Hilton Grand Vacations Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Grand Vacations Bundle

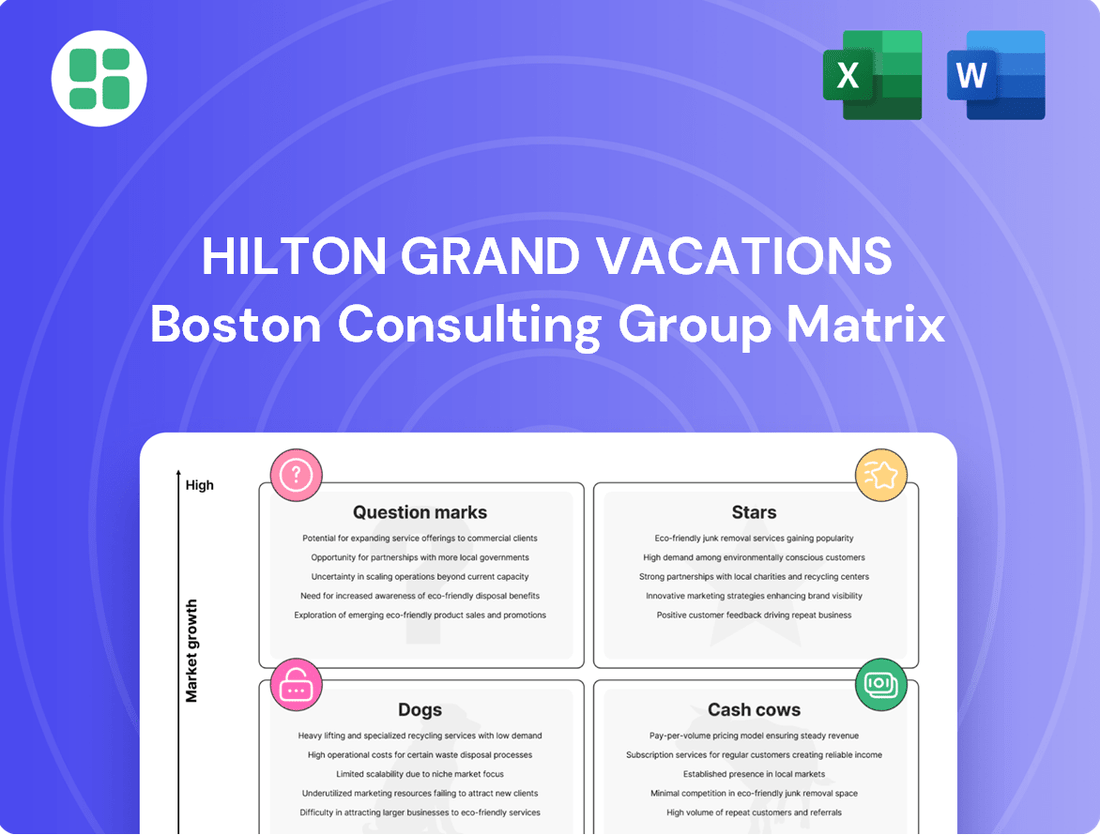

Curious about Hilton Grand Vacations' product portfolio? Our BCG Matrix preview highlights their market position, revealing potential Stars, Cash Cows, and areas needing attention. Don't miss the full strategic picture.

Unlock the complete BCG Matrix for Hilton Grand Vacations to gain a comprehensive understanding of their offerings. Purchase the full report for detailed quadrant analysis and actionable insights to drive your investment decisions.

Stars

The HGV Max loyalty program's expansion to include legacy Bluegreen owners is a strategic move, positioning it as a strong contender in the BCG Matrix's star category. This initiative is designed to leverage the integration of Bluegreen Vacations, which finalized in January 2024, by offering a more compelling value proposition to a larger customer base.

By providing access to Hilton Grand Vacations' extensive portfolio, HGV Max aims to deepen engagement with these newly acquired owners, potentially boosting future sales and increasing member lifetime value. The addition of roughly 200,000 Bluegreen members to the HGV Max ecosystem is a substantial driver for this growth phase.

