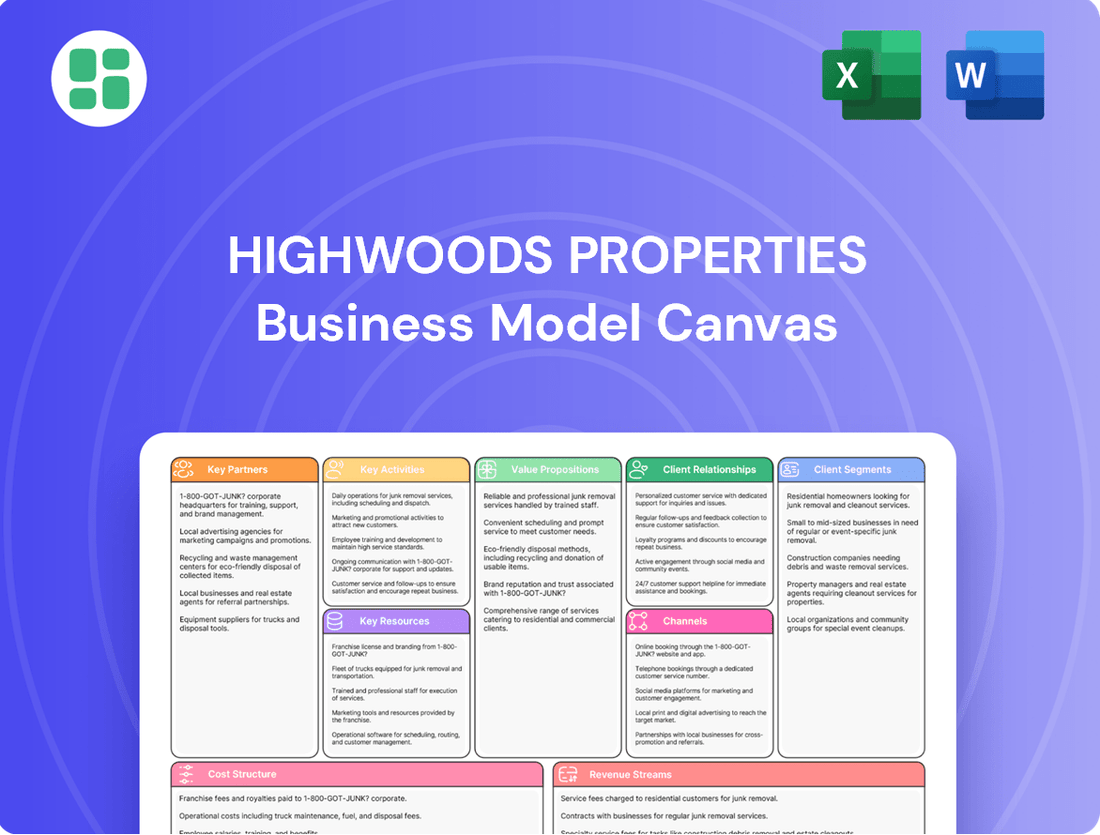

Highwoods Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Highwoods Properties Bundle

Unlock the strategic blueprint of Highwoods Properties with our comprehensive Business Model Canvas. This detailed analysis reveals their approach to key partnerships, customer relationships, and revenue streams within the competitive office real estate market. Discover how they create and deliver value to their stakeholders.

Ready to gain a deeper understanding of Highwoods Properties's success? Download the full Business Model Canvas to explore their core activities, cost structure, and competitive advantages. This professionally crafted document is your key to unlocking actionable insights for your own business strategy.

Partnerships

Highwoods Properties relies on a network of construction and development partners to bring its new properties and major renovation projects to fruition. These collaborations are essential for managing the complexities of large-scale real estate ventures.

The successful stabilization of the 2827 Peachtree development in Q1 2025 exemplifies the importance of these partnerships in delivering projects on time and within budget. Such collaborations ensure Highwoods can execute its strategic growth plans effectively.

Highwoods Properties actively cultivates relationships with financial institutions and lenders, securing essential capital for its strategic initiatives. These partnerships are crucial for funding property acquisitions, new development projects, and ensuring overall corporate liquidity.

Maintaining a robust balance sheet and readily available cash is a top priority for Highwoods, and these strong ties with banks and other financial entities directly support this objective. For instance, in 2024, Highwoods continued to leverage its credit facilities, demonstrating the ongoing importance of these financial partnerships in managing its portfolio and growth.

Highwoods Properties relies on a robust network of external real estate brokers and its dedicated internal leasing teams. This dual approach is crucial for sourcing new tenant opportunities and ensuring smooth lease renewals across their office portfolio. In 2024, Highwoods reported a significant portion of its leasing activity was driven by these partnerships, contributing to their goal of maintaining strong occupancy levels.

Technology and Service Providers

Highwoods Properties collaborates with technology and service providers to integrate cutting-edge building management systems and tenant-focused solutions. These partnerships are crucial for delivering an enhanced tenant experience and improving operational efficiency across their portfolio.

Key technology integrations include platforms like SmartPark for parking management, VersaPay for streamlined payment processing, and Prism Services for comprehensive building operations. These systems aim to make tenant interactions smoother and property management more effective.

- SmartPark: Enhances parking experience and management.

