Highwoods Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Highwoods Properties Bundle

Highwoods Properties navigates a competitive landscape shaped by significant buyer power and the constant threat of substitutes. Understanding the intensity of these forces is crucial for any investor or strategist looking to capitalize on opportunities within the office REIT sector.

The complete report reveals the real forces shaping Highwoods Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for Highwoods Properties, like many real estate firms, is typically moderate. The industry utilizes a broad range of services from construction to property management, and for many of these, there are numerous providers, which limits any single supplier's power. For instance, in 2024, the U.S. construction industry saw a significant number of small to medium-sized businesses contributing to the vast number of projects, indicating a fragmented supplier base for general construction needs.

Switching costs for Highwoods Properties' suppliers can differ significantly. For routine services like janitorial or landscaping, the ease of changing providers means Highwoods generally holds more leverage. This flexibility allows them to negotiate better terms or switch suppliers if service quality declines.

However, the landscape shifts dramatically for more complex or integrated services. Consider the scenario of replacing a sophisticated property management software system or engaging a new contractor for a major building renovation. The investment in new technology, employee training, and the potential for operational downtime during the transition all contribute to higher switching costs. This can empower suppliers in these specialized areas, as Highwoods might be hesitant to incur the expense and disruption of a change.

The uniqueness of inputs and services significantly influences supplier bargaining power for Highwoods Properties. While basic construction materials are largely commoditized, the availability of specialized skilled labor in areas like advanced HVAC systems or intricate structural engineering can be limited. Suppliers offering unique or proprietary building technologies or systems, for instance, can leverage their distinctiveness to negotiate more favorable pricing and contract terms, as Highwoods has fewer readily available alternatives.

Threat of Forward Integration

The threat of suppliers engaging in forward integration within the commercial real estate sector, specifically concerning companies like Highwoods Properties, is typically quite low. This is largely due to the substantial capital investment and specialized operational knowledge required to function as a Real Estate Investment Trust (REIT).

For instance, construction firms or material providers would face significant hurdles in acquiring the necessary expertise in property management, leasing, and capital markets that REITs like Highwoods possess. The sheer scale of investment needed to acquire and manage a portfolio of office buildings makes direct competition through forward integration an improbable strategy for most suppliers. In 2024, the average cost to construct a Class A office building in major U.S. markets continued to be in the hundreds of millions of dollars, a barrier that few suppliers could overcome to directly enter the REIT space.

- Low Likelihood of Supplier Forward Integration: Suppliers in the commercial real estate sector, such as construction companies or material providers, are unlikely to enter the REIT business due to high capital requirements and specialized operational expertise.

- High Capital Barriers: The significant financial resources needed to acquire, develop, and manage office properties deter suppliers from direct competition with established REITs like Highwoods.

- Specialized REIT Operations: REITs require distinct skills in property management, leasing, financing, and investor relations, which are typically outside the core competencies of construction and material supply businesses.

Impact of Supplier Input on Quality/Cost

The quality and cost of materials and labor from suppliers are critical for Highwoods Properties. If suppliers raise prices for construction materials like steel or lumber, or if labor costs in the construction sector increase, it directly impacts Highwoods' development budgets and potential profits. For instance, the Producer Price Index for construction materials saw significant year-over-year increases in late 2023 and early 2024, putting pressure on development costs.

This supplier influence extends to the operational phase as well. The cost of services like property management, maintenance, and utilities, often sourced from specialized suppliers, can affect Highwoods' net operating income. Higher utility rates or increased maintenance contract costs can erode profitability, especially in a market where lease rates may not immediately absorb these escalating expenses.

- Material Costs: Fluctuations in the cost of steel, concrete, and lumber directly impact project budgets.

- Labor Costs: Wage inflation in the construction and property management sectors affects operational expenses.

- Service Contracts: The pricing of maintenance, security, and utility services from third-party providers influences profitability.

- Supply Chain Disruptions: Delays or shortages from suppliers can impact project timelines and increase overall development costs.

The bargaining power of suppliers for Highwoods Properties is generally moderate, influenced by the availability of numerous providers for common services like construction and property management. However, for specialized inputs or unique technologies, suppliers can wield more influence due to limited alternatives and higher switching costs for Highwoods.

