Hilton Grand Vacations PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Grand Vacations Bundle

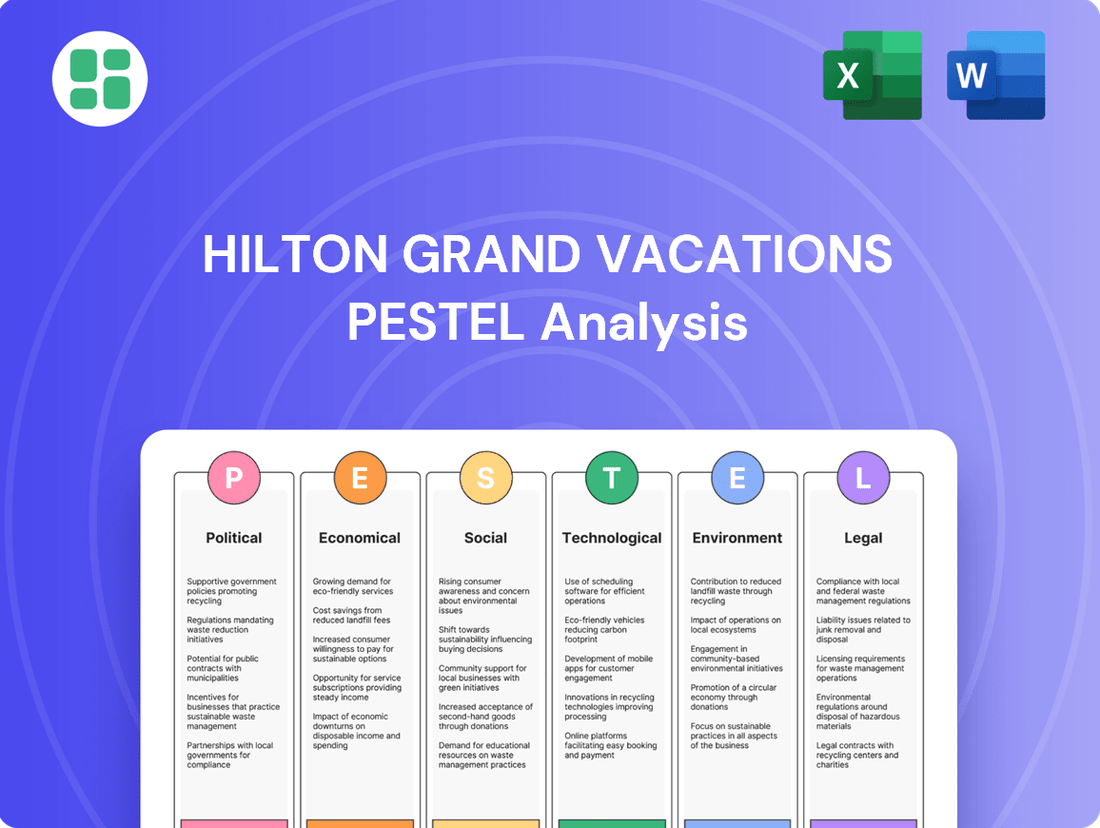

Unlock the strategic advantages of Hilton Grand Vacations by understanding the external forces at play. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping the company's trajectory. Gain critical insights to inform your investment decisions or market strategies. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

Government regulations, especially those focused on consumer protection and sales ethics within the timeshare sector, directly influence Hilton Grand Vacations (HGV). Changes in legislation, such as Spain's Organic Law 1/2025, are designed to bolster transparency and legal clarity in timeshare agreements, potentially altering HGV's sales methodologies and contract frameworks.

Navigating these dynamic regulatory landscapes is essential for HGV to prevent legal disputes and sustain customer confidence, with compliance being a continuous operational imperative.

Government support significantly shapes the hospitality sector. For instance, the U.S. Travel Association reported that in 2024, travel and tourism contributed over $1.1 trillion to the U.S. economy, highlighting the impact of supportive policies. Hilton Grand Vacations (HGV) benefits directly from government initiatives like infrastructure development and promotional campaigns aimed at boosting domestic and international tourism.

Conversely, restrictive policies can pose challenges. New tourism taxes or stringent environmental regulations, for example, could increase HGV's operational costs and potentially dampen consumer demand for vacation ownership and travel experiences. The World Tourism Organization (UNWTO) projects a strong rebound in global tourism for 2025, with international arrivals expected to reach pre-pandemic levels, generally creating a favorable environment for HGV.

International travel restrictions and evolving visa policies significantly impact Hilton Grand Vacations' (HGV) ability to draw international members and manage its worldwide resort operations. While domestic travel has shown resilience, a robust return of international visitors, particularly from crucial source markets, is essential for HGV's balanced expansion.

The pace of international travel recovery varies by region; for instance, the United States experienced a slower rebound in international visitor spending, and China anticipates a slowdown. This unevenness directly shapes HGV's strategic market approaches for the upcoming period.

