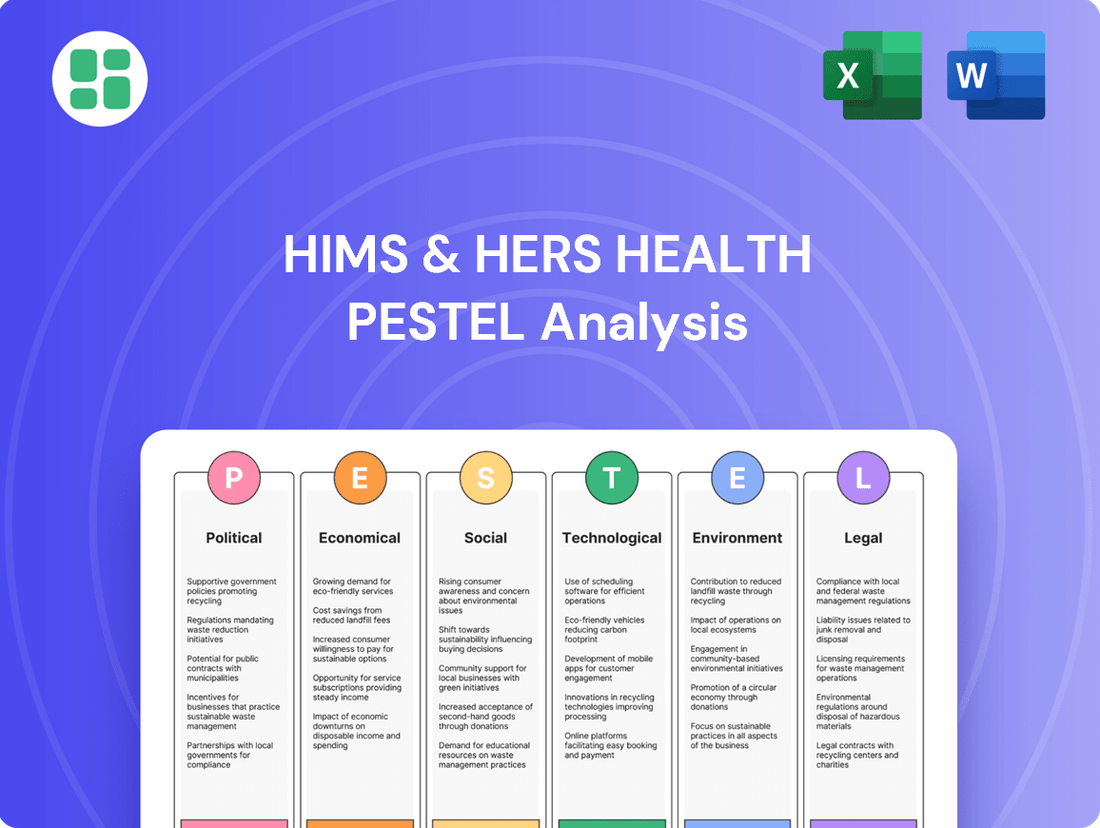

Hims & Hers Health PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hims & Hers Health Bundle

Unlock the secrets to Hims & Hers Health's market dominance with our comprehensive PESTLE analysis. We delve into the political, economic, social, technological, legal, and environmental factors that are shaping their trajectory, offering you a critical advantage. Don't just react to market shifts – anticipate them. Download the full PESTLE analysis now and gain the strategic foresight to elevate your own business.

Political factors

Government policies are a significant tailwind for Hims & Hers, particularly through continued support for telehealth expansion. Many COVID-19 era flexibilities for Medicare telehealth coverage have been extended through at least September 30, 2025, ensuring ongoing accessibility and reliability for a broader patient demographic.

These federal initiatives aim to permanently integrate certain telehealth flexibilities while maintaining others temporarily, actively accelerating adoption and awareness of these vital services.

While the Interstate Medical Licensure Compact (IMLC) aims to simplify physician licensing across states, telehealth providers like Hims & Hers still face significant challenges due to varying cross-state regulations. Many states require specific licensure for out-of-state practitioners, forcing Hims & Hers to navigate a patchwork of laws to ensure broad service availability.

