Hims & Hers Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hims & Hers Health Bundle

Hims & Hers Health navigates a dynamic telehealth landscape, facing moderate threats from new entrants drawn by the sector's growth and significant buyer power from consumers seeking convenient, affordable healthcare solutions. The company's ability to differentiate its offerings and build brand loyalty is crucial in mitigating these pressures.

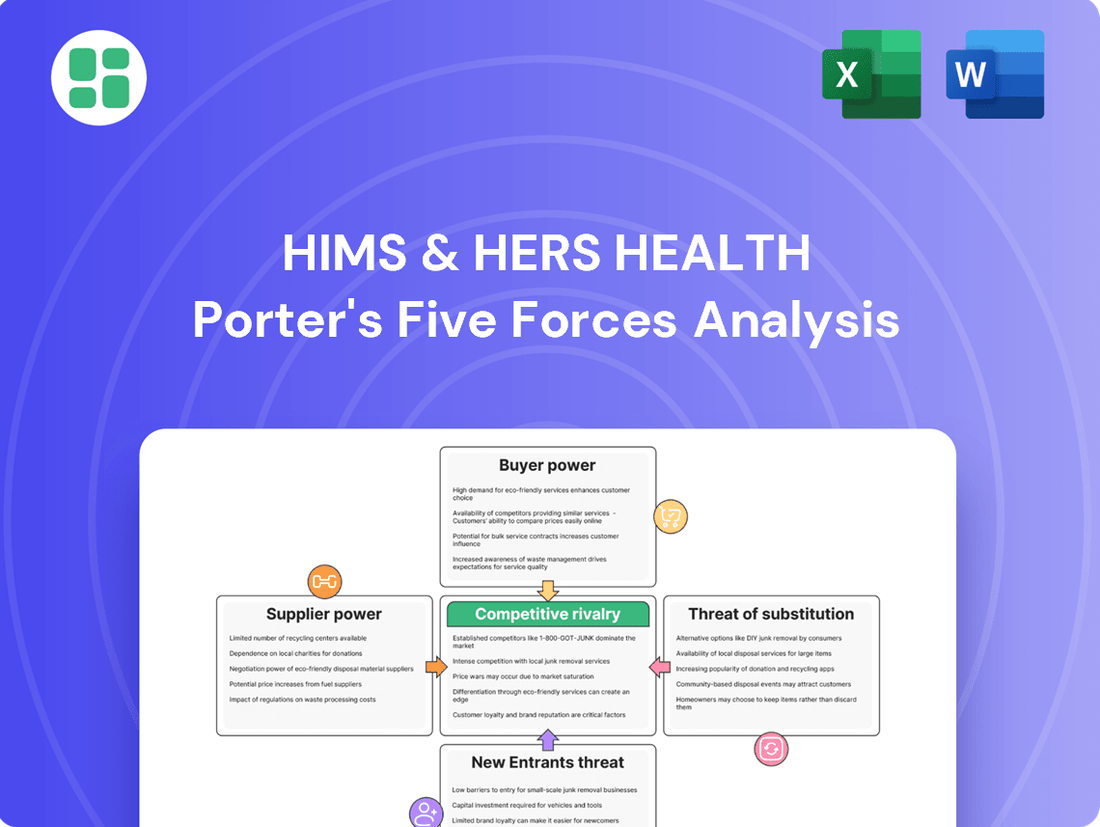

The full analysis reveals the strength and intensity of each market force affecting Hims & Hers Health, complete with visuals and summaries for fast, clear interpretation. Unlock key insights into Hims & Hers Health’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Hims & Hers Health's reliance on pharmaceutical manufacturers and distributors for prescription medications means these suppliers can wield significant bargaining power. This power is particularly pronounced when dealing with patented or specialized drugs, as the market for these is often controlled by a limited number of major producers.

The company's ability to secure favorable pricing is directly tied to its purchasing volume and the presence of generic alternatives for the health conditions it addresses. For instance, if Hims & Hers can negotiate bulk discounts, or if there are readily available and cost-effective generic versions of the medications it prescribes, its leverage increases.

In 2024, the pharmaceutical industry continued to see consolidation, potentially increasing the bargaining power of larger suppliers. However, the ongoing push for telehealth and direct-to-consumer models, like Hims & Hers, also creates opportunities for negotiation, especially as these platforms drive significant patient volume.

