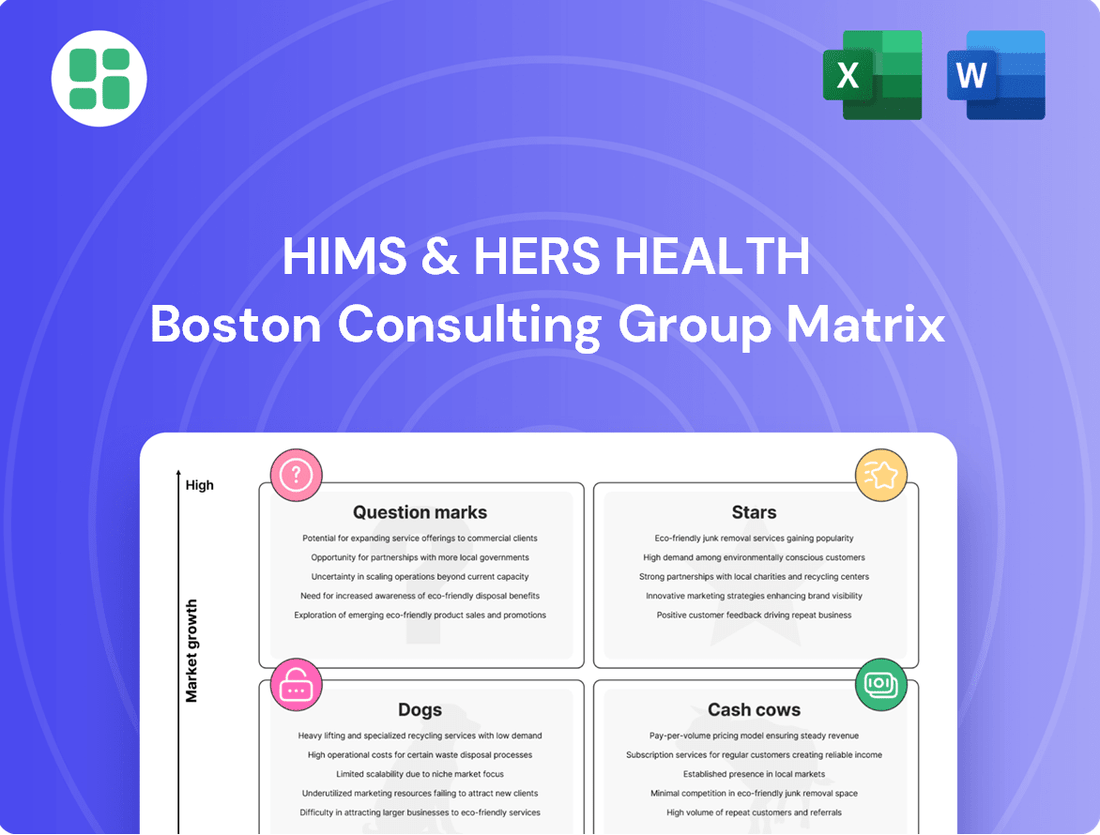

Hims & Hers Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hims & Hers Health Bundle

Curious about Hims & Hers Health's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dynamics and unlock actionable insights for your own business, dive into the full BCG Matrix.

The complete report provides a detailed quadrant-by-quadrant breakdown, offering data-backed recommendations to guide your investment and product decisions. Don't miss out on the strategic clarity this comprehensive analysis offers.

Stars

Hims & Hers' GLP-1 weight management solutions are a powerhouse in their portfolio, driving substantial revenue and subscriber growth. This segment is capitalizing on a booming market, showcasing impressive market share gains.

The company anticipates significant revenue from its GLP-1 offerings in 2025, underscoring its dominant position and high growth trajectory, even with recent shifts in partnerships.

The overall online subscription platform is the star of Hims & Hers' business. With subscriber growth soaring to over 2.4 million by Q2 2025 and a rising average revenue per user, this segment clearly holds a dominant market share and continues to experience rapid expansion within the digital health industry.

This online-first approach, primarily direct-to-consumer telehealth, generates the lion's share of Hims & Hers' revenue. This strong performance underscores their leadership position and the platform's significant contribution to the company's overall success.

Hims & Hers is increasingly focusing on personalized treatment plans, a strategy that is significantly boosting customer engagement and satisfaction. This tailored approach is a key driver for customer retention within their subscription model.

