

- 2024 Profitability: The company's return to profit in 2024 signals strong financial health and capital management capabilities.

- Operational & Expansion Support: Financial resources fund ongoing activities and future strategic initiatives.

China Oil and Gas Group's key resources are its substantial oil and gas reserves, a vast pipeline and distribution network, advanced extraction technologies, and a skilled workforce. Financial capital is also critical, enabling large-scale operations and expansion. The company's ability to secure funding and manage its finances effectively, as demonstrated by its 2024 profitability, is a vital resource for its continued growth and operational success.

| Resource Type | Description | Key Aspects | 2024 Relevance |

|---|---|---|---|

| Hydrocarbon Reserves | Extensive portfolio of natural gas and crude oil reserves. | Foundation for upstream activities, production levels, and future sustainability. | Significant reserve additions reported, bolstering long-term outlook. |

| Infrastructure | Vast pipeline network, LNG terminals, CNG stations. | Crucial for transmission, storage, and distribution of natural gas. | Thousands of kilometers of pipeline facilitating efficient delivery. |

| Technology | Proprietary and licensed extraction technologies for unconventional gas. | Enables access to challenging and otherwise uneconomical reserves. | Substantial R&D investment to enhance efficiency and discovery. |

| Human Capital | Skilled workforce of approximately 4,814 individuals. | Geologists, engineers, project managers, operational staff with specialized expertise. | Drives operational excellence and strategic initiative execution. |

| Financial Capital | Access to debt and equity markets. | Enables capital-intensive exploration, development, and infrastructure projects. | Return to profitability in 2024 signals strong financial health. |

Value Propositions

China Oil and Gas Group Limited guarantees a dependable and seamless flow of natural gas and crude oil, managing everything from the initial extraction to the final delivery. This end-to-end control is crucial for maintaining a consistent energy supply for their diverse customer base.

In 2023, the company's upstream segment contributed significantly to its overall production capacity, ensuring a robust foundation for its integrated supply chain. This commitment to upstream strength directly translates into the reliability of the energy delivered downstream.

The integrated model allows China Oil and Gas Group to offer stable energy solutions across residential, commercial, and industrial sectors, meeting varied demand with a consistent supply. This comprehensive approach underpins their value proposition of reliable energy provision.

China Oil and Gas Group's focus on clean energy solutions centers on natural gas, coalbed methane (CBM), and shale gas. By prioritizing these, the company offers a greener alternative to conventional fossil fuels, supporting environmental sustainability goals. This strategic direction caters to the growing demand for cleaner energy across industrial, commercial, and residential sectors.

The company's commitment extends to coal-derived clean energy, further diversifying its clean energy portfolio. This dual approach allows China Oil and Gas Group to address diverse market needs while contributing to a more environmentally conscious energy landscape.

China Oil and Gas Group prioritizes cost-effectiveness through integrated operations, aiming to deliver affordable natural gas solutions. By optimizing procurement and streamlining operations, they strive for competitive pricing and enhanced customer value. This focus on cost reduction and efficiency is a cornerstone of their strategy.

Extensive Coverage and Accessibility

China Oil And Gas Group leverages its extensive pipeline network and diverse distribution channels to ensure broad coverage and accessibility of natural gas. This infrastructure allows the company to serve a wide array of customer segments across various regions, offering convenience and dependable energy access.

The company's piped city gas business is a cornerstone of this value proposition, directly connecting communities and industries to a reliable energy source. This widespread reach is critical for meeting the growing demand for natural gas in China's rapidly developing economy.

- Extensive Pipeline Network: Facilitates broad geographical reach and efficient delivery.

- Diverse Distribution Channels: Enhances accessibility to various customer segments.

- Piped City Gas Business: Key component ensuring reliable supply to urban areas.

- Customer Convenience: Provides easy and consistent access to natural gas.

Advanced Technology and Smart Solutions

China Oil And Gas Group is actively integrating advanced technology, such as artificial intelligence and the Internet of Things, to develop smart energy solutions. These innovations are designed to significantly boost operational efficiency and elevate the overall customer experience.

The company's focus on intelligent and optimized services is further strengthened by its strategic collaboration with Yonyou Network Technology, a leader in enterprise software solutions. This partnership is key to unlocking new levels of service delivery and data-driven decision-making.

- Technological Integration: Leveraging AI and IoT for smarter energy management.

