Hilton Grand Vacations SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Grand Vacations Bundle

Hilton Grand Vacations leverages its strong brand recognition and extensive resort portfolio, but faces challenges in adapting to evolving consumer travel preferences and intense competition. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Hilton Grand Vacations' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hilton Grand Vacations (HGV) enjoys a powerful advantage through its association with the Hilton brand, consistently ranked among the top hotel brands globally. This strong brand equity translates directly into consumer trust and broad customer appeal, tapping into Hilton's long-standing reputation for excellence in hospitality services.

This affiliation provides HGV with a significant competitive edge, particularly in marketing efforts and the crucial process of acquiring new customers. In 2023, Hilton Hotels & Resorts maintained its position as a leading global hospitality brand, a testament to the enduring appeal and recognition that HGV leverages.

Hilton Grand Vacations (HGV) showcases a robust and diverse portfolio, featuring premium vacation ownership resorts in sought-after locations across the United States, the Caribbean, and Europe. This broad selection provides members with a wealth of travel choices and adaptable vacation opportunities, catering to a wide array of preferences.

The strategic acquisition of Bluegreen Vacations in early 2024 significantly bolstered HGV's global presence and member base. This move integrated approximately 200,000 new members and introduced HGV to 14 additional geographic markets, enhancing its reach and competitive standing.

Hilton Grand Vacations boasts a formidable Club Member base, exceeding 725,000 individuals. This extensive network signifies a deep well of customer loyalty, a critical asset in the hospitality sector.

The company's commitment to member satisfaction is evident through its tiered loyalty program, including the HGV Max initiative. These programs are instrumental in driving repeat business, as they offer compelling value propositions that encourage continued engagement and spending.

These robust loyalty programs are designed to cultivate enduring relationships with members, ensuring a consistent and predictable revenue stream. By providing exclusive benefits and personalized experiences, Hilton Grand Vacations effectively fosters long-term customer retention.

Strong Financial Performance and Liquidity

Hilton Grand Vacations (HGV) showcases impressive financial strength, evidenced by its robust revenue figures. For the first quarter of 2025, the company reported total revenues of $1.148 billion, building on a strong performance in the full year 2024, which saw revenues reach $5 billion. This consistent revenue generation highlights the company's ability to navigate market dynamics effectively.

The company's liquidity position is equally noteworthy. HGV maintains a healthy current ratio, indicating its capacity to meet short-term obligations. Furthermore, a substantial contract sales pipeline provides a reliable stream of future revenue, bolstering its financial stability and operational flexibility.

Strategic initiatives are in place to further enhance HGV's financial health. The Financing Business Optimization program is specifically designed to improve free cash flow generation. This increased cash flow is anticipated to provide greater capacity for capital allocation, including supporting share repurchase programs, which can benefit shareholder value.

- Strong Revenue Growth: $1.148 billion in Q1 2025 revenues and $5 billion for the full year 2024.

- Healthy Liquidity: Demonstrated by a robust current ratio.

- Sales Pipeline: Significant contract sales pipeline ensures future revenue streams.

- Cash Flow Enhancement: Financing Business Optimization program aims to boost free cash flow.

Flexible Ownership Models

Hilton Grand Vacations (HGV) excels with its flexible ownership models, offering deeded, points-based, and floating week options. This variety caters to diverse consumer preferences, allowing members to customize vacation timing, location, and duration, which is crucial in today's travel market. The points system, a key component, unlocks access to a wider range of destinations within HGV's extensive portfolio, enhancing member value and appeal.

This adaptability is a significant strength, as demonstrated by the growing demand for personalized travel experiences. For instance, in 2023, HGV continued to see strong engagement with its points-based offerings, reflecting a broader industry trend. This flexibility directly supports member retention and attracts new buyers seeking tailored vacation solutions.

- Deeded Ownership: Provides a specific week or unit at a particular resort.

- Points-Based System: Offers greater flexibility in choosing resorts, seasons, and unit sizes.

- Floating Week Options: Allows reservation of a specific unit type during a designated season.