For example, in 2024, the construction industry's reliance on specific skilled trades, like advanced HVAC technicians or specialized facade installers, means that suppliers with these capabilities can command better terms. This is compounded by the fact that acquiring and integrating new, proprietary building systems can involve substantial upfront investment and training for Highwoods, making them less inclined to switch.

The threat of suppliers integrating forward into the REIT business is minimal. The immense capital requirements, estimated in the hundreds of millions for major projects in 2024, and the specialized expertise in property management and finance needed to operate as a REIT, present significant barriers that most suppliers cannot overcome.

| Factor | Impact on Highwoods Properties | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Moderate for general services, low for specialized inputs | Fragmented U.S. construction market with numerous small to medium-sized players. |

| Switching Costs | Low for routine services, high for integrated systems/specialized contractors | High costs associated with new property management software or major renovation contractors. |

| Input Uniqueness | Low for commoditized materials, high for proprietary technologies/skilled labor | Limited availability of specialized skilled labor and unique building technologies can empower suppliers. |

| Forward Integration Threat | Very Low | Hundreds of millions in capital needed for Class A office construction deters supplier entry into REITs. |

What is included in the product

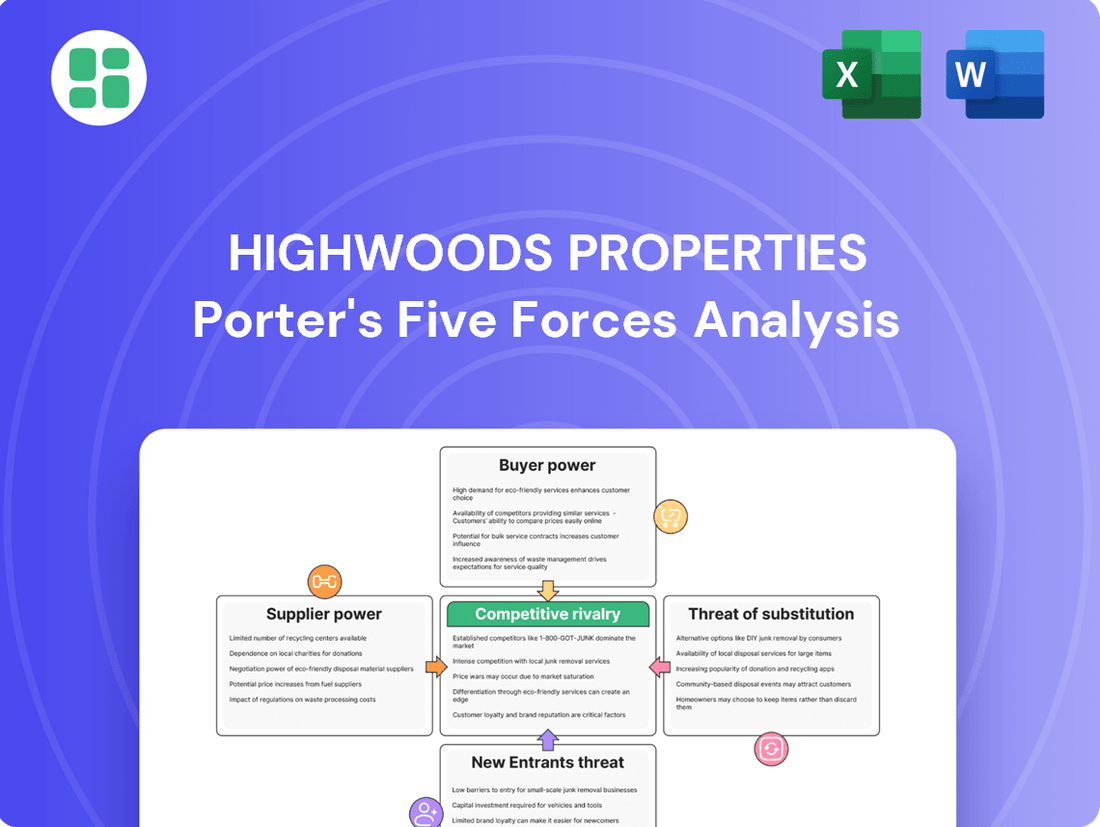

This analysis details the competitive forces impacting Highwoods Properties, including buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the office REIT sector.

