Hisun Pharmaceutical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

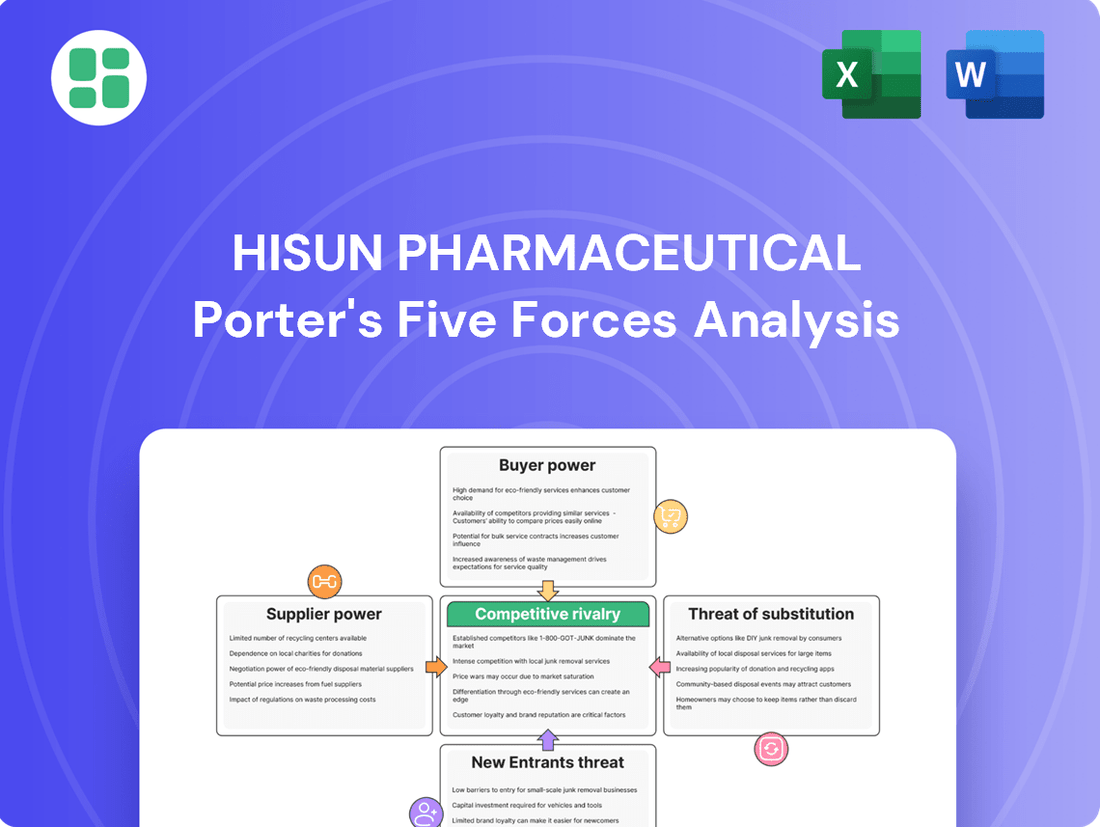

Hisun Pharmaceutical faces significant competitive pressures, with moderate threats from new entrants and substitutes impacting its market share. Understanding the bargaining power of buyers and suppliers is crucial for navigating this landscape.

The complete report reveals the real forces shaping Hisun Pharmaceutical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hisun Pharmaceutical's reliance on specialized active pharmaceutical ingredients (APIs) means that if a small number of companies supply these crucial components, those suppliers gain considerable leverage. This concentration of suppliers for essential raw materials can directly impact Hisun's cost of goods sold, potentially leading to higher production expenses if supply is limited or prices are increased by these few dominant players.

Suppliers who hold patents on crucial intermediate compounds or advanced manufacturing technologies wield significant bargaining power. Hisun Pharmaceutical would face restricted alternatives, likely encountering elevated licensing expenses or increased raw material costs.

