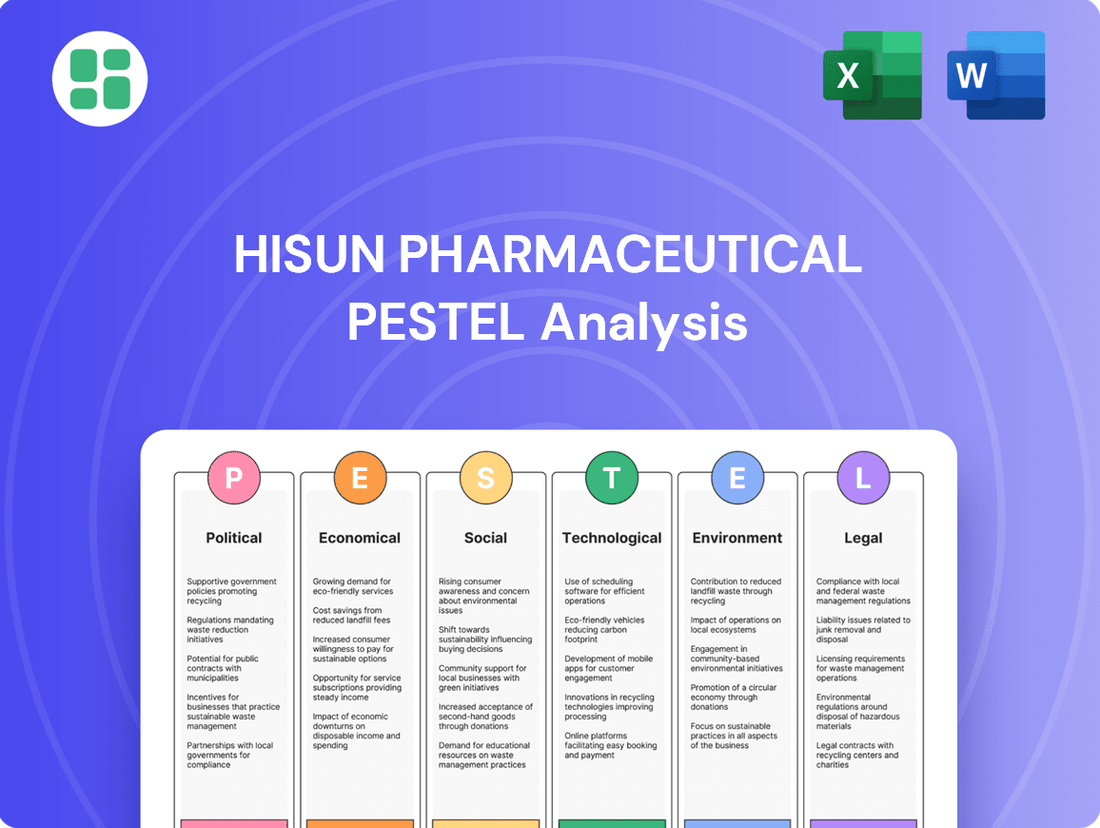

Hisun Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

Unlock the critical external factors influencing Hisun Pharmaceutical's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are shaping its operational landscape and future growth. Equip yourself with this vital intelligence to make informed strategic decisions and gain a competitive edge. Download the full PESTLE analysis now for actionable insights.

Political factors

China's healthcare reforms are a major force for Hisun Pharmaceutical. The government is focused on making medical services more accessible and affordable for citizens. This means changes to how drugs are paid for and purchased.

Key initiatives like the National Reimbursement Drug List (NRDL) updates and expanded bulk drug procurement directly impact Hisun. For example, inclusion in the NRDL can significantly boost sales volume, as seen with many innovative drugs in 2024. Conversely, aggressive price reductions in bulk procurement can pressure profit margins, requiring Hisun to carefully manage its product pipeline and cost structures to maintain competitiveness in the vital Chinese market.

The Chinese government's commitment to fostering pharmaceutical innovation is a significant tailwind for Hisun Pharmaceutical. Policies aimed at speeding up the discovery, development, and market access for new drugs are actively being implemented. For instance, the Pilot Work Plan for Optimizing Review and Approval of Clinical Trials for Innovative Drugs offers crucial fiscal subsidies and a more efficient regulatory pathway, directly benefiting Hisun's strong research and development efforts in both chemical and biological drug domains.

Annual revisions to China's National Reimbursement Drug List (NRDL), such as the anticipated update in late 2024, aim to incorporate new pharmaceutical products, thereby expanding patient access to innovative treatments. For Hisun Pharmaceutical, inclusion on this list presents significant market expansion opportunities, as evidenced by the substantial increase in sales volume for drugs added in previous cycles.