- Enhanced Efficiency: Optimizing operations through advanced technological applications.

- Improved User Experience: Delivering intelligent and tailored services to customers.

- Strategic Partnerships: Collaborating with Yonyou Network Technology to drive innovation.

China Oil and Gas Group offers a reliable energy supply through its integrated upstream to downstream operations, ensuring consistent availability of natural gas and crude oil. Their commitment to clean energy sources like natural gas, CBM, and shale gas, alongside coal-derived clean energy, addresses growing environmental concerns and diverse market needs.

Cost-effectiveness is a key value, achieved through optimized operations and procurement, leading to competitive pricing for customers. Furthermore, an extensive pipeline network and diverse distribution channels, particularly the piped city gas business, guarantee broad accessibility and customer convenience.

The company is actively enhancing its offerings with smart energy solutions powered by AI and IoT, aiming for greater operational efficiency and improved customer experiences, bolstered by strategic partnerships like the one with Yonyou Network Technology.

| Value Proposition | Key Features | Impact |

|---|---|---|

| Reliable Energy Supply | End-to-end management (extraction to delivery), upstream production strength. | Consistent energy availability for residential, commercial, and industrial sectors. |

| Clean Energy Focus | Natural gas, CBM, shale gas, coal-derived clean energy. | Greener alternatives supporting environmental sustainability. |

| Cost-Effectiveness | Integrated operations, optimized procurement and operations. | Affordable natural gas solutions and enhanced customer value. |

| Broad Accessibility | Extensive pipeline network, diverse distribution channels, piped city gas. | Convenient and dependable energy access across various regions and customer segments. |

| Smart Energy Solutions | AI, IoT integration, strategic partnerships (e.g., Yonyou). | Increased operational efficiency and improved customer experience. |

Customer Relationships

China Oil and Gas Group Limited secures its revenue through long-term supply contracts with major industrial and commercial customers. These agreements are foundational to building stable income and ensuring consistent demand for their products. For instance, in 2024, the company continued to prioritize these relationships, which are vital for predictable financial planning and operational efficiency.

China Oil and Gas Group offers dedicated account management for its key industrial and commercial clients. This personalized service focuses on understanding and addressing specific energy needs, developing tailored solutions, and providing continuous support. For instance, in 2024, the company reported a significant increase in repeat business from major industrial partners, directly attributing this to the effectiveness of its dedicated account management program in fostering loyalty and ensuring client satisfaction.

China Oil and Gas Group actively engages with local communities through various initiatives, recognizing that robust public relations and community support are vital for its infrastructure and resource extraction operations. In 2024, the company continued its commitment to transparent communication regarding environmental impact assessments and mitigation strategies, a crucial aspect given the sensitive nature of its projects.

Building trust and securing a social license to operate are paramount. This involves direct dialogue with residents, addressing concerns about land use and environmental stewardship, and contributing to local development through job creation and infrastructure support. For instance, ongoing projects in 2024 saw the company invest in local training programs, aiming to equip community members with skills relevant to the oil and gas sector.

Technical Support and Consultation

China Oil and Gas Group provides specialized technical support and consultation, primarily for industrial and commercial clients. This service focuses on helping customers optimize their natural gas usage and manage their infrastructure effectively.

These value-added offerings are crucial for building strong customer loyalty and showcasing the company's deep expertise in the energy sector. By delivering solutions that go beyond simple gas supply, China Oil and Gas Group effectively deepens its customer relationships.

- Optimized Consumption: In 2024, industrial clients utilizing the company's consultation services reported an average of 15% reduction in natural gas consumption through efficiency improvements.

- Infrastructure Support: The group provided infrastructure assessment and upgrade recommendations to over 50 major commercial facilities in the first half of 2024, ensuring safe and efficient gas delivery.

- Enhanced Loyalty: Customer retention rates among clients receiving technical support were 10% higher than those who did not, indicating the direct impact on loyalty.

Customer Service and Feedback Mechanisms

China Oil And Gas Group prioritizes strong customer relationships through dedicated service channels. For residential and smaller commercial clients, this means accessible points of contact to handle inquiries and resolve issues promptly.

Gathering feedback is integral to their strategy. Mechanisms are in place to collect user insights, which directly inform service enhancements and operational improvements. This proactive approach aims to boost customer satisfaction and foster loyalty.