Taxation Policies Affecting Real Estate and Hospitality

Changes in property taxes and other levies directly affect Hilton Grand Vacations' (HGV) operational costs and the affordability of vacation ownership for customers. For instance, Florida's ongoing discussions about reassessing timeshare property valuations for tax purposes could lead to lower tax burdens for companies like HGV, although it might also impact local government revenue streams.

These policy shifts can significantly influence HGV's financial performance. A reduction in property taxes, as potentially seen in Florida, could directly translate to improved profitability for the company. Conversely, an increase in taxes would likely be passed on to consumers, potentially dampening demand for timeshare products.

- Property Tax Impact: Fluctuations in property taxes, a key operating expense for HGV, directly influence profitability.

- Consumer Affordability: Levies on real estate and hospitality affect the final cost of vacation ownership, impacting consumer purchasing decisions.

- Regulatory Scrutiny: Evolving tax valuation methods, like those debated in Florida for timeshare properties, can create both opportunities and challenges for large hospitality groups.

Political Stability and Geopolitical Tensions

Political stability within the regions where Hilton Grand Vacations (HGV) operates is paramount for maintaining the safety and attractiveness of its resort properties. Instability can directly impact guest confidence and operational continuity.

Geopolitical tensions and broader global uncertainties can significantly dampen travel demand and discretionary consumer spending on leisure. This creates a more cautious environment for vacation ownership purchases and travel bookings, potentially affecting HGV's revenue streams.

While the general travel outlook for 2025 is anticipated to be robust, these ongoing geopolitical uncertainties present tangible downside risks. For instance, the ongoing conflicts in Eastern Europe and the Middle East, as reported by various international relations think tanks throughout 2024, continue to influence travel sentiment in affected regions and can spill over into broader global travel patterns.

- Regional Stability: HGV's presence in diverse locations means it's susceptible to localized political unrest or policy changes that could impact property values or guest access.

- Global Uncertainty Impact: Events like trade disputes or international sanctions can indirectly affect consumer confidence and disposable income available for luxury travel.

- 2025 Outlook Nuance: Despite a generally positive travel forecast for 2025, specific geopolitical flashpoints could lead to localized downturns or shifts in popular travel destinations.

Government regulations, particularly those concerning consumer protection and sales practices in the timeshare industry, directly impact Hilton Grand Vacations (HGV). New legislation, like Spain's Organic Law 1/2025, aims to boost transparency in timeshare contracts, potentially requiring HGV to adapt its sales strategies and agreement structures.

Government support for the travel sector, such as infrastructure development and tourism promotion, benefits HGV. The U.S. Travel Association noted that travel and tourism contributed over $1.1 trillion to the U.S. economy in 2024, underscoring the positive impact of supportive government policies on companies like HGV.

Changes in property taxes and other levies can significantly influence HGV's operating costs and the affordability of vacation ownership. For example, discussions in Florida regarding reassessing timeshare property valuations for tax purposes could lead to tax reductions for HGV, though this might also affect local government revenue.

Political stability in HGV's operating regions is crucial for maintaining guest confidence and operational continuity. Geopolitical tensions and global uncertainties can dampen travel demand and discretionary spending, creating a more cautious environment for vacation ownership purchases and potentially impacting HGV's revenue streams, despite a generally positive travel outlook for 2025.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Hilton Grand Vacations across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the industry landscape.

The Hilton Grand Vacations PESTLE analysis offers a clean, summarized version of external factors, relieving the pain point of sifting through extensive data for quick referencing during meetings or presentations.

Economic factors

Hilton Grand Vacations (HGV) thrives on consumer discretionary spending, as vacation ownership represents a significant leisure purchase. When the economy falters, inflation rises, or people feel less confident about their finances, contract sales and member participation tend to dip.

For instance, in Q1 2024, HGV reported total contract sales of $771 million, a slight decrease from the previous year, reflecting some consumer caution. However, the company also highlighted strong average contract values, indicating resilience among its core customer base.

Conversely, periods of robust economic expansion and higher disposable incomes typically boost demand for HGV's offerings. As of early 2024, U.S. consumer spending has shown continued growth, with retail sales increasing month-over-month, providing a generally supportive backdrop for HGV's business.

Interest rates significantly influence the appeal of vacation ownership. When rates rise, the overall cost of financing a timeshare increases, making it less attractive for potential buyers. This can lead to slower sales for companies like Hilton Grand Vacations (HGV).

For instance, if benchmark interest rates, such as the Federal Funds Rate, were to climb by 1% in late 2024 or early 2025, the monthly payments on a typical $30,000 timeshare loan could increase by roughly $25 to $30, impacting affordability.

Conversely, lower interest rates make financing more palatable, potentially boosting HGV's sales volume. HGV's successful $300 million securitization in early 2024 demonstrates investor appetite for timeshare receivables, but the cost of this financing is directly tied to prevailing interest rate environments.