This dynamic is especially pronounced within the high-value active pharmaceutical ingredient (API) and biological drug sectors. For instance, in 2023, the global pharmaceutical patent landscape saw continued innovation, with companies investing heavily in R&D for novel drug delivery systems and complex synthesis methods, often leading to single-source suppliers for critical components.

High switching costs significantly bolster the bargaining power of suppliers to Hisun Pharmaceutical. The pharmaceutical industry demands stringent qualification, validation, and regulatory approvals for any new supplier. This process is not only time-consuming but also incredibly resource-intensive for Hisun.

Consequently, Hisun faces substantial hurdles in transitioning to alternative suppliers, even when existing terms become unfavorable. The considerable investment in time and resources needed for re-validation effectively grants current suppliers considerable leverage over Hisun.

Forward Integration Threat

The threat of forward integration by Hisun Pharmaceutical's key API suppliers poses a significant risk to its bargaining power. If these suppliers can move into finished dosage form manufacturing, they transition from being essential partners to direct competitors, potentially disrupting Hisun's operations and market standing.

This capability allows suppliers to leverage their control over critical raw materials, giving them leverage in price negotiations and supply agreements. For instance, a supplier controlling a vital active pharmaceutical ingredient (API) for a blockbuster drug could threaten to produce the finished product themselves, effectively holding Hisun's supply chain hostage.

- Forward Integration Threat: Suppliers moving into finished dosage forms create direct competition for Hisun.

- Supply Chain Disruption: This integration can jeopardize Hisun's access to essential APIs.

- Increased Supplier Power: Suppliers gain leverage, potentially dictating terms and pricing.

Quality and Regulatory Compliance

Suppliers who consistently meet demanding international quality standards, such as current Good Manufacturing Practices (cGMP), and adhere to strict regulatory requirements are crucial for Hisun Pharmaceutical. The reliability and safety of Hisun's finished products are directly tied to the quality of the raw materials and active pharmaceutical ingredients (APIs) it sources. This reliance on high-quality inputs means suppliers with a proven track record of compliance can often negotiate higher prices, reflecting the reduced risk and assurance they provide.

For instance, in 2023, the global pharmaceutical excipients market, a key input category, was valued at approximately USD 10.5 billion, with significant growth driven by the demand for high-purity and compliant ingredients. Suppliers demonstrating robust quality management systems and a history of successful regulatory audits are therefore in a strong position.

- Supplier Quality Assurance: Hisun's dependence on suppliers meeting cGMP and other stringent international quality standards significantly enhances supplier bargaining power.

- Regulatory Compliance: Suppliers with a strong history of regulatory compliance offer a critical assurance, allowing them to command premium pricing.

- Input Criticality: The direct impact of supplier input quality on Hisun's product safety and efficacy elevates the importance and bargaining leverage of compliant suppliers.

Suppliers of specialized active pharmaceutical ingredients (APIs) and critical raw materials possess significant bargaining power over Hisun Pharmaceutical, especially when few suppliers exist for these essential inputs. This concentration allows them to influence Hisun's production costs by potentially raising prices or limiting supply, directly impacting the cost of goods sold.

The threat of forward integration, where suppliers might begin producing finished drug products themselves, further amplifies their leverage. This capability transforms them from mere suppliers into potential competitors, enabling them to dictate terms and pricing by controlling access to vital components, as seen in the 2023 global pharmaceutical patent landscape where R&D investments led to complex synthesis methods often controlled by single-source suppliers.

High switching costs, stemming from the rigorous and time-consuming qualification, validation, and regulatory approval processes required in the pharmaceutical industry, lock Hisun into existing supplier relationships. This makes transitioning to new suppliers a substantial undertaking, granting current suppliers considerable power in negotiations.