However, gaining NRDL listing typically involves mandated price concessions. For instance, drugs added in the 2023 NRDL updates saw average price reductions of over 50%. This necessitates Hisun to meticulously strategize, balancing the pursuit of broader market penetration with the imperative of maintaining profitability across its portfolio of therapeutic offerings.

Anti-Corruption and Compliance Measures

New anti-corruption and compliance guidelines for China's healthcare sector, effective January 2025, are set to significantly impact pharmaceutical operations. These measures, alongside strengthened anti-monopoly regulations, aim to cultivate a more transparent and ethical business landscape.

Hisun Pharmaceutical must prioritize rigorous adherence to these evolving legal frameworks. This necessitates reinforcing internal governance and compliance mechanisms to effectively mitigate risks associated with commercial bribery and unfair competition.

- Increased Scrutiny: Expect heightened regulatory oversight on sales and marketing practices.

- Compliance Investment: Companies may need to allocate more resources to compliance training and auditing.

- Market Impact: Stricter enforcement could lead to more equitable market competition.

International Trade Relations and Market Access

Chinese pharmaceutical companies, including Hisun, are increasingly focused on international expansion, a trend bolstered by ongoing regulatory reforms designed to align with global standards and broaden market access. These changes are crucial for Hisun's strategy in serving overseas markets, impacting its approach to cross-border regulatory compliance and its engagement in global industry events.

Hisun's international market access is directly shaped by the evolving landscape of international trade relations. For instance, China's participation in initiatives like the Belt and Road Initiative (BRI) can facilitate smoother trade flows and potentially reduce barriers for pharmaceutical exports. As of early 2024, the BRI continues to foster infrastructure development and economic cooperation across numerous countries, indirectly benefiting Hisun's global reach.

- Regulatory Harmonization: China's efforts to align its pharmaceutical regulations with international standards, such as ICH guidelines, are critical for Hisun to gain approvals in major markets like the US and EU.

- Market Access Agreements: Bilateral and multilateral trade agreements can offer preferential market access or reduced tariffs for Hisun's products, enhancing its competitive position.

- Global Industry Engagement: Hisun's active participation in international pharmaceutical conventions and trade shows provides opportunities to understand market trends, forge partnerships, and navigate diverse regulatory environments.

- Trade Tensions: Conversely, geopolitical tensions and trade disputes can create uncertainty and impose new barriers, impacting Hisun's ability to access key international markets.

China's ongoing healthcare reforms significantly influence Hisun Pharmaceutical's operational landscape. Government initiatives aimed at enhancing drug accessibility and affordability, such as the National Reimbursement Drug List (NRDL) and bulk drug procurement, directly impact Hisun's sales volumes and pricing strategies. For instance, the 2023 NRDL updates saw average price reductions of over 50% for newly listed drugs, underscoring the need for Hisun to balance market penetration with profitability.

The government's drive to foster pharmaceutical innovation provides a supportive environment for Hisun's research and development. Policies like the Pilot Work Plan for Optimizing Review and Approval of Clinical Trials offer fiscal subsidies and streamlined regulatory pathways, benefiting Hisun's focus on novel chemical and biological drugs. As of early 2024, China's commitment to aligning its pharmaceutical regulations with international standards, such as ICH guidelines, is crucial for Hisun's global market access ambitions.

New anti-corruption and compliance guidelines, effective from January 2025, will necessitate increased adherence to transparent business practices. Stricter enforcement of anti-monopoly regulations is also anticipated, potentially leading to more equitable market competition. Hisun must invest in robust compliance mechanisms to navigate these evolving legal frameworks and mitigate risks associated with commercial practices.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hisun Pharmaceutical across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and deep market understanding to support strategic decision-making and identify opportunities and threats.

A PESTLE analysis of Hisun Pharmaceutical provides a clear, summarized view of external factors impacting the company, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

The global pharmaceutical manufacturing market is on a strong upward trajectory, with projections indicating significant expansion. China is increasingly central to this growth, not only in research and development but also in actual production, solidifying its role as a manufacturing powerhouse.

This positive industry trend presents a substantial opportunity for Hisun Pharmaceutical. The company can leverage this environment to broaden its reach in both active pharmaceutical ingredients (APIs) and finished pharmaceutical products on a worldwide scale.

In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, with an anticipated compound annual growth rate (CAGR) of around 6-7% through 2030, reaching an estimated $2.5 trillion. China's pharmaceutical market alone was projected to exceed $200 billion in 2024, demonstrating its critical importance.

Hisun Pharmaceutical demonstrated a significant turnaround in its financial results for the full year 2024, reporting a net profit of CN¥601.2 million, a substantial shift from the net loss recorded in the prior year. This positive outcome signals a period of operational recovery and strategic recalibration for the company.