Inflation directly impacts Hilton Grand Vacations' (HGV) operating expenses. Costs for essential services like staff wages, energy for resorts, property upkeep, and everyday supplies are all subject to upward pressure. For instance, the U.S. Consumer Price Index (CPI) for all urban consumers saw a 3.3% increase in May 2024 compared to a year ago, indicating persistent inflationary trends that trickle down to businesses like HGV.

Effectively controlling these escalating costs is paramount for HGV to safeguard its profit margins. This challenge can also shape how HGV approaches its pricing for vacation ownership memberships and the various services offered at its properties, potentially leading to adjustments to stay competitive while covering increased expenditures.

While the overall travel and tourism sector continues to show resilience and growth, even amidst economic uncertainties, navigating the persistent issue of inflation remains a central operational hurdle for companies like HGV. The industry's expansion, as evidenced by a projected 13.5% growth in global tourism revenue for 2024 according to some forecasts, highlights demand but also underscores the importance of cost management in this environment.

Real Estate Market Trends

Real estate market trends significantly shape Hilton Grand Vacations' (HGV) operational capacity. Fluctuations in property values and the cost of new development directly impact HGV's ability to expand its resort portfolio and acquire prime locations. A robust real estate market generally supports higher asset valuations and facilitates growth, whereas a market contraction can hinder investment and devalue existing vacation ownership interests.

The acquisition of Bluegreen Vacations in 2024 was a pivotal event, substantially broadening HGV's geographical reach and customer base. This strategic move, completed in mid-2024, added approximately 70 properties and over 200,000 member families to HGV's existing operations, demonstrating a proactive response to market dynamics and a commitment to portfolio expansion.

- Property Value Impact: Rising property values can increase the cost of acquiring new resort sites, potentially impacting HGV's development pipeline and profitability.

- Development Costs: Escalating construction and labor costs in 2024 and projected into 2025 can strain the economics of new resort development, requiring careful financial planning.

- Market Downturns: A slowdown in real estate markets could lead to lower appraisals of HGV's existing assets and a reduced appetite for new vacation ownership purchases, affecting revenue streams.

- Acquisition Synergies: The Bluegreen acquisition, valued at approximately $1.5 billion, is expected to yield significant cost and revenue synergies, bolstering HGV's market position despite potential real estate headwinds.

Global Travel and Tourism Industry Growth

The global travel and tourism sector is a significant driver for Hilton Grand Vacations (HGV). Continued expansion in this industry directly translates to increased opportunities for HGV's core business.

Looking ahead to 2025, the outlook for international travel remains strong. Global tourism is projected to contribute significantly to the world's Gross Domestic Product (GDP), with international visitor spending expected to see robust growth.

This favorable economic climate supports HGV's strategic goals for expansion and member acquisition. The increasing propensity for people to travel internationally creates a fertile ground for HGV to enhance its market presence.

- Global tourism's contribution to world GDP is anticipated to reach $14.4 trillion by 2025.

- International tourist arrivals are projected to grow by an average of 3.5% annually through 2025.

- Spending by international visitors is expected to increase by 4.7% year-over-year in 2025.

Economic stability is paramount for Hilton Grand Vacations (HGV) as consumer discretionary spending drives its business. Periods of high inflation or economic uncertainty can dampen demand for vacation ownership, as seen in a slight dip in Q1 2024 contract sales, though strong average contract values indicate underlying resilience.

Interest rates directly impact the affordability of timeshare financing; rising rates increase monthly payments, potentially deterring buyers, while lower rates can stimulate sales. HGV's successful $300 million securitization in early 2024 highlights the market's appetite for its receivables, but financing costs remain sensitive to rate environments.

Inflation pressures HGV's operating costs, from wages to supplies, as evidenced by the 3.3% CPI increase in May 2024. Managing these rising expenses is crucial for maintaining profitability and influences pricing strategies for memberships and resort services.

Real estate market trends affect HGV's ability to expand its portfolio. The 2024 acquisition of Bluegreen Vacations, adding around 70 properties, demonstrates HGV's strategy to grow despite potential cost increases for new developments and property valuations.

| Economic Factor | Impact on HGV | 2024/2025 Data/Outlook |

|---|---|---|

| Consumer Spending & Confidence | Directly influences vacation ownership demand. Lower confidence can reduce contract sales. | U.S. consumer spending showed continued growth in early 2024. |

| Interest Rates | Affects financing costs for buyers, impacting affordability and sales volume. | A 1% increase in benchmark rates could raise monthly timeshare loan payments by ~$25-$30. |

| Inflation | Increases operating costs (wages, supplies, energy) and can influence pricing. | U.S. CPI was up 3.3% year-over-year in May 2024. Global tourism revenue projected to grow 13.5% in 2024. |

| Real Estate Market | Impacts property acquisition costs and development economics. | Bluegreen Vacations acquisition (mid-2024) added ~70 properties; development costs are a consideration for 2025. |

| Global Travel & Tourism | Growth in the sector creates opportunities for HGV's expansion. | Global tourism GDP contribution projected at $14.4 trillion by 2025; international arrivals to grow 3.5% annually through 2025. |

Same Document Delivered

Hilton Grand Vacations PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hilton Grand Vacations covers Political, Economic, Social, Technological, Legal, and Environmental factors, providing a deep dive into the company's operational landscape and strategic considerations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain valuable insights into the external forces shaping Hilton Grand Vacations' business, enabling informed decision-making and strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a detailed examination of the opportunities and threats presented by the current global environment for Hilton Grand Vacations.

