Highwoods Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Highwoods Properties Bundle

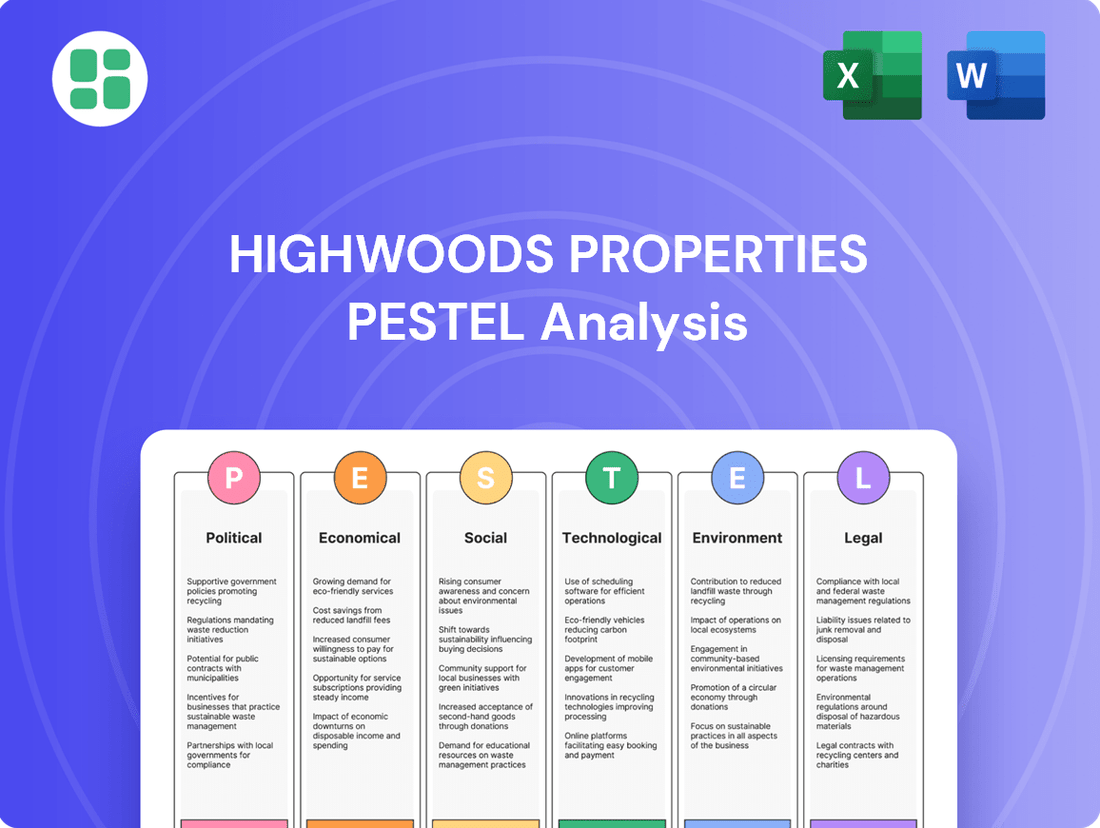

Navigate the complex external forces shaping Highwoods Properties's trajectory with our comprehensive PESTLE analysis. Uncover critical insights into political, economic, social, technological, legal, and environmental factors impacting the real estate sector. Empower your strategic decisions and gain a competitive advantage by understanding these vital influences. Download the full analysis now for actionable intelligence.

Political factors

Government policies, or the absence of them, on returning to the office significantly shape the demand for commercial office space. Highwoods Properties, with its focus on prime business districts, is directly impacted by these mandates, which influence occupancy levels and leasing activity.

For instance, in 2024, many cities saw a gradual increase in return-to-office mandates, with some major metropolitan areas reporting office utilization rates climbing into the 50-60% range, a positive sign for companies like Highwoods. Conversely, a continued emphasis on flexible or remote work arrangements could slow down the recovery of the office sector, affecting leasing pipelines and rental income for properties in Best Business Districts.

Changes in land use and zoning regulations at the municipal and state levels directly influence Highwoods' capacity for new development and the repurposing of existing assets. For instance, a shift in zoning in a key market like Austin, Texas, could significantly alter the feasibility of Highwoods' planned mixed-use projects.

Legislation designed to streamline rezoning for mixed-use or residential conversions, especially in states where Highwoods has a substantial presence, presents a dual-edged sword. While these changes could unlock opportunities for adaptive reuse of office spaces, they might also challenge the long-term valuation of traditional, single-use office properties, a core component of Highwoods' portfolio.