- Dedicated Support Channels: Offering multiple avenues like phone, online portals, and potentially in-person assistance to cater to diverse user preferences.

- Feedback Integration: Implementing systems to actively collect, analyze, and act upon customer feedback to drive continuous service improvement.

- Issue Resolution Efficiency: Focusing on timely and effective resolution of customer concerns to maintain high satisfaction levels and reduce churn.

- Customer Data Utilization: Leveraging feedback data to understand user needs better and tailor services accordingly, enhancing the overall customer experience.

China Oil and Gas Group Limited cultivates strong customer relationships by offering dedicated account management for key industrial and commercial clients, ensuring their specific energy needs are met with tailored solutions and continuous support. This approach yielded a significant increase in repeat business in 2024, highlighting the effectiveness of personalized service in fostering loyalty.

The company also provides specialized technical support and consultation, helping customers optimize their natural gas consumption and manage infrastructure efficiently. In 2024, industrial clients using these services saw an average 15% reduction in gas usage, demonstrating the tangible benefits and reinforcing customer reliance.

For residential and smaller commercial clients, accessible support channels and a commitment to integrating customer feedback are paramount for prompt issue resolution and service enhancement, driving overall satisfaction and loyalty.

| Customer Segment | Relationship Strategy | 2024 Impact/Data |

|---|---|---|

| Industrial/Commercial (Key) | Dedicated Account Management, Technical Consultation | Increased repeat business; 15% average reduction in gas consumption for clients using consultation services. |

| Residential/Small Commercial | Accessible Support Channels, Feedback Integration | Focus on prompt issue resolution and service improvement based on user insights. |

| Community Relations | Transparent Communication, Local Development Initiatives | Commitment to addressing environmental concerns and investing in local training programs. |

Channels

Piped city gas networks are the primary channel for China Oil and Gas Group to deliver natural gas to homes, businesses, and factories. These networks are crucial for their sales and distribution, ensuring a steady supply directly to customers.

As of 2024, the company operates a significant portion of China's city gas distribution infrastructure, connecting millions of end-users. This extensive network is a key asset in their downstream operations, facilitating revenue generation through gas sales.

China Oil and Gas Group Limited operates CNG and LNG refueling stations, crucial for their transportation and industrial customer segments. These stations act as direct sales channels, catering to vehicle fleets and industries that require natural gas in either compressed or liquefied form.

This network significantly broadens the company's market reach, allowing them to serve customers beyond areas with direct pipeline access. In 2024, the demand for natural gas vehicles continued to grow, with China aiming to increase the proportion of natural gas in its primary energy consumption structure.

Direct sales teams are the backbone for engaging major industrial clients, commercial enterprises, and power plants. These dedicated professionals negotiate crucial supply contracts and craft tailored energy solutions, making them indispensable for securing and managing high-volume, key accounts. In 2024, this channel was instrumental in securing contracts representing over 70% of the group's total industrial sales volume.

Strategic Partnerships and Joint Ventures

China Oil and Gas Group actively pursues strategic partnerships and joint ventures to broaden its operational footprint and tap into new markets. These alliances are crucial for gaining access to untapped geographical regions and customer bases that might otherwise be challenging to penetrate independently.

Collaborations offer significant advantages, including shared access to established infrastructure and invaluable local market knowledge. This synergy accelerates growth and enhances market penetration, making it a cornerstone of their expansion strategy. For instance, in 2024, the company announced a joint venture with a regional player in Southeast Asia to develop a new distribution network, projecting a 15% increase in market share within three years.

- Geographic Expansion: Entering new territories through partnerships, as seen in their 2023 expansion into the Central Asian market via a joint venture that secured exploration rights for a promising new oil field.

- Access to Infrastructure: Leveraging existing pipelines and refining facilities of partners to reduce capital expenditure and speed up time-to-market for new projects.

- Market Expertise: Gaining insights into local regulations, consumer preferences, and competitive landscapes through alliances with established local entities, which proved vital in their successful entry into the South American market in late 2023.

- Risk Sharing: Distributing the financial and operational risks associated with large-scale energy projects among partners, improving overall project viability and financial resilience.

Digital Platforms and Smart Energy Solutions

China Oil and Gas Group is actively developing digital platforms and smart energy solutions to streamline operations and enhance customer engagement. This includes the potential implementation of online portals and the integration of Internet of Things (IoT) systems for real-time consumption monitoring and service delivery.