The bargaining power of licensed healthcare professionals, such as doctors, nurses, and therapists, is a crucial element for Hims & Hers. Their platform fundamentally relies on this network to deliver its core telehealth services. If there's a scarcity of telehealth-qualified practitioners, or if these professionals show a strong inclination towards specific platforms, their leverage increases significantly.

To counter this, Hims & Hers needs to ensure it offers attractive compensation packages and fosters a positive work environment. This strategy is vital for both attracting new talent and retaining existing healthcare providers. For instance, in 2023, the demand for telehealth services continued to surge, placing greater emphasis on the availability and retention of qualified professionals across the industry.

Hims & Hers relies on technology and software providers for its telehealth operations, encompassing electronic health records (EHR), video conferencing, and cybersecurity. The specialized nature of healthcare technology can grant these vendors significant leverage, especially given the potential costs and complexities associated with switching platforms.

The bargaining power of these tech suppliers is amplified by the critical nature of their services; a disruption could severely impact Hims & Hers' ability to deliver care. For instance, the market for specialized healthcare IT solutions is projected to grow, with the global digital health market expected to reach over $660 billion by 2025, indicating strong demand for advanced platforms.

Furthermore, the rapid integration of artificial intelligence (AI) into healthcare is increasing the demand for sophisticated, specialized tech solutions, potentially giving providers of these advanced services greater negotiating power with companies like Hims & Hers.

Logistics and Delivery Partners

Hims & Hers Health relies heavily on third-party logistics and shipping partners for getting its medications and wellness products directly to customers. This dependence means the bargaining power of these delivery providers can significantly impact the company's costs and operational efficiency. The scale of Hims & Hers' operations plays a crucial role; larger volumes generally translate to more favorable pricing from logistics companies.

However, the competitive nature of the last-mile delivery market also influences this dynamic. If Hims & Hers primarily uses a few dominant carriers, those carriers gain increased leverage. Efficient and timely fulfillment is absolutely essential for maintaining customer satisfaction, making reliable delivery partners a critical component of the business model. For example, in 2024, the global last-mile delivery market was valued at approximately $200 billion, with significant growth driven by e-commerce, highlighting the importance of these partnerships.

- Dependence on Third Parties: Hims & Hers outsources its direct-to-consumer delivery, making it reliant on external logistics providers.

- Market Dynamics: The bargaining power of logistics partners is shaped by the competitiveness of the last-mile delivery sector.

- Volume Discounts: Higher shipping volumes can allow Hims & Hers to negotiate better rates with carriers.

- Carrier Concentration Risk: Over-reliance on a limited number of major shipping companies can increase their bargaining power.

Compounding Pharmacies

Hims & Hers Health's expansion into compounded medications, especially for weight loss, highlights the critical role of compounding pharmacies. By acquiring its own 503A and 503B compounding facilities, Hims & Hers is vertically integrating its operations.

This strategic move significantly reduces the bargaining power of external compounding suppliers. For instance, in 2023, the demand for compounded semaglutide, a key weight loss medication, surged, increasing the leverage of independent compounding pharmacies. Hims & Hers' acquisition aims to mitigate this by controlling its supply chain.

- Vertical Integration: Hims & Hers is bringing compounding in-house, reducing reliance on third-party pharmacies.

- Cost Reduction: By owning facilities, the company anticipates lower costs associated with producing specialized medications.

- Supply Chain Control: Direct ownership enhances Hims & Hers' ability to manage the availability and quality of compounded treatments.

- Market Responsiveness: In-house compounding allows for quicker adaptation to changing patient needs and market trends for popular treatments.

The bargaining power of suppliers for Hims & Hers Health is notably influenced by the pharmaceutical industry's structure and the specialized nature of healthcare. For instance, in 2024, the pharmaceutical sector continued to see consolidation, potentially strengthening the negotiating position of larger drug manufacturers and distributors, especially for patented or specialized medications. This reliance on a limited number of producers for key treatments can give suppliers significant leverage over pricing and terms.

However, Hims & Hers' growing scale and its focus on direct-to-consumer telehealth models can also create opportunities for more favorable negotiations. The company's ability to secure competitive pricing is often tied to its purchasing volume and the availability of generic alternatives for the conditions it treats. For example, in 2023, the increasing demand for telehealth services highlighted the importance of efficient supply chain partnerships, allowing companies like Hims & Hers to negotiate better terms with providers who value their patient volume.