Hilton Grand Vacations is actively investing in new, premium resorts in locations experiencing robust travel demand. A prime example is the development of Maui Bay Villas, with an expected completion in 2027, positioning it as a significant growth driver. This strategy aims to attract new members and provide additional options for current owners, tapping into the persistent consumer desire for prime vacation spots.

The integration of Bluegreen Vacations, finalized in early 2024, is a pivotal move for Hilton Grand Vacations (HGV), solidifying its position as a leader in vacation ownership and experiences. This strategic combination is projected to unlock substantial cost synergies, estimated to be around $30 million annually by 2026, and boost free cash flow significantly.

Beyond financial gains, the acquisition provides HGV with access to Bluegreen's established base of younger timeshare members, a crucial demographic for future growth. This demographic expansion, coupled with Bluegreen's extensive geographical footprint and diverse asset portfolio, positions the integrated entity for robust expansion and enhanced market penetration.

Digital Transformation & Enhanced Customer Experience

Hilton Grand Vacations (HGV) is significantly investing in digital transformation to elevate the customer experience, a key driver for its Stars segment in the BCG matrix.

These investments include advanced online booking engines, immersive virtual property tours, and user-friendly app-based systems for managing ownership. This digital push is designed to attract younger demographics like millennials and Gen Z, who prioritize convenience and transparency in their travel planning and vacation ownership processes.

By enhancing digital touchpoints, HGV aims to capture a greater market share in the evolving vacation ownership landscape, directly contributing to the growth and appeal of its Stars products.

- Digital Investment: HGV's commitment to digital platforms is a cornerstone of its strategy.

- Customer Convenience: Virtual tours and app management offer unparalleled ease of use.

- Demographic Appeal: Modern technology resonates strongly with millennial and Gen Z consumers.

- Market Share Growth: Enhanced digital experiences are crucial for capturing evolving market demands.

Strategic Partnerships and Experiential Offerings

Hilton Grand Vacations (HGV) leverages strategic partnerships and unique experiential offerings to drive growth, positioning these as key components of its business strategy. These initiatives are designed to broaden the company's appeal beyond conventional timeshare models and tap into the growing demand for memorable travel experiences.

The company's inherited partnerships, notably with Bass Pro Shops and NASCAR, inherited through the Bluegreen Vacations acquisition, are significant drivers. For instance, in 2024, HGV continued to integrate these collaborations, aiming to reach new customer demographics. These partnerships are crucial for expanding HGV's market reach and creating diversified revenue streams.

Furthermore, the HGV Ultimate Access platform provides exclusive, curated experiences for its members. This experiential focus is a critical differentiator, attracting customers who prioritize unique activities and personalized travel. In 2024, HGV reported strong engagement with these events, underscoring their value in building customer loyalty and attracting new members.

- Strategic Partnerships: Collaborations with Bass Pro Shops and NASCAR provide access to large, engaged customer bases, enhancing brand visibility and driving new member acquisition.

- Experiential Offerings: The HGV Ultimate Access platform offers unique, member-exclusive events, differentiating HGV in the competitive vacation ownership market and fostering deeper customer engagement.

- Customer Diversification: These initiatives attract a broader range of consumers, including those less familiar with traditional timeshares but keen on experiential travel, thereby expanding HGV's potential market.

- Brand Legacy: Building on HGV's history of innovation, these partnerships and experiences reinforce the brand's commitment to adventure and creating lasting memories for its members.

Hilton Grand Vacations (HGV) is strategically leveraging its HGV Max loyalty program, particularly with the integration of Bluegreen owners, to solidify its position in the Stars category of the BCG Matrix. This move is expected to drive significant growth by expanding the member base and offering enhanced value.

The company's substantial investments in digital transformation, including advanced booking engines and virtual tours, are crucial for attracting younger demographics and improving customer convenience, further bolstering its Star products.