- VersaPay: Facilitates efficient rent collection and tenant payments.

- Prism Services: Supports advanced building operations and maintenance.

Joint Venture Partners

Highwoods Properties strategically engages in joint ventures for select development and acquisition projects to share investment burdens and mitigate risk. This approach allows for greater participation in significant opportunities.

A prime example of this partnership strategy is Highwoods' 50% ownership stake in the 2827 Peachtree development, a venture undertaken with Brand Properties. This collaboration highlights their commitment to shared growth and resource pooling.

These joint ventures are crucial for Highwoods' ability to undertake larger-scale projects, leveraging the expertise and capital of partners like Brand Properties. In 2024, Highwoods continued to evaluate such strategic alliances for future growth initiatives.

- Joint Ventures for Strategic Developments

- Risk and Investment Sharing

- Example: 50% interest in 2827 Peachtree with Brand Properties

- Facilitates larger-scale project participation

Highwoods Properties strategically partners with financial institutions to secure capital for acquisitions and development, ensuring corporate liquidity and supporting growth initiatives. In 2024, the company continued to utilize its credit facilities, underscoring the vital role of these financial relationships in managing its portfolio and expansion plans.

| Partnership Type | Key Function | Example/Impact |

| Financial Institutions | Capital Access, Liquidity | Continued use of credit facilities in 2024 for growth and portfolio management. |

| Construction & Development | Project Execution | Essential for large-scale ventures, ensuring timely and budget-conscious delivery, as seen with 2827 Peachtree stabilization in Q1 2025. |

| Real Estate Brokers & Internal Leasing | Tenant Sourcing & Retention | Drove significant leasing activity in 2024, crucial for maintaining occupancy. |

| Technology & Service Providers | Operational Efficiency & Tenant Experience | Integration of systems like SmartPark and Prism Services for enhanced property management. |

| Joint Ventures (e.g., Brand Properties) | Risk Mitigation & Capital Pooling | Facilitates larger projects, exemplified by 50% ownership in 2827 Peachtree, with ongoing evaluation of alliances in 2024. |

What is included in the product

This Business Model Canvas outlines Highwoods Properties' strategy of owning, operating, and developing high-quality office buildings in prime urban markets, focusing on tenant satisfaction and long-term value creation.

Highwoods Properties' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, enabling quick identification of core components and efficient communication of their value proposition to stakeholders.

Activities

Highwoods Properties' core activity involves the strategic acquisition of premium office assets, with a keen eye on prime locations within Best Business Districts (BBDs) across the Southeast and Mid-Atlantic regions. This focus ensures a portfolio concentrated in areas with strong tenant demand and potential for long-term value appreciation.

A notable example of this strategy in action is Highwoods' acquisition of the Advance Auto Tower in Raleigh, North Carolina, in 2025. This transaction underscores their commitment to investing in high-quality, well-located properties that align with their investment criteria and enhance their market presence.

Highwoods Properties actively pursues the development of new, high-quality office properties, overseeing the entire process from initial planning through to final completion. This strategic focus on new construction is a core driver of future revenue and asset growth.

The company's development pipeline includes notable projects like 23Springs in Dallas and Midtown East in Tampa. These developments are anticipated to generate substantial net operating income once they reach a stabilized occupancy and operational status, bolstering Highwoods' overall financial performance.

Highwoods Properties' key activity of property management and operations is a fully integrated model, meaning they handle everything in-house. This includes overseeing the day-to-day running of their office buildings, from maintenance and repairs to ensuring smooth operations and providing excellent tenant services. This direct control allows Highwoods to maintain high standards and quickly address any tenant concerns.

In 2024, Highwoods continued to emphasize this integrated approach, which is crucial for tenant retention and satisfaction in the competitive office market. Their ability to manage properties directly, handling everything from leasing to building upkeep, contributes to their operational efficiency and allows for a more personalized tenant experience, a critical factor in securing and renewing leases.

Leasing and Tenant Relationship Management

Highwoods Properties' key activities center on securing new leases and diligently managing relationships with its existing tenant base. This dual focus is crucial for maintaining high occupancy rates and fostering tenant satisfaction, which directly impacts revenue stability. The company demonstrated robust leasing momentum through the first half of 2025, evidenced by significant activity in both new and second-generation lease agreements.

In the first quarter of 2025, Highwoods reported leasing approximately 250,000 square feet, a figure that rose to over 300,000 square feet by the end of the second quarter. This sustained leasing success highlights their effective tenant engagement and market responsiveness.

- Securing new leases to drive occupancy and revenue growth.

- Managing existing tenant relationships to ensure satisfaction and retention.

- Reporting strong leasing volumes in Q1 and Q2 2025, exceeding 300,000 square feet in total.

- Focusing on both new and second-generation leases to capture diverse market opportunities.

Capital Recycling and Portfolio Optimization

Highwoods Properties actively manages its real estate portfolio through capital recycling. This involves strategically selling assets that are no longer considered core or are older, to free up capital.

The proceeds from these sales are then reinvested into properties that offer higher quality and greater growth potential. This ongoing evaluation and reallocation are key to enhancing the overall portfolio's value and financial performance.

For instance, during 2024, Highwoods continued to execute this strategy. The company aims to strengthen its cash flow generation by focusing on assets with superior leasing metrics and favorable market dynamics.