The company's strategic move to acquire compounding pharmacies in 2023 significantly mitigates the bargaining power of external compounding suppliers, particularly for high-demand treatments like compounded semaglutide. This vertical integration provides greater control over costs and supply, reducing dependence on third-party pharmacies and enhancing market responsiveness.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Hims & Hers | Mitigation Strategies |

| Pharmaceutical Manufacturers/Distributors | Limited number of producers for specialized drugs, industry consolidation (2024) | Potential for higher drug costs, supply chain risks | Negotiating volume discounts, exploring generic alternatives, vertical integration (compounding) |

| Healthcare Professionals (Telehealth Providers) | Scarcity of qualified practitioners, platform preference | Increased labor costs, potential service disruptions | Attractive compensation, positive work environment, expanding provider network |

| Technology & Software Providers | Specialized nature of healthcare IT, critical service dependency | High switching costs, potential for increased software fees | Standardizing platforms, negotiating long-term contracts, exploring open-source solutions |

| Logistics & Shipping Partners | Competitiveness of last-mile delivery, carrier concentration | Fluctuating shipping costs, reliance on delivery timeliness | Leveraging shipping volume for discounts, diversifying carrier relationships |

What is included in the product

This analysis dissects Hims & Hers Health's competitive environment by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Effortlessly visualize the competitive landscape of telehealth, identifying key pressures to inform Hims & Hers' strategic responses.

Customers Bargaining Power

Customers seeking non-urgent care, such as for hair loss or sexual health, often exhibit high price sensitivity. This means they are more likely to shop around for the best deals. In 2023, the telehealth market saw significant growth, with companies competing fiercely on price, putting pressure on providers like Hims & Hers to remain competitive.

This price sensitivity gives consumers considerable bargaining power. They can easily switch to a competitor if Hims & Hers' pricing for its subscription services or individual treatments is perceived as too high compared to other available options. For instance, a consumer might compare the monthly cost of Hims & Hers' hair loss treatment with a similar offering from a competitor or even over-the-counter solutions.

Hims & Hers attempts to mitigate this by offering bundled services and transparent pricing through its subscription model. This strategy aims to create a perceived value proposition that goes beyond just the cost of individual treatments, encouraging customer loyalty and reducing the ease with which customers can switch based solely on price. The company reported that in Q1 2024, its subscriber base continued to grow, indicating some success in this strategy.

For many of the health concerns Hims & Hers addresses, such as hair loss or erectile dysfunction, the cost for customers to switch to a competitor or traditional in-person care is minimal. This low barrier to entry means patients can readily explore alternative providers if they discover better pricing, more convenient service options, or a physician they connect with more. This ease of movement significantly amplifies customer bargaining power.

The telehealth market is experiencing significant growth, with projections indicating a substantial expansion in the coming years. For instance, the global telehealth market was valued at approximately $130 billion in 2022 and is expected to reach over $600 billion by 2030, demonstrating a compound annual growth rate of around 20%. This rapid expansion fuels competition, providing consumers with a wealth of options for virtual healthcare services.

This increasing availability of telehealth providers directly amplifies the bargaining power of customers. With numerous platforms offering comparable services, consumers can readily switch to competitors if Hims & Hers fails to meet their expectations regarding price, quality of care, or convenience. In 2024, the ease of comparing services and pricing across different telehealth companies empowers individuals to negotiate for better terms or seek out providers who offer more attractive value propositions.

Access to Information and Reviews

Customers today are incredibly well-informed, thanks to the vast amount of information available online. They can easily access reviews, compare different telehealth providers, and see direct-to-consumer marketing from companies like Hims & Hers. This transparency means they can make smarter choices about what services fit their needs and budget.

This heightened customer awareness puts pressure on companies to offer competitive pricing and a superior customer experience. For Hims & Hers, this means a strong focus on building a positive brand reputation and ensuring high levels of customer satisfaction are maintained. In 2023, customer reviews and online sentiment played a significant role in shaping brand perception across the telehealth sector.

The bargaining power of customers is amplified by:

- Easy access to online reviews and comparison platforms.

- Direct-to-consumer marketing providing clear value propositions.