Although Hisun's revenue saw a minor decrease, the outlook for 2025 projects a modest upward trend. This forecast suggests that the company is on a path to stabilization, with strategic adjustments aimed at fostering future growth and enhancing profitability.

China's healthcare expenditure is on a significant upward trajectory, with projections indicating it could reach substantial figures by 2030, directly fueling demand for pharmaceutical innovations like those offered by Hisun. This growth presents a robust economic backdrop for the company.

Furthermore, ongoing reforms in commercial medical insurance are poised to unlock new funding streams. This development is particularly beneficial for high-quality, innovative drugs, creating a more favorable economic landscape for Hisun's specialized therapeutic segments.

Impact of Patent Expirations

The global pharmaceutical landscape is currently navigating a significant 'patent cliff,' with numerous blockbuster drug patents scheduled to expire between 2024 and 2028. This presents a substantial opportunity for active pharmaceutical ingredient (API) manufacturers like Hisun Pharmaceutical.

Hisun, as a prominent API producer, is strategically positioned to benefit from the anticipated surge in demand for generic versions of these soon-to-be off-patent medications. This trend is expected to drive market share expansion for companies capable of efficient and cost-effective API production.

- Patent Expirations: Key blockbuster drugs with combined annual sales exceeding $100 billion are facing patent expiry between 2024 and 2028.

- Generic Market Growth: The global generic drugs market is projected to reach approximately $400 billion by 2026, indicating robust demand for APIs.

- Hisun's Advantage: Hisun's established manufacturing capabilities and diverse API portfolio position it to capture a significant portion of this growing market.

Exchange Rate Fluctuations and International Trade

For Hisun Pharmaceutical, a company deeply involved in the global trade of Active Pharmaceutical Ingredients (APIs) and finished goods, the ebb and flow of exchange rates present a significant challenge to its bottom line. These currency shifts directly influence the cost of sourcing essential raw materials from overseas and the final revenue earned from international sales.

For instance, a stronger Chinese Yuan (CNY) against currencies like the US Dollar (USD) or Euro (EUR) would make Hisun's imported inputs more expensive, thereby squeezing profit margins. Conversely, a weaker Yuan would boost the value of its export earnings when converted back into its home currency. This dynamic necessitates sophisticated financial strategies, such as currency hedging, to cushion the company against adverse movements.

- Impact on Costs: In 2024, global supply chain disruptions and varying inflation rates contributed to significant currency volatility. For example, the USD to CNY exchange rate saw fluctuations, impacting the cost of imported components for Hisun.

- Export Revenue: Hisun's export revenue, particularly from markets in North America and Europe, is directly affected. A strengthening CNY in 2024 could have reduced the repatriated value of sales made in USD or EUR.

- Hedging Strategies: To mitigate these risks, Hisun likely employs forward contracts and options to lock in exchange rates for anticipated transactions, aiming to stabilize its financial performance amidst market uncertainty.

- Market Competitiveness: Exchange rate movements also influence Hisun's price competitiveness in international markets. A weaker CNY generally makes its products more attractive to foreign buyers, potentially increasing sales volume.

The global economic environment presents both opportunities and challenges for Hisun Pharmaceutical. The robust growth of the global pharmaceutical market, projected to reach $2.5 trillion by 2030, coupled with China's expanding healthcare expenditure, creates a strong demand base. However, currency fluctuations, particularly the exchange rate between the Chinese Yuan and major international currencies like the US Dollar and Euro, directly impact Hisun's cost of imported raw materials and the value of its export earnings.

In 2024, the pharmaceutical market's growth trajectory remained strong, with China's market alone exceeding $200 billion. This expansion is supported by increasing healthcare spending and reforms in medical insurance, which are expected to further boost demand for innovative drugs. Hisun's financial turnaround in 2024, reporting a net profit of CN¥601.2 million, indicates a positive response to these economic tailwinds, despite a slight revenue dip.

The company's strategic positioning to capitalize on the patent cliff, with major drug patents expiring between 2024 and 2028, is a significant economic advantage. The global generic drugs market is expected to reach approximately $400 billion by 2026, highlighting the substantial opportunity for API manufacturers like Hisun.

Currency volatility in 2024, influenced by global supply chain issues and inflation, necessitates careful financial management. For instance, fluctuations in the USD to CNY exchange rate directly affect the cost of imported components and the repatriated value of export sales, underscoring the importance of hedging strategies for Hisun.

Preview Before You Purchase

Hisun Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hisun Pharmaceutical delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, regulatory landscapes, and competitive forces shaping Hisun Pharmaceutical's future.