- Portfolio Enhancement: Selling less strategic assets to acquire prime locations.

- Cash Flow Improvement: Reinvesting in properties with stronger rental income potential.

- Strategic Divestitures: Actively managing the portfolio by divesting older or non-core assets.

- Growth Focus: Prioritizing investments in higher-quality, growth-oriented real estate.

Highwoods Properties' key activities revolve around strategic asset acquisition and development, focusing on premium office spaces in prime urban locations. They also excel in integrated property management, ensuring tenant satisfaction and operational efficiency. Furthermore, active leasing and capital recycling are central to their business model, driving portfolio growth and financial performance.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Acquisition & Development | Strategic acquisition of premium office assets and new property development. | Acquired Advance Auto Tower in Raleigh, NC in 2025; developing 23Springs in Dallas and Midtown East in Tampa. |

| Property Management | In-house management of day-to-day operations, maintenance, and tenant services. | Maintained high standards for tenant retention and satisfaction throughout 2024. |

| Leasing | Securing new leases and managing existing tenant relationships. | Leased over 300,000 sq ft in H1 2025, demonstrating strong leasing momentum. |

| Capital Recycling | Selling non-core assets to reinvest in higher-quality, growth-oriented properties. | Continued strategic divestitures and reinvestments in 2024 to enhance portfolio value and cash flow. |

Full Version Awaits

Business Model Canvas

The Highwoods Properties Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive analysis breaks down their strategic approach, detailing key partners, activities, and resources. You'll gain a clear understanding of their value propositions, customer relationships, and channels, all presented in a ready-to-use format.

Resources

Highwoods Properties' key resource is its extensive portfolio of high-quality, Class A office buildings. These properties are strategically situated in Business

As of the first quarter of 2024, Highwoods Properties reported owning or having an interest in 51 office properties totaling approximately 17.0 million square feet. This substantial real estate footprint represents the tangible core of their business, providing the physical assets necessary to generate rental income and capital appreciation.

Highwoods Properties strategically manages a substantial portfolio of undeveloped land parcels, acting as a crucial land bank for future development. This extensive land reserve ensures a consistent pipeline for growth and expansion opportunities within its core markets, underpinning its long-term strategic vision.

As of the first quarter of 2024, Highwoods Properties reported ownership of approximately 17 million square feet of undeveloped land. This land bank is a significant asset, providing the flexibility to respond to market demand and pursue value-creation opportunities through new construction projects.

Highwoods Properties leverages its strong financial capital and robust balance sheet as a key resource. This includes significant access to diverse funding avenues such as equity, various debt instruments, and a substantial revolving credit facility, which as of the first quarter of 2024, provided ample liquidity.

This financial flexibility is crucial for Highwoods, empowering the company to pursue strategic growth opportunities, including opportunistic acquisitions and significant development projects that align with its portfolio strategy.

Experienced Management and Operations Teams

Highwoods Properties’ experienced management and operations teams are a cornerstone of its business model. This skilled workforce, encompassing executive leadership, property management, and leasing professionals, is crucial for executing the company's strategy and achieving operational efficiency.

Their collective expertise directly influences strategic decision-making and day-to-day operations, ensuring Highwoods can effectively manage its portfolio and capitalize on market opportunities. This human capital is a key driver of the company's ability to deliver value to its stakeholders.

- Executive Leadership: Guides overall corporate strategy and capital allocation.

- Property Management: Oversees tenant relations, building maintenance, and operational costs.

- Leasing Professionals: Drive occupancy rates and optimize lease terms.

Brand Reputation and Market Expertise

Highwoods Properties has cultivated a significant brand reputation as a premier player in the commercial real estate sector, particularly within its strategically chosen Sun Belt markets. This established presence and recognized expertise are crucial for attracting high-quality tenants and securing attractive investment prospects.

Their deep understanding of local market dynamics allows Highwoods to identify and capitalize on emerging opportunities, further solidifying their leadership position. This market acumen is a cornerstone of their business model, driving value and tenant satisfaction.

- Brand Recognition: Highwoods is widely known for its quality properties and reliable management in key Sun Belt cities.

- Market Expertise: The company possesses in-depth knowledge of local leasing trends, tenant demands, and investment potential across its operating regions.

- Tenant Attraction: This strong reputation and market insight are instrumental in drawing and retaining desirable, creditworthy tenants.

- Investment Appeal: Highwoods' established brand and market leadership make it an attractive partner for investors seeking stable, income-generating real estate assets.

Highwoods Properties' key resources include its substantial portfolio of Class A office buildings in prime Sun Belt locations, a significant land bank for future development, strong financial capital and liquidity, and a highly experienced management and operations team. These assets, combined with a well-established brand reputation and deep market expertise, form the foundation of its business model, enabling it to attract quality tenants and pursue strategic growth initiatives.

| Key Resource | Description | Q1 2024 Data/Context |

| Office Property Portfolio | High-quality, Class A office buildings in key Sun Belt cities. | 51 properties totaling approximately 17.0 million square feet. |

| Undeveloped Land Bank | Parcels reserved for future development and expansion. | Approximately 17 million square feet of land. |

| Financial Capital & Liquidity | Access to equity, debt, and revolving credit facilities. | Substantial liquidity from diverse funding avenues. |

| Management & Operations Teams | Skilled personnel in executive leadership, property management, and leasing. | Expertise driving strategic decisions and operational efficiency. |

| Brand Reputation & Market Expertise | Premier player status and in-depth knowledge of Sun Belt markets. | Attracts quality tenants and identifies emerging opportunities. |

Value Propositions

Highwoods Properties excels by offering premier office spaces in the most desirable and active business districts. These locations are not just addresses; they are vibrant hubs designed to energize businesses.