Hilton Grand Vacations leverages the immense power of the Hilton brand, a globally recognized leader in hospitality, which translates into significant customer trust and broad market appeal. This strong brand association is a key driver for customer acquisition and marketing efforts, as evidenced by Hilton Hotels & Resorts' consistent top rankings in 2023.

The company boasts a diverse and premium portfolio of vacation ownership resorts strategically located in desirable destinations across the United States, Caribbean, and Europe, offering members extensive travel choices. The acquisition of Bluegreen Vacations in early 2024 further expanded this portfolio, adding approximately 200,000 members and reaching 14 new markets.

HGV's substantial member base, exceeding 725,000 individuals, underscores a deep foundation of customer loyalty. This is further reinforced by robust loyalty programs like HGV Max, designed to drive repeat business and foster long-term member engagement through valuable offerings.

Financially, HGV demonstrates strength with $1.148 billion in Q1 2025 revenues, building on $5 billion in full-year 2024 revenues, supported by healthy liquidity and a strong contract sales pipeline. Initiatives like the Financing Business Optimization program aim to enhance free cash flow, supporting capital allocation and shareholder value.

| Strength | Description | Supporting Data/Fact |

| Brand Equity | Leverages the globally recognized Hilton brand for trust and appeal. | Hilton Hotels & Resorts consistently ranked top globally in 2023. |

| Diverse Portfolio & Expansion | Offers premium resorts in prime locations, enhanced by strategic acquisitions. | Acquisition of Bluegreen Vacations added ~200,000 members and 14 new markets in early 2024. |

| Loyalty & Member Base | Extensive member base and strong loyalty programs drive repeat business. | Over 725,000 members, with programs like HGV Max fostering engagement. |

| Financial Performance | Demonstrates robust revenue, liquidity, and cash flow enhancement initiatives. | $1.148 billion Q1 2025 revenue; $5 billion full-year 2024 revenue. |

What is included in the product

Delivers a strategic overview of Hilton Grand Vacations’s internal and external business factors, highlighting its strong brand, loyalty programs, and resort portfolio while acknowledging potential economic sensitivities and competitive pressures.

Identifies critical market vulnerabilities and internal weaknesses to proactively address potential disruptions and capitalize on emerging opportunities.

Weaknesses

Timeshare purchases, including those from Hilton Grand Vacations (HGV), come with substantial initial price tags, with many properties averaging between $20,000 and $60,000 or more for premium options. These significant upfront investments can deter many potential buyers from entering the market.

Beyond the purchase price, ongoing annual maintenance fees present another considerable financial commitment, and these fees have been steadily climbing, often outpacing general inflation rates. This continuous cost can strain the budgets of existing owners and impact overall satisfaction with their timeshare ownership.

Hilton Grand Vacations' reliance on consumer discretionary spending makes it vulnerable to economic downturns. A notable trend observed in late 2023 and early 2024 is a general caution among consumers regarding non-essential purchases, which directly impacts the demand for vacation ownership. This sensitivity means that any significant economic uncertainty or recessionary pressure could lead to a material reduction in sales and profitability for the company.

Timeshare contracts are notoriously complex, often laden with legal terminology that can obscure crucial details for buyers. This intricacy can lead to misunderstandings about usage rights, maintenance fees, and resale limitations, potentially resulting in buyer dissatisfaction. For instance, in 2024, reports indicated that a significant percentage of timeshare owners felt they did not fully grasp their contract terms at the point of sale.

Sales Performance Fluctuations and Missed Estimates

While Hilton Grand Vacations (HGV) has demonstrated robust historical sales growth, recent performance has seen some stumbles. In the latter half of 2024, the company experienced periods where its revenue and earnings per share (EPS) fell short of what financial analysts had predicted. For instance, Q3 2024 results indicated a miss on EPS estimates, a trend that continued into Q4 2024, impacting investor sentiment.

These deviations from expectations can be attributed to several factors. Challenges within the sales force, particularly in late 2024, coupled with a broader slowdown in consumer demand for travel and leisure services, have negatively affected new business forecasts. This has led to a more cautious outlook on future sales pipelines.