The Drug Enforcement Administration (DEA) and the Department of Health and Human Services (HHS) have extended temporary rules, allowing controlled substances to be prescribed via telehealth through December 31, 2025, under specific conditions without requiring an in-person visit. This extension significantly benefits companies like Hims & Hers, especially for treatments related to opioid use disorder, enabling continued growth in their digital health services.

New regulations, effective March 21, 2025, specifically permit the virtual prescription of certain medications used to treat addiction. This regulatory environment supports Hims & Hers' telehealth model, particularly for its mental health and substance use disorder offerings, by providing a clear pathway for patient access to necessary medications.

Medicare Reimbursement Policies

The Centers for Medicare & Medicaid Services (CMS) has adjusted its fee schedule for 2025, notably phasing out some temporary telehealth payment boosts from 2024. This shift introduces some uncertainty for providers relying on those temporary increases.

However, a significant positive development for Hims & Hers is the permanent inclusion of certain behavioral and mental health services under telehealth for Medicare beneficiaries, effective January 1, 2025. This policy change offers crucial stability and predictability for a core service offering of the company.

- CMS 2025 Fee Schedule: Removal of some temporary telehealth payment increases from 2024.

- Behavioral Health Telehealth: Permanent coverage for Medicare patients starting January 1, 2025.

- Impact on Hims & Hers: Increased stability for a key service area, despite broader telehealth payment adjustments.

Public Health Initiatives and Priorities

Government and public health initiatives are increasingly championing digital care solutions to broaden healthcare accessibility. This focus is particularly aimed at reaching underserved communities and those in rural areas, recognizing telehealth's crucial role in bridging healthcare gaps. For instance, a 2024 report indicated that telehealth utilization in rural areas saw a significant increase, helping to mitigate delays in diagnosis and treatment.

Hims & Hers directly aligns with these public health priorities by providing accessible, personalized, and convenient healthcare services. Their digital platform allows for efficient delivery of care, addressing the government's push to reduce healthcare disparities. The company's model supports timely interventions and ongoing management of health conditions, contributing to improved public health outcomes.

- Expansion of Digital Health Access: Government bodies are actively promoting telehealth and digital health platforms to enhance healthcare reach, especially in remote regions.

- Telehealth's Role in Equity: Telehealth has been identified as a key tool in reducing healthcare disparities, ensuring more equitable access to medical services.

- Hims & Hers' Strategic Alignment: The company's service model directly supports these public health objectives by offering convenient and personalized healthcare solutions through digital channels.

Government support for telehealth continues, with extensions of COVID-era flexibilities through September 2025, bolstering Hims & Hers' accessibility. However, the DEA and HHS have extended temporary rules allowing telehealth prescriptions of controlled substances, including those for addiction treatment, through December 31, 2025, a significant benefit for Hims & Hers' mental health services.

While permanent inclusion of behavioral health services for Medicare beneficiaries starting January 2025 provides stability, the CMS 2025 fee schedule phases out some temporary telehealth payment boosts from 2024, introducing minor revenue uncertainties.

Despite interstate licensing complexities, Hims & Hers benefits from government initiatives promoting digital health to reach underserved populations, aligning with public health goals to reduce disparities.

| Policy/Regulation | Effective Date/Period | Impact on Hims & Hers |

|---|---|---|

| Telehealth Flexibilities Extension | Through September 30, 2025 | Continued accessibility and reliability for a broader patient base. |

| Controlled Substance Telehealth Prescriptions | Through December 31, 2025 | Enables continued growth in digital health services, especially for addiction treatment. |

| Permanent Behavioral Health Telehealth (Medicare) | January 1, 2025 | Provides crucial stability and predictability for a core service offering. |

| CMS Fee Schedule Adjustments | 2025 | Phasing out of some temporary telehealth payment boosts introduces minor revenue uncertainty. |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing Hims & Hers Health's telehealth and wellness offerings.

It provides actionable insights for strategic planning by detailing how these external forces create both opportunities and challenges for the company's growth and operations.

The Hims & Hers Health PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings and strategic planning.