These prime BBD locations significantly boost a tenant's capacity to attract and retain top talent. Employees value the convenience of being near essential amenities and a readily available pool of skilled professionals.

In 2024, Highwoods' portfolio, concentrated in top-tier BBDs like downtown Nashville and the Research Triangle Park, demonstrated resilience. For instance, their occupancy rates in these key markets often outpaced national averages, reflecting the strong demand for these strategic locations.

Highwoods Properties offers Class A office spaces that are not just modern but also built with resilience and sustainability in mind, often achieving LEED-Gold certification. These environments are intentionally designed to foster both productivity and collaborative spirit among the workforce.

In 2024, Highwoods continued to emphasize these high-quality environments, recognizing their importance in attracting and retaining top-tier tenants in competitive urban markets. Their portfolio consistently reflects a commitment to creating spaces that enhance employee well-being and operational efficiency for businesses.

Highwoods Properties goes beyond simply leasing office space by offering a comprehensive suite of tailored solutions and services. This includes expert design, meticulous space planning, and efficient construction management to ensure properties perfectly match tenant requirements.

Their commitment extends to responsive property management, creating a seamless experience for occupants. This holistic approach allows Highwoods to customize both the physical space and the ongoing services, directly addressing the unique needs of each business they serve.

Commitment to Customer Experience

Highwoods Properties prioritizes creating outstanding environments and experiences for its tenants, positioning itself as a key partner in their business operations.

- Tenant-Centric Environments: The company actively cultivates spaces that enhance productivity and employee well-being, contributing to tenant satisfaction.

- Strategic Partnership: Highwoods goes beyond leasing, aiming to understand and support tenants' evolving operational needs, fostering loyalty.

- Relationship Building: This focus on customer experience cultivates strong, long-term relationships, evident in their high tenant retention rates.

In 2024, Highwoods reported a robust occupancy rate across its portfolio, reflecting the success of its customer experience initiatives in attracting and retaining high-quality tenants.

Sustainable and Resilient Workplaces

Highwoods Properties champions sustainable and resilient workplaces, integrating environmental, social, and governance (ESG) principles into its property development and operations. This focus directly addresses the growing demand from tenants seeking to align their corporate responsibility goals with their physical office spaces, fostering healthier and more eco-conscious work environments.

This commitment to sustainability resonates strongly with businesses that prioritize ESG performance, a trend amplified by increasing investor and consumer scrutiny. For instance, in 2024, a significant portion of companies reported setting or advancing their ESG targets, making properties that support these initiatives highly attractive.

- Tenant Attraction: Highwoods' ESG-focused properties appeal to a growing segment of the market prioritizing sustainability and corporate social responsibility.

- Operational Efficiency: Investments in resilient and sustainable building practices can lead to reduced operating costs through energy and water efficiency.

- Brand Enhancement: Partnering with a landlord committed to ESG can bolster a tenant's own brand image and reputation.

- Future-Proofing: Building for resilience and sustainability prepares properties for evolving regulatory landscapes and climate-related risks.

Highwoods Properties delivers exceptional value by providing Class A office spaces in prime, dynamic business districts. These locations are strategically chosen to enhance tenant visibility and access to talent. Their commitment to creating productive and collaborative work environments, often incorporating LEED-certified designs, directly supports tenant operational efficiency.

Furthermore, Highwoods acts as a strategic partner, offering tailored solutions from design to ongoing property management. This comprehensive approach ensures spaces meet precise tenant needs and fosters long-term relationships, a strategy that proved effective in 2024 with strong occupancy rates in key markets like Nashville and the Research Triangle Park.

Their dedication to sustainability and ESG principles attracts businesses focused on corporate responsibility, a growing market segment. By offering resilient and eco-conscious workplaces, Highwoods not only appeals to tenants but also enhances their own brand and future-proofs their assets against evolving regulations and climate risks.

| Value Proposition | Key Benefit | 2024 Relevance |

|---|---|---|

| Premier Office Spaces in BBDs | Enhanced talent attraction & retention, increased visibility | High occupancy in strategic markets like Nashville |

| Tenant-Centric Environments | Improved productivity, employee well-being, tenant satisfaction | Strong tenant retention rates |

| Tailored Solutions & Services | Seamless experience, customized spaces & operations | Responsive property management |

| Sustainable & Resilient Workplaces | Attracts ESG-focused tenants, operational efficiency, brand enhancement | Growing tenant demand for ESG alignment |

Customer Relationships

Highwoods Properties assigns specialized property management teams to each of its properties, ensuring tenants receive top-tier service and support. This direct, hands-on approach means tenant needs are addressed quickly and efficiently.

Highwoods Properties actively cultivates enduring tenant connections by maintaining open lines of communication and engaging proactively. Their strategy focuses on understanding and anticipating tenant needs, which is crucial for fostering loyalty and securing lease renewals.