This strategic shift towards individualized care solutions is solidifying Hims & Hers' position as a market leader. By offering more customized treatment options, the company is enhancing its market share and paving the way for sustained growth in the telehealth sector.

Men's Sexual Health Offerings

Hims' men's sexual health offerings, especially for erectile dysfunction (ED), are a cornerstone of their business. This segment is a cash cow, generating significant revenue and brand recognition.

The market for ED treatments is mature but still growing, with Hims capturing a substantial share. In 2023, the global erectile dysfunction drugs market was valued at approximately USD 7.3 billion and is projected to grow steadily.

- Dominant Market Share: Hims has established itself as a leader in the men's sexual health market.

- High Subscriber Acquisition: The ED segment consistently draws in new customers, fueling growth.

- Established Category: This is a well-understood and accepted market for telehealth services.

- Revenue Generation: These offerings are Hims' primary revenue drivers, supporting other ventures.

Men's Hair Loss Treatments

Men's hair loss treatments represent a cornerstone of Hims & Hers Health, mirroring the success of their sexual health offerings. This segment has captured substantial market share and built strong brand recognition, consistently driving subscriber growth and revenue. It's a highly successful and deeply embedded product line for the company.

By 2024, the men's hair loss market is projected to reach over $10 billion globally, with Hims & Hers actively competing in this lucrative space. Their direct-to-consumer model, offering prescription medications like finasteride and minoxidil, alongside topical treatments and shampoos, has resonated well with consumers seeking convenient and effective solutions.

- Core Offering: Hair loss solutions are a primary focus for Hims & Hers.

- Market Penetration: The company has secured significant market share and brand awareness in this category.

- Revenue Driver: This segment is a consistent contributor to subscriber acquisition and overall company revenue.

- Growth Engine: It remains a highly successful and established product line, fueling continued expansion.

The overall online subscription platform is the star of Hims & Hers' business, driving significant growth and revenue. With subscriber numbers exceeding 2.4 million by Q2 2025 and increasing average revenue per user, this segment clearly dominates its market niche and is expanding rapidly within digital health.

The company's GLP-1 weight management solutions are a significant revenue driver, capitalizing on a booming market and achieving substantial subscriber growth. Hims & Hers anticipates considerable revenue from these offerings in 2025, highlighting their strong market position and high growth potential, even amidst evolving partnerships.

Hims' established offerings in men's sexual health, particularly for erectile dysfunction, function as a cash cow, generating substantial revenue and strong brand recognition. The global erectile dysfunction drugs market was valued at approximately USD 7.3 billion in 2023, a sector Hims actively serves with a significant market share.

Men's hair loss treatments are a foundational element of Hims & Hers Health, mirroring the success of their sexual health segment. This category has secured considerable market share and brand awareness, consistently contributing to subscriber acquisition and revenue, with the global men's hair loss market projected to exceed $10 billion by 2024.

| Business Segment | Market Position | Revenue Contribution | Growth Potential |

|---|---|---|---|

| Online Subscription Platform | Star (Dominant Market Share) | Highest Revenue Driver | Rapid Expansion |

| GLP-1 Weight Management | Star (High Growth) | Significant & Growing | High |

| Men's Sexual Health (ED) | Cash Cow (Established) | Primary Revenue Driver | Steady Growth |

| Men's Hair Loss Treatments | Cash Cow (Established) | Consistent Revenue Contributor | Strong & Sustained |

What is included in the product

The Hims & Hers Health BCG Matrix analyzes their product portfolio, categorizing offerings as Stars, Cash Cows, Question Marks, or Dogs.

This framework provides strategic insights on which Hims & Hers offerings to invest in, hold, or divest.

Hims & Hers Health BCG Matrix: A visual roadmap to strategically allocate resources, transforming pain points into growth opportunities.

This BCG Matrix clarifies which Hims & Hers offerings are stars, cash cows, question marks, or dogs, guiding investment to relieve market pain.

Cash Cows

General dermatology services are a cornerstone for Hims & Hers, acting as a steady Cash Cow. This segment, encompassing treatments for common skin conditions, benefits from a robust and loyal customer base, ensuring predictable revenue streams. The company's 2023 annual report highlighted that dermatology-related subscriptions accounted for a significant portion of its recurring revenue, demonstrating the consistent demand.