- The ability to switch between providers based on price and service quality.

- Increased transparency in pricing and service offerings.

Desire for Personalized and Convenient Care

Customers today are looking for more than just basic healthcare; they want personalized experiences and the ease of receiving care on their own terms. This desire for convenience and tailored treatments is a significant factor influencing the bargaining power of consumers in the healthcare market.

Hims & Hers Health is strategically positioned to meet this demand. By offering customized treatment plans and leveraging technology like its AI-driven MedMatch system for personalized recommendations, the company directly addresses the customer's wish for individualized care. The direct-to-consumer model further enhances this convenience, allowing seamless access to services and products.

However, the effectiveness of this personalization is key. If customers don't perceive the tailored aspects of Hims & Hers' offerings as truly unique or demonstrably superior to alternatives, their bargaining power remains substantial. For instance, if competitors can easily replicate personalized digital consultations or direct-to-consumer delivery, customers can readily switch, putting pressure on Hims & Hers to continuously innovate and deliver perceived value.

- Customer Demand for Personalization: A 2024 survey indicated that over 70% of consumers value personalized healthcare experiences, citing improved outcomes and satisfaction.

- Hims & Hers' Strategy: The company's platform is built around tailoring treatments, with services like personalized prescription management and virtual consultations aiming to capture this market segment.

- Potential for Commoditization: Despite personalization efforts, if core services like prescription delivery become standard across the industry, customers can easily compare prices and switch providers, increasing their bargaining power.

- Impact of AI in Healthcare: AI tools like MedMatch are designed to enhance personalization, but their perceived effectiveness by consumers will dictate their ability to mitigate customer bargaining power.

Customers in the telehealth space, particularly for non-urgent needs like hair loss or sexual health, are highly price-sensitive and actively compare options. This sensitivity significantly boosts their bargaining power, as they can easily switch to competitors offering better value. The expanding telehealth market, projected to grow substantially in the coming years, further intensifies competition, giving consumers more choices and leverage.

Hims & Hers counters this by focusing on bundled services and a transparent subscription model to foster loyalty. However, the low cost of switching providers means customers can readily move if they find better pricing or more convenient services elsewhere. This ease of transition amplifies their ability to negotiate or seek out more attractive offerings, a trend evident in the competitive landscape of 2024.

The increasing availability of telehealth providers directly amplifies customer bargaining power. With numerous platforms offering comparable services, consumers can readily switch to competitors if Hims & Hers fails to meet their expectations regarding price, quality of care, or convenience. In 2024, the ease of comparing services and pricing across different telehealth companies empowers individuals to negotiate for better terms or seek out providers who offer more attractive value propositions.

The bargaining power of customers is amplified by easy access to online reviews, direct-to-consumer marketing, the ability to switch providers based on price and service quality, and increased transparency in offerings.

| Factor | Impact on Hims & Hers | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High, leading to easy switching | Continued focus on competitive pricing in telehealth |

| Availability of Alternatives | Increases customer leverage | Rapid growth in telehealth providers |

| Switching Costs | Low for consumers | Minimal barriers to entry for new telehealth services |

| Information Accessibility | Empowers informed decision-making | Rise of comparison sites and detailed online reviews |

Same Document Delivered

Hims & Hers Health Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Hims & Hers Health, offering a deep dive into the competitive landscape of their telehealth and wellness services. The document you see here is precisely what you'll receive immediately after purchase, providing actionable insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. You can trust that this professionally crafted analysis is ready for your immediate use, with no hidden placeholders or missing sections.

Rivalry Among Competitors

The telehealth landscape is incredibly crowded, with a multitude of companies vying for market share. This intense competition means that many providers offer very similar online consultation and prescription services, creating a crowded marketplace for various health needs.

Competitors vary widely, from niche players focusing on specific areas like mental health or dermatology, to larger, more established telehealth giants such as Teladoc Health and Amwell. For instance, in 2023, the global telehealth market was valued at approximately $117.7 billion, highlighting the significant number of participants and the intense battle for customers.

This high level of rivalry naturally leads to considerable pressure on pricing strategies and a constant need for service differentiation. Companies must work harder to stand out and attract patients in a market where switching costs are often low.

The telehealth market is booming, with projections indicating it will reach USD 227.18 billion by 2025. This rapid expansion, growing at an annual rate of 11.83%, is a magnet for new companies and substantial investments.