Instantly identify and mitigate competitive threats by visualizing Highwoods Properties' Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of Highwoods Properties' customers, primarily its tenants, is a significant factor, generally ranging from moderate to high, especially given the current office market dynamics. Large corporate tenants, often referred to as anchor tenants, wield substantial leverage because of the sheer volume of space they occupy and their overall importance to a property's occupancy rate.

Highwoods' strategic positioning in Best Business District (BBD) locations within high-growth Sun Belt markets is designed to mitigate this power by fostering a strong and diverse tenant base, thereby enhancing its ability to attract and retain lessees.

Customers wield considerable influence because there are so many other office spaces available. Highwoods faces competition from a multitude of REITs, private developers, and property owners, all providing diverse office options.

The national office vacancy rate reached 19.8% in 2024. This high vacancy signifies a plentiful supply across many locations, giving tenants more leverage to secure better lease agreements.

Customer switching costs for Highwoods Properties' tenants are typically substantial. These costs encompass the expenses and operational disruptions associated with finding a new location, undertaking new build-outs, and ensuring business continuity during a move. For instance, a company relocating its headquarters might incur hundreds of thousands, if not millions, in moving expenses, lease termination penalties, and new office setup costs.

However, the competitive landscape in the office real estate sector, particularly evident in 2024, sees landlords actively working to mitigate these switching costs. Highwoods Properties, like its peers, has been observed offering attractive incentives such as extended periods of free rent or generous tenant improvement allowances. These concessions are designed to make it more financially palatable for tenants to renew leases or to attract new tenants by effectively lowering their initial outlay and reducing the perceived risk of relocation.

Price Sensitivity of Customers

Highwoods Properties faces significant customer price sensitivity, especially concerning its non-Class A assets or in markets with ample office space availability. Tenants closely monitor rental costs, operating expenses, and the overall value they receive.

The ongoing trend towards hybrid work models has amplified this sensitivity. Businesses are now more rigorously assessing their office space needs, which could lead to reductions in their overall footprint or a preference for more efficient, cost-effective layouts.

- Tenant Scrutiny: In 2024, the average lease renewal rate for office properties saw a slight decrease as tenants became more demanding regarding concessions and rental rates, particularly in secondary markets.

- Value Proposition Focus: Companies are increasingly prioritizing flexible lease terms and amenities that support hybrid work, directly impacting their willingness to pay premium rents for traditional office spaces.

- Market Saturation Impact: In markets with high vacancy rates, such as parts of downtown Chicago, landlords like Highwoods may need to offer more aggressive rent abatements or tenant improvement allowances to secure new leases, reflecting heightened price sensitivity.

Threat of Backward Integration

The threat of backward integration for Highwoods Properties' customers is notably low. It's highly improbable that their typical office tenants, such as corporations or professional services firms, would venture into acquiring, developing, and managing their own office buildings.

This is primarily because such an undertaking requires significant capital outlay and specialized real estate management expertise, which are far outside the core competencies of these businesses. For instance, the average cost to develop a Class A office building in a major U.S. market can easily exceed $300 million as of 2024, a prohibitive investment for most tenants.

- Low Likelihood of Tenant Backward Integration: Office tenants typically lack the capital and expertise to develop and manage their own properties.

- High Capital Investment Barrier: The substantial financial commitment required for real estate development deters tenants.

- Focus on Core Business: Tenants prioritize their primary business operations over real estate ownership and management.

- Reduced Customer Bargaining Power: This low threat limits a significant avenue through which customers could exert power over Highwoods.

The bargaining power of Highwoods' customers, primarily tenants, is generally moderate to high, influenced by market conditions and tenant size. Large anchor tenants hold significant sway due to their substantial space needs, impacting a property's overall occupancy. The national office vacancy rate stood at 19.8% in 2024, a figure that empowers tenants by increasing available options and strengthening their negotiating position for lease terms and concessions.