- Sales Performance Misses: HGV missed analyst revenue and EPS estimates in multiple quarters during 2024.

- Demand Slowdown Impact: A general cooling in consumer spending on travel affected new sales projections.

- Sales Force Challenges: Internal sales force effectiveness issues in late 2024 contributed to underperformance.

- Investor Confidence: Inconsistent sales results can erode investor confidence and hinder the ability to meet growth targets.

High Debt Levels and Interest Rate Sensitivity

Hilton Grand Vacations (HGV) carries a substantial debt load, which can restrict its financial maneuverability and elevate interest expenditures. For instance, as of the first quarter of 2024, the company reported total debt of approximately $3.0 billion. This level of indebtedness can make it harder to secure additional financing or respond to unexpected market shifts.

The company's profitability is also sensitive to fluctuations in interest rates. An increase in borrowing costs directly impacts HGV's expenses for its existing debt and the cost of financing programs it offers to its customers. For example, a hypothetical 1% increase in interest rates could add tens of millions to annual interest expenses, impacting net income.

This interest rate sensitivity is particularly concerning given the economic outlook. Central banks in major economies have indicated a cautious approach to rate cuts in 2024, and potential rate hikes remain a possibility in some regions. This environment means HGV could face higher financing costs or reduced demand for financed vacation ownership packages.

- Significant Debt Burden: HGV's total debt stood at roughly $3.0 billion in Q1 2024, potentially limiting financial flexibility.

- Interest Rate Exposure: Rising interest rates directly increase the cost of borrowing and impact the profitability of customer financing.

- Economic Sensitivity: Uncertainty surrounding interest rate movements in 2024 could exacerbate financial risks for the company.

Hilton Grand Vacations (HGV) faces challenges with the inherent complexity of timeshare contracts, which can lead to buyer confusion and dissatisfaction, as evidenced by reports in 2024 indicating many owners didn't fully grasp their terms. Furthermore, the company's financial performance in late 2024 showed a vulnerability to economic shifts, with missed analyst expectations for revenue and EPS partly due to a slowdown in consumer discretionary spending on travel. This sensitivity to economic downturns, coupled with internal sales force challenges observed in late 2024, directly impacts future sales pipelines and investor confidence.

| Weakness | Description | Data/Context |

|---|---|---|

| Contract Complexity | Timeshare agreements can be difficult for buyers to fully understand. | Reports in 2024 showed many owners felt they didn't grasp contract terms at sale. |

| Economic Sensitivity | Reliance on discretionary spending makes HGV vulnerable to economic downturns. | Consumer caution on non-essential purchases impacted demand in late 2023/early 2024. |

| Sales Performance | HGV experienced periods of underperformance against analyst expectations. | Missed EPS estimates in Q3 and Q4 2024, linked to demand slowdown and sales force issues. |