Economic factors

Healthcare expenditure and consumer spending patterns are pivotal for Hims & Hers. The telehealth market is booming, with global projections exceeding USD 55 billion by the end of 2025, and the U.S. market alone anticipated to reach $41.71 billion in the same year. This surge in virtual care adoption directly supports Hims & Hers' business model.

Consumers are increasingly comfortable with and actively seeking out digital health solutions, a trend Hims & Hers is well-positioned to capitalize on. This shift in spending towards accessible, convenient online healthcare services directly benefits companies like Hims & Hers, which offer subscription-based access to care.

Hims & Hers demonstrated this trend with its own impressive financial performance, reporting an 111% year-over-year revenue growth in Q1 2025, reaching $586 million. This substantial increase underscores the strong consumer demand for their integrated telehealth and pharmacy services.

Inflationary pressures are a significant concern for Hims & Hers, impacting their operational costs. While the company has a vertically integrated model designed to offer cost advantages, rising prices for key inputs, particularly drug components and supply chain logistics, can squeeze gross margins. For instance, in Q1 2025, gross margins saw some contraction, a trend that could be exacerbated by ongoing inflation in the pharmaceutical sector.

Economic downturns can significantly curb consumer spending on non-essential health and wellness services, potentially impacting Hims & Hers' revenue streams. For instance, during periods of economic contraction, individuals might delay or reduce spending on elective treatments for conditions not deemed critical.

However, Hims & Hers' business model, which emphasizes personalized and often recurring treatments for ongoing health needs, may provide a degree of resilience against minor economic fluctuations. The company's ability to retain customers through subscription services is a key factor here.

By the first quarter of 2025, Hims & Hers had cultivated a robust subscriber base, exceeding 2.3 million users. This substantial and loyal customer base suggests a degree of stickiness, making them less likely to churn even when facing economic headwinds, particularly for services they perceive as essential to their well-being.

Insurance Coverage for Telehealth Services

The evolving landscape of insurance coverage for telehealth services is a critical economic driver. While Medicare has made some flexibilities permanent, commercial insurers are increasingly scrutinizing telehealth reimbursement, potentially impacting provider revenue and patient costs. For instance, a survey by the Kaiser Family Foundation in early 2024 indicated a mixed bag, with some commercial plans reducing coverage for certain telehealth services compared to the pandemic peak.

Furthermore, the adoption of payment parity laws by various states is a significant economic factor. These laws mandate that insurers reimburse telehealth services at the same rate as in-person visits, which can incentivize providers to offer more virtual care. As of mid-2024, over 20 states have enacted some form of payment parity legislation, creating a more favorable economic environment for telehealth expansion.

The economic implications extend to patient affordability. Changes in insurance coverage directly influence out-of-pocket expenses for consumers. If commercial payers reduce coverage or increase co-pays for telehealth, it could dampen patient demand, even if providers are willing to offer services. Conversely, robust payment parity policies can lead to more predictable costs for patients utilizing telehealth.

- Medicare's Permanent Flexibilities: Certain telehealth services previously expanded during the public health emergency have been made permanent by Medicare, providing a stable reimbursement baseline for some virtual care.

- Commercial Payer Scrutiny: Many commercial insurance companies are reviewing and potentially tightening their coverage policies for telehealth, which could lead to lower reimbursement rates for providers.

- State-Level Payment Parity: Over 20 states had enacted payment parity laws by mid-2024, requiring equal reimbursement for telehealth and in-person services, thereby bolstering telehealth adoption.

- Impact on Patient Costs: Shifts in insurance coverage directly affect patient out-of-pocket expenses, influencing their willingness to use telehealth services.

Competitive Landscape and Pricing Strategies

The telehealth sector is intensely competitive, featuring established players like Teladoc and Amazon Clinic alongside niche providers. Hims & Hers must continuously refine its service differentiation and pricing models to capture and maintain subscribers amidst this rivalry.

To stand out, Hims & Hers leverages personalization and cultivates direct-to-consumer brand loyalty, creating a distinct competitive advantage. This approach is crucial as the market matures and consumer expectations evolve.

- Market Share Competition: Hims & Hers competes with giants like Teladoc, which reported over $2.4 billion in revenue for 2023, and Amazon Clinic, which is expanding its telehealth footprint.