Federal and state tax policies, particularly those impacting Real Estate Investment Trusts (REITs), property taxes, and potential green energy tax credits, are critical to Highwoods Properties' profitability and strategic investment choices. For example, the Inflation Reduction Act of 2022 offers significant tax credits for energy-efficient building upgrades, which could lower operating costs and enhance property values for Highwoods.

Changes to tax deferral strategies, such as the 1031 like-kind exchange, directly influence Highwoods' acquisition and disposition strategies by affecting the timing and amount of capital gains taxes realized. In 2024, the ongoing debate around potential changes to capital gains tax rates could further shape these decisions.

Geopolitical Stability and Trade Policies

Broader geopolitical uncertainties and fluctuating trade policies, like potential tariffs on construction materials, can significantly affect development costs for companies such as Highwoods Properties. For instance, in 2024, the ongoing global supply chain adjustments and trade tensions could lead to unexpected increases in the price of steel, lumber, and other key building components. This volatility introduces unknowns that might prompt a more conservative approach to new construction investments, potentially slowing down project timelines due to higher input expenses.

These geopolitical factors directly influence overall economic confidence, which in turn impacts real estate demand and investment decisions. For example, a sudden imposition of tariffs in late 2024 or early 2025 could raise the cost of imported building materials by an estimated 5-15%, directly impacting project budgets. This environment necessitates careful risk assessment and strategic sourcing for Highwoods Properties to mitigate potential cost overruns and maintain project viability.

- Tariff Impact: Potential tariffs on construction materials could increase project costs for Highwoods Properties by 5-15% in 2024-2025.

- Economic Confidence: Geopolitical instability can dampen investor and consumer confidence, affecting demand for commercial real estate.

- Supply Chain Risks: Fluctuations in global trade policies create uncertainty in the availability and cost of essential building supplies.

Federal Funding and Infrastructure Investments

Government investments in infrastructure and federal funding for urban development in Highwoods' target regions can significantly enhance the attractiveness and accessibility of their Business and Technology Center (BTC) locations. For instance, the Infrastructure Investment and Jobs Act of 2021, with its substantial federal funding, is driving projects that could improve public transit and urban revitalization efforts. These initiatives can indirectly boost demand for high-quality office spaces in areas where Highwoods has a strong portfolio presence, such as in major metropolitan hubs.

Improved public transportation networks, a key focus of recent federal infrastructure spending, can make commuting easier for employees, thus increasing the desirability of office spaces. Similarly, urban revitalization projects supported by federal grants can lead to more vibrant and amenity-rich environments surrounding office buildings. This creates a more appealing ecosystem for businesses looking to attract and retain talent, directly benefiting Highwoods' property value and occupancy rates.

Specific examples of federal funding impacting urban development include:

- Increased allocations for public transit upgrades, potentially improving access to Highwoods' properties in cities like Austin and Raleigh.

- Grants for downtown revitalization projects, making surrounding areas more attractive to tenants and their employees.

- Federal support for smart city initiatives, which can enhance the technological infrastructure of business districts where Highwoods operates.

Government policies regarding remote work and return-to-office mandates directly influence office space demand. In 2024, many cities saw office utilization rates rise to 50-60%, a positive trend for Highwoods Properties. Conversely, continued flexible work policies could slow sector recovery.

Zoning and land use regulations at local and state levels impact Highwoods' development and repurposing capabilities. For example, changes in Austin, Texas, could affect planned mixed-use projects. Legislation facilitating adaptive reuse might benefit Highwoods but could also challenge traditional office property valuations.

Tax policies, including those affecting REITs and property taxes, are crucial for Highwoods' profitability. The Inflation Reduction Act of 2022 offers tax credits for energy-efficient upgrades, potentially lowering operating costs and enhancing property values.

Geopolitical factors and trade policies, such as potential tariffs on building materials, can increase development costs. In 2024-2025, global supply chain adjustments and trade tensions could raise the cost of essential materials by 5-15%, impacting project budgets and necessitating careful risk assessment.

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Highwoods Properties, providing a comprehensive understanding of the external landscape.

A clear, actionable PESTLE analysis for Highwoods Properties, presented in a digestible format, alleviates the pain of sifting through complex data, enabling faster strategic decision-making.

Economic factors

The Federal Reserve's monetary policy, particularly its benchmark interest rate, significantly impacts Highwoods Properties. As of early 2024, the Federal Funds Rate remained elevated, influencing borrowing costs for Highwoods' development projects and acquisitions. Higher rates make debt financing more expensive, potentially affecting the feasibility and valuation of new real estate ventures.