Strategic partnerships, such as those with Bass Pro Shops and NASCAR, alongside unique experiential offerings through HGV Ultimate Access, are key differentiators. These initiatives broaden HGV's appeal and are vital for capturing new market segments and fostering loyalty.

| HGV Star Segment Drivers | Key Initiatives | Impact | 2024 Data/Projections |

|---|---|---|---|

| Loyalty Program Expansion | HGV Max integration with Bluegreen owners | Increased member base, enhanced value proposition | ~200,000 Bluegreen members added to HGV Max ecosystem |

| Digital Transformation | Online booking, virtual tours, app management | Improved customer experience, appeal to younger demographics | Focus on enhancing digital touchpoints for millennials and Gen Z |

| Strategic Partnerships & Experiences | Bluegreen partnerships (Bass Pro Shops, NASCAR), HGV Ultimate Access | Broader market reach, unique offerings, customer loyalty | Continued integration of inherited partnerships; strong engagement with experiential events reported |

| Resort Development | Investment in premium, high-demand locations | Attracting new members, providing options for existing owners | Development of Maui Bay Villas (completion expected 2027) |

What is included in the product

This BCG Matrix analysis for Hilton Grand Vacations provides clear descriptions and strategic insights for its Stars, Cash Cows, Question Marks, and Dogs.

The Hilton Grand Vacations BCG Matrix offers a clear, one-page overview of business unit performance, simplifying complex strategic decisions.

Cash Cows

Hilton Grand Vacations' (HGV) core vacation ownership sales and its existing member base represent a significant cash cow. This established business model, focused on selling timeshare intervals to a loyal customer base, generates consistent and predictable revenue streams.

With around 725,000 club members, HGV benefits from recurring income through maintenance fees and continued sales to these existing owners. This mature segment benefits from high market share and reduced acquisition costs for repeat customers, contributing substantially to the company's financial stability.

Resort operations and club management fees represent a significant cash cow for Hilton Grand Vacations (HGV). This segment consistently generates substantial revenue through the management of its numerous high-quality vacation ownership resorts and the provision of club membership benefits and services.

The profit margins within this segment are typically robust, driven by recurring fees for essential services such as property management, vacation exchange programs, and various owner support. For instance, HGV's fiscal year 2023 saw its resort operations and club segment contribute significantly to overall profitability, with management fees and other revenues playing a crucial role.

A key characteristic of these operations is their minimal need for new investment in promotion and placement. This allows for a strong and steady generation of cash flow, reinforcing its position as a reliable cash cow within HGV's business portfolio.

Hilton Grand Vacations' (HGV) timeshare loan financing portfolio acts as a significant cash cow, generating consistent and substantial interest income. This segment is built on a large, mature portfolio of timeshare receivables, ensuring a steady stream of cash flow. For instance, in the first quarter of 2024, HGV reported interest income from financing receivables of $90.5 million, highlighting its robust contribution to overall revenue.

The securitization of these loans further solidifies their cash cow status, demonstrating strong investor demand and providing a reliable funding source. This stability allows HGV to continue investing in its core hospitality operations while benefiting from the predictable earnings of its financing arm. The company's ability to successfully securitize these assets, even amidst fluctuating interest rates, underscores the perceived quality and stability of its loan book.

Mature, High-Occupancy Resorts

Mature, high-occupancy resorts within Hilton Grand Vacations (HGV) function as significant cash cows. These are well-established properties, often in prime locations, that consistently maintain high occupancy rates. Their profitability is a testament to their strong brand recognition and the loyalty of repeat customers, requiring less incremental marketing spend to sustain their performance.

These mature assets are in stable, developed markets, meaning their operational efficiency and consistent demand contribute substantially to HGV's overall cash flow. This reliable income stream allows HGV to fund other strategic initiatives, such as investing in emerging markets or developing new product lines.

- Proven Profitability: These resorts have a long history of generating consistent profits, demonstrating their resilience and market demand.

- Low Marketing Needs: Situated in mature markets, they benefit from established brand loyalty, reducing the need for extensive new marketing campaigns.

- High Occupancy: Consistently achieving high occupancy rates ensures efficient asset utilization and maximizes revenue generation.

- Strong Cash Generation: Their operational efficiency and steady demand make them significant contributors to HGV's overall cash reserves.