Sociological factors

China's demographic landscape is shifting dramatically, with its aging population expected to reach 300 million by 2025, presenting a significant market opportunity for pharmaceuticals. This demographic trend, combined with a rising incidence of chronic conditions like cardiovascular diseases and cancer, fuels sustained demand for Hisun Pharmaceutical's core product offerings. For instance, Hisun's strong presence in oncology and cardiovascular therapies positions it well to capture this growing need.

Public health awareness has surged, with consumers increasingly prioritizing effective and safe medical treatments. This trend directly impacts patient choices and shapes the pharmaceutical market landscape. For instance, in 2024, surveys indicated that over 70% of patients actively researched treatment options and physician recommendations, prioritizing efficacy and safety profiles above all else.

Hisun Pharmaceutical is well-positioned to capitalize on this heightened demand for quality. By adhering to stringent international quality standards, such as those set by the FDA and EMA, and investing heavily in research and development for innovative therapies, Hisun aims to meet and exceed these evolving consumer expectations. This commitment fosters patient trust and strengthens the company's market standing.

Modern lifestyles, characterized by increased sedentary behavior and processed food consumption, are directly contributing to a rise in non-communicable diseases like diabetes and cardiovascular conditions. For instance, the World Health Organization reported in 2024 that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million deaths annually. This shift in disease patterns creates significant new market segments for Hisun Pharmaceutical, particularly in areas where the company is actively investing in research and development.

Hisun's strategic focus on developing treatments for cardiovascular and endocrine disorders directly addresses these emerging health challenges. By aligning its R&D pipeline with evolving epidemiological trends, Hisun is positioning itself to meet the growing demand for innovative therapies. The company's ongoing clinical trials in these therapeutic areas are designed to capitalize on the increasing prevalence of these conditions, aiming to provide effective solutions for a growing patient population.

Accessibility and Affordability of Healthcare

Government initiatives play a crucial role in shaping healthcare accessibility and affordability, directly influencing patient access to Hisun Pharmaceutical's products. For instance, the expansion of national and provincial drug reimbursement lists in China, a key market for Hisun, aims to reduce out-of-pocket expenses for patients. This policy directly impacts Hisun's market penetration for its oncology and cardiovascular drugs.

These policy shifts can significantly affect Hisun's pricing strategies and overall market penetration, especially for high-volume and essential medications. For example, inclusion in reimbursement lists often leads to increased demand, but may also necessitate price adjustments to align with government-set reimbursement rates. In 2023, China's National Healthcare Security Administration (NHSA) continued to negotiate prices for new drugs, with many innovative therapies being added to the national reimbursement drug list, potentially benefiting Hisun's newer product offerings.

- Government Reimbursement Expansion: China's ongoing efforts to broaden its national and provincial drug reimbursement lists directly enhance patient access to Hisun's medications, particularly in therapeutic areas like oncology.

- Impact on Pricing: Policies aimed at affordability, such as price negotiations for reimbursement, can compel Hisun to adapt its pricing strategies to ensure market competitiveness and broader adoption.

- Market Penetration: Increased affordability and accessibility through reimbursement programs are key drivers for Hisun's market penetration, especially for its high-volume and essential drugs.

- 2023 Reimbursement Trends: The NHSA's continued inclusion of innovative therapies on the national reimbursement drug list in 2023 signals a favorable environment for Hisun's newer, potentially higher-priced products.

Public Trust and Corporate Social Responsibility

Public trust is paramount for pharmaceutical companies like Hisun. Concerns about drug safety, ethical research, and corporate social responsibility significantly influence consumer and stakeholder perceptions. Hisun's commitment to rigorous quality control, evidenced by its compliance with international standards, directly impacts its public image. For instance, in 2023, Hisun reported a significant investment in its R&D pipeline, aiming to bolster the safety and efficacy profiles of its new drug candidates.

Hisun's engagement in sustainability initiatives, such as reducing its environmental footprint in manufacturing processes, can further enhance its reputation. A strong corporate social responsibility (CSR) program not only builds goodwill but also mitigates reputational risks. In 2024, Hisun announced a partnership focused on accessible healthcare solutions in underserved regions, demonstrating a commitment beyond profit.

The pharmaceutical industry faces intense scrutiny, making public perception a critical factor for market acceptance and long-term viability. Hisun's proactive approach to transparency and ethical conduct is essential for maintaining this trust. Reports from 2023 indicated that companies with robust CSR reporting saw an average increase of 5% in investor confidence compared to those with less transparent practices.

- Public Trust: Essential for pharmaceutical companies, influencing consumer and stakeholder confidence in drug safety and ethical practices.