Preview Before You Purchase

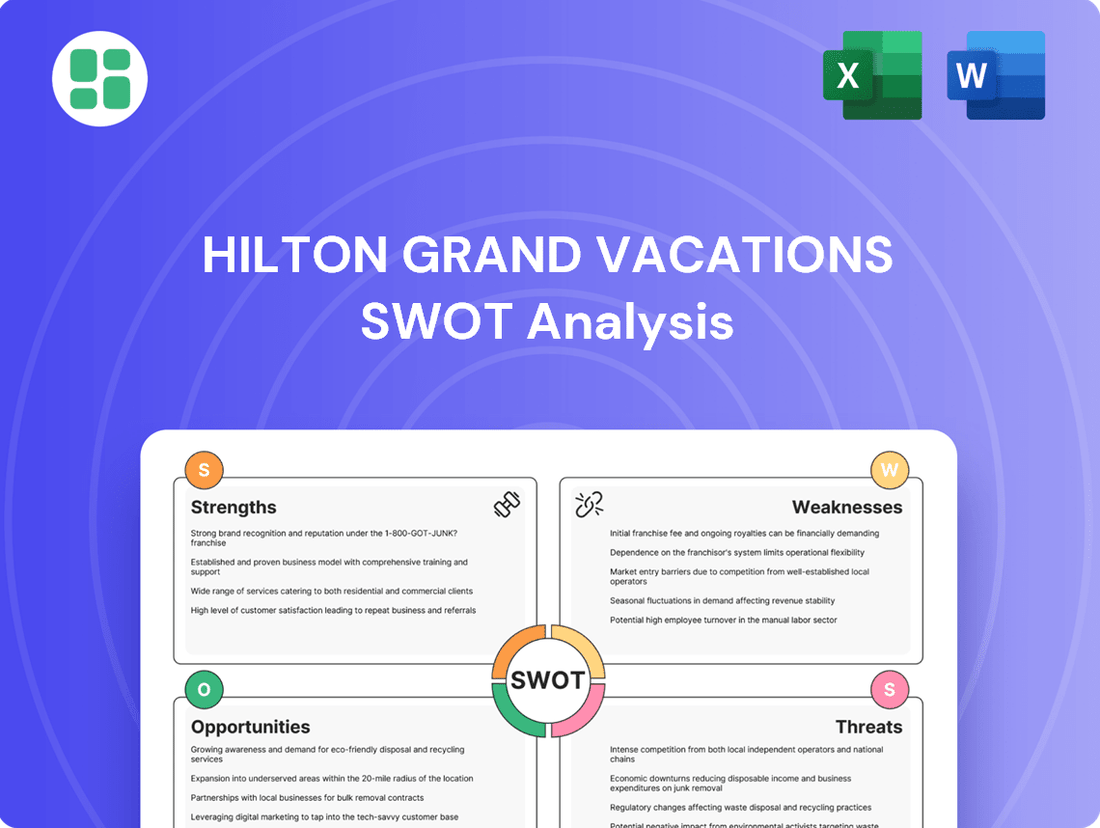

Hilton Grand Vacations SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Hilton Grand Vacations SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

Post-pandemic travel trends highlight a significant shift towards flexible booking and unique, experiential vacations. This is a strong tailwind for the timeshare industry.

Hilton Grand Vacations, with its point-based system, is adept at meeting this demand. It allows members to customize their trips, offering diverse destinations and activities that resonate with younger demographics like Millennials and Gen Z, who increasingly prioritize experiences over material possessions.

In 2024, the global travel and tourism market is projected to reach over $9.6 trillion, with experiential travel being a key driver. Hilton Grand Vacations’ ability to offer personalized, flexible travel solutions positions it favorably to capture a larger share of this expanding market.

The acquisition of Bluegreen Vacations in August 2023 for $1.5 billion offers a prime opportunity for Hilton Grand Vacations (HGV) to unlock significant synergy benefits. These include potential cost efficiencies through operational integration and the expansion of HGV's member base by an estimated 200,000 households.

Introducing the HGV Max program to Bluegreen's existing members is a key strategic move anticipated to boost upgrade rates and enhance the overall value proposition. This integration aims to solidify HGV's position as a market leader in the vacation ownership sector by leveraging the combined strengths of both brands.

Hilton Grand Vacations (HGV) can capitalize on the burgeoning global vacation ownership market, which is seeing significant expansion, especially in the Asia Pacific region. This growth is fueled by increasing disposable incomes and a surge in international travel, presenting a prime opportunity for HGV to broaden its reach.

By strategically entering and developing its presence in these emerging markets, HGV can diversify its revenue streams. Offering services specifically designed to meet the preferences of these new customer bases will be key to tapping into this growth potential and expanding its global footprint beyond its established markets.

Leveraging Technology for Enhanced Customer Experience

Hilton Grand Vacations (HGV) can significantly boost customer satisfaction by embracing digital advancements. This includes refining online booking platforms, offering immersive virtual tours of properties, and developing user-friendly app features for managing ownership. These enhancements cater to modern consumer preferences for convenience and personalized digital experiences.