Sociological factors

Modern travelers, particularly Millennials and Gen Z, are shifting their focus from traditional fixed-week timeshares to more flexible, personalized, and experience-driven vacations. This demographic, which represents a significant portion of the travel market, values unique adventures and authentic local immersion.

Hilton Grand Vacations' strategy, centered on flexible, leisure-focused travel through its points-based system and shared ownership, directly taps into these evolving consumer desires. For instance, a 2024 report indicated that over 60% of Gen Z travelers consider unique experiences a top priority when booking trips.

To further capture this market, companies like Hilton Grand Vacations are increasingly diversifying their portfolios. This includes integrating offerings such as wellness retreats and eco-friendly resorts, which resonate strongly with younger travelers seeking sustainable and health-conscious travel options.

The historical perception of timeshares, often marred by aggressive sales tactics and opaque contracts, can still cast a shadow on consumer willingness to engage with vacation ownership. Hilton Grand Vacations (HGV) leverages its association with the globally recognized Hilton brand, a name synonymous with quality hospitality, to build inherent trust and mitigate negative historical perceptions. This brand equity is a significant advantage in a market where consumer confidence is paramount.

Industry-wide initiatives focused on enhancing transparency in contract terms and bolstering consumer protections are vital for shifting sentiment. HGV's commitment to these principles, coupled with strong operational performance, such as demonstrated by high occupancy rates and owner satisfaction scores, directly contributes to a more positive perception of the timeshare model. For instance, in 2023, HGV reported a strong owner satisfaction rate, reflecting the positive impact of these efforts.

The global population is aging, with the World Health Organization reporting that by 2030, one in six people will be over 60. This demographic shift presents both opportunities and challenges for Hilton Grand Vacations (HGV). Older travelers often have more disposable income and time for leisure, but their travel preferences may differ from younger generations.

Millennials, on the other hand, are increasingly entering their prime travel years. Data from 2024 indicates a strong preference among millennials for experiences over material possessions, often seeking spontaneous trips and diverse destinations. This generation also values flexibility in booking and a wide range of resort options, influencing HGV's need for adaptable marketing strategies and product development to capture this growing market segment.

To thrive, HGV must continue to tailor its offerings to these varied demographic needs. This includes developing flexible booking policies and curating resort portfolios that appeal to both the established preferences of older travelers and the evolving desires of younger demographics, ensuring sustained member growth and retention in a dynamic travel landscape.

Work-Life Balance and Vacation Frequency

The growing societal focus on work-life balance is a significant driver for vacation ownership, with many individuals seeking to integrate travel into their lives more seamlessly. The rise of remote work further fuels this, potentially leading to longer, more immersive vacation experiences and increased demand for flexible accommodation options like those offered by Hilton Grand Vacations (HGV).

Consumers are increasingly prioritizing travel experiences. Data from 2024 indicates a strong consumer sentiment towards spending on travel, with many viewing it as a necessity rather than a luxury. Timeshare owners, in particular, demonstrate a robust commitment to their vacation plans, often traveling more frequently than the average leisure traveler, which directly benefits HGV's business model.

This trend is supported by several key observations:

- Increased Vacation Intent: A significant percentage of consumers, especially those with existing vacation ownership, plan to take multiple vacations annually, underscoring the perceived value and commitment to travel.

- Remote Work Impact: The flexibility afforded by remote work arrangements in 2024 and 2025 allows for extended stays, blurring the lines between work and leisure and making vacation ownership more appealing for longer periods.

- Prioritization of Experiences: Societal shifts show a clear preference for spending on experiences over material goods, with travel consistently ranking high on consumer spending priorities.

Influence of Social Media and Online Reviews

Social media and online review sites are now crucial in how people choose vacations and perceive travel brands like Hilton Grand Vacations (HGV). Positive feedback and genuine stories from members shared online act as potent marketing, influencing potential customers. For instance, a study in early 2024 indicated that over 85% of travelers consider online reviews before booking a hotel or resort.

Conversely, negative reviews can swiftly damage sales and erode customer trust. HGV's proactive management of its online reputation, responding to feedback and engaging with guests on platforms like TripAdvisor and Instagram, is vital. By mid-2024, companies with strong online engagement strategies saw an average 15% higher customer retention rate compared to those with minimal digital presence.

Leveraging these digital channels for direct engagement and showcasing authentic member experiences is becoming a cornerstone of HGV's marketing strategy.

- Digital Influence: Over 85% of travelers consult online reviews before booking, highlighting the power of social proof in the travel industry.