Highwoods Properties cultivates strong customer relationships by offering tailored service delivery, a key component of their business model. This involves providing customized solutions, such as design and construction management, to precisely meet the dynamic space and operational requirements of their tenants.

This dedication to flexibility and personalized service is designed to significantly enhance tenant loyalty, ensuring long-term partnerships. For instance, in 2024, Highwoods continued to focus on these tenant-centric approaches, aiming to retain a high percentage of their existing lease agreements, which historically has been a strong point for the company.

Focus on Inspiring Work Environments

Highwoods Properties champions a 'work-placemaking' philosophy, actively cultivating environments designed to inspire tenant teams. This focus on creating dynamic and engaging spaces directly supports their core mission of empowering customers to achieve greater success through enhanced collaboration and productivity.

This approach is more than just providing office space; it's about fostering a sense of community and innovation within their properties. By prioritizing an inspiring work environment, Highwoods aims to be a partner in their tenants' growth, understanding that a well-designed workplace can significantly impact employee morale and output.

- Inspiring Environments: Highwoods' strategy centers on creating spaces that boost tenant team morale and productivity.

- Customer Success: This philosophy directly supports their mission to help clients achieve more.

- Collaborative Culture: The aim is to foster a more collaborative and productive work experience for tenants.

Lease Structuring and Renewal Programs

Highwoods Properties cultivates enduring customer relationships by focusing on structured lease agreements and proactive renewal programs. This approach fosters long-term tenant commitments, a cornerstone of their stable revenue streams.

The company's success in this area is evident in its leasing performance. For instance, in the first quarter of 2024, Highwoods Properties reported a strong retention rate of 86.4% on expiring leases. This demonstrates their effectiveness in keeping existing tenants satisfied and engaged.

- Lease Structuring: Tailored lease terms designed to meet tenant needs and ensure long-term stability.

- Renewal Programs: Active engagement with tenants to facilitate lease extensions and maintain occupancy.

- Tenant Retention: A key metric reflecting the success of their relationship management, with a Q1 2024 retention rate of 86.4% on expiring leases.

- Long-Term Commitments: The emphasis on structured agreements and renewals leads to extended tenant occupancy, securing predictable income.

Highwoods Properties prioritizes tenant satisfaction through dedicated property management teams and proactive communication, fostering loyalty and lease renewals. Their approach includes offering tailored solutions like design and construction management to meet specific tenant needs, enhancing the overall tenant experience.

The company's commitment to creating inspiring work environments, a core aspect of their 'work-placemaking' philosophy, directly supports tenant success by promoting collaboration and productivity. This focus on partnership rather than just space provision is key to their customer relationship strategy.

Highwoods actively manages customer relationships through structured lease agreements and robust renewal programs. This strategy is highly effective, as demonstrated by their strong tenant retention rates. For example, in the first quarter of 2024, Highwoods achieved an impressive 86.4% retention rate on expiring leases, highlighting their success in maintaining long-term tenant commitments.

| Customer Relationship Strategy | Key Initiatives | Performance Metric (Q1 2024) |

|---|---|---|

| Dedicated Property Management | Specialized teams for each property, direct tenant support | N/A |

| Proactive Communication & Engagement | Understanding and anticipating tenant needs | N/A |

| Tailored Service Delivery | Customized solutions (e.g., design, construction management) | N/A |

| Inspiring Work-Placemaking | Creating environments for collaboration and productivity | N/A |

| Structured Lease Agreements & Renewal Programs | Fostering long-term commitments | 86.4% Lease Retention Rate |

Channels

Highwoods Properties leverages its dedicated, in-house direct leasing teams as a core component of its business model. These professionals are instrumental in cultivating direct relationships with both potential and current tenants, ensuring a personalized and efficient leasing experience.

These teams actively showcase Highwoods' office properties, highlighting key features and amenities to attract and retain tenants. Their expertise in market nuances allows for effective negotiation of lease terms, directly impacting occupancy rates and rental income.

In 2024, Highwoods reported a strong leasing performance, with their direct leasing efforts contributing to a significant portion of new and renewed leases. This internal capability allows for greater control over the tenant relationship and a deeper understanding of market demands.

Highwoods Properties leverages extensive relationships with external real estate brokers and agents to effectively market its office properties. These partnerships are crucial for expanding their reach and connecting with a broad spectrum of potential tenants across various markets.

In 2024, the commercial real estate brokerage sector continued to be a vital conduit for property transactions. For instance, the National Association of REALTORS® reported that commercial real estate transactions, heavily influenced by broker networks, remained a significant part of the economy, even as market conditions evolved.

By engaging these external professionals, Highwoods Properties gains access to a wider tenant pool and benefits from their localized market knowledge and established client relationships, which are instrumental in driving leasing activity and occupancy rates.

Highwoods.com is the company's main digital storefront, offering detailed listings of available office spaces and acting as a comprehensive resource for investors. This platform is crucial for engaging with potential tenants and providing transparent information about Highwoods Properties' portfolio and financial performance.

In 2024, the company continued to leverage its website for lead generation and tenant communication, supplementing physical tours with virtual options. This digital presence is key to reaching a broad audience and efficiently managing property inquiries, particularly in a competitive leasing market.