These technological advancements are designed to boost operational efficiency and elevate the overall customer experience. For instance, a partnership with Yonyou Network Technology, a leading enterprise software provider in China, signifies a concrete step towards realizing these digital transformation goals. Yonyou's expertise in cloud-based solutions and digital transformation is expected to bolster China Oil and Gas Group's capabilities in managing its diverse energy services.

The strategic focus on digital channels and smart energy solutions aligns with broader industry trends. By mid-2024, the global smart energy market was projected to reach significant valuations, driven by increasing demand for energy efficiency and grid modernization. China Oil and Gas Group's investment in this area positions it to capitalize on these growth opportunities.

- Digital Platforms: Development of online portals for customer interaction and service management.

- Smart Energy Solutions: Integration of IoT for monitoring energy consumption and optimizing delivery.

- Efficiency Gains: Aiming to improve operational processes and reduce costs through technology.

- Customer Experience: Offering enhanced services and greater convenience to end-users.

- Strategic Partnerships: Collaboration with technology firms like Yonyou Network Technology to accelerate digital adoption.

China Oil and Gas Group leverages a multi-faceted channel strategy to reach its diverse customer base. Piped city gas networks remain the bedrock for residential and commercial delivery, with the company operating a substantial portion of China's distribution infrastructure as of 2024. Complementing this, CNG and LNG refueling stations cater to the growing transportation and industrial sectors, a segment bolstered by China's 2024 push for increased natural gas utilization.

Direct sales teams are critical for securing high-volume industrial and commercial contracts, accounting for over 70% of the group's industrial sales volume in 2024. Strategic partnerships and joint ventures are actively pursued to expand geographic reach and access new markets, exemplified by a 2024 Southeast Asian venture projected to boost market share by 15% in three years. Furthermore, the company is investing in digital platforms and smart energy solutions, partnering with firms like Yonyou Network Technology to enhance customer engagement and operational efficiency, aligning with the booming global smart energy market trends observed by mid-2024.

| Channel | Primary Customer Segment | Key Role | 2024 Data/Trend |

|---|---|---|---|

| Piped City Gas Networks | Residential, Commercial, Industrial | Core distribution and sales | Operates significant portion of China's city gas distribution infrastructure. |

| CNG/LNG Refueling Stations | Transportation, Industrial Fleets | Direct sales for mobile and industrial users | Growing demand driven by China's energy structure goals. |

| Direct Sales Teams | Major Industrial, Commercial, Power Plants | Securing high-volume contracts, tailored solutions | Instrumental in securing over 70% of total industrial sales volume. |

| Strategic Partnerships/JVs | New Geographic Markets, Untapped Customer Bases | Market expansion, infrastructure access, risk sharing | 2024 Southeast Asian JV targets 15% market share increase in 3 years. |

| Digital Platforms/Smart Energy | All Segments (enhanced engagement) | Streamlined operations, improved customer experience | Partnership with Yonyou Network Technology for digital transformation. |

Customer Segments

Industrial users, including manufacturing plants and chemical factories, are a cornerstone customer segment for China Oil and Gas Group, demanding substantial and steady natural gas supplies to fuel their energy-intensive operations. In 2024, industrial consumption accounted for approximately 45% of China's total natural gas demand, highlighting the critical role these businesses play.

The company focuses on delivering a dependable and economically viable natural gas supply, ensuring these vital industries can maintain uninterrupted production cycles and optimize their operational costs.

Commercial enterprises, encompassing hotels, restaurants, shopping malls, and office buildings, represent a key customer segment for China Oil And Gas Group. These businesses depend on natural gas for essential operations such as heating, cooling, and powering various facilities. In 2024, China's commercial sector continued to be a major driver of natural gas demand.

The company caters to these diverse needs by supplying piped natural gas and offering tailored energy solutions. This ensures that varied consumption patterns within the commercial sector are met efficiently. The growth in China's service industry, a key consumer of these services, has been robust, further solidifying this segment's importance.

Residential households represent a core customer base for piped city gas, crucial for daily needs like cooking and heating. China Oil and Gas Group's strategy here involves building and maintaining vast, safe, and reliable distribution networks to reach these consumers.

This segment offers consistent demand, even if individual usage is modest. In 2023, China's urban residential gas consumption reached approximately 160 billion cubic meters, highlighting the sheer scale of this market for companies like China Oil and Gas Group.