This influx of capital and new participants intensifies competition. Established players and emerging startups are locked in a continuous battle for market share, driving aggressive marketing campaigns and a relentless pursuit of innovation.

Customers can easily switch between telehealth providers because the barriers to entry are low. This means companies like Hims & Hers have to work hard to keep their customers happy and to attract new ones. They do this by offering a better experience, unique services, and good prices.

The ease of switching for customers directly fuels intense competition in the telehealth market. For instance, in 2024, the telehealth sector continued to see numerous new entrants, many focusing on niche services, further fragmenting the market and increasing customer choice. This necessitates ongoing investment in customer retention strategies and marketing to stand out.

Product and Service Differentiation Efforts

Hims & Hers is actively differentiating its offerings to lessen the intensity of competition. They are moving beyond simple telehealth consultations by providing personalized treatment plans and incorporating mental health services into their telehealth model. This focus on unique value propositions aims to reduce the pressure of competing solely on price.

The company is also expanding into new health areas, such as weight management programs, further distinguishing its service portfolio. For instance, by the end of 2023, Hims & Hers reported a significant increase in their subscription base, with a notable portion attributed to new service lines beyond their initial hair loss and ED offerings, indicating successful differentiation.

- Personalized Treatment Plans: Tailoring care based on individual patient needs.

- Integrated Mental Health: Offering combined physical and mental wellness support.

- Expansion into New Categories: Broadening services to include areas like weight management, capturing a wider market.

- Subscription Growth: Hims & Hers saw its subscriber count grow substantially through 2023, with new service lines playing a key role in this expansion, demonstrating the effectiveness of their differentiation strategy in attracting and retaining customers.

Aggressive Marketing and Customer Acquisition

The telehealth sector, characterized by low customer switching costs and a crowded marketplace, sees intense competition driving aggressive marketing and customer acquisition efforts. This often translates into higher advertising expenditures, potentially squeezing profit margins for players like Hims & Hers. In 2023, for instance, the digital health market saw significant investment in customer acquisition, with many companies allocating substantial portions of their budgets to online advertising and promotional campaigns to stand out.

Hims & Hers' success hinges on its capacity to acquire customers efficiently amidst this competitive churn. For example, in Q1 2024, the company reported a customer acquisition cost (CAC) that it aims to keep competitive through optimized digital marketing strategies. The pressure to constantly attract new users means that staying ahead requires innovative approaches to reach and convert potential customers without overspending.

- High Marketing Spend: Telehealth companies often invest heavily in digital advertising, social media marketing, and influencer partnerships to gain visibility.

- Customer Acquisition Cost (CAC): The cost to acquire a new customer is a critical metric, and its management is vital for profitability.

- Brand Building: Beyond direct acquisition, companies focus on building strong brands to foster loyalty and reduce reliance on continuous, costly acquisition efforts.

- Promotional Offers: Discounts, introductory offers, and referral programs are common tactics used to attract new users in this competitive landscape.

The telehealth market is intensely competitive, with numerous providers offering similar services, leading to significant pressure on pricing and a constant need for differentiation. The global telehealth market, valued at approximately $117.7 billion in 2023, is projected to reach $227.18 billion by 2025, attracting many new entrants and substantial investment, further intensifying rivalry.

Low customer switching costs mean companies like Hims & Hers must focus on customer retention through superior experience, unique services, and competitive pricing. In 2024, new niche players continued to enter the market, increasing customer choice and requiring ongoing investment in marketing and customer loyalty initiatives.

Hims & Hers differentiates by offering personalized treatment plans and integrated mental health services, moving beyond basic telehealth. Their expansion into areas like weight management, supported by substantial subscriber growth in 2023 attributed to these new lines, demonstrates a successful strategy to mitigate direct competitive pressures.