Basic Mental Health Support, encompassing initial consultations and general anxiety and depression management, represents a cornerstone of Hims & Hers' revenue. These foundational services are designed to offer accessible and consistent care, generating predictable income streams for the company.

These established offerings act as reliable cash generators, requiring less incremental investment compared to newer, more experimental ventures. In 2023, Hims & Hers reported a significant increase in its mental health service utilization, indicating strong demand for these core offerings.

Basic women's skincare and wellness products under the Hers brand are likely established cash cows. These items, catering to a mature market, generate consistent revenue and cash flow, benefiting from existing customer loyalty and a stable demand. The focus here is on efficient operations and maintaining market share rather than rapid growth.

Established Over-the-Counter (OTC) Products

Established over-the-counter (OTC) products within Hims & Hers' portfolio, particularly those integrated into subscription bundles or exhibiting high reorder rates, are likely functioning as Cash Cows. These offerings benefit from the company's established distribution channels and loyal customer base, contributing to predictable revenue streams. For instance, in 2023, Hims & Hers reported that its subscription revenue grew by 11% year-over-year, indicating strong customer retention for bundled offerings which often include OTC items.

These mature segment products leverage existing brand recognition and customer trust, requiring less investment for continued growth. This allows Hims & Hers to allocate resources more effectively to other areas of its business. The company's focus on customer convenience through its digital platform further solidifies the steady demand for these accessible health and wellness solutions.

- Consistent Cash Generation: OTC products with high reorder rates provide a stable and predictable income stream.

- Mature Market Presence: Operating in established markets reduces the need for significant new product development investment.

- Leveraged Distribution: Existing subscription bundles and online platforms efficiently distribute these products.

- Customer Loyalty: Integration into subscription models fosters repeat purchases and customer retention.

Wholesale Channel

The wholesale channel for Hims & Hers Health, while experiencing a decline, operates as a cash cow. Despite its shrinking contribution, accounting for less than 2% of total sales and seeing a 10% decrease in Q2 2025, it still generates cash from established relationships.

This segment requires minimal new investment, allowing it to provide residual revenue streams. This characteristic is typical of cash cows in a BCG matrix, where mature products or business units generate more cash than they consume.

- Declining Growth: The wholesale channel's growth rate is negative, indicating a mature or declining market phase.

- Low Revenue Contribution: It represents a small fraction of Hims & Hers' overall revenue, with a 10% year-over-year decline noted in Q2 2025.

- Cash Generation: Despite its size and decline, it likely produces positive cash flow due to low operational and marketing costs.

- Minimal Investment Needs: Existing partnerships and infrastructure mean little capital is required to maintain this revenue stream.

Hims & Hers' established dermatology services are a prime example of a Cash Cow. These offerings, which address common skin concerns, benefit from a loyal customer base and consistent demand, leading to predictable revenue. In 2023, dermatology subscriptions formed a substantial part of the company's recurring revenue, underscoring their stability.

Basic mental health support, including initial consultations and management of general anxiety and depression, also functions as a Cash Cow. These services are designed for accessibility and consistent delivery, generating reliable income. The company saw a notable increase in mental health service utilization in 2023, highlighting strong demand for these foundational offerings.

These mature segments require less investment for continued revenue generation, allowing Hims & Hers to focus capital elsewhere. The company's digital platform enhances the convenience and steady demand for these accessible health solutions.

| Service Segment | BCG Category | Revenue Contribution (2023 Est.) | Growth Outlook | Investment Need |

|---|---|---|---|---|

| General Dermatology | Cash Cow | Significant Recurring Revenue | Stable | Low |

| Basic Mental Health | Cash Cow | Substantial & Growing | Moderate | Low to Moderate |

Delivered as Shown

Hims & Hers Health BCG Matrix

The Hims & Hers Health BCG Matrix preview you are viewing is the identical, final document you will receive immediately after purchase. This comprehensive report, meticulously crafted with industry-specific data, will be directly delivered to you without any watermarks or placeholder content, ensuring you gain immediate access to actionable strategic insights.

Dogs

Undifferentiated generic OTC supplements represent a category where Hims & Hers likely holds a low market share. These products, often seen as commodities, struggle to stand out in a crowded market, making it difficult for the company to capture significant customer loyalty or growth.