- Pricing Sensitivity: Subscribers are often price-sensitive, requiring Hims & Hers to balance competitive pricing with the value proposition of its personalized services.

- Brand Loyalty as a Moat: The company's investment in brand building and customer relationships aims to foster loyalty, a key differentiator against less personalized competitors.

The telehealth market's rapid expansion, projected to surpass $55 billion globally by 2025, directly fuels Hims & Hers' growth. Consumer comfort with digital health solutions is high, as evidenced by Hims & Hers' Q1 2025 revenue surge of 111% to $586 million, showcasing strong demand for their accessible online services.

Inflationary pressures present a challenge, potentially impacting Hims & Hers' gross margins due to rising costs for drug components and logistics, as seen in Q1 2025. Economic downturns could also reduce consumer spending on non-essential wellness services, though Hims & Hers' subscription model and over 2.3 million users by Q1 2025 offer some resilience.

Insurance coverage for telehealth is a mixed economic factor; while Medicare has made some flexibilities permanent, commercial payers are scrutinizing coverage. However, over 20 states enacted payment parity laws by mid-2024, mandating equal reimbursement for telehealth and in-person visits, which benefits providers and patient affordability.

Preview Before You Purchase

Hims & Hers Health PESTLE Analysis

The Hims & Hers Health PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hims & Hers. You'll gain immediate access to this professionally structured report upon completing your purchase.

Sociological factors

Consumers are increasingly drawn to the ease and availability of digital health solutions. Recent data indicates a significant societal shift, with over 80% of consumers having tried telemedicine, and a remarkable 89% reporting satisfaction with their virtual care experiences.

This widespread acceptance of telehealth directly supports the core business model of companies like Hims & Hers, which are built upon providing accessible and convenient healthcare services through digital platforms.

Societies are increasingly seeking healthcare that is specifically designed for them, moving away from generic treatments. This shift reflects a desire for more effective and targeted health outcomes.

Hims & Hers has tapped into this by providing customized solutions for a range of health concerns. By Q1 2025, their personalized offerings had attracted more than 1.4 million subscribers, demonstrating the strong market appeal of this approach.

This emphasis on individual patient needs is a key driver of Hims & Hers' continued subscriber growth and market penetration.

Societal attitudes are shifting, with growing openness around mental and sexual health. This destigmatization encourages more people to seek help, often opting for convenient and private solutions like those offered by Hims & Hers. Telehealth, particularly telepsychiatry, is seeing significant adoption, with studies in 2024 indicating high patient satisfaction and a growing demand for accessible mental health services.

Demographic Shifts and Tech Adoption

The increasing digital literacy across all age groups, including seniors, is a significant driver for telehealth adoption. This trend directly benefits Hims & Hers by expanding its potential user base as more individuals become comfortable with online health services.

Telemedicine usage has seen a notable increase across all demographics, with studies indicating higher adoption rates among women. For instance, a 2023 report found that women were 13% more likely than men to have used telehealth services in the past year, highlighting a key segment for Hims & Hers to target.

- Growing Digital Comfort: An increasing percentage of the population, including older adults, report comfort with digital platforms, fostering greater acceptance of telehealth.

- Expanding User Base: Hims & Hers leverages this trend by tapping into a larger segment of the population that is already tech-savvy and open to virtual healthcare solutions.

- Gender-Specific Adoption: Telemedicine use is higher among women, presenting a specific demographic opportunity for Hims & Hers to tailor its offerings and marketing efforts.

Health Literacy and Digital Divide

While telehealth, the core of Hims & Hers' model, significantly boosts healthcare accessibility, a persistent digital divide remains a challenge. This is especially true in rural regions where reliable broadband internet is scarce, potentially excluding a segment of the population. For instance, a 2023 Pew Research Center report indicated that around 25% of U.S. adults in rural areas still lack broadband internet access at home.

Hims & Hers must develop strategies to bridge this gap. This could involve exploring partnerships for subsidized internet access or offering alternative consultation methods. Considering that approximately 10% of U.S. households still rely on dial-up or mobile-only internet, as per FCC data from 2023, audio-only consultations could be a vital component of their service delivery to ensure inclusivity.