A sustained period of higher interest rates, often termed a 'higher-for-longer' scenario, can also diminish the relative attractiveness of real estate as an investment compared to fixed-income alternatives. This can lead to downward pressure on property valuations as investors demand higher yields to compensate for increased financing costs and the opportunity cost of capital.

The overall health of the U.S. economy, especially in the Southeast and Mid-Atlantic where Highwoods Properties has significant holdings, directly influences demand for office space. Strong GDP growth typically translates to more job creation and business expansion, both key drivers for leasing activity.

However, economic forecasts for 2025 indicate a potential slowdown, even if it's a soft landing. For instance, the Congressional Budget Office projected U.S. real GDP growth to moderate to 2.3% in 2024 and then slow further to 1.7% in 2025. This suggests a more cautious outlook for commercial real estate, potentially impacting leasing volumes and rental rate growth for Highwoods.

The national office vacancy rate hit a record 20.4% in the first quarter of 2025, a significant hurdle for Highwoods Properties. This elevated vacancy impacts rental income and property valuations across its portfolio.

While some specific markets are experiencing positive net absorption, indicating renewed demand, the broader office sector continues to grapple with the overhang of empty space. This trend directly affects Highwoods' ability to command higher rents and maintain occupancy levels.

Regional rent growth trends present a mixed picture, with some areas showing resilience while others lag behind. Highwoods' performance will be closely tied to its ability to navigate these diverse market conditions and adapt to evolving tenant needs.

Construction Costs and Labor Availability

Construction costs remain a significant factor for Highwoods Properties. Elevated prices for key materials like lumber and steel, exacerbated by supply chain issues and tariffs on imported goods, directly impact development expenses. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, reflecting these pressures.

Labor availability further complicates the construction landscape. Shortages in skilled trades can lead to project delays and increased labor costs, impacting Highwoods' ability to execute development plans efficiently. The Bureau of Labor Statistics has consistently reported a demand for construction workers exceeding the available supply in many regions.

- Rising Material Prices: Lumber prices, a key indicator, have experienced volatility, with spot prices fluctuating significantly throughout 2024, impacting overall project budgets.

- Labor Shortages: The construction industry faces ongoing challenges in attracting and retaining skilled labor, contributing to higher wage demands and extended project timelines.

- Tariff Impact: Tariffs on steel and other imported building materials directly increase input costs for developers like Highwoods, potentially affecting the feasibility of new projects.

- Projected Cost Increases: Industry forecasts for 2025 suggest continued upward pressure on construction costs due to these combined factors, requiring careful financial planning for Highwoods.

Investment Activity and Capital Flows

Investment activity in the commercial real estate sector is a key indicator of market health. While transaction volumes saw a dip in early 2024 due to economic uncertainty, projections for 2025 suggest a rebound, with an anticipated 5-7% increase in deal volume. This growth reflects renewed investor confidence and improved liquidity.

However, this renewed activity comes with a shift in investor preferences. Capital is flowing more selectively, with a pronounced focus on prime, well-located assets that offer stable income streams. Properties with demonstrable progress towards sustainability goals, particularly those with clear pathways to net-zero emissions, are attracting significant attention and commanding premium valuations.

Cap rates, a measure of a property's potential return, are stabilizing after a period of adjustment. In 2024, average office cap rates hovered around 6.5-7.5%, varying by market quality. For 2025, analysts predict a slight compression in cap rates for top-tier assets, reflecting increased demand and a flight to quality.

- Projected 2025 commercial real estate transaction volume growth: 5-7%

- Average 2024 office cap rates: 6.5-7.5%

- Investor focus: Prime assets and net-zero emission properties

The U.S. economic outlook for 2024-2025 presents a mixed bag for commercial real estate. While the Federal Reserve's monetary policy, with rates holding steady in early 2024, influences borrowing costs, a projected slowdown in GDP growth to 1.7% in 2025 by the CBO signals potential headwinds for office space demand.

The national office vacancy rate reached a concerning 20.4% in Q1 2025, a direct challenge for Highwoods Properties' leasing efforts. This elevated vacancy impacts rental income and property valuations, even as some markets show positive net absorption.