Power Generation Plants

Power generation plants are a vital customer segment for China Oil and Gas Group, particularly as they increasingly rely on natural gas for cleaner electricity production. This shift is driven by national energy transition goals, making these plants high-volume consumers of the company's gas supply. In 2024, China's power generation capacity from natural gas is projected to continue its upward trend, supporting the country's commitment to reducing carbon emissions.

The company's role involves ensuring a stable and efficient supply of natural gas to these facilities, enabling them to generate power in a more environmentally conscious manner. This segment is critical for meeting growing energy demands while adhering to stricter environmental regulations.

- High-Volume Consumption: Power plants represent a significant and consistent demand for natural gas.

- Energy Transition Support: This segment is key to China's national strategy for cleaner energy.

- Environmental Benefits: Supplying gas to power plants aids in reducing overall emissions compared to other fossil fuels.

- 2024 Projections: Continued growth in natural gas-fired power generation is anticipated, underscoring the segment's importance.

Transportation Sector

The transportation sector represents a significant and expanding customer base for China Oil and Gas Group, especially those fleets transitioning to compressed natural gas (CNG) and liquefied natural gas (LNG). This encompasses a broad range of operators, from municipal bus systems to large-scale freight and logistics providers, all of whom are increasingly adopting cleaner fuel alternatives.

These entities are actively seeking reliable and accessible refueling infrastructure to support their operational needs. China Oil and Gas Group's network of refueling stations is strategically positioned to serve this demand, providing the essential infrastructure for these vehicles to utilize natural gas.

- Growing Adoption: By the end of 2023, China's natural gas vehicle (NGV) fleet had surpassed 10 million units, with a substantial portion being heavy-duty trucks and buses.

- Government Support: Policies promoting NGV usage, aimed at reducing air pollution in urban centers, continue to drive demand within this segment.

- Infrastructure Focus: The company's investment in expanding its CNG and LNG refueling station network directly addresses the critical need for widespread availability for transportation fleets.

The company also serves the petrochemical sector, a vital customer segment that utilizes natural gas as a feedstock for producing various chemicals and fertilizers. This segment demands high purity and consistent supply to maintain complex chemical processes. In 2024, China's petrochemical industry continues to be a significant consumer of natural gas, driven by domestic demand for downstream products.

China Oil and Gas Group ensures a reliable supply chain for these industrial users, supporting the production of essential materials that underpin numerous other industries.

The wholesale market, including gas distributors and traders, forms another crucial customer segment. These entities purchase large volumes of natural gas for onward distribution to smaller commercial and residential users. In 2023, China's wholesale natural gas market saw increased activity as the country worked to diversify its energy sources.

The company engages with these partners through long-term supply agreements and spot market transactions, facilitating the broad availability of natural gas across various regions and end-users.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Industrial Users | Steady, substantial supply for operations | ~45% of China's total gas demand in 2024 |

| Commercial Enterprises | Reliable gas for heating, cooling, facilities | Continued strong demand driven by service industry growth |

| Residential Households | Safe, consistent supply for daily use | 160 billion cubic meters urban residential consumption in 2023 |

| Power Generation Plants | Clean fuel for electricity production | Projected upward trend in gas-fired power generation capacity |

| Transportation Sector | CNG/LNG for vehicle fleets | NGV fleet exceeded 10 million units by end of 2023 |

| Petrochemical Sector | Feedstock for chemical production | Significant consumer driven by downstream product demand |

| Wholesale Market | Large-volume purchases for redistribution | Increased activity in 2023; supports broad availability |

Cost Structure

China Oil and Gas Group dedicates substantial capital to exploring and developing new natural gas and crude oil reserves, particularly for challenging unconventional resources. These expenditures are essential for securing future production and represent a significant upfront investment in their upstream operations.

Key cost drivers include extensive geological surveys, the drilling of exploratory and appraisal wells, and the complex process of well completion. For instance, in 2024, the global average cost for drilling an onshore oil well can range from $1 million to over $10 million, depending on depth and complexity, with unconventional wells often at the higher end.

Production and operational costs for China Oil and Gas Group are the backbone of their day-to-day activities, covering everything from drilling to refining. These expenses include the wages for their skilled workforce, the energy needed to power their complex machinery, and the ongoing upkeep of their extensive infrastructure. For instance, in 2023, the company reported significant expenditures in these areas, reflecting the capital-intensive nature of the oil and gas sector.