- Reputation Management: Negative online sentiment can significantly impact sales, making proactive reputation management essential for HGV.

- Engagement Benefits: Companies actively engaging online, like HGV aims to, experienced approximately 15% higher customer retention in early 2024.

- Marketing Leverage: Authentic member experiences shared on social media serve as powerful, cost-effective marketing tools for HGV.

Societal trends show a growing emphasis on experiences over possessions, with travel consistently ranking high in consumer spending priorities. This aligns with Hilton Grand Vacations' (HGV) flexible, leisure-focused model, as data from 2024 indicates a strong consumer sentiment towards prioritizing travel spending.

The increasing acceptance of remote work arrangements in 2024 and 2025 also fuels demand for longer, more immersive vacations, benefiting HGV's flexible accommodation offerings and blurring work-life boundaries.

Online reputation and social proof are paramount, with over 85% of travelers consulting reviews before booking, making HGV's active online engagement and management of member experiences a critical success factor for customer retention.

Demographic shifts, such as the aging global population and the rising influence of Millennials, necessitate HGV's continued adaptation of its portfolio and marketing to cater to diverse travel preferences and priorities.

Technological factors

Hilton Grand Vacations (HGV) must leverage digital marketing and sales platforms to connect with today's consumers. In 2023, the company reported a significant increase in digital engagement, with online bookings accounting for over 60% of total reservations, a trend expected to continue growing through 2024 and 2025.

The vacation ownership sector is increasingly prioritizing technology for a smooth customer journey, from initial booking to managing ownership. HGV's investment in user-friendly online interfaces and personalized digital experiences is key to attracting travelers who prefer self-service and digital-first interactions.

By offering seamless online booking and management tools, HGV caters to a growing segment of travelers. This digital transformation is vital for enhancing customer satisfaction and driving sales in a competitive market, with projections indicating that digital channels will represent an even larger share of HGV's sales pipeline in 2024-2025.

Hilton Grand Vacations (HGV) is increasingly leveraging artificial intelligence and data analytics to significantly enhance customer experience (CX). This technological shift allows for highly personalized recommendations, more efficient operations, and improved customer service interactions.

By integrating AI, HGV aims to elevate both the guest and employee experience. For instance, predictive planning powered by member data can lead to smarter, data-driven decisions across the organization, optimizing resource allocation and anticipating guest needs. In 2023, companies across the travel sector saw significant ROI from AI-driven personalization, with some reporting up to a 15% increase in customer engagement.

Virtual Reality (VR) and Augmented Reality (AR) are transforming how potential timeshare buyers experience properties. Hilton Grand Vacations can leverage these technologies for immersive virtual tours, allowing customers to explore resorts from anywhere in the world. This offers unparalleled convenience and engagement, potentially boosting sales by making the decision-making process more tangible and exciting.

The adoption of VR/AR in real estate, including vacation ownership, is growing. By 2025, the global VR in real estate market is projected to reach $2.6 billion, indicating a significant shift towards digital property showcasing. This presents Hilton Grand Vacations with a powerful tool to attract a wider audience and provide a memorable, interactive preview of their offerings, differentiating them in a competitive market.

Smart Room Technologies and IoT in Resorts

Hilton Grand Vacations (HGV) is leveraging smart room technologies and the Internet of Things (IoT) to elevate the guest experience and streamline operations. These advancements are crucial for differentiating HGV's properties in a competitive hospitality market. For instance, the adoption of digital room keys and integrated mobile app controls for in-room amenities directly addresses growing traveler demand for seamless, tech-enabled stays. This focus on connected experiences is becoming a standard expectation, with a significant portion of travelers willing to pay more for smart hotel rooms.

The implementation of IoT devices offers tangible benefits beyond guest satisfaction. HGV can achieve greater operational efficiency through smart energy management systems that optimize heating, cooling, and lighting based on occupancy, potentially leading to substantial cost savings. Furthermore, predictive maintenance capabilities powered by IoT sensors can reduce downtime and improve resource allocation, ensuring a consistently high-quality guest environment. By 2025, the global smart hospitality market is projected to reach over $100 billion, underscoring the strategic importance of these technological investments for HGV.

- Enhanced Guest Experience: Digital room keys and mobile-controlled in-room features cater to evolving guest preferences for convenience and personalization.

- Operational Efficiency: IoT sensors enable smart energy management and predictive maintenance, reducing operational costs and improving asset longevity.

- Market Differentiation: Advanced smart room technologies provide a competitive edge by offering unique, tech-forward amenities that attract and retain guests.

- Growing Demand: A significant percentage of travelers, particularly millennials and Gen Z, actively seek out hotels with smart room features, indicating a strong market trend.

Cybersecurity and Data Privacy

Hilton Grand Vacations (HGV) faces significant technological challenges in cybersecurity and data privacy. Protecting sensitive member and company data is crucial, especially with the increasing sophistication of cyber threats. A robust cybersecurity infrastructure is essential to prevent breaches and maintain operational integrity.