Construction costs remain elevated, with lumber prices volatile and skilled labor shortages persisting, contributing to project delays and increased expenses. Tariffs on imported materials further inflate input costs, impacting development feasibility for Highwoods.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Highwoods Properties |

|---|---|---|---|

| Federal Funds Rate | Elevated (early 2024) | Stabilizing/Slightly Lowering | Influences borrowing costs for development and acquisitions. |

| U.S. Real GDP Growth | 2.3% | 1.7% | Moderating growth may dampen demand for office space. |

| National Office Vacancy Rate | Record 20.4% (Q1 2025) | Expected to remain high | Reduces leasing opportunities and rental income potential. |

| Construction Material Prices | Elevated/Volatile | Continued upward pressure | Increases development costs and impacts project feasibility. |

| Commercial Real Estate Transaction Volume | Dip in early 2024, rebound expected | 5-7% growth | Indicates renewed investor confidence, but focus on quality assets. |

| Office Cap Rates | 6.5-7.5% (2024) | Slight compression for prime assets | Suggests increased demand for top-tier, stable income properties. |

Preview Before You Purchase

Highwoods Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Highwoods Properties delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

Sociological factors

Hybrid work models remain a significant sociological factor, influencing how and where people choose to work. This shift directly impacts the demand for traditional office spaces, pushing companies to re-evaluate their real estate needs and tenant preferences for flexibility. For Highwoods Properties, which specializes in Business Districts, this means adapting its portfolio to meet evolving tenant requirements.

The challenge for landlords like Highwoods Properties is to create office environments that not only accommodate hybrid schedules but also actively draw employees back to the office for collaboration and to foster company culture. This is particularly relevant as many companies struggle to enforce strict return-to-office mandates, making the office a destination rather than a requirement. As of Q1 2024, office vacancy rates in major U.S. cities still hovered around 18-20%, underscoring this ongoing adjustment.

Population migration continues to heavily favor Sun Belt states, a trend directly benefiting Highwoods Properties. For instance, states like Florida and Texas, where Highwoods has significant holdings, saw substantial population growth in 2023, attracting both individuals and businesses seeking lower costs of living and favorable economic conditions. This influx fuels demand for office and retail spaces, aligning perfectly with Highwoods' strategic focus on these high-growth markets.

Modern tenants, especially those in the 2024-2025 period, are prioritizing office spaces that go beyond basic functionality, demanding a rich amenity mix and engaging experiences. This shift is driven by evolving workplace expectations, with a significant emphasis on health, wellness, and opportunities for social interaction and collaboration.

Highwoods Properties' strategic focus on 'work-placemaking' directly addresses these tenant preferences. By designing environments that are not only functional but also inspiring and conducive to employee well-being, Highwoods aims to attract and retain top-tier tenants in a competitive market. For instance, their commitment to creating flexible spaces and incorporating biophilic design elements reflects this understanding of current tenant desires.

Employee Engagement and Well-being

Declining employee engagement and rising stress levels are significant sociological trends impacting the workplace. Property owners like Highwoods Properties must adapt by creating environments that actively support employee well-being and enhance productivity. This means offering more than just physical space; it involves cultivating a positive atmosphere that acknowledges the human element of work.

To address these concerns, Highwoods can focus on integrating amenities that promote health and reduce stress. This could include incorporating more natural light, access to green spaces, or areas designed for relaxation and informal collaboration. Providing flexible benefits packages that cater to diverse employee needs is also crucial in attracting and retaining talent in today's market.

- Employee Engagement: Gallup's 2023 report indicated that only 33% of employees globally feel engaged in their work, a statistic that underscores the need for supportive work environments.

- Well-being Focus: Companies increasingly recognize that employee well-being is directly linked to productivity and retention, driving demand for office spaces that facilitate this.

- Flexible Workspaces: The demand for adaptable office layouts that cater to hybrid work models and promote collaboration is growing, with companies seeking properties that offer this flexibility.

Evolving Corporate Culture and Collaboration Needs

Companies are increasingly prioritizing in-person collaboration and the cultivation of robust corporate cultures. This shift fuels a demand for premium office environments that actively encourage teamwork and spark innovation. Highwoods Properties' strategic concentration on Best Business Districts (BBDs) directly addresses this by offering locations sought after by businesses aiming to meet these evolving cultural and collaborative needs.

The desire for enhanced employee engagement and a stronger sense of community within organizations is a key driver. This sociological trend underscores the value of physical office spaces designed to foster spontaneous interactions and strengthen team cohesion. For instance, a 2024 survey by a leading HR consulting firm indicated that 75% of employees believe regular in-person interaction is crucial for building strong company culture.

Highwoods' portfolio, situated in prime urban centers, offers the kind of prestigious addresses that align with companies' efforts to attract and retain top talent by projecting an image of stability and forward-thinking culture. These locations often provide amenities and accessibility that support employee well-being and the collaborative spirit companies are striving to build.

- Focus on Collaboration: Companies are investing in office designs that promote interaction, with 68% of businesses planning to reconfigure their workspaces for more collaborative zones by the end of 2024.

- Culture-Driven Demand: A strong corporate culture is now a significant factor in employee retention, with 60% of professionals citing company culture as a primary reason for staying with an employer.