Telehealth, when implemented equitably, holds immense potential to reduce existing healthcare disparities. However, the digital divide directly impacts this potential. For example, a 2024 study published in JAMA Network Open found that individuals with lower socioeconomic status and those in underserved communities experienced greater barriers to accessing telehealth services, underscoring the need for proactive solutions.

- Digital Divide Impact: Approximately 25% of U.S. rural adults lacked broadband in 2023, limiting telehealth access.

- Service Adaptation: Exploring audio-only consultations is crucial, given that about 10% of U.S. households rely on mobile-only internet.

- Disparity Reduction: Telehealth's ability to lessen healthcare disparities is hindered by unequal digital access, as highlighted by a 2024 JAMA study.

Societal comfort with digital platforms is expanding, with older demographics increasingly adopting telehealth, broadening Hims & Hers' potential customer base.

Women show a higher propensity for telehealth use, a trend Hims & Hers can capitalize on through targeted strategies.

Despite increased digital literacy, a persistent digital divide, particularly in rural areas, limits telehealth accessibility for a significant portion of the population.

Hims & Hers must address this by exploring solutions like audio-only consultations to ensure inclusivity for those with limited internet access.

| Sociological Factor | Description | Relevance to Hims & Hers | Supporting Data (2023-2025) |

|---|---|---|---|

| Digital Adoption | Increasing comfort with online services across age groups. | Expands potential user base for telehealth. | 89% satisfaction with virtual care (2024 data). |

| Personalization Demand | Consumer preference for tailored health solutions. | Drives subscriber growth for customized offerings. | Over 1.4 million subscribers by Q1 2025. |

| Destigmatization | Growing openness around mental and sexual health. | Increases demand for discreet, accessible services. | High patient satisfaction in telepsychiatry (2024 studies). |

| Digital Divide | Unequal access to reliable internet. | Creates barriers for rural and low-income populations. | 25% of U.S. rural adults lacked broadband (2023). |

Technological factors

Artificial intelligence and machine learning are increasingly vital in telehealth, enhancing diagnostic accuracy, personalizing treatment, and optimizing operations. Hims & Hers is actively investing in AI to refine its personalization strategies, utilizing data analytics to craft treatments specifically for each user's unique requirements.

Telehealth platforms like Hims & Hers must prioritize robust cybersecurity to protect sensitive patient information. The increasing volume of digital health data necessitates advanced encryption and threat detection technologies.

Anticipated 2025 HIPAA Security Rule updates will likely mandate yearly internal audits and multifactor authentication for ePHI. This will require Hims & Hers to continuously invest in and upgrade its technological infrastructure to ensure compliance and maintain patient trust.

The ability of telehealth platforms to scale is absolutely critical for companies like Hims & Hers. This is especially true as they experience rapid subscriber growth and aim to branch out into more specialized medical areas. Their business model, which combines telehealth services with in-house prescription fulfillment, is designed for efficient expansion, allowing them to handle increased demand smoothly.

For Hims & Hers, scalability means their technology infrastructure can support a growing user base without performance degradation. This is crucial for maintaining a positive customer experience and operational efficiency. In 2023, Hims & Hers reported a significant increase in telehealth visits, highlighting the need for robust and scalable platforms to manage this volume effectively and continue their growth trajectory into 2024 and beyond.

Integration with Wearable Devices

The increasing adoption of remote patient monitoring (RPM) devices and wearable health trackers offers a significant avenue for Hims & Hers to enhance its service offerings. By integrating these technologies, the company can tap into the growing demand for proactive health management and real-time data analysis, thereby delivering more personalized and effective care to its users.

This technological integration allows for the continuous tracking of vital biomarkers, providing valuable insights that can inform treatment plans and improve patient outcomes. For instance, the global wearable medical devices market was valued at approximately $32.6 billion in 2023 and is projected to grow substantially. Hims & Hers can leverage this trend by incorporating data from popular wearables like Apple Watch or Fitbit into its telehealth consultations, enabling a more comprehensive understanding of a patient's health status between appointments.

- Enhanced Patient Engagement: Wearable integration can foster greater patient involvement in their health journey through continuous data feedback.

- Data-Driven Personalization: Real-time biomarker analysis from wearables allows for highly tailored treatment adjustments and health recommendations.