Suppliers demonstrating consistent adherence to international quality standards like cGMP and robust regulatory compliance are highly valued by Hisun, as input quality directly affects product safety and efficacy. For instance, the global pharmaceutical excipients market, valued at approximately USD 10.5 billion in 2023, highlights the demand for compliant ingredients, allowing quality-focused suppliers to command premium pricing due to reduced risk and assured reliability.

| Factor | Impact on Hisun | Supplier Leverage | Supporting Data/Example |

| Supplier Concentration | Increased cost of goods sold, potential supply shortages | High | Few suppliers for specialized APIs |

| Forward Integration Threat | Supply chain disruption, direct competition | High | Suppliers entering finished dosage form manufacturing |

| Switching Costs | Difficulty in changing suppliers, reliance on existing ones | High | Time and resource-intensive validation processes |

| Supplier Quality & Compliance | Higher input costs, assurance of product safety | High | 2023 excipients market ~USD 10.5 billion; cGMP adherence |

What is included in the product

This analysis specifically examines Hisun Pharmaceutical's competitive environment, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Hisun Pharmaceutical's market landscape.

Customers Bargaining Power

Centralized procurement policies in China, particularly those implemented through volume-based bidding, significantly bolster the bargaining power of institutional customers. Hospitals and national healthcare systems, acting as consolidated buyers, leverage their scale to negotiate substantial price reductions. This dynamic directly impacts Hisun Pharmaceutical's revenue streams and profit margins, as these large-volume purchasers demand considerable concessions.

The increasing price sensitivity of these powerful buyers, driven by government cost-containment measures, means Hisun must contend with constant pressure to lower its prices. This trend, evident throughout 2024, is projected to intensify and continue shaping the competitive landscape for pharmaceutical companies in China through 2025, forcing strategic adjustments in pricing and product portfolio management.

The growing presence of generic and biosimilar drugs across many medical fields significantly boosts customer bargaining power. This means pharmacies, hospitals, and insurance providers have more options to choose from, often at lower price points.

Consequently, Hisun Pharmaceutical faces increased pressure to keep its pricing competitive, particularly for established products. This dynamic is further intensified as patents for major drugs expire, opening the door for even more affordable alternatives to enter the market.

Hisun Pharmaceutical's large-volume buyers, such as major distributors, extensive hospital networks, and government health initiatives, wield considerable bargaining power. These entities, by consolidating their purchasing needs, can demand lower prices and more favorable credit terms. For instance, in 2023, Hisun's revenue from its top ten customers represented a significant portion of its total sales, highlighting the concentration of its buyer base and their influence on pricing strategies.

Customer Information and Transparency

Customer information and transparency are increasingly empowering buyers. Initiatives like the Inflation Reduction Act in the US, which aims to lower prescription drug costs, are pushing for greater clarity on pricing and effectiveness. This means customers, including large payers and even individual patients, can more readily compare Hisun's products against alternatives. By 2025, this heightened transparency will likely intensify pressure on Hisun to demonstrate superior value and competitive pricing.

The digital health revolution is a key driver here. Platforms offering comparative drug pricing and real-world efficacy data are becoming more prevalent. For instance, by mid-2024, several health technology companies were reporting significant user growth on their platforms that aggregate prescription drug information. This allows buyers to scrutinize Hisun's offerings more thoroughly, potentially leading to demands for price adjustments or greater emphasis on unique product benefits.

- Increased Transparency: Digital health platforms and regulatory pushes are making drug pricing and efficacy data more accessible to customers.

- Enhanced Comparison: Buyers can now more easily compare Hisun's products against those of its competitors based on objective data.

- Pricing Pressure: This improved information flow puts pressure on Hisun to justify its pricing strategies with clear value propositions.

- Shaping Healthcare Decisions: By 2025, this trend is expected to significantly influence how healthcare providers and patients make purchasing choices.

Switching Costs for Customers

While Hisun Pharmaceutical's customers might encounter some hurdles when switching, these are generally less pronounced than those faced by suppliers. These costs can include a physician's established familiarity with Hisun's medications or the presence of these drugs within hospital formularies. For instance, a doctor accustomed to prescribing a specific Hisun product for a chronic condition might be hesitant to switch due to the learning curve associated with a new drug.