- BBD Advantage: Highwoods' presence in BBDs positions them to capture demand from companies seeking central, accessible locations that enhance their employer brand and facilitate employee collaboration.

- Talent Attraction: Prime office locations in BBDs are seen as critical for attracting talent, as companies recognize that their physical workspace reflects their commitment to employee experience.

The evolving expectations around employee well-being and engagement are reshaping office space demands. Tenants are increasingly seeking environments that foster collaboration, offer robust amenities, and support a healthy work-life balance, directly influencing Highwoods Properties' portfolio strategy.

Hybrid work models continue to be a dominant sociological factor, impacting office utilization and tenant preferences for flexibility. Highwoods Properties must adapt its offerings to cater to these shifts, ensuring its Business District properties remain attractive and functional for a modern workforce.

Population migration trends, particularly towards Sun Belt states where Highwoods has a strong presence, are a significant sociological driver of demand. This influx of people and businesses fuels the need for quality office and retail spaces, aligning well with Highwoods' strategic market focus.

| Sociological Factor | Impact on Highwoods Properties | Supporting Data (2024-2025) |

|---|---|---|

| Hybrid Work Models | Increased demand for flexible office solutions and amenity-rich environments. | Office vacancy rates in major U.S. cities remained around 18-20% in Q1 2024, highlighting the ongoing adjustment. |

| Employee Well-being & Engagement | Need for environments that support health, collaboration, and community. | 60% of professionals cite company culture as a primary reason for staying with an employer (2024 data). |

| Population Migration | Growth in Sun Belt states benefits Highwoods' key markets. | Sun Belt states continued to see substantial population growth in 2023, attracting businesses and individuals. |

| Culture & Collaboration Focus | Demand for premium office spaces that foster teamwork and corporate identity. | 75% of employees believe regular in-person interaction is crucial for building strong company culture (2024 survey). |

Technological factors

Smart building technologies and the Internet of Things (IoT) are increasingly vital for Highwoods Properties. These systems allow for better energy management, aiming to reduce operational costs and environmental impact. For instance, in 2024, many commercial real estate firms are investing in IoT sensors to monitor occupancy and adjust HVAC systems dynamically, potentially cutting energy consumption by up to 20% in optimized spaces.

The integration of IoT also enhances operational efficiencies through predictive maintenance, minimizing downtime and unexpected repair costs. By analyzing data from building systems, Highwoods can anticipate equipment failures before they occur, ensuring seamless operations and a better tenant experience. This proactive approach is becoming a standard expectation in modern office environments, with tenants increasingly valuing amenity-rich, technologically advanced spaces.

Artificial intelligence is transforming real estate management, with applications in demand forecasting, property valuation, and risk analysis. Highwoods Properties can utilize AI for enhanced market intelligence, leading to more optimized pricing strategies and streamlined customer interactions. For example, AI-powered tools can analyze vast datasets to predict rental demand in specific submarkets, potentially improving occupancy rates.

The property technology (PropTech) sector is rapidly evolving, offering digital solutions for everything from property management and transactions to tenant engagement. This technological wave is fundamentally reshaping how real estate is bought, sold, and operated.

Highwoods Properties can leverage these PropTech innovations to streamline operations and boost tenant experience. For instance, adopting virtual tour technology, which saw significant uptake in 2023 and is projected to grow further, can attract a wider pool of potential tenants. Digital transaction platforms are also enhancing efficiency in leasing and sales processes.

In 2024, the global PropTech market is expected to continue its strong growth trajectory, with investments focusing on AI-driven analytics and smart building technologies. By integrating these digital tools, Highwoods can improve operational efficiency, reduce costs, and provide a more seamless and satisfying experience for its tenants, thereby strengthening its competitive position.

Cybersecurity and Data Protection

As commercial properties increasingly integrate advanced technology, the need for strong cybersecurity to safeguard tenant data and building operations becomes paramount for Highwoods Properties. The escalating sophistication of cyber threats means that robust data protection is no longer optional but a critical risk mitigation strategy. A significant increase in cyberattacks targeting businesses, including those in the real estate sector, underscores this growing concern.

Highwoods must therefore invest heavily in cybersecurity infrastructure and protocols to prevent data breaches and associated financial or reputational damage. The financial impact of data breaches can be substantial; for instance, the average cost of a data breach in 2024 was reported to be over $4.5 million globally, a figure that continues to rise annually.

- Increased reliance on smart building technology necessitates advanced cybersecurity.

- Tenant data privacy is a key concern, with growing regulatory scrutiny on data protection.

- The financial and reputational risks associated with cyber incidents are significant and growing.