The fierce competition necessitates high marketing spend and efficient customer acquisition, with companies allocating significant budgets to digital advertising. Managing customer acquisition costs (CAC) is crucial for profitability, as seen in Q1 2024, where Hims & Hers focused on optimizing digital marketing to maintain a competitive CAC.

| Metric | 2023 Value (Approx.) | 2024 Trend | Impact on Hims & Hers |

|---|---|---|---|

| Global Telehealth Market Value | $117.7 Billion | Continued Growth | Increased competitive landscape |

| Projected Market Value (2025) | $227.18 Billion | Strong upward trajectory | Opportunity for expansion, but also more competition |

| Customer Acquisition Cost (CAC) | Varies by company | Focus on optimization | Need for efficient marketing strategies |

SSubstitutes Threaten

The most significant substitute for Hims & Hers' telehealth services remains traditional in-person healthcare, encompassing doctor visits and physical pharmacy pickups. For many medical conditions, particularly those necessitating a physical examination or intricate diagnostic procedures, in-person care continues to be the preferred or even the only viable option.

Furthermore, a notable segment of the patient population values the personal connection and reassurance derived from face-to-face interactions with healthcare providers. This preference can act as a constraint on the complete adoption of telehealth solutions, as it highlights a limitation for Hims & Hers in fully capturing market share where such personal interaction is paramount.

In 2023, telehealth utilization saw a slight decrease from its pandemic peaks but remained significantly elevated compared to pre-pandemic levels, with an estimated 37% of Americans using telehealth services at least once. This indicates that while convenient, the inherent limitations of remote care for certain conditions and patient preferences still drive a substantial portion of the market towards traditional healthcare models.

The threat of substitutes for Hims & Hers is significant, particularly from over-the-counter (OTC) medications and supplements. For common concerns like hair loss or minor skin issues, consumers can easily find readily available alternatives. These OTC options often bypass the need for a prescription or consultation, directly competing with Hims & Hers' telehealth model for less severe conditions.

Consumers increasingly explore lifestyle changes and home remedies as alternatives to conventional medical treatments for various health and wellness issues. For instance, a significant portion of the population actively seeks out dietary adjustments, exercise routines, and stress-reduction techniques as primary methods for managing conditions like anxiety or improving overall well-being. This trend presents a potential substitute for services like those offered by Hims & Hers, particularly in areas where their offerings overlap with preventative or lifestyle-focused wellness.

The growing popularity of self-care and natural health solutions means that individuals might bypass prescription medications or professional consultations for more accessible, DIY approaches. This is especially true for less severe conditions or for those prioritizing holistic health. For example, reports from 2024 indicate a surge in searches for natural remedies for sleep disturbances and mild skin irritations, areas where Hims & Hers also provides solutions.

Specialty Clinics and Wellness Centers

Specialty clinics and wellness centers present a significant threat of substitution for Hims & Hers Health. These physical locations, focusing on areas like dermatology, sexual health, or mental wellness, offer a more traditional and hands-on approach to care. For consumers who value in-person interaction and a dedicated, specialized environment, these clinics can be a compelling alternative to Hims & Hers' telehealth model.

The appeal of these substitutes lies in their ability to provide a deeply immersive experience, which virtual platforms may not fully replicate. This is particularly relevant for conditions requiring physical examination or a more personal touch. For instance, the global telehealth market, while growing, still sees a strong preference for in-person consultations in certain medical specialties.

Hims & Hers is actively mitigating this threat by developing strategic partnerships that facilitate in-person referrals. This approach acknowledges the value consumers place on both virtual convenience and specialized, physical care, aiming to bridge the gap and retain customers within their ecosystem.

- Specialty Clinics: Offer focused, in-person care for specific health needs.

- Immersive Experience: Provide a hands-on approach that virtual services may not fully match.

- Consumer Preference: Some individuals prefer traditional, specialized medical settings.

- Hims & Hers Strategy: Partnerships for in-person referrals aim to address this substitution threat.

Pharmacy-Based Clinics and Services

Pharmacies are increasingly offering convenient health services, acting as a significant substitute threat to Hims & Hers. These in-person clinics provide basic health screenings, vaccinations, and consultations for minor ailments, offering a readily accessible, local alternative for consumers seeking quick care without the full telehealth commitment. For instance, CVS Health's MinuteClinic has seen substantial patient volumes, with millions of visits annually for services like flu shots and treatment for common colds, directly competing with Hims & Hers for acute care needs.

This trend poses a direct challenge by providing a familiar and easily accessible point of care. The convenience of walk-in services at pharmacies can draw consumers away from the digital-first approach of telehealth providers, especially for non-chronic conditions. By 2024, the number of retail clinics in the U.S. is projected to continue its steady growth, further solidifying their position as a viable substitute.