- Market Opportunity: Capitalizing on the expanding wearable technology market aligns Hims & Hers with a significant growth sector in digital health.

Broadband and 5G Penetration

Improved internet connectivity, particularly the expansion of 5G networks, is fundamental for Hims & Hers to deliver reliable and high-quality virtual consultations. This enhanced infrastructure directly supports the seamless delivery of telehealth services, a core component of their business model.

While urban centers often boast robust broadband access, continued investment in infrastructure is vital to bridge the digital divide. Ensuring equitable access to telehealth, especially in rural and underserved areas, remains a key challenge and opportunity for Hims & Hers to broaden its reach.

- 5G Expansion: As of early 2024, 5G coverage continues to expand, with projections indicating significant growth in availability throughout 2024 and into 2025, enhancing data speeds and reducing latency for virtual interactions.

- Broadband Adoption: In the US, broadband adoption rates are high, but disparities persist. For instance, Pew Research Center data from 2023 showed that while 86% of US adults had home broadband, this figure was lower in rural areas.

- Telehealth Usage: The demand for telehealth services has surged, with many patients now accustomed to virtual appointments, underscoring the importance of consistent and high-speed internet for continued patient engagement.

Hims & Hers leverages AI for personalized treatment plans and operational efficiency, with significant investment in data analytics to refine user-specific strategies. The company must maintain robust cybersecurity, anticipating 2025 HIPAA updates that will likely require yearly audits and multifactor authentication for protected health information.

The firm's technology infrastructure is designed for scalability to support rapid subscriber growth and expansion into new medical areas, ensuring a positive customer experience. Integration of remote patient monitoring devices and wearables, like those from Apple Watch or Fitbit, offers a key opportunity for enhanced, data-driven personalization, tapping into the growing wearable medical devices market, valued at approximately $32.6 billion in 2023.

Continued expansion of 5G networks is crucial for reliable virtual consultations, though bridging the digital divide remains important, as 2023 data indicated broadband adoption disparities in rural US areas.

| Technology Factor | Description | Impact on Hims & Hers | Data Point/Trend |

|---|---|---|---|

| Artificial Intelligence & Machine Learning | Enhancing diagnostics, personalization, and operations. | Refining personalization strategies and optimizing user treatments. | AI investment for data analytics. |

| Cybersecurity | Protecting sensitive patient data. | Ensuring compliance with evolving regulations (e.g., 2025 HIPAA updates). | Anticipated yearly audits and multifactor authentication mandates. |

| Scalability | Ability of technology to handle growth. | Supporting subscriber growth and expansion into new medical areas. | Reported increase in telehealth visits in 2023. |

| Remote Patient Monitoring & Wearables | Integrating real-time health data. | Enhancing service offerings and enabling data-driven personalization. | Wearable medical devices market valued at ~$32.6 billion in 2023. |

| Internet Connectivity (5G/Broadband) | Enabling reliable virtual consultations. | Crucial for service delivery; addressing digital divide is key. | Continued 5G expansion; 86% US adult broadband adoption in 2023 (Pew Research). |

Legal factors

The Health Insurance Portability and Accountability Act (HIPAA) remains central to patient data privacy. For 2024-2025, expect even more stringent guidelines concerning privacy, security, and how breaches are reported. Hims & Hers must navigate these evolving rules, which include mandatory audits and upgraded encryption standards to protect sensitive patient data.

Telehealth providers like Hims & Hers navigate a complex web of state-specific regulations and licensing requirements. Most states mandate that healthcare professionals hold a license in the state where the patient receives care, as well as where the provider is located. This creates a significant compliance burden, even with the existence of interstate licensing compacts, as Hims & Hers must ensure its network of physicians and specialists are properly credentialed across numerous jurisdictions.

FDA decisions directly shape Hims & Hers' product pipeline. For instance, the February 2025 resolution of the semaglutide shortage, a critical drug for their GLP-1 programs, highlights the company's reliance on FDA actions. This situation underscores the need for Hims & Hers to remain agile in managing its formulary and supply chain.