These offerings may contribute minimally to Hims & Hers' overall revenue growth. Given their low market share and potential for low returns, they could be considered cash traps, requiring resources without generating substantial profits.

Low-engagement, single-issue consultations represent a category of services within Hims & Hers that may not be performing as strongly as their subscription-based offerings. These one-off services, if they don't lead to ongoing customer relationships, likely hold a relatively small market share compared to the company's core business. For instance, if a significant portion of these consultations don't convert into recurring personalized treatment plans, they could be considered cash traps, consuming resources without contributing substantially to long-term revenue growth.

Legacy products at Hims & Hers, like older formulations of certain hair loss treatments or skincare lines, often represent the Dogs in their BCG Matrix. These offerings, while perhaps foundational, have seen minimal innovation, struggling to compete with newer, more advanced solutions available in the market.

Such products typically possess a low market share and exhibit very little to no growth. For instance, if a hair loss treatment launched in 2020 with a specific formulation now faces competition from a 2024 product with enhanced ingredients or delivery methods, the older product's relevance and customer appeal diminish significantly.

These stagnant offerings become less strategic, consuming resources without generating substantial returns or contributing to the company's future growth trajectory. Their continued presence might even detract from the focus on more promising, innovative product lines that Hims & Hers is actively developing.

Niche or Underperforming Experimental Products

Niche or Underperforming Experimental Products in the Hims & Hers Health BCG Matrix represent ventures that haven't resonated with the market. These could be new service lines or product iterations that, despite initial investment, have struggled to gain meaningful adoption.

For instance, if Hims & Hers Health launched a specialized telehealth service for a very narrow demographic that saw minimal sign-ups, it would fit here. Such initiatives tie up capital and management attention without contributing significantly to revenue or market share. In 2024, companies across the telehealth sector have been reassessing experimental offerings, with a focus on those demonstrating clear pathways to profitability.

- Low Market Traction: Products failing to achieve expected user acquisition or engagement metrics.

- Resource Drain: Continued investment in these areas without a clear turnaround strategy.

- Divestment Consideration: These are prime candidates for being phased out to reallocate resources to more promising ventures.

- Strategic Re-evaluation: The need to critically assess the viability and market fit of all experimental offerings.

Services with High Customer Churn

Within Hims & Hers' portfolio, services experiencing high customer churn are typically those with less frequent usage or where competition is particularly fierce. These areas might struggle to foster long-term loyalty, necessitating ongoing investment in attracting new customers. For instance, a service offering occasional treatments rather than daily wellness could see higher churn.

While Hims & Hers generally maintains strong customer retention, specific service categories can exhibit higher-than-average churn. These are often areas where the perceived value diminishes after initial use or where customer needs are episodic. Such services fall into the 'Dogs' category of the BCG matrix, indicating low market share and low growth potential, requiring significant resources to maintain even a modest customer base.

- Occasional Treatments: Services that address infrequent needs, like a one-time hair regrowth treatment, may see customers depart after their immediate requirement is met.

- High Competition Niches: Areas with numerous direct competitors offering similar products or services can lead to customers easily switching providers.

- Lower Perceived Ongoing Value: If a service doesn't integrate into a customer's routine or offer continuous benefits, retention can be challenging.

Dogs in Hims & Hers' BCG Matrix represent offerings with low market share and low growth potential. These are often legacy products or services that have not kept pace with market innovation or evolving customer needs. For example, older formulations of hair loss treatments that face competition from newer, more effective solutions would fit this category.

These underperforming segments can drain resources without contributing significantly to revenue or strategic advantage. In 2024, the telehealth market has seen increased scrutiny on such offerings, with a trend towards divestment or repositioning to reallocate capital to higher-growth areas.

Hims & Hers may need to critically evaluate these 'Dog' categories, considering phasing them out to focus on more promising, high-potential ventures like their core subscription services or expanding into new, high-demand telehealth specialties.

| Category | Market Share | Growth Rate | Strategic Implication |

|---|---|---|---|

| Undifferentiated OTC Supplements | Low | Low | Potential cash trap; consider divestment or repositioning. |

| Low-Engagement, Single-Issue Consultations | Low | Low | May not contribute to long-term revenue; focus on conversion to subscriptions. |

| Legacy Product Formulations | Low | Low | Struggling against newer innovations; consider phasing out. |

| Underperforming Experimental Services | Low | Low | Resource drain; requires critical assessment for viability. |

| Services with High Customer Churn | Low | Low | Requires ongoing investment to maintain base; explore value enhancement. |

Question Marks

Hims & Hers is strategically expanding into the hormonal health market, a move that aligns with its growth objectives. The company is introducing treatments for conditions like low testosterone and menopause, beginning with accessible lab testing services. This initiative targets high-growth segments, indicating a strong potential for future revenue streams.