Switching costs for tenants are typically high, involving expenses for relocation, new build-outs, and operational disruptions, often running into hundreds of thousands or millions of dollars. However, landlords like Highwoods often mitigate these costs through incentives such as free rent or tenant improvement allowances to secure renewals and new leases, especially in competitive markets.

Tenants exhibit considerable price sensitivity, particularly for non-Class A properties or in markets with high vacancy. The rise of hybrid work models in 2024 has further amplified this, leading businesses to scrutinize space needs and prioritize cost-effectiveness and flexibility, impacting their willingness to pay premium rents.

| Factor | Impact on Highwoods' Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Tenant Size & Importance | Large tenants have higher power due to space volume. | Anchor tenants are crucial for occupancy rates. |

| Market Vacancy Rate | Higher vacancy increases tenant power. | National office vacancy at 19.8% in 2024. |

| Switching Costs | High costs generally limit power, but incentives can reduce this. | Relocation costs can be millions; landlords offer concessions. |

| Price Sensitivity | Tenants are sensitive to rent and operating expenses. | Hybrid work trends increase scrutiny of space needs and costs. |

Preview the Actual Deliverable

Highwoods Properties Porter's Five Forces Analysis

This preview showcases the complete Highwoods Properties Porter's Five Forces Analysis, offering a detailed examination of industry competitiveness. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The office Real Estate Investment Trust (REIT) sector is a crowded space, with Highwoods Properties contending against a broad array of competitors. This includes other publicly traded REITs, private real estate firms, large institutional investors like pension funds and insurance companies, and even individual property owners.

The sheer volume of active participants underscores the intense competition. For instance, as of early 2024, the National Association of Real Estate Investment Trusts (NAREIT) reported over 200 publicly traded REITs in the U.S., many of which operate in the office sector, directly competing for tenants and investment capital.

The office sector within the broader REIT market has faced significant headwinds, and this trend is expected to persist for office REITs through 2025. This slower or even negative growth rate naturally intensifies competitive rivalry.

When demand is stagnant or shrinking, companies like Highwoods Properties must compete more aggressively for the available tenants. This is especially true given the ongoing shifts in work patterns, such as the rise of hybrid and remote work, which directly impact the need for traditional office space.

Highwoods Properties distinguishes itself by concentrating on premium office spaces situated in prime Best Business District (BBD) locations across the Southeast and Mid-Atlantic. This strategic focus targets tenants prioritizing high-quality, amenity-rich environments in sought-after urban centers, setting them apart from more standardized office rental options.

Exit Barriers

Exit barriers in the commercial real estate sector are notably high, primarily due to the inherent illiquidity of property assets. These substantial capital investments, often stretching over decades, coupled with long-term lease agreements, make it challenging for companies like Highwoods Properties to divest quickly. This immobility forces competitors to persist in the market, even during economic slumps, thereby intensifying competition as they vie for dwindling market share and tenant demand.

The significant capital outlay required to acquire and maintain commercial properties creates a strong disincentive for exiting the market. For instance, a prime office building represents a massive investment that cannot be easily liquidated without substantial losses. This capital intensity means that even when market conditions are unfavorable, companies are often locked into their existing portfolios, leading to sustained competitive pressure.

- High Capital Investment: Commercial real estate demands significant upfront capital, making it difficult to exit without incurring substantial financial penalties or losses.

- Illiquidity of Assets: Unlike stocks or bonds, real estate cannot be sold instantly, leading to prolonged selling periods and potential price reductions.

- Long-Term Lease Commitments: Existing leases bind owners to tenants for extended periods, restricting the ability to repurpose or sell properties freely.

- Specialized Nature of Properties: Many commercial properties are built for specific tenant needs, limiting their appeal to a broader buyer pool if a sale is attempted.

Fixed Costs

The commercial real estate sector, including companies like Highwoods Properties, operates with substantial fixed costs. These include ongoing expenses such as property taxes, routine maintenance, and the servicing of debt, which must be paid irrespective of whether a property is occupied or not. For instance, in 2024, property taxes and insurance for a Class A office building can easily represent 15-20% of a property's operating expenses.