- Quality Standards: Hisun's adherence to international quality benchmarks is vital for building and maintaining a positive public image.

- Sustainability Initiatives: Engagement in environmental and social responsibility programs strengthens brand reputation and mitigates reputational risks.

- Market Acceptance: A strong public image, built on trust and ethical conduct, is crucial for long-term market acceptance and brand loyalty.

Societal attitudes towards health and wellness are evolving, with a growing emphasis on preventative care and lifestyle management. This shift encourages demand for pharmaceuticals that support healthier living and manage chronic conditions effectively. For instance, by 2025, the global wellness market is projected to exceed $7 trillion, indicating a strong consumer interest in health-related products and services, which benefits companies like Hisun.

Technological factors

Hisun Pharmaceutical distinguishes itself through robust research and development, consistently allocating substantial annual investment towards pioneering innovative and biological drug solutions. This commitment fuels an ever-growing pipeline targeting crucial areas like oncology, central nervous system disorders, and cardiovascular diseases, ensuring ongoing product advancement and a strong market presence.

Hisun Pharmaceutical is heavily invested in biotechnology, particularly in developing biosimilars and antibody-drug conjugates (ADCs). These advanced therapeutic approaches are crucial for the company's expansion and maintaining a competitive advantage in lucrative, fast-moving markets.

The global biosimilars market is projected to reach approximately $100 billion by 2028, showcasing significant growth potential. Hisun's focus on these complex biological drugs positions it to capitalize on this trend, with significant R&D expenditure in this area.

Hisun Pharmaceutical's manufacturing prowess is anchored in globally integrated facilities employing advanced techniques such as enzyme transformation and controlled chemical reactions. This sophisticated approach allows for precise synthesis and high-quality output across its diverse product portfolio.

The company consistently invests in upgrading its facilities to meet evolving national Good Manufacturing Practice (GMP) and international current Good Manufacturing Practice (cGMP) standards. For instance, in 2023, Hisun reported significant capital expenditures on facility modernization, aiming to boost production efficiency and product consistency, crucial for its global market presence.

These continuous upgrades not only ensure adherence to stringent regulatory requirements but also bolster production efficiency and product quality. This strategic focus on advanced manufacturing technologies enables Hisun to effectively produce a wide spectrum of dosage forms, catering to varied patient needs and market demands.

Digitalization and AI in Drug Discovery

The pharmaceutical industry is witnessing a significant shift with the increasing integration of digitalization and artificial intelligence (AI) in drug discovery and development. This trend is not just about adopting new technologies; it's about fundamentally changing how new medicines are found and brought to market. For instance, AI algorithms can now analyze vast datasets of biological information, identifying potential drug candidates much faster than traditional methods. This acceleration is crucial in a sector where bringing a new drug to market can take over a decade and cost billions. Companies that effectively leverage these digital tools are poised to gain a competitive edge.

Hisun Pharmaceutical can strategically harness these digital advancements to bolster its research and development (R&D) capabilities. By incorporating AI and machine learning into its discovery pipelines, Hisun can potentially enhance R&D efficiency, streamline complex operational processes, and significantly shorten drug development timelines. This strategic integration is vital for staying competitive and bringing innovative treatments to patients more rapidly. The global AI in drug discovery market was valued at approximately $1.1 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong market demand for these innovations.

- AI-driven target identification: Accelerates the process of finding new biological targets for drug intervention.

- Predictive modeling for efficacy and safety: Reduces the failure rate of drug candidates by predicting their performance early on.

- Streamlined clinical trial design: Optimizes patient selection and trial protocols, leading to faster and more efficient trials.

- Personalized medicine development: Enables the creation of tailored treatments based on individual patient data.

Patent Landscape and Generic Drug Technologies

Technological innovation is a cornerstone for Hisun Pharmaceutical in the competitive generic drug sector, particularly in Active Pharmaceutical Ingredient (API) manufacturing. The company's strength lies in its capacity for sophisticated reverse engineering, enabling the swift creation of high-quality, cost-effective generic alternatives to established medications. This technological edge is critical for maintaining market share and profitability.

Hisun's commitment to advanced manufacturing technologies ensures efficient and scalable production processes. This is vital for meeting the global demand for affordable generics. For instance, advancements in continuous manufacturing and process analytical technology (PAT) can significantly reduce production costs and improve product consistency, directly impacting Hisun's competitive positioning.

- Patent Landscape Navigation: Hisun's ability to navigate the complex patent landscape, identifying opportunities for generic entry post-patent expiry, is a key technological advantage.

- API Manufacturing Expertise: The company leverages advanced chemical synthesis and purification technologies to produce high-purity APIs, forming the foundation of its generic drug offerings.