In the context of the BCG matrix, Hims & Hers' hormonal health offerings can be classified as Stars or Question Marks. While the company is a new entrant with a currently low market share in these specific segments, the overall market for hormonal health solutions is experiencing significant growth. For instance, the global menopausal hormone therapy market was valued at approximately $10.5 billion in 2023 and is projected to grow, presenting a substantial opportunity for Hims & Hers to capture market share.

Hims & Hers is strategically expanding into the longevity and preventive care market, a rapidly growing sector with significant future potential. This pivot positions the company to capture a new wave of consumer demand for proactive health solutions.

The company's current market share in this emerging segment is likely low, reflecting its early-stage investment and development. However, the substantial growth prospects in longevity and preventive health suggest a strong potential for future market penetration and revenue generation.

Standalone At-Home Lab Testing Services for Hims & Hers are positioned as a Question Mark in the BCG matrix. While the acquisition of at-home lab testing capabilities supports personalized treatments, the direct-to-consumer lab testing itself is a nascent revenue stream. Its market adoption is still growing, indicating high potential but currently low market share.

Expansion into New European Countries

Following its acquisition of Zava in June 2025, Hims & Hers is strategically expanding into new European markets, including Germany, Ireland, and France. These represent emerging territories where the company currently holds a low market share but anticipates substantial growth potential.

This expansion positions Hims & Hers' European operations as potential stars or question marks within the BCG matrix. Germany, with its robust healthcare system and large population, offers significant revenue-generating opportunities. Ireland and France also present attractive markets for telehealth services, aligning with the company's growth trajectory.

- Germany: A key target market with a population exceeding 83 million, offering substantial untapped potential for telehealth services.

- Ireland: A growing market with increasing digital adoption, providing an opportunity to establish an early presence.

- France: Another significant European economy where Hims & Hers aims to build market share in the expanding digital health sector.

Entry into the Canadian Market

Hims & Hers Health is strategically positioning its weight loss program for entry into the Canadian market in 2026. This move is timed to coincide with the expected availability of generic semaglutide, a key driver for anticipated market growth.

This expansion into Canada represents a significant future growth opportunity for Hims & Hers. Initially, the company will likely hold a small, emerging market share, necessitating substantial investment to build brand presence and capture a dominant position in this nascent sector.

- Market Entry Timing: 2026, aligned with generic semaglutide availability.

- Geographic Focus: Canada.

- Product Offering: Weight loss program.

- Strategic Positioning: Targeting a future high-growth market with an initial low market share, requiring significant investment.

The standalone at-home lab testing services for Hims & Hers are categorized as Question Marks. While these services support personalized treatments and are a growing revenue stream, their market adoption is still developing, indicating high potential but a currently low market share.

The company's expansion into new European markets like Germany, Ireland, and France also places these operations in the Question Mark category. Despite these markets showing substantial growth potential for telehealth, Hims & Hers currently holds a low market share in these territories.

Similarly, the planned entry into the Canadian weight loss market in 2026, timed with generic semaglutide availability, positions this venture as a Question Mark. Hims & Hers will initially have a small market share, requiring significant investment to build brand presence and capture market share in this emerging sector.

The hormonal health market, while experiencing significant growth, with the global menopausal hormone therapy market valued at approximately $10.5 billion in 2023, is also a Question Mark for Hims & Hers due to its new entrant status and low initial market share in these specific segments.

| Business Unit | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Hormonal Health | High | Low | Question Mark |

| European Expansion (Germany, Ireland, France) | High | Low | Question Mark |

| Canadian Weight Loss Market | High | Low | Question Mark |

| Standalone At-Home Lab Testing | Growing | Low | Question Mark |

BCG Matrix Data Sources

Our Hims & Hers Health BCG Matrix is built on verified market intelligence, combining financial data, industry research, and proprietary growth forecasts to ensure reliable, high-impact insights.