These inherent fixed costs create a strong incentive for Highwoods to achieve and maintain high occupancy rates and favorable lease terms. The pressure to cover these persistent expenses often drives competitive pricing and aggressive leasing tactics. Companies actively seek to attract and retain tenants, especially in markets with significant available space, to ensure revenue streams can offset these unavoidable costs.

- High Fixed Costs: Property taxes, maintenance, and debt service are non-negotiable expenses for commercial real estate owners.

- Occupancy Imperative: High occupancy is crucial for Highwoods to cover fixed costs and achieve profitability.

- Competitive Strategies: Companies employ aggressive pricing and leasing to secure and keep tenants in a competitive landscape.

- 2024 Market Pressure: The need to maximize lease rates is amplified by current economic conditions and tenant demand fluctuations.

The office REIT sector is highly competitive, with numerous public REITs, private firms, and institutional investors vying for tenants and capital. This intense rivalry is exacerbated by slower market growth, forcing companies like Highwoods Properties to compete more aggressively for available space, particularly as hybrid work models reshape demand. Highwoods focuses on prime, amenity-rich locations to differentiate itself in this challenging environment.

Exit barriers in commercial real estate are substantial due to illiquid assets and long-term leases, keeping competitors in the market and intensifying rivalry. The high capital investment required for properties means companies are often committed long-term, even during downturns, leading to sustained competition for market share.

High fixed costs, such as property taxes and maintenance, necessitate high occupancy for companies like Highwoods. This drives aggressive leasing and pricing strategies to secure tenants and cover ongoing expenses, a pressure amplified in the current market conditions of 2024.

| Competitor Type | Examples | Market Share Impact |

| Public REITs | Boston Properties, Vornado Realty Trust | Direct competition for tenants and investment capital. |

| Private Real Estate Firms | Blackstone Real Estate, Starwood Capital | Acquire and manage properties, influencing market dynamics. |

| Institutional Investors | Pension Funds, Insurance Companies | Significant capital deployers, impacting property valuations. |

| Individual Property Owners | Local investors | Fragmented competition, particularly in smaller markets. |

SSubstitutes Threaten

The most significant substitute for traditional office space is the widespread adoption of remote and hybrid work models. The continued entrenchment of these flexible arrangements, with office attendance hovering around 54% since 2023, directly diminishes the demand for physical office footprints.

This shift forces companies to re-evaluate their leased space needs, potentially leading to downsizing or a preference for shorter, more adaptable lease terms, impacting landlords like Highwoods Properties.

The growing popularity of co-working spaces and flexible office solutions presents a significant threat of substitutes for traditional office landlords like Highwoods Properties. These alternatives offer businesses, from startups to larger enterprises, the ability to bypass long-term leases, access shared amenities, and reduce upfront capital investment. For example, in 2024, the flexible office market continued its expansion, with major players like WeWork and Industrious reporting increased occupancy rates as companies prioritize agility and cost-effectiveness in their real estate strategies.

Companies are actively optimizing their office footprints, leading to a reduction in the demand for traditional office space. For instance, a 2024 survey by CBRE indicated that 55% of companies were considering or implementing hybrid work models, which often translates to less physical office space per employee. This trend directly impacts landlords like Highwoods Properties by decreasing the need for new leases and potentially shrinking existing tenant requirements.

The rise of efficient space utilization strategies, such as hot-desking and flexible layouts, acts as a significant substitute for traditional office leasing. Even if a company maintains its headquarters, these internal substitutions mean less square footage is needed. This phenomenon directly challenges Highwoods' ability to secure new leases and expand revenue from its current tenant base, as companies become more adept at maximizing their existing leased areas.

Technological Advancements in Collaboration

The increasing sophistication of collaboration technologies, including advanced video conferencing and cloud-based productivity suites, significantly reduces the need for physical office spaces. These tools empower seamless remote work, directly challenging traditional office leasing models.