Brand Recognition and Affiliation with Hilton

Hilton Grand Vacations (HGV) benefits immensely from its strong brand recognition, directly tied to its affiliation with the globally recognized Hilton Hotels & Resorts. This association is a cornerstone of its cash cow status, attracting a consistent customer base and fostering immediate trust. In 2024, Hilton’s overall brand strength continued to be a significant driver of bookings across its portfolio, including HGV.

- Brand Equity: The Hilton name alone provides HGV with a powerful marketing advantage, reducing the need for substantial new customer acquisition costs.

- Customer Trust: Affiliation with Hilton ensures a baseline level of quality and service assurance, which is critical in the timeshare industry.

- Market Presence: This established market presence translates into predictable demand for HGV’s core vacation ownership products.

- Reduced Marketing Spend: The built-in appeal of the Hilton brand allows HGV to allocate fewer resources to marketing compared to independent competitors.

Hilton Grand Vacations' (HGV) timeshare loan financing portfolio is a prime example of a cash cow, generating consistent and substantial interest income. This segment relies on a large, mature portfolio of timeshare receivables, ensuring a steady cash flow. In the first quarter of 2024, HGV reported interest income from financing receivables of $90.5 million, underscoring its significant contribution to revenue. The company's ability to successfully securitize these assets further solidifies their cash cow status, providing a reliable funding source and demonstrating strong investor demand.

| Financial Segment | Contribution Type | Q1 2024 Data | Significance |

|---|---|---|---|

| Timeshare Loan Financing | Interest Income | $90.5 million | Steady cash flow from mature receivables |

| Resort Operations & Club | Management Fees | Significant contributor to profitability | Robust margins from essential services |

| Established Resorts | Occupancy Revenue | High and consistent | Reliable income with low marketing needs |

What You See Is What You Get

Hilton Grand Vacations BCG Matrix

The Hilton Grand Vacations BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report designed for strategic decision-making.

Dogs

Underperforming legacy properties within Hilton Grand Vacations' portfolio are those older or less desirable assets that may struggle with lower occupancy rates or higher maintenance expenses. These properties might not align with current market trends, potentially leading to minimal cash flow or even losses.

For instance, as of the first quarter of 2024, while Hilton Grand Vacations reported a system-wide occupancy rate of 82.1%, certain older properties might be experiencing significantly lower figures, impacting their overall profitability.

These legacy assets can tie up valuable capital without generating substantial returns, often demanding disproportionate investment for upkeep compared to their revenue contribution. Such a situation is characteristic of the 'dog' quadrant in the BCG matrix.

Hilton Grand Vacations' (HGV) vacation ownership programs or membership tiers that haven't resonated with modern travelers or have seen declining interest could be classified as 'dogs' in the BCG Matrix. These might include older, less flexible ownership models or specific resort locations that no longer align with current demand. For instance, if a particular legacy timeshare program saw only a 2% increase in new member sign-ups in 2023 compared to a 15% growth in newer, points-based systems, it might be a candidate for this category.

Such offerings typically hold a small market share within HGV's portfolio and contribute minimally to the company's overall revenue, potentially less than 1% of total sales in the last fiscal year. The cost of maintaining and marketing these less popular programs might outweigh the returns they generate. In 2024, HGV's focus is on optimizing its portfolio, meaning resources could be better allocated to high-growth areas like its ClubPoints system or expanding into new, in-demand destinations rather than propping up underperforming legacy products.

While the Bluegreen acquisition is a significant positive for Hilton Grand Vacations (HGV), some acquired assets might struggle to integrate smoothly. If certain Bluegreen properties or operational processes don't align with HGV's established efficiency or brand standards, they could become a financial drain rather than a contributor to growth.

Segments with Declining Resale Value

Timeshare intervals in certain locations or those with rigid usage restrictions can fall into the 'dog' category within Hilton Grand Vacations' BCG Matrix. These offerings often struggle in the resale market, exhibiting consistently low or declining values. For instance, a report from January 2024 indicated that the average resale price for some older, less desirable timeshare locations had decreased by as much as 15% year-over-year.

Owners finding it difficult to offload these intervals can lead to a ripple effect of dissatisfaction. This discontent can negatively influence potential new buyers and reduce the likelihood of positive referrals, impacting overall brand perception and future sales pipelines. Such segments are characterized by both low market share and minimal growth potential.