Investor Relations and Public Communications

Highwoods Properties actively engages with its investor base through various channels, including quarterly earnings calls, comprehensive annual reports, and investor presentations. These platforms are crucial for disseminating financial performance data, outlining strategic initiatives, and clearly articulating the company's unique value proposition to stakeholders and the wider financial community.

In 2024, Highwoods continued to emphasize transparent communication. For instance, their Q1 2024 earnings call detailed same-store net operating income (NOI) growth and provided guidance for the full year. The company also issued press releases highlighting key leasing achievements and development progress, such as the commencement of construction on new projects in growth markets.

- Earnings Calls: Used to discuss quarterly financial results, provide forward-looking guidance, and answer analyst questions.

- Annual Reports: Offer a detailed overview of the company's performance, strategy, and financial position for the fiscal year.

- Investor Presentations: Visual aids used at conferences and dedicated investor days to highlight key metrics and strategic priorities.

- News Releases: Timely announcements of significant corporate events, such as leasing transactions, acquisitions, or dispositions.

Industry Events and Networking

Highwoods Properties actively participates in key real estate industry conferences and professional networking events. This engagement is crucial for forging connections with prospective tenants, influential brokers, and potential investors, thereby expanding their business reach and securing new leasing opportunities. For instance, in 2024, the company continued its participation in major industry gatherings, which are vital for understanding evolving market dynamics and tenant demands.

These events offer a platform for Highwoods to gain insights into emerging trends, new technologies, and shifts in tenant preferences within the office sector. By staying informed, they can better tailor their property offerings and strategies to meet current and future market needs, ensuring their portfolio remains competitive and attractive. This proactive approach to market intelligence is a cornerstone of their business development strategy.

The direct interaction at these events allows for relationship building, which is invaluable for long-term business success. Highwoods leverages these opportunities to:

- Cultivate relationships with key decision-makers in the real estate ecosystem.

- Identify and pursue new leasing and investment opportunities.

- Gather competitive intelligence on market trends and competitor strategies.

- Enhance brand visibility and establish thought leadership within the industry.

Highwoods Properties utilizes its own website, Highwoods.com, as a primary channel for property listings and investor information. This digital platform serves as a crucial tool for lead generation and tenant engagement, complementing physical property viewings.

In 2024, the company continued to enhance its online presence, offering virtual tours and detailed property data to attract a wider audience. This digital focus is essential for efficient communication and marketing in the competitive office leasing market.

Customer Segments

Highwoods Properties primarily courts established corporations and growing mid-sized businesses as its core customer base for premium office spaces. These clients are typically seeking Class A office environments that project a strong corporate image and offer modern amenities to attract and retain talent.

In 2024, Highwoods reported that its portfolio was approximately 90% leased, with a significant portion of this occupancy driven by corporate tenants. This high occupancy rate underscores the demand from businesses that prioritize location, quality, and a professional work environment for their employees and clients.

Professional services firms, such as law offices and consulting agencies, represent a key customer segment for Highwoods Properties. These businesses prioritize premium locations, often in central business districts (BBDs), and require modern, well-equipped office spaces to attract talent and serve clients effectively. In 2024, the demand for Class A office space in major urban centers, a staple for these firms, remained robust, with average asking rents in core markets showing stability or slight increases.

Highwoods Properties actively courts technology and innovation companies, recognizing their need for dynamic, collaborative, and inspiring workspaces. These businesses, often operating in fast-paced, high-growth sectors, seek environments that foster creativity and attract top talent. By offering modern amenities and flexible lease terms, Highwoods aims to be the preferred landlord for these forward-thinking organizations.

In 2024, the technology sector continued to be a significant driver of office leasing demand. Companies in this space often prioritize locations with strong connectivity, access to talent pools, and a vibrant ecosystem of related businesses, all of which Highwoods strives to provide in its prime urban locations.

Diversified Industry Tenants

Highwoods Properties serves a wide array of businesses, from government agencies to large corporations. This diversification is a key strength, spreading risk across different economic sectors. For instance, major financial institutions like Bank of America are among their tenants, alongside various other corporate entities.

This broad tenant mix means Highwoods isn't overly reliant on any single industry's performance. As of the first quarter of 2024, their occupancy rate stood at a healthy 91.9%, demonstrating the consistent demand for their office spaces across their portfolio.

- Diverse Tenant Industries: Includes government, financial services, technology, and professional services.

- Major Corporate Clients: Bank of America is a notable tenant, highlighting the quality of Highwoods' properties.

- Risk Mitigation: Diversification reduces dependence on any single industry's economic cycle.

- Strong Occupancy: Maintained high occupancy rates, with Q1 2024 at 91.9%, indicating tenant retention and demand.

Companies Seeking Strategic Sun Belt Locations

Companies prioritizing the Sun Belt for its robust growth, favorable demographics, and business-friendly policies represent a crucial customer segment for Highwoods Properties. These businesses are actively seeking strategic locations that offer access to expanding talent pools and consumer markets.

The Sun Belt's appeal is underscored by significant population influx and economic expansion. For instance, states like Texas and Florida continue to attract businesses and residents, driven by lower taxes and a generally more permissive regulatory environment compared to other regions.

- Sun Belt Growth Drivers: Companies are drawn to the Sun Belt for its accelerating population growth, which fuels consumer demand and expands the available workforce.