- Increased Accessibility: Pharmacies offer walk-in convenience, reducing the need for appointments.

- Broad Service Offering: Basic screenings, vaccinations, and minor ailment consultations are common.

- Consumer Familiarity: Established pharmacy brands build trust and encourage patronage.

- Cost-Effectiveness: For certain services, pharmacy clinics can be perceived as more affordable than specialized telehealth.

The threat of substitutes for Hims & Hers is substantial, with traditional in-person healthcare remaining a primary alternative, especially for conditions requiring physical examination. Many patients also value the personal connection offered by face-to-face consultations, a factor telehealth platforms may not fully replicate. While telehealth utilization remains high, an estimated 37% of Americans used these services in 2023, indicating that a significant portion of the market still prefers or requires traditional care models.

Over-the-counter medications and lifestyle changes also present a considerable threat. Consumers can easily access readily available OTC options for common issues like hair loss or minor skin conditions, bypassing the need for a consultation. Furthermore, a growing trend sees individuals adopting dietary adjustments, exercise, and stress-reduction techniques as primary methods for managing health, directly competing with Hims & Hers' offerings in preventative and wellness areas.

Specialty clinics and pharmacies offering walk-in services further dilute the market. These physical locations provide focused, hands-on care and convenient access for minor ailments, vaccination, and screenings. For example, CVS Health's MinuteClinic sees millions of visits annually, directly competing for acute care needs. By 2024, the continued growth of retail clinics in the U.S. will solidify their position as accessible substitutes.

| Substitute Type | Key Characteristics | Impact on Hims & Hers | 2023/2024 Data Point |

|---|---|---|---|

| Traditional In-Person Healthcare | Physical examination, personal connection, direct diagnostics | Preferred for complex conditions, patient preference for face-to-face interaction | 37% of Americans used telehealth in 2023, implying a large segment still uses traditional care. |

| Over-the-Counter (OTC) Products | Readily available, no prescription/consultation needed for minor issues | Direct competition for common ailments like hair loss, skin conditions | Searches for natural remedies for sleep and skin issues surged in 2024. |

| Lifestyle & Home Remedies | Dietary changes, exercise, stress reduction, natural approaches | Alternative for preventative and wellness-focused health management | Growing consumer interest in holistic health bypasses professional consultations. |

| Specialty Clinics & Retail Pharmacies | Focused in-person care, walk-in convenience, basic health services | Offers accessible, familiar alternatives for acute care and screenings | CVS Health's MinuteClinic serves millions annually; U.S. retail clinics are projected for steady growth by 2024. |

Entrants Threaten

Entering the telehealth market, like that of Hims & Hers, faces substantial regulatory hurdles. Navigating the patchwork of state-by-state licensing for healthcare providers and telemedicine platforms is a significant barrier. For instance, in 2024, many states continued to refine their telehealth regulations, requiring providers to be licensed in the state where the patient is located, adding complexity for national operators.

Compliance with stringent privacy laws such as HIPAA, coupled with evolving prescribing regulations, particularly for controlled substances, presents a considerable legal and administrative challenge. The Drug Enforcement Administration (DEA) waiver requirements, which saw significant discussion and potential changes in 2024, further illustrate the dynamic and demanding regulatory environment that new entrants must meticulously manage.

Building a sophisticated telehealth platform, like the one Hims & Hers operates, demands substantial capital. This includes investing in secure software, robust cybersecurity measures, and reliable data storage, creating a high barrier to entry for newcomers. For instance, the global telehealth market was valued at over $150 billion in 2023 and is projected to grow significantly, indicating the scale of investment required to compete.

New entrants must also allocate funds for scalable technology capable of managing increasing patient loads and integrating with diverse healthcare systems. This technological investment, coupled with the growing patient expectation for seamless user experiences and integration, presents a considerable financial hurdle for potential competitors looking to enter the telehealth space.

Building a robust network of licensed healthcare professionals is a significant hurdle for new entrants in the telehealth space. Hims & Hers, for example, has invested heavily in attracting and credentialing a vast pool of doctors, nurses, and therapists, a process that requires substantial resources and time to ensure quality care and compliance. By 2024, the demand for telehealth services continued to surge, making the recruitment and retention of qualified professionals even more competitive.