Navigating FDA regulations is paramount for Hims & Hers' ability to offer a diverse range of medications. The company must consistently monitor and adapt to evolving FDA guidance and approval processes for both branded and compounded drugs. This proactive approach ensures compliance and supports the continued availability of their telehealth services and prescribed treatments.

Prescription Drug Advertising and Marketing Laws

Hims & Hers operates under rigorous prescription drug advertising and marketing laws, a critical legal factor for its direct-to-consumer model. The company must meticulously adhere to federal and state regulations that dictate how prescription medications can be promoted, ensuring all claims are substantiated and patient information is accurately presented. Failure to comply can lead to significant penalties and damage consumer trust.

The Food and Drug Administration (FDA) plays a pivotal role in overseeing drug advertising, with specific guidelines for prescription drug promotion. For instance, in 2023, the FDA continued its focus on ensuring that direct-to-consumer advertising for prescription drugs is truthful, not misleading, and balanced in its presentation of risks and benefits. Hims & Hers’ marketing efforts, including online content and social media campaigns, are continuously evaluated against these standards.

- FDA Oversight: The FDA mandates that all prescription drug advertising must present a fair balance of benefits and risks.

- Truthful Claims: Marketing materials cannot make unsubstantiated claims about a drug's efficacy or safety.

- Patient Information: Regulations require clear and accessible information about drug usage, side effects, and contraindications.

- Enforcement Actions: Non-compliance can result in warning letters, fines, and mandated corrective advertising campaigns.

Malpractice Liability in Virtual Care

The evolving legal landscape for malpractice liability in virtual care presents a significant challenge for companies like Hims & Hers. As telehealth services expand, regulators are still defining the precise standards of care and accountability for remote medical consultations. This uncertainty means Hims & Hers must be exceptionally diligent in its compliance efforts.

To navigate these risks, Hims & Hers must ensure all its contracted healthcare professionals adhere to established medical practice standards, even in a virtual setting. This includes rigorous credentialing and ongoing oversight. Furthermore, the company's platform needs robust features for secure patient data management and detailed documentation of each virtual encounter. Such measures are crucial for demonstrating adherence to care standards and mitigating potential legal exposure.

The telehealth sector experienced a surge in adoption, with a significant portion of healthcare services moving online. For instance, a 2023 report indicated that telehealth utilization remained substantially higher than pre-pandemic levels, highlighting its integration into mainstream healthcare. This continued reliance on virtual care underscores the importance of clear legal frameworks and robust risk management strategies for providers like Hims & Hers.

Key considerations for Hims & Hers in managing malpractice liability include:

- Ensuring compliance with state-specific telehealth regulations: Laws governing virtual care vary by state, requiring Hims & Hers to maintain up-to-date knowledge and adherence to each jurisdiction's requirements.

- Implementing comprehensive patient consent protocols: Clear and informed consent regarding the nature and limitations of virtual care is essential to manage patient expectations and reduce liability.

- Maintaining high-quality electronic health records: Detailed and accurate documentation of all patient interactions, diagnoses, and treatment plans is critical for defending against malpractice claims.

- Regularly updating platform security and data privacy measures: Protecting sensitive patient information is paramount and directly impacts liability in the event of a data breach.

The legal framework surrounding telehealth, particularly concerning prescription drug marketing and patient data privacy, continues to evolve. For 2024-2025, Hims & Hers must remain vigilant in adhering to FDA guidelines on truthful and balanced advertising, as well as increasingly stringent HIPAA regulations for patient data protection. State-specific telehealth licensing and evolving malpractice liability standards also demand careful navigation to ensure compliance across all operational jurisdictions.

Environmental factors

Telehealth services, like those offered by Hims & Hers, significantly cut down on travel for both patients and healthcare providers. This reduction in commutes directly translates to fewer carbon emissions from vehicles, contributing to a healthier environment. For instance, a 2023 study indicated that telehealth visits can reduce carbon footprints by an average of 89% compared to in-person appointments.

The increasing adoption of virtual care models is a key environmental benefit. It's estimated that widespread telehealth use could lead to a substantial decrease in the healthcare sector's overall environmental impact, aligning with global sustainability goals. In 2024, the telehealth market is projected to continue its robust growth, further amplifying these environmental advantages.

