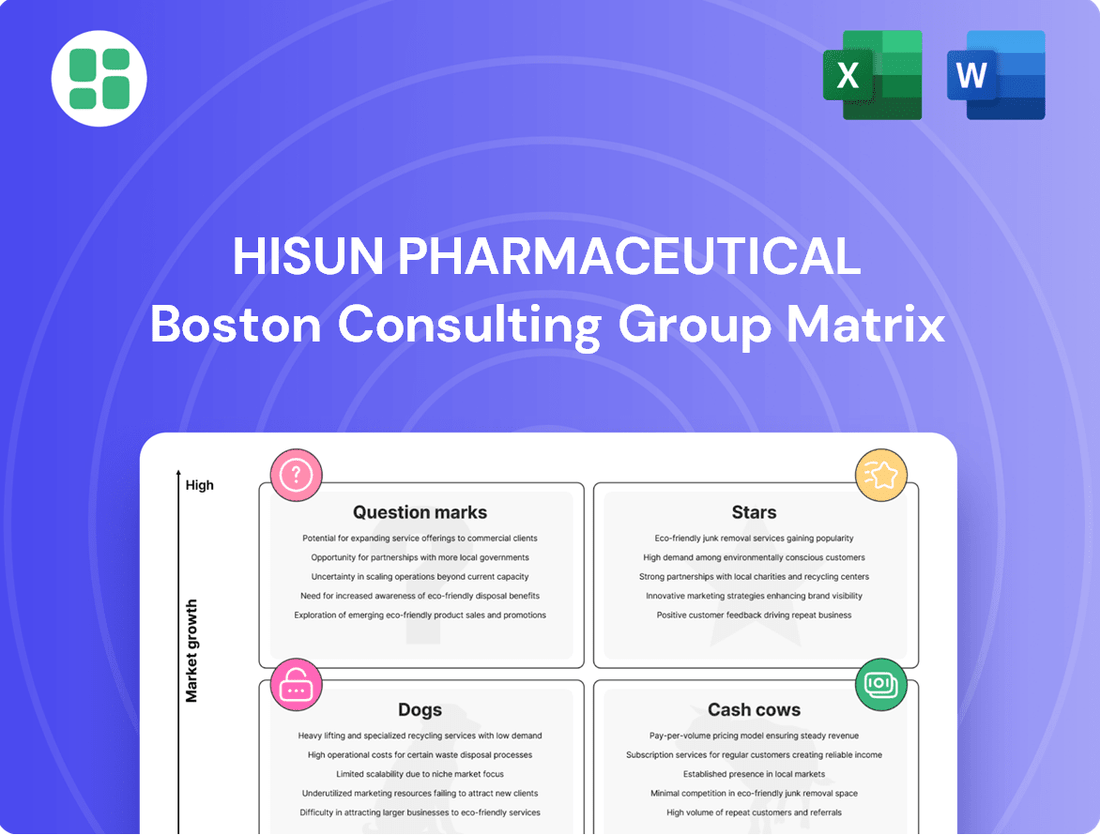

Hisun Pharmaceutical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

Curious about Hisun Pharmaceutical's product portfolio? Our BCG Matrix analysis offers a strategic snapshot, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their current strengths lie and where future growth opportunities might emerge. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to inform your investment decisions.

Stars

Hisun Pharmaceutical is making significant strides in oncology, with new drug candidates like HS387 tablets, which received clinical trial approval in July 2025 for ovarian and non-small cell lung cancer. This strategic push into high-growth cancer treatments aims to establish these candidates as future market leaders.

The company is channeling substantial research and development resources into these oncology assets. This investment is designed to secure a considerable market share in a therapeutic area experiencing rapid evolution and robust demand, reflecting a strong commitment to innovation in cancer care.

Hisun Pharmaceutical's late-stage biosimilars, including Adalimumab, a Rituximab bio-better, and Trastuzumab, represent a significant growth vector. These products are poised to capitalize on the expanding global biosimilar market, which is projected to reach over $65 billion by 2025, with numerous new launches anticipated.

The successful commercialization of these late-stage biosimilars offers Hisun a prime opportunity to capture substantial market share. By leveraging its established biologics manufacturing expertise, Hisun is well-positioned for these biosimilars to become key contributors to its revenue streams in the coming years.

Hisun Pharmaceutical's high-growth endocrine products are shining stars in their portfolio. The first half of 2024 saw a significant surge, with revenue climbing 67.67% year-on-year. This impressive growth is largely thanks to the strong performance of key products such as Olisat and Acarbose.

This rapid expansion within the endocrine medicine sector clearly shows these products are capturing substantial market share. Such momentum suggests a strong demand and successful market penetration for Hisun's offerings in this specialized therapeutic area.

Maintaining a strategic focus and continuing investment in this segment is crucial for Hisun. By doing so, they can further solidify their leadership position and capitalize on the ongoing growth opportunities within the endocrine product market.

Innovative Biologics Pipeline

Hisun Pharmaceutical's innovative biologics pipeline is a key driver of future growth, moving beyond established biosimilars. This division is actively developing novel treatments like monoclonal antibodies and recombinant proteins. These advanced biological drugs are designed to address critical unmet medical needs across diverse therapeutic areas, positioning Hisun for significant market penetration in high-potential segments.

The company's commitment to cutting-edge research and development in biologics signifies a strategic pivot towards higher-value, proprietary products. Early achievements in this complex R&D space are anticipated to yield groundbreaking therapies. For instance, in 2024, Hisun reported a substantial increase in R&D investment allocated to its biologics segment, underscoring its strategic importance.

- Novel Biologics Development: Focus on monoclonal antibodies and recombinant proteins targeting unmet medical needs.

- High-Growth Potential: Addressing diverse therapeutic areas with significant market expansion opportunities.

- R&D Investment: Increased allocation of resources in 2024 to bolster the biologics pipeline.

- Future Market Share: Aiming for groundbreaking products with substantial long-term market impact.

International Expansion of Key Products

Hisun Pharmaceutical's strategic push to expand internationally is evident, with a significant 80% of its Active Pharmaceutical Ingredient (API) income already derived from overseas markets. This strong global foundation is crucial for the rapid adoption of its successful new drug launches, enabling them to capture substantial global market share quickly.

By utilizing its existing international distribution channels, Hisun is well-positioned to efficiently scale the rollout of new, high-potential products across numerous countries. This global infrastructure is key to transforming promising new drug candidates into significant revenue generators.

- Global API Dominance: 80% of Hisun's API income originates from international markets, highlighting their established global presence.

- Rapid Market Penetration: Successful new drug launches can leverage existing international networks for swift global market share acquisition.

- Scalability through Distribution: Established overseas distribution enables efficient scaling of high-potential products across multiple countries.

- International Growth Driver: The international expansion strategy is designed to turn new product innovations into significant global successes.

Hisun Pharmaceutical's endocrine products, including Olisat and Acarbose, are performing exceptionally well. In the first half of 2024, this segment saw revenue jump by 67.67% year-on-year, demonstrating strong market penetration and demand. This rapid growth solidifies these products as stars within the company's portfolio, indicating significant future potential.

The company's innovative biologics pipeline, focusing on novel treatments like monoclonal antibodies and recombinant proteins, represents another key star. Increased R&D investment in this area during 2024 underscores its strategic importance for developing high-value, proprietary products that address unmet medical needs and aim for substantial long-term market impact.

Hisun's late-stage biosimilars, such as Adalimumab and Trastuzumab, are also considered stars. These products are positioned to capitalize on the expanding global biosimilar market, projected to exceed $65 billion by 2025. Leveraging established biologics manufacturing expertise, these biosimilars are expected to become significant revenue contributors.

The company's strong international presence, with 80% of API income from overseas, further supports its star performers. This global foundation allows for rapid adoption and swift market share acquisition of new drug launches, leveraging existing distribution channels for efficient scaling.

| Product Category | Key Products | H1 2024 Growth (YoY) | Market Position | Future Outlook |

|---|---|---|---|---|

| Endocrine | Olisat, Acarbose | 67.67% | Strong Market Penetration | Continued Growth Potential |

| Biosimilars | Adalimumab, Trastuzumab | N/A (Late-stage) | Capitalizing on growing market | Significant Revenue Contributors |

| Novel Biologics | Monoclonal Antibodies, Recombinant Proteins | N/A (Pipeline) | Addressing unmet needs | High Long-Term Impact Potential |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Hisun Pharmaceutical’s product portfolio, highlighting which units to invest in, hold, or divest.

Hisun Pharmaceutical's BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain point of unclear portfolio management.

Cash Cows

Established Active Pharmaceutical Ingredients (APIs) represent Hisun Pharmaceutical's cash cows. The company boasts over 130 API products, with a significant global footprint, exporting to more than 60 countries. Notably, 80% of its API revenue in 2024 was derived from international markets, underscoring its strong global market share in this mature sector.

These well-established APIs are reliable generators of substantial cash flow for Hisun. Their mature market position means they require minimal incremental investment in promotion or market development, allowing them to consistently contribute to the company's financial strength and fund other strategic initiatives.

Hisun Pharmaceutical's anti-infective drug portfolio represents a significant cash cow. The company commands a leading market share within China's anti-infectives sector, boasting numerous products each generating over 100 million yuan in annual sales. This strong market position, even with moderate overall market growth, translates into stable and robust profit margins.

These established anti-infective drugs are crucial for generating consistent cash flow. This reliable income stream effectively underwrites Hisun's ongoing research and development endeavors and covers essential operational expenses, providing a solid financial foundation for the company's broader strategic initiatives.

Hisun Pharmaceutical's core cardiovascular products, such as rosuvastatin calcium tablets and irbesartan, are firmly positioned as Cash Cows. These drugs were pioneers in China, being among the first to successfully pass consistency evaluations, underscoring their quality and market readiness.

Operating within a mature but consistently high-demand cardiovascular market, these established products allow Hisun to maintain a robust market share. This strong market presence translates into a reliable and significant source of cash flow for the company, contributing steadily to its overall financial health.

The proven efficacy and widespread market acceptance of these cardiovascular medications solidify their role as stable and predictable profit generators. Their consistent performance underpins Hisun's ability to fund other ventures and maintain overall business stability.

Select Mature Generic Drug Formulations

Hisun Pharmaceutical's selection of mature generic drug formulations represents a significant Cash Cow. These products, including established capsules, tablets, and parenterals, are distributed to approximately 10,000 hospitals across China, ensuring broad market penetration and consistent sales.

The strength of these mature generics lies in their consistent revenue generation, often bolstered by strong brand recognition and competitive pricing strategies. While not experiencing rapid market expansion, their reliable cash flow is crucial for funding other business initiatives and investments.

For instance, in 2023, Hisun reported that its established generic portfolio continued to be a primary driver of profitability. The company's extensive distribution network across China underpins the steady demand for these essential medications.

- Consistent Revenue: Mature generics provide a stable income stream, contributing significantly to Hisun's cash reserves.

- Broad Distribution: Reaching nearly 10,000 hospitals across China ensures widespread adoption and sales.

- Brand Recognition: Established products benefit from trust and familiarity among healthcare providers and patients.

Immunosuppressants APIs

Hisun Pharmaceutical's immunosuppressants APIs are a prime example of a Cash Cow within their Business Growth-Share Matrix. The global market for these crucial compounds was valued at an estimated USD 2.78 billion in 2024, demonstrating a robust and expanding sector. Hisun's established position as a significant contributor to this market signifies a strong competitive advantage.

This strong market standing allows Hisun to generate substantial and consistent revenue from its immunosuppressants API offerings. The company's ability to maintain a high market share in this growing segment underscores its role as a reliable source of stable income for the pharmaceutical giant.

- Market Value: The global immunosuppressants API market reached USD 2.78 billion in 2024.

- Growth Potential: The market is projected for significant future expansion, indicating sustained demand.

- Hisun's Position: Hisun is a key player, benefiting from an established presence and strong market participation.

- Revenue Generation: This segment provides stable and considerable revenue streams due to high market share and demand.

Hisun Pharmaceutical's established active pharmaceutical ingredients (APIs) are its primary cash cows, with 80% of API revenue in 2024 coming from international markets across over 60 countries.

These mature APIs, numbering over 130 products, require minimal new investment and consistently generate substantial cash flow, funding other strategic company initiatives.

The company's anti-infective drugs, with several products exceeding 100 million yuan in annual sales within China, also serve as significant cash cows, providing stable profits and underwriting R&D.

Core cardiovascular products like rosuvastatin calcium tablets and irbesartan, being among the first to pass consistency evaluations in China, maintain a robust market share and deliver predictable cash flow.

Mature generic drug formulations, distributed to approximately 10,000 Chinese hospitals, represent another key cash cow, offering consistent revenue driven by brand recognition and competitive pricing.

Hisun's immunosuppressants APIs are also a strong cash cow, contributing to stable revenue in a global market valued at USD 2.78 billion in 2024.

| Product Category | Key Characteristics | Revenue Driver | Market Presence | 2024 Data Point |

| Established APIs | 130+ products, global export | International sales (80% of API revenue) | 60+ countries | 80% of API revenue from international markets |

| Anti-infectives | Leading domestic market share | Multiple products > 100M yuan annual sales | Strong within China | Several products exceed 100 million yuan annual sales |

| Cardiovascular Products | Pioneering consistency evaluations | High demand, stable market share | Mature but high-demand market | Pioneers in Chinese consistency evaluations |

| Mature Generics | Capsules, tablets, parenterals | Consistent sales, brand recognition | ~10,000 hospitals in China | Distributed to ~10,000 hospitals |

| Immunosuppressants APIs | Significant global market contributor | Stable and substantial revenue | Key player in growing sector | Global market valued at USD 2.78 billion |

What You See Is What You Get

Hisun Pharmaceutical BCG Matrix

The Hisun Pharmaceutical BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Hisun Pharmaceutical strategically divested its pharmaceutical distribution and raw material segment, a move impacting its H1 2024 revenue, which saw a decline. This action aligns with the typical management of 'Dog' units in a BCG matrix – those with low market share and low growth, often draining resources. For instance, in the first half of 2024, this segment's contribution to overall revenue was minimal, making its abandonment a logical step for resource optimization.

By exiting this low-margin business, Hisun aims to redirect capital and management focus toward its more promising 'Star' and 'Cash Cow' segments. This strategic pivot is designed to improve overall profitability and enhance the company's competitive positioning in higher-growth therapeutic areas. The company's financial reports for 2024 will likely reflect the initial impact of this divestiture, followed by potential improvements as resources are reallocated.

Products like I VNest, which failed to be selected in the eighth batch of group procurement, have seen their revenue contribution dwindle. This exclusion from centralized purchasing significantly curtails market access and share within China.

These underperforming products, characterized by low growth prospects and minimal returns, are now prime candidates for divestiture or a thorough strategic re-evaluation to stem further losses.

Within Hisun Pharmaceutical's API portfolio, certain older generic APIs are experiencing significant challenges. These products often grapple with fierce price wars and a shrinking customer base, leading to a diminished market presence and stagnant growth prospects. For instance, in 2024, the global generic API market saw increased pressure on older molecules due to the influx of new manufacturers, particularly from emerging economies, driving down prices by an average of 5-10% for established products.

Consequently, these underperforming APIs are likely contributing little to profitability, potentially even operating at a loss. This situation effectively locks up valuable capital that could be strategically reinvested in more promising areas of the business, such as research and development for novel therapeutics or expansion into high-growth markets. In 2023, the pharmaceutical industry reported that companies were increasingly divesting or discontinuing low-margin API lines to optimize resource allocation.

Therefore, a critical strategic imperative for Hisun is to meticulously identify these underperforming assets and implement a well-defined plan for their gradual phasing out. This proactive approach ensures that resources are channeled towards APIs with greater potential for market penetration and profitability, ultimately strengthening Hisun's competitive position and financial health.

Struggling Animal Health Sector Segments

Hisun's animal health segment experienced considerable headwinds in the first half of 2024. Widespread losses in economic animal farming and a subdued pet market put significant pressure on sales. This challenging environment means that segments within Hisun's animal health business that already have low market share and are seeing declining profitability would be considered Dogs in a BCG Matrix analysis.

These underperforming areas within the animal health sector demand a thorough review. Continued investment in these segments needs careful consideration due to their current trajectory. For instance, if a specific veterinary drug segment saw its market share drop from 5% to 3% in 2024 with a corresponding decline in gross profit margin, it would likely fall into the Dog category.

- Low Market Share: Segments where Hisun holds a minimal percentage of the overall market.

- Declining Profitability: Business areas experiencing a downward trend in their profit margins.

- Limited Growth Prospects: Segments unlikely to see significant expansion in the near future.

- Strategic Re-evaluation: Areas requiring a critical assessment of their future viability and investment needs.

Outdated or Commoditized Chemical Synthesis Products

Hisun Pharmaceutical's journey began with chemical synthesis, and some of its older, commoditized chemical products or intermediates now face intensely competitive markets with razor-thin profit margins and minimal growth potential. These products, if they aren't strategically updated or diversified, risk becoming resource drains that barely cover their costs.

For instance, a significant portion of Hisun's legacy chemical intermediates, while foundational, might be experiencing price erosion due to increased global competition, particularly from manufacturers with lower production costs. Continuous evaluation is crucial to ensure these legacy products don't become cash traps, siphoning off valuable capital that could be invested in more promising areas of the business.

- Market Saturation: Many basic chemical synthesis products historically produced by Hisun now operate in markets with numerous global suppliers, leading to intense price competition.

- Low Growth Environment: These commoditized chemicals often serve industries with stable but slow-growing demand, limiting significant revenue expansion opportunities.

- Margin Compression: The combination of high competition and limited demand growth has squeezed profit margins on these older chemical lines, potentially making them unprofitable without cost efficiencies.

- Resource Allocation Risk: Continued investment in outdated chemical synthesis lines without clear growth strategies can divert capital and management attention from higher-potential pharmaceutical development.

Hisun Pharmaceutical's divestment of its distribution and raw material segment in H1 2024, alongside underperforming legacy chemical intermediates and certain older generic APIs, exemplifies the management of 'Dog' units. These segments exhibit low market share and limited growth, often draining resources.

Products like I VNest, excluded from group procurement, and specific animal health segments facing market headwinds, also fit the 'Dog' profile. These areas are characterized by declining profitability and minimal future expansion prospects.

The company's strategic imperative is to identify and phase out these underperforming assets. This allows for the reallocation of capital and management focus towards more promising 'Star' and 'Cash Cow' segments, ultimately improving overall profitability and competitive positioning.

For instance, in 2024, older generic APIs faced an average price erosion of 5-10% due to increased global competition, highlighting the challenges in these low-margin segments.

Question Marks

Hisun Pharmaceutical's HS387 tablets, recently approved for clinical trials in ovarian and non-small cell lung cancer, are positioned as a Question Mark in the BCG matrix. This classification reflects their presence in a high-growth market segment with significant future potential. The oncology drug market, particularly for these indications, is experiencing robust expansion, with projections indicating continued growth driven by unmet medical needs and advancements in treatment modalities.

Despite the promising market outlook, HS387 currently holds zero market share, a defining characteristic of a Question Mark. The path to market penetration requires substantial investment in clinical trials, regulatory approvals, and subsequent marketing efforts. For instance, the global oncology market was valued at over $200 billion in 2023 and is expected to grow at a compound annual growth rate of approximately 8-10% through 2030, highlighting the competitive landscape Hisun is entering.

Hisun Pharmaceutical's early-stage oncology pipeline, beyond its lead candidate HS387, showcases a commitment to a high-growth therapeutic area. These emerging assets are currently in preclinical and Phase I trials, necessitating substantial R&D investment. For instance, in 2023, Hisun reported R&D expenses of approximately RMB 3.6 billion, with a significant portion allocated to novel drug development in oncology.

Hisun Pharmaceutical's biosimilar pipeline includes several candidates in advanced development, but the potential for these products to enter already crowded markets presents a significant challenge. For example, the market for biosimilars targeting blockbuster biologics like Humira (adalimumab) has seen numerous entrants, with several approved and launched in the US in 2023 and 2024.

While the global biosimilar market is projected to reach substantial figures, with some estimates placing it over $100 billion by 2028, individual biosimilar products entering highly competitive therapeutic areas may face intense pricing pressure and require substantial marketing investment to achieve meaningful market penetration. This competitive environment necessitates strong differentiation strategies and potentially lower initial pricing to capture market share.

Newly Registered Veterinary Drugs

Hisun Pharmaceutical's recent registration of new veterinary drugs, including treatments for canine vomiting and a cat vaccine, places them in the question mark category of the BCG matrix. These represent new ventures with the potential for future growth.

The animal health sector, however, is experiencing considerable pressure. In 2024, the global veterinary pharmaceutical market was valued at approximately $35 billion, but faced challenges from increasing regulatory hurdles and rising R&D costs. This means Hisun's new products are entering a competitive landscape with initially low market share.

To succeed, these veterinary drugs will require significant strategic investment and focused marketing efforts. The goal is to build market awareness and capture a larger share within this demanding sector.

- New Market Entries: Canine vomiting treatment and cat vaccine.

- Market Conditions: Animal health sector facing pressure in 2024, with a global market value of around $35 billion.

- Strategic Need: Targeted investment and marketing are crucial for market penetration.

- Potential: Opportunity for growth if market challenges are effectively navigated.

Novel R&D Initiatives in Emerging Areas

Hisun Pharmaceutical's commitment to novel research and development is evident in its significant investment, consistently exceeding 8% of its annual revenue. This substantial R&D expenditure fuels exploration across cutting-edge fields such as biotechnology, enzyme engineering, and the intricate study of natural compounds for groundbreaking drug discovery.

These early-stage, high-risk, high-reward initiatives are precisely where Hisun's potential future blockbusters are being cultivated. While these novel drug candidates and platforms currently represent negligible market presence, their success could unlock substantial growth trajectories.

The company's strategic focus on these emerging areas positions them for future market leadership, acknowledging the considerable ongoing investment required to bring these innovations to fruition.

- Biotechnology: Focus on advanced biologics and gene therapies.

- Enzyme Engineering: Developing novel enzymes for therapeutic applications.

- Natural Compounds: Investigating plant and microbial sources for new drug leads.

- High-Risk, High-Reward: Emphasis on disruptive innovation with uncertain but potentially large market impact.

Hisun Pharmaceutical's early-stage oncology pipeline, including HS387, represents significant question marks. These products are in high-growth markets but currently have zero market share, demanding substantial investment for development and commercialization. For example, Hisun's R&D spending in 2023 was approximately RMB 3.6 billion, largely directed towards novel drug development in oncology.

| Product/Pipeline Area | Market Growth | Current Market Share | Investment Need | BCG Category |

| HS387 (Oncology) | High | 0% | High | Question Mark |

| Biosimilar Pipeline | Moderate to High | Low to Moderate | Moderate | Question Mark |

| Veterinary Drugs | Moderate | Low | Moderate to High | Question Mark |

| Biotechnology R&D | High | Negligible | Very High | Question Mark |

BCG Matrix Data Sources

Our Hisun Pharmaceutical BCG Matrix is built on robust data, integrating internal financial statements, market research reports, and competitor analysis to provide strategic clarity.