Brand Building and Trust Establishment

In the healthcare sector, particularly for direct-to-consumer brands like Hims & Hers, establishing trust and a strong brand reputation is a significant barrier to entry. New companies must dedicate substantial resources to marketing and patient acquisition to gain visibility and credibility in a competitive landscape.

Existing players have already cultivated brand loyalty over years of operation. For instance, Hims & Hers reported revenue of approximately $1.05 billion for the fiscal year 2023, demonstrating a significant market presence built on established trust. This makes it challenging for newcomers to attract customers away from trusted providers.

- Brand Loyalty: Hims & Hers has built a loyal customer base through consistent service and marketing efforts.

- Marketing Investment: New entrants need considerable capital for marketing to compete with established brands.

- Credibility Gap: Building trust in healthcare takes time, creating a hurdle for new, unproven entities.

- Patient Acquisition Costs: Acquiring new patients in the telehealth space is expensive, impacting profitability for challengers.

Economies of Scale in Prescription Fulfillment and Logistics

Companies like Hims & Hers leverage significant economies of scale in their prescription fulfillment and logistics operations. This allows them to source medications at lower costs and negotiate better rates with delivery services, directly impacting their competitive pricing. For instance, in 2024, major telehealth providers continued to consolidate their supply chains, aiming to reduce per-prescription costs by an estimated 5-10% through increased volume.

New entrants face a substantial hurdle in matching these established economies of scale. Without the same purchasing power and logistical efficiency, they would likely incur higher per-unit costs for both medications and shipping. This cost disadvantage makes it challenging to compete on price with incumbents and could strain early-stage profitability, requiring substantial upfront investment to achieve comparable operational efficiency.

Furthermore, the vertical integration into compounding pharmacies by some players adds another layer to this barrier. This integration provides greater control over product quality and supply, creating a more resilient and potentially cost-effective model that is difficult for new, unintegrated entrants to replicate quickly.

- Economies of Scale: Hims & Hers benefits from bulk purchasing and streamlined logistics, reducing per-unit costs.

- New Entrant Disadvantage: Startups struggle with higher initial costs due to lack of scale in sourcing and delivery.

- Pricing Pressure: The cost gap makes it difficult for new players to compete on price with established telehealth companies.

- Vertical Integration: Control over compounding pharmacies further solidifies the barrier to entry for new competitors.

The threat of new entrants into the telehealth market, particularly for companies like Hims & Hers, is significantly mitigated by high capital requirements. Building a robust platform, securing necessary licenses, and investing in a strong network of healthcare professionals demand substantial financial backing. For example, the global telehealth market's continued growth, projected to exceed $370 billion by 2028, underscores the scale of investment needed to establish a competitive presence.

Existing players, including Hims & Hers, benefit from established brand loyalty and significant marketing investments, creating a credibility gap for newcomers. In 2023, Hims & Hers achieved revenues of approximately $1.05 billion, a testament to their market penetration. New entrants must overcome this entrenched trust and brand recognition, which requires considerable capital for patient acquisition and marketing efforts.

Economies of scale in prescription fulfillment and logistics present another formidable barrier. Hims & Hers leverages its size to negotiate lower costs for medications and delivery, a competitive advantage that new entrants struggle to match. In 2024, many telehealth providers focused on supply chain consolidation, aiming for cost reductions of 5-10% per prescription through increased volume, further widening the cost disadvantage for smaller, newer companies.

| Barrier | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | High investment needed for technology, licensing, and professional networks. | Significant financial hurdle; requires substantial funding to launch and scale. | Global telehealth market valued over $150 billion in 2023. |

| Brand Loyalty & Marketing | Established trust and brand recognition built over time. | Difficult to attract customers from established, trusted providers. | Hims & Hers FY2023 revenue: ~$1.05 billion. |

| Economies of Scale | Lower per-unit costs due to high volume in sourcing and logistics. | Higher initial operating costs compared to incumbents, impacting pricing. | Projected 5-10% cost reduction per prescription via supply chain consolidation in 2024. |

Porter's Five Forces Analysis Data Sources

Our Hims & Hers Porter's Five Forces analysis is built upon a foundation of publicly available data, including Hims & Hers' SEC filings, investor relations reports, and industry-specific market research from firms like Statista and IBISWorld. We also incorporate insights from competitor announcements and relevant trade publications to provide a comprehensive view of the competitive landscape.