Building System Automation and Energy Efficiency

Technological advancements in building automation systems (BAS) are revolutionizing how commercial properties manage energy. These systems allow for granular control over lighting, heating, ventilation, and air conditioning (HVAC), directly impacting operational costs. For instance, smart thermostats and occupancy sensors can reduce energy consumption by up to 15-20% in commercial buildings, according to industry reports from 2024.

Highwoods Properties can leverage these innovations to bolster its sustainability initiatives. Implementing advanced BAS can lead to significant energy savings, potentially reducing utility expenses by 10-25% annually, as demonstrated by case studies in the real estate sector throughout 2024 and early 2025. This not only lowers operating costs but also enhances the appeal of their portfolio to environmentally conscious tenants and investors.

- Enhanced Energy Management: BAS offers real-time monitoring and predictive analytics for optimizing energy usage.

- Cost Reduction: Reduced utility bills contribute directly to improved net operating income (NOI).

- Sustainability Credentials: Demonstrates commitment to ESG goals, attracting green-focused tenants.

- Tenant Comfort and Productivity: Precise environmental controls improve occupant satisfaction.

The increasing integration of smart building technologies, including the Internet of Things (IoT), is a key technological factor for Highwoods Properties. These systems facilitate enhanced energy management, aiming to reduce operational expenses and environmental impact. For example, in 2024, many commercial real estate firms are adopting IoT sensors to monitor occupancy and dynamically adjust HVAC systems, potentially cutting energy consumption by up to 20% in optimized spaces.

Artificial intelligence (AI) is also reshaping real estate management through applications in demand forecasting, property valuation, and risk analysis. Highwoods Properties can leverage AI for improved market intelligence, leading to more effective pricing strategies and streamlined customer interactions. AI-powered tools can analyze extensive datasets to predict rental demand in specific submarkets, potentially boosting occupancy rates.

The property technology (PropTech) sector continues its rapid evolution, offering digital solutions for property management, transactions, and tenant engagement. Highwoods Properties can capitalize on these PropTech innovations to streamline operations and enhance the tenant experience. Virtual tour technology, which saw significant uptake in 2023 and is projected for further growth, can attract a broader range of potential tenants.

| Technology Area | Impact on Highwoods Properties | Key Data/Trend (2024-2025) |

|---|---|---|

| Smart Building Tech/IoT | Improved energy efficiency, predictive maintenance, enhanced tenant experience. | Potential energy savings of 15-20% through smart thermostats and occupancy sensors. |

| Artificial Intelligence (AI) | Enhanced market intelligence, optimized pricing, improved customer interactions. | AI-driven analytics expected to drive growth in PropTech investments. |

| PropTech Solutions | Streamlined operations, better tenant engagement, efficient transactions. | Virtual tour technology adoption growing; digital transaction platforms increasing efficiency. |

| Cybersecurity | Protection of tenant data and building operations from escalating threats. | Average cost of a data breach in 2024 exceeded $4.5 million globally. |

Legal factors

Highwoods Properties must meticulously follow evolving building codes and construction regulations across federal, state, and local jurisdictions for all development and renovation initiatives. These mandates, covering everything from structural integrity to energy efficiency, directly influence material selection, design specifications, and safety protocols, inevitably impacting project budgets and schedules. For instance, the increasing emphasis on sustainable building practices, often codified in updated regulations, can necessitate higher upfront costs for materials and technologies, though potentially leading to long-term operational savings.

Growing regulatory scrutiny and investor demand for Environmental, Social, and Governance (ESG) performance are reshaping real estate operations. This includes mandates for enhanced energy efficiency and commitments to net-zero emissions, directly impacting property development and management practices.

Highwoods Properties, like its peers, faces increasing legal obligations to meet evolving environmental standards. Failure to comply with these regulations, such as stricter building codes or carbon reporting requirements, could lead to penalties and operational disruptions.

The financial implications are substantial; properties that do not align with ESG mandates may find it harder to obtain financing or attract institutional investors. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) is influencing investment decisions, making ESG compliance a critical factor for market access and capital availability.

Changes in tenancy laws, particularly those affecting rent stabilization and eviction procedures, directly influence Highwoods Properties' operational costs and tenant retention strategies. For instance, a state implementing stricter rent control measures could limit Highwoods' ability to adjust rental income in line with market demands, potentially impacting revenue growth. Staying abreast of these legal shifts, such as new regulations enacted in 2024 regarding tenant notification periods for rent hikes, is crucial for maintaining compliance and mitigating legal risks.