- Low Resale Market Performance: Specific timeshare locations with limited appeal or stringent usage rules often see their resale values diminish over time.

- Owner Dissatisfaction: Difficulty in reselling can breed discontent among owners, potentially harming brand reputation and new sales efforts.

- BCG Matrix Classification: These segments represent 'dogs' due to their low market share and low growth prospects.

High-Cost, Low-Return Marketing Channels

Certain marketing or sales channels that yield a low conversion rate despite high investment could be classified as dogs for Hilton Grand Vacations (HGV). If HGV continues to allocate significant resources to these channels without seeing a proportionate return in contract sales or new member acquisition, it represents an inefficient use of capital. These methods would have a low market share of new customer acquisition and low growth efficiency.

For example, consider the cost per acquisition (CPA) for different marketing efforts. If a particular digital advertising campaign in 2024, despite a substantial budget, only brought in a handful of new timeshare owners, its CPA would be exceptionally high, indicating it's a dog. This contrasts sharply with more effective channels that might have a significantly lower CPA, demonstrating better capital allocation.

- High CPA Channels: Marketing initiatives with a cost per acquisition exceeding industry benchmarks or internal targets, indicating poor conversion efficiency.

- Low Conversion Rates: Campaigns or platforms where a large number of leads are generated but a very small percentage result in a closed sale or new membership.

- Resource Drain: Significant financial and human resources are tied up in these channels without generating commensurate revenue or member growth.

- Strategic Re-evaluation: These dog segments necessitate a critical review, potentially leading to budget reallocation or complete discontinuation of underperforming marketing tactics.

These are offerings with low market share and little growth potential, often requiring significant investment without generating substantial returns. For Hilton Grand Vacations (HGV), this could include older timeshare programs with rigid usage rules or specific legacy properties that no longer align with traveler demand, as evidenced by potentially lower occupancy rates compared to the system-wide average of 82.1% in Q1 2024.

Such assets may also exhibit poor performance in the resale market, with some older locations seeing resale values drop by as much as 15% year-over-year as of January 2024. These 'dogs' represent an inefficient use of capital, as resources might be better deployed in high-growth areas like the ClubPoints system or new destination expansions.

Marketing channels with high cost per acquisition (CPA) and low conversion rates also fall into this category, draining resources without commensurate revenue growth. HGV's strategic focus in 2024 on portfolio optimization underscores the need to address these underperforming segments.

The Bluegreen acquisition, while beneficial overall, might also contain specific properties or processes that don't integrate smoothly, potentially becoming financial drains if not managed effectively, fitting the 'dog' profile.

Question Marks

Hilton Grand Vacations' (HGV) push into new international territories, exemplified by the upcoming Tradimo Kyoto Gojo property in Japan set for a Q1 2026 debut, positions these ventures as question marks in the BCG matrix. These emerging markets hold substantial promise for growth, fueled by a rising tide of global tourism, yet HGV’s current foothold remains relatively small.

The significant capital outlay needed to build brand awareness and secure market share in these developing regions presents a challenge, with the immediate financial returns being somewhat unpredictable. For instance, HGV’s international segment revenue, while growing, still represents a smaller portion of its overall business compared to its established domestic markets, indicating the early stage of these expansion efforts.

The full potential of new partnerships, especially those integrated via the Bluegreen acquisition such as Bass Pro Shops and NASCAR, for acquiring new Hilton Grand Vacations (HGV) members remains a significant question mark. These collaborations offer access to previously untapped customer bases, but their actual impact on expanding HGV's core product market share is still under evaluation.

While these strategic alliances present high growth prospects, their current contribution to HGV's overall market share is notably low. For example, in 2024, HGV reported that while the integration of Bluegreen provided access to a broader customer base, the direct conversion rate from these new partnership channels into timeshare sales is still being optimized, with initial conversion metrics being closely monitored.