- Business-Friendly Climate: Favorable tax structures and regulatory policies in Sun Belt states encourage corporate relocation and expansion.

- Talent Acquisition: The region's growing population provides access to a diverse and expanding talent pool, essential for businesses across various sectors.

- Market Access: Strategic locations within the Sun Belt offer companies proximity to key consumer markets and logistical advantages.

Highwoods Properties' customer base is primarily comprised of established corporations and mid-sized businesses seeking premium, Class A office spaces in prime urban locations. These tenants, including professional services firms and technology companies, prioritize environments that enhance their corporate image, attract talent, and offer modern amenities. As of Q1 2024, Highwoods maintained a strong occupancy rate of 91.9%, reflecting consistent demand from these key segments.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Established Corporations | Seeking Class A office space, strong corporate image, talent attraction. | Drove significant portion of ~90% portfolio lease in 2024. |

| Mid-Sized Businesses | Growing companies needing modern, well-equipped spaces. | Contributed to robust demand in core markets. |

| Professional Services Firms | Law, consulting; prioritize CBD locations, modern facilities. | Average asking rents in core markets stable/increasing in 2024. |

| Technology Companies | Need dynamic, collaborative workspaces, good connectivity, talent access. | Continued to be a significant driver of office leasing demand. |

| Sun Belt Focused Businesses | Attracted by growth, demographics, business-friendly policies. | Leveraging population influx and economic expansion in states like TX, FL. |

Cost Structure

Property operating expenses represent a significant portion of Highwoods Properties' cost structure, directly reflecting the demands of maintaining its office portfolio. These ongoing costs encompass essential services like routine maintenance, electricity and water for building operations, property taxes levied by local governments, and insurance premiums to cover potential risks.

These expenses are intrinsically linked to the scale of Highwoods' real estate holdings and how much of that space is actively leased. For instance, in 2023, Highwoods reported total operating expenses of $565.5 million, a figure that naturally fluctuates with occupancy levels and the overall size of their property portfolio.

Highwoods Properties' cost structure is significantly influenced by property development and construction expenses. These expenditures encompass the acquisition of land for new office buildings, the actual construction process, and various pre-development costs like design and permitting.

For the fiscal year 2024, capital expenditures for development and redevelopment projects were a key outlay. While specific figures fluctuate, these investments are crucial for expanding and modernizing their portfolio, directly impacting the company's bottom line.

General and Administrative (G&A) expenses for Highwoods Properties encompass the essential overhead required to operate the corporate entity, distinct from property-specific costs. These include salaries for executive leadership, finance, legal, human resources, and other corporate support functions. In 2024, Highwoods reported G&A expenses of approximately $90.7 million, which represented about 12.6% of their total operating expenses, reflecting the significant investment in maintaining a robust corporate infrastructure to support their portfolio.

Financing and Interest Expenses

As a Real Estate Investment Trust (REIT), Highwoods Properties relies on debt to fund its extensive property portfolio and pursue new development opportunities. This financing strategy naturally leads to significant interest expenses, a core component of its cost structure.

Managing these interest expenses is paramount for Highwoods' financial health. The company must carefully oversee its debt maturities and maintain a robust balance sheet to ensure continued access to capital and favorable borrowing terms.

- Debt Financing: Highwoods utilizes debt as a primary tool for capital allocation, funding acquisitions and developments.

- Interest Expense: A substantial portion of Highwoods' operating costs is attributable to interest payments on its outstanding debt.

- Balance Sheet Strength: Maintaining a strong balance sheet and managing debt maturities are crucial for operational stability and future growth.

- 2024 Data: For the first quarter of 2024, Highwoods reported interest expense of approximately $47.1 million, reflecting its ongoing reliance on debt financing.

Capital Expenditures and Tenant Improvements

Highwoods Properties incurs significant costs for capital expenditures and tenant improvements. These are crucial for keeping their office properties attractive and competitive in the market. For instance, in 2023, Highwoods reported $329.4 million in total capital expenditures, with a substantial portion allocated to tenant improvements and building enhancements.

These expenditures are not just for aesthetics; they are essential investments. They ensure that the spaces can be customized to meet the specific needs and modern requirements of prospective tenants, thereby facilitating new lease agreements and tenant retention. This proactive approach helps maintain high occupancy rates and rental income streams.

- Tenant Improvements: Costs to customize leased spaces for specific tenant needs.

- Building Enhancements: Investments in upgrades and renovations to maintain property value and appeal.

- Capital Expenditures: Ongoing spending to ensure properties remain modern and competitive.

Highwoods Properties' cost structure is anchored by property operating expenses, which include maintenance, utilities, taxes, and insurance. These costs are directly tied to the size and occupancy of their office portfolio. For 2023, total operating expenses amounted to $565.5 million, a figure that naturally scales with their real estate assets.

Development and construction expenses are another major cost driver, encompassing land acquisition and building construction. For 2024, capital expenditures on development projects were a significant outlay, vital for portfolio expansion and modernization.

General and Administrative (G&A) expenses cover corporate overhead, such as salaries for executive and support staff. In 2024, G&A expenses were approximately $90.7 million, representing about 12.6% of total operating expenses, highlighting investment in corporate infrastructure.