Despite some companies mandating a return to the office, the underlying technological infrastructure for remote collaboration continues to mature, offering viable alternatives to physical presence. For instance, by Q2 2024, the global market for collaboration software was projected to reach over $60 billion, indicating strong adoption and continued innovation.

- Virtual Reality (VR) and Augmented Reality (AR) are emerging as powerful collaboration tools, offering immersive remote meeting experiences that can substitute for in-person interactions.

- Cloud-based platforms like Microsoft Teams and Slack saw significant user growth in 2023 and early 2024, demonstrating their effectiveness in facilitating distributed workforces.

- The continued development of these technologies lowers the switching costs for businesses looking to move away from traditional office leases.

Repurposing of Commercial Buildings

The repurposing of commercial buildings presents a significant threat of substitutes for traditional office spaces. Older or underutilized office properties are increasingly being converted into residential units, hotels, or specialized facilities. This trend directly impacts the demand for new office development and existing office leases. For instance, in 2024, cities like New York and San Francisco saw a notable uptick in office-to-residential conversions, aiming to address housing shortages and revitalize urban cores.

This shift away from purely office use means that Highwoods Properties, and similar REITs, must consider how these conversions affect overall office supply and demand dynamics. While it can reduce the long-term availability of office space, it also signals a fundamental change in how commercial real estate is utilized in certain markets. This can lead to a decrease in rental income from traditional office leases if demand falters in the face of these alternative uses.

- Office-to-Residential Conversions: Cities are actively encouraging these conversions to boost housing stock and repurpose aging commercial assets.

- Impact on Office Supply: Repurposing reduces the net effective supply of office space, potentially benefiting remaining office properties if demand remains stable.

- Shifting Demand Dynamics: The attractiveness of office space as an investment is challenged by the viability of alternative, often higher-yielding, uses for commercial buildings.

The threat of substitutes for traditional office space is substantial, driven by evolving work arrangements and technological advancements. Remote and hybrid work models, now firmly established, directly reduce the need for physical office footprints, with office attendance figures stabilizing around 54% since 2023.

Co-working spaces and flexible office solutions offer businesses agility and cost savings, bypassing long-term leases. In 2024, this sector continued to grow, with companies prioritizing adaptability. Furthermore, advanced collaboration technologies like VR/AR and cloud platforms facilitate seamless remote work, diminishing the necessity for in-person interactions and physical office presence.

| Substitute Type | Description | 2024 Impact/Trend |

|---|---|---|

| Remote/Hybrid Work | Reduced need for physical office space per employee. | Office attendance ~54% (since 2023); 55% of companies considering hybrid models (CBRE, 2024). |

| Co-working/Flexible Offices | Agility, shared amenities, lower upfront costs. | Continued market expansion, increased occupancy rates for providers. |

| Collaboration Technology | Enables effective remote work and virtual interaction. | Global collaboration software market projected >$60 billion (Q2 2024); strong adoption of platforms like Teams/Slack. |

| Repurposing of Buildings | Office spaces converted to residential, hotels, etc. | Notable uptick in conversions in major cities (e.g., NYC, SF) in 2024. |

Entrants Threaten

The commercial real estate sector, especially for office properties, requires massive upfront capital. Newcomers must contend with the steep costs of acquiring land, constructing buildings, and securing financing, which in 2024 has remained a significant hurdle. For instance, the average cost to build a Class A office building in major US markets can easily run into hundreds of millions of dollars, creating a substantial barrier to entry.

Established REITs like Highwoods Properties leverage decades of experience, fostering deep-seated relationships with key stakeholders including tenants, brokers, and financial institutions. This history translates into a strong reputation for reliability and performance in development and property management, a significant barrier for newcomers.

New entrants often struggle to replicate this ingrained network and trusted reputation, making it challenging to secure prime properties, attract premium tenants, and obtain competitive financing terms. For instance, in 2024, the average time to secure a significant commercial lease renewal for established landlords often exceeds six months, highlighting the value of existing tenant relationships.

Highwoods Properties strategically targets Best Business District (BBD) locations, areas where available land for new construction is exceptionally scarce. This scarcity, coupled with often rigorous zoning laws, naturally limits the ability of new companies to establish a foothold.