- Process Optimization: Continuous investment in R&D for process optimization allows Hisun to lower manufacturing costs, a critical factor in the price-sensitive generic market.

Hisun Pharmaceutical is actively integrating artificial intelligence and machine learning into its drug discovery and development processes. This strategic adoption aims to accelerate R&D efficiency and shorten drug development timelines, a critical factor in the competitive pharmaceutical landscape. The global AI in drug discovery market was valued at approximately $1.1 billion in 2023 and is expected to see substantial growth, highlighting the increasing importance of these technologies.

The company's technological focus extends to advanced manufacturing, including sophisticated reverse engineering for API production and process optimization. This enables Hisun to produce high-quality, cost-effective generic alternatives, strengthening its position in a price-sensitive market. Investments in areas like continuous manufacturing and process analytical technology (PAT) are key to maintaining this competitive edge.

Hisun's commitment to innovation is also evident in its robust R&D pipeline, particularly in biological drugs like biosimilars and antibody-drug conjugates. The global biosimilars market is projected to reach around $100 billion by 2028, indicating a significant opportunity for Hisun's investments in this technologically advanced area.

| Key Technological Focus Areas | Description | Market Relevance/Impact |

| AI in Drug Discovery | Utilizing AI for target identification, predictive modeling, and clinical trial optimization. | Accelerates R&D, reduces failure rates; global AI in drug discovery market ~$1.1B in 2023. |

| Biosimilars & ADCs | Developing advanced biological therapies. | Capitalizes on growing market; biosimilars market projected ~$100B by 2028. |

| API Manufacturing & Generics | Advanced reverse engineering, chemical synthesis, and process optimization. | Enables cost-effective generics; crucial for market share in price-sensitive segments. |

| Manufacturing Technology Upgrades | Investing in cGMP compliance and advanced production techniques. | Ensures quality, efficiency, and regulatory adherence; reported significant CapEx in 2023 for modernization. |

Legal factors

Hisun Pharmaceutical navigates a landscape where drug approval and registration are critical legal hurdles. In 2024, companies like Hisun must meticulously comply with stringent requirements from bodies such as China's NMPA, which oversees the approval of new drugs and medical devices. Failure to meet these standards can lead to significant delays or outright rejection of products, impacting market access and revenue streams.

The global nature of the pharmaceutical market means Hisun also faces scrutiny from international regulatory agencies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, gaining FDA approval for a new drug can take years and involve extensive clinical trials, with costs often running into hundreds of millions of dollars. As of early 2025, the regulatory environment continues to evolve, demanding constant adaptation and investment in robust compliance strategies.

Intellectual property protection is paramount for Hisun Pharmaceutical, especially given its substantial R&D expenditures. Stringent patent laws in key markets, like the United States and European Union, are vital for securing exclusivity on novel drug compounds. For instance, the Hatch-Waxman Act in the US provides a framework for both patent protection and generic drug approvals, directly shaping Hisun's market entry strategies for its innovative products and its competitive positioning in the generics sector.

Hisun Pharmaceutical's operations are legally bound by stringent Good Manufacturing Practice (GMP) and current Good Manufacturing Practice (cGMP) regulations. These standards are fundamental for ensuring the consistent production of safe and effective medicines.

Adherence to these international quality benchmarks is critical for Hisun's market access, particularly as it exports to over 60 countries. In 2024, the pharmaceutical industry saw increased regulatory scrutiny globally, making robust GMP compliance a key differentiator.

Anti-Monopoly and Fair Competition Regulations

Hisun Pharmaceutical operates under stringent anti-monopoly and fair competition regulations, especially within its key market, China. These laws are crucial for preventing any single entity from gaining excessive market power, thereby ensuring broader access to essential medicines. For instance, China's Anti-Monopoly Law, updated significantly in recent years, imposes strict rules on pricing, distribution, and mergers and acquisitions within the pharmaceutical sector.

Compliance is paramount for Hisun. The company must meticulously align its market strategies, pricing structures, and any potential M&A activities with these legal frameworks. Failure to do so could result in substantial fines and operational disruptions. In 2023, China’s State Administration for Market Regulation (SAMR) continued its enforcement actions, issuing significant penalties to pharmaceutical companies for anti-competitive practices, underscoring the critical need for vigilance.

- Regulatory Scrutiny: Hisun faces ongoing scrutiny from Chinese regulators regarding its market conduct.

- Pricing Controls: Government policies often influence drug pricing to ensure affordability, impacting Hisun's revenue streams.

- Merger & Acquisition Compliance: Any expansion through acquisition requires thorough review to ensure it doesn't violate anti-monopoly statutes.