Compliance with evolving global data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is a critical factor. Failure to adhere to these laws can result in substantial fines and damage to HGV's reputation. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, highlighting the financial implications of inadequate security measures.

- Increased Investment in Cybersecurity: HGV likely allocates significant resources to advanced threat detection, prevention, and response systems.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is paramount to avoid penalties and maintain member trust.

- Reputational Risk: Data breaches can severely damage brand reputation and member confidence, impacting future bookings and loyalty.

- Technological Adaptation: Continuously updating security protocols and technologies is necessary to counter emerging cyber threats.

Hilton Grand Vacations (HGV) is actively integrating advanced technologies to enhance customer engagement and operational efficiency. In 2023, over 60% of HGV's bookings were made online, a figure projected to rise through 2024 and 2025, underscoring the importance of digital platforms.

The company is leveraging Artificial Intelligence (AI) and data analytics for personalized guest experiences and smarter decision-making, with the travel sector seeing up to a 15% increase in customer engagement from AI initiatives in 2023.

Furthermore, HGV is exploring Virtual Reality (VR) and Augmented Reality (AR) for immersive property tours, tapping into a market projected to reach $2.6 billion by 2025, and implementing IoT for smart room features and operational efficiencies within the booming smart hospitality market, expected to exceed $100 billion by 2025.

However, HGV must also navigate significant cybersecurity challenges, with the average cost of a data breach reaching $4.73 million globally in 2024, necessitating robust protection of sensitive data and strict adherence to privacy regulations like GDPR and CCPA.

| Technology Area | HGV Application | Market Trend/Data (2023-2025) | Impact |

|---|---|---|---|

| Digital Platforms | Online bookings, sales | 60%+ online bookings in 2023, growing trend | Increased customer reach and sales |

| AI & Data Analytics | Personalization, predictive planning | 15% engagement increase in travel sector (2023) | Enhanced CX, operational efficiency |

| VR/AR | Virtual property tours | VR in real estate market to reach $2.6B by 2025 | Improved sales conversion, market differentiation |

| IoT & Smart Rooms | Smart room features, energy management | Smart hospitality market > $100B by 2025 | Elevated guest experience, cost savings |

| Cybersecurity | Data protection, privacy compliance | Data breach cost $4.73M globally (2024) | Reputation management, risk mitigation |

Legal factors

Hilton Grand Vacations (HGV) navigates a landscape shaped by timeshare consumer protection laws, which differ significantly across states and countries. These regulations often dictate cooling-off periods, requiring sellers to provide comprehensive information about the timeshare product and clearly define what rights the buyer is acquiring, whether it's the right to use a property or actual ownership.

Recent legislative actions, like Spain's Organic Law 1/2025, are specifically designed to bolster consumer confidence by demanding greater transparency and legal clarity in timeshare contracts. Such changes can influence how HGV structures its sales agreements and marketing approaches, ensuring compliance with evolving legal standards and protecting customer interests.

Hilton Grand Vacations (HGV) operates under a complex web of real estate and property laws across its global portfolio. These regulations dictate everything from where resorts can be built and how they are constructed, to the very ownership structures of the timeshare interests they offer. For instance, zoning laws in popular tourist destinations can significantly impact development timelines and costs, while specific property ownership frameworks, like those governing fractional ownership or deeded interests, must be meticulously adhered to in each market.

Navigating these diverse legal landscapes is crucial for HGV's success. In 2024, the company continued to expand its presence in key markets, requiring a deep understanding of local real estate ordinances. This includes securing necessary construction permits, which can vary widely; for example, obtaining permits in a densely populated urban area might involve different processes and timelines than in a more remote resort location.

Furthermore, property ownership laws directly influence HGV's business model. The company must ensure compliance with regulations concerning the sale and transfer of timeshare intervals, which often have specific consumer protection clauses. As of early 2025, HGV's commitment to transparency and adherence to these property laws remains a cornerstone of its operations, underpinning its ability to maintain brand trust and legal standing in the competitive hospitality sector.

Strict data privacy regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) significantly shape how Hilton Grand Vacations (HGV) handles customer information. These laws dictate how HGV must collect, store, process, and protect personal data, impacting everything from marketing outreach to loyalty program management.

Compliance is not just a legal necessity but a crucial element for maintaining customer trust and avoiding substantial financial penalties. For instance, GDPR violations can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher. Ensuring robust data protection practices is therefore paramount for HGV's reputation and financial stability.

Furthermore, the timeshare industry is experiencing a growing emphasis on consumer protection and privacy within timeshare acts. This trend suggests that regulatory scrutiny over customer data in this sector is likely to intensify, requiring HGV to remain vigilant and adaptable in its data management strategies to align with evolving legal landscapes and consumer expectations.

Labor and Employment Laws

Hilton Grand Vacations (HGV) navigates a complex web of labor and employment laws across its numerous resort locations. These regulations govern everything from minimum wage and overtime to workplace safety and benefits, directly influencing HGV's human resource strategies and overall operating expenses. The company must ensure compliance with a patchwork of federal, state, and international statutes, which can be a significant undertaking.