Acquiring prime, well-situated land parcels represents a substantial hurdle for potential new entrants. Such opportunities are not only rare but also highly coveted by existing, well-capitalized companies like Highwoods, making it difficult for newcomers to compete for these essential assets.

Regulatory and Zoning Hurdles

The commercial real estate sector, particularly for office spaces like those developed by Highwoods Properties, faces significant barriers to entry due to stringent regulatory frameworks. Navigating complex zoning laws, obtaining permits, and completing environmental impact studies are time-consuming and expensive processes. For instance, in many major metropolitan areas, the entitlement process for a new office building can take several years and involve multiple public hearings and agency reviews.

These regulatory and zoning hurdles act as a substantial deterrent for potential new entrants. The sheer complexity and cost associated with compliance can make it difficult for smaller or less experienced developers to compete. This creates a more stable environment for established players like Highwoods Properties, who have the expertise and resources to manage these challenges effectively.

- Regulatory Complexity: Commercial real estate development requires adherence to a vast array of local, state, and federal regulations.

- Zoning Restrictions: Land use regulations often limit where and what type of commercial properties can be built, impacting site selection and project feasibility.

- Environmental Assessments: Thorough environmental reviews are mandatory, adding time and cost to the development lifecycle.

- Permitting Delays: Obtaining the necessary building permits can be a lengthy and unpredictable process, increasing project risk and holding costs.

Market Saturation and Oversupply in Some Segments

The threat of new entrants for Highwoods Properties, despite its focus on resilient Sun Belt markets, is influenced by broader office sector challenges. The national office vacancy rate hovered around 19.7% in Q1 2024, indicating significant existing capacity. This high vacancy, coupled with the persistent impact of remote work on office demand, suggests potential oversupply in specific segments. New players entering a market already grappling with elevated vacancy and reduced leasing activity would face intense pressure on rental rates and occupancy, making profitability a significant hurdle.

This market saturation can deter new entrants for several reasons:

- Reduced Profitability: Existing oversupply leads to downward pressure on rents, diminishing potential returns for newcomers.

- Higher Capital Requirements: To compete effectively in an oversupplied market, new entrants might need to invest more in amenities and tenant inducements.

- Slower Absorption Rates: New office space will take longer to lease up when there's already a surplus of available units.

- Intensified Competition: Existing landlords, including Highwoods, may become more aggressive in retaining tenants and attracting new ones, raising the bar for new competitors.

The threat of new entrants for Highwoods Properties is considerably low due to substantial capital requirements and established relationships. The sheer cost of acquiring prime land and constructing modern office buildings, often in the hundreds of millions of dollars as seen in 2024, acts as a significant deterrent. Furthermore, Highwoods' long-standing reputation and deep ties with tenants and financial institutions are difficult for newcomers to replicate, making it challenging to secure competitive financing and desirable tenants.

The scarcity of prime locations, often in Best Business Districts, combined with stringent zoning and permitting processes that can take years to navigate, further limits new competition. These regulatory hurdles, alongside the need for extensive environmental assessments, add significant time and cost, favoring established players with the expertise to manage such complexities.

Market saturation, with national office vacancy rates around 19.7% in Q1 2024, also discourages new entrants by reducing potential profitability and slowing absorption rates. In such an environment, new developers face intense competition and pressure on rental rates, making it a less attractive proposition compared to markets with higher demand and lower vacancy.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land acquisition and construction (hundreds of millions of dollars). | Significant hurdle, limiting the pool of potential competitors. |

| Established Relationships | Decades of experience fostering trust with tenants and financial institutions. | Difficult for new entrants to match, impacting leasing and financing. |

| Location Scarcity & Zoning | Limited prime land availability and complex, lengthy entitlement processes. | Restricts site selection and increases development time/cost for newcomers. |

| Market Saturation | High office vacancy rates (e.g., 19.7% in Q1 2024) and persistent remote work impacts. | Deters entry due to reduced profitability and slower lease-up potential. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Highwoods Properties is built upon a foundation of publicly available financial data, including annual reports and SEC filings, supplemented by industry-specific market research and reports from reputable real estate analytics firms.