Hilton Grand Vacations' innovative experiential travel offerings, such as curated adventure packages or exclusive cultural immersion trips, are currently positioned as question marks in the BCG matrix. These new, specialized products cater to a growing demand for unique travel experiences, moving beyond the conventional timeshare model. While they show promise for high growth, their current market share within HGV's broader portfolio remains relatively small.

The success of these experiential offerings hinges on significant investment in both their development and marketing to effectively reach and resonate with evolving traveler preferences. For instance, in 2024, HGV has been actively exploring partnerships and pilot programs for these niche experiences, aiming to gauge consumer interest and refine their appeal before a wider rollout.

Digital Product Innovations and Platform Investments

Hilton Grand Vacations (HGV) is exploring significant investments in digital product innovations, moving beyond traditional booking and management tools. These ventures, such as advanced AI-powered guest features or entirely new online engagement platforms, are categorized as question marks in the BCG matrix. They represent high-growth potential by aiming to revolutionize the customer experience, but currently hold a small market share as they are developed and introduced.

These initiatives demand substantial capital expenditure with the promise of considerable returns if they achieve widespread adoption. For instance, in 2024, HGV continued to focus on enhancing its digital capabilities, with a portion of its capital expenditure allocated to technology and innovation. While specific figures for these nascent digital products are often proprietary, the broader trend indicates a strategic push into areas that could redefine guest interaction and loyalty.

- AI-Powered Guest Features: Development of personalized recommendations, virtual concierge services, and enhanced in-room technology.

- New Online Engagement Platforms: Creation of interactive digital spaces for community building, exclusive content, and loyalty program integration.

- Market Entry Challenges: These innovations start with a low market share, requiring significant effort to gain traction against established digital offerings.

- Investment Profile: High investment needs coupled with the potential for substantial future revenue streams if successful in capturing market interest.

Targeting Younger Demographics (Millennials/Gen Z)

Hilton Grand Vacations (HGV) is exploring strategies to attract Millennials and Gen Z, recognizing their future importance in the vacation ownership market. Their flexible, points-based systems and digital engagement are key to this effort, but success in capturing this younger demographic remains a question mark.

While these younger generations represent a significant growth opportunity, HGV's current penetration within these segments may be limited. Capturing a substantial market share will likely require considerable investment in tailored marketing campaigns and product innovation designed to resonate with their preferences.

- Market Penetration: HGV's current market share among Millennials and Gen Z is an area of focus, as this demographic is crucial for future growth.

- Digital Engagement: The company is leveraging digital platforms and flexible point systems to appeal to the tech-savvy younger consumer.

- Investment Needs: Significant marketing and product adaptation investments are anticipated to effectively convert the potential of these demographics into tangible market share gains.

- Growth Potential: Millennials and Gen Z are identified as high-growth segments, making their acquisition a strategic priority for HGV's long-term success.

Hilton Grand Vacations (HGV) is actively exploring new international markets, such as its planned Tradimo Kyoto Gojo property. These ventures are considered question marks because, while they offer high growth potential due to increasing global tourism, HGV's current presence in these regions is minimal.

Significant investment is required to build brand recognition and market share in these developing areas, making immediate financial returns uncertain. For example, while HGV's international segment revenue is growing, it still represents a smaller portion of the company's overall business compared to its established domestic markets, highlighting the early stage of these expansion efforts.

The integration of new partners, like those acquired through Bluegreen such as Bass Pro Shops and NASCAR, presents a question mark for HGV's member acquisition strategy. These collaborations offer access to new customer bases, but their actual impact on expanding HGV's core product market share is still being evaluated.

While these strategic alliances have the potential for high growth, their current contribution to HGV's overall market share is relatively low. In 2024, HGV noted that while the Bluegreen integration opened up a broader customer base, the direct conversion rate from these new partnership channels into timeshare sales is still being optimized.

| Initiative | BCG Category | Market Potential | Current Share | Investment Need |

|---|---|---|---|---|

| International Market Expansion (e.g., Japan) | Question Mark | High | Low | High |

| New Partnership Integrations (e.g., Bluegreen alliances) | Question Mark | High | Low | Moderate |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Hilton Grand Vacations' annual reports, industry research on the timeshare sector, and competitor analysis to ensure reliable insights.