The dynamic nature of labor laws presents ongoing challenges. For instance, in 2024, many U.S. states saw adjustments to their minimum wage rates, with some reaching $15 or more per hour, impacting HGV's payroll costs. Furthermore, evolving regulations around paid sick leave and family leave in various jurisdictions require continuous adaptation of HGV's employee policies.

- Minimum Wage Compliance: Adherence to varying federal, state, and local minimum wage laws, which saw increases in several U.S. states during 2024.

- Workplace Safety Standards: Compliance with Occupational Safety and Health Administration (OSHA) regulations and similar international bodies to ensure a safe working environment for all employees.

- Employee Benefits Mandates: Meeting legal requirements for employee benefits, such as health insurance contributions (e.g., Affordable Care Act in the U.S.) and retirement plan regulations.

- Fair Labor Standards Act (FLSA): Ensuring proper classification of employees (exempt vs. non-exempt) and accurate calculation of overtime pay for eligible staff across different operational units.

Contract Law and Ownership Agreements

The enforceability and clarity of Hilton Grand Vacations (HGV) vacation ownership and club membership contracts are absolutely critical to its operations. These agreements form the bedrock of the customer relationship and revenue generation. Recent legal trends, particularly observed through 2024 and into early 2025, are pushing for greater transparency in all aspects of these contracts, from pricing structures to how usage rights are communicated. This focus aims to build stronger customer trust and proactively reduce potential disputes.

Clear definitions within these contracts are paramount. They must explicitly outline usage schedules, property access policies, and the specifics of booking privileges. For instance, ensuring that the process for reserving specific weeks or types of accommodations is unambiguous helps manage owner expectations and operational efficiency. HGV's commitment to adhering to these evolving legal standards directly impacts its ability to maintain a loyal customer base and avoid costly legal challenges, which could otherwise affect profitability. In 2024, the timeshare industry, in general, saw increased scrutiny on disclosure practices, reinforcing the need for HGV to maintain impeccable contract clarity.

- Contractual Clarity: HGV's contracts must precisely define owner rights and responsibilities regarding usage, maintenance fees, and exchange programs.

- Regulatory Compliance: Adherence to consumer protection laws, which are continually being updated, ensures HGV operates within legal boundaries and avoids penalties.

- Dispute Resolution: Well-defined contract terms facilitate smoother dispute resolution processes, minimizing legal costs and protecting brand reputation.

- Transparency in Pricing: Clear disclosure of all associated costs, including potential future increases in maintenance fees, is a key legal requirement and a driver of customer satisfaction.

Hilton Grand Vacations (HGV) must navigate a complex and evolving legal framework governing timeshare sales and operations. Consumer protection laws, varying by jurisdiction, dictate disclosure requirements, cooling-off periods, and contract clarity, as seen with Spain's Organic Law 1/2025 enhancing transparency in contracts. These laws directly influence HGV's sales practices and marketing strategies, requiring constant adaptation to ensure compliance and maintain customer trust.

Environmental factors

Hilton Grand Vacations is actively pursuing sustainability, aiming to reduce its environmental impact across its portfolio. This includes initiatives focused on lowering carbon emissions, conserving water, and minimizing waste generation at its various resort locations.

The company leverages its proprietary Hilton LightStay™ program to meticulously track and manage its environmental performance, ensuring accountability and driving continuous improvement. This program is instrumental in identifying areas for enhanced efficiency and the implementation of eco-friendly practices.

In 2023, Hilton Worldwide, which includes HGV's operational frameworks, reported a 10% reduction in energy intensity and a 12% reduction in water intensity compared to their 2019 baseline, demonstrating tangible progress in resource management across their brands.

HGV is also investing in sustainable energy solutions, such as solar power installations at select properties, and implementing advanced water-saving technologies to further its commitment to environmental stewardship.

Hilton Grand Vacations' (HGV) resort locations, particularly those in coastal areas, face significant threats from climate change. Rising sea levels, as projected by the IPCC, could inundate beachfront properties, increasing insurance costs and potentially necessitating costly infrastructure upgrades or even relocation. For instance, many Hawaiian resorts, a key market for HGV, are vulnerable to coastal erosion and sea-level rise, with some studies indicating substantial land loss by 2050.

Extreme weather events, such as hurricanes and intensified storms, also pose a direct risk to HGV's physical assets and operational stability. The increasing frequency and severity of these events, linked to climate change, can lead to property damage, temporary resort closures, and disruptions to guest travel plans. The 2023 Atlantic hurricane season, while not directly impacting major HGV resorts, saw significant damage to tourism infrastructure in other regions, highlighting the potential financial and operational fallout.