However, for generic or biosimilar products, which represent a significant portion of the pharmaceutical market, these switching costs are considerably lower. This allows customers, including healthcare providers and patients, more flexibility to prioritize price and availability. In 2024, the global generic drugs market was valued at approximately $450 billion, highlighting the intense price competition and the importance of low switching costs for market share.

- Physician Familiarity: Doctors may prefer to stick with drugs they know well, impacting switching decisions.

- Formulary Inclusion: Hospital and insurance formularies can create inertia, making it harder to switch medications.

- Generic Market Dynamics: In 2024, the generic drug market's substantial size ($450 billion) means price and availability are key drivers, reducing switching costs for these products.

The bargaining power of Hisun Pharmaceutical's customers is substantial, particularly due to the consolidation of purchasing power among large institutional buyers like hospitals and government health programs in China. These entities leverage volume-based bidding to secure significant price reductions, directly impacting Hisun's revenue. The increasing price sensitivity, driven by government cost-containment efforts throughout 2024, further intensifies this pressure, forcing Hisun to maintain competitive pricing strategies.

The proliferation of generic and biosimilar alternatives significantly amplifies customer leverage. With more options available at lower price points, customers like pharmacies and insurance providers can readily switch, forcing Hisun to remain competitive, especially as patents expire. This dynamic is underscored by the global generic drug market's estimated $450 billion valuation in 2024, highlighting intense price competition.

Digital health advancements and regulatory initiatives are fostering greater price and efficacy transparency, empowering customers to compare Hisun's products more effectively. By mid-2024, growth in health technology platforms aggregating drug information allowed for deeper scrutiny of Hisun's offerings, potentially leading to demands for price adjustments or a greater focus on product differentiation.

| Factor | Impact on Hisun | 2024 Data/Trend |

| Consolidated Buyers (China) | High bargaining power, demand price concessions | Volume-based bidding common |

| Price Sensitivity | Increased pressure on pricing | Government cost-containment measures |

| Generic/Biosimilar Availability | More customer choice, drives price competition | Global generic market ~$450 billion (2024) |

| Information Transparency | Enables easier product comparison | Growth in digital health platforms |

Same Document Delivered

Hisun Pharmaceutical Porter's Five Forces Analysis

This preview displays the complete Hisun Pharmaceutical Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're viewing the exact document you'll receive, providing actionable insights into threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and the intensity of rivalry. This professionally formatted analysis is ready for immediate use upon purchase.

Rivalry Among Competitors

Hisun Pharmaceutical operates within China's highly competitive pharmaceutical sector, a market teeming with both domestic and international companies. This crowded environment means Hisun is constantly vying for market share against a diverse range of rivals, from global giants to nimble local innovators.

The intensity of this rivalry is underscored by the sheer volume of players. For instance, in 2023, China's National Medical Products Administration (NMPA) approved a significant number of new drug applications, reflecting the dynamic and expanding nature of the industry. This influx of new products and companies creates a challenging landscape where differentiation and operational efficiency are paramount for survival and growth.

Aggressive pricing is a hallmark of the Chinese pharmaceutical market, largely fueled by centralized procurement policies and the widespread availability of generic drugs. This intense competition, especially for established products, forces companies like Hisun to engage in price wars, directly impacting profit margins and market share. For instance, in 2024, many high-volume generic drugs saw double-digit price reductions through government tenders.

The pharmaceutical industry's competitive rivalry is intensely fueled by the relentless pace of innovation. Companies like Hisun Pharmaceutical are compelled to continuously invest in research and development to create novel drugs and enhance existing ones. This commitment to R&D is absolutely critical for maintaining a competitive edge against rivals who are consistently introducing groundbreaking therapies or improved versions of current treatments.