Data Privacy and Cybersecurity Laws

Highwoods Properties operates in an environment where data privacy and cybersecurity are paramount legal considerations. With the growing integration of smart building technologies and digital platforms for tenant services and property management, the company must adhere to stringent regulations like the California Consumer Privacy Act (CCPA) and potentially the General Data Protection Regulation (GDPR) if operating in or with entities in relevant jurisdictions. Non-compliance can lead to significant fines and reputational damage.

These legal frameworks mandate robust protection of sensitive tenant information, including personal details, financial data, and usage patterns within smart buildings. Ensuring the security of digital transactions, such as lease payments and service requests, is also a critical legal obligation. As of early 2024, data breach notification laws are becoming more comprehensive across various states, requiring timely and transparent reporting of any security incidents.

- Data Protection Compliance: Highwoods must ensure its data handling practices align with evolving privacy laws, such as CCPA, which grants consumers rights over their personal information.

- Cybersecurity Measures: Implementing strong cybersecurity protocols is legally mandated to prevent unauthorized access to sensitive tenant data and protect digital infrastructure.

- Regulatory Fines: Violations of data privacy and cybersecurity laws can result in substantial financial penalties; for instance, CCPA violations can incur fines of up to $7,500 per intentional violation.

- Tenant Trust: Demonstrating a commitment to data security and privacy is crucial for maintaining tenant trust and a positive brand image in the competitive real estate market.

Property Tax Laws and Valuation Challenges

Property tax laws are a significant legal consideration for Highwoods Properties. Fluctuations and changes in these laws, such as potential caps on appraised value increases or adjustments to deductions, directly impact the company's operating expenses. For instance, in 2024, some jurisdictions are reviewing property tax rates to address budget shortfalls, which could lead to increased burdens for commercial property owners like Highwoods. The company must actively navigate these legal frameworks, which may involve challenging property assessments to effectively manage its overall tax liability.

Navigating property tax regulations requires constant vigilance. Highwoods needs to stay abreast of legislative changes that could affect its portfolio. For example, recent discussions in several states in late 2024 and early 2025 have centered on reforming commercial property tax assessment methodologies, potentially leading to more volatile valuations. The ability to contest assessments and engage with local tax authorities is crucial for mitigating unexpected cost increases and maintaining financial predictability for its real estate assets.

Highwoods Properties must navigate a complex web of legal and regulatory frameworks impacting its operations and financial performance. Changes in building codes, environmental standards, and data privacy laws, such as the California Consumer Privacy Act (CCPA), directly influence development costs, operational efficiency, and tenant relations.

Compliance with evolving ESG mandates is becoming a legal necessity, with non-compliance risking financing difficulties and investor alienation. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) is increasingly influencing global investment decisions, making ESG alignment critical for capital access.

Tenancy laws, including rent stabilization and eviction procedures, directly affect revenue streams and tenant retention strategies. Recent legislative updates in 2024 regarding tenant notification periods for rent increases highlight the need for continuous legal monitoring to avoid penalties and maintain predictable income.

The company faces significant legal obligations related to data protection and cybersecurity, particularly with the rise of smart building technologies. Violations of privacy laws like CCPA can lead to substantial fines, with penalties reaching up to $7,500 per intentional violation, underscoring the importance of robust security measures.

Environmental factors

Highwoods Properties' portfolio, concentrated in the Southeast and Mid-Atlantic, faces heightened risks from climate change. This includes increased frequency and severity of hurricanes, floods, and wildfires, which directly impact operational costs through higher insurance premiums and potential for significant property damage. For instance, the Southeast has seen a notable uptick in hurricane activity in recent years, with the 2023 Atlantic hurricane season being particularly active.

The commercial real estate sector faces increasing pressure to curb energy use and carbon emissions, a trend amplified by ambitious sustainability targets and evolving regulatory landscapes. Highwoods Properties' focus on reducing its carbon footprint through eco-friendly building designs and operational practices is crucial not only for environmental stewardship but also for appealing to tenants who prioritize sustainability.

In 2023, Highwoods reported a 13% reduction in greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress in their decarbonization efforts. This commitment is further underscored by their ongoing investments in energy-efficient technologies across their portfolio, aiming to achieve a 30% reduction in energy consumption by 2030.

Highwoods Properties faces increasing pressure to adopt sustainable water management, with efficient water use and stormwater runoff control becoming critical for commercial properties. By implementing smart water systems and features like retention ponds, Highwoods can lessen its environmental footprint and reduce risks such as flooding.

In 2024, the commercial real estate sector saw a heightened focus on water conservation, with many companies reporting reductions in water usage. For instance, some leading REITs aimed to cut water consumption by 15-20% by 2025 through upgraded fixtures and smart irrigation, a trend Highwoods is likely to align with to meet stakeholder expectations and regulatory requirements.