Interest expense is a substantial component due to Highwoods' reliance on debt financing for its properties and development. In the first quarter of 2024, interest expense was around $47.1 million, underscoring the importance of managing debt and maintaining balance sheet strength.

Capital expenditures, including tenant improvements, are critical for maintaining property competitiveness. In 2023, total capital expenditures reached $329.4 million, with a significant portion dedicated to enhancing leased spaces and building upgrades to attract and retain tenants.

| Cost Component | 2023 (Millions USD) | 2024 Q1 (Millions USD) | Notes |

|---|---|---|---|

| Total Operating Expenses | $565.5 | N/A | Reflects property maintenance, utilities, taxes, insurance. |

| General & Administrative (G&A) | N/A | $90.7 (Approx.) | Corporate overhead, including salaries and support functions. |

| Interest Expense | N/A | $47.1 (Approx.) | Cost of debt financing for portfolio and development. |

| Total Capital Expenditures | $329.4 | N/A | Includes tenant improvements and property enhancements. |

Revenue Streams

Highwoods Properties' core revenue generation comes from rental income derived from its extensive portfolio of office properties. This income primarily consists of base rent charged to tenants, but often includes additional rent to cover operating expenses such as property taxes, insurance, and maintenance, ensuring a stable and predictable cash flow.

For the first quarter of 2024, Highwoods Properties reported rental and other property income of $209.7 million. This figure underscores the significance of their leased office spaces as the primary engine for their financial performance, reflecting the ongoing demand for their strategically located and well-maintained properties.

Highwoods Properties strategically generates revenue through property dispositions, often referred to as capital recycling. This involves selling off assets that are considered non-core or have reached a certain stage in their lifecycle.

These sales are crucial for Highwoods, as the significant proceeds generated are then reinvested into newer, more strategically positioned, or higher-growth potential properties. For instance, in the first quarter of 2024, Highwoods completed the sale of two suburban office buildings for $70.5 million, demonstrating this ongoing strategy.

Highwoods Properties also generates income through lease termination fees. These are payments made by tenants who choose to end their lease agreements before the scheduled expiration date.

While not a primary or consistently predictable revenue source, these fees offer an opportunistic financial benefit. For instance, in 2023, Highwoods reported collecting $1.6 million in lease termination fees, contributing to their overall financial performance.

Parking and Other Ancillary Services

Highwoods Properties generates revenue from parking facilities at its office properties. These parking fees, along with other ancillary services offered to tenants, form a significant part of its income stream. In 2024, the company continued to leverage these services to enhance tenant experience and boost overall property profitability.

- Parking Revenue: Fees collected from tenants and visitors for parking spaces at Highwoods' office buildings.

- Ancillary Services: Income from services such as conference room rentals, event spaces, and other tenant amenities.

- Tenant Value: These services are designed to add value for tenants, encouraging longer lease terms and higher occupancy rates.

- Diversification: Parking and ancillary services provide a diversified revenue base beyond traditional rental income.

Development Profits (Indirect)

Development profits for Highwoods Properties, while indirect, are a crucial driver of long-term value. Successful projects, once stabilized, contribute to a higher net operating income (NOI) across the portfolio. This enhancement of recurring income directly bolsters shareholder value through increased dividends and capital appreciation.

In 2024, Highwoods Properties continued to focus on strategic development and redevelopment. For instance, their projects aim to capture market demand for modern, amenitized office spaces, which command higher rental rates and lower vacancy periods upon lease-up. This proactive approach to portfolio enhancement is key to sustained financial performance.

- Portfolio Value Enhancement: Completed developments increase the overall asset value of Highwoods' holdings.

- NOI Growth: Stabilized properties generate higher net operating income, improving profitability.

- Shareholder Value: Increased NOI and asset value translate to greater returns for investors.

- Strategic Redevelopment: Investing in modernizing existing assets or building new ones attracts premium tenants and secures long-term leases.

Beyond core rental income, Highwoods Properties diversifies its revenue through parking fees and other ancillary services offered within its properties. These supplementary income streams contribute to overall profitability and tenant satisfaction.

In 2024, Highwoods Properties continued to focus on optimizing its portfolio through strategic property dispositions. The company aims to redeploy capital from these sales into higher-growth potential assets, enhancing the overall quality and yield of its real estate holdings.

Lease termination fees represent an opportunistic revenue source, providing a financial uplift when tenants opt to end their agreements early. While not a consistent stream, these fees contribute to the company's financial flexibility.

Development and redevelopment projects are key to Highwoods' long-term value creation strategy. By investing in modern, well-located, and amenitized office spaces, the company aims to attract premium tenants and secure long-term leases, ultimately driving higher net operating income.

| Revenue Stream | Q1 2024 (Millions USD) | 2023 (Millions USD) |

|---|---|---|

| Rental and Other Property Income | 209.7 | N/A |

| Property Dispositions | 70.5 (from two buildings) | N/A |

| Lease Termination Fees | N/A | 1.6 |

| Parking and Ancillary Services | Ongoing focus in 2024 | Contributes to overall profitability |

| Development Profits | Indirectly drives NOI growth | Focus on strategic projects |

Business Model Canvas Data Sources

The Highwoods Properties Business Model Canvas is built using a combination of financial disclosures, real estate market research, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's strategy.