Hims & Hers can leverage sustainable packaging and supply chain practices to enhance its brand image and appeal to environmentally conscious consumers. For instance, in 2024, the global sustainable packaging market was valued at over $300 billion, indicating significant consumer demand for eco-friendly options.

By sourcing biodegradable or recyclable materials for its product shipments and optimizing logistics to reduce carbon emissions, Hims & Hers can align with growing environmental regulations and consumer preferences. Efficient supply chains are crucial; a 2025 report highlighted that companies with robust sustainability initiatives in their supply chains often see operational cost reductions of up to 15%.

The responsible disposal of pharmaceutical waste, including expired or unused medications, is a critical environmental consideration for companies like Hims & Hers involved in drug delivery. Ensuring operations align with best practices for pharmaceutical waste management is paramount to minimizing environmental impact.

In 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize proper disposal methods to prevent contamination of water sources, a concern directly relevant to telehealth pharmacies. For instance, the EPA's National Prescription Drug Take Back Day events in April 2024 collected over 760,000 pounds of unneeded medications, highlighting the scale of the issue and the public's engagement with responsible disposal.

Corporate Social Responsibility Initiatives

Hims & Hers can significantly boost its brand image and attract consumers who prioritize sustainability by expanding its corporate social responsibility (CSR) efforts. This includes establishing clear environmental goals and transparently reporting on progress. For instance, in 2024, many companies in the health and wellness sector are focusing on reducing their carbon footprint, with some aiming for a 20% reduction by 2027.

Engaging in community programs that resonate with health and wellness themes can further strengthen Hims & Hers' connection with its audience. This could involve partnerships with organizations focused on mental health awareness or environmental conservation. As of early 2025, consumer surveys indicate that over 60% of millennials and Gen Z are more likely to support brands with strong CSR commitments.

Key areas for Hims & Hers' CSR initiatives could include:

- Reducing packaging waste: Implementing more sustainable packaging solutions, such as using recycled materials or offering refillable options.

- Supporting health equity: Partnering with non-profits to provide access to healthcare services for underserved communities.

- Promoting sustainable practices: Educating consumers on environmentally friendly health and wellness choices.

Climate Change Impact on Health and Demand for Remote Care

Climate change could indirectly boost the demand for Hims & Hers' remote healthcare services. As extreme weather events and health crises become more frequent, telehealth offers a vital, accessible alternative to traditional in-person care, highlighting its enduring importance.

This trend is likely to accelerate the adoption of virtual care models. For instance, a 2024 report indicated that telehealth utilization remained significantly higher than pre-pandemic levels, with many patients preferring the convenience of remote consultations for various conditions.

- Increased Demand: Growing awareness of climate-related health risks, such as heatstroke or respiratory issues exacerbated by pollution, may lead more individuals to seek virtual medical advice.

- Accessibility: During climate-driven disruptions like floods or wildfires, remote care ensures continuous access to healthcare, a critical factor for patient retention and service expansion.

- Resilience: The ability of telehealth platforms to operate during environmental emergencies positions them as a resilient healthcare solution, attracting users and potentially increasing market share for providers like Hims & Hers.

The shift towards telehealth significantly reduces travel, lowering carbon emissions; telehealth visits can cut carbon footprints by up to 89% compared to in-person appointments, a benefit amplified by the 2024 projected growth in the telehealth market.

Sustainable packaging, valued at over $300 billion globally in 2024, presents an opportunity for Hims & Hers to appeal to environmentally conscious consumers, with efficient supply chains potentially yielding operational cost reductions of up to 15% by 2025.

Responsible pharmaceutical waste disposal is crucial, as highlighted by EPA initiatives in 2024 that collected over 760,000 pounds of unneeded medications, underscoring the need for proper handling by telehealth pharmacies.

Climate change may increase demand for remote healthcare, as extreme weather events make virtual access vital, with telehealth utilization remaining significantly higher post-pandemic in 2024.

PESTLE Analysis Data Sources

Our Hims & Hers Health PESTLE Analysis is built on a foundation of diverse and credible data sources, including regulatory filings from health authorities, market research reports from leading industry analysts, and economic data from reputable financial institutions. This ensures a comprehensive understanding of the external factors influencing the telehealth and wellness sectors.