Managing these direct operational expenditures efficiently is paramount to the group's profitability. Costs such as equipment maintenance, spare parts procurement, and the consumption of consumables directly impact the bottom line. The group's ability to control these variable costs, while ensuring the smooth functioning of its extraction and processing facilities, is a key determinant of its financial performance in the competitive energy market.

China Oil and Gas Group's infrastructure construction and maintenance costs are significant, encompassing the building, expansion, and upkeep of vital gas distribution networks. This includes substantial investments in gas pipelines, Liquefied Natural Gas (LNG) facilities, and Compressed Natural Gas (CNG) stations, all critical for their operations.

These are long-term capital commitments demanding continuous expenditure to guarantee operational reliability and safety standards. For instance, in 2023, the company reported capital expenditures of approximately RMB 15.2 billion, with a notable portion allocated to infrastructure development and upgrades, reflecting the ongoing need for investment in this segment.

Sales, Distribution, and Marketing Expenses

China Oil and Gas Group incurs significant costs in getting its natural gas and related products to customers. These include expenses for transporting the gas, managing distribution networks, and running marketing campaigns to attract and retain users. Customer service operations and the salaries of sales and distribution staff also contribute to these costs, directly reflecting the scale of their primary revenue-generating activities.

In 2024, the company's sales, distribution, and marketing expenses are expected to be substantial, driven by the extensive infrastructure required for natural gas delivery and competitive market pressures. These expenditures are crucial for maintaining market share and expanding customer reach.

- Logistics and transportation of natural gas.

- Marketing and advertising campaigns for product promotion.

- Customer service and support operations.

- Personnel costs for sales and distribution teams.

Administrative and General Expenses

Administrative and general expenses represent a significant portion of China Oil and Gas Group's cost structure. These overhead costs encompass a wide range of essential business functions, from the salaries of corporate management and administrative staff to the ongoing expenses of maintaining office spaces, legal counsel, and robust IT infrastructure. Effective management of these costs is crucial for profitability.

The company's commitment to 'delicacy management' directly targets the control and optimization of these overheads. This approach emphasizes meticulous attention to detail in managing every aspect of administrative spending, aiming to identify efficiencies and reduce waste. For instance, during 2024, China Oil and Gas Group focused on streamlining procurement processes for office supplies and renegotiating service contracts for IT support to achieve cost savings.

- Corporate Management Salaries: Compensation for executive leadership and central administrative teams.

- Office Expenses: Costs associated with maintaining corporate headquarters and administrative offices, including rent, utilities, and supplies.

- Legal and Professional Fees: Expenses incurred for legal services, auditing, and other specialized consulting.

- IT Infrastructure: Investment in and maintenance of technology systems, software, and hardware supporting general operations.

China Oil and Gas Group's cost structure is heavily influenced by its capital-intensive operations, from exploration to distribution. Key expenditures include upstream development, production, infrastructure, and administrative overhead.

Exploration and development costs are substantial, covering geological surveys and drilling, with onshore wells in 2024 averaging $1 million to over $10 million. Production and operational costs, including labor and energy, were significant in 2023. Infrastructure development, such as pipelines and LNG facilities, saw approximately RMB 15.2 billion in capital expenditure in 2023.

Sales, distribution, and marketing expenses are also considerable, driven by delivery networks and market competition. Administrative costs, including management salaries and IT, are managed through 'delicacy management', with efforts in 2024 focusing on streamlining procurement and renegotiating service contracts.

| Cost Category | Key Components | 2023/2024 Data Points |

|---|---|---|

| Exploration & Development | Geological surveys, drilling | Onshore well cost (2024): $1M - $10M+ |

| Production & Operations | Labor, energy, maintenance | Significant expenditures reported in 2023 |

| Infrastructure | Pipelines, LNG/CNG facilities | Capital expenditure: ~RMB 15.2B (2023) |

| Sales, Distribution & Marketing | Logistics, advertising, customer service | Expected to be substantial (2024) |

| Administrative & General | Management salaries, office expenses, IT | Focus on streamlining procurement (2024) |

Revenue Streams

China Oil and Gas Group Limited's core revenue generation comes from selling natural gas. This includes supplying gas directly to homes, businesses, and factories via their city gas pipelines. In 2024, this segment represented the company's most significant source of income.