Furthermore, changes in local ecosystems, driven by warming temperatures and altered precipitation patterns, can affect the natural appeal of HGV's destinations. This could manifest as coral bleaching impacting popular diving sites near tropical resorts or changes in snow patterns affecting ski destinations. Such environmental shifts can diminish the desirability of these locations for vacationers, impacting booking trends and revenue.

Hilton Grand Vacations (HGV) is actively pursuing waste reduction, aiming to eliminate single-use plastics and boost recycling across its resort operations. This includes strategic partnerships, such as their collaboration with Clean the World to recycle hygiene products, showcasing a tangible commitment to diverting waste and conserving resources.

Water conservation is another key environmental focus for HGV. They are implementing high-efficiency appliances and exploring innovative solutions like rainwater harvesting systems to minimize their water footprint.

Environmental Regulations and Permitting

Hilton Grand Vacations (HGV) must navigate a complex web of environmental regulations and secure permits for its properties. These rules cover everything from air emissions and water quality to waste management and the preservation of local ecosystems. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stricter standards on wastewater discharge, impacting resort operations. Failure to comply can result in significant fines and operational disruptions, as seen when a similar hospitality company faced penalties in 2024 for improper waste disposal at one of its sites.

Adherence to these environmental mandates is not just about avoiding legal trouble; it's also crucial for maintaining HGV's brand reputation. Consumers, particularly those interested in vacation ownership, increasingly value sustainability and responsible corporate citizenship. HGV's commitment to environmental stewardship, including initiatives like reducing its carbon footprint and minimizing water usage, directly influences customer perception and loyalty. For example, a 2024 survey indicated that over 60% of leisure travelers consider a company's environmental practices when choosing accommodations.

The permitting process itself can be a significant hurdle, often requiring detailed environmental impact assessments and public consultations. These can extend project timelines and increase development costs. For example, a new resort development in a sensitive coastal area might face years of review to ensure compliance with regulations protecting marine life and coastal habitats. HGV's ability to efficiently manage these regulatory requirements is therefore a key factor in its expansion and operational success.

Key environmental considerations for HGV include:

- Compliance with air and water quality standards

- Sustainable waste management and recycling programs

- Protection of natural habitats and biodiversity at resort locations

- Securing necessary permits for construction and ongoing operations

Consumer Demand for Eco-Friendly Travel

Consumers increasingly prioritize eco-friendly and sustainable travel, directly impacting their booking choices. This trend is a significant environmental factor for hospitality companies like Hilton Grand Vacations (HGV).

HGV's commitment to sustainable tourism and robust environmental policies can attract travelers who value ecological responsibility, thereby boosting brand reputation. For example, a 2024 survey indicated that 72% of travelers are more likely to choose accommodations with visible sustainability practices.

The rise of eco-conscious resorts, often featuring wellness amenities, is a key driver. These properties are seeing increased demand, with a growing segment of travelers actively seeking out experiences that align with environmental and personal well-being values.

- Growing Consumer Preference: A significant portion of travelers now consider sustainability when booking trips.

- Brand Appeal: HGV's environmental initiatives can differentiate it and attract a key demographic.

- Market Momentum: Eco-friendly and wellness-focused resorts are experiencing a notable upswing in popularity.

- Data Point: Reports from 2024 suggest that over 60% of travel bookings are influenced by sustainability factors.

Hilton Grand Vacations (HGV) faces direct risks from climate change, including potential property damage from extreme weather events and rising sea levels impacting coastal resorts. For instance, studies suggest significant land loss by 2050 in vulnerable areas like Hawaii, a key market for HGV. Environmental regulations, such as stricter wastewater discharge standards enforced by the EPA in 2023, also necessitate ongoing compliance and investment to avoid penalties and maintain operational integrity.

Consumer demand for sustainable travel is a growing environmental factor, with over 60% of travelers in 2024 considering a company's environmental practices when booking. HGV's proactive sustainability initiatives, like waste reduction and water conservation, enhance brand appeal and attract environmentally conscious travelers. The company's commitment is further demonstrated by Hilton Worldwide's 2023 report of a 10% reduction in energy intensity and a 12% reduction in water intensity against a 2019 baseline.

| Environmental Factor | Impact on HGV | Supporting Data/Initiatives |

|---|---|---|

| Climate Change & Extreme Weather | Property damage, operational disruptions, increased insurance costs | Vulnerability of coastal resorts to sea-level rise and erosion; 2023 hurricane season impact on tourism infrastructure |

| Environmental Regulations | Compliance costs, permitting delays, potential fines | EPA wastewater standards (2023); need for environmental impact assessments for new developments |

| Consumer Sustainability Preferences | Brand reputation, market differentiation, booking influence | >60% of travelers consider sustainability (2024); HGV's waste reduction and water conservation efforts; Hilton's 10% energy intensity reduction (2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Hilton Grand Vacations is built upon a robust foundation of data from reputable sources, including government economic reports, industry-specific market research from firms like STR and Phocuswright, and analyses of global travel and hospitality trends. We also incorporate insights from financial news outlets and regulatory updates to ensure a comprehensive understanding of the macro-environment.