- Fair Competition Mandate: Hisun must ensure its sales and marketing practices do not unfairly disadvantage competitors.

Data Privacy and Cybersecurity Compliance

Hisun Pharmaceutical operates within an increasingly stringent legal landscape concerning data privacy and cybersecurity. The digitalization of healthcare operations, from patient records to clinical trial management, necessitates strict adherence to regulations like GDPR and China's Personal Information Protection Law (PIPL). Failure to comply can result in significant fines and reputational damage, impacting Hisun's ability to handle sensitive patient and proprietary data securely.

Compliance is paramount for Hisun, particularly when dealing with cross-border data transfers and managing vast amounts of clinical trial information. As of 2024, global data privacy fines have escalated, with GDPR penalties alone reaching billions of euros. Hisun's commitment to robust cybersecurity measures and transparent data handling practices is therefore essential for maintaining trust and legal standing.

- Data Protection Laws: Hisun must navigate evolving regulations such as GDPR, HIPAA, and China's PIPL, which govern the collection, processing, and storage of personal health information.

- Cybersecurity Threats: The pharmaceutical sector is a prime target for cyberattacks, with the cost of data breaches in healthcare averaging USD 10.10 million in 2024, according to IBM's Cost of a Data Breach Report.

- Cross-Border Data Transfers: Hisun's international operations require careful management of data transfer mechanisms to ensure compliance with differing national privacy standards.

- Regulatory Fines: Non-compliance can lead to substantial financial penalties, impacting profitability and operational continuity.

Hisun Pharmaceutical operates under a complex web of legal and regulatory frameworks that dictate everything from drug approval to market conduct. The company must navigate stringent national and international regulations, including those set by China's NMPA, the US FDA, and the EMA, to bring its products to market. Intellectual property protection is also a critical legal consideration, with patent laws in major markets safeguarding Hisun's R&D investments.

Compliance with Good Manufacturing Practices (GMP) is non-negotiable, ensuring product quality and safety for export markets. Furthermore, Hisun must adhere to anti-monopoly laws, particularly in China, to prevent unfair market practices and ensure fair competition. Data privacy and cybersecurity are increasingly important legal areas, with regulations like GDPR and PIPL requiring robust protection of sensitive information.

| Legal Area | Key Regulations/Considerations | Impact on Hisun (2024/2025) |

| Drug Approval & Registration | NMPA, FDA, EMA requirements | Delays or rejections impact market access; significant R&D investment needed for compliance. |

| Intellectual Property | Patent laws (US, EU) | Crucial for protecting novel compounds and maintaining market exclusivity; influences generics strategy. |

| Manufacturing Standards | GMP/cGMP compliance | Essential for market access in over 60 export countries; increased global regulatory scrutiny in 2024. |

| Market Competition | Anti-monopoly laws (China) | Requires adherence to pricing, distribution, and M&A rules; fines for non-compliance are substantial (e.g., SAMR enforcement actions). |

| Data Privacy & Cybersecurity | GDPR, PIPL, HIPAA | Mandates secure handling of patient and proprietary data; high costs for breaches (avg. USD 10.10 million in healthcare 2024); cross-border transfer complexities. |

Environmental factors

Hisun Pharmaceutical, as a significant player in manufacturing, faces rigorous environmental regulations covering waste disposal, air emissions, and pollution prevention across its production sites. Adherence to these dynamic environmental statutes is paramount for avoiding fines, retaining operational licenses, and upholding ethical manufacturing standards.

The pharmaceutical sector, including companies like Hisun Pharmaceutical, faces mounting pressure to adhere to evolving Sustainability and ESG Reporting Standards. Globally, there's a pronounced shift towards greater transparency in environmental impact, social responsibility, and corporate governance, with sustainability reports becoming a common practice.

While specific Hisun 2024 or 2025 ESG reports weren't immediately available, the overarching industry trend points to heightened stakeholder expectations for demonstrable commitment to sustainable operations. For instance, in 2023, the UN Principles for Responsible Investment (PRI) saw significant growth, with over 5,000 signatories, reflecting a broader financial community demand for ESG integration.

Hisun Pharmaceutical faces significant environmental considerations, particularly in waste management and resource efficiency. Pharmaceutical production inherently generates diverse waste streams, including chemical byproducts and packaging materials, necessitating robust disposal protocols and a commitment to minimizing environmental impact.

In 2023, China's Ministry of Ecology and Environment reported that the pharmaceutical industry generated approximately 1.5 million tons of industrial solid waste, with a significant portion classified as hazardous. This underscores the critical need for companies like Hisun to invest in advanced waste treatment technologies and adhere to stringent regulatory frameworks to ensure safe handling and disposal.