By investing in a robust digital ecosystem, HGV can streamline the entire customer journey. This translates to greater ease of use, increased transparency in transactions, and deeper engagement with its ownership base. For instance, in 2024, the travel industry saw a continued surge in mobile bookings, with many travelers expecting seamless app integration for managing reservations and accessing property information.

- Enhanced Online Booking: Streamlining the reservation process through intuitive digital interfaces.

- Virtual Property Tours: Offering immersive digital experiences to showcase resort amenities and unit features.

- App-Based Ownership Management: Providing owners with convenient tools for booking, managing their accounts, and accessing resort information via mobile devices.

- Personalized Digital Services: Leveraging data to offer tailored recommendations and communication, improving overall customer engagement.

Optimizing Financing Business and Capital Returns

Hilton Grand Vacations (HGV) has a significant opportunity to boost shareholder returns by optimizing its financing business. The company's established expertise in securitization markets can be further leveraged to generate additional cash flow. This improved financial flexibility directly supports enhanced share repurchase programs, signaling confidence in HGV's long-term growth prospects and financial health.

This strategy allows HGV to:

- Enhance Shareholder Value: By generating more cash, HGV can increase the amount allocated to share buybacks, which can boost earnings per share and the stock price.

- Strengthen Financial Position: Successfully optimizing financing operations demonstrates robust financial management and can improve credit ratings, potentially lowering future borrowing costs.

- Capitalize on Market Strengths: HGV's proven track record in securitization provides a solid foundation to expand and refine these activities for greater profitability.

Hilton Grand Vacations (HGV) is well-positioned to capitalize on evolving travel preferences, particularly the demand for flexible and experiential vacations, a trend amplified in the post-pandemic era.

The company's strategic acquisition of Bluegreen Vacations in August 2023 for $1.5 billion is a significant opportunity, projected to add approximately 200,000 households to its member base and unlock substantial synergy benefits.

Furthermore, HGV can leverage the growing vacation ownership market, especially in the Asia Pacific region, to diversify its revenue streams and expand its global footprint, aligning with the projected over $9.6 trillion global travel market for 2024.

Investing in digital advancements, such as enhanced online booking and app-based ownership management, presents a clear path to improving customer satisfaction and engagement, mirroring the travel industry's continued surge in mobile bookings in 2024.

Threats

Economic downturns pose a significant threat to Hilton Grand Vacations (HGV). A recession or sustained high inflation can drastically reduce consumer discretionary spending, directly impacting leisure travel and the purchase of vacation ownership. This contraction in consumer spending is a critical concern for HGV's revenue streams.

HGV has already observed a noticeable shift in consumer spending habits, with a pullback in discretionary purchases. This trend directly affects sales performance and raises concerns about future profitability as consumers become more cautious with their vacation budgets and large expenditures like timeshare purchases.

Hilton Grand Vacations (HGV) faces significant pressure from a growing array of lodging choices beyond traditional timeshares. Platforms like Airbnb continue to expand their reach, offering unique and often more affordable vacation experiences that appeal to a broad consumer base. This trend is further intensified by the ongoing expansion and innovation within the traditional hotel sector, which frequently introduces new brands and loyalty programs that compete directly for leisure travelers.

The proliferation of these alternatives directly impacts HGV's market position. It can lead to downward pressure on occupancy rates as consumers opt for diverse lodging solutions, potentially eroding HGV's ability to maintain premium pricing. Furthermore, to counter this competition, HGV may need to increase its marketing expenditure, thereby impacting overall profitability and requiring strategic adjustments to its value proposition to remain competitive in the evolving travel landscape.

The timeshare sector faces a complex web of regulations that differ significantly across various locations. Hilton Grand Vacations (HGV) must navigate these evolving legal landscapes, which can impact operations and profitability.

Increased regulatory scrutiny, especially around contract terms and customer exit strategies, presents a notable threat. For instance, in 2024, several states continued to review and potentially update consumer protection laws affecting timeshare sales and rescission periods, which could lead to higher compliance costs or necessitate changes to HGV's sales practices.