Hisun's strong R&D capabilities are a cornerstone in this dynamic environment. For instance, in 2024, the global pharmaceutical R&D spending was projected to exceed $250 billion, highlighting the immense investment required to stay ahead. Companies are increasingly leveraging advanced technologies like AI-driven drug discovery, which promises to accelerate the identification and development of new medicines, further intensifying the competitive landscape.

Product Portfolio Breadth and Specialization

Competitors in the pharmaceutical space often differentiate themselves through the sheer breadth of their product offerings, spanning numerous therapeutic categories, or by honing in on specific, rapidly expanding market niches. Hisun Pharmaceutical leverages its diverse product range, which notably includes anti-infectives and oncology treatments, as a key competitive advantage. However, the company must remain vigilant, constantly evaluating its strategic positioning against rivals who may either concentrate their resources on specialized areas or present a more extensive, all-encompassing product catalog.

The intensity of this rivalry is further shaped by how effectively companies manage their product portfolios. For instance, in 2024, companies with strong pipelines in biologics and gene therapies saw significant investor interest, indicating a market trend towards specialization in cutting-edge treatments. Hisun’s ability to compete hinges on its capacity to innovate and maintain a strong presence in its chosen therapeutic areas while also being agile enough to adapt to evolving market demands for specialized medicines.

- Broad Portfolios: Companies like Pfizer and Novartis maintain vast portfolios across multiple therapeutic areas, offering a wide range of solutions.

- Specialization: Firms such as Moderna or BioNTech have achieved significant market impact by focusing on mRNA technology and specific disease areas.

- Market Share Dynamics: In 2024, the oncology market alone was valued at over $200 billion globally, highlighting the intense competition within even specialized segments.

- Strategic Assessment: Hisun must continuously benchmark its product development and market penetration against both broad-spectrum competitors and highly specialized innovators.

Internationalization and Global Market Access

Hisun Pharmaceutical, like many Chinese drugmakers, is actively expanding its global footprint. This push for internationalization directly escalates competitive pressures across various markets. For instance, in 2023, Chinese pharmaceutical exports saw a notable increase, reflecting this trend.

Simultaneously, global pharmaceutical giants are increasingly targeting China's vast and growing healthcare sector. This reciprocal market entry strategy intensifies rivalry, not only within China but also in the international arenas where Hisun is establishing its presence.

- Increased Global Competition: Hisun faces heightened rivalry from both domestic and international players as it expands overseas.

- Market Access Dynamics: Foreign pharmaceutical firms are also increasing their focus on gaining greater access to the Chinese market, intensifying local competition.

- Interplay of Forces: The internationalization strategies of companies like Hisun create a dynamic where competition is amplified across multiple geographical fronts.

The competitive rivalry within China's pharmaceutical market is fierce, driven by a large number of domestic and international players. This intense competition is evident in aggressive pricing strategies, particularly for generics, with significant price reductions observed in 2024 through government tenders. Innovation is another key battleground, necessitating substantial R&D investment, with global R&D spending projected to exceed $250 billion in 2024, further intensifying the landscape as companies adopt technologies like AI for drug discovery.

| Rivalry Factor | Description | Impact on Hisun | Example (2024 Data/Trends) |

|---|---|---|---|

| Number of Competitors | High density of domestic and international firms | Pressure on market share and pricing | Significant number of new drug approvals by NMPA in 2023 |

| Pricing Pressures | Aggressive pricing, driven by procurement policies and generics | Reduced profit margins | Double-digit price reductions for high-volume generics in government tenders |

| Innovation Pace | Rapid development of new drugs and therapies | Need for continuous R&D investment | Global R&D spending projected over $250 billion; AI in drug discovery |

| Product Differentiation | Broad portfolios vs. niche specialization | Requires strategic portfolio management | Oncology market valued over $200 billion globally |

SSubstitutes Threaten

The most significant threat of substitution for Hisun Pharmaceutical stems from generic and biosimilar drugs. As Hisun's patented medications near their expiration dates, or when competitors' drugs face new generic or biosimilar entries, these cost-effective alternatives can rapidly diminish market share and pricing leverage. This dynamic is becoming increasingly pronounced, with the global biosimilars market projected to reach approximately $100 billion by 2025.