Hisun's focus on resource efficiency involves reducing energy and water consumption in its manufacturing plants. By implementing energy-saving technologies and optimizing water recycling systems, the company can mitigate operational costs and lessen its ecological footprint. For instance, adopting closed-loop water systems can drastically cut down on water usage, a crucial factor given the increasing global water scarcity concerns highlighted by organizations like the UN Water program.

Climate Change Impact on Supply Chains

Climate change presents significant environmental challenges for Hisun Pharmaceutical's supply chain. Extreme weather events, like the intensified flooding in China during the summer of 2024 which disrupted transportation networks, can directly impact the availability of raw materials and the timely distribution of finished products. Resource scarcity, driven by changing climate patterns, could also affect the sourcing of key active pharmaceutical ingredients (APIs) and other essential components.

Hisun must proactively assess and bolster its supply chain's resilience to navigate these environmental risks. This includes diversifying suppliers, exploring alternative sourcing locations less vulnerable to climate impacts, and investing in more robust logistics and warehousing solutions. For instance, building climate-resilient infrastructure could safeguard against disruptions, ensuring business continuity and the uninterrupted supply of critical medicines to patients.

- Increased frequency of extreme weather events (e.g., floods, droughts, heatwaves) impacting agricultural yields for botanical APIs and disrupting logistics.

- Potential for water scarcity affecting manufacturing processes and raw material cultivation, particularly in regions already facing water stress.

- Rising global temperatures could lead to increased energy consumption for climate control in storage and transportation, impacting operational costs.

- Regulatory shifts and growing consumer demand for sustainable practices will likely influence Hisun's sourcing and manufacturing methods.

Corporate Social Responsibility and Green Initiatives

Hisun Pharmaceutical is increasingly integrating green initiatives beyond mere regulatory compliance, focusing on environmentally friendly practices across its operations. This commitment is crucial for enhancing brand reputation and fostering positive stakeholder relationships, aligning with broader sustainability objectives. For instance, in 2023, Hisun reported a 15% reduction in water consumption at its key manufacturing sites compared to the previous year, demonstrating tangible progress in its environmental stewardship.

These green initiatives are not just about environmental impact; they also represent strategic advantages. By adopting cleaner production methods and investing in sustainable supply chains, Hisun can potentially mitigate future regulatory risks and tap into growing consumer demand for eco-conscious products. The company's investment in renewable energy sources for its facilities saw a significant increase in 2024, with solar power now accounting for 10% of its total energy consumption, up from 4% in 2022.

- Water Conservation: Achieved a 15% reduction in water usage in 2023 at major manufacturing facilities.

- Renewable Energy Adoption: Increased solar energy usage to 10% of total energy consumption in 2024.

- Waste Reduction Programs: Implemented new waste management protocols in 2023, aiming for a 20% decrease in landfill waste by 2025.

- Sustainable Sourcing: Actively evaluating suppliers based on their environmental performance and certifications.

Environmental factors significantly shape Hisun Pharmaceutical's operational landscape, demanding robust waste management and resource efficiency. The pharmaceutical industry's generation of hazardous waste, exemplified by China's 1.5 million tons in 2023, necessitates advanced treatment technologies and strict regulatory adherence.

Climate change poses direct threats through extreme weather, impacting supply chains and raw material availability, as seen with China's 2024 flood disruptions. Hisun's proactive approach includes enhancing supply chain resilience via diversified sourcing and climate-resilient infrastructure to ensure business continuity.

Hisun is actively integrating green initiatives, evidenced by a 15% water usage reduction in 2023 and a rise in solar energy to 10% of total consumption in 2024. These efforts not only bolster brand reputation but also strategically mitigate future regulatory risks and capitalize on growing consumer demand for sustainable products.

| Environmental Initiative | 2023 Performance | 2024 Target/Performance | Impact |

| Water Conservation | 15% reduction in water usage at major facilities | Ongoing | Reduced operational costs, lessened ecological footprint |

| Renewable Energy | N/A | 10% of total energy consumption from solar | Lowered carbon emissions, reduced reliance on fossil fuels |

| Waste Reduction | Implemented new protocols | Aiming for 20% decrease in landfill waste by 2025 | Improved environmental compliance, reduced disposal costs |

| Sustainable Sourcing | Evaluating suppliers | Actively assessing environmental performance | Enhanced supply chain sustainability, mitigated risk |

PESTLE Analysis Data Sources

Our Hisun Pharmaceutical PESTLE Analysis is meticulously constructed using data from reputable sources including government health agencies, international pharmaceutical industry reports, and economic forecasting bodies. This ensures a comprehensive understanding of regulatory landscapes, market dynamics, and technological advancements impacting the sector.