Legal disputes, such as those related to alleged misrepresentation in sales or difficulties in timeshare resale, can result in substantial fines and reputational damage. In 2023, the industry saw ongoing litigation concerning exit programs, highlighting the potential for legal challenges to disrupt business models and incur significant legal expenses for companies like HGV.

Rising Maintenance Fees and Owner Dissatisfaction

Hilton Grand Vacations (HGV) faces a significant threat from rising maintenance fees, which are a common pain point for timeshare owners. These fees, which can outpace general inflation, are a key driver of owner dissatisfaction. For instance, in 2024, many timeshare owners reported increases in their annual fees that were notably higher than the consumer price index. This growing expense can lead to owner fatigue, increasing the likelihood of owners seeking to exit their contracts and negatively impacting HGV's customer retention and new sales efforts.

Furthermore, the perceived value of timeshare ownership can diminish when owners experience limitations in booking their preferred locations or dates, particularly during peak travel seasons. This scarcity, coupled with escalating costs, fuels owner frustration. Reports from early 2025 indicate a continued trend of owners expressing discontent over both fee increases and availability challenges, suggesting a potential dampening effect on the brand's appeal.

- Rising Maintenance Fees: Annual maintenance fees for HGV properties have shown a consistent upward trend, often exceeding the rate of inflation, as reported by owner forums and industry analyses throughout 2024 and early 2025.

- Owner Dissatisfaction: This fee escalation is a primary driver of negative sentiment among existing timeshare owners, leading to a desire to exit contracts and potentially harming brand reputation.

- Availability Constraints: Limited availability during high-demand periods exacerbates owner frustration, further contributing to the perception of declining value for their timeshare investment.

Shifting Consumer Preferences and Travel Behaviors

A significant threat to Hilton Grand Vacations (HGV) is the evolving landscape of consumer preferences and travel behaviors. While HGV's flexible offerings are a strength, a growing segment of travelers are opting for more spontaneous, short-term rentals, or are drawn to niche travel experiences like eco-tourism or adventure travel. If the timeshare model doesn't adapt swiftly to these changing desires, it could alienate potential customers.

The timeshare industry, including HGV, must prioritize continuous innovation to stay relevant. For example, in 2024, the global travel market saw a notable increase in demand for unique, experiential stays, with platforms catering to these preferences reporting robust growth. HGV's challenge lies in integrating such evolving travel behaviors into its core product.

- Increased Demand for Alternative Accommodations: Reports indicate a continued rise in bookings for vacation rentals and boutique hotels, directly competing with traditional timeshare models.

- Shift Towards Experiential Travel: Consumers are increasingly prioritizing authentic experiences over traditional resort stays, posing a challenge for brands that don't offer unique local immersion.

- Need for Digital Agility: The speed at which booking platforms and travel services are digitizing requires HGV to maintain a cutting-edge online presence and booking experience.

The competitive landscape for Hilton Grand Vacations (HGV) is intensifying with the rise of alternative lodging options. Platforms like Airbnb and expanded offerings from traditional hotels provide consumers with diverse and often more flexible choices, directly challenging HGV's market share.

These alternatives can put downward pressure on occupancy rates and pricing power for HGV. Furthermore, the need to increase marketing spend to counter this competition, as seen with increased digital ad spend by competitors in 2024, could impact profitability.

Regulatory changes present a significant threat, particularly concerning consumer protection laws that may affect sales practices and contract terms. For example, in 2024, several states reviewed timeshare regulations, potentially increasing compliance costs for HGV.

Rising maintenance fees are a growing concern for timeshare owners, with increases often outpacing inflation. In early 2025, owner feedback highlighted dissatisfaction with these escalating costs and limited booking availability, potentially impacting customer retention and future sales.

SWOT Analysis Data Sources

This SWOT analysis for Hilton Grand Vacations is built upon a foundation of verified financial reports, comprehensive market intelligence, and insightful expert commentary from industry analysts. These sources provide a robust understanding of the company's performance and the broader hospitality landscape.