In China, the deep-rooted cultural preference for Traditional Chinese Medicine (TCM) and herbal remedies presents a significant threat of substitutes for Hisun Pharmaceutical's conventional drug offerings. For ailments considered less severe, or as a complementary approach, patients may opt for these traditional alternatives, potentially diverting market share. For instance, the TCM market in China was valued at approximately RMB 900 billion (around $125 billion) in 2023, indicating its substantial presence and influence.

The growing emphasis on preventive healthcare and lifestyle changes presents a significant threat of substitutes for Hisun Pharmaceutical. For conditions like diabetes or cardiovascular disease, adopting healthier diets and increasing physical activity can lessen the need for certain medications, impacting demand for Hisun's therapeutic offerings in these areas. For instance, a 2024 report indicated that 60% of adults in developed nations are actively seeking lifestyle interventions to manage chronic conditions, a trend that could indirectly reduce the market share for some of Hisun's established drugs.

Advanced Therapies and Non-Pharmaceutical Interventions

Emerging medical technologies, including gene and cell therapies, alongside advanced medical devices, present a growing threat by offering alternative treatment pathways that could diminish reliance on traditional pharmaceuticals. For example, the global gene therapy market was valued at approximately USD 7.7 billion in 2023 and is projected to grow significantly, potentially impacting established drug sales.

While Hisun Pharmaceutical might be exploring some of these advanced modalities within its research and development pipeline, the swift pace of innovation in these fields poses a sustained, long-term challenge to the conventional drug market segments where Hisun currently operates.

- Gene Therapy Market Growth: The gene therapy sector experienced substantial growth, with market size estimates reaching around USD 7.7 billion in 2023.

- Cell Therapy Advancements: Cell therapy, another key area of innovation, is also seeing rapid development, offering novel treatment approaches.

- Medical Device Innovation: Sophisticated medical devices can provide non-pharmacological solutions for various conditions, reducing the demand for drug-based treatments.

- Impact on Pharmaceutical Demand: The increasing viability and adoption of these advanced therapies and interventions could lead to a gradual but persistent erosion of market share for traditional pharmaceutical products.

Over-the-Counter (OTC) Medications and Supplements

The threat of substitutes for Hisun Pharmaceutical is significant, particularly from over-the-counter (OTC) medications and dietary supplements. For many common ailments, patients can opt for readily available OTC products instead of seeking prescription drugs. This trend is amplified by the lower price point of OTC alternatives, encouraging self-medication and potentially diverting sales from Hisun's less specialized prescription offerings.

In 2024, the global OTC drug market was valued at approximately $150 billion, showcasing the sheer scale of accessible alternatives. Furthermore, the dietary supplement market continued its robust growth, with projections indicating it would reach over $230 billion by 2027, demonstrating a growing consumer preference for self-care solutions that can bypass traditional prescription pathways. This accessibility and cost-effectiveness of OTC and supplement options present a direct challenge to Hisun's market share for certain therapeutic categories.

- Accessibility of OTC Options: Consumers can easily purchase OTC medications from pharmacies, supermarkets, and online retailers, bypassing the need for a doctor's visit.

- Cost Advantage: OTC drugs and supplements are generally much cheaper than prescription medications, making them an attractive alternative for price-sensitive consumers.

- Growing Self-Care Trend: There's an increasing consumer inclination towards self-management of mild to moderate health conditions, further fueling the demand for substitutes.

- Impact on Prescription Volume: For less severe conditions treated by Hisun, the availability of effective OTC substitutes can directly reduce the volume of prescriptions written, impacting revenue.