Green Building Certifications and Standards

The market's increasing preference for environmentally sound structures is a significant driver. Buildings holding certifications like LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method) are increasingly sought after due to their operational efficiencies and appeal to premium tenants. For instance, in 2024, the U.S. Green Building Council reported that over 100,000 commercial projects globally were LEED certified, a testament to the growing demand.

Highwoods Properties' proactive approach to incorporating green building innovations and obtaining these certifications directly bolsters its environmental credentials. This strategy not only aligns with evolving regulatory landscapes but also positions the company favorably against competitors, attracting environmentally conscious tenants and potentially commanding higher rental rates. A 2025 report by JLL indicated that LEED-certified buildings can achieve rental premiums of up to 5% compared to non-certified properties in many markets.

- Rising Demand: Tenant preference for LEED and BREEAM certified buildings continues to grow.

- Efficiency Gains: Green-certified buildings often demonstrate lower operating costs.

- Market Competitiveness: Highwoods' adoption of these standards enhances its market appeal.

- Premium Rents: Certified properties can command higher rental income.

Waste Management and Circular Economy Principles

Highwoods Properties can enhance its environmental sustainability by embracing circular economy principles. This involves actively minimizing waste generated during construction and renovation phases, a critical aspect for a real estate developer. For instance, adopting practices that prioritize reclaimed materials or sourcing building components locally can significantly reduce the environmental footprint.

Integrating these circular economy strategies offers tangible benefits for Highwoods. Beyond demonstrating environmental leadership, these practices can lead to substantial cost reductions through decreased material disposal fees and more efficient resource utilization. As of early 2024, the commercial real estate sector is increasingly scrutinizing embodied carbon and waste diversion rates, making proactive adoption of these principles a competitive advantage.

- Waste Reduction Targets: Implementing specific targets for construction waste diversion, aiming for over 75% diversion from landfills, aligns with industry best practices.

- Material Sourcing: Prioritizing the use of recycled content materials, such as steel with high recycled content or reclaimed wood, can reduce reliance on virgin resources.

- Life Cycle Assessment: Conducting life cycle assessments for new developments to understand and minimize the environmental impact of materials and construction processes.

- Tenant Engagement: Encouraging tenants to participate in waste reduction and recycling programs within Highwoods’ managed properties.

Environmental factors present both risks and opportunities for Highwoods Properties. The increasing frequency of extreme weather events, such as hurricanes in its core Southeast markets, necessitates robust risk management and can lead to higher insurance costs. Concurrently, a growing demand for sustainable buildings, evidenced by the 2024 surge in LEED certifications, offers a competitive edge and potential for premium rents, as highlighted by a 2025 JLL report indicating up to a 5% rental premium for certified properties.

Highwoods' commitment to reducing its environmental footprint is demonstrated by a 13% decrease in greenhouse gas emissions intensity by 2023 compared to a 2019 baseline, with a goal of 30% energy consumption reduction by 2030. Embracing circular economy principles, such as prioritizing reclaimed materials and achieving high waste diversion rates (aiming for over 75%), can further reduce operational costs and enhance its appeal to environmentally conscious tenants and investors.

| Environmental Focus | 2023/2024 Data/Trend | Impact on Highwoods Properties |

|---|---|---|

| Climate Change Impact | Active 2023 Atlantic hurricane season; increased frequency of extreme weather events. | Higher insurance premiums, potential property damage, increased operational costs. |

| Sustainability Demand | Growing tenant preference for LEED/BREEAM certified buildings; over 100,000 global LEED projects in 2024. | Opportunity for premium rents (up to 5% as per 2025 JLL report), enhanced market competitiveness. |

| Emissions Reduction | 13% reduction in GHG emissions intensity (vs. 2019 baseline) by 2023; 30% energy reduction goal by 2030. | Improved operational efficiency, positive brand image, alignment with regulatory trends. |

| Water Management | Heightened focus on water conservation in commercial real estate (e.g., 15-20% reduction targets by 2025). | Reduced operational costs, mitigation of flood risks, compliance with evolving regulations. |

| Circular Economy | Increased scrutiny on embodied carbon and waste diversion rates in early 2024. | Cost savings from reduced material disposal and efficient resource use; competitive advantage. |

PESTLE Analysis Data Sources

Our Highwoods Properties PESTLE Analysis is built on a robust foundation of data from official government agencies, reputable financial institutions, and leading industry research firms. We incorporate economic indicators, regulatory updates, technological advancements, and social demographic shifts to provide a comprehensive view.