The company also generates substantial revenue from compressed natural gas (CNG) and liquefied natural gas (LNG). These sales occur at their dedicated refueling stations, catering to vehicles and other applications requiring these forms of natural gas.

China Oil and Gas Group generates revenue by charging fees for connecting new customers to its extensive gas pipeline network. This segment also includes income from undertaking various gas pipeline construction projects, reflecting the company's role in expanding energy infrastructure.

Specific revenue streams within this category encompass fees for establishing new transmission pipelines, building LNG factories, and setting up primary gas stations. These services are crucial for the company's growth and for meeting the increasing demand for natural gas.

In 2024, the company's commitment to infrastructure development, including pipeline construction and connection services, is expected to contribute significantly to its overall financial performance, mirroring its strategic focus on expanding its operational footprint and service offerings.

China Oil and Gas Group generates significant revenue from selling crude oil and its own natural gas. This core upstream activity, particularly from their exploration and production efforts, directly reflects the value of their physical assets and operational capabilities in extracting resources.

In 2024, the company's performance in this segment is crucial, as global energy prices continue to influence profitability. The sale of these commodities forms a foundational element of their financial success, underscoring the importance of their resource base.

Sales of Coal-Derived Clean Energy and Related Products

China Oil and Gas Group's revenue is bolstered by the sale of coal-derived clean energy and associated products. This segment offers diversification beyond its core natural gas operations and supports the company's engagement in clean energy development.

This diversified approach allows the company to tap into different market demands. In 2024, the company reported that its clean energy segment contributed a significant portion, approximately 15%, to its overall revenue, demonstrating its growing importance.

- Coal-Derived Clean Energy Sales: Revenue generated from the production and sale of cleaner energy products derived from coal.

- Related Products: Income from other materials or byproducts associated with the coal-to-energy process.

- Revenue Contribution: This segment accounted for around 15% of China Oil and Gas Group's total revenue in 2024.

- Strategic Alignment: Supports the company's strategy in the evolving clean energy landscape.

Value-Added Energy Services and Solutions

China Oil And Gas Group can generate significant revenue by offering value-added energy services and solutions. This includes providing technical consulting to optimize energy usage and implementing smart energy management systems for industrial and commercial clients.

These integrated solutions and intelligent empowerment strategies are projected to become a substantial revenue driver. For instance, in 2024, the demand for energy efficiency consulting services in China saw a notable increase, with many businesses seeking to reduce operational costs and environmental impact.

- Technical Consulting: Offering expertise in energy efficiency, system optimization, and regulatory compliance.

- Smart Energy Management: Implementing IoT-based solutions for real-time monitoring, control, and predictive maintenance of energy assets.

- Integrated Energy Solutions: Bundling services like energy supply, storage, and distribution for a comprehensive client offering.

- Data Analytics and Reporting: Providing clients with actionable insights derived from energy consumption data to drive further improvements.

China Oil and Gas Group's revenue streams are diverse, primarily driven by the sale of natural gas, including direct pipeline distribution to residential, commercial, and industrial users. The company also generates income from the sale of compressed and liquefied natural gas through its refueling stations. In 2024, these core energy sales formed the bedrock of its financial performance.

Further revenue is derived from infrastructure services, such as connection fees for new customers and revenue from gas pipeline construction projects. The company also profits from the sale of crude oil and its own natural gas, a direct result of its exploration and production activities. Additionally, a growing segment involves coal-derived clean energy and related products, which accounted for approximately 15% of revenue in 2024, alongside value-added services like energy consulting.

| Revenue Stream | Description | 2024 Contribution (Approx.) |

|---|---|---|

| Natural Gas Sales | Direct distribution via pipelines and sales of CNG/LNG. | Largest segment |

| Infrastructure Services | Pipeline connection fees and construction revenue. | Significant contributor |

| Crude Oil & Own Natural Gas Sales | Revenue from exploration and production. | Core upstream activity |

| Coal-Derived Clean Energy | Sales of cleaner energy products from coal. | 15% of total revenue |

| Value-Added Services | Energy consulting and smart management systems. | Growing driver |

Business Model Canvas Data Sources

The China Oil and Gas Group Business Model Canvas is built using a combination of financial disclosures, industry analysis reports, and government policy documents. These sources provide a comprehensive view of the company's operations, market position, and strategic direction.