The threat of substitutes for Hisun Pharmaceutical is multifaceted, ranging from direct pharmaceutical alternatives to broader health management approaches. Generic and biosimilar drugs represent a primary threat, especially as patents expire, with the global biosimilars market expected to reach around $100 billion by 2025. Additionally, the significant cultural preference for Traditional Chinese Medicine in China, a market valued at approximately $125 billion in 2023, offers an alternative for certain health needs.

Lifestyle changes and preventive healthcare are also emerging as potent substitutes, with 60% of adults in developed nations actively seeking healthier habits in 2024, potentially reducing demand for some of Hisun's chronic disease medications. Furthermore, advanced medical technologies like gene therapy, a market valued at $7.7 billion in 2023, offer entirely new treatment paradigms that could displace traditional pharmaceuticals.

The accessibility and affordability of over-the-counter (OTC) medications and dietary supplements present a considerable challenge. The global OTC drug market reached approximately $150 billion in 2024, while the dietary supplement market is projected to exceed $230 billion by 2027, indicating a strong consumer trend towards self-medication and alternative wellness solutions.

| Substitute Category | Market Size/Growth Indicator | Relevance to Hisun |

|---|---|---|

| Generic & Biosimilar Drugs | Biosimilars market ~$100 billion by 2025 | Direct competition post-patent expiry |

| Traditional Chinese Medicine (TCM) | China TCM market ~$125 billion (2023) | Cultural preference, alternative for certain ailments |

| Lifestyle & Preventive Health | 60% adults in developed nations adopting lifestyle interventions (2024) | Reduces need for certain chronic disease drugs |

| Emerging Medical Technologies | Gene therapy market ~$7.7 billion (2023) | Novel treatment pathways potentially displacing drugs |

| OTC Drugs & Supplements | OTC market ~$150 billion (2024); Supplements market >$230 billion by 2027 | Accessible, affordable alternatives for common conditions |

Entrants Threaten

The pharmaceutical sector, particularly in developing Active Pharmaceutical Ingredients (APIs) and intricate finished drug products, demands immense capital. This includes significant outlays for research and development, rigorous clinical trials, and state-of-the-art manufacturing plants. For instance, bringing a new drug to market can cost upwards of $2.6 billion, a figure that includes the cost of failed attempts. Such substantial financial requirements create a formidable barrier to entry for aspiring new companies.

Hisun Pharmaceutical benefits from its established infrastructure and robust R&D capabilities, giving it a distinct competitive edge. The company’s existing manufacturing capacity and ongoing investment in innovation, which saw R&D expenses reach RMB 2.2 billion in 2023, position it favorably against potential new market entrants who would need to replicate these substantial investments.

New entrants into the pharmaceutical industry, particularly in China, face formidable barriers due to stringent regulatory requirements and lengthy approval processes. For instance, obtaining approval for new drugs from the National Medical Products Administration (NMPA) can take years, demanding extensive clinical trials and data submission. Adherence to international quality standards, such as current Good Manufacturing Practices (cGMP), adds another layer of complexity and cost, requiring significant investment in facilities and quality control systems.

The pharmaceutical sector's reliance on intellectual property, especially patents, significantly deters new entrants. Companies like Hisun Pharmaceutical must navigate a complex IP landscape, either by investing heavily in developing proprietary drugs or by waiting for existing patent protections to lapse, a process often spanning over a decade and costing millions in research and development. Hisun's robust patent portfolio, encompassing numerous novel compounds and manufacturing processes, acts as a substantial barrier, protecting its market share and discouraging competitors from easily entering with similar products.

Established Distribution Channels and Brand Recognition

Hisun Pharmaceutical benefits significantly from its deeply entrenched distribution channels and strong brand recognition, making it difficult for new players to penetrate the market. Building these foundational elements requires substantial time and capital, resources that emerging competitors often lack. For instance, by the end of 2023, Hisun had secured partnerships with over 1,500 distributors across China, a network that took decades to cultivate.

New entrants face a formidable barrier in replicating Hisun's established relationships with healthcare providers and the trust it has garnered among patients. This loyalty, built over years of consistent product quality and reliable supply, translates into preferred access and prescribing habits that are hard to disrupt. In 2024, Hisun reported that its top 10 pharmaceutical products maintained an average market share of over 25% in their respective therapeutic areas, a testament to this enduring brand equity.

- Established Distribution Networks: Hisun's extensive network, built over years, provides unparalleled market reach.

- Brand Recognition and Trust: Decades of operation have fostered significant brand loyalty among healthcare professionals and patients.

- High Entry Costs: New entrants must invest heavily in building similar distribution and marketing infrastructure.

- Competitive Advantage: Existing relationships and trust create a significant hurdle for new pharmaceutical companies entering the market.

Talent Acquisition and Specialized Expertise

The pharmaceutical sector's reliance on highly specialized talent presents a significant barrier to entry. New companies must contend with the difficulty of attracting and retaining skilled professionals in critical areas like research and development, regulatory compliance, and advanced manufacturing processes. This scarcity of expertise, particularly for cutting-edge biologicals and novel drug development, can substantially impede a new entrant's ability to establish a competitive foothold.

Consider the intense competition for talent. In 2024, the demand for biopharmaceutical scientists and clinical researchers remained exceptionally high, with many roles experiencing extended hiring timelines. For instance, a report indicated that the average time-to-fill for specialized R&D positions in the biopharma sector in 2023-2024 often exceeded six months, reflecting the scarcity of qualified candidates.

- High Demand for Specialized Skills: The need for PhD-level scientists, experienced pharmacologists, and regulatory affairs specialists is a constant challenge.

- Talent Retention Costs: Established companies often offer competitive compensation and benefits packages, making it difficult for new entrants to attract top-tier talent without significant investment.

- Geographic Concentration of Talent: Key talent pools are often concentrated in specific biotech hubs, requiring new entrants to either relocate or offer highly attractive remote work options.

- Long Training and Development Cycles: Developing in-house expertise in areas like GMP manufacturing or advanced clinical trial management requires substantial time and resources, further increasing the barrier for newcomers.

The threat of new entrants for Hisun Pharmaceutical is relatively low due to substantial barriers. These include immense capital requirements for R&D and manufacturing, stringent regulatory hurdles, and the need for intellectual property protection. Hisun's established distribution networks, strong brand recognition, and access to specialized talent further solidify its position, making it challenging for newcomers to compete effectively.

For instance, the average cost to bring a new drug to market can exceed $2.6 billion, a figure that naturally deters smaller, less-capitalized entrants. Hisun's 2023 R&D investment of RMB 2.2 billion and its extensive distribution network, comprising over 1,500 partners by the end of 2023, represent significant investments that new companies would need to match.

| Barrier Type | Description | Impact on New Entrants | Hisun's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for R&D, clinical trials, and manufacturing. | Significant financial hurdle. | Established infrastructure and R&D investment (RMB 2.2 billion in 2023). |

| Regulatory Hurdles | Lengthy approval processes and strict quality standards (e.g., NMPA, cGMP). | Time-consuming and costly compliance. | Expertise in navigating regulatory landscapes. |

| Intellectual Property | Patents and proprietary drug development. | Requires innovation or waiting for patent expiry. | Robust patent portfolio. |

| Distribution & Brand | Established networks and customer trust. | Difficult to replicate market access and loyalty. | Over 1,500 distributors (end of 2023), strong brand equity. |

| Specialized Talent | Scarcity of skilled professionals in R&D, regulatory, and manufacturing. | Challenges in attracting and retaining expertise. | Ability to attract and retain top talent. |

Porter's Five Forces Analysis Data Sources

Our Hisun Pharmaceutical Porter's Five Forces analysis is built upon a comprehensive review of company annual reports, investor presentations, and regulatory filings from entities like the SEC. We also incorporate insights from reputable industry research firms and pharmaceutical trade publications to capture current market